Key Insights

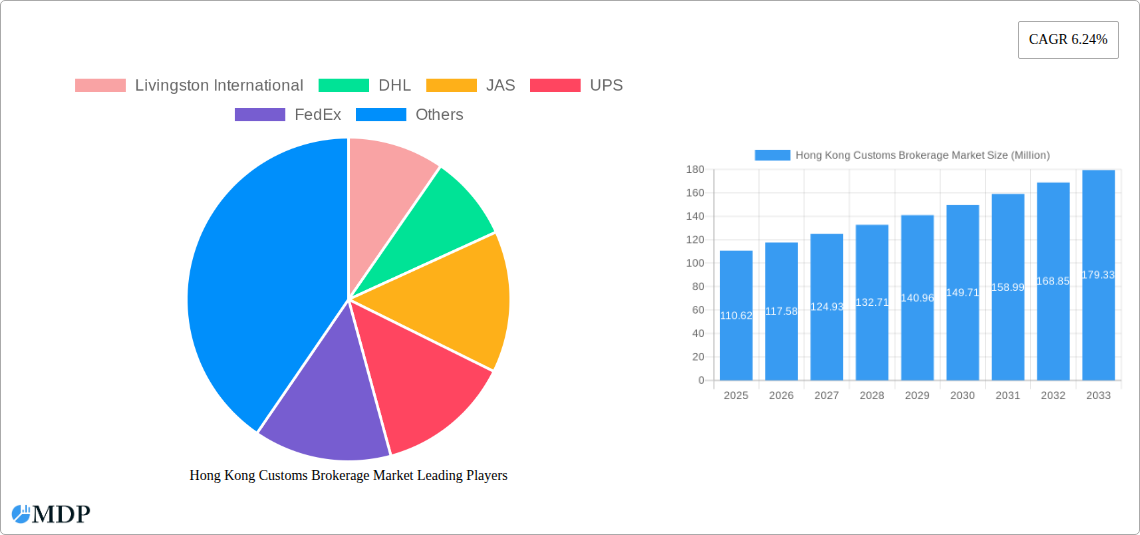

The Hong Kong Customs Brokerage Market, valued at $110.62 million in 2025, is projected to experience robust growth, driven by the city's strategic position as a global trade hub and increasing cross-border e-commerce activity. A compound annual growth rate (CAGR) of 6.24% from 2025 to 2033 indicates a significant expansion of the market over the forecast period. This growth is fueled by several key factors. The increasing complexity of international trade regulations necessitates the expertise of customs brokers for efficient and compliant import and export processes. Furthermore, the rise of e-commerce and the associated surge in smaller shipments are boosting demand for streamlined customs brokerage services. While challenges such as fluctuating global economic conditions and potential trade disputes could act as restraints, the overall positive outlook for Hong Kong's trade sector and the continuous modernization of customs procedures suggest a sustained upward trend for the market. Major players like Livingston International, DHL, FedEx, and UPS, along with numerous regional and specialized firms, actively compete in this market, offering a diverse range of services to cater to varying client needs. The market segmentation by mode of transport (sea, air, and cross-border land) reflects the multifaceted nature of Hong Kong's logistics landscape and underscores the adaptability of customs brokerage services to these different channels.

Hong Kong Customs Brokerage Market Market Size (In Million)

The market’s segmentation further highlights the diversity of service offerings. Sea freight, given Hong Kong's pivotal role in global maritime trade, likely constitutes the largest share of the market. Air freight, catering to time-sensitive shipments, represents a significant and rapidly growing segment. Cross-border land transport, while potentially smaller in comparison, is experiencing a growth spurt due to increasing trade with mainland China and other neighboring regions. The competitive landscape is dynamic, with established multinational companies alongside agile local players. The continued success of market participants will hinge on their ability to leverage technological advancements, enhance operational efficiency, and adapt to evolving regulatory requirements. The forecast suggests a considerable increase in market value by 2033, highlighting the sustained potential for growth and investment within the Hong Kong customs brokerage sector.

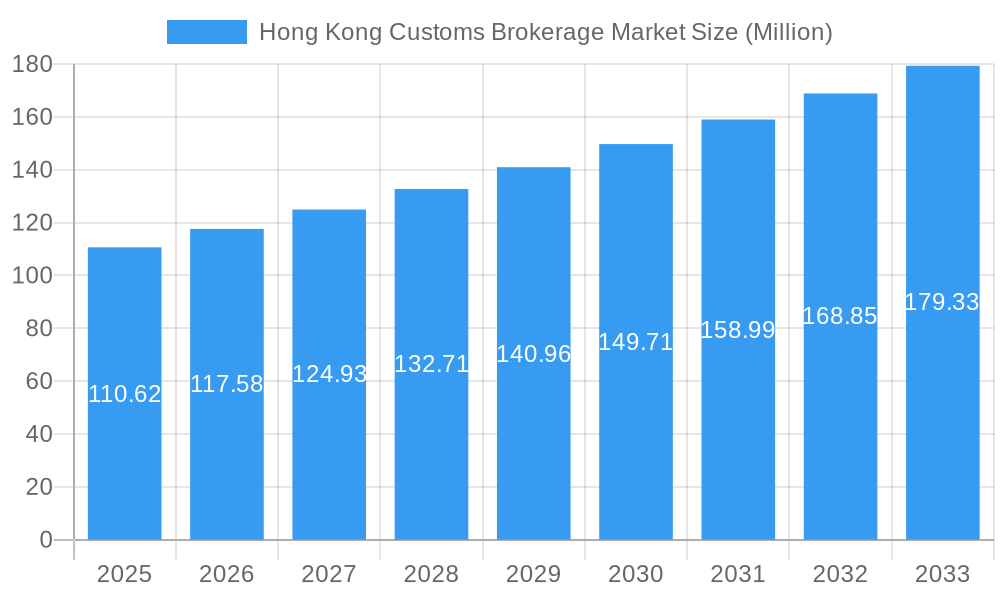

Hong Kong Customs Brokerage Market Company Market Share

Hong Kong Customs Brokerage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Hong Kong Customs Brokerage Market, covering market dynamics, industry trends, leading players, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and businesses operating within or seeking entry into this dynamic market. The market size is expected to reach xx Million by 2033.

Hong Kong Customs Brokerage Market Dynamics & Concentration

The Hong Kong Customs Brokerage Market exhibits a moderately consolidated structure, with key players like Livingston International, DHL, JAS, UPS, FedEx, CBIP Logistics, Janio, Jaguar Logistics, Sino Shipping, Geodis, TIBA Group, and ClearCust holding significant market share. However, the market also accommodates numerous smaller, specialized brokers.

Market concentration is influenced by several factors:

- Regulatory Framework: Stringent customs regulations and licensing requirements create a barrier to entry, favoring established players with extensive experience and compliance expertise.

- Technological Advancements: Adoption of advanced technologies like blockchain and AI for streamlined customs processing favors larger firms with greater investment capacity.

- Mergers & Acquisitions (M&A): The market has witnessed a moderate number of M&A activities (xx deals in the last 5 years), driven by the desire for scale, geographic expansion, and enhanced service offerings. Market leaders have leveraged M&A to consolidate market share, leading to a higher concentration ratio.

- Innovation Drivers: Increased e-commerce activity and the need for faster, more efficient cross-border shipping have driven innovation in customs brokerage services. This includes the development of specialized software solutions and value-added services such as inventory management and supply chain optimization.

- Product Substitutes: While direct substitutes are limited, the rise of self-service customs platforms and digital freight forwarding solutions poses some level of indirect competitive pressure.

- End-User Trends: Growing demand for transparency, traceability, and sustainability in supply chains is pushing the adoption of digital solutions and environmentally conscious practices among customs brokers.

Hong Kong Customs Brokerage Market Industry Trends & Analysis

The Hong Kong Customs Brokerage Market is experiencing robust growth, driven by a multitude of factors. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, with the market expected to grow at a CAGR of xx% during the forecast period (2025-2033). Market penetration in key segments like air freight has reached approximately xx%, leaving room for substantial future growth in cross-border land transport and sea freight.

Key market growth drivers include:

- E-commerce Boom: The surging popularity of online shopping has significantly increased the volume of cross-border shipments, fueling demand for customs brokerage services.

- Technological Disruptions: The adoption of automation, AI, and blockchain technology is streamlining customs procedures, improving efficiency, and reducing processing times.

- Government Initiatives: Government initiatives aimed at improving trade facilitation and streamlining customs processes have created a more favorable environment for growth.

- Competitive Dynamics: Intense competition among market players is driving innovation and the development of value-added services to enhance customer offerings and capture market share.

Leading Markets & Segments in Hong Kong Customs Brokerage Market

The Hong Kong Customs Brokerage Market is dominated by the Air Freight segment, driven by the high volume of time-sensitive air shipments supporting the region's robust e-commerce and manufacturing sectors. This segment commands approximately xx% of the market share.

Key Drivers of Air Freight Dominance:

- Strong E-commerce Activity: Hong Kong serves as a major hub for e-commerce, with a significant proportion of goods moving via air freight to meet consumer demand for speedy delivery.

- Advanced Airport Infrastructure: Hong Kong International Airport's advanced infrastructure and connectivity facilitate efficient handling of air freight.

- Government Support: Government policies supporting air freight infrastructure and logistics have contributed to segment growth.

The Sea Freight segment is also significant, accounting for approximately xx% of the market.

Key Drivers of Sea Freight Growth:

- High Import and Export Volumes: Hong Kong's role as a global trading hub results in substantial volumes of goods transported by sea.

- Cost-Effectiveness: Sea freight remains a cost-effective option for transporting large volumes of less time-sensitive goods.

- Port Infrastructure: Hong Kong's port infrastructure, despite facing challenges with space constraints, is still robust enough to handle substantial sea freight traffic.

The Cross-border Land Transport segment is comparatively smaller, representing approximately xx% of the overall market. However, it shows potential for growth fueled by the increasing integration of Hong Kong with mainland China.

Hong Kong Customs Brokerage Market Product Developments

Recent product innovations within the Hong Kong Customs Brokerage Market focus on digitalization and enhanced service offerings. This includes the development of cloud-based customs compliance platforms, AI-powered risk management tools, and integrated logistics management systems. These innovations aim to improve efficiency, reduce costs, and enhance transparency for clients. The market is witnessing a shift towards comprehensive, end-to-end supply chain solutions, rather than solely focusing on customs clearance.

Key Drivers of Hong Kong Customs Brokerage Market Growth

Several factors contribute to the growth of the Hong Kong Customs Brokerage Market:

- Technological Advancements: Automation, AI, and blockchain technology are improving efficiency and reducing processing times.

- Economic Growth: Hong Kong's vibrant economy and its role as a global trading hub fuel demand for customs brokerage services.

- Government Regulations: Supportive government policies and initiatives aimed at improving trade facilitation encourage market expansion.

Challenges in the Hong Kong Customs Brokerage Market

The Hong Kong Customs Brokerage Market faces several challenges:

- Regulatory Complexity: Stringent regulations and compliance requirements can increase operational costs and complexity.

- Supply Chain Disruptions: Global supply chain disruptions, such as those experienced in recent years, can impact the efficiency and reliability of customs brokerage services, potentially affecting profit margins by xx%.

- Intense Competition: Competition among established and emerging players creates pricing pressure.

Emerging Opportunities in Hong Kong Customs Brokerage Market

Several opportunities exist for growth in the Hong Kong Customs Brokerage Market:

- Expansion of E-commerce: The continued expansion of e-commerce creates ongoing demand for efficient and reliable customs brokerage services.

- Technological Innovation: The adoption of emerging technologies like AI and blockchain offers scope for enhanced efficiency and value-added service development.

- Strategic Partnerships: Collaboration between customs brokers and technology providers can unlock new growth avenues.

Leading Players in the Hong Kong Customs Brokerage Market Sector

- Livingston International

- DHL

- JAS

- UPS

- FedEx

- CBIP Logistics

- Janio

- Jaguar Logistics

- Sino Shipping

- Geodis

- TIBA Group

- ClearCust

Key Milestones in Hong Kong Customs Brokerage Market Industry

- May 2023: DHL launched its GoGreen Plus service in Hong Kong, offering customers a way to reduce emissions using Sustainable Aviation Fuel (SAF). This initiative responds to increasing demand for environmentally conscious logistics solutions.

- June 2023: FedEx partnered with Floship to create end-to-end digitalized fulfillment and return solutions for e-commerce brands. This collaboration enhances operational efficiency and improves the customer experience.

Strategic Outlook for Hong Kong Customs Brokerage Market Market

The Hong Kong Customs Brokerage Market is poised for sustained growth driven by the ongoing expansion of e-commerce, technological innovation, and favorable government policies. Companies that embrace digitalization, develop specialized service offerings, and form strategic partnerships will be best positioned to capture significant market share and achieve long-term success. The market's future lies in leveraging technology to enhance efficiency, transparency, and sustainability within the increasingly complex global supply chain landscape.

Hong Kong Customs Brokerage Market Segmentation

-

1. Mode of Transport

- 1.1. Sea

- 1.2. Air

- 1.3. Cross-border Land Transport

Hong Kong Customs Brokerage Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hong Kong Customs Brokerage Market Regional Market Share

Geographic Coverage of Hong Kong Customs Brokerage Market

Hong Kong Customs Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Air cargo Transportation

- 3.3. Market Restrains

- 3.3.1. High Operation and Maintainance Cost

- 3.4. Market Trends

- 3.4.1. Hong Kong’s Trade Activities Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hong Kong Customs Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.1.1. Sea

- 5.1.2. Air

- 5.1.3. Cross-border Land Transport

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6. North America Hong Kong Customs Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6.1.1. Sea

- 6.1.2. Air

- 6.1.3. Cross-border Land Transport

- 6.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 7. South America Hong Kong Customs Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 7.1.1. Sea

- 7.1.2. Air

- 7.1.3. Cross-border Land Transport

- 7.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 8. Europe Hong Kong Customs Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 8.1.1. Sea

- 8.1.2. Air

- 8.1.3. Cross-border Land Transport

- 8.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 9. Middle East & Africa Hong Kong Customs Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 9.1.1. Sea

- 9.1.2. Air

- 9.1.3. Cross-border Land Transport

- 9.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 10. Asia Pacific Hong Kong Customs Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 10.1.1. Sea

- 10.1.2. Air

- 10.1.3. Cross-border Land Transport

- 10.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Livingston International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DHL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JAS

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 UPS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FedEx

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CBIP Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Janio

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jaguar Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sino Shipping

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Geodis

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 TIBA Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ClearCust**List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Livingston International

List of Figures

- Figure 1: Global Hong Kong Customs Brokerage Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hong Kong Customs Brokerage Market Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 3: North America Hong Kong Customs Brokerage Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 4: North America Hong Kong Customs Brokerage Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Hong Kong Customs Brokerage Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Hong Kong Customs Brokerage Market Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 7: South America Hong Kong Customs Brokerage Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 8: South America Hong Kong Customs Brokerage Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Hong Kong Customs Brokerage Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Hong Kong Customs Brokerage Market Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 11: Europe Hong Kong Customs Brokerage Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 12: Europe Hong Kong Customs Brokerage Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Hong Kong Customs Brokerage Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Hong Kong Customs Brokerage Market Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 15: Middle East & Africa Hong Kong Customs Brokerage Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 16: Middle East & Africa Hong Kong Customs Brokerage Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Hong Kong Customs Brokerage Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Hong Kong Customs Brokerage Market Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 19: Asia Pacific Hong Kong Customs Brokerage Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 20: Asia Pacific Hong Kong Customs Brokerage Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Hong Kong Customs Brokerage Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hong Kong Customs Brokerage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 2: Global Hong Kong Customs Brokerage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Hong Kong Customs Brokerage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 4: Global Hong Kong Customs Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Hong Kong Customs Brokerage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 9: Global Hong Kong Customs Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Hong Kong Customs Brokerage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 14: Global Hong Kong Customs Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Hong Kong Customs Brokerage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 25: Global Hong Kong Customs Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Hong Kong Customs Brokerage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 33: Global Hong Kong Customs Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Hong Kong Customs Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hong Kong Customs Brokerage Market?

The projected CAGR is approximately 6.24%.

2. Which companies are prominent players in the Hong Kong Customs Brokerage Market?

Key companies in the market include Livingston International, DHL, JAS, UPS, FedEx, CBIP Logistics, Janio, Jaguar Logistics, Sino Shipping, Geodis, TIBA Group, ClearCust**List Not Exhaustive.

3. What are the main segments of the Hong Kong Customs Brokerage Market?

The market segments include Mode of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD 110.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Air cargo Transportation.

6. What are the notable trends driving market growth?

Hong Kong’s Trade Activities Driving the Market.

7. Are there any restraints impacting market growth?

High Operation and Maintainance Cost.

8. Can you provide examples of recent developments in the market?

June 2023: FedEx (a global logistics service provider), entered a partnership with Floship, a leading global circular supply chains solutions provider for e-commerce brands. This partnership will create end-to-end digitalized fulfillment and return solutions, enhancing operational efficiency through optimal inventory management and best-in-class delivery using FedEx services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hong Kong Customs Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hong Kong Customs Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hong Kong Customs Brokerage Market?

To stay informed about further developments, trends, and reports in the Hong Kong Customs Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence