Key Insights

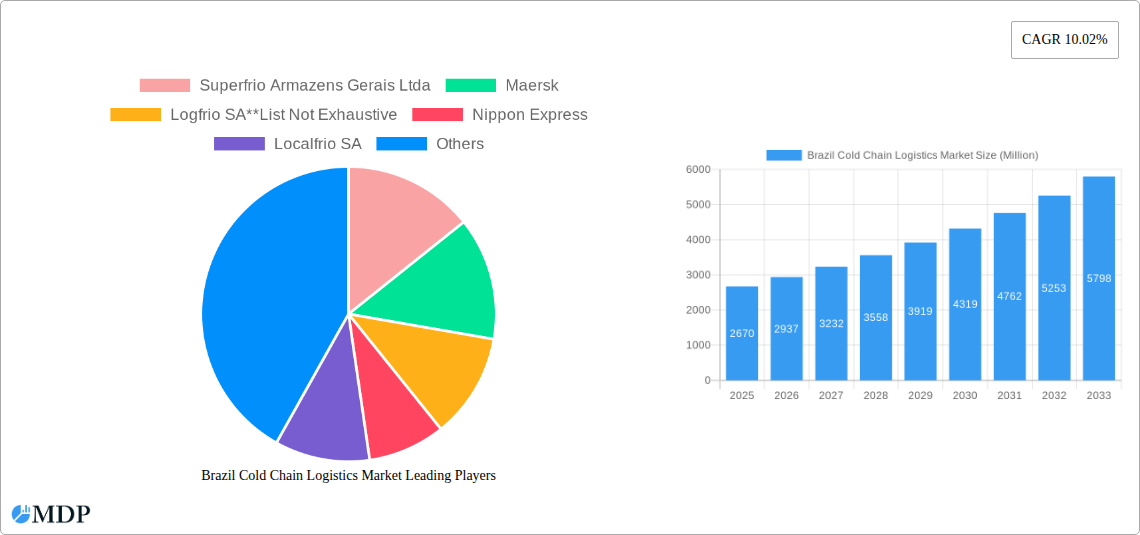

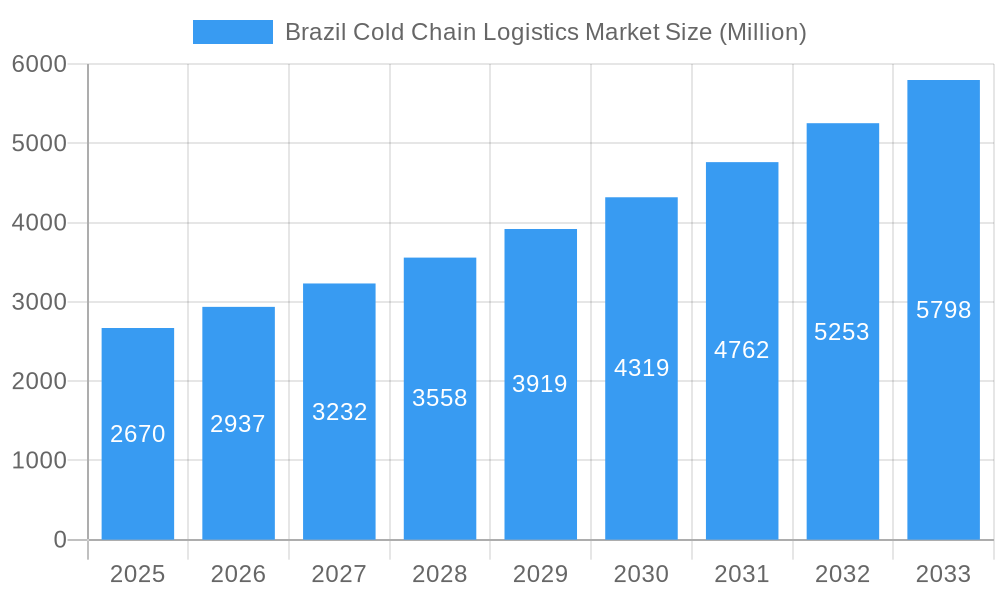

The Brazilian cold chain logistics market, valued at $2.67 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 10.02% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning middle class and increasing urbanization in Brazil are driving higher demand for perishable goods, particularly fresh produce, meats, and processed foods. Furthermore, the growing e-commerce sector, with its reliance on timely and temperature-controlled delivery, significantly contributes to market growth. Improvements in infrastructure, including enhanced warehousing and transportation networks, are facilitating the efficient movement of temperature-sensitive products across the country. The increasing adoption of advanced technologies, such as real-time tracking and monitoring systems, further enhances operational efficiency and reduces spoilage, adding to the market's positive trajectory. Key players like Superfrio, Maersk, and Logfrio are actively investing in expansion and technological upgrades, solidifying their market positions and driving innovation within the sector.

Brazil Cold Chain Logistics Market Market Size (In Billion)

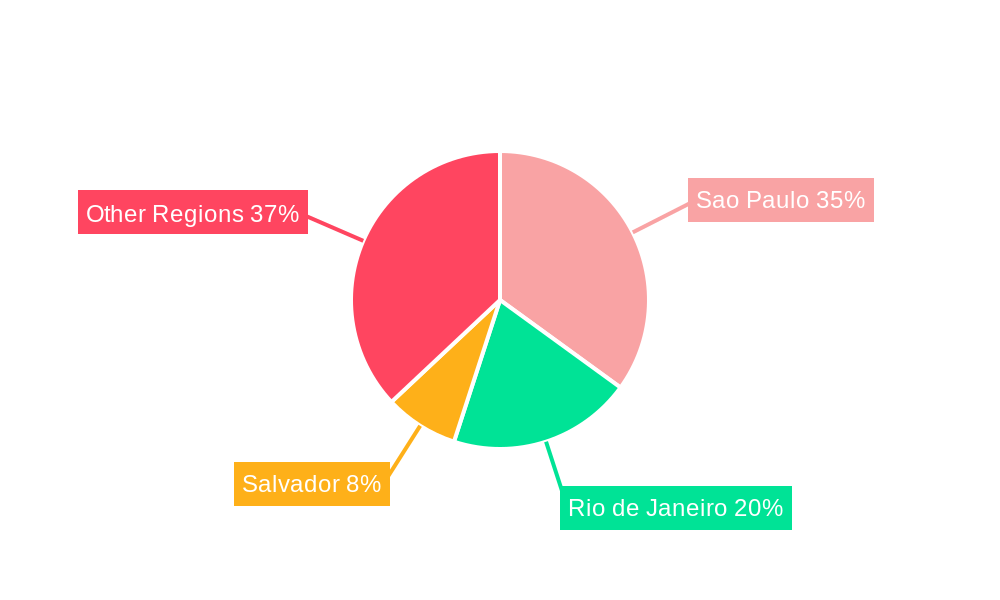

However, challenges remain. Fluctuations in the Brazilian economy and the associated impact on consumer spending could pose a potential constraint. Infrastructure limitations in certain regions, particularly in remote areas, continue to present obstacles to efficient cold chain logistics. The need for stringent regulatory compliance regarding food safety and temperature control adds to the operational complexities. Despite these hurdles, the long-term outlook for the Brazilian cold chain logistics market remains positive, driven by sustained economic growth, rising disposable incomes, and the growing preference for fresh and processed foods among consumers. The market's segmentation, encompassing diverse service offerings (storage, transport, value-added services) and application areas (horticulture, meats, pharmaceuticals), indicates significant opportunities for specialized providers across the cold chain value chain. The expansion of cold chain infrastructure in key cities like Sao Paulo, Rio de Janeiro, and Salvador further underscores the market's potential.

Brazil Cold Chain Logistics Market Company Market Share

Brazil Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Brazil cold chain logistics market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, trends, leading players, and future growth prospects. The report utilizes rigorous data analysis and forecasts to present a clear picture of this rapidly evolving market. Download now to gain a competitive edge!

Brazil Cold Chain Logistics Market Dynamics & Concentration

The Brazilian cold chain logistics market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Superfrio Armazens Gerais Ltda, Maersk, and Logfrio SA are prominent examples, though the market also includes numerous smaller, regional operators. The market's dynamics are shaped by several key factors:

- Innovation Drivers: Technological advancements in refrigeration, transportation, and tracking systems are driving efficiency gains and reducing losses. Automated warehousing and the adoption of IoT-enabled solutions are significantly impacting operations.

- Regulatory Frameworks: Government regulations concerning food safety and hygiene standards are crucial, influencing investment decisions and operational practices within the cold chain. Changes in regulations regarding transportation and logistics directly impact market participants.

- Product Substitutes: While limited direct substitutes exist, improvements in packaging and preservation technologies can indirectly influence market demand.

- End-User Trends: Growing consumer demand for fresh and processed food products, along with increasing health consciousness, fuels market growth. The expanding middle class in Brazil significantly contributes to this trend.

- M&A Activities: The market has witnessed a moderate number (xx) of mergers and acquisitions in the past five years, indicating consolidation and an increase in market concentration. The largest deals have involved (xx Million) in total value, with an average deal size of (xx Million). This consolidation trend is likely to continue as larger players seek to expand their market share and operational reach. Market share for the top three players in 2025 is estimated at xx%.

Brazil Cold Chain Logistics Market Industry Trends & Analysis

The Brazilian cold chain logistics market exhibits a robust growth trajectory, driven by factors such as:

- Expanding Food Processing Industry: Growth in the food processing sector, particularly in processed foods, meat, and poultry, directly increases the demand for cold chain services. The market is experiencing a CAGR of xx% during the forecast period (2025-2033).

- Rising Disposable Incomes: Increasing disposable incomes in Brazil are boosting consumer spending on higher-quality, perishable goods, which necessitates effective cold chain infrastructure.

- E-commerce Growth: The surge in online grocery shopping is creating significant demand for efficient and reliable last-mile cold chain delivery solutions.

- Technological Advancements: The implementation of advanced technologies, such as GPS tracking, temperature monitoring systems, and blockchain technology, improves efficiency and transparency in cold chain operations. Market penetration of IoT solutions is estimated at xx% in 2025. This leads to a reduction in spoilage and enhanced traceability.

- Competitive Dynamics: The market is characterized by a mix of large multinational corporations and smaller, local players. Competition is fierce, with companies focusing on service differentiation, technology adoption, and cost optimization strategies.

Leading Markets & Segments in Brazil Cold Chain Logistics Market

- By Key Cities: São Paulo dominates the market due to its large population, extensive industrial activity, and robust infrastructure. Rio de Janeiro and Salvador follow, exhibiting strong but comparatively smaller markets. São Paulo's dominance is driven by its significant concentration of food processing industries and larger consumer base. The key driver for growth in these cities is the expansion of the retail sector and the rise in e-commerce.

- By Service: Storage accounts for the largest segment, followed by transportation and value-added services. The increasing demand for value-added services such as blast freezing, labeling, and inventory management reflects the need for comprehensive cold chain solutions. The growth in value-added services is driven by the increasing demand for specialized handling and processing of temperature-sensitive goods.

- By Temperature Type: Frozen products constitute the larger segment due to the prevalence of frozen foods and the necessity of preserving perishables for extended periods.

- By Application: The meat, fish, and poultry sector represents a significant portion of the market, followed by horticulture and processed food products. The pharmaceuticals and life sciences sector is a rapidly growing segment, demanding stringent temperature control and traceability.

Brazil Cold Chain Logistics Market Product Developments

Recent product developments focus on enhancing temperature control, improving tracking capabilities, and optimizing transportation efficiency. Innovations include advanced refrigeration technologies, IoT-enabled monitoring devices, and sophisticated logistics software for route optimization and predictive maintenance. These developments are enhancing the efficiency, safety, and reliability of cold chain logistics, aligning with market demands for greater transparency and reduced product spoilage.

Key Drivers of Brazil Cold Chain Logistics Market Growth

Several factors are driving the growth of the Brazilian cold chain logistics market: Firstly, the expanding middle class and increasing disposable incomes are boosting demand for perishable goods. Secondly, government initiatives aimed at improving infrastructure and supporting the food processing sector are contributing to market expansion. Finally, the adoption of advanced technologies is enhancing efficiency and minimizing losses within the cold chain.

Challenges in the Brazil Cold Chain Logistics Market Market

Significant challenges include infrastructure limitations in certain regions, particularly regarding transportation networks and warehousing facilities. Furthermore, inconsistent electricity supply in some areas poses a threat to cold chain integrity. This causes an estimated xx Million in losses annually. High fuel prices add to operational costs. Stringent regulatory compliance requirements can also impose significant burdens on businesses.

Emerging Opportunities in Brazil Cold Chain Logistics Market

Significant opportunities exist in expanding cold chain infrastructure to underserved regions and leveraging technology to improve efficiency and traceability. Strategic partnerships between cold chain providers and food producers can lead to improved supply chain integration and reduce losses. Expansion into specialized segments, such as pharmaceuticals and life sciences, presents strong potential for growth.

Leading Players in the Brazil Cold Chain Logistics Market Sector

- Superfrio Armazens Gerais Ltda

- Maersk (www.maersk.com)

- Logfrio SA

- Nippon Express

- Localfrio SA

- Comfrio

- Martini Meat SA

- Arfrio Armazens Gerais Frigorificos

- Friozem Armazens Frigorificos Ltda

- Brado Logistica SA

- CAP Logistica Frigorificada Ltda

- Brasfrigo SA

Key Milestones in Brazil Cold Chain Logistics Market Industry

- 2021: Implementation of new food safety regulations by ANVISA (Brazilian Health Surveillance Agency).

- 2022: Launch of a major cold storage facility in São Paulo by a leading logistics provider.

- 2023: Increased adoption of IoT-enabled temperature monitoring systems across the industry.

- 2024: Significant investments in cold chain infrastructure by the Brazilian government. (Further details on specific investments are not available for the years beyond 2024)

Strategic Outlook for Brazil Cold Chain Logistics Market Market

The Brazilian cold chain logistics market is poised for substantial growth, driven by increasing consumer demand, technological advancements, and government initiatives. Companies focusing on innovation, infrastructure development, and strategic partnerships will be well-positioned to capture significant market share. The market's potential is considerable, with opportunities for expansion in both established and underserved regions. Further development and implementation of technologies that improve efficiency and reduce spoilage will be crucial for future success in this dynamic market.

Brazil Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Meats, Fish, and Poultry

- 3.3. Processed Food Products

- 3.4. Pharmaceuticals, Life Sciences, and Chemicals

- 3.5. Other Applications

-

4. Key Cities

- 4.1. Sao Paulo

- 4.2. Rio de Janeiro

- 4.3. Salvador

Brazil Cold Chain Logistics Market Segmentation By Geography

- 1. Brazil

Brazil Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Brazil Cold Chain Logistics Market

Brazil Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Payments from Mobile

- 3.4. Market Trends

- 3.4.1. Increasing Meat Exports to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Meats, Fish, and Poultry

- 5.3.3. Processed Food Products

- 5.3.4. Pharmaceuticals, Life Sciences, and Chemicals

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Key Cities

- 5.4.1. Sao Paulo

- 5.4.2. Rio de Janeiro

- 5.4.3. Salvador

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Superfrio Armazens Gerais Ltda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maersk

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Logfrio SA**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Localfrio SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Comfrio

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Martini Meat SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arfrio Armazens Gerais Frigorificos

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Friozem Armazens Frigorificos Ltda

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Brado Logistica SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CAP Logistica Frigorificada Ltda

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Brasfrigo SA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Superfrio Armazens Gerais Ltda

List of Figures

- Figure 1: Brazil Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 5: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 8: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 10: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Cold Chain Logistics Market?

The projected CAGR is approximately 10.02%.

2. Which companies are prominent players in the Brazil Cold Chain Logistics Market?

Key companies in the market include Superfrio Armazens Gerais Ltda, Maersk, Logfrio SA**List Not Exhaustive, Nippon Express, Localfrio SA, Comfrio, Martini Meat SA, Arfrio Armazens Gerais Frigorificos, Friozem Armazens Frigorificos Ltda, Brado Logistica SA, CAP Logistica Frigorificada Ltda, Brasfrigo SA.

3. What are the main segments of the Brazil Cold Chain Logistics Market?

The market segments include Service, Temperature Type, Application, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.67 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used.

6. What are the notable trends driving market growth?

Increasing Meat Exports to Drive the Market.

7. Are there any restraints impacting market growth?

Increasing Usage of Payments from Mobile.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Brazil Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence