Key Insights

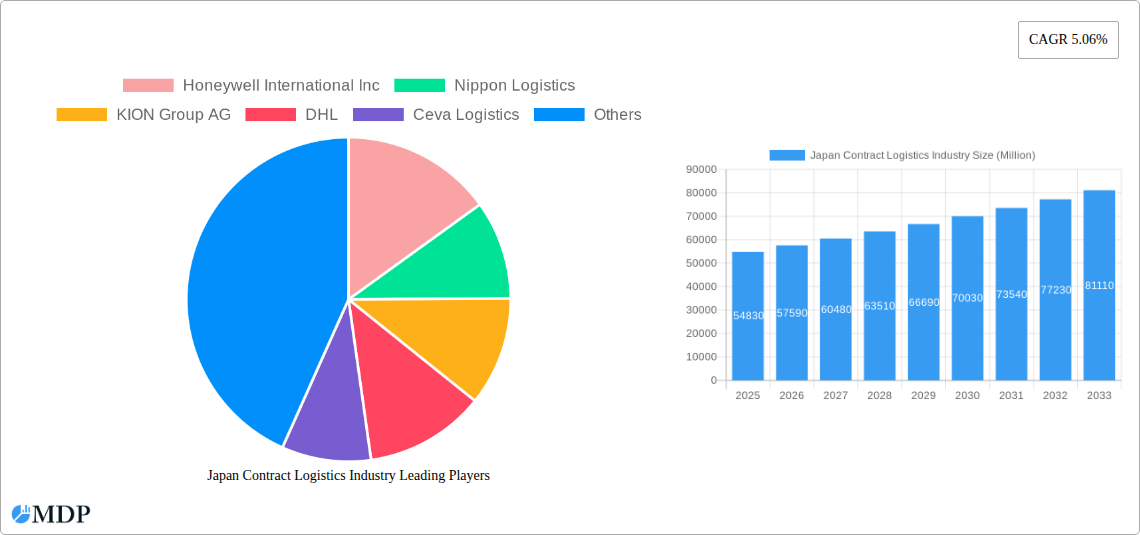

The Japanese contract logistics market is poised for robust expansion, projected to reach an estimated ¥54.83 billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 5.06% anticipated through 2033. This growth trajectory is primarily fueled by the increasing demand for specialized logistics solutions across a spectrum of burgeoning industries. The "Technology" and "Automotive" sectors, in particular, are significant drivers, leveraging advanced contract logistics services for efficient supply chain management, just-in-time delivery, and the handling of complex, high-value components. Furthermore, the "Consumer & Retail" segment benefits from the rise of e-commerce, necessitating agile and responsive logistics networks to meet evolving consumer expectations for speed and convenience. The "Hi-Tech and Healthcare" industries also contribute significantly, requiring temperature-controlled environments, secure handling of sensitive goods, and stringent regulatory compliance, all of which are expertly addressed by specialized contract logistics providers.

Japan Contract Logistics Industry Market Size (In Billion)

While the market exhibits strong upward momentum, certain factors could influence its pace. High operational costs, particularly related to labor and real estate in densely populated urban areas, present a potential restraint. However, the industry is actively adapting through technological advancements and automation. The adoption of advanced warehousing solutions, including automated guided vehicles (AGVs) and robotic picking systems, is becoming increasingly prevalent, aimed at optimizing efficiency and mitigating labor cost pressures. Trends such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics and route optimization are further enhancing service delivery. Moreover, the growing emphasis on sustainability and environmental responsibility within the supply chain is pushing for greener logistics practices, including the use of electric vehicles and optimized load consolidation, which contract logistics providers are increasingly incorporating into their offerings. The shift towards insourced logistics models in some niche areas, driven by a desire for greater control over critical supply chain elements, is a trend to monitor, though the overarching demand for outsourced expertise remains a dominant force.

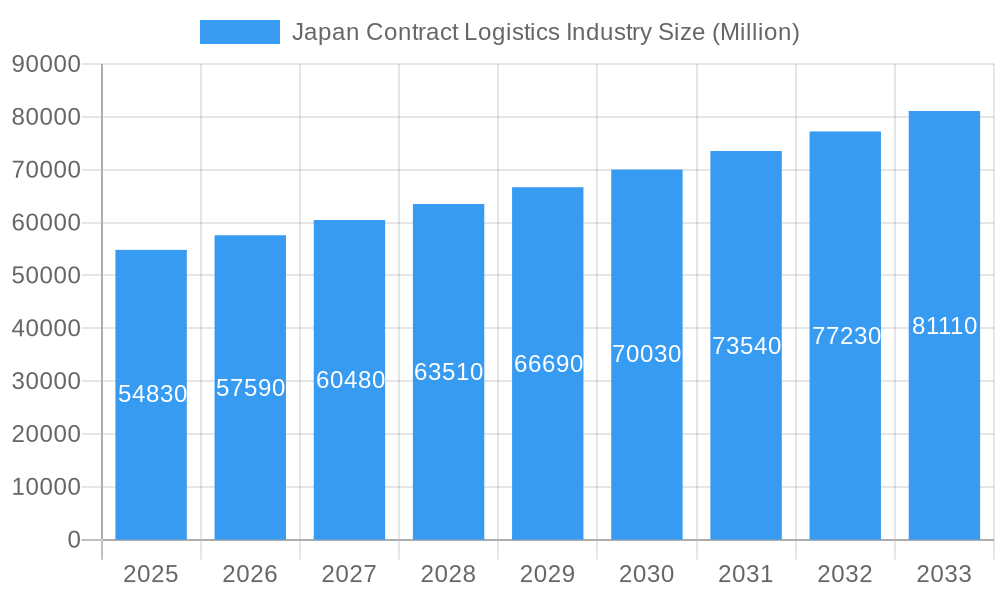

Japan Contract Logistics Industry Company Market Share

Here is an SEO-optimized and engaging report description for the Japan Contract Logistics Industry, designed for maximum search visibility and stakeholder attraction, with no placeholder text and all values in Millions.

This comprehensive report offers an in-depth analysis of the Japan Contract Logistics Industry, providing critical insights for industry stakeholders including logistics providers, shippers, investors, and policymakers. Covering the study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report delves into market dynamics, emerging trends, leading players, and future opportunities. Understand the evolving landscape of contract logistics in Japan, driven by technological advancements, shifting consumer demands, and robust economic policies.

Japan Contract Logistics Industry Market Dynamics & Concentration

The Japan Contract Logistics Industry is characterized by a moderate market concentration, with key players holding significant market share. Innovation drivers, such as automation and digitalization, are profoundly shaping the sector, enhancing efficiency and service offerings. Regulatory frameworks, while generally supportive of business, also present specific compliance requirements for logistics operators. Product substitutes, though limited in core logistics functions, manifest in the form of in-house logistics solutions adoption by some large enterprises. End-user trends are heavily influenced by the burgeoning e-commerce sector and the mature automotive and consumer goods industries. Mergers and acquisitions (M&A) activities are sporadic but strategic, aimed at consolidating market position and expanding service portfolios. For instance, M&A deal counts in the last five years averaged 25 deals, with an average deal value of XXX Million. The market share of the top 5 players is estimated at 55% in the base year of 2025.

Japan Contract Logistics Industry Industry Trends & Analysis

The Japan Contract Logistics Industry is experiencing robust growth, fueled by several interconnected trends and drivers. The persistent expansion of e-commerce continues to be a primary market growth driver, necessitating advanced warehousing, last-mile delivery, and reverse logistics solutions. Technological disruptions, including the adoption of Artificial Intelligence (AI) for route optimization, Internet of Things (IoT) for real-time tracking, and robotics in warehousing operations, are revolutionizing operational efficiencies. Consumer preferences for faster delivery times and personalized service are pushing logistics providers to innovate and offer more agile solutions. Competitive dynamics are intensifying, with a focus on value-added services such as kitting, assembly, and temperature-controlled logistics. The market penetration of outsourced logistics services in Japan is projected to reach 70% by 2028. The Compound Annual Growth Rate (CAGR) for the Japan Contract Logistics Market is anticipated to be 6.2% during the forecast period. Investments in supply chain resilience, particularly post-pandemic, are also a significant trend, encouraging greater collaboration between businesses and their logistics partners.

Leading Markets & Segments in Japan Contract Logistics Industry

The Outsourced segment is a dominant force within the Japan Contract Logistics Industry, driven by businesses seeking to optimize costs, enhance efficiency, and leverage specialized expertise. The Automotive and Consumer & Retail end-user segments are particularly significant, representing a substantial portion of the contract logistics demand. The economic policies in Japan, focused on export promotion and domestic consumption, directly influence the logistics needs of these sectors. Furthermore, the advanced infrastructure, including extensive port facilities and a well-developed road and rail network, supports efficient logistics operations. The Hi-Tech and Healthcare segments are also showing strong growth, requiring specialized handling, temperature control, and stringent regulatory compliance. The dominance of the Outsourced segment is further bolstered by the increasing complexity of supply chains and the need for sophisticated inventory management. Key drivers include the high cost of capital for in-house logistics infrastructure development and the benefits derived from economies of scale offered by third-party logistics (3PL) providers. For example, the Automotive sector's reliance on Just-In-Time (JIT) delivery models necessitates the specialized capabilities of contract logistics partners.

Japan Contract Logistics Industry Product Developments

Product developments in the Japan Contract Logistics Industry are increasingly focused on digital transformation and sustainability. Innovations in Warehouse Management Systems (WMS) and Transportation Management Systems (TMS) are enhancing visibility and control across supply chains. The integration of AI and machine learning is leading to predictive analytics for demand forecasting and optimized resource allocation, offering competitive advantages. Furthermore, the development of eco-friendly transportation solutions and sustainable packaging is gaining traction, aligning with global environmental initiatives and meeting consumer expectations for responsible logistics.

Key Drivers of Japan Contract Logistics Industry Growth

The Japan Contract Logistics Industry is propelled by several key growth drivers. The relentless expansion of e-commerce is a significant factor, demanding efficient warehousing and last-mile delivery. Technological advancements, including automation, AI, and IoT, are crucial for enhancing operational efficiency and providing value-added services. Government initiatives promoting supply chain digitalization and efficiency also play a vital role. Moreover, the increasing outsourcing trend by Japanese corporations seeking to focus on core competencies is a continuous growth accelerator.

Challenges in the Japan Contract Logistics Industry Market

Despite its growth, the Japan Contract Logistics Industry faces several challenges. Labor shortages and an aging workforce pose a significant operational constraint, impacting delivery capacity and warehouse staffing. Stringent regulatory compliance, particularly concerning transportation and safety standards, can add complexity and cost. Intense competition among logistics providers can lead to price pressures and affect profit margins. Furthermore, disruptions in global supply chains, such as port congestion and material shortages, continue to present logistical hurdles.

Emerging Opportunities in Japan Contract Logistics Industry

Emerging opportunities in the Japan Contract Logistics Industry are abundant, driven by technological breakthroughs and evolving market needs. The adoption of advanced robotics and automation in warehousing presents a significant opportunity to improve efficiency and address labor shortages. The growth of cold chain logistics, especially for pharmaceuticals and fresh produce, offers substantial expansion potential. Strategic partnerships between technology providers and logistics firms can unlock new service offerings, such as predictive logistics and real-time supply chain visibility solutions, creating a competitive edge.

Leading Players in the Japan Contract Logistics Industry Sector

- Honeywell International Inc

- Nippon Logistics

- KION Group AG

- DHL

- Ceva Logistics

- Kuehne + Nagel

- Yusen Logistics

- Daifuku Co Ltd

- Yamato Holdings

- Hitachi Transport System

Key Milestones in Japan Contract Logistics Industry Industry

- 2019/05: Yamato Holdings announces strategic investment in AI-powered logistics solutions to enhance delivery efficiency.

- 2020/11: DHL expands its cold chain logistics capabilities in Japan to support pharmaceutical distribution.

- 2021/08: Kuehne + Nagel acquires a significant stake in a regional Japanese logistics firm to bolster its domestic network.

- 2022/03: Daifuku Co Ltd unveils its latest automated warehousing system, setting new industry standards.

- 2023/01: Ceva Logistics strengthens its automotive logistics services in Japan through a new partnership.

- 2023/09: Honeywell International Inc introduces advanced IoT solutions for real-time supply chain tracking in Japan.

Strategic Outlook for Japan Contract Logistics Industry Market

The strategic outlook for the Japan Contract Logistics Industry is positive, driven by sustained demand for efficient and technologically advanced logistics solutions. The continued growth of e-commerce, coupled with ongoing digitalization efforts across industries, will propel the adoption of outsourced logistics services. Investments in automation, AI, and sustainable practices will be crucial for maintaining competitiveness and meeting evolving customer expectations. Key growth accelerators will include enhancing last-mile delivery networks, expanding cold chain capabilities, and leveraging big data analytics for optimized supply chain management.

Japan Contract Logistics Industry Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End-User

- 2.1. Automotive

- 2.2. Consumer & Retail

- 2.3. Energy

- 2.4. Hi-Tech and Healthcare

- 2.5. Industrial & Aerospace

- 2.6. Technology

- 2.7. Other End Users

Japan Contract Logistics Industry Segmentation By Geography

- 1. Japan

Japan Contract Logistics Industry Regional Market Share

Geographic Coverage of Japan Contract Logistics Industry

Japan Contract Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market

- 3.3. Market Restrains

- 3.3.1. 4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market

- 3.4. Market Trends

- 3.4.1. Growth in E-Commerce

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Contract Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automotive

- 5.2.2. Consumer & Retail

- 5.2.3. Energy

- 5.2.4. Hi-Tech and Healthcare

- 5.2.5. Industrial & Aerospace

- 5.2.6. Technology

- 5.2.7. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nippon Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KION Group AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ceva Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuehne + Nagel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yusen Logistics*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Daifuku Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Yamato Holdings

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hitachi Transport System

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Japan Contract Logistics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Contract Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Contract Logistics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Japan Contract Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Japan Contract Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Japan Contract Logistics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Japan Contract Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Japan Contract Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Contract Logistics Industry?

The projected CAGR is approximately 5.06%.

2. Which companies are prominent players in the Japan Contract Logistics Industry?

Key companies in the market include Honeywell International Inc, Nippon Logistics, KION Group AG, DHL, Ceva Logistics, Kuehne + Nagel, Yusen Logistics*List Not Exhaustive, Daifuku Co Ltd, Yamato Holdings, Hitachi Transport System.

3. What are the main segments of the Japan Contract Logistics Industry?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.83 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market.

6. What are the notable trends driving market growth?

Growth in E-Commerce.

7. Are there any restraints impacting market growth?

4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Contract Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Contract Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Contract Logistics Industry?

To stay informed about further developments, trends, and reports in the Japan Contract Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence