Key Insights

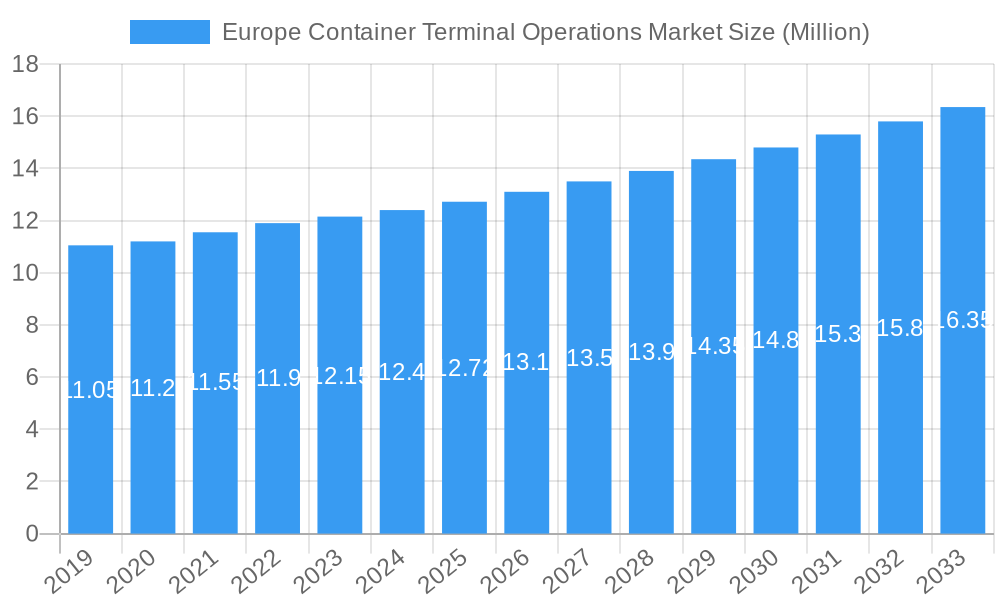

The Europe Container Terminal Operations Market is a dynamic and critical component of global trade, currently valued at approximately USD 12.72 billion in 2025. This market is projected to expand at a Compound Annual Growth Rate (CAGR) of 3.70% over the forecast period of 2025-2033, reaching an estimated USD 17.2 billion by 2033. This steady growth is primarily fueled by the increasing volume of international trade, the expansion of global supply chains, and the continuous need for efficient and technologically advanced port infrastructure. Key drivers for this expansion include investments in port modernization, the adoption of automation and digitalization to enhance operational efficiency, and the growing demand for multimodal transportation solutions that seamlessly integrate sea, rail, and road logistics. Emerging trends such as the development of smart ports, the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) for predictive maintenance and optimized cargo flow, and the increasing focus on sustainability and green port initiatives are further shaping the market landscape.

Europe Container Terminal Operations Market Market Size (In Million)

However, the market is not without its challenges. Restraints such as the high capital expenditure required for infrastructure upgrades, stringent environmental regulations that necessitate significant investment in eco-friendly technologies, and the susceptibility of port operations to geopolitical events and supply chain disruptions can pose hurdles. Furthermore, labor union negotiations and the need for skilled workforce development to manage advanced terminal technologies also present ongoing considerations. The market is segmented by service into Stevedoring, Cargo and handling transportation, and Others, with Stevedoring and Cargo and handling transportation being the dominant segments due to their core role in port operations. Cargo types are broadly categorized into Dry Cargo, Crude Oil, and Other Liquid Cargo, with Dry Cargo representing a significant portion of throughput. Major players like Ports America Inc., SSA Marine, and Rhenus Group are actively investing in expansion and technological advancements across key European regions, including Germany, the UK, and Rotterdam, to capture market share and adapt to evolving trade dynamics.

Europe Container Terminal Operations Market Company Market Share

This in-depth report provides a strategic overview and detailed analysis of the Europe Container Terminal Operations Market, exploring key dynamics, industry trends, leading segments, and future growth opportunities. With a study period spanning 2019 to 2033, including a base year of 2025 and a forecast period of 2025–2033, this report offers actionable insights for stakeholders navigating this crucial sector. The market is projected to witness significant advancements driven by technological innovation, evolving trade patterns, and robust investment in port infrastructure.

Europe Container Terminal Operations Market Dynamics & Concentration

The Europe Container Terminal Operations Market exhibits a moderate to high concentration, characterized by the presence of established global players and regional specialists. Innovation drivers are primarily centered on automation, digitalization, and sustainable operational practices. Regulatory frameworks, encompassing environmental standards, safety protocols, and trade agreements, significantly influence market entry and operational efficiency. Product substitutes are limited within the core container handling services, but efficiency gains in intermodal transportation and alternative logistics solutions present indirect competitive pressures. End-user trends indicate a growing demand for faster turnaround times, enhanced cargo visibility, and reduced environmental impact. Mergers and acquisitions (M&A) activities are a significant factor in shaping market concentration, with recent deals aimed at expanding geographical reach and consolidating service offerings. For instance, key players are actively seeking to integrate advanced technologies and streamline operations through strategic alliances and acquisitions. The Europe Container Terminal Operations Market witnessed approximately 5 significant M&A deals in the historical period (2019-2024), reflecting a trend towards consolidation. Market share among the top five players is estimated to be around 55% in the base year of 2025.

Europe Container Terminal Operations Market Industry Trends & Analysis

The Europe Container Terminal Operations Market is poised for robust growth, fueled by escalating global trade volumes, increasing demand for efficient supply chains, and significant investments in modernizing port infrastructure. The CAGR for the forecast period (2025-2033) is projected to be approximately 6.5%, driven by a confluence of factors. Technological disruptions are at the forefront, with the widespread adoption of automation, artificial intelligence (AI), and the Internet of Things (IoT) revolutionizing terminal operations. These technologies enhance efficiency, reduce operational costs, and improve safety. For example, the implementation of automated stacking cranes and intelligent gate systems is becoming standard practice across major European ports. Consumer preferences are shifting towards faster and more reliable cargo delivery, putting pressure on terminals to optimize their processes. This includes the demand for real-time cargo tracking and enhanced visibility throughout the supply chain. Competitive dynamics are intensifying, with companies differentiating themselves through service quality, technological innovation, and sustainable practices. The penetration of advanced digital solutions is expected to reach over 70% in major terminals by 2030. Furthermore, government initiatives aimed at promoting intermodal transport and green logistics are indirectly boosting the demand for efficient container terminal operations. The increasing complexity of global supply chains and the need for resilient logistics networks further underpin the market’s growth trajectory. The market penetration of advanced cargo handling technologies is currently estimated at 45% and is expected to grow substantially.

Leading Markets & Segments in Europe Container Terminal Operations Market

The Europe Container Terminal Operations Market is dominated by a few key regions and segments, reflecting established trade routes and critical logistical hubs.

Dominant Regions:

- North Europe: Countries like the Netherlands (Rotterdam), Belgium (Antwerp), and Germany (Hamburg) represent the largest and most advanced container terminal markets in Europe. Their strategic locations, extensive hinterland connectivity, and massive port infrastructure make them pivotal for global trade. The economic policies encouraging free trade and the presence of major shipping lines contribute significantly to their dominance.

- Mediterranean Region: Ports in Spain, Italy, and France are experiencing substantial growth due to their proximity to emerging markets and their role as gateways for trade between Europe and Asia, Africa, and the Americas. Investment in port expansion and digitalization is a key driver here.

Dominant Segments:

- Service - Stevedoring: This core service remains the backbone of container terminal operations, encompassing the loading and unloading of vessels. The efficiency and speed of stevedoring operations directly impact overall vessel turnaround times and port competitiveness. Investments in advanced gantry cranes and automated equipment are crucial for maintaining leadership in this segment.

- Cargo Type - Dry Cargo: While various cargo types are handled, dry cargo, particularly manufactured goods and raw materials in containers, constitutes the largest share of throughput in Europe. The robust manufacturing base and extensive consumer markets in Europe drive consistent demand for dry cargo handling.

- Service - Cargo and handling transportation: This segment, encompassing internal movement of containers within the terminal and onward transportation via rail or road, is critical for seamless logistics. Investment in intermodal infrastructure and efficient yard management systems are key differentiators. The market penetration of integrated cargo and handling transportation solutions is estimated at 60%.

Europe Container Terminal Operations Market Product Developments

Product developments in the Europe Container Terminal Operations Market are heavily focused on enhancing efficiency, sustainability, and safety. Innovations include advanced automated guided vehicles (AGVs) for container movement, AI-powered yard management systems for optimized container stacking and retrieval, and real-time data analytics platforms for improved operational visibility. The integration of IoT sensors across terminal equipment provides predictive maintenance capabilities, minimizing downtime and operational disruptions. Furthermore, the development of eco-friendly technologies, such as electric-powered cranes and shore power connections, is gaining traction to reduce the environmental footprint of terminal operations. These developments offer competitive advantages by enabling faster cargo handling, reducing labor costs, and meeting increasingly stringent environmental regulations.

Key Drivers of Europe Container Terminal Operations Market Growth

Several key factors are propelling the growth of the Europe Container Terminal Operations Market:

- Increasing Global Trade Volumes: Sustained growth in international trade, particularly between Europe and Asia, drives higher container throughput.

- Technological Advancements: Automation, AI, and digitalization are enhancing operational efficiency and reducing costs.

- Port Infrastructure Investment: Significant investments in modernizing and expanding port facilities across Europe are crucial for handling larger vessels and increasing capacity.

- Growth of E-commerce: The burgeoning e-commerce sector requires faster and more efficient logistics, boosting demand for rapid container handling.

- Sustainability Initiatives: Growing pressure for greener operations incentivizes the adoption of eco-friendly technologies.

Challenges in the Europe Container Terminal Operations Market Market

Despite strong growth prospects, the Europe Container Terminal Operations Market faces several challenges:

- Regulatory Hurdles: Navigating complex and evolving environmental, safety, and labor regulations can be time-consuming and costly.

- Supply Chain Disruptions: Geopolitical events, port congestion, and labor disputes can significantly disrupt operations and impact efficiency.

- High Capital Investment: The adoption of advanced technologies and infrastructure upgrades requires substantial upfront capital.

- Skilled Workforce Shortage: Finding and retaining skilled personnel to operate and maintain advanced terminal equipment is a growing concern.

- Cybersecurity Threats: Increased digitalization makes terminals vulnerable to cyberattacks, necessitating robust security measures.

Emerging Opportunities in Europe Container Terminal Operations Market

Emerging opportunities within the Europe Container Terminal Operations Market are driven by continued innovation and strategic expansion. The development and implementation of fully autonomous port operations present a significant long-term growth catalyst. Strategic partnerships between terminal operators, shipping lines, and technology providers are fostering collaborative ecosystems for optimized supply chain solutions. Market expansion into under-served regions or specialized cargo handling niches offers potential for diversification and revenue growth. Furthermore, the integration of blockchain technology for enhanced cargo tracking and secure transactions is an emerging opportunity to improve transparency and efficiency. The focus on green port initiatives and the development of cold chain logistics infrastructure also represent significant growth avenues.

Leading Players in the Europe Container Terminal Operations Market Sector

- Ports America Inc

- Bayliner

- SSA Marine

- Rhenus Group

- Husky Terminal and Stevedoring LLC

- Viking Line

- Indiana Port Commission

- MEYER WERFT GmbH & Co KG

- Mississippi State Port Authority at Gulfport

- Mediterranean Shipping Company S A

Key Milestones in Europe Container Terminal Operations Market Industry

- 2019: Increased investment in port automation technologies across major North European ports.

- 2020: Launch of several digitalization initiatives aimed at improving cargo visibility and operational efficiency in response to supply chain pressures.

- 2021: Significant M&A activity focused on consolidating market share and expanding service portfolios.

- 2022: Growing adoption of AI-powered solutions for optimizing yard management and vessel scheduling.

- 2023: Introduction of new environmental regulations pushing for greener terminal operations and shore power adoption.

- 2024: Expansion of intermodal connectivity through new rail and inland waterway links for key European ports.

Strategic Outlook for Europe Container Terminal Operations Market Market

The strategic outlook for the Europe Container Terminal Operations Market is characterized by a strong emphasis on technological integration, operational resilience, and sustainability. Growth accelerators will include the widespread deployment of AI and IoT for predictive analytics and autonomous operations, further optimizing efficiency and reducing costs. Strategic partnerships and collaborations will be crucial for developing end-to-end supply chain solutions and enhancing network connectivity. Investment in green technologies and sustainable practices will not only address regulatory demands but also attract environmentally conscious stakeholders. The market is expected to witness continued consolidation and specialized service offerings, catering to the evolving needs of global trade and logistics.

Europe Container Terminal Operations Market Segmentation

-

1. Service

- 1.1. Stevedoring

- 1.2. Cargo and handling transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Dry Cargo

- 2.2. Crude Oil

- 2.3. Other Liquid Cargo

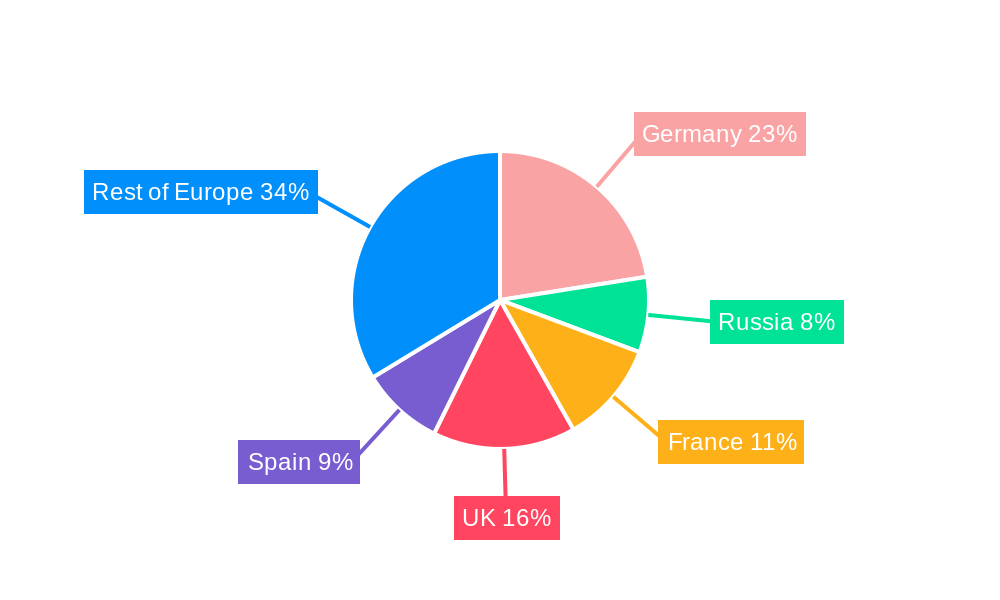

Europe Container Terminal Operations Market Segmentation By Geography

- 1. Germany

- 2. Russia

- 3. France

- 4. UK

- 5. Spain

- 6. Rest of Europe

Europe Container Terminal Operations Market Regional Market Share

Geographic Coverage of Europe Container Terminal Operations Market

Europe Container Terminal Operations Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing global trade activities; Infrastructure Development is on rise

- 3.3. Market Restrains

- 3.3.1. Manufacturers' lack of control over logistics services and also increasing logistical costs

- 3.4. Market Trends

- 3.4.1. Smart Port Infrastructure Drove the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Stevedoring

- 5.1.2. Cargo and handling transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Dry Cargo

- 5.2.2. Crude Oil

- 5.2.3. Other Liquid Cargo

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. Russia

- 5.3.3. France

- 5.3.4. UK

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Germany Europe Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Stevedoring

- 6.1.2. Cargo and handling transportation

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Cargo Type

- 6.2.1. Dry Cargo

- 6.2.2. Crude Oil

- 6.2.3. Other Liquid Cargo

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Russia Europe Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Stevedoring

- 7.1.2. Cargo and handling transportation

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Cargo Type

- 7.2.1. Dry Cargo

- 7.2.2. Crude Oil

- 7.2.3. Other Liquid Cargo

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. France Europe Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Stevedoring

- 8.1.2. Cargo and handling transportation

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Cargo Type

- 8.2.1. Dry Cargo

- 8.2.2. Crude Oil

- 8.2.3. Other Liquid Cargo

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. UK Europe Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Stevedoring

- 9.1.2. Cargo and handling transportation

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Cargo Type

- 9.2.1. Dry Cargo

- 9.2.2. Crude Oil

- 9.2.3. Other Liquid Cargo

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Spain Europe Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Stevedoring

- 10.1.2. Cargo and handling transportation

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Cargo Type

- 10.2.1. Dry Cargo

- 10.2.2. Crude Oil

- 10.2.3. Other Liquid Cargo

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Rest of Europe Europe Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Stevedoring

- 11.1.2. Cargo and handling transportation

- 11.1.3. Others

- 11.2. Market Analysis, Insights and Forecast - by Cargo Type

- 11.2.1. Dry Cargo

- 11.2.2. Crude Oil

- 11.2.3. Other Liquid Cargo

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Ports America Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Bayliner

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 SSA Marine

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Rhenus Group

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Husky Terminal and Stevedoring LLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Viking Line

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Indiana Port Commission

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 MEYER WERFT GmbH & Co KG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Mississippi State Port Authority at Gulfport**List Not Exhaustive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Mediterranean Shipping Company S A

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Ports America Inc

List of Figures

- Figure 1: Europe Container Terminal Operations Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Container Terminal Operations Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Europe Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 3: Europe Container Terminal Operations Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Europe Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 6: Europe Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Europe Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Europe Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 9: Europe Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Europe Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 11: Europe Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 12: Europe Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Europe Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 15: Europe Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 17: Europe Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 18: Europe Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Europe Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 20: Europe Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 21: Europe Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Container Terminal Operations Market?

The projected CAGR is approximately 3.70%.

2. Which companies are prominent players in the Europe Container Terminal Operations Market?

Key companies in the market include Ports America Inc, Bayliner, SSA Marine, Rhenus Group, Husky Terminal and Stevedoring LLC, Viking Line, Indiana Port Commission, MEYER WERFT GmbH & Co KG, Mississippi State Port Authority at Gulfport**List Not Exhaustive, Mediterranean Shipping Company S A.

3. What are the main segments of the Europe Container Terminal Operations Market?

The market segments include Service, Cargo Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing global trade activities; Infrastructure Development is on rise.

6. What are the notable trends driving market growth?

Smart Port Infrastructure Drove the Market.

7. Are there any restraints impacting market growth?

Manufacturers' lack of control over logistics services and also increasing logistical costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Container Terminal Operations Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Container Terminal Operations Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Container Terminal Operations Market?

To stay informed about further developments, trends, and reports in the Europe Container Terminal Operations Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence