Key Insights

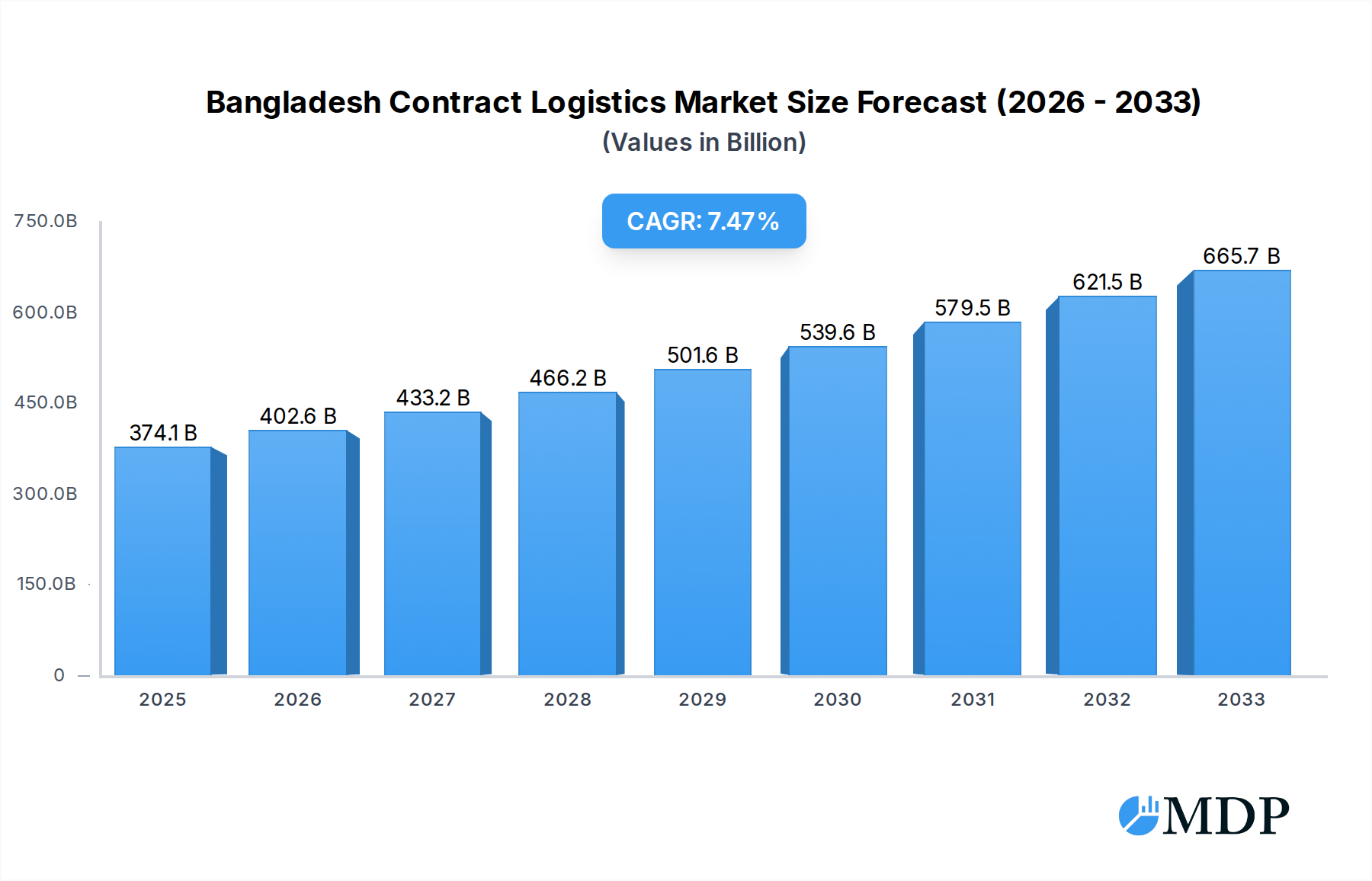

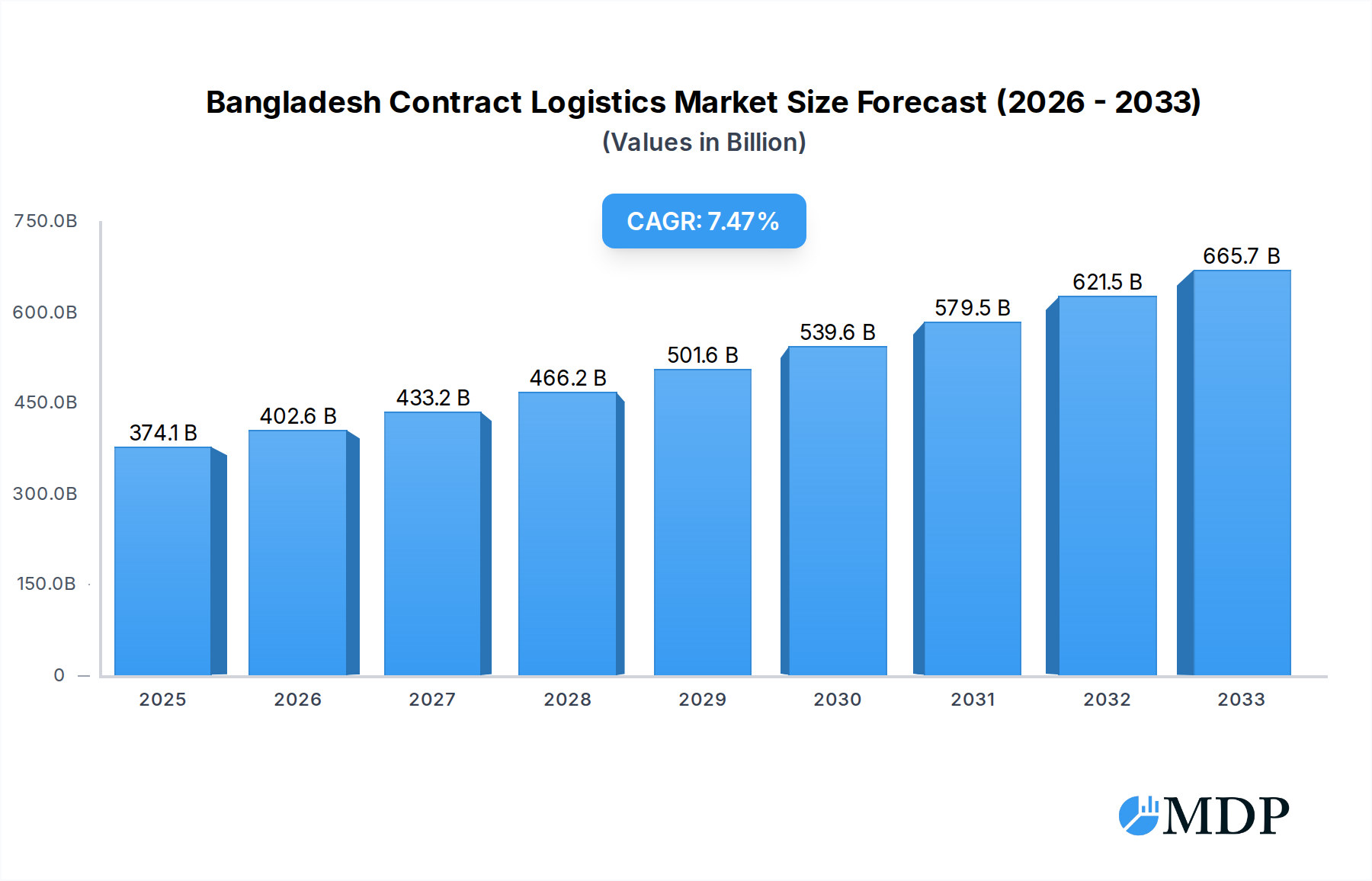

The Bangladesh contract logistics market is poised for robust expansion, driven by burgeoning trade activities and an increasing emphasis on supply chain efficiency across key sectors. With an estimated market size of 374.09 billion USD in 2025, the sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.56% through 2033. This growth is primarily fueled by the expanding manufacturing and automotive industries, coupled with a dynamic consumer goods and retail sector. The high-tech and healthcare and pharmaceuticals industries are also contributing significantly as they increasingly rely on specialized logistics solutions for their complex supply chains. The shift towards outsourced logistics services is a prominent trend, as businesses seek to leverage the expertise and infrastructure of third-party logistics providers to optimize operations, reduce costs, and enhance service delivery. This strategic outsourcing allows companies to focus on their core competencies while entrusting logistics management to specialists.

Bangladesh Contract Logistics Market Market Size (In Billion)

The market dynamics are further shaped by the increasing sophistication of logistics networks within Bangladesh. Major global players like Maersk, DHL, and Kuehne + Nagel are actively involved, alongside emerging local providers such as Navana Logistics and SARVAM Logistics, indicating a competitive landscape. While the market exhibits strong growth potential, certain restraints might emerge, such as infrastructural bottlenecks and the need for further technological integration in smaller enterprises. However, the overall trajectory points towards a mature and integrated contract logistics ecosystem. The substantial investment and strategic focus on improving logistics infrastructure and digital capabilities are expected to mitigate these challenges, paving the way for sustained growth and innovation in the Bangladesh contract logistics market, particularly benefiting the manufacturing, retail, and high-tech sectors.

Bangladesh Contract Logistics Market Company Market Share

Bangladesh Contract Logistics Market: Comprehensive Industry Analysis & Growth Forecast (2019-2033)

This in-depth report provides a granular analysis of the Bangladesh contract logistics market, a dynamic sector poised for significant expansion. Delve into market drivers, emerging trends, competitive landscapes, and future outlooks, supported by robust data and expert insights. Uncover strategic opportunities within segments like Manufacturing & Automotive and Consumer Goods & Retail, and understand the impact of key players like Maersk and DHL Global Forwarding on shaping the industry's trajectory. Our analysis covers the historical period (2019-2024), base year (2025), and an extensive forecast period (2025-2033) to offer a complete picture of this evolving market.

Bangladesh Contract Logistics Market Market Dynamics & Concentration

The Bangladesh contract logistics market is characterized by a moderate level of concentration, with a few key global players and an increasing number of local entities vying for market share. Innovation is primarily driven by the demand for more efficient and technologically advanced supply chain solutions, particularly from the booming readymade garments (RMG) sector. Regulatory frameworks are evolving to support logistics infrastructure development, but inconsistencies can still pose challenges. Product substitutes are limited in the context of comprehensive contract logistics services, emphasizing the importance of tailored solutions. End-user trends are shifting towards greater reliance on outsourced logistics to optimize costs and focus on core competencies. Mergers and acquisitions (M&A) activities, while not yet at a fever pitch, are expected to increase as larger players seek to consolidate their presence and acquire local expertise. The market share distribution is dynamic, with major players like Maersk and DHL Global Forwarding holding significant portions, estimated to be in the range of 15-20% collectively. M&A deal counts, currently estimated at 2-3 significant transactions per year, are projected to rise.

- Market Concentration: Moderate, with a mix of global and local players.

- Innovation Drivers: Technology adoption (automation, real-time tracking), sustainability initiatives, and specialized industry solutions.

- Regulatory Frameworks: Evolving, with a focus on infrastructure development and trade facilitation, though bureaucratic processes remain a consideration.

- Product Substitutes: Limited for end-to-end contract logistics solutions; focus on service quality and customization.

- End-User Trends: Increasing outsourcing for efficiency, specialized handling requirements for sectors like pharmaceuticals and high-tech.

- M&A Activities: Expected to grow as companies seek market consolidation and expansion.

Bangladesh Contract Logistics Market Industry Trends & Analysis

The Bangladesh contract logistics market is experiencing robust growth, fueled by the nation's expanding manufacturing base, increasing export volumes, and a growing emphasis on supply chain efficiency. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is an impressive xx%, indicating substantial market expansion. This growth is largely propelled by the burgeoning RMG sector, which relies heavily on efficient inbound and outbound logistics for raw materials and finished goods. Furthermore, the government's strategic initiatives to improve infrastructure, including port expansions and connectivity, are creating a more conducive environment for logistics operations. The increasing adoption of technology, such as Warehouse Management Systems (WMS) and Transportation Management Systems (TMS), is enhancing operational efficiency and visibility. Consumer preferences for faster delivery times and customized logistics solutions are also playing a crucial role in shaping service offerings. The competitive landscape is intensifying, with both international giants and agile local players striving to capture market share. Market penetration of advanced contract logistics services is still in its nascent stages for certain segments, offering significant room for growth. The demand for specialized logistics for high-growth sectors like healthcare and pharmaceuticals, requiring temperature-controlled and compliant handling, is a significant trend.

Leading Markets & Segments in Bangladesh Contract Logistics Market

Within the Bangladesh contract logistics market, the Outsourced segment is poised to dominate, driven by businesses seeking to leverage specialized expertise and reduce operational overheads. This segment is projected to capture an estimated xx% of the market share by 2033. The Manufacturing and Automotive sector is a key end-user segment, contributing significantly to market demand due to the extensive supply chains involved in production and distribution, estimated to account for xx% of the market. The Consumer Goods and Retail segment also represents a substantial portion, driven by e-commerce growth and the need for efficient last-mile delivery solutions.

Dominant Type Segment: Outsourced Contract Logistics

- Key Drivers: Cost optimization for businesses, access to specialized infrastructure and technology, focus on core competencies, scalability of operations.

- Dominance Analysis: Businesses are increasingly recognizing the strategic advantage of outsourcing their logistics functions. This allows them to benefit from economies of scale offered by specialized logistics providers, access to advanced warehousing and transportation technologies, and reduced capital expenditure on logistics infrastructure. The increasing complexity of supply chains further amplifies the need for professional logistics management.

Dominant End User Segment: Manufacturing and Automotive

- Key Drivers: Complex inbound and outbound supply chain requirements, just-in-time (JIT) inventory management, need for specialized handling of components and finished products, growing export-oriented manufacturing.

- Dominance Analysis: The manufacturing sector, particularly the dominant readymade garments industry, requires extensive logistics support for sourcing raw materials, managing work-in-progress inventory, and distributing finished goods globally. The automotive sector, though still developing in Bangladesh, also presents substantial logistics needs for vehicle assembly and parts distribution. The integration of these industries into global value chains necessitates sophisticated contract logistics solutions.

Other Significant Segments:

- Consumer Goods and Retail: Driven by the rise of modern retail and e-commerce, demanding efficient warehousing, inventory management, and last-mile delivery.

- Healthcare and Pharmaceuticals: Characterized by stringent regulatory requirements, cold chain logistics, and the need for specialized handling of sensitive products.

- High-tech: Requires secure warehousing, specialized transportation for delicate electronics, and efficient reverse logistics.

Bangladesh Contract Logistics Market Product Developments

Product developments in the Bangladesh contract logistics market are increasingly focused on leveraging technology to enhance efficiency, visibility, and customer experience. Innovations include the deployment of advanced Warehouse Management Systems (WMS) for optimized inventory control and space utilization, and sophisticated Transportation Management Systems (TMS) for route planning and load optimization. Real-time tracking solutions, utilizing GPS and IoT devices, are becoming standard, providing clients with end-to-end visibility of their shipments. Furthermore, there is a growing emphasis on sustainable logistics practices, with companies exploring eco-friendly transportation options and warehouse designs. The competitive advantage for providers lies in their ability to offer integrated, technology-driven solutions tailored to specific industry needs, such as temperature-controlled logistics for pharmaceuticals or specialized handling for high-value goods.

Key Drivers of Bangladesh Contract Logistics Market Growth

Several key drivers are propelling the growth of the Bangladesh contract logistics market. The robust expansion of the manufacturing sector, particularly the readymade garments industry, is a primary catalyst, demanding efficient supply chain solutions for raw material sourcing and finished goods distribution. Government initiatives aimed at improving infrastructure, such as port development and connectivity, are significantly enhancing logistical capabilities. The increasing adoption of technology and automation within warehouses and for transportation is boosting operational efficiency and reducing costs. Furthermore, growing foreign direct investment (FDI) in various sectors necessitates more sophisticated and reliable logistics services. Finally, the rising e-commerce penetration is creating a substantial demand for agile and efficient last-mile delivery and fulfillment services.

Challenges in the Bangladesh Contract Logistics Market Market

Despite its strong growth trajectory, the Bangladesh contract logistics market faces several significant challenges. Inadequate infrastructure, particularly outside major urban centers, can lead to increased transit times and higher operational costs. Bureaucratic hurdles and complex customs procedures can cause delays and hinder the smooth flow of goods. Limited availability of skilled labor for specialized logistics operations and a shortage of trained personnel in areas like supply chain management present a constraint. Intense competition among existing players, coupled with price sensitivity from some clients, can put pressure on profit margins. Furthermore, regulatory inconsistencies and challenges in enforcing compliance can create an uneven playing field.

Emerging Opportunities in Bangladesh Contract Logistics Market

Emerging opportunities in the Bangladesh contract logistics market are abundant, driven by several catalysts for long-term growth. The expansion of e-commerce presents a significant opportunity for the development of specialized fulfillment centers and last-mile delivery networks. Technological breakthroughs in areas like AI-powered route optimization, predictive analytics for demand forecasting, and drone delivery (in specific contexts) offer avenues for service differentiation. Strategic partnerships between local logistics providers and international players can facilitate knowledge transfer and access to global best practices. The increasing focus on value-added services, such as kitting, assembly, and reverse logistics, offers higher margin potential. Furthermore, the growing awareness of sustainability is creating opportunities for providers offering eco-friendly logistics solutions.

Leading Players in the Bangladesh Contract Logistics Market Sector

- Maersk

- DHL Global Forwarding

- Ceva Logistics

- We Freight

- Kuehne + Nagel

- Bolloré Logistics

- GEODIS

- XPO Logistics

- Agility Logistics Pvt Ltd

- Navana Logistics

- SARVAM Logistics

- 3i Logistics

- DB Schenker

- DSV

Key Milestones in Bangladesh Contract Logistics Market Industry

- May 2023: DHL Global Forwarding committed over 2 million euros to expand its specialized Container Freight Station (CFS) capacity, addressing the critical need for such facilities in Bangladesh, where fewer than 20 are operational. These CFSs are vital for consolidating products from various sources into single containers for efficient transportation.

- November 2022: Maersk initiated the construction of a new 100,000-square-foot warehouse in Chattogram. This expansion enhances Maersk's warehousing operations and offers strategic proximity to Chattogram Port, with excellent access to the Dhaka-Chattogram Highway via the Outer Ring Road and Karnaphuly Tunnel, benefiting garment exporters.

- July 2022: [Specific development detail for July 2022 is missing and thus not included in the report description.]

Strategic Outlook for Bangladesh Contract Logistics Market Market

The strategic outlook for the Bangladesh contract logistics market is highly optimistic, driven by a confluence of economic growth and evolving industry demands. Future market potential will be significantly shaped by continued investment in modernizing logistics infrastructure, including dedicated freight corridors and advanced port facilities. The increasing adoption of digital technologies will be crucial for enhancing supply chain visibility, efficiency, and data analytics capabilities. Strategic opportunities lie in developing specialized logistics solutions for high-growth sectors like pharmaceuticals, perishables, and e-commerce. Furthermore, fostering public-private partnerships can accelerate infrastructure development and regulatory reforms. Companies that focus on building a skilled workforce and embracing sustainable logistics practices will be well-positioned for long-term success and market leadership in this dynamic and expanding sector.

Bangladesh Contract Logistics Market Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Consumer Goods and Retail

- 2.3. High-tech

- 2.4. Healthcare and Pharmaceuticals

- 2.5. Other End Users

Bangladesh Contract Logistics Market Segmentation By Geography

- 1. Bangladesh

Bangladesh Contract Logistics Market Regional Market Share

Geographic Coverage of Bangladesh Contract Logistics Market

Bangladesh Contract Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 SAG'S Increased Focus Toward Transportation Infrastructure

- 3.2.2 Including Railways

- 3.2.3 Airports

- 3.2.4 And Seaports; Establishment Of Special Economic Zones

- 3.3. Market Restrains

- 3.3.1. Limited Visible of Shipments; Increasing Transportation

- 3.4. Market Trends

- 3.4.1. Pharmaceutical and healthcare spending is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladesh Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Consumer Goods and Retail

- 5.2.3. High-tech

- 5.2.4. Healthcare and Pharmaceuticals

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Maresk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ceva Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 We Freight

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kuhene + Nagel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bolloré Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GEODIS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 XPO Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Agility Logistics Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Navana Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SARVAM Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 3i Logistics

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 DB Schenkar

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 DSV

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Maresk

List of Figures

- Figure 1: Bangladesh Contract Logistics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Bangladesh Contract Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Bangladesh Contract Logistics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Bangladesh Contract Logistics Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Bangladesh Contract Logistics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Bangladesh Contract Logistics Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Bangladesh Contract Logistics Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Bangladesh Contract Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladesh Contract Logistics Market?

The projected CAGR is approximately 7.56%.

2. Which companies are prominent players in the Bangladesh Contract Logistics Market?

Key companies in the market include Maresk, DHL, Ceva Logistics, We Freight, Kuhene + Nagel, Bolloré Logistics, GEODIS, XPO Logistics, Agility Logistics Pvt Ltd, Navana Logistics, SARVAM Logistics, 3i Logistics, DB Schenkar, DSV.

3. What are the main segments of the Bangladesh Contract Logistics Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

SAG'S Increased Focus Toward Transportation Infrastructure. Including Railways. Airports. And Seaports; Establishment Of Special Economic Zones.

6. What are the notable trends driving market growth?

Pharmaceutical and healthcare spending is driving the market.

7. Are there any restraints impacting market growth?

Limited Visible of Shipments; Increasing Transportation.

8. Can you provide examples of recent developments in the market?

May 2023: To serve Bangladesh's ever-expanding readymade garments (RMG) industry, DHL Global Forwarding, the freight-specializing division of Deutsche Post DHL Group, recently committed more than 2 million euros to extend its specialized Container Freight Station (CFS) capacity. Less than 20 CFSs are present in the entire nation of Bangladesh, making CFSs rare. These facilities assist in gathering products from various sources, combining them into a single container, and then transporting the container to the desired location.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladesh Contract Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladesh Contract Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladesh Contract Logistics Market?

To stay informed about further developments, trends, and reports in the Bangladesh Contract Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence