Key Insights

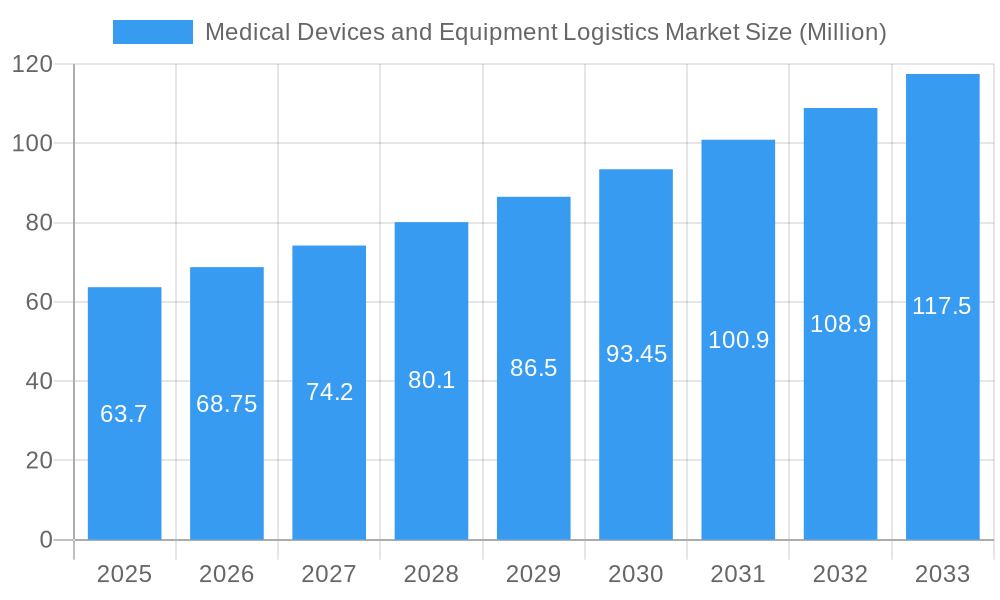

The Medical Devices and Equipment Logistics Market is poised for robust expansion, projected to reach a substantial USD 63.70 million in 2025 and grow at a compelling Compound Annual Growth Rate (CAGR) of 7.81% through 2033. This significant market size and growth trajectory are underpinned by several key drivers, primarily the increasing global demand for advanced medical technologies and the growing complexity of healthcare supply chains. The escalating prevalence of chronic diseases worldwide necessitates a steady influx of specialized medical devices and equipment, from sophisticated diagnostic tools to life-saving therapeutic machinery. Furthermore, an aging global population, coupled with rising healthcare expenditures in emerging economies, is fueling demand for both standard and specialized medical products. The shift towards home healthcare and remote patient monitoring also contributes to the logistical challenges and opportunities, requiring efficient, temperature-controlled, and secure transportation solutions for a diverse range of medical items. Key trends shaping the market include the adoption of advanced tracking and monitoring technologies, such as IoT and blockchain, to enhance visibility and security within the cold chain, and the increasing focus on specialized logistics services tailored for different medical product categories like pharmaceuticals, biologics, and capital equipment.

Medical Devices and Equipment Logistics Market Market Size (In Million)

The market's expansion, however, is not without its challenges. Stringent regulatory compliance across different regions for the transportation of medical devices and equipment presents a significant hurdle, requiring specialized knowledge and adherence to rigorous standards. The high cost associated with specialized logistics, including temperature-controlled warehousing and transportation, can also act as a restraint, particularly for smaller manufacturers or in less developed markets. Supply chain disruptions, whether due to geopolitical events, natural disasters, or pandemics, further complicate operations and necessitate resilient logistical strategies. Despite these challenges, the inherent necessity of timely and secure delivery of medical products for patient care, combined with ongoing technological advancements and strategic partnerships between healthcare providers and logistics companies, suggests a dynamic and growth-oriented future for the Medical Devices and Equipment Logistics Market. Key players like UPS Healthcare, DHL Supply Chain, and FedEx Healthcare Solutions are heavily investing in specialized infrastructure and services to capitalize on these evolving market demands.

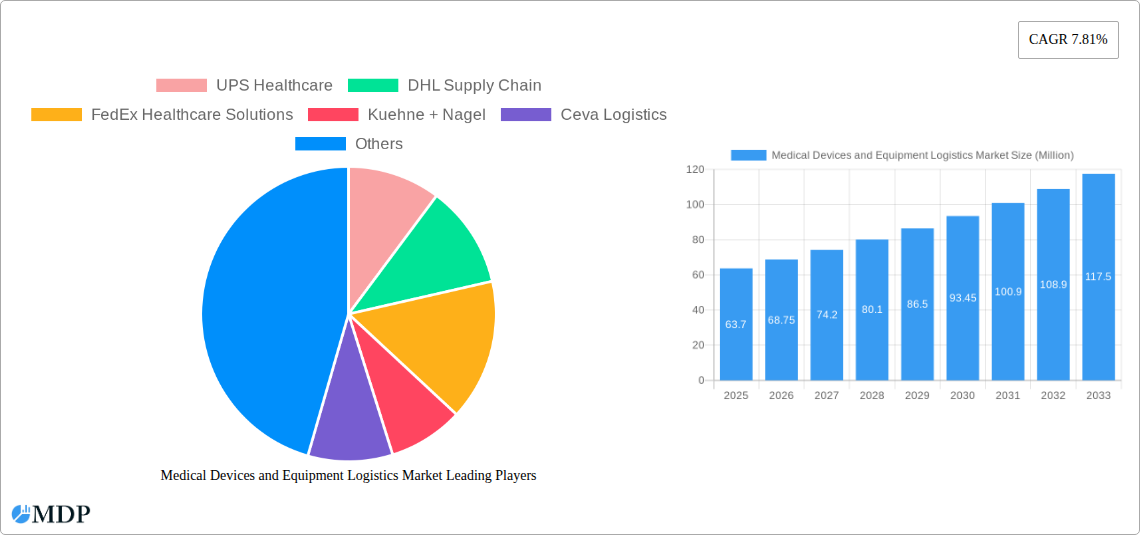

Medical Devices and Equipment Logistics Market Company Market Share

Unlock critical insights into the burgeoning Medical Devices and Equipment Logistics Market. This in-depth report, covering 2019–2033 with a base and estimated year of 2025, delves into market dynamics, industry trends, leading segments, product innovations, growth drivers, challenges, opportunities, and the strategic moves of key players like UPS Healthcare, DHL Supply Chain, FedEx Healthcare Solutions, Kuehne + Nagel, Ceva Logistics, Cardinal Health, Owens & Minor, DB Schenker, DSV, and World Courier (List Not Exhaustive; 7+ Other Companies). Navigate the complexities of medical device logistics with actionable intelligence for stakeholders seeking to capitalize on this rapidly evolving sector.

Medical Devices and Equipment Logistics Market Market Dynamics & Concentration

The Medical Devices and Equipment Logistics Market is characterized by moderate to high concentration, with a significant share held by a few dominant global logistics providers specializing in healthcare. Innovation drivers are primarily focused on enhancing supply chain visibility, temperature-controlled logistics, and the adoption of advanced technologies like AI and blockchain for improved tracking and compliance. Regulatory frameworks, including GDP (Good Distribution Practice) and HIPAA, significantly influence market operations, demanding stringent adherence to quality and security standards. Product substitutes are limited given the specialized nature of medical logistics, but advancements in portable diagnostic tools and remote monitoring technologies indirectly impact the demand for traditional equipment logistics. End-user trends reveal a growing preference for integrated logistics solutions, outsourcing non-core functions, and a demand for specialized handling of sensitive and high-value medical products. Mergers and acquisitions (M&A) activities are moderately prevalent, driven by the pursuit of expanded geographical reach, specialized service offerings, and economies of scale. For instance, recent M&A activities within the broader healthcare logistics space have seen some providers consolidating their operations to better serve the complex needs of the medical device industry. The market share distribution is heavily skewed towards established players, with approximately 60-70% of the market share concentrated among the top 5-7 companies. M&A deal counts have averaged around 5-8 significant transactions annually over the historical period (2019-2024).

Medical Devices and Equipment Logistics Market Industry Trends & Analysis

The Medical Devices and Equipment Logistics Market is poised for robust expansion, driven by several interconnected trends and factors. The increasing global healthcare expenditure, fueled by an aging population and the rising prevalence of chronic diseases, directly translates into higher demand for medical devices and equipment, thereby necessitating efficient logistics solutions. Technological advancements in medical devices, leading to smaller, more complex, and highly specialized equipment, demand sophisticated handling, storage, and transportation capabilities, including cold chain and sterile environments. The accelerating pace of clinical trials worldwide, particularly in emerging economies, also creates a significant demand for specialized logistics services to manage the timely and secure delivery of trial materials and samples. The growing emphasis on patient-centric care and the increasing adoption of home healthcare models are further driving the need for last-mile delivery of medical devices directly to patient residences, often requiring specialized delivery protocols and trained personnel.

Furthermore, the ongoing digitalization of healthcare supply chains is a transformative trend. Companies are investing heavily in integrated platforms that offer end-to-end visibility, real-time tracking, inventory management, and predictive analytics. This digital transformation is crucial for optimizing routes, minimizing transit times, ensuring compliance with temperature excursions, and reducing overall logistics costs. The advent of advanced technologies like IoT sensors for real-time monitoring of temperature, humidity, and shock, coupled with blockchain for enhanced traceability and security, is revolutionizing how medical devices are transported and managed. The market penetration of these advanced technologies is steadily increasing, with an estimated CAGR of 8-10% for specialized cold chain logistics services and a projected CAGR of 7-9% for the overall market during the forecast period. Consumer preferences are also evolving, with healthcare providers and manufacturers increasingly seeking logistics partners that can offer customized solutions, reliable service, and a demonstrated commitment to quality and safety. The competitive dynamics within the market are intense, with a constant push for service differentiation, operational efficiency, and geographical expansion. Companies are differentiating themselves through specialized service offerings, such as high-value equipment logistics, implant logistics, and specialized temperature-controlled transport for biologics and vaccines, all of which are integral components of the broader medical device logistics landscape.

Leading Markets & Segments in Medical Devices and Equipment Logistics Market

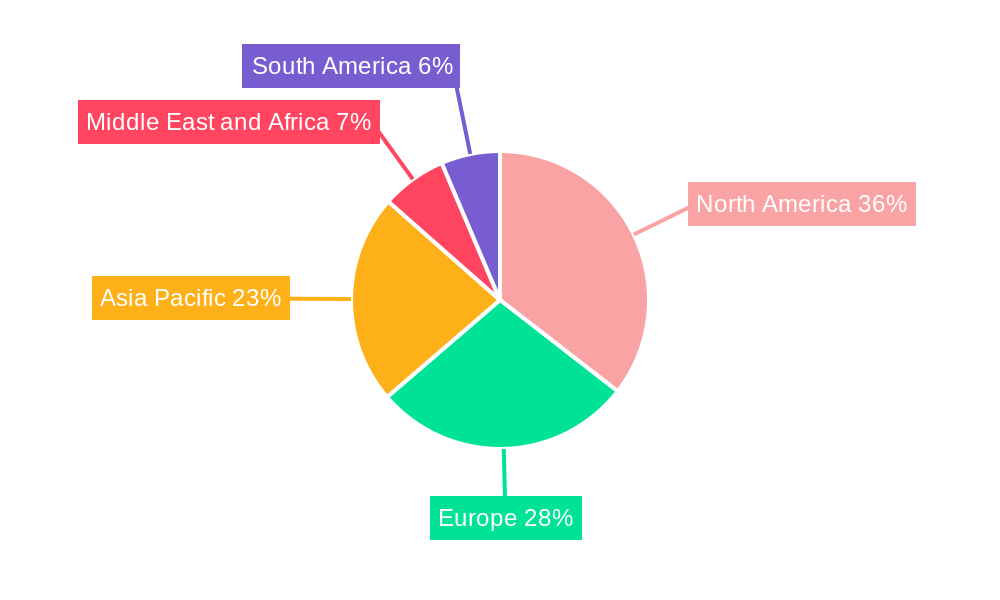

The Medical Devices and Equipment Logistics Market exhibits significant regional variations and segment dominance.

Dominant Region: North America currently holds a substantial market share due to its advanced healthcare infrastructure, high per capita healthcare spending, and a robust presence of medical device manufacturers and research institutions. The United States, in particular, drives this dominance through stringent regulatory oversight and a large patient pool demanding sophisticated medical technologies.

Emerging Markets: Asia-Pacific is witnessing the fastest growth rate, propelled by increasing healthcare investments, a burgeoning middle class, and a growing demand for advanced medical treatments and devices. Countries like China and India are becoming pivotal hubs for both manufacturing and consumption of medical products, consequently boosting their logistics requirements.

Product Type Dominance:

- Medical Devices: This segment commands a larger share due to the sheer volume and diverse range of products, from consumables and diagnostic tools to advanced implantable devices. Key drivers for its dominance include:

- Technological Innovation: Continuous development of new and complex medical devices.

- Aging Global Population: Increased demand for devices related to chronic disease management and age-related conditions.

- Growing Healthcare Access: Expansion of healthcare services in emerging economies.

- Medical Equipment: While representing a smaller segment by volume compared to consumables, medical equipment logistics are critical for high-value, large-scale items such as MRI machines, CT scanners, and surgical robots. Their dominance is influenced by:

- Capital Investments: Significant expenditure by hospitals and healthcare facilities on advanced diagnostic and therapeutic equipment.

- Installation & Maintenance: The need for specialized logistics that includes installation, calibration, and often on-site maintenance support.

- Infrastructure Development: Expansion of new hospitals and diagnostic centers, especially in developing regions.

Country-Level Dominance: Beyond the US, countries like Germany, Japan, and the United Kingdom are significant contributors to the market's value due to their established healthcare systems and strong domestic medical device industries. The economic policies in these nations, often supporting R&D and healthcare innovation, directly translate into sustained demand for sophisticated logistics.

Medical Devices and Equipment Logistics Market Product Developments

Product developments in the Medical Devices and Equipment Logistics Market are largely centered around enhancing efficiency, security, and compliance. Innovations include specialized packaging solutions that offer superior temperature control and shock absorption for sensitive devices, such as advanced cryo-packaging for biological samples and temperature-controlled containers for vaccines and pharmaceuticals. The integration of IoT sensors within logistics operations allows for real-time monitoring of environmental conditions during transit, providing crucial data for compliance and quality assurance. Furthermore, the development of software platforms that offer end-to-end supply chain visibility, predictive analytics for inventory management, and automated compliance reporting are enhancing the competitive advantages for logistics providers. These product developments aim to address the stringent requirements for handling high-value, time-sensitive, and temperature-critical medical products, ensuring patient safety and product integrity throughout the supply chain.

Key Drivers of Medical Devices and Equipment Logistics Market Growth

The Medical Devices and Equipment Logistics Market is propelled by several key growth drivers:

- Technological Advancements in Healthcare: The continuous innovation in medical devices, leading to smaller, more complex, and often temperature-sensitive products, necessitates specialized and advanced logistics solutions.

- Aging Global Population & Chronic Diseases: The increasing prevalence of age-related illnesses and chronic conditions worldwide drives sustained demand for a wide range of medical devices and equipment.

- Growth of the Pharmaceutical and Biotechnology Sectors: The expanding market for biologics, vaccines, and specialized therapies requires sophisticated cold chain logistics, a core competency in medical device logistics.

- Increasing Healthcare Expenditure: Rising investments in healthcare infrastructure and services globally, particularly in emerging economies, directly fuels the demand for medical devices and their associated logistics.

- Stringent Regulatory Compliance: The need to adhere to strict Good Distribution Practices (GDP) and other healthcare regulations necessitates highly controlled and compliant logistics operations.

Challenges in the Medical Devices and Equipment Logistics Market Market

Despite its growth, the Medical Devices and Equipment Logistics Market faces significant challenges:

- Regulatory Hurdles: Navigating complex and diverse international regulations for medical devices and pharmaceuticals can be challenging, requiring constant updates and specialized expertise.

- Cold Chain Integrity: Maintaining precise temperature control throughout the supply chain for sensitive products is critical and technically demanding, with significant financial implications if compromised.

- Counterfeiting and Diversion: The high value of medical devices makes them susceptible to counterfeiting and diversion, necessitating robust security measures and traceability solutions.

- Skilled Workforce Shortage: A lack of trained personnel with expertise in handling specialized medical logistics, including cold chain management and hazardous material transport, poses a challenge.

- Rising Logistics Costs: Increasing fuel prices, labor costs, and the need for advanced infrastructure can escalate operational expenses, impacting profitability.

Emerging Opportunities in Medical Devices and Equipment Logistics Market

Emerging opportunities within the Medical Devices and Equipment Logistics Market are vast and driven by innovation and evolving healthcare landscapes:

- Expansion of E-commerce in Healthcare: The growing trend of online pharmacies and direct-to-consumer sales of medical devices and supplies opens new avenues for last-mile delivery and specialized e-logistics.

- Growth in Personalized Medicine: The rise of personalized medicine and gene therapies requires ultra-cold chain logistics and highly specialized handling for individual patient treatments.

- Increased Demand for Clinical Trial Logistics: The global expansion of clinical trials necessitates the secure and timely transportation of investigational products, biological samples, and essential trial equipment.

- Technological Integration: The adoption of AI, IoT, and blockchain offers opportunities for enhanced supply chain visibility, predictive maintenance, and improved compliance, creating value-added services.

- Emerging Market Penetration: Untapped potential in developing regions presents significant opportunities for logistics providers to establish and expand their specialized healthcare logistics networks.

Leading Players in the Medical Devices and Equipment Logistics Market Sector

- UPS Healthcare

- DHL Supply Chain

- FedEx Healthcare Solutions

- Kuehne + Nagel

- Ceva Logistics

- Cardinal Health

- Owens & Minor

- DB Schenker

- DSV

- World Courier

Key Milestones in Medical Devices and Equipment Logistics Market Industry

- April 2024: UPS Healthcare channeled EUR 55 million (USD 60 million) into expanding its footprint in Italy, adding 100,000 sq. m of warehouse space in Passo Corese and Somaglia to align facilities with stringent distribution and manufacturing practices for medical and pharmaceutical products.

- February 2024: FedEx Express inaugurated the 'FedEx Life Science Center' in Mumbai, India, a significant development enhancing the global clinical trial supply chain by catering to storage and logistics needs for domestic and international clinical trial clients.

Strategic Outlook for Medical Devices and Equipment Logistics Market Market

The strategic outlook for the Medical Devices and Equipment Logistics Market is overwhelmingly positive, driven by sustained global healthcare demand and continuous technological innovation. Logistics providers will focus on expanding their specialized cold chain capabilities, investing in advanced track-and-trace technologies, and developing integrated, end-to-end supply chain solutions. Strategic partnerships with medical device manufacturers, pharmaceutical companies, and healthcare providers will be crucial for securing long-term contracts and expanding service offerings. The increasing demand for localized warehousing and last-mile delivery in emerging markets presents a significant growth accelerator. Furthermore, a commitment to sustainability and digital transformation will be paramount for maintaining a competitive edge and meeting the evolving needs of the healthcare industry, positioning the market for continued robust growth.

Medical Devices and Equipment Logistics Market Segmentation

-

1. Product Type

- 1.1. Medical Devices

- 1.2. Medical Equipment

Medical Devices and Equipment Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Medical Devices and Equipment Logistics Market Regional Market Share

Geographic Coverage of Medical Devices and Equipment Logistics Market

Medical Devices and Equipment Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Global Expansion of Healthcare Services; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Global Expansion of Healthcare Services; Technological Advancements

- 3.4. Market Trends

- 3.4.1. Medical Devices Manufacturer Integrate Cutting-edge Logistics Solutions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Devices and Equipment Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Medical Devices

- 5.1.2. Medical Equipment

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Medical Devices and Equipment Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Medical Devices

- 6.1.2. Medical Equipment

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Medical Devices and Equipment Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Medical Devices

- 7.1.2. Medical Equipment

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Medical Devices and Equipment Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Medical Devices

- 8.1.2. Medical Equipment

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Medical Devices and Equipment Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Medical Devices

- 9.1.2. Medical Equipment

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Medical Devices and Equipment Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Medical Devices

- 10.1.2. Medical Equipment

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 UPS Healthcare

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DHL Supply Chain

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FedEx Healthcare Solutions

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kuehne + Nagel

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ceva Logistics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cardinal Health

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Owens & Minor

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DB Schenker

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DSV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 World Courier**List Not Exhaustive 7 3 Other Companie

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 UPS Healthcare

List of Figures

- Figure 1: Global Medical Devices and Equipment Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Medical Devices and Equipment Logistics Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Medical Devices and Equipment Logistics Market Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Medical Devices and Equipment Logistics Market Volume (Billion), by Product Type 2025 & 2033

- Figure 5: North America Medical Devices and Equipment Logistics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Medical Devices and Equipment Logistics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Medical Devices and Equipment Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Medical Devices and Equipment Logistics Market Volume (Billion), by Country 2025 & 2033

- Figure 9: North America Medical Devices and Equipment Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Medical Devices and Equipment Logistics Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Medical Devices and Equipment Logistics Market Revenue (Million), by Product Type 2025 & 2033

- Figure 12: Europe Medical Devices and Equipment Logistics Market Volume (Billion), by Product Type 2025 & 2033

- Figure 13: Europe Medical Devices and Equipment Logistics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Europe Medical Devices and Equipment Logistics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 15: Europe Medical Devices and Equipment Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Medical Devices and Equipment Logistics Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Medical Devices and Equipment Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Medical Devices and Equipment Logistics Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Medical Devices and Equipment Logistics Market Revenue (Million), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Medical Devices and Equipment Logistics Market Volume (Billion), by Product Type 2025 & 2033

- Figure 21: Asia Pacific Medical Devices and Equipment Logistics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Asia Pacific Medical Devices and Equipment Logistics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Asia Pacific Medical Devices and Equipment Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Medical Devices and Equipment Logistics Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Medical Devices and Equipment Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Medical Devices and Equipment Logistics Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East and Africa Medical Devices and Equipment Logistics Market Revenue (Million), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Medical Devices and Equipment Logistics Market Volume (Billion), by Product Type 2025 & 2033

- Figure 29: Middle East and Africa Medical Devices and Equipment Logistics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East and Africa Medical Devices and Equipment Logistics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Middle East and Africa Medical Devices and Equipment Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Middle East and Africa Medical Devices and Equipment Logistics Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Medical Devices and Equipment Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Medical Devices and Equipment Logistics Market Volume Share (%), by Country 2025 & 2033

- Figure 35: South America Medical Devices and Equipment Logistics Market Revenue (Million), by Product Type 2025 & 2033

- Figure 36: South America Medical Devices and Equipment Logistics Market Volume (Billion), by Product Type 2025 & 2033

- Figure 37: South America Medical Devices and Equipment Logistics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: South America Medical Devices and Equipment Logistics Market Volume Share (%), by Product Type 2025 & 2033

- Figure 39: South America Medical Devices and Equipment Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 40: South America Medical Devices and Equipment Logistics Market Volume (Billion), by Country 2025 & 2033

- Figure 41: South America Medical Devices and Equipment Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Medical Devices and Equipment Logistics Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 7: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United States Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 16: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 17: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Germany Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: France Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Italy Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Spain Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 33: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 35: China Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: China Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Japan Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Japan Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: India Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: India Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Australia Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Australia Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: South Korea Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Asia Pacific Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 48: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 49: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 51: GCC Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: GCC Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: South Africa Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: South Africa Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Rest of Middle East and Africa Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Middle East and Africa Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 58: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 59: Global Medical Devices and Equipment Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Medical Devices and Equipment Logistics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 61: Brazil Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Brazil Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Argentina Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Argentina Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Rest of South America Medical Devices and Equipment Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of South America Medical Devices and Equipment Logistics Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Devices and Equipment Logistics Market?

The projected CAGR is approximately 7.81%.

2. Which companies are prominent players in the Medical Devices and Equipment Logistics Market?

Key companies in the market include UPS Healthcare, DHL Supply Chain, FedEx Healthcare Solutions, Kuehne + Nagel, Ceva Logistics, Cardinal Health, Owens & Minor, DB Schenker, DSV, World Courier**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Medical Devices and Equipment Logistics Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Global Expansion of Healthcare Services; Technological Advancements.

6. What are the notable trends driving market growth?

Medical Devices Manufacturer Integrate Cutting-edge Logistics Solutions.

7. Are there any restraints impacting market growth?

Global Expansion of Healthcare Services; Technological Advancements.

8. Can you provide examples of recent developments in the market?

April 2024: UPS Healthcare channeled EUR 55 million (USD 60 million) into expanding its footprint in Italy. This investment sees the addition of 100,000 sq. m of warehouse space, split between Passo Corese, near Rome, and Somaglia in Lodi. With this financial commitment, UPS Healthcare aims to align the Passo Corese and Somaglia facilities with stringent distribution and manufacturing practices, ensuring the safe storage of medical and pharmaceutical products.February 2024: FedEx Express, a subsidiary of FedEx Corp., inaugurated the 'FedEx Life Science Center' in Mumbai, marking a milestone in India's and the global clinical trial supply chain. This new center is designed to cater to the storage and logistics needs of healthcare clients participating in clinical trials, both domestically in India and internationally shipping to the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Devices and Equipment Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Devices and Equipment Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Devices and Equipment Logistics Market?

To stay informed about further developments, trends, and reports in the Medical Devices and Equipment Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence