Key Insights

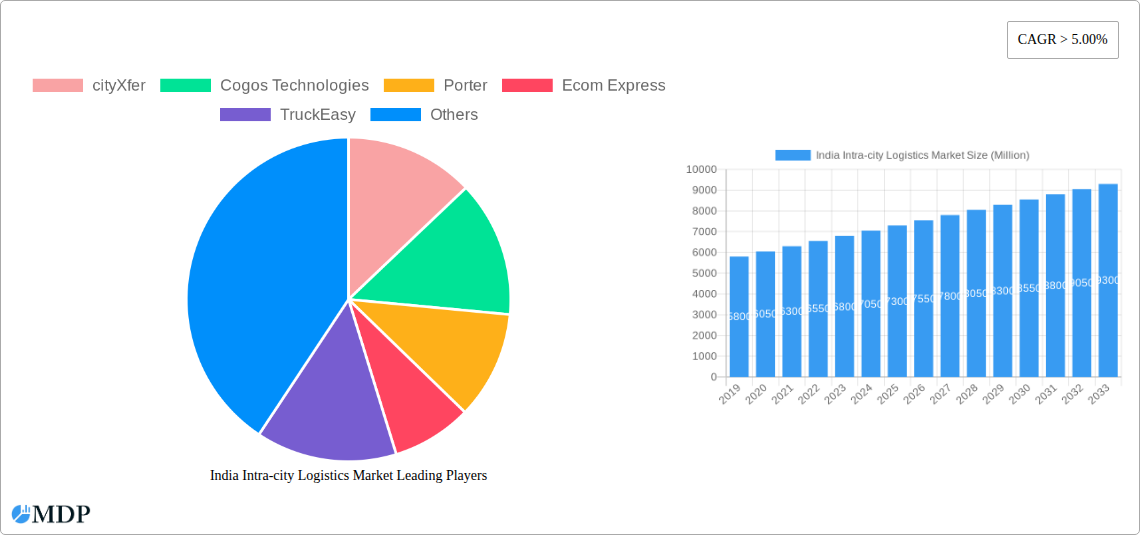

The India Intra-city Logistics Market is poised for significant expansion, projected to reach an estimated market size of USD 7,500 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) exceeding 5.00%. This growth is primarily fueled by the burgeoning e-commerce sector, which necessitates efficient and rapid last-mile delivery solutions across major urban centers. The increasing adoption of advanced technologies, including real-time tracking, route optimization software, and a growing fleet of electric vehicles, are key enablers of this expansion. Furthermore, the evolving consumer demand for faster deliveries and the "buy online, pick up in-store" (BOPIS) models are compelling businesses to invest in sophisticated intra-city logistics networks. Major metropolitan areas like Delhi, Bangalore, Mumbai, and Hyderabad are at the forefront of this transformation, experiencing a surge in demand for integrated logistics services that encompass transportation, warehousing, and value-added services.

India Intra-city Logistics Market Market Size (In Billion)

The market is witnessing a dynamic shift towards more integrated and technology-driven solutions. Companies like Porter, Shadowfax, and Ecom Express are leading this charge by offering comprehensive platforms that streamline the entire delivery process. The competitive landscape is characterized by both established players and agile startups, fostering innovation and efficiency. Warehousing and distribution services are crucial components, with a growing emphasis on strategically located micro-fulfillment centers within cities to reduce delivery times. Value-added services, such as reverse logistics and specialized handling, are also gaining traction as businesses seek end-to-end solutions. While the market benefits from strong demand, challenges such as increasing operational costs, traffic congestion in urban areas, and the need for skilled manpower in logistics management present potential restraints. However, the overall trajectory remains strongly positive, indicating a dynamic and evolving intra-city logistics ecosystem in India.

India Intra-city Logistics Market Company Market Share

Gain unparalleled insights into India's rapidly expanding intra-city logistics market. This comprehensive report delves deep into market dynamics, identifies key growth drivers, and forecasts future trends from 2019 to 2033. Discover strategic opportunities and understand the competitive landscape shaping urban logistics in India.

This report is an indispensable resource for logistics providers, e-commerce businesses, manufacturers, investors, and policymakers seeking to understand and capitalize on the burgeoning Indian intra-city logistics sector. We provide in-depth analysis of market concentration, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, and critical milestones, all meticulously analyzed for the period 2019–2033, with 2025 as the base and estimated year, and a 2025–2033 forecast period. The historical analysis covers 2019–2024.

India Intra-city Logistics Market Market Dynamics & Concentration

The India Intra-city Logistics Market is characterized by a moderate to high concentration, with a few prominent players holding significant market share, particularly in major metropolitan areas. Key innovation drivers include the relentless demand for faster last-mile delivery, fueled by the e-commerce boom, and the increasing adoption of technology for route optimization and fleet management. Regulatory frameworks are evolving, with a focus on improving road infrastructure, standardizing logistics operations, and promoting sustainable logistics solutions. Product substitutes are limited in the core transportation segment, but digital platforms offering end-to-end logistics solutions are gaining traction, blurring the lines between traditional service providers. End-user trends reveal a growing preference for on-demand delivery services, real-time tracking, and cost-effective logistics solutions across various industries. M&A activities are a significant indicator of market consolidation and strategic expansion. For instance, November 2022 saw Mahindra Logistics acquire delivery services provider Whizzard, bolstering their last-mile delivery and EV-based delivery capabilities. Similarly, July 2022, Bengaluru-based COGOS Technologies acquired Porter's FMCG modern trade business, strengthening its platform for municipal logistics. The market share of top players is estimated to be around 60-70% in key urban centers, with an average of 5-10 M&A deals annually over the past three years, indicating a dynamic and consolidating landscape.

India Intra-city Logistics Market Industry Trends & Analysis

The India Intra-city Logistics Market is experiencing robust growth, driven by a confluence of factors that are fundamentally reshaping urban supply chains. The e-commerce revolution remains the primary growth engine, with a consistent surge in online retail sales translating directly into higher demand for efficient and rapid last-mile deliveries. This trend is further amplified by the increasing adoption of online grocery shopping and the burgeoning quick-commerce segment, which necessitate extremely fast delivery times, often within minutes. Technological advancements are pivotal, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) for route optimization, demand forecasting, and warehouse management becoming standard. The proliferation of mobility solutions, including electric vehicles (EVs) and a growing fleet of two-wheelers, is enhancing delivery efficiency and sustainability. Consumer preferences are evolving towards greater convenience and transparency. Customers now expect real-time tracking of their shipments, flexible delivery windows, and a seamless return process. This shift compels logistics companies to invest in customer-centric technologies and service models. Competitive dynamics are intensifying, with both established players and agile startups vying for market dominance. The market is witnessing a rise in specialized logistics providers catering to specific industry needs, such as cold chain logistics for pharmaceuticals and perishables, and hyper-local delivery services for small businesses. The overall market penetration of organized intra-city logistics is estimated to be around 45%, with significant room for expansion. The Compound Annual Growth Rate (CAGR) for the India Intra-city Logistics Market is projected to be approximately 12-15% over the forecast period, a testament to its immense growth potential. Digitalization of logistics operations, from booking to proof of delivery, is becoming a critical differentiator, leading to increased operational efficiency and reduced costs. The growing urbanization and the expansion of Tier 2 and Tier 3 cities as consumption hubs are also contributing significantly to the market's expansion.

Leading Markets & Segments in India Intra-city Logistics Market

The Transportation segment stands as the dominant force within the India Intra-city Logistics Market, driven by the sheer volume of goods requiring movement within urban environments. This dominance is underpinned by the continuous surge in e-commerce and retail sales, which necessitates efficient pick-up and delivery services. Delhi, Bangalore, and Mumbai are the leading cities in terms of intra-city logistics activity, owing to their dense populations, thriving commercial hubs, and high concentration of e-commerce fulfillment centers. The economic policies promoting trade and commerce, coupled with substantial investments in infrastructure development, particularly improved road networks and urban logistics corridors, significantly boost these metropolitan areas.

- Transportation: This segment accounts for an estimated 70-75% of the total market revenue. Key drivers include the increasing number of online transactions, the growth of quick commerce, and the need for rapid last-mile delivery solutions.

- Warehousing and Distribution: Contributing approximately 20-25% of the market share, this segment is crucial for optimizing inventory management and facilitating timely deliveries. The expansion of fulfillment centers and dark stores within city limits is a significant growth catalyst.

- Value-added Services: This segment, comprising around 5-10% of the market, includes services like reverse logistics, packaging, and customized delivery solutions. As businesses aim to enhance customer satisfaction, the demand for these services is steadily rising.

The dominance of cities like Delhi, Bangalore, and Mumbai is further accentuated by their status as major economic and consumption centers. Bangalore, in particular, benefits from its strong presence of technology companies and a youthful, tech-savvy population that drives e-commerce adoption. Mumbai's position as India's financial capital and its vast industrial base ensure a constant flow of goods. Delhi, with its extensive network of distribution channels and a massive consumer base, also represents a critical market. The presence of advanced logistical infrastructure, including dedicated freight corridors and efficient public transport systems that can be leveraged for logistics, plays a vital role in supporting the growth of these key cities. Regulatory frameworks that facilitate faster clearances and optimize traffic flow also contribute to their leading positions.

India Intra-city Logistics Market Product Developments

Product developments in the India Intra-city Logistics Market are primarily focused on enhancing efficiency, speed, and sustainability. Innovations in route optimization software, powered by AI, are leading to reduced transit times and fuel consumption. The development of advanced warehouse management systems (WMS) is improving inventory accuracy and order fulfillment rates. Furthermore, there is a discernible trend towards the adoption of electric vehicles (EVs) for last-city deliveries, driven by government incentives and a growing environmental consciousness among consumers and businesses. These EV fleets offer zero tailpipe emissions and lower operational costs, providing a significant competitive advantage. Smart packaging solutions that monitor temperature and humidity are also emerging for specialized logistics needs.

Key Drivers of India Intra-city Logistics Market Growth

The India Intra-city Logistics Market is propelled by several potent growth drivers. The relentless surge in e-commerce and online retail sales, coupled with the rapid expansion of quick commerce, creates an insatiable demand for efficient last-mile delivery. Technological advancements, including the widespread adoption of AI for route optimization, real-time tracking, and predictive analytics, are revolutionizing operational efficiency. The increasing penetration of smartphones and affordable data plans empowers consumers to demand faster and more transparent delivery experiences. Furthermore, government initiatives promoting digital India and improving urban infrastructure, alongside a growing focus on sustainable logistics solutions, are creating a favorable ecosystem for market expansion.

Challenges in the India Intra-city Logistics Market Market

Despite its robust growth, the India Intra-city Logistics Market faces significant challenges. Navigating congested urban traffic remains a primary hurdle, leading to unpredictable delivery times and increased operational costs. The fragmented nature of the logistics industry, with a large number of unorganized players, poses challenges in standardization and quality control. Regulatory hurdles, including complex permit requirements and varying local compliance rules, can hinder seamless operations. High real estate costs for warehousing in prime urban locations also present a considerable barrier. Moreover, the consistent demand for lower pricing from e-commerce giants puts immense pressure on margins for logistics providers, necessitating continuous innovation in cost-efficiency.

Emerging Opportunities in India Intra-city Logistics Market

The India Intra-city Logistics Market is ripe with emerging opportunities. The untapped potential in Tier 2 and Tier 3 cities, driven by increasing internet penetration and rising disposable incomes, presents a significant avenue for expansion. The growing demand for specialized logistics, such as cold chain for pharmaceuticals and perishables, and hyper-local delivery for local businesses, offers niche market opportunities. Strategic partnerships between logistics providers and e-commerce platforms are crucial for optimizing supply chains. Furthermore, the increasing adoption of advanced technologies like drones and autonomous vehicles for delivery in the long term, coupled with a growing emphasis on green logistics and the adoption of electric vehicle fleets, are poised to redefine the future of intra-city logistics.

Leading Players in the India Intra-city Logistics Market Sector

- cityXfer

- Cogos Technologies

- Porter

- Ecom Express

- TruckEasy

- DTDC

- FM Logistic India

- Lets Transport

- Shadowfax

- Blowhorn

Key Milestones in India Intra-city Logistics Market Industry

- November 2022: Mahindra Logistics acquired delivery services provider Whizzard. Mahindra Logistic's current last-mile delivery business and its electric vehicle-based delivery services would be enhanced by the acquisition.

- July 2022: Bengaluru-based COGOS Technologies has acquired logistics startup Porter's FMCG modern trade business. This acquisition will strengthen COGOS' platform and allow it to meet the demand for municipal logistics.

Strategic Outlook for India Intra-city Logistics Market Market

The strategic outlook for the India Intra-city Logistics Market is exceptionally positive, driven by sustained demand from the e-commerce sector and the increasing adoption of advanced technologies. Focus on optimizing last-mile delivery networks through AI-powered solutions and the expansion of the electric vehicle fleet will be critical for enhancing efficiency and sustainability. Partnerships and collaborations will be key to consolidating market presence and expanding service offerings. The burgeoning demand in Tier 2 and Tier 3 cities presents a significant growth accelerator, requiring strategic investments in infrastructure and network development. Ultimately, a commitment to innovation, customer-centricity, and operational excellence will define the success of players in this dynamic market.

India Intra-city Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Distribution

- 1.3. Value-added Services

-

2. City

- 2.1. Delhi

- 2.2. Bangalore

- 2.3. Mumbai

- 2.4. Hyderabad

- 2.5. Chennai

- 2.6. Others

India Intra-city Logistics Market Segmentation By Geography

- 1. India

India Intra-city Logistics Market Regional Market Share

Geographic Coverage of India Intra-city Logistics Market

India Intra-city Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Industrial Growth Supporting the Market; Global Trade Driving the Market

- 3.3. Market Restrains

- 3.3.1. Compliance Challenges Affecting the Market; Limited Infrastructure Inhibiting the Market

- 3.4. Market Trends

- 3.4.1. Growing Demand for Intra-city Logistics from Tier-2 and Tier- 3 Cities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Intra-city Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Distribution

- 5.1.3. Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Delhi

- 5.2.2. Bangalore

- 5.2.3. Mumbai

- 5.2.4. Hyderabad

- 5.2.5. Chennai

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 cityXfer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cogos Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Porter

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ecom Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TruckEasy

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DTDC**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FM Logistic India

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lets Transport

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shadowfax

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Blowhorn

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 cityXfer

List of Figures

- Figure 1: India Intra-city Logistics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Intra-city Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: India Intra-city Logistics Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 2: India Intra-city Logistics Market Revenue undefined Forecast, by City 2020 & 2033

- Table 3: India Intra-city Logistics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Intra-city Logistics Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 5: India Intra-city Logistics Market Revenue undefined Forecast, by City 2020 & 2033

- Table 6: India Intra-city Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Intra-city Logistics Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the India Intra-city Logistics Market?

Key companies in the market include cityXfer, Cogos Technologies, Porter, Ecom Express, TruckEasy, DTDC**List Not Exhaustive, FM Logistic India, Lets Transport, Shadowfax, Blowhorn.

3. What are the main segments of the India Intra-city Logistics Market?

The market segments include Service, City.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Industrial Growth Supporting the Market; Global Trade Driving the Market.

6. What are the notable trends driving market growth?

Growing Demand for Intra-city Logistics from Tier-2 and Tier- 3 Cities.

7. Are there any restraints impacting market growth?

Compliance Challenges Affecting the Market; Limited Infrastructure Inhibiting the Market.

8. Can you provide examples of recent developments in the market?

November 2022 - Mahindra Logistics acquired delivery services provider Whizzard. Mahindra Logistic's current last-mile delivery business and its electric vehicle-based delivery services would be enhanced by the acquisition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Intra-city Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Intra-city Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Intra-city Logistics Market?

To stay informed about further developments, trends, and reports in the India Intra-city Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence