Key Insights

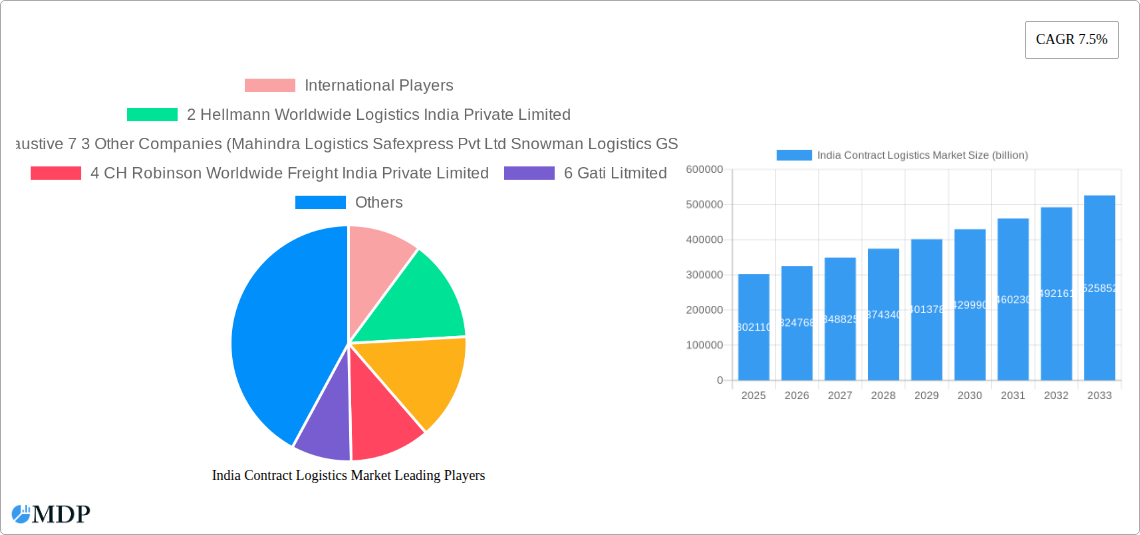

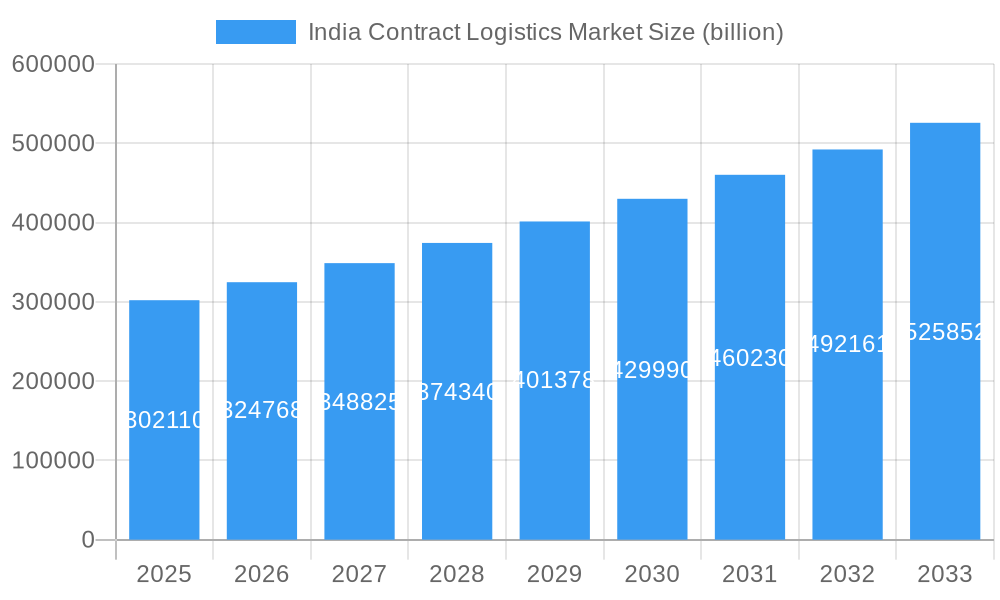

The India Contract Logistics Market is poised for substantial growth, projected to reach USD 302.11 billion by 2025. This expansion is fueled by a robust Compound Annual Growth Rate (CAGR) of 7.5%, indicating a dynamic and evolving landscape. A primary driver for this growth is the increasing adoption of outsourced logistics solutions by businesses seeking to optimize supply chain efficiency, reduce operational costs, and gain a competitive edge. The manufacturing and automotive sectors, along with consumer goods & retail, are leading the charge, leveraging sophisticated contract logistics services for inventory management, warehousing, transportation, and value-added services. The high-tech industry's demand for specialized handling and temperature-controlled environments, coupled with the healthcare and pharmaceutical sector's stringent regulatory compliance needs, also significantly contributes to market expansion. This intricate web of demand across diverse industries underscores the maturity and increasing sophistication of India's contract logistics ecosystem.

India Contract Logistics Market Market Size (In Billion)

Emerging trends such as the integration of advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) are revolutionizing contract logistics operations, enabling real-time tracking, predictive analytics, and automated warehousing. This technological infusion is crucial for meeting the growing complexities of modern supply chains. However, the market faces certain restraints, including the high cost of infrastructure development and a shortage of skilled labor, which could potentially temper rapid expansion. Despite these challenges, the continuous investment by both international and domestic players, including stalwarts like Mahindra Logistics, Adani Logistics, Delhivery, and Kuehne + Nagel, signifies strong confidence in the market's future. The strategic focus on expanding service offerings and geographical reach by these companies will be instrumental in navigating these hurdles and capitalizing on the immense opportunities within the Indian contract logistics sector.

India Contract Logistics Market Company Market Share

India Contract Logistics Market: Comprehensive Analysis & Growth Projections (2019-2033)

Unlock unparalleled insights into the rapidly expanding India Contract Logistics Market with this definitive report. Spanning from 2019 to 2033, with a dedicated focus on the 2025 base year and robust 2025-2033 forecast, this analysis delves deep into market dynamics, key trends, leading players, and future opportunities. Discover the potential of this trillion-dollar industry, driven by booming e-commerce, manufacturing growth, and increasing outsourcing adoption. This report is meticulously crafted for supply chain professionals, investors, and industry strategists seeking actionable intelligence on India's contract logistics landscape.

India Contract Logistics Market Market Dynamics & Concentration

The India Contract Logistics Market exhibits a moderate concentration, with a significant presence of both domestic and international players vying for market share. Innovation is primarily driven by the escalating demand for technologically advanced warehousing solutions, such as automation and AI-powered inventory management, and the need for specialized logistics for sectors like pharmaceuticals and high-tech. Regulatory frameworks, while evolving, are increasingly supportive of foreign direct investment and infrastructure development, fostering a more conducive business environment. Product substitutes are limited in core contract logistics services, but the rise of on-demand logistics and in-house fulfillment presents indirect competition. End-user trends indicate a strong preference for outsourcing to specialized third-party logistics (3PL) providers to enhance efficiency, reduce costs, and gain access to expertise. Merger and acquisition (M&A) activities are on the rise as companies seek to consolidate their market position, expand service portfolios, and achieve economies of scale. Key M&A activities are expected to shape the competitive landscape in the coming years.

- Market Share: Dominated by a mix of established global giants and agile domestic enterprises.

- Innovation Drivers: Technological adoption (automation, AI), demand for cold chain logistics, e-commerce fulfillment solutions, and sustainability initiatives.

- Regulatory Frameworks: Government initiatives promoting manufacturing, trade facilitation, and infrastructure development are key.

- Product Substitutes: In-house logistics, on-demand delivery platforms.

- End-User Trends: Increasing outsourcing, focus on supply chain visibility, demand for customized solutions.

- M&A Activities: Strategic acquisitions and partnerships are shaping market consolidation.

India Contract Logistics Market Industry Trends & Analysis

The India Contract Logistics Market is poised for exponential growth, driven by a confluence of powerful industry trends and evolving consumer preferences. The burgeoning e-commerce sector continues to be a primary growth engine, necessitating efficient, last-mile delivery networks and sophisticated warehousing solutions. Furthermore, the Indian government's "Make in India" initiative and the Production Linked Incentive (PLI) schemes are spurring significant growth in manufacturing and automotive sectors, consequently boosting demand for integrated contract logistics services. Technological disruptions, including the adoption of IoT for real-time tracking, blockchain for enhanced transparency, and AI for predictive analytics and route optimization, are transforming operational efficiencies and customer experiences. Consumer preferences are increasingly leaning towards faster delivery times, seamless returns processes, and personalized logistics services, pushing contract logistics providers to innovate and adapt their offerings. The competitive dynamics are intensifying, with both established global players and nimble domestic companies fiercely competing on service quality, technological prowess, and pricing. The market penetration of outsourced contract logistics is steadily increasing as businesses recognize the strategic advantage of leveraging specialized expertise and infrastructure. The compound annual growth rate (CAGR) is projected to be robust, reflecting the market's immense potential and underlying growth drivers. This dynamic environment fosters continuous innovation and strategic partnerships to meet the ever-growing demands of the Indian economy.

Leading Markets & Segments in India Contract Logistics Market

The India Contract Logistics Market is characterized by a distinct dominance within specific segments and end-user industries, reflecting the country's economic priorities and consumption patterns. The Outsourced segment consistently leads, driven by businesses seeking to optimize costs, enhance efficiency, and focus on core competencies. Companies are increasingly divesting from in-house logistics operations to leverage the expertise and advanced infrastructure offered by third-party providers.

Among end-users, the Manufacturing and Automotive sector represents a significant market share, fueled by the country's robust industrial growth and global supply chain integration. This sector demands sophisticated inbound and outbound logistics, including just-in-time inventory management, parts distribution, and finished goods warehousing. The Consumer Goods & Retail segment is another powerhouse, propelled by India's vast consumer base and the rapid expansion of organized retail and e-commerce. This segment requires efficient warehousing, last-mile delivery, and reverse logistics capabilities. The High-Tech sector, while smaller, exhibits high growth potential due to the increasing adoption of electronics and the need for specialized handling and secure storage. Similarly, the Healthcare and Pharmaceutical sector is a critical and growing segment, demanding stringent temperature-controlled logistics, regulatory compliance, and secure transportation of sensitive products.

- Dominant Type Segment: Outsourced contract logistics, driven by cost-efficiency and expertise.

- Key Drivers: Focus on core competencies, access to advanced technology, scalable infrastructure, risk mitigation.

- Leading End User Segments:

- Manufacturing and Automotive:

- Key Drivers: Government manufacturing initiatives (Make in India), increasing FDI, complex supply chain requirements, just-in-time delivery needs.

- Consumer Goods & Retail:

- Key Drivers: E-commerce boom, large consumer base, demand for faster delivery, organized retail expansion, seasonal demand fluctuations.

- High-Tech:

- Key Drivers: Rapid technology adoption, demand for secure and specialized handling, product obsolescence.

- Healthcare and Pharmaceutical:

- Key Drivers: Strict regulatory compliance, cold chain requirements, increasing healthcare spending, demand for efficient drug distribution.

- Manufacturing and Automotive:

India Contract Logistics Market Product Developments

Recent product developments in the India Contract Logistics Market are largely centered around technological integration and service enhancement. Companies are investing in advanced warehouse management systems (WMS) and transportation management systems (TMS) that offer real-time visibility, predictive analytics, and automation. Innovations in last-mile delivery, including the use of electric vehicles (EVs) and drone technology, are gaining traction to improve efficiency and sustainability. Furthermore, the development of specialized solutions for sectors like pharmaceuticals (cold chain logistics) and high-tech (secure handling) is a key competitive advantage. These developments aim to optimize supply chain operations, reduce costs, and provide a superior customer experience, aligning with the evolving demands of the Indian market.

Key Drivers of India Contract Logistics Market Growth

The India Contract Logistics Market is propelled by several potent growth drivers. The rapid expansion of e-commerce continues to be a primary catalyst, demanding efficient warehousing and last-mile delivery solutions. Government initiatives like "Make in India" and production-linked incentive (PLI) schemes are boosting domestic manufacturing, leading to increased demand for integrated supply chain services. Technological advancements, including automation, AI, and IoT, are enhancing operational efficiency and offering competitive advantages. Growing foreign direct investment (FDI) in the logistics sector further fuels growth. Economic liberalization and a burgeoning middle class are also contributing to higher consumption, thereby driving demand for logistics services across various sectors.

Challenges in the India Contract Logistics Market Market

Despite its promising growth, the India Contract Logistics Market faces several challenges. Infrastructure gaps, particularly in rural and semi-urban areas, can lead to logistical bottlenecks and increased transit times. Complex and varying state-level regulations can create compliance hurdles for businesses operating nationwide. The shortage of skilled labor, especially for specialized roles in warehousing and technology management, remains a concern. Intense competition among players can lead to price wars, impacting profitability. Furthermore, the increasing cost of real estate for warehousing, especially in prime urban locations, presents a significant operational challenge.

Emerging Opportunities in India Contract Logistics Market

Emerging opportunities in the India Contract Logistics Market are vast and varied. The ongoing digital transformation presents a significant avenue for growth, with companies investing in AI, IoT, and blockchain to create more efficient and transparent supply chains. The burgeoning demand for cold chain logistics, driven by the pharmaceutical and food & beverage industries, offers substantial growth potential. Strategic partnerships and collaborations between logistics providers and technology firms are creating innovative solutions. Furthermore, the increasing focus on sustainability and green logistics presents opportunities for companies adopting eco-friendly practices. Expansion into tier-2 and tier-3 cities, catering to the growing demand in these regions, also represents a significant market expansion strategy.

Leading Players in the India Contract Logistics Market Sector

- Hellmann Worldwide Logistics India Private Limited

- TVS Supply Chain Solutions

- Mahindra Logistics

- Safexpress Pvt Ltd

- Snowman Logistics

- GS Logistics

- Nitco Logistics

- Gateway Distriparks Limited

- CH Robinson Worldwide Freight India Private Limited

- Gati Limited

- Expeditors International (India) Private Limited

- Transport Corporation of India

- VRL Logistics Ltd

- Future Supply Chain Solutions Ltd

- Delhivery Limited

- DSV Panalpina

- Adani Logistics Company

- FedEx Corporation

- Nippon Express (India) Private Limited

- Aegis Logistics Ltd

- Kuehne + Nagel Private Limited

- Agility Logistics

- All Cargo Logistics Limited

Key Milestones in India Contract Logistics Market Industry

- September 2022: DHL Supply Chain (Contract logistics provider) announced plans to invest over USD 553 million in India over the next five years. This investment aims to expand warehousing capacity, enhance the workforce, and bolster sustainability initiatives, including adding 12 million sq. ft of warehousing space to reach a total capacity of approximately 22 million sq. ft by 2026.

- August 2022: DB Schenker (global logistics provider) outlined its strategic intention to acquire companies in India. The primary focus is to expand its operational footprint, build comprehensive end-to-end contract logistics capabilities, and secure a larger share of delivery contracts from rapidly growing e-commerce players.

Strategic Outlook for India Contract Logistics Market Market

The strategic outlook for the India Contract Logistics Market is overwhelmingly positive, characterized by sustained growth and significant opportunities. Key accelerators include the continued digital transformation, with an emphasis on AI, automation, and data analytics to drive efficiency and visibility. The growing demand for specialized logistics, such as cold chain and temperature-controlled solutions, presents a lucrative niche. Strategic partnerships between logistics providers, technology firms, and end-users will be crucial for developing innovative, integrated solutions. Furthermore, a heightened focus on sustainability and ESG (Environmental, Social, and Governance) initiatives will shape future investments and operational strategies. The market is poised for consolidation through M&A activities, leading to stronger, more capable industry players. Companies that invest in technology, talent, and sustainable practices will be best positioned to capitalize on the immense potential of this dynamic market.

India Contract Logistics Market Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Consumer Goods & Retail

- 2.3. High - Tech

- 2.4. Healthcare and Pharmaceutical

- 2.5. Other En

India Contract Logistics Market Segmentation By Geography

- 1. India

India Contract Logistics Market Regional Market Share

Geographic Coverage of India Contract Logistics Market

India Contract Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in global trade activites; Increase in infrastrustrure and construction

- 3.3. Market Restrains

- 3.3.1. Long distances and sometimes difficult terrain can contribute to increased transportation costs

- 3.4. Market Trends

- 3.4.1. Increasing E-commerce Sales are Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Consumer Goods & Retail

- 5.2.3. High - Tech

- 5.2.4. Healthcare and Pharmaceutical

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 International Players

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 2 Hellmann Worldwide Logistics India Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 9 TVS Supply Chain Solutions **List Not Exhaustive 7 3 Other Companies (Mahindra Logistics Safexpress Pvt Ltd Snowman Logistics GS Logistics Nitco Logistics Gateway Distriparks Limited*

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 4 CH Robinson Worldwide Freight India Private Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 6 Gati Litmited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 8 Expeditors International (India) Private Limited *

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 5 Transport Corporation of India

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 2 VRL Logistics Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 8 Future Supply Chain Solutions Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Domestic Players

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 7 Delhivery Private Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 5 DSV Panalpina

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 3 Adani Logistics Company

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 7 FedEx Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 6 Nippon Express (India) Private Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 4 Aegis Logistics Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 1 Kuehne + Nagel Private Limited

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 3 Agility Logistics

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 1 All Cargo Logistics Limited

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.1 International Players

List of Figures

- Figure 1: India Contract Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Contract Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: India Contract Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: India Contract Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: India Contract Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Contract Logistics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: India Contract Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: India Contract Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Contract Logistics Market?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the India Contract Logistics Market?

Key companies in the market include International Players, 2 Hellmann Worldwide Logistics India Private Limited, 9 TVS Supply Chain Solutions **List Not Exhaustive 7 3 Other Companies (Mahindra Logistics Safexpress Pvt Ltd Snowman Logistics GS Logistics Nitco Logistics Gateway Distriparks Limited*, 4 CH Robinson Worldwide Freight India Private Limited, 6 Gati Litmited, 8 Expeditors International (India) Private Limited *, 5 Transport Corporation of India, 2 VRL Logistics Ltd, 8 Future Supply Chain Solutions Ltd, Domestic Players, 7 Delhivery Private Limited, 5 DSV Panalpina, 3 Adani Logistics Company, 7 FedEx Corporation, 6 Nippon Express (India) Private Limited, 4 Aegis Logistics Ltd, 1 Kuehne + Nagel Private Limited, 3 Agility Logistics, 1 All Cargo Logistics Limited.

3. What are the main segments of the India Contract Logistics Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 302.11 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in global trade activites; Increase in infrastrustrure and construction.

6. What are the notable trends driving market growth?

Increasing E-commerce Sales are Driving the Market Growth.

7. Are there any restraints impacting market growth?

Long distances and sometimes difficult terrain can contribute to increased transportation costs.

8. Can you provide examples of recent developments in the market?

September 2022: DHL Supply Chain (Contract logistics provider), planned to invest more than USD 553 million in India over the next five years to expand its warehousing capacity, workforce, and sustainability initiatives. Under this expansion, DHL Supply Chain will add 12 million sq. ft of warehousing space in its existing portfolio to take its total capacity to about 22 million sq. ft by 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Contract Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Contract Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Contract Logistics Market?

To stay informed about further developments, trends, and reports in the India Contract Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence