Key Insights

The Turkey Freight & Logistics Market is projected for significant expansion, estimated to reach $13.41 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 8.1%. This robust growth is driven by Turkey's strategic geopolitical position, a thriving manufacturing base, and increasing foreign direct investment. The nation's economic development and integration into global supply chains are fueling demand for advanced logistics solutions. Key trends include the adoption of IoT and AI for real-time tracking and route optimization, the surge in e-commerce requiring efficient last-mile delivery, and a growing commitment to sustainable logistics. Expansion in warehousing and value-added services, such as kitting and assembly, further supports market growth.

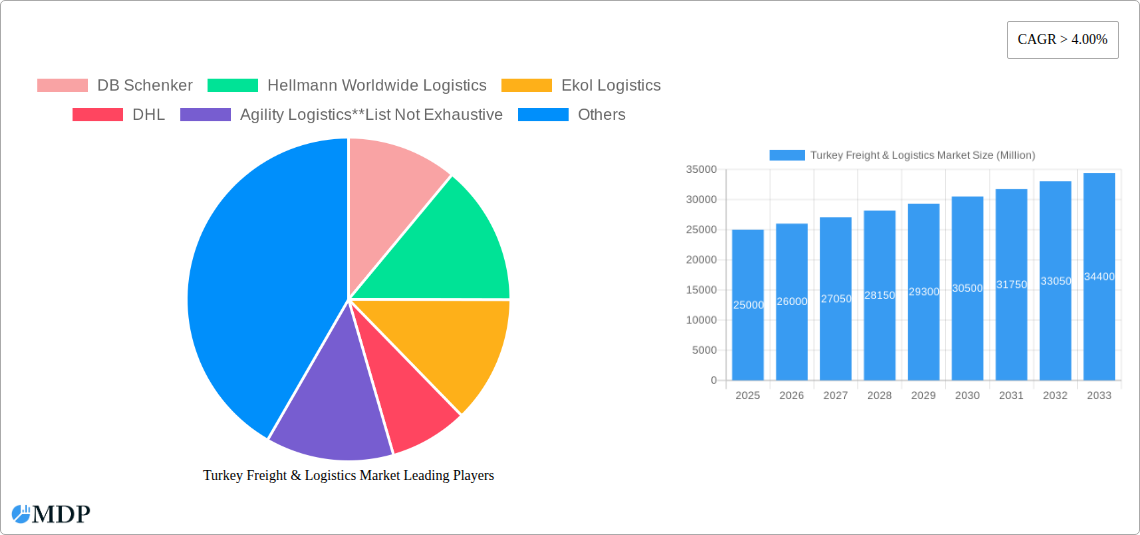

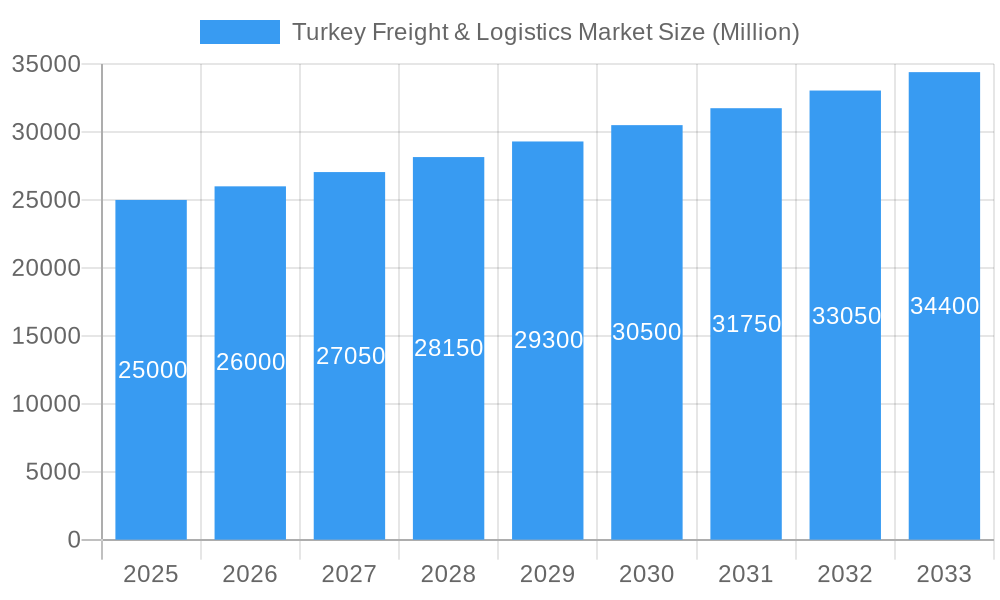

Turkey Freight & Logistics Market Market Size (In Billion)

Challenges such as regional infrastructure limitations, regulatory complexities, and the need for skilled labor are being addressed through government and private sector initiatives. The market is segmented by function, with Freight Transport (road and rail) holding a leading position. Freight Forwarding, Warehousing, and Value-added Services are also crucial segments. Major end-user industries include Manufacturing and Automotive, Oil & Gas, Mining & Quarrying, and Agriculture. The competitive landscape features global players like DB Schenker, DHL, and CEVA Logistics, alongside prominent local companies such as Omsan Logistics and Ekol Logistics, all investing in service expansion and operational capacity to leverage market opportunities.

Turkey Freight & Logistics Market Company Market Share

Discover key insights and future projections for the Turkey Freight & Logistics Market. This report details market size, growth rate, segmentation, trends, drivers, restraints, and competitive strategies.

Turkey Freight & Logistics Market: Comprehensive Industry Analysis & Growth Forecast (2019–2033)

Gain unparalleled insights into the dynamic Turkey freight and logistics market, a pivotal hub for global trade and supply chain excellence. This in-depth report meticulously analyzes the market from 2019 to 2033, with a base year of 2025, providing critical data, trends, and strategic recommendations for stakeholders navigating this rapidly evolving landscape. Discover the key growth drivers, emerging opportunities, and competitive strategies shaping Turkey's logistics sector, from road freight transport and air cargo to sophisticated freight forwarding and warehousing solutions. This report is essential for understanding the Turkish supply chain, its integration with international markets, and the technological advancements driving efficiency and innovation.

Turkey Freight & Logistics Market Market Dynamics & Concentration

The Turkey freight and logistics market exhibits a moderate concentration, with key players like DB Schenker, Hellmann Worldwide Logistics, Ekol Logistics, DHL, Agility Logistics, Omsan Logistics, Nippon Express, XPO Logistics, CEVA Logistics, and C H Robinson driving innovation and service expansion. The market's growth is propelled by increasing trade volumes, a strategic geographical location bridging Europe and Asia, and significant investments in infrastructure. Regulatory frameworks, including those aimed at enhancing customs efficiency and promoting digital logistics, are crucial in shaping market dynamics. While direct product substitutes for core logistics services are limited, efficiency gains through technology and optimized route planning act as continuous competitive drivers. End-user industries such as Manufacturing and Automotive, Oil and Gas, and Construction are increasingly demanding integrated and technology-driven logistics solutions, influencing service offerings and operational strategies. Mergers and acquisitions (M&A) activity, though not at extreme levels, plays a role in consolidating market share and expanding service portfolios. The market share distribution sees established global players alongside strong local operators, creating a competitive yet collaborative ecosystem. M&A deal counts are closely monitored for insights into strategic consolidations and expansion efforts.

Turkey Freight & Logistics Market Industry Trends & Analysis

The Turkey freight and logistics market is experiencing robust growth, driven by several interconnected factors that are reshaping its trajectory. The CAGR is projected to be xx% during the forecast period. A primary growth driver is the country's burgeoning e-commerce sector, which necessitates faster, more efficient, and last-mile delivery solutions. This surge in online retail has directly translated into increased demand for warehousing solutions, advanced freight forwarding services, and specialized value-added services such as reverse logistics and customized packaging. Furthermore, Turkey's strategic geopolitical position as a transit country for goods moving between Asia, Europe, and Africa continues to fuel its importance in global supply chains. Significant government initiatives aimed at modernizing infrastructure, including the expansion of ports, airports, and high-speed rail networks, are enhancing connectivity and reducing transit times, thereby bolstering the efficiency of road, rail, and air freight transport.

Technological disruptions are at the forefront of industry transformation. The adoption of digital logistics platforms, IoT-enabled tracking systems, blockchain for supply chain transparency, and artificial intelligence (AI) for route optimization and demand forecasting are becoming standard practices. These technologies not only improve operational efficiency but also provide greater visibility and control over shipments, a key preference for end-users concerned about supply chain resilience. Consumer preferences are increasingly leaning towards faster delivery times, real-time tracking, and personalized logistics services, pushing logistics providers to innovate and adapt their offerings. The competitive dynamics are characterized by intense rivalry among both global giants and agile local players, all vying for market share through service differentiation, technological adoption, and strategic partnerships. Market penetration for advanced logistics solutions is steadily increasing, indicating a shift towards more sophisticated supply chain management practices across various end-user industries. The Turkish logistics industry is also benefiting from a growing manufacturing base that requires reliable inbound and outbound logistics support, further solidifying its growth prospects.

Leading Markets & Segments in Turkey Freight & Logistics Market

Within the Turkey freight and logistics market, Freight Transport stands out as the dominant segment, with Road Freight Transport holding the lion's share due to its extensive network coverage and flexibility for domestic and cross-border movements. The increasing volume of manufacturing output and the booming e-commerce sector are key drivers for the sustained demand in this sub-segment. Air Freight is also experiencing significant growth, particularly for high-value goods and time-sensitive shipments, facilitated by the expansion of Istanbul Airport and other key cargo hubs.

The Warehousing segment is crucial, with demand escalating for modern, technologically equipped facilities offering temperature-controlled storage, cross-docking, and inventory management. This is directly linked to the growth of the Manufacturing and Automotive sectors, as well as the retail industry. Freight Forwarding remains a vital service, connecting shippers with carriers and managing complex international supply chains, benefiting from Turkey's strategic trade location. Value-added Services, such as customs brokerage, packaging, labeling, and last-mile delivery optimization, are increasingly sought after as companies aim to streamline their entire supply chain operations.

In terms of end-user industries, the Manufacturing and Automotive sector is a primary consumer of logistics services, demanding efficient inbound and outbound transportation, just-in-time delivery, and robust supply chain management. The Construction industry's logistics needs, focused on heavy equipment and material transport, also contribute significantly to market volume. While the Oil and Gas, Mining and Quarrying, and Agriculture, Fishing, and Forestry sectors have specific, often project-based logistics requirements, their overall contribution to the market's daily volume is less pronounced compared to manufacturing and retail. The Distribu and Other En (e.g., pharmaceuticals, chemicals) segments further diversify the demand landscape, each with unique logistical challenges and opportunities. Economic policies promoting industrial growth and export-oriented manufacturing are key drivers supporting the dominance of these segments.

Turkey Freight & Logistics Market Product Developments

Product developments in the Turkey freight and logistics market are increasingly focused on digital integration and operational efficiency. Innovations include the deployment of AI-powered route optimization software, IoT sensors for real-time shipment monitoring, and the adoption of blockchain technology to enhance supply chain transparency and traceability. Companies are investing in advanced Warehouse Management Systems (WMS) and Transportation Management Systems (TMS) to streamline operations. Furthermore, the development of specialized logistics solutions for temperature-sensitive goods, e-commerce fulfillment, and oversized cargo is gaining traction, providing competitive advantages through tailored service offerings that meet specific industry demands and enhance market fit.

Key Drivers of Turkey Freight & Logistics Market Growth

Several key factors are propelling the growth of the Turkey freight and logistics market. The country's strategic geographical location, serving as a crucial transit point between Europe, Asia, and the Middle East, significantly boosts international trade and transit volumes. Robust economic growth and an expanding manufacturing sector, particularly in automotive and textiles, drive demand for efficient inbound and outbound logistics. Furthermore, the rapid growth of e-commerce necessitates advanced and faster delivery networks. Government initiatives focused on infrastructure development, including new highways, ports, and airports, along with efforts to digitalize customs procedures and streamline trade facilitation, are critical enablers of market expansion and efficiency.

Challenges in the Turkey Freight & Logistics Market Market

Despite its growth potential, the Turkey freight and logistics market faces several challenges. Regulatory hurdles and bureaucratic complexities in customs clearance can lead to delays and increased costs. Intense competition among a large number of service providers, including both local and international players, can put pressure on profit margins. Infrastructure limitations in certain regions and the need for continued investment in modern logistics facilities, particularly for specialized cargo like refrigerated goods, remain ongoing concerns. Furthermore, the increasing demand for highly skilled logistics professionals, coupled with the need for continuous technological upgrades, presents a significant operational challenge for many companies.

Emerging Opportunities in Turkey Freight & Logistics Market

Emerging opportunities in the Turkey freight and logistics market are primarily driven by technological advancements and evolving trade patterns. The widespread adoption of digitalization, including AI, IoT, and big data analytics, presents opportunities for enhanced efficiency, cost reduction, and improved customer service. The growing demand for sustainable logistics solutions and green transportation is creating new niches and driving innovation in eco-friendly practices. Strategic partnerships between logistics providers and e-commerce platforms, as well as manufacturers seeking integrated supply chain solutions, are poised to unlock significant growth. Furthermore, Turkey's role as a gateway for trade into Central Asia and Eastern Europe continues to offer expansion opportunities for logistics companies looking to broaden their regional footprint.

Leading Players in the Turkey Freight & Logistics Market Sector

- DB Schenker

- Hellmann Worldwide Logistics

- Ekol Logistics

- DHL

- Agility Logistics

- Omsan Logistics

- Nippon Express

- XPO Logistics

- CEVA Logistics

- C H Robinson

Key Milestones in Turkey Freight & Logistics Market Industry

- 2019-2024: Increased investment in digital transformation and supply chain technology by major players.

- 2020: Significant surge in e-commerce logistics demand due to global pandemic, accelerating last-mile delivery innovations.

- 2021: Expansion of warehousing facilities and automation technologies to meet growing inventory needs.

- 2022: Enhanced focus on sustainable logistics practices and investment in greener transportation solutions.

- 2023: Increased M&A activities aimed at consolidating market share and expanding service portfolios.

- 2024: Continued integration of AI and big data for advanced route planning and predictive analytics in logistics operations.

Strategic Outlook for Turkey Freight & Logistics Market Market

The strategic outlook for the Turkey freight and logistics market is exceptionally positive, fueled by ongoing infrastructure development, a growing industrial base, and increasing adoption of advanced technologies. Future growth accelerators will include the further digitalization of supply chains, the expansion of multimodal transport options to enhance efficiency and sustainability, and the development of specialized logistics services tailored to burgeoning sectors like pharmaceuticals and renewable energy. Strategic partnerships and collaborations will be crucial for market players to leverage synergies, expand their reach, and offer end-to-end supply chain solutions. The market is well-positioned to capitalize on its strategic location and evolving trade dynamics, solidifying its role as a vital logistics hub.

Turkey Freight & Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Inland Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Others

-

1.1. Freight Transport

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distribu

- 2.6. Other En

Turkey Freight & Logistics Market Segmentation By Geography

- 1. Turkey

Turkey Freight & Logistics Market Regional Market Share

Geographic Coverage of Turkey Freight & Logistics Market

Turkey Freight & Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Number of Partnerships among Automobile Manufacturers and Logistics Partners; Growth in international trade

- 3.3. Market Restrains

- 3.3.1. Nature of Supply Chain Business

- 3.4. Market Trends

- 3.4.1. Expansion of road network

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey Freight & Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Inland Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Others

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distribu

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hellmann Worldwide Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ekol Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Agility Logistics**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Omsan Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nippon Express

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 XPO Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CEVA Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 C H Robinson

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Turkey Freight & Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Turkey Freight & Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Turkey Freight & Logistics Market Revenue billion Forecast, by Function 2020 & 2033

- Table 2: Turkey Freight & Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Turkey Freight & Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Turkey Freight & Logistics Market Revenue billion Forecast, by Function 2020 & 2033

- Table 5: Turkey Freight & Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Turkey Freight & Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey Freight & Logistics Market?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Turkey Freight & Logistics Market?

Key companies in the market include DB Schenker, Hellmann Worldwide Logistics, Ekol Logistics, DHL, Agility Logistics**List Not Exhaustive, Omsan Logistics, Nippon Express, XPO Logistics, CEVA Logistics, C H Robinson.

3. What are the main segments of the Turkey Freight & Logistics Market?

The market segments include Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.41 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Number of Partnerships among Automobile Manufacturers and Logistics Partners; Growth in international trade.

6. What are the notable trends driving market growth?

Expansion of road network.

7. Are there any restraints impacting market growth?

Nature of Supply Chain Business.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey Freight & Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey Freight & Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey Freight & Logistics Market?

To stay informed about further developments, trends, and reports in the Turkey Freight & Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence