Key Insights

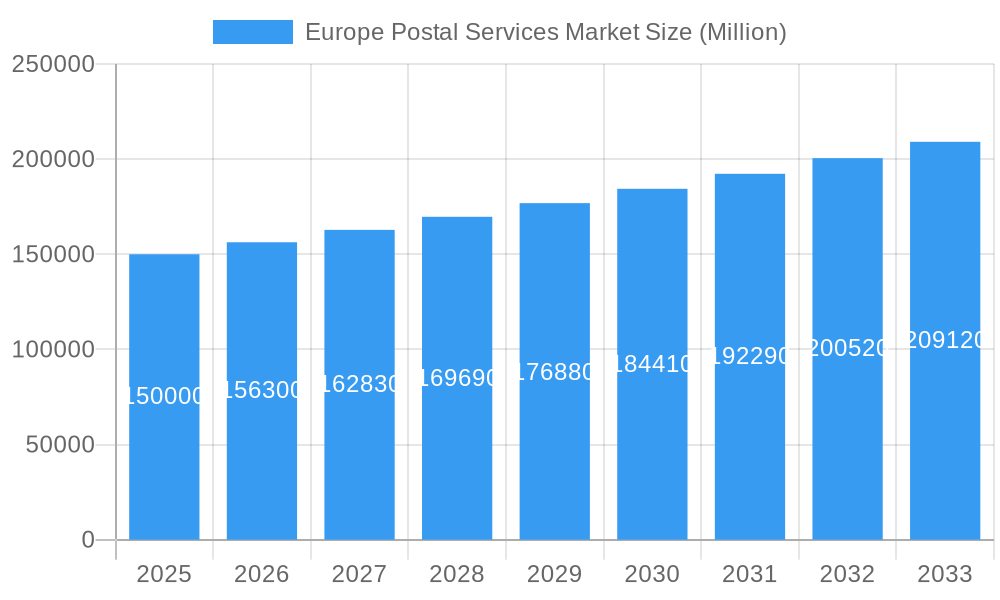

The European Postal Services Market is poised for significant expansion, projected to reach $168.28 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 10.39% from 2025 to 2033. This growth is propelled by the burgeoning e-commerce sector, driving demand for express parcel delivery across domestic and international segments. Omnichannel retail strategies further amplify this need, necessitating efficient and dependable postal networks. Technological advancements, including automated sorting and enhanced tracking, are optimizing operational efficiency and customer experience. Increased cross-border trade within Europe and globally also stimulates international postal services. While challenges such as fluctuating fuel prices and private courier competition exist, the market's resilience, particularly in key economies like Germany, the UK, and France, is expected to offset these. The market is segmented by service type (express and standard), item (letter and parcel), and destination (domestic and international), offering insights into specific growth avenues. Leading players such as Deutsche Post DHL, La Poste, FedEx/TNT Express, and Royal Mail are actively innovating to meet evolving customer demands and secure market share.

Europe Postal Services Market Market Size (In Billion)

Future growth of the European Postal Services Market depends on operators' adaptation to the digital era, involving investments in infrastructure, technology, and strategic partnerships for integrated logistics solutions. A focus on sustainability, including eco-friendly delivery options and reduced carbon footprints, will attract environmentally conscious consumers and businesses. Streamlined regulatory frameworks and cross-border cooperation are vital for efficient operations and seamless deliveries. The expansion of last-mile delivery solutions, addressing urban and remote area challenges, will be crucial for sustained market growth. Key players leveraging data analytics to optimize routing and predict demand will be essential for efficiency and profitability. Continuous innovation and adaptability to the global logistics industry's dynamics will define the market's future.

Europe Postal Services Market Company Market Share

Europe Postal Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European postal services market, covering market dynamics, industry trends, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and strategic planners. The report analyzes key segments including express and standard postal services, letters and parcels, domestic and international deliveries, and market performance across key European countries like Germany, UK, France, Russia, Spain, Netherlands, and the Rest of Europe. The market size is projected to reach xx Million by 2033.

Europe Postal Services Market Market Dynamics & Concentration

The European postal services market is characterized by a complex interplay of factors impacting its dynamics and concentration. Market concentration is moderate, with several large players dominating specific segments and regions. However, increasing competition from smaller, specialized logistics providers and the rise of e-commerce are reshaping the competitive landscape. Innovation drivers include the adoption of automation technologies, the implementation of sustainable practices (such as DHL's new CO2-neutral facility), and the development of advanced tracking and delivery solutions. Regulatory frameworks, particularly concerning data privacy and cross-border shipments, significantly influence market operations. Product substitutes, including alternative delivery methods and digital communication channels, pose ongoing challenges. End-user trends, driven primarily by e-commerce growth and changing consumer expectations for speed and transparency, are pushing the sector toward greater efficiency and customization. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a focus on strategic partnerships and expansion into new markets. While precise M&A deal counts for the period are unavailable, they reflect a consolidated but competitive environment. The top players, including La Poste, FedEx/TNT Express, and Deutsche Post DHL, hold significant market share.

Europe Postal Services Market Industry Trends & Analysis

The European postal services market demonstrates a dynamic environment marked by consistent growth, driven by e-commerce expansion and robust parcel volume growth. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%. Technological disruptions are revolutionizing the industry through automation, improved tracking systems, and the integration of data analytics for optimization. Consumer preferences for faster, more reliable, and environmentally friendly delivery options significantly influence market developments. Intense competitive dynamics, including price wars, service innovations, and strategic alliances, are constantly reshaping the industry landscape. Market penetration of express postal services is expected to increase, driven by the increasing demand for timely delivery of goods, while standard postal services will continue to cater to the market need for cost-effective letter and document delivery.

Leading Markets & Segments in Europe Postal Services Market

The European postal services market shows variations across different countries and segments. The parcel segment is the fastest-growing, driven by e-commerce, while the express postal services segment experiences high demand due to businesses' need for faster deliveries.

By Country: Germany, the UK, and France remain leading markets due to robust economies and high e-commerce penetration. Factors such as advanced infrastructure and efficient logistics networks contribute to their dominance.

By Destination: International postal services are experiencing substantial growth due to global trade, while domestic postal services still constitute a significant portion of the market.

By Item: Parcel deliveries drive market expansion due to the growth of e-commerce, while letter services are gradually declining.

By Type: Express postal services demonstrate significant growth due to time-sensitive deliveries, while standard postal services remain crucial for non-urgent mail.

Europe Postal Services Market Product Developments

Recent product developments focus on enhancing speed, reliability, and sustainability. Advanced tracking technologies, automated sorting systems, and last-mile delivery optimization are key areas of innovation. The adoption of electric vehicles and sustainable packaging solutions is becoming increasingly common, reflecting the industry's commitment to environmental responsibility. These innovations aim to improve efficiency and provide consumers with enhanced service offerings that cater to their evolving demands.

Key Drivers of Europe Postal Services Market Growth

Several factors propel growth in the European postal services market: the continuing expansion of e-commerce, driving increased parcel volumes; technological advancements, improving efficiency and delivery speed; government initiatives and investments in logistics infrastructure across various European nations; and the increasing demand for reliable, transparent, and trackable delivery services. The growing preference for same-day and next-day delivery options further fuels market expansion.

Challenges in the Europe Postal Services Market Market

The European postal services market faces challenges including increasing competition from independent delivery companies and new entrants, fluctuating fuel prices impacting operating costs, and strict regulatory compliance requirements affecting operational efficiency. Additionally, ensuring the security of the mail and packages, optimizing last-mile delivery in densely populated urban areas, and managing fluctuating labor costs are areas of significant concern for the industry. These challenges lead to decreased profitability margins for some players.

Emerging Opportunities in Europe Postal Services Market

Emerging opportunities lie in leveraging technological advancements for enhanced efficiency, expanding into specialized services like cold chain logistics, and forging strategic partnerships to expand into new market segments or geographic areas. Developing green logistics solutions using electric vehicles and sustainable packaging is vital. Moreover, data analytics can enable optimized route planning, reducing costs and improving efficiency.

Leading Players in the Europe Postal Services Market Sector

- La Poste

- FedEx/TNT Express

- DPD/ Geopost

- Poste Italiane

- Chronopost

- UPS

- Swiss Post

- PostNord AB

- Bpost

- PostNL

- Asendia

- Deutsche Post DHL

- Europe Post

- Omniva/Eesti Post

- Royal Mail

Key Milestones in Europe Postal Services Market Industry

July 2022: La Poste announced a redesign of its mail services to meet evolving customer needs, reduce its carbon footprint, and ensure the long-term viability of universal postal services. This involved introducing a choice of three letter types from January 1, 2023, while maintaining six-day delivery.

October 2022: DHL Express initiated construction of a 15,000m² service center in Courcelles, Belgium, with a capacity to handle 3,000 packages per hour, infrastructure for 60 electric vans, rooftop solar panels, and a commitment to CO2 neutrality. This facility, adhering to BREEAM and DHL CRE Go Green standards, is set to replace the Charleroi center by July 2023.

Strategic Outlook for Europe Postal Services Market Market

The future of the European postal services market is bright, driven by sustained e-commerce growth, technological innovation, and strategic partnerships. Companies that embrace digital transformation, prioritize sustainability, and offer customized solutions will thrive. The focus on last-mile delivery optimization and the expansion of niche services will be crucial for capturing market share. The market's long-term potential is significant, presenting substantial opportunities for growth and investment.

Europe Postal Services Market Segmentation

-

1. Type

- 1.1. Express Postal Services

- 1.2. Standard Postal Services

-

2. Item

- 2.1. Letter

- 2.2. Parcel

-

3. Destination

- 3.1. Domestic

- 3.2. International

Europe Postal Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Postal Services Market Regional Market Share

Geographic Coverage of Europe Postal Services Market

Europe Postal Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 3.; Online Pharmacies to Facilitate Growth3.; Increasing Demand for Over-the-counter (OTC) Medicines

- 3.3. Market Restrains

- 3.3.1. 3.; High Cost of Logistics3.; Stringent Government Regulations

- 3.4. Market Trends

- 3.4.1. The Postal and Delivery Sector Is Significant to the EU Economy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Postal Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Express Postal Services

- 5.1.2. Standard Postal Services

- 5.2. Market Analysis, Insights and Forecast - by Item

- 5.2.1. Letter

- 5.2.2. Parcel

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 La Poste

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FedEx/TNT Express

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DPD/ Geopost

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Poste Italiane**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chronopost

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 UPS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Swiss Post

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PostNord AB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bpost

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PostNL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Asendia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Deutsche Post DHL

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Europe Post

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Omniva/Eesti Post

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Royal Mail

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 La Poste

List of Figures

- Figure 1: Europe Postal Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Postal Services Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 3: Europe Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 4: Europe Postal Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 7: Europe Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 8: Europe Postal Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Postal Services Market?

The projected CAGR is approximately 10.39%.

2. Which companies are prominent players in the Europe Postal Services Market?

Key companies in the market include La Poste, FedEx/TNT Express, DPD/ Geopost, Poste Italiane**List Not Exhaustive, Chronopost, UPS, Swiss Post, PostNord AB, Bpost, PostNL, Asendia, Deutsche Post DHL, Europe Post, Omniva/Eesti Post, Royal Mail.

3. What are the main segments of the Europe Postal Services Market?

The market segments include Type, Item, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD 168.28 billion as of 2022.

5. What are some drivers contributing to market growth?

3.; Online Pharmacies to Facilitate Growth3.; Increasing Demand for Over-the-counter (OTC) Medicines.

6. What are the notable trends driving market growth?

The Postal and Delivery Sector Is Significant to the EU Economy.

7. Are there any restraints impacting market growth?

3.; High Cost of Logistics3.; Stringent Government Regulations.

8. Can you provide examples of recent developments in the market?

October 2022: A 15,000m2 service center for DHL Express is being built in Courcelles, Belgium. The facility is anticipated to have a 3,000 package-per-hour handling capacity and the infrastructure to load 60 electric vans. Additionally, it will have rooftop solar panels, be completely gasless, and be CO2 neutral. The website was created in accordance with BREEAM standards and DHL CRE Go Green criteria. This new distribution facility is planned to take over as DHL's main hub in the province of Hainaut by July 2023, replacing the current service center in Charleroi, Belgium.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Postal Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Postal Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Postal Services Market?

To stay informed about further developments, trends, and reports in the Europe Postal Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence