Key Insights

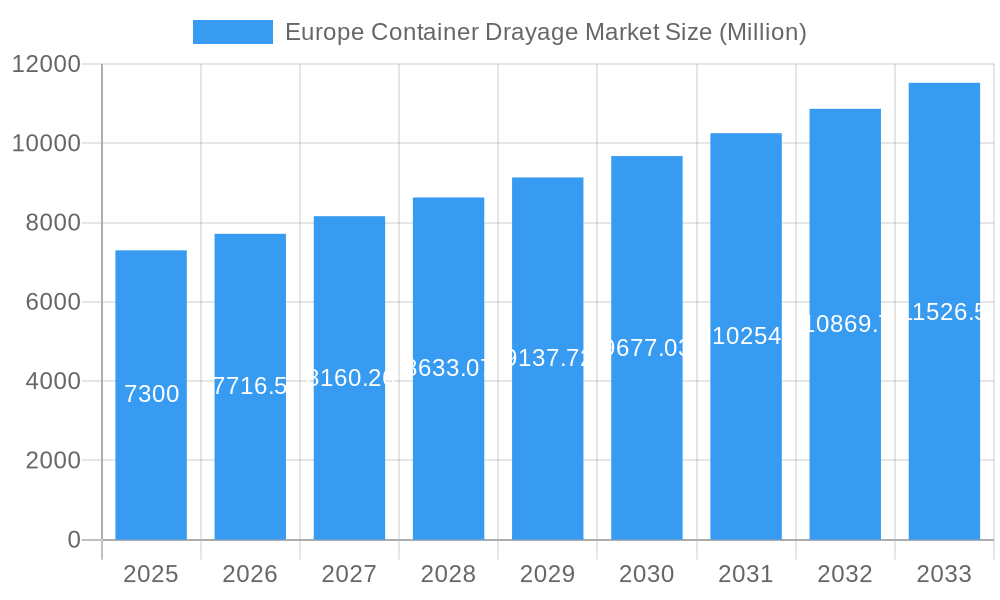

The Europe Container Drayage market, valued at €7.3 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 5.5% from 2025 to 2033. This expansion is fueled by several key factors. The rise of e-commerce continues to drive demand for efficient last-mile delivery solutions, increasing the reliance on container drayage services for timely and cost-effective transportation of goods from ports to inland destinations. Furthermore, the ongoing expansion of major European ports and improvements in logistics infrastructure are enhancing operational efficiency and facilitating greater throughput. Increased focus on supply chain optimization and just-in-time delivery models among businesses further contributes to market growth. However, challenges such as fluctuating fuel prices, driver shortages, and the increasing complexity of regulatory compliance pose potential restraints on market expansion. The market is segmented by various factors, including transport mode (road, rail, and intermodal), cargo type, and region. Leading players like DHL, DB Schenker, Kuehne + Nagel, and major shipping lines such as Maersk and MSC are actively vying for market share through strategic partnerships, technological investments, and service innovations.

Europe Container Drayage Market Market Size (In Billion)

The competitive landscape is highly fragmented, with several smaller regional players contributing significantly to the overall market volume. The market's growth is expected to be uneven across different European regions, with those possessing strong port infrastructure and high e-commerce penetration likely witnessing faster growth. The forecast period (2025-2033) will see continued innovation in areas such as digitalization, automation, and sustainability, impacting operational efficiency and cost optimization within the sector. This will involve increased adoption of technologies like GPS tracking, route optimization software, and real-time data analytics to improve service quality and enhance supply chain visibility. Companies are also increasingly focused on adopting sustainable practices, including the use of alternative fuels and eco-friendly transport solutions to meet evolving environmental regulations and customer expectations.

Europe Container Drayage Market Company Market Share

Europe Container Drayage Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Container Drayage Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, trends, and opportunities within this crucial segment of the European logistics landscape. Expect detailed analysis of market size (in Millions), growth projections, and key player strategies.

Europe Container Drayage Market Market Dynamics & Concentration

The European container drayage market exhibits a moderately concentrated landscape, with a few major players holding significant market share. DHL, DB Schenker, Kuehne + Nagel, CMA CGM, Maersk Line, Hapag-Lloyd, MSC (Mediterranean Shipping Company), COSCO Shipping, Evergreen Marine, and Yang Ming are key players, collectively accounting for an estimated xx% of the market in 2025. However, a significant number of smaller, regional players also contribute to the overall market volume.

Market concentration is influenced by several factors:

- Economies of scale: Larger players benefit from significant cost advantages due to their extensive network infrastructure and operational efficiencies.

- Technological advancements: Investment in advanced technologies like real-time tracking, route optimization software, and automated systems provides a competitive edge.

- Strategic partnerships & M&A activity: The recent acquisition of ContainerWorld Forwarding Services Inc. by Mullen Group Ltd. (May 2024) exemplifies the ongoing consolidation within the sector. The number of M&A deals in the historical period (2019-2024) totaled xx, indicating a trend of market consolidation. Further M&A activity is anticipated during the forecast period (2025-2033). This activity is expected to be driven by the need to enhance service offerings, expand geographical reach, and improve operational efficiency.

- Regulatory frameworks: Stringent environmental regulations and evolving transport policies impact operational costs and influence market dynamics.

- End-user trends: The growing preference for faster delivery times and increased demand for specialized drayage services are shaping market trends. This is leading to an increased demand for value-added services and the development of customized solutions.

Europe Container Drayage Market Industry Trends & Analysis

The Europe Container Drayage Market is experiencing robust growth, driven by the flourishing e-commerce sector, expanding global trade, and an increase in intermodal transportation. The market's Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. Market penetration of advanced technologies like digital freight platforms and smart containers remains relatively low (xx%), presenting opportunities for technological disruption and efficiency gains. Growing consumer demand for faster and more reliable delivery contributes significantly to the upward trajectory. Competition is intense, with established players continuously innovating to retain market share and newer entrants adopting differentiated strategies.

Leading Markets & Segments in Europe Container Drayage Market

The dominant region within the European container drayage market is currently Western Europe, driven primarily by high levels of import/export activity and well-developed infrastructure. Within Western Europe, key countries such as Germany, the Netherlands, and the United Kingdom show particularly high market concentration, due to their strategic port locations and strong manufacturing base.

- Key Drivers for Western Europe:

- Extensive port infrastructure and logistics networks.

- Strong manufacturing and distribution centers.

- High volumes of import and export activities.

- Favorable economic policies and regulatory frameworks.

Europe Container Drayage Market Product Developments

Recent product developments focus on enhancing efficiency and transparency across the supply chain. Innovations include the implementation of real-time tracking systems, improved route optimization software, and the use of digital platforms for streamlined communication and documentation. These advancements aim to improve delivery speed, reduce costs, and increase supply chain visibility. The market is witnessing increased adoption of intermodal solutions to enhance efficiency and sustainability.

Key Drivers of Europe Container Drayage Market Growth

Several factors contribute to the growth of the Europe Container Drayage Market:

- E-commerce expansion: The rapid growth of online retail fuels the demand for efficient last-mile delivery solutions.

- Increased global trade: Growing international trade volumes require robust drayage services to move containers efficiently.

- Technological advancements: Innovation in logistics technology, such as digital platforms and automated systems, streamlines operations and increases efficiency.

- Favorable government policies: Supportive regulations and infrastructure investments stimulate market growth.

Challenges in the Europe Container Drayage Market Market

The Europe Container Drayage Market faces several challenges:

- Driver shortages: A persistent lack of qualified drivers hampers operational efficiency and increases costs.

- Port congestion: Delays at major ports cause bottlenecks and negatively affect delivery times, leading to additional expenses.

- Fuel price volatility: Fluctuations in fuel prices directly impact operational costs and profitability.

- Increased competition: The market's competitive nature requires constant innovation and cost optimization to maintain profitability.

Emerging Opportunities in Europe Container Drayage Market

Several opportunities are poised to drive long-term growth in the Europe Container Drayage Market. These include the integration of advanced technologies like AI and machine learning for predictive maintenance and route optimization; the expansion of intermodal transportation through strategic partnerships, such as the recent collaboration between PKP Cargo and COSCO (June 2024); and the development of sustainable drayage solutions that cater to growing environmental concerns.

Leading Players in the Europe Container Drayage Market Sector

Key Milestones in Europe Container Drayage Market Industry

- June 2024: PKP Cargo and COSCO announced a partnership to enhance intermodal flows throughout Europe, significantly impacting rail freight services.

- May 2024: Mullen Group Ltd. acquired ContainerWorld Forwarding Services Inc., consolidating the market and expanding service offerings.

Strategic Outlook for Europe Container Drayage Market Market

The Europe Container Drayage Market is expected to experience continued growth, driven by technological advancements, strategic partnerships, and increased demand. Companies that successfully adapt to emerging trends, such as sustainable logistics and technological integration, are poised to capture significant market share and drive future expansion. The focus on enhancing efficiency, transparency, and sustainability will be pivotal for long-term success in this dynamic market.

Europe Container Drayage Market Segmentation

-

1. Mode of Transport

- 1.1. Rail

- 1.2. Road

- 1.3. Other Modes of Transport

Europe Container Drayage Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Container Drayage Market Regional Market Share

Geographic Coverage of Europe Container Drayage Market

Europe Container Drayage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing International Trade Driving the Market4.; Increasing Importance of Environmental Sustainability Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing International Trade Driving the Market4.; Increasing Importance of Environmental Sustainability Driving the Market

- 3.4. Market Trends

- 3.4.1. Demand for Containers Driven by Cross-border E-commerce

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Container Drayage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.1.1. Rail

- 5.1.2. Road

- 5.1.3. Other Modes of Transport

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kuehne + Nagel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CMA CGM

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Maersk Line

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hapag-Lloyd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MSC (Mediterranean Shipping Company)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 COSCO Shipping

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Evergreen Marine

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Yang Ming**List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: Europe Container Drayage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Container Drayage Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Container Drayage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 2: Europe Container Drayage Market Volume Billion Forecast, by Mode of Transport 2020 & 2033

- Table 3: Europe Container Drayage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Container Drayage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Europe Container Drayage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 6: Europe Container Drayage Market Volume Billion Forecast, by Mode of Transport 2020 & 2033

- Table 7: Europe Container Drayage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Europe Container Drayage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Germany Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: France Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Italy Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Netherlands Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Netherlands Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Belgium Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Belgium Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Sweden Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Sweden Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Norway Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Norway Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Poland Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Poland Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Denmark Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Denmark Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Container Drayage Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Europe Container Drayage Market?

Key companies in the market include DHL, DB Schenker, Kuehne + Nagel, CMA CGM, Maersk Line, Hapag-Lloyd, MSC (Mediterranean Shipping Company), COSCO Shipping, Evergreen Marine, Yang Ming**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the Europe Container Drayage Market?

The market segments include Mode of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.30 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing International Trade Driving the Market4.; Increasing Importance of Environmental Sustainability Driving the Market.

6. What are the notable trends driving market growth?

Demand for Containers Driven by Cross-border E-commerce.

7. Are there any restraints impacting market growth?

4.; Increasing International Trade Driving the Market4.; Increasing Importance of Environmental Sustainability Driving the Market.

8. Can you provide examples of recent developments in the market?

June 2024: PKP Cargo and COSCO announced that they are poised to enhance intermodal flows throughout Europe. Focusing on transport and logistics, their partnership is strategically geared toward robust development. Together, they plan to extend intermodal services, spanning Western, Central, and Eastern Europe. PKP Cargo also plays a pivotal role in strengthening COSCO's rail freight presence in Europe.May 2024: Mullen Group Ltd finalized its acquisition of ContainerWorld Forwarding Services Inc. ContainerWorld, headquartered in Richmond, British Columbia, has been a key player in the logistics scene since its establishment in 1993. Specializing in tailored supply chain solutions, ContainerWorld primarily caters to Canada's alcoholic beverage and hospitality industries. Going forward, ContainerWorld will function as a standalone subsidiary under Mullen Group's ownership.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Container Drayage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Container Drayage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Container Drayage Market?

To stay informed about further developments, trends, and reports in the Europe Container Drayage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence