Key Insights

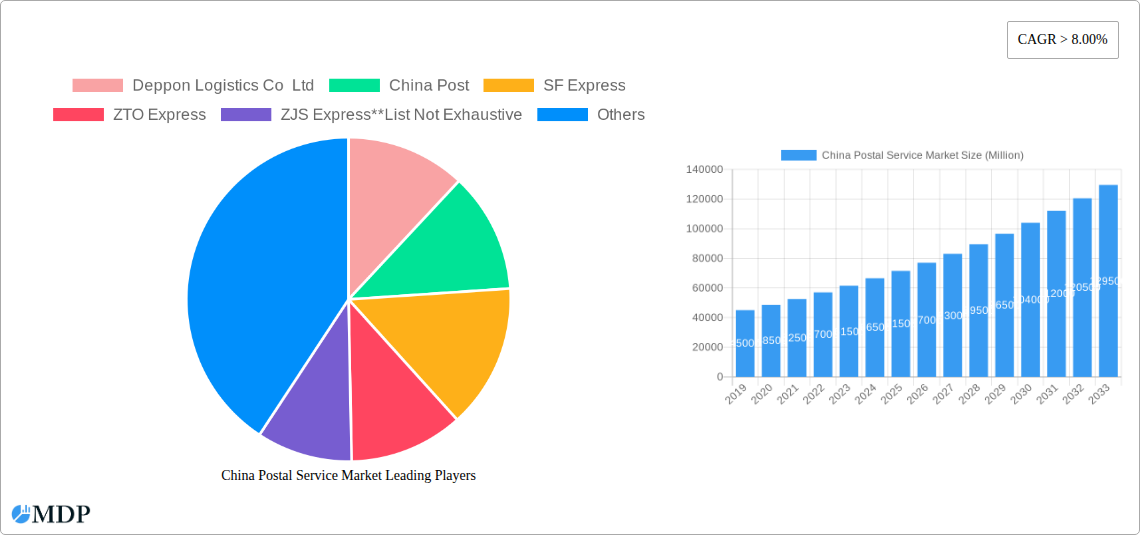

The China Postal Service Market is projected to experience substantial growth, reaching an estimated 216.5 billion by 2025 and continuing its expansion with a Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This surge is largely attributed to the rapidly expanding e-commerce sector, fueled by China's vast digital consumer base. Key market players are accelerating development through the adoption of advanced technologies such as automation, AI-powered sorting, and real-time tracking systems, which enhance operational efficiency, reduce delivery times, and improve customer satisfaction in a competitive environment. The increasing prevalence of Business-to-Business (B2B) and Business-to-Customer (B2C) models, alongside the growth of e-commerce platforms, are significant drivers. Digital integration and continuous service enhancement are critical for maintaining and increasing market share.

China Postal Service Market Market Size (In Billion)

While the market exhibits strong growth potential, it faces challenges including intense price competition and substantial capital investment requirements for infrastructure, technological upgrades, and talent development. Strategic investments in modernization and expansion are actively addressing these constraints. The market is segmented by e-commerce and non-e-commerce applications, serving key end-user industries such as services, wholesale and retail trade, healthcare, and industrial manufacturing. China's postal service plays a crucial role in supporting the supply chains of these diverse sectors. Future market evolution is expected to focus on optimizing last-mile delivery, implementing sustainable logistics practices, and enhancing customer experience through digital interfaces. Consolidation of smaller entities and strategic alliances among major players are anticipated trends, fostering a more dynamic and efficient market.

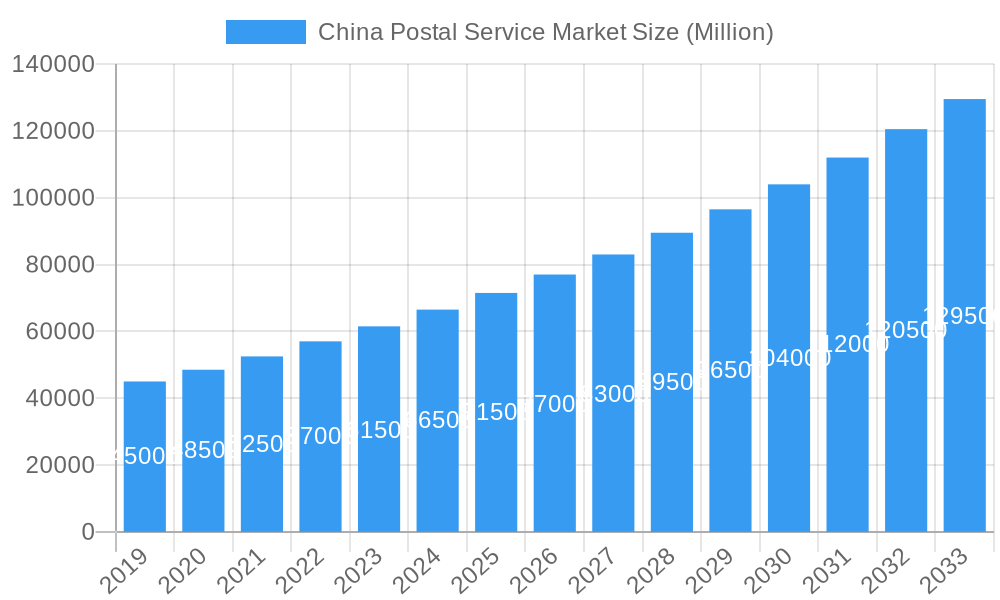

China Postal Service Market Company Market Share

This comprehensive report offers an in-depth analysis of the China Postal Service Market from 2019 to 2033. Driven by e-commerce expansion, evolving consumer demands, and technological advancements, China's postal and logistics sector is a significant market force. The report details market dynamics, industry trends, key segments, product developments, growth drivers, challenges, emerging opportunities, and strategic outlooks, providing actionable insights for investors, logistics providers, e-commerce businesses, and industry analysts. The competitive landscape includes leading companies such as Deppon Logistics Co Ltd, China Post, SF Express, ZTO Express, ZJS Express, FedEx, Yunda Express, Haihang Tiantian Express, Kerry Logistics, STO Express Co Ltd, Best Inc, and YTO Express Group Co Ltd. Key segments analyzed include Business-to-Business (B2B), Business-to-Customer (B2C), and Customer-to-Customer (C2C) business models, E-commerce and Non-E-commerce types, and end-user industries including Services, Wholesale and Retail Trade, Healthcare, Industrial Manufacturing, and Other End Users. With a base year of 2025 and a forecast period extending to 2033, this report is an essential guide to understanding and capitalizing on the China Postal Service Market.

China Postal Service Market Market Dynamics & Concentration

The China Postal Service Market is characterized by a high degree of concentration, dominated by a few key players, alongside a burgeoning number of smaller, specialized logistics providers. Innovation is a primary driver, fueled by the relentless demand for faster, more efficient, and cost-effective delivery solutions, particularly in the e-commerce segment. Regulatory frameworks, while evolving to foster fair competition and ensure service quality, also present evolving compliance requirements for market participants. Product substitutes are emerging in the form of instant delivery services and peer-to-peer logistics platforms, challenging traditional models. End-user trends showcase a clear preference for seamless, trackable, and sustainable delivery options, pushing companies to invest in green logistics and advanced tracking technologies like China Postal Tracking. Mergers and acquisition (M&A) activities remain a significant strategy for consolidation and market expansion, with a projected XX M&A deals in the forecast period. For instance, the market share of the top 5 players is estimated at over 70% in the base year 2025. Key M&A targets often include innovative technology startups or regional players with established networks.

China Postal Service Market Industry Trends & Analysis

The China Postal Service Market is experiencing robust growth, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2019 to 2033. This expansion is primarily propelled by the sustained surge in online retail and the increasing adoption of digital commerce across diverse consumer demographics. Technological disruptions are at the forefront, with the integration of artificial intelligence (AI) for route optimization, drone delivery trials in remote areas, and the widespread use of IoT for real-time package tracking significantly enhancing operational efficiency. Consumer preferences are increasingly geared towards same-day or next-day delivery, alongside a growing demand for environmentally friendly logistics solutions, pushing companies to adopt electric vehicles and optimize packaging. Competitive dynamics are intense, with established giants like China Post and SF Express facing stiff competition from agile e-commerce logistics specialists such as ZTO Express and YTO Express Group Co Ltd. The market penetration of advanced logistics technologies is expected to reach XX% by 2030, transforming the delivery experience. The continuous development of smart warehousing and automated sorting facilities is further boosting the sector's capacity and speed. The market’s capacity is set to increase by over 50% from 2025 to 2030, driven by investments in automation and expanded infrastructure.

Leading Markets & Segments in China Postal Service Market

The E-commerce segment undeniably leads the China Postal Service Market, driven by its massive consumer base and the proliferation of online shopping platforms. Within the business models, Business-to-Business (B2B) remains a dominant force, catering to the extensive supply chains of manufacturers and retailers, while Business-to-Customer (B2C) is experiencing exponential growth due to direct-to-consumer e-commerce sales. Customer-to-Customer (C2C), though smaller, contributes significantly through second-hand platforms and peer-to-peer transactions. The Wholesale and Retail Trade end-user segment is the primary beneficiary of efficient postal and logistics services, with steady demand for inventory management and distribution. However, the Services sector, encompassing everything from document delivery to the logistics of service-based businesses, is also a substantial contributor.

- Dominant Region: Eastern China, with its dense population centers and advanced economic infrastructure, represents the largest and most dynamic market for postal services.

- Key Drivers for E-commerce Dominance:

- Government initiatives promoting digital economy growth.

- High smartphone penetration and internet accessibility.

- Expanding middle-class population with increased purchasing power.

- Convenience and variety offered by online retail.

- B2B Growth Catalysts:

- Globalization of manufacturing and trade.

- Just-in-time inventory management requirements.

- Development of sophisticated B2B e-commerce platforms.

- End User Segment Dominance (Wholesale and Retail Trade):

- Massive domestic consumption driven by a large population.

- Rapid growth of organized retail and supermarkets.

- Increasing demand for efficient last-mile delivery to diverse retail points.

- Healthcare Logistics Advancement: The Healthcare sector is witnessing significant growth in demand for specialized cold chain logistics and secure delivery of pharmaceuticals and medical equipment, a trend projected to accelerate.

China Postal Service Market Product Developments

Product development in the China Postal Service Market is characterized by a strong focus on technological integration and customer-centric solutions. Innovations include the deployment of smart lockers for convenient package pickup, the development of AI-powered customer service chatbots for real-time support, and the introduction of blockchain technology for enhanced transparency and security in supply chains. Companies are also investing in sustainable packaging solutions and electric vehicle fleets to reduce their environmental footprint. These developments not only enhance operational efficiency but also provide competitive advantages by meeting evolving customer expectations for speed, reliability, and eco-consciousness.

Key Drivers of China Postal Service Market Growth

The China Postal Service Market growth is propelled by several potent factors. The burgeoning e-commerce industry is the most significant driver, fueled by a massive online consumer base and continuous expansion of online retail. Technological advancements, including automation, AI, and data analytics, are revolutionizing operational efficiency and service quality. Government support through infrastructure development and policies promoting the logistics sector further bolsters growth. Furthermore, increasing consumer demand for convenience and faster delivery times is a constant impetus for innovation and expansion. The increasing adoption of cross-border e-commerce also opens new avenues for growth.

Challenges in the China Postal Service Market Market

Despite its rapid growth, the China Postal Service Market faces significant challenges. Intense competition among numerous players leads to price wars and pressure on profit margins. Rising operational costs, including labor and fuel, pose a continuous restraint. Regulatory hurdles and evolving compliance requirements, particularly concerning data privacy and environmental standards, demand constant adaptation. Supply chain disruptions, whether due to geopolitical events, natural disasters, or infrastructure limitations, can significantly impact service delivery. Furthermore, the last-mile delivery bottleneck in densely populated urban areas presents persistent logistical challenges.

Emerging Opportunities in China Postal Service Market

Emerging opportunities in the China Postal Service Market are abundant, driven by ongoing digital transformation and evolving consumer behavior. The growth of cross-border e-commerce presents a substantial opportunity for international logistics providers and specialized customs clearance services. The increasing demand for cold chain logistics in sectors like healthcare and fresh produce offers a niche but highly profitable growth area. Technological breakthroughs, such as autonomous delivery vehicles and advanced route optimization software, promise to unlock new levels of efficiency and cost savings. Strategic partnerships between logistics companies, e-commerce platforms, and technology providers are poised to create synergistic growth and expand market reach. The development of rural logistics networks also represents a significant untapped market.

Leading Players in the China Postal Service Market Sector

- Deppon Logistics Co Ltd

- China Post

- SF Express

- ZTO Express

- ZJS Express

- FedEx

- Yunda Express

- Haihang Tiantian Express

- Kerry Logistics

- STO Express Co Ltd

- Best Inc

- YTO Express Group Co Ltd

Key Milestones in China Postal Service Market Industry

- 2019: Significant investment in drone delivery pilots across several provinces by leading logistics firms.

- 2020: Widespread adoption of contactless delivery methods due to the global pandemic, accelerating digital payment integration.

- 2021: Launch of blockchain-enabled supply chain solutions by major players for enhanced transparency and security.

- 2022: Increased focus on green logistics with a surge in electric vehicle fleet expansion and sustainable packaging initiatives.

- 2023: Government announces new policies to streamline cross-border logistics and further digitalize the postal network.

- 2024: Accelerated implementation of AI-powered sorting and route optimization technologies across major distribution hubs.

Strategic Outlook for China Postal Service Market Market

The strategic outlook for the China Postal Service Market is one of continued, robust expansion, driven by sustained e-commerce growth and ongoing technological innovation. Key growth accelerators include further investment in smart logistics infrastructure, including automated warehouses and advanced tracking systems. Companies will increasingly focus on providing value-added services, such as reverse logistics and specialized delivery solutions for niche markets like healthcare and perishables. Strategic partnerships and collaborations will be crucial for market players to expand their reach, enhance service offerings, and achieve greater economies of scale. The integration of AI and big data analytics will be paramount for optimizing operations, personalizing customer experiences, and gaining a competitive edge in this rapidly evolving landscape.

China Postal Service Market Segmentation

-

1. Business Model

- 1.1. Business-to-Business (B2B)

- 1.2. Business-to-Customer (B2C)

- 1.3. Customer-to-Customer (C2C)

-

2. Type

- 2.1. E-commerce

- 2.2. Non E-commerce

-

3. End User

- 3.1. Services

- 3.2. Wholesale and Retail Trade

- 3.3. Healthcare

- 3.4. Industrial Manufacturing

- 3.5. Other End Users

China Postal Service Market Segmentation By Geography

- 1. China

China Postal Service Market Regional Market Share

Geographic Coverage of China Postal Service Market

China Postal Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing New Energy Vehicles Sales

- 3.3. Market Restrains

- 3.3.1. Trade War between China and the United States

- 3.4. Market Trends

- 3.4.1. Growth of E-Commerce in China Driving the CEP Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Postal Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 5.1.1. Business-to-Business (B2B)

- 5.1.2. Business-to-Customer (B2C)

- 5.1.3. Customer-to-Customer (C2C)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. E-commerce

- 5.2.2. Non E-commerce

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Services

- 5.3.2. Wholesale and Retail Trade

- 5.3.3. Healthcare

- 5.3.4. Industrial Manufacturing

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deppon Logistics Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Post

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SF Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ZTO Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ZJS Express**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yunda Express

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Haihang Tiantian Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kerry Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 STO Express Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 China Postal Tracking

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Best Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 YTO Express Group Co Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Deppon Logistics Co Ltd

List of Figures

- Figure 1: China Postal Service Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Postal Service Market Share (%) by Company 2025

List of Tables

- Table 1: China Postal Service Market Revenue billion Forecast, by Business Model 2020 & 2033

- Table 2: China Postal Service Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: China Postal Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: China Postal Service Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: China Postal Service Market Revenue billion Forecast, by Business Model 2020 & 2033

- Table 6: China Postal Service Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: China Postal Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: China Postal Service Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Postal Service Market?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the China Postal Service Market?

Key companies in the market include Deppon Logistics Co Ltd, China Post, SF Express, ZTO Express, ZJS Express**List Not Exhaustive, FedEx, Yunda Express, Haihang Tiantian Express, Kerry Logistics, STO Express Co Ltd, China Postal Tracking, Best Inc, YTO Express Group Co Ltd.

3. What are the main segments of the China Postal Service Market?

The market segments include Business Model, Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 216.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing New Energy Vehicles Sales.

6. What are the notable trends driving market growth?

Growth of E-Commerce in China Driving the CEP Market.

7. Are there any restraints impacting market growth?

Trade War between China and the United States.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Postal Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Postal Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Postal Service Market?

To stay informed about further developments, trends, and reports in the China Postal Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence