Key Insights

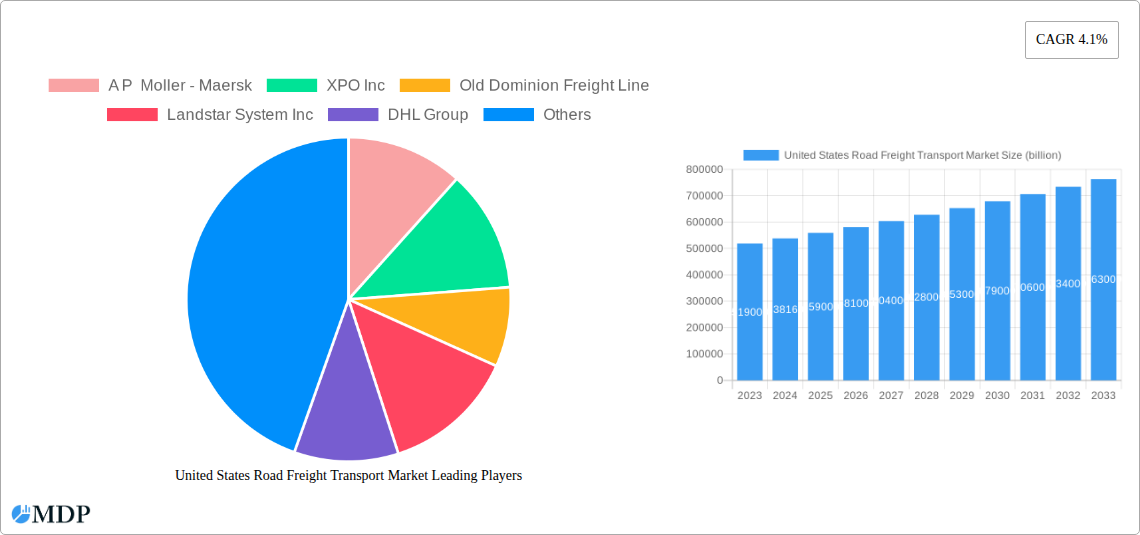

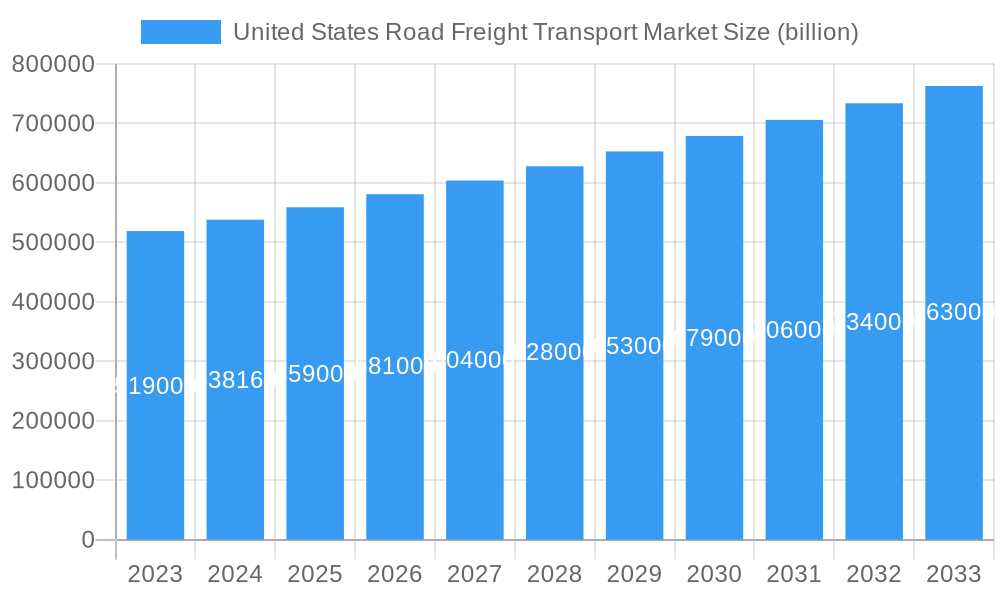

The United States Road Freight Transport Market is poised for steady expansion, with an estimated market size of $538.16 billion in 2024, projecting a Compound Annual Growth Rate (CAGR) of 4.1% through 2033. This robust growth is fueled by several key drivers, primarily the increasing demand from diverse end-user industries. The manufacturing sector, construction, and the wholesale and retail trade continue to be significant contributors, requiring efficient and reliable transportation of goods across the nation. Furthermore, the ongoing growth in e-commerce has dramatically increased the volume of goods needing to be moved, placing greater reliance on road freight for last-mile delivery and intermodal transfers. Technological advancements, such as improved fleet management systems, real-time tracking, and the gradual adoption of autonomous driving technologies, are also enhancing operational efficiency and safety, further supporting market growth.

United States Road Freight Transport Market Market Size (In Billion)

Despite a positive outlook, the market faces certain restraints that could temper its trajectory. Rising fuel costs remain a persistent challenge for trucking companies, impacting operational expenses and profit margins. Labor shortages within the trucking industry, particularly for skilled drivers, continue to strain capacity and drive up wages. Stringent environmental regulations and the increasing focus on reducing carbon emissions necessitate investments in more fuel-efficient vehicles and alternative fuel technologies, which can be costly. However, the market's resilience is evident in its ability to adapt. Trends such as the increasing adoption of Less-than-Truckload (LTL) services for smaller shipments, the growing preference for containerized transport, and the demand for temperature-controlled solutions for perishable goods are shaping the market landscape and creating new opportunities for specialized service providers within the domestic and international freight segments.

United States Road Freight Transport Market Company Market Share

United States Road Freight Transport Market: Comprehensive Insights and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the United States Road Freight Transport Market, offering a comprehensive understanding of its dynamics, key trends, leading players, and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an indispensable resource for logistics providers, shippers, investors, and policymakers seeking to navigate this vital sector. We delve into market concentration, innovation drivers, regulatory landscapes, and the evolving needs of various end-user industries, including Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others. The report also examines key segmentation by Destination (Domestic, International), Truckload Specification (FTL, LTL), Containerization (Containerized, Non-Containerized), Distance (Long Haul, Short Haul), Goods Configuration (Fluid Goods, Solid Goods), and Temperature Control (Non-Temperature Controlled). Discover actionable insights on market growth drivers, technological disruptions, consumer preferences, and competitive dynamics shaping the US trucking market, freight forwarding industry, and logistics and supply chain management. With an estimated market value poised to reach billions of dollars, understanding the nuances of this market is crucial for strategic decision-making.

United States Road Freight Transport Market Market Dynamics & Concentration

The United States Road Freight Transport Market is characterized by a moderately concentrated structure, with several large, established players dominating a significant portion of the market share. However, a substantial number of smaller carriers and specialized niche providers contribute to a dynamic and competitive landscape. Innovation is primarily driven by the relentless pursuit of efficiency and cost reduction, fueled by advancements in freight technology, logistics software, and supply chain optimization. Regulatory frameworks, including hours-of-service regulations and environmental standards, play a crucial role in shaping operational practices and investment decisions. While direct product substitutes for road freight are limited for many goods, intermodal transport options and the rise of e-commerce continue to influence modal choices. End-user trends, particularly the growth of e-commerce and the demand for faster delivery times, are exerting significant pressure on the industry. Merger and acquisition (M&A) activities are a consistent feature, as larger companies seek to expand their network coverage, acquire technological capabilities, or consolidate market positions. Over the historical period (2019-2024), we have observed an increasing number of M&A deals valued in the hundreds of millions to billions of dollars, indicating strategic consolidation. Key metrics like market share for the top 10 companies range from 5% to 15% each, with the combined share of the top 5 players exceeding 40%.

United States Road Freight Transport Market Industry Trends & Analysis

The United States Road Freight Transport Market is experiencing robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) driven by several interconnected factors. A primary growth driver is the sustained expansion of the e-commerce sector, which necessitates an efficient and agile last-mile delivery network. This surge in online retail, coupled with evolving consumer expectations for rapid delivery, places immense demand on trucking companies and freight services. Technological disruptions are at the forefront of shaping the industry. The adoption of Artificial Intelligence (AI) and Machine Learning (ML) for route optimization, predictive maintenance, and demand forecasting is becoming increasingly prevalent, enhancing operational efficiency and reducing costs. The implementation of telematics and IoT devices provides real-time visibility into shipments, improving tracking and security. Furthermore, the ongoing digital transformation of the logistics and supply chain management sector is streamlining processes from booking to final delivery. Consumer preferences are shifting towards sustainability, leading to increased demand for eco-friendly logistics solutions and the exploration of alternative fuel vehicles. Competitive dynamics are intensifying, with a focus on service differentiation, technological integration, and the ability to offer end-to-end logistics solutions. Companies are investing heavily in their freight brokerage and carrier services to gain a competitive edge. The market penetration of advanced logistics technologies is steadily increasing, with an estimated X% of carriers now utilizing some form of AI-powered optimization tool. The overall market size is projected to reach hundreds of billions of dollars by the end of the forecast period.

Leading Markets & Segments in United States Road Freight Transport Market

The United States Road Freight Transport Market exhibits significant dominance across various segments, reflecting the diverse needs of the nation's economy. Wholesale and Retail Trade consistently emerges as the largest end-user industry, driven by the sheer volume of goods moved to support consumer demand and supply chains. The Manufacturing sector also represents a substantial segment, requiring the transport of raw materials and finished products across the country.

Dominant End User Industry:

- Wholesale and Retail Trade: This segment's dominance is fueled by the robust growth of e-commerce and the continuous flow of consumer goods. The demand for efficient freight solutions to restock shelves and fulfill online orders is unparalleled.

- Manufacturing: Essential for moving components to assembly lines and finished goods to distribution centers, manufacturing logistics are a cornerstone of the road freight market.

Dominant Destination:

- Domestic: The vast majority of road freight movement occurs within the United States due to its extensive internal market and well-developed highway infrastructure.

Dominant Truckload Specification:

- Full-Truck-Load (FTL): For bulk shipments and dedicated deliveries, FTL remains the preferred option due to its efficiency and cost-effectiveness for larger volumes.

Dominant Containerization:

- Non-Containerized: While containerized transport is prevalent for international imports and exports, a significant portion of domestic road freight, particularly manufactured goods and raw materials, moves without containers.

Dominant Distance:

- Long Haul: The sheer geographical expanse of the U.S. necessitates extensive long-haul trucking operations to connect distant production centers with consumer markets.

Dominant Goods Configuration:

- Solid Goods: The wide array of manufactured products, agricultural output, and retail merchandise makes solid goods the predominant cargo type.

Dominant Temperature Control:

- Non-Temperature Controlled: While specialized segments like cold chain logistics are growing, the majority of general freight does not require temperature-specific transport.

Factors such as economic policies supporting domestic manufacturing, infrastructure investments in highways and logistics hubs, and consumer spending patterns significantly influence the dominance of these segments. The US trucking industry continues to adapt to these demands, with a focus on optimizing operations within these key areas.

United States Road Freight Transport Market Product Developments

Recent product developments in the United States Road Freight Transport Market are heavily skewed towards enhancing operational efficiency and providing greater visibility. Companies are investing in sophisticated freight management software and logistics platforms that leverage AI and machine learning for advanced route planning, dynamic pricing, and load optimization. The integration of IoT devices and telematics systems allows for real-time tracking and monitoring of shipments, improving security and customer service. Innovations in warehouse management systems and yard management solutions are further streamlining the movement of goods, reducing dwell times, and improving inventory accuracy. These developments aim to address the increasing complexities of supply chains and meet the demand for faster, more reliable, and cost-effective freight services. The market fit for these innovations is strong, as they directly address pain points experienced by both carriers and shippers in the competitive freight transportation landscape.

Key Drivers of United States Road Freight Transport Market Growth

The United States Road Freight Transport Market is propelled by a confluence of powerful drivers. The relentless growth of e-commerce and the subsequent demand for efficient last-mile delivery solutions is a primary catalyst. Advancements in freight technology, including AI for route optimization and predictive analytics, are significantly enhancing operational efficiency and reducing costs for trucking companies. Government initiatives supporting infrastructure development and trade facilitation also play a crucial role. Furthermore, the increasing need for specialized logistics services, such as cold chain transport for perishables and pharmaceuticals, is opening new avenues for growth. The ongoing digitization of supply chains, promoting greater transparency and collaboration, further fuels the market's expansion.

Challenges in the United States Road Freight Transport Market Market

Despite its growth trajectory, the United States Road Freight Transport Market faces significant challenges. A persistent shortage of qualified truck drivers remains a critical constraint, impacting capacity and driving up labor costs. Stringent and evolving regulatory frameworks, including emissions standards and hours-of-service rules, can increase operational complexities and compliance costs. Rising fuel prices and ongoing supply chain disruptions, such as port congestion and weather-related delays, continue to exert pressure on profitability and service reliability. Intense competition among freight carriers and brokers can also lead to price wars, impacting margins. The aging infrastructure in some regions further exacerbates transit times and maintenance costs.

Emerging Opportunities in United States Road Freight Transport Market

Emerging opportunities in the United States Road Freight Transport Market are centered around technological innovation and evolving market demands. The widespread adoption of autonomous trucking and electric vehicles (EVs) holds the potential to revolutionize efficiency and sustainability in the long term. The expansion of specialized logistics services, particularly in temperature-controlled transport for pharmaceuticals and groceries, presents significant growth avenues. Strategic partnerships between carriers, shippers, and technology providers are fostering integrated logistics solutions. Furthermore, the increasing demand for supply chain visibility and data analytics is creating opportunities for companies offering advanced tracking and reporting capabilities, supporting the overall US logistics industry.

Leading Players in the United States Road Freight Transport Market Sector

- A P Moller - Maersk

- XPO Inc

- Old Dominion Freight Line

- Landstar System Inc

- DHL Group

- Yellow Corporation

- FedEx

- Knight-Swift Transportation Holdings Inc

- United Parcel Service of America Inc (UPS)

- Werner Enterprises

- C H Robinson

- ArcBest®

- Schneider National Inc

- J B Hunt Transport Inc

- Ryder System Inc

Key Milestones in United States Road Freight Transport Market Industry

- February 2024: C.H. Robinson has developed a new technology that creates a major efficiency in freight shipping: removing the work of scheduling an appointment at the place where a load needs to be picked up and scheduling another appointment where the load needs to be delivered. The technology also uses artificial intelligence to determine the optimal appointment, based on transit-time data from C.H. Robinson’s millions of shipments across 300,000 shipping lanes. This innovation significantly streamlines the booking and delivery process, reducing delays and improving carrier utilization.

- October 2023: Ryder Systems continues to expand its multiclient warehouse network, adding a 400,000-square-foot distribution center in Aurora, Ill. The newly built facility is the latest addition to a now six-building campus totaling 2.4 million square feet, primarily serving shippers of consumer packaged goods (CPG), including food and beverage, food ingredients, health and beauty, household products, and general retail merchandise. This expansion enhances Ryder's capacity to serve growing demand for outsourced warehousing and fulfillment.

- September 2023: UPS has entered into an agreement to acquire MNX Global Logistics (MNX), a global time-critical logistics provider. MNX’s capabilities in radio-pharmaceuticals and temperature-controlled logistics will help UPS’ healthcare segment and clinical trial logistics subsidiary Marken meet the growing demand for these services. The transaction is expected to close by the end of the year. This acquisition strengthens UPS's position in the high-value healthcare logistics market.

Strategic Outlook for United States Road Freight Transport Market Market

The strategic outlook for the United States Road Freight Transport Market is one of continued evolution and adaptation. Growth will be accelerated by the persistent demand for faster and more transparent logistics services, driven by e-commerce and evolving consumer behavior. Investments in freight technology, particularly in AI, automation, and sustainable transportation solutions like electric trucks, will be critical for maintaining a competitive edge. Strategic partnerships and collaborations will become increasingly important for building resilient and integrated supply chains. Companies that can effectively navigate regulatory changes and address the persistent driver shortage through innovative recruitment and retention strategies will be well-positioned for long-term success in this dynamic US trucking market.

United States Road Freight Transport Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

United States Road Freight Transport Market Segmentation By Geography

- 1. United States

United States Road Freight Transport Market Regional Market Share

Geographic Coverage of United States Road Freight Transport Market

United States Road Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Road Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. United States

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 A P Moller - Maersk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 XPO Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Old Dominion Freight Line

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Landstar System Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Yellow Corporatio

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FedEx

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Knight-Swift Transportation Holdings Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 United Parcel Service of America Inc (UPS)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Werner Enterprises

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 C H Robinson

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ArcBest®

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Schneider National Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 J B Hunt Transport Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Ryder System Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 A P Moller - Maersk

List of Figures

- Figure 1: United States Road Freight Transport Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Road Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: United States Road Freight Transport Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: United States Road Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 3: United States Road Freight Transport Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 4: United States Road Freight Transport Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 5: United States Road Freight Transport Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 6: United States Road Freight Transport Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 7: United States Road Freight Transport Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 8: United States Road Freight Transport Market Revenue billion Forecast, by Region 2020 & 2033

- Table 9: United States Road Freight Transport Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 10: United States Road Freight Transport Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 11: United States Road Freight Transport Market Revenue billion Forecast, by Truckload Specification 2020 & 2033

- Table 12: United States Road Freight Transport Market Revenue billion Forecast, by Containerization 2020 & 2033

- Table 13: United States Road Freight Transport Market Revenue billion Forecast, by Distance 2020 & 2033

- Table 14: United States Road Freight Transport Market Revenue billion Forecast, by Goods Configuration 2020 & 2033

- Table 15: United States Road Freight Transport Market Revenue billion Forecast, by Temperature Control 2020 & 2033

- Table 16: United States Road Freight Transport Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Road Freight Transport Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the United States Road Freight Transport Market?

Key companies in the market include A P Moller - Maersk, XPO Inc, Old Dominion Freight Line, Landstar System Inc, DHL Group, Yellow Corporatio, FedEx, Knight-Swift Transportation Holdings Inc, United Parcel Service of America Inc (UPS), Werner Enterprises, C H Robinson, ArcBest®, Schneider National Inc, J B Hunt Transport Inc, Ryder System Inc.

3. What are the main segments of the United States Road Freight Transport Market?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD 538.16 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

February 2024: C.H. Robinson has developed a new technology that creates a major efficiency in freight shipping: removing the work of scheduling an appointment at the place where a load needs to be picked up and scheduling another appointment where the load needs to be delivered. The technology also uses artificial intelligence to determine the optimal appointment, based on transit-time data from C.H. Robinson’s millions of shipments across 300,000 shipping lanes.October 2023: Ryder Systems continues to expand its multiclient warehouse network, adding a 400,000-square-foot distribution center in Aurora, Ill. The newly built facility is the latest addition to a now six-building campus totaling 2.4 million square feet, primarily serving shippers of consumer packaged goods (CPG), including food and beverage, food ingredients, health and beauty, household products, and general retail merchandise.September 2023: UPS has entered into an agreement to acquire MNX Global Logistics (MNX), a global time-critical logistics provider. MNX’s capabilities in radio-pharmaceuticals and temperature-controlled logistics will help UPS’ healthcare segment and clinical trial logistics subsidiary Marken meet the growing demand for these services. The transaction is expected to close by the end of the year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Road Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Road Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Road Freight Transport Market?

To stay informed about further developments, trends, and reports in the United States Road Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence