Key Insights

The North American international express service market is projected for significant expansion, forecast to reach $136.11 billion by 2025. This market is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.3% from 2025 to 2033. Key growth drivers include the surge in e-commerce, necessitating rapid and dependable cross-border logistics for lightweight parcels. Concurrently, expanding global trade and increasing international commerce are escalating the demand for efficient and secure express delivery of heavier goods. Advancements in logistics technology, including sophisticated tracking and automated operations, are enhancing efficiency and customer experience, further bolstering market expansion. The market is segmented by shipment weight (heavy, light, medium), with the lightweight segment anticipated to lead, driven by e-commerce prevalence. Major competitors such as UPS, FedEx, and DHL are committed to innovation, investing in infrastructure and technology to meet escalating demands for speed and reliability.

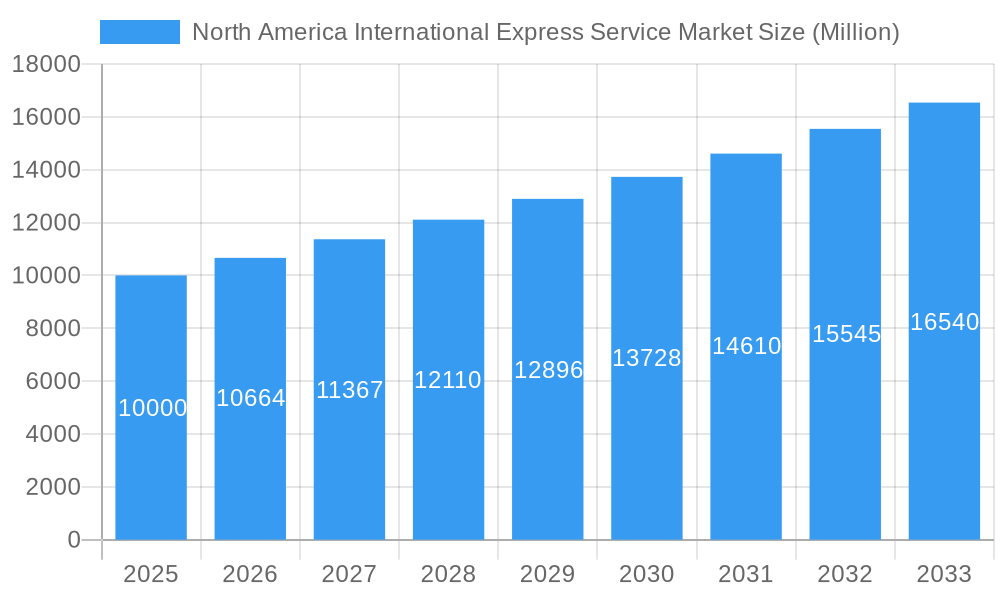

North America International Express Service Market Market Size (In Billion)

Despite positive projections, the market confronts challenges. Volatile global fuel prices and economic instability can affect operational expenses and profitability. Additionally, complex international regulations and customs procedures can introduce logistical hurdles and delays. Intense competition from established and emerging players also shapes the market landscape. Growth within North America is particularly influenced by robust trade between the United States, Canada, and Mexico, underscoring the region's economic interdependence. Nevertheless, the long-term outlook for the North American international express service market remains optimistic, supported by sustained e-commerce growth, globalization trends, and ongoing technological innovation.

North America International Express Service Market Company Market Share

North America International Express Service Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America International Express Service Market, covering the period 2019-2033. It delves into market dynamics, industry trends, leading players, and future growth prospects, offering invaluable insights for stakeholders across the logistics and express delivery sectors. With a focus on key segments like heavy, light, and medium-weight shipments, this report is an essential resource for strategic planning and investment decisions. The report utilizes data from the base year 2025 and forecasts market trends until 2033, providing a clear picture of the market's trajectory.

North America International Express Service Market Market Dynamics & Concentration

The North American international express service market is characterized by a high level of concentration, with a few major players dominating the landscape. Market share data reveals that the top three players (UPS, FedEx, and DHL) collectively hold approximately xx% of the market, exhibiting strong brand recognition and extensive network infrastructure. However, smaller players, including regional specialists like OnTrac and Power Link Expedite, cater to niche market segments and compete on specialized service offerings.

Several factors drive innovation within this market. Stringent regulatory frameworks, particularly concerning customs compliance and security, necessitate continuous improvement in tracking technologies and operational efficiency. The rise of e-commerce fuels the demand for faster and more reliable delivery options, pushing companies to invest in automation and advanced logistics solutions. Substitute products, such as postal services and freight forwarding, offer alternative options, but express services retain their dominance due to speed and reliability. End-user trends lean towards increased demand for real-time tracking, delivery flexibility, and personalized service options.

Mergers and acquisitions (M&A) activity in the sector has been relatively steady, with xx major deals recorded between 2019 and 2024. These activities often focus on expanding geographical reach, integrating technological capabilities, and enhancing service portfolios. The competitive landscape is dynamic, characterized by both aggressive competition and strategic collaborations.

- Market Concentration: Top 3 players hold approximately xx% market share (2024).

- Innovation Drivers: E-commerce growth, regulatory compliance, technological advancements.

- M&A Activity: xx major deals recorded between 2019 and 2024.

- End-User Trends: Demand for real-time tracking, delivery flexibility, and personalized service.

North America International Express Service Market Industry Trends & Analysis

The North American international express service market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several key factors. The sustained growth of e-commerce, both B2C and B2B, significantly fuels the demand for rapid and reliable international shipping. Technological disruptions, such as the increasing adoption of automation, artificial intelligence (AI) for route optimization, and blockchain for enhanced security and transparency, are reshaping the industry. Consumer preferences are shifting towards seamless, omnichannel experiences, emphasizing speed, convenience, and visibility throughout the delivery process.

The competitive dynamics within the sector are intensely competitive, characterized by continuous price wars and the constant pursuit of operational efficiencies. Market penetration by major players remains high, but opportunities exist for specialized service providers focusing on niche markets and offering customized solutions. The industry is also witnessing the increasing adoption of sustainable logistics practices, driven by growing environmental concerns and regulatory pressures. These factors create both challenges and opportunities for market participants. Market penetration of express services within the overall logistics sector is estimated at xx% in 2024 and projected to reach xx% by 2033.

Leading Markets & Segments in North America International Express Service Market

While the entire North American market presents significant opportunities, certain regions and segments exhibit stronger growth dynamics. The United States remains the dominant market, accounting for the largest share of revenue, fueled by its robust economy and high level of e-commerce penetration. Canada and Mexico are also key markets, although their growth trajectories are influenced by unique economic and infrastructural conditions.

- Shipment Weight:

- Heavy Weight Shipments: This segment is driven by the manufacturing and industrial sectors, with strong growth potential linked to increased cross-border trade in manufactured goods. Key drivers include robust manufacturing activities in the US and Mexico, and efficient cross-border logistics infrastructure.

- Light Weight Shipments: Dominated by e-commerce, this segment is characterized by high volume and requires efficient last-mile delivery solutions. Growth is largely driven by sustained e-commerce growth and the increasing preference for fast deliveries.

- Medium Weight Shipments: This segment caters to a broad range of industries and demonstrates consistent growth, representing a balanced segment bridging the gap between light and heavy-weight shipments.

North America International Express Service Market Product Developments

Recent product innovations focus on enhancing speed, traceability, and convenience. This includes advancements in tracking technologies, offering real-time updates and proactive notifications. Companies are also investing in specialized packaging solutions to improve product protection and reduce damage during transit. The integration of AI and machine learning in route optimization, warehouse management, and customer service is significantly improving operational efficiency and enhancing customer experience. These developments are crucial in maintaining a competitive edge in a dynamic market.

Key Drivers of North America International Express Service Market Growth

The growth of the North America international express service market is propelled by several key factors. The ongoing expansion of e-commerce, particularly cross-border transactions, remains a significant driver. Technological advancements, such as automation and AI-powered logistics, enhance efficiency and reduce costs, further boosting market growth. Favorable economic conditions in key markets such as the US, combined with supportive government policies, stimulate trade and investment, driving demand for express delivery services.

Challenges in the North America International Express Service Market Market

The North America international express service market faces several significant challenges. Fluctuating fuel prices and increasing labor costs exert pressure on profitability. Supply chain disruptions, exacerbated by geopolitical events, can lead to delays and increased operational complexities. Intense competition among established players and the emergence of new entrants create pricing pressure and necessitate continuous innovation. Stringent regulatory compliance requirements related to customs, security, and environmental concerns add to operational costs. These challenges require companies to adopt robust strategies to mitigate risks and ensure sustainable growth.

Emerging Opportunities in North America International Express Service Market

The market presents significant long-term opportunities driven by technological advancements like drone delivery and autonomous vehicles, promising enhanced efficiency and reduced costs. Strategic partnerships among logistics providers, technology companies, and retailers can unlock new service models and expand market reach. The growing adoption of sustainable logistics practices, such as electric vehicles and eco-friendly packaging, represents a significant opportunity for companies committed to environmental responsibility. Expansion into underserved markets and the development of tailored solutions for specific industries offer further avenues for growth.

Leading Players in the North America International Express Service Market Sector

- United Parcel Service of America Inc (UPS)

- DHL Group

- Power Link Expedite

- FedEx

- Asendia

- International Distributions Services (including GLS)

- OnTrac

- Aramex

- DTDC Express Limited

Key Milestones in North America International Express Service Market Industry

- July 2023: DHL Express invested USD 9.6 million in a new service point in Denver, expanding its capacity and infrastructure.

- March 2023: Aramex entered a joint venture with AD Ports Group to establish a new NVOCC enterprise.

- February 2023: Aramex reported a 27% drop in annual net profit to USD 45.02 million, primarily due to currency fluctuations.

Strategic Outlook for North America International Express Service Market Market

The North America international express service market is poised for continued growth, driven by ongoing e-commerce expansion, technological innovation, and strategic partnerships. Companies that effectively leverage technology, prioritize customer experience, and adopt sustainable practices are well-positioned to capture significant market share. The long-term outlook is positive, with considerable opportunities for both established players and new entrants to capitalize on evolving market dynamics and consumer demands.

North America International Express Service Market Segmentation

-

1. Shipment Weight

- 1.1. Heavy Weight Shipments

- 1.2. Light Weight Shipments

- 1.3. Medium Weight Shipments

-

2. End User Industry

- 2.1. E-Commerce

- 2.2. Financial Services (BFSI)

- 2.3. Healthcare

- 2.4. Manufacturing

- 2.5. Primary Industry

- 2.6. Wholesale and Retail Trade (Offline)

- 2.7. Others

North America International Express Service Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America International Express Service Market Regional Market Share

Geographic Coverage of North America International Express Service Market

North America International Express Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Fueling the Growth of 3PL Market

- 3.3. Market Restrains

- 3.3.1. Slow Infrastructure Development

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America International Express Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.1.1. Heavy Weight Shipments

- 5.1.2. Light Weight Shipments

- 5.1.3. Medium Weight Shipments

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. E-Commerce

- 5.2.2. Financial Services (BFSI)

- 5.2.3. Healthcare

- 5.2.4. Manufacturing

- 5.2.5. Primary Industry

- 5.2.6. Wholesale and Retail Trade (Offline)

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Shipment Weight

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 United Parcel Service of America Inc (UPS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Power Link Expedite

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FedEx

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Asendia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 International Distributions Services (including GLS)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OnTrac

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aramex

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DTDC Express Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 United Parcel Service of America Inc (UPS

List of Figures

- Figure 1: North America International Express Service Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America International Express Service Market Share (%) by Company 2025

List of Tables

- Table 1: North America International Express Service Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 2: North America International Express Service Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 3: North America International Express Service Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America International Express Service Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 5: North America International Express Service Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 6: North America International Express Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America International Express Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America International Express Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America International Express Service Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America International Express Service Market?

The projected CAGR is approximately 7.3%.

2. Which companies are prominent players in the North America International Express Service Market?

Key companies in the market include United Parcel Service of America Inc (UPS, DHL Group, Power Link Expedite, FedEx, Asendia, International Distributions Services (including GLS), OnTrac, Aramex, DTDC Express Limited.

3. What are the main segments of the North America International Express Service Market?

The market segments include Shipment Weight, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 136.11 billion as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Fueling the Growth of 3PL Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Infrastructure Development.

8. Can you provide examples of recent developments in the market?

July 2023: With the USD 9.6 million investment, DHL Express acquired a location closer to the commercial core in downtown Denver. The new DHL Service Point includes nearly 56,000 sq. ft of combined warehouse and office space, along with 60 positions for vehicles to load and unload shipments around its conveyable sorting system.March 2023: Aramex signed a joint venture with AD Ports Group, one of the leading global trade, logistics, and industry facilitators, to develop and operate a new Non-Vessel Operating Common Carrier (“NVOCC”) enterprise.February 2023: Aramex's annual net profit dropped by 27% to USD 45.02 million due to currency fluctuations in certain markets, primarily in Lebanon and Egypt. Its 2022 revenue was broadly in line with 2021, while Q4 2022 revenue decreased 5% to USD 0.416 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America International Express Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America International Express Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America International Express Service Market?

To stay informed about further developments, trends, and reports in the North America International Express Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence