Key Insights

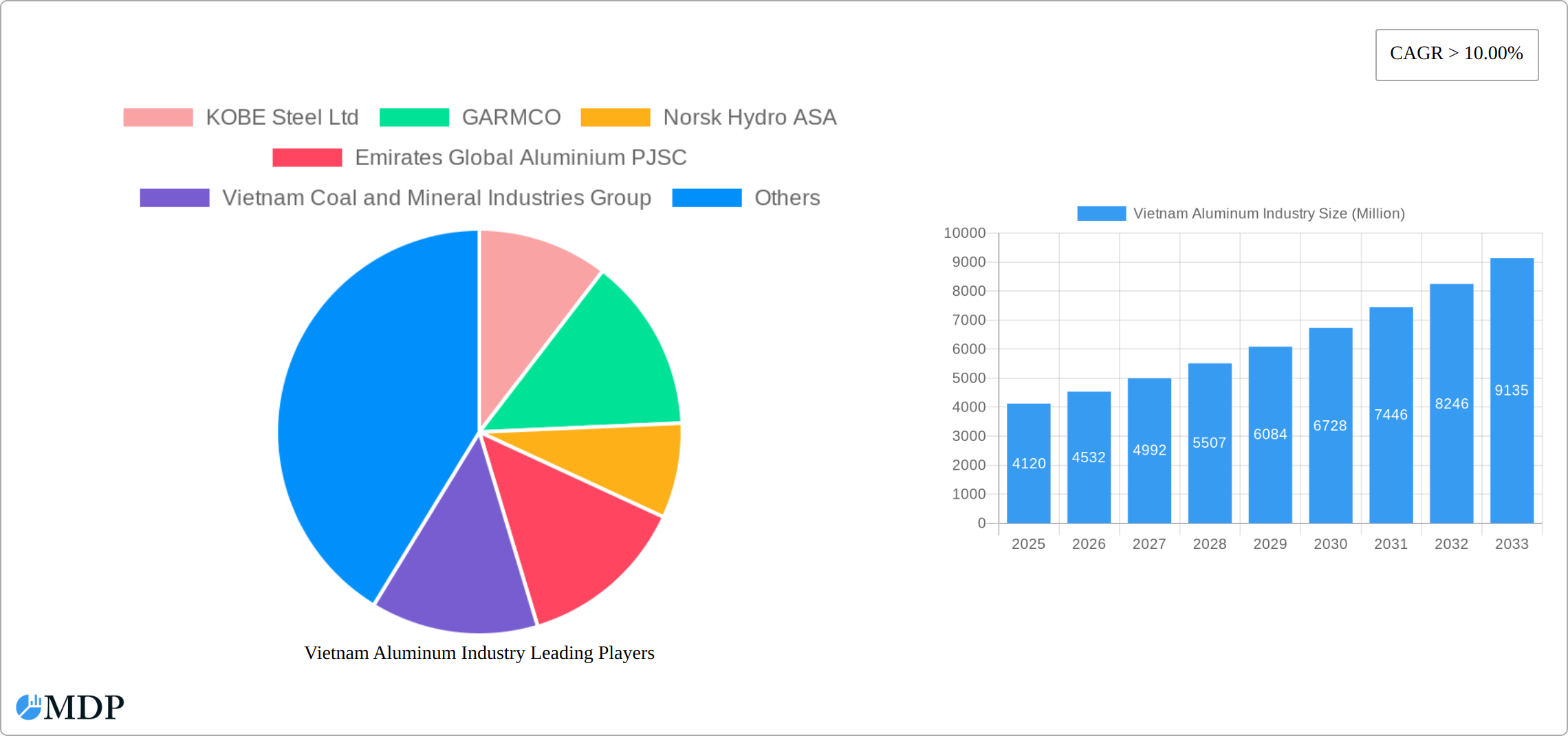

The Vietnam aluminum industry presents a robust growth trajectory, projected to reach a market size exceeding $4.12 billion by 2025 and maintaining a Compound Annual Growth Rate (CAGR) of over 10% through 2033. This expansion is fueled by several key drivers. Firstly, Vietnam's burgeoning construction sector, driven by rapid urbanization and infrastructure development, necessitates substantial aluminum usage in building materials and construction projects. Secondly, the country's thriving automotive and electronics manufacturing industries, attracting significant foreign direct investment, significantly increase demand for aluminum components. Thirdly, government initiatives promoting sustainable development and industrial diversification are indirectly supporting the aluminum sector’s expansion. The industry's segmentation reveals a diverse landscape, with notable contributions from castings, extrusions, and flat-rolled products, catering to various end-user industries. While precise market share data for each segment and end-user industry is not available, it is reasonable to assume that automotive and construction sectors currently represent the largest consumers of aluminum in Vietnam, given their significant growth and substantial material requirements. However, the aerospace and defense, and electrical and electronics segments are expected to experience significant growth in the coming years.

Despite this promising outlook, the Vietnam aluminum industry faces some challenges. Fluctuations in global aluminum prices, dependent on international supply chains and energy costs, pose a significant risk. Additionally, competition from other materials, such as steel and plastics, necessitates innovation and competitive pricing strategies for aluminum manufacturers. Furthermore, environmental concerns regarding aluminum production and waste management require continuous improvements in sustainable practices. Leading players like Kobe Steel Ltd, GARMCO, Norsk Hydro ASA, and others are actively involved in the Vietnamese market, demonstrating the industry's attractiveness to both domestic and international companies. Their strategic investments and technological advancements will play a significant role in shaping the industry’s future growth. To maintain its strong growth trajectory, the Vietnam aluminum industry needs to focus on technological innovation, sustainable practices, and strategic partnerships to navigate the global economic dynamics and environmental considerations.

Vietnam Aluminum Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the Vietnam aluminum industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence on market dynamics, leading players, and future growth opportunities. The report leverages data from the historical period (2019-2024) to predict future trends accurately. The total market size is projected to reach xx Million by 2033, representing a significant growth opportunity.

Vietnam Aluminum Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the Vietnamese aluminum market, examining market concentration, innovation drivers, regulatory influences, substitute products, end-user trends, and mergers and acquisitions (M&A) activity. The market is characterized by a moderate level of concentration, with a few major players holding significant market share. However, the presence of numerous smaller players indicates a competitive environment. For example, in 2024, the top three players held approximately xx% of the market share collectively.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the Vietnamese aluminum market was estimated at xx in 2024, suggesting a moderately concentrated market.

- Innovation Drivers: Increased demand for lightweight materials in the automotive and aerospace sectors is driving innovation in aluminum alloys and processing techniques.

- Regulatory Framework: Government policies promoting industrial development and infrastructure investment positively impact market growth. However, environmental regulations related to aluminum production pose a challenge.

- Product Substitutes: Steel and other materials compete with aluminum in various applications. However, aluminum's lightweight and corrosion-resistant properties maintain its competitive edge.

- End-User Trends: Growth in construction, automotive, and electronics sectors fuels demand for aluminum products. The shift towards sustainable materials also benefits the aluminum industry.

- M&A Activity: Between 2019 and 2024, there were approximately xx M&A deals in the Vietnamese aluminum industry, indicating consolidation trends and strategic investments.

Vietnam Aluminum Industry Industry Trends & Analysis

This section delves into the key trends shaping the Vietnam aluminum industry, including market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. The Vietnamese aluminum market has experienced significant growth in recent years, primarily driven by robust economic growth and increasing industrialization. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 was approximately xx%, and market penetration in key end-user sectors continues to rise.

Technological advancements are improving the efficiency and sustainability of aluminum production. Furthermore, consumer preferences for lightweight, durable, and recyclable materials are boosting aluminum demand. The competitive landscape is marked by both domestic and international players vying for market share. Price fluctuations in raw materials (bauxite and alumina) and energy costs pose challenges to the industry.

Leading Markets & Segments in Vietnam Aluminum Industry

This section analyzes the key regions, countries, and segments driving the Vietnamese aluminum industry. While precise, publicly available market share data for each segment is limited, analysis indicates that flat-rolled products constitute the largest processing segment, followed by extrusions. The building and construction sector remains the dominant end-use market, significantly impacting overall demand.

Key Drivers:

- Robust Economic Growth: Vietnam's consistently strong GDP growth fuels demand across various sectors, creating a favorable environment for aluminum consumption.

- Government Initiatives: Supportive industrial policies, including tax incentives and infrastructure investments, actively stimulate growth within the aluminum sector.

- Infrastructure Development Boom: Massive investments in infrastructure projects, from high-speed rail to urban development, significantly increase the demand for aluminum in construction and transportation applications.

- Expanding Automotive and Electronics Sectors: The growth of these industries introduces significant new demand for lightweight and durable aluminum components.

Dominance Analysis:

The dominance of flat-rolled products is directly linked to the booming construction sector, fueled by both government spending and private investment. This segment’s strength mirrors Vietnam's rapid urbanization and infrastructure development.

Further analysis reveals a growing importance of the extrusion segment, particularly in specialized applications within the automotive and electronics sectors. This diversification indicates a maturing and increasingly sophisticated market.

Vietnam Aluminum Industry Product Developments

Recent product innovations focus on developing high-strength, lightweight aluminum alloys for the automotive and aerospace industries. These advancements enhance fuel efficiency and reduce emissions, aligning with global sustainability goals. The focus on improving the recyclability of aluminum products also addresses environmental concerns. This is driving the adoption of new technologies in casting, extrusion, and forging processes, enhancing product quality, and lowering production costs.

Key Drivers of Vietnam Aluminum Industry Growth

The Vietnamese aluminum industry's robust growth is driven by a confluence of factors: rapid economic expansion, substantial infrastructure development (especially in construction and transportation), increasing demand from the automotive and electronics sectors, and consistent government support for industrial growth. Technological advancements in aluminum production, emphasizing efficiency and sustainability, are also key contributors to market expansion. The country's strategic location and growing manufacturing base further enhance its attractiveness as an aluminum production and processing hub.

Challenges in the Vietnam Aluminum Industry Market

The Vietnam aluminum industry faces challenges, including fluctuations in raw material prices (bauxite and alumina), dependence on energy imports which affects production cost, and intense competition from both domestic and international players. Moreover, environmental regulations and concerns about carbon emissions necessitate investments in cleaner production technologies.

Emerging Opportunities in Vietnam Aluminum Industry

The Vietnamese aluminum industry presents considerable untapped potential. The surging investment in renewable energy infrastructure creates significant opportunities for aluminum utilization in solar panel frames, wind turbine components, and electric vehicle charging infrastructure. Strategic partnerships and joint ventures between domestic and international companies are fostering technological transfer and market access. Growing demand for high-performance aluminum in the aerospace and defense sectors presents another significant avenue for expansion. Furthermore, the increasing focus on sustainable and recyclable materials positions the industry favorably for long-term growth.

Leading Players in the Vietnam Aluminum Industry Sector

- KOBE Steel Ltd

- GARMCO

- Norsk Hydro ASA

- Emirates Global Aluminium PJSC

- Vietnam Coal and Mineral Industries Group

- Rusal

- Daiki Aluminium Industry Co Ltd

- Alcoa Corporation

Key Milestones in Vietnam Aluminum Industry Industry

- 2020: Significant investments in aluminum recycling facilities, reflecting a growing commitment to environmental sustainability and resource efficiency.

- 2022: Establishment of a new state-of-the-art aluminum extrusion plant by a major international player, substantially increasing domestic production capacity and enhancing technological capabilities.

- 2023: Government-led initiatives actively promote the use of aluminum in infrastructure projects, highlighting its role in achieving national carbon reduction targets and improving overall infrastructure resilience.

- 2024: A major merger and acquisition (M&A) deal involving two key industry players reshapes the competitive landscape, creating a more consolidated market with potential for increased efficiency and investment.

Strategic Outlook for Vietnam Aluminum Industry Market

The Vietnam aluminum industry exhibits strong prospects for continued growth, driven by sustained economic expansion, ongoing infrastructure development, and rising demand across diverse end-use sectors. Strategic investments in advanced technologies, sustainable manufacturing practices, and collaborative partnerships will be critical for capturing market share and achieving long-term success. The industry's trajectory suggests a promising future, presenting attractive opportunities for both domestic and international investors.

Vietnam Aluminum Industry Segmentation

-

1. Processing Type

- 1.1. Castings

- 1.2. Extrusions

- 1.3. Forgings

- 1.4. Flat-rolled Products

- 1.5. Pigments and Powders

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Aerospace and Defense

- 2.3. Building and Construction

- 2.4. Electrical and Electronics

- 2.5. Packaging

- 2.6. Industrial

- 2.7. Other En

Vietnam Aluminum Industry Segmentation By Geography

- 1. Vietnam

Vietnam Aluminum Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Substitution of Stainless Steel with Aluminum by Automotive Companies; Growing Construction and Infrastructure Activities in the Country; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Unfavorable Conditions Arising Due to the COVID-19 Outbreak; Other Restraints

- 3.4. Market Trends

- 3.4.1. Growth in Demand from the Building and Construction Industry is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Aluminum Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Processing Type

- 5.1.1. Castings

- 5.1.2. Extrusions

- 5.1.3. Forgings

- 5.1.4. Flat-rolled Products

- 5.1.5. Pigments and Powders

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Aerospace and Defense

- 5.2.3. Building and Construction

- 5.2.4. Electrical and Electronics

- 5.2.5. Packaging

- 5.2.6. Industrial

- 5.2.7. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Processing Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 KOBE Steel Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GARMCO

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Norsk Hydro ASA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Emirates Global Aluminium PJSC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vietnam Coal and Mineral Industries Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rusal

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Daiki Aluminium Industry Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alcoa Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 KOBE Steel Ltd

List of Figures

- Figure 1: Vietnam Aluminum Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Aluminum Industry Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Aluminum Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Aluminum Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Vietnam Aluminum Industry Revenue Million Forecast, by Processing Type 2019 & 2032

- Table 4: Vietnam Aluminum Industry Volume K Tons Forecast, by Processing Type 2019 & 2032

- Table 5: Vietnam Aluminum Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Vietnam Aluminum Industry Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 7: Vietnam Aluminum Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Vietnam Aluminum Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Vietnam Aluminum Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Vietnam Aluminum Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Vietnam Aluminum Industry Revenue Million Forecast, by Processing Type 2019 & 2032

- Table 12: Vietnam Aluminum Industry Volume K Tons Forecast, by Processing Type 2019 & 2032

- Table 13: Vietnam Aluminum Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: Vietnam Aluminum Industry Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 15: Vietnam Aluminum Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Vietnam Aluminum Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Aluminum Industry?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Vietnam Aluminum Industry?

Key companies in the market include KOBE Steel Ltd, GARMCO, Norsk Hydro ASA, Emirates Global Aluminium PJSC, Vietnam Coal and Mineral Industries Group, Rusal, Daiki Aluminium Industry Co Ltd, Alcoa Corporation.

3. What are the main segments of the Vietnam Aluminum Industry?

The market segments include Processing Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Substitution of Stainless Steel with Aluminum by Automotive Companies; Growing Construction and Infrastructure Activities in the Country; Other Drivers.

6. What are the notable trends driving market growth?

Growth in Demand from the Building and Construction Industry is Driving the Market.

7. Are there any restraints impacting market growth?

Unfavorable Conditions Arising Due to the COVID-19 Outbreak; Other Restraints.

8. Can you provide examples of recent developments in the market?

The recent developments pertaining to the major players in the market are being covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Aluminum Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Aluminum Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Aluminum Industry?

To stay informed about further developments, trends, and reports in the Vietnam Aluminum Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence