Key Insights

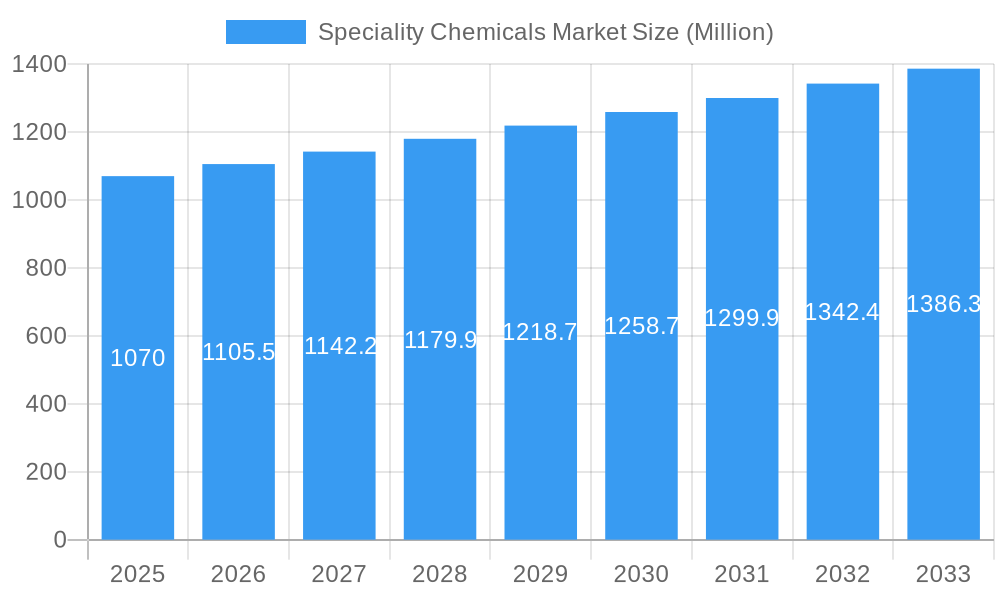

The global specialty chemicals market is poised for robust expansion, projected to reach $1.07 billion with a Compound Annual Growth Rate (CAGR) of 3.31% from 2025 to 2033. This growth is underpinned by a dynamic interplay of driving forces and evolving trends across a diverse range of applications. The increasing demand for high-performance materials in sectors like automotive, electronics, and construction fuels the need for advanced chemical formulations. Furthermore, a growing emphasis on sustainability and eco-friendly solutions is driving innovation in bio-based and recyclable specialty chemicals. Key segments such as paints and coatings, construction chemicals, and cosmetic chemicals are exhibiting significant momentum, propelled by their essential roles in enhancing product performance, aesthetics, and functionality. The market's trajectory is also influenced by stringent regulatory frameworks and a continuous pursuit of cost-efficiency, pushing manufacturers towards developing specialized solutions that offer superior value and environmental benefits.

Speciality Chemicals Market Market Size (In Billion)

Despite the promising outlook, certain restraints could influence the market's pace. Fluctuations in raw material prices, particularly those derived from petrochemicals, can impact production costs and profit margins. Additionally, the complex and often lengthy R&D cycles for developing novel specialty chemicals require substantial investment, posing a challenge for smaller players. However, these challenges are being addressed through strategic partnerships, technological advancements, and a keen focus on niche market segments. The Asia Pacific region is expected to lead market growth, driven by its burgeoning industrial base and increasing disposable incomes. Innovations in areas like electronic chemicals, water treatment chemicals, and lubricant additives are expected to carve out significant market shares, reflecting the broad and deep impact of specialty chemicals across virtually every modern industry.

Speciality Chemicals Market Company Market Share

Unlocking Growth: The Definitive Speciality Chemicals Market Report (2019-2033)

Dive deep into the dynamic speciality chemicals market, a sector pivotal for innovation across industries. This comprehensive report, covering 2019-2033 with a base year of 2025, provides unparalleled insights into market dynamics, industry trends, leading segments, and future opportunities. Explore the strategies of key players like Ferro Corporation, Infineum International Limited, Henkel AG & Co KGaA, DIC Corporation, Corteva, Clariant, Ecolab, GCP Applied Technologies Inc, Holcim, and Nouryon. With millions in market value analyzed, gain actionable intelligence to navigate this rapidly evolving landscape.

Speciality Chemicals Market Market Dynamics & Concentration

The speciality chemicals market is characterized by dynamic forces shaping its growth and competitive landscape. Market concentration is moderate, with a blend of large, established players and niche innovators. Innovation drivers are paramount, fueled by increasing demand for sustainable solutions, advanced performance materials, and customized product formulations across diverse end-use industries. Regulatory frameworks, particularly those concerning environmental impact and product safety, play a significant role in product development and market entry strategies. Product substitutes exist across various applications, necessitating continuous innovation to maintain market share. End-user trends, such as the growing demand for eco-friendly products in consumer goods and the need for high-performance materials in electronics and automotive sectors, are key market shapers. Mergers and Acquisitions (M&A) activities remain a consistent strategy for market consolidation and portfolio expansion. For instance, numerous M&A deals, estimated at over 50 within the historical period 2019-2024, have aimed at acquiring specialized technologies and expanding geographical reach. The estimated market share of the top 10 players is projected to be around 55-60% by 2025, indicating a consolidated yet competitive environment.

Speciality Chemicals Market Industry Trends & Analysis

The global speciality chemicals market is poised for robust growth, driven by a confluence of technological advancements, evolving consumer preferences, and expanding industrial applications. The estimated Compound Annual Growth Rate (CAGR) for the forecast period 2025-2033 is a healthy 6.2%, highlighting the sector's significant expansion potential. This growth is underpinned by the increasing demand for high-performance and tailored chemical solutions across a multitude of industries. Technological disruptions, such as the rise of bio-based chemicals, advanced catalysis, and digital manufacturing processes, are revolutionizing product development and production efficiencies. Consumer preferences are increasingly shifting towards sustainable, safe, and ethically sourced products, creating significant opportunities for speciality chemical manufacturers to develop eco-friendly alternatives and formulations. For example, the penetration of sustainable ingredients in personal care and cosmetic segments is projected to exceed 30% by 2025. Competitive dynamics are intensifying, with companies focusing on R&D, strategic collaborations, and supply chain optimization to gain a competitive edge. The market penetration of advanced polymers in the automotive sector alone is expected to reach 45% by 2026, demonstrating the growing reliance on specialized chemical solutions. Furthermore, the increasing adoption of digitalization and automation in chemical production processes is leading to enhanced operational efficiency and reduced costs, further fueling market growth.

Leading Markets & Segments in Speciality Chemicals Market

The Paints and Coatings segment continues to dominate the speciality chemicals market, driven by its extensive applications in Architectural, Automotive, and Industrial sectors. The global market for paints and coatings is valued at approximately $160,000 Million in 2025.

Paints and Coatings:

- Dynamics: Driven by demand for aesthetic appeal, protection, and specialized functionalities like anti-corrosion and self-cleaning properties.

- Applications:

- Architectural: Significant growth due to urbanization and renovation projects worldwide.

- Automotive: High-performance coatings for aesthetics and durability, with a growing demand for eco-friendly, low-VOC formulations.

- Industrial: Critical for infrastructure, manufacturing, and heavy machinery, requiring specialized protective coatings.

- Wood: Protective and decorative coatings for furniture and construction.

- Other Applications: Including marine, aerospace, and packaging.

Construction Chemicals: This segment is experiencing substantial growth, estimated at $85,000 Million in 2025, fueled by global infrastructure development and increasing construction activity in residential and commercial sectors.

- Dynamics: Essential for enhancing the performance, durability, and sustainability of construction materials.

- Applications:

- Commercial & Industrial: High-performance admixtures, waterproofing, and protective coatings.

- Infrastructure: Crucial for roads, bridges, and tunnels, ensuring longevity and resilience.

- Residential: Enhancing living spaces with improved insulation, aesthetics, and durability.

- Public Space: For beautification and functional enhancement of public amenities.

Agrochemicals: Expected to reach $200,000 Million by 2025, this segment is vital for global food security, with demand driven by population growth and the need for enhanced crop yields.

- Dynamics: Focus on efficacy, environmental safety, and sustainable agricultural practices.

- Types:

- Fertilizers: Essential for nutrient replenishment and crop growth.

- Herbicide, Fungicide, Insecticide, Nematicide, Molluscicide: Critical for crop protection against pests and diseases.

- Other Crop Protection Chemicals: Including plant growth regulators and soil conditioners.

Electronic Chemicals: A rapidly expanding segment, projected to reach $70,000 Million in 2025, driven by the burgeoning demand for semiconductors and integrated circuits in consumer electronics, automotive, and telecommunications.

- Dynamics: Requiring ultra-high purity chemicals for precision manufacturing processes.

- Applications:

- Semiconductors and Integrated Circuits: Essential for chip fabrication, lithography, and etching.

- Printed Circuit Boards: For manufacturing electronic components.

Water Treatment Chemicals: Critical for ensuring clean water availability and industrial process efficiency, valued at $55,000 Million in 2025.

- Dynamics: Driven by increasing water scarcity, stringent environmental regulations, and industrial water management needs.

- Functions:

- Flocculants and Coagulants: For removing suspended solids.

- Biocides and Disinfectants: For microbial control.

- Defoamers and Defoaming Agents: To control foam in industrial processes.

- pH Adjusters and Softeners: For water quality management.

Speciality Chemicals Market Product Developments

Product innovation in the speciality chemicals market is primarily focused on enhancing performance, sustainability, and cost-effectiveness. Key developments include the introduction of advanced bio-based polymers with improved biodegradability, high-performance coatings with extended durability and reduced environmental impact, and novel catalytic systems enabling more efficient chemical synthesis. For example, the development of water-borne adhesives with performance rivaling solvent-borne counterparts addresses environmental concerns while expanding application possibilities. Furthermore, the market is witnessing the emergence of smart chemicals with self-healing or responsive properties, catering to advanced applications in electronics and aerospace. These innovations are driven by a need for customized solutions and a commitment to greener chemistry, offering significant competitive advantages to manufacturers.

Key Drivers of Speciality Chemicals Market Growth

The speciality chemicals market is experiencing significant growth propelled by several key drivers. Technological advancements, particularly in areas like nanotechnology and biotechnology, are enabling the creation of novel materials with superior properties. Increasing global demand for sustainable and eco-friendly products is a major catalyst, pushing manufacturers to develop greener chemical formulations and processes. Economic growth, especially in emerging economies, translates to increased industrial activity and a higher demand for specialized chemical inputs across sectors like construction, automotive, and consumer goods. Stringent environmental regulations, while sometimes posing challenges, also drive innovation towards safer and more sustainable chemical alternatives. For instance, the push for REACH compliance in Europe has spurred the development of safer chemical substances.

Challenges in the Speciality Chemicals Market Market

Despite its robust growth, the speciality chemicals market faces several challenges. Stringent and evolving regulatory landscapes across different regions can create complexities in product development, registration, and market access, impacting time-to-market and increasing compliance costs. Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, can affect production schedules and profitability. Intense competition from both established players and emerging companies necessitates continuous innovation and cost optimization. Furthermore, the need for significant R&D investment to develop cutting-edge speciality chemicals can be a barrier for smaller enterprises. The projected impact of supply chain disruptions on market growth is estimated to be around a 1-1.5% reduction in CAGR during periods of significant volatility.

Emerging Opportunities in Speciality Chemicals Market

Emerging opportunities in the speciality chemicals market are largely driven by advancements in sustainable chemistry and the growing demand for specialized solutions in high-growth sectors. The increasing adoption of electric vehicles (EVs) presents a significant opportunity for speciality chemicals used in battery components, lightweight materials, and advanced coatings. The burgeoning demand for personalized and natural cosmetic ingredients fuels innovation in cosmetic chemicals. Furthermore, the global focus on water scarcity and resource management opens avenues for advanced water treatment chemicals. Strategic partnerships and collaborations between chemical manufacturers and end-use industries can accelerate the development and adoption of tailored solutions. For instance, collaborations focused on developing biodegradable plastics are expected to gain significant traction.

Leading Players in the Speciality Chemicals Market Sector

- Ferro Corporation

- Infineum International Limited

- Henkel AG & Co KGaA

- DIC Corporation

- Corteva

- Clariant

- Ecolab

- GCP Applied Technologies Inc

- Holcim

- Nouryon

Key Milestones in Speciality Chemicals Market Industry

- December 2022: Clariant AG announced its strategic move to strengthen its position in China and expand its care chemicals facility in the country. This expansion encompasses pharmaceutical, personal care, home care, and industrial applications, reinforcing Clariant's commitment to its specialty segment.

- April 2022: Evonik made a significant investment to increase its production capacity for isobutene derivatives at its Marl location by 50%. The isobutene part of the C4 production network is crucial for producing petrochemical specialties like Tertiary Butanol (TBA), Di-isobutene (DiB), and 3,5,5 Trimethylhexanal (TMH). Tertiary Butanol, in particular, serves as a unique solvent and tablet coating for the pharmaceutical industry, highlighting its impact on niche markets.

Strategic Outlook for Speciality Chemicals Market Market

The strategic outlook for the speciality chemicals market is highly promising, with a strong emphasis on sustainable innovation and market diversification. Companies are expected to focus on developing bio-based and biodegradable chemicals to meet increasing environmental demands. The expansion into high-growth application areas such as electric vehicles, advanced electronics, and healthcare will be crucial for sustained growth. Strategic mergers, acquisitions, and partnerships will continue to be key strategies for gaining market share, accessing new technologies, and expanding geographical footprints. The integration of digital technologies in R&D and manufacturing processes will enhance efficiency and competitiveness. The market is poised for significant growth, with an estimated global market value of over $1 Million Million by 2033.

Speciality Chemicals Market Segmentation

-

1. Paints and Coatings

- 1.1. Dynamics

-

1.2. Application

- 1.2.1. Architectural

- 1.2.2. Automotive

- 1.2.3. Industrial

- 1.2.4. Wood

- 1.2.5. Other Applications

-

2. Catalysts

- 2.1. Dynamics

-

2.2. Function

- 2.2.1. Chemical Synthesis Catalysts

- 2.2.2. Petroleum Refining Catalysts

- 2.2.3. Polymerization Catalysts

-

3. Construction Chemicals

- 3.1. Dynamics

-

3.2. Application

- 3.2.1. Commercial

- 3.2.2. Industrial

- 3.2.3. Infrastructure

- 3.2.4. Residential

- 3.2.5. Public Space

-

4. Cosmetic Chemicals

- 4.1. Dynamics

-

4.2. Application

- 4.2.1. Hair Care

- 4.2.2. Skin Care

- 4.2.3. Oral Care

- 4.2.4. Personal Hygiene

- 4.2.5. Other Applications

-

5. Dyes, Inks, and Pigments

- 5.1. Dynamics

-

5.2. Type

- 5.2.1. Organic Pigments

- 5.2.2. Inorganic Pigments

-

6. Electronic Chemicals

- 6.1. Dynamics

-

6.2. Application

- 6.2.1. Semiconductors and Integrated Circuits

- 6.2.2. Printed Circuit Boards

-

7. Water Treatment Chemicals

- 7.1. Dynamics

-

7.2. Function

- 7.2.1. Flocculants

- 7.2.2. Coagulants

- 7.2.3. Biocides and Disinfectants

- 7.2.4. Defoamers and Defoaming Agents

- 7.2.5. pH Adjusters and Softeners

- 7.2.6. Other Functions

-

8. Food Additives

- 8.1. Dynamics

-

8.2. Type

- 8.2.1. Natural Additives

- 8.2.2. Synthetic Additives

-

9. Agrochemicals

- 9.1. Dynamics

-

9.2. Type

- 9.2.1. Fertilizers

- 9.2.2. Herbicide

- 9.2.3. Fungicide

- 9.2.4. Insecticide

- 9.2.5. Nematicide

- 9.2.6. Molluscicide

- 9.2.7. Other Crop Protection Chemicals

-

10. Industrial and Institutional Cleaners

- 10.1. Dynamics

-

10.2. Application

- 10.2.1. General Purpose Cleaners

- 10.2.2. Disinfectants and Sanitizers

- 10.2.3. Laundry Care Products

- 10.2.4. Vehicle Wash Products

-

11. Lubricant Additives

- 11.1. Dynamics

-

11.2. Product Type

- 11.2.1. Dispersants and Emulsifiers

- 11.2.2. Detergents

- 11.2.3. Oxidation Inhibitors

- 11.2.4. Extreme-pressure Additives and Anti-wear Additives

- 11.2.5. Viscosity Index Modifiers

- 11.2.6. Friction Modifiers

- 11.2.7. Corrosion Inhibitors

- 11.2.8. Other Product Types

-

12. Mining Chemicals

- 12.1. Dynamics

-

12.2. Function

- 12.2.1. Flotation Chemicals

- 12.2.2. Extraction Chemicals

- 12.2.3. Grinding Aids

-

13. Oilfield Chemicals

- 13.1. Dynamics

-

13.2. Application

- 13.2.1. Biocide

- 13.2.2. Corrosion and Scale Inhibitor

- 13.2.3. Demulsifier

- 13.2.4. Polymer

- 13.2.5. Surfactant

- 13.2.6. Other Chemical Types

-

14. Adhesives and Sealants

- 14.1. Dynamics

-

14.2. Technology

- 14.2.1. Water-borne Adhesives

- 14.2.2. Solvent-borne Adhesives

- 14.2.3. Hot-melt Adhesives

- 14.2.4. Reactive Adhesives

- 14.2.5. Other Adhesives

-

15. Plastic Additives

- 15.1. Dynamics

-

15.2. Plastic Type

- 15.2.1. Polyethylene (PE)

- 15.2.2. Polystyrene (PS)

- 15.2.3. Polypropylene (PP)

- 15.2.4. Polyamide (PA)

- 15.2.5. Polyethylene Terephthalate (PET)

- 15.2.6. Polyvinyl Chloride (PVC)

- 15.2.7. Polycarbonate (PC)

- 15.2.8. Other Plastic Types

-

16. Rubber Processing Chemicals

- 16.1. Dynamics

-

16.2. Application

- 16.2.1. Tire

- 16.2.2. Non-tire

-

17. Specialty Polymers

- 17.1. Dynamics

-

18. Textile Chemicals

- 18.1. Dynamics

-

18.2. Application

- 18.2.1. Coating and Sizing Chemicals

- 18.2.2. Colorants and Auxiliaries

- 18.2.3. Finishing Agents

- 18.2.4. Desizing Agents

- 18.2.5. Other Application

Speciality Chemicals Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

- 2.4. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Spain

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Speciality Chemicals Market Regional Market Share

Geographic Coverage of Speciality Chemicals Market

Speciality Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Robust Growth of Construction Activities in Asia-Pacific

- 3.2.2 and Middle East and Africa; Growing Population is Propelling the Demand for Food Worldwide

- 3.3. Market Restrains

- 3.3.1. Low Resistance to Extreme Weather Conditions; Rising Global Regulations on its Usage

- 3.4. Market Trends

- 3.4.1. Agrochemicals Segment to Dominate the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Speciality Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Paints and Coatings

- 5.1.1. Dynamics

- 5.1.2. Application

- 5.1.2.1. Architectural

- 5.1.2.2. Automotive

- 5.1.2.3. Industrial

- 5.1.2.4. Wood

- 5.1.2.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Catalysts

- 5.2.1. Dynamics

- 5.2.2. Function

- 5.2.2.1. Chemical Synthesis Catalysts

- 5.2.2.2. Petroleum Refining Catalysts

- 5.2.2.3. Polymerization Catalysts

- 5.3. Market Analysis, Insights and Forecast - by Construction Chemicals

- 5.3.1. Dynamics

- 5.3.2. Application

- 5.3.2.1. Commercial

- 5.3.2.2. Industrial

- 5.3.2.3. Infrastructure

- 5.3.2.4. Residential

- 5.3.2.5. Public Space

- 5.4. Market Analysis, Insights and Forecast - by Cosmetic Chemicals

- 5.4.1. Dynamics

- 5.4.2. Application

- 5.4.2.1. Hair Care

- 5.4.2.2. Skin Care

- 5.4.2.3. Oral Care

- 5.4.2.4. Personal Hygiene

- 5.4.2.5. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by Dyes, Inks, and Pigments

- 5.5.1. Dynamics

- 5.5.2. Type

- 5.5.2.1. Organic Pigments

- 5.5.2.2. Inorganic Pigments

- 5.6. Market Analysis, Insights and Forecast - by Electronic Chemicals

- 5.6.1. Dynamics

- 5.6.2. Application

- 5.6.2.1. Semiconductors and Integrated Circuits

- 5.6.2.2. Printed Circuit Boards

- 5.7. Market Analysis, Insights and Forecast - by Water Treatment Chemicals

- 5.7.1. Dynamics

- 5.7.2. Function

- 5.7.2.1. Flocculants

- 5.7.2.2. Coagulants

- 5.7.2.3. Biocides and Disinfectants

- 5.7.2.4. Defoamers and Defoaming Agents

- 5.7.2.5. pH Adjusters and Softeners

- 5.7.2.6. Other Functions

- 5.8. Market Analysis, Insights and Forecast - by Food Additives

- 5.8.1. Dynamics

- 5.8.2. Type

- 5.8.2.1. Natural Additives

- 5.8.2.2. Synthetic Additives

- 5.9. Market Analysis, Insights and Forecast - by Agrochemicals

- 5.9.1. Dynamics

- 5.9.2. Type

- 5.9.2.1. Fertilizers

- 5.9.2.2. Herbicide

- 5.9.2.3. Fungicide

- 5.9.2.4. Insecticide

- 5.9.2.5. Nematicide

- 5.9.2.6. Molluscicide

- 5.9.2.7. Other Crop Protection Chemicals

- 5.10. Market Analysis, Insights and Forecast - by Industrial and Institutional Cleaners

- 5.10.1. Dynamics

- 5.10.2. Application

- 5.10.2.1. General Purpose Cleaners

- 5.10.2.2. Disinfectants and Sanitizers

- 5.10.2.3. Laundry Care Products

- 5.10.2.4. Vehicle Wash Products

- 5.11. Market Analysis, Insights and Forecast - by Lubricant Additives

- 5.11.1. Dynamics

- 5.11.2. Product Type

- 5.11.2.1. Dispersants and Emulsifiers

- 5.11.2.2. Detergents

- 5.11.2.3. Oxidation Inhibitors

- 5.11.2.4. Extreme-pressure Additives and Anti-wear Additives

- 5.11.2.5. Viscosity Index Modifiers

- 5.11.2.6. Friction Modifiers

- 5.11.2.7. Corrosion Inhibitors

- 5.11.2.8. Other Product Types

- 5.12. Market Analysis, Insights and Forecast - by Mining Chemicals

- 5.12.1. Dynamics

- 5.12.2. Function

- 5.12.2.1. Flotation Chemicals

- 5.12.2.2. Extraction Chemicals

- 5.12.2.3. Grinding Aids

- 5.13. Market Analysis, Insights and Forecast - by Oilfield Chemicals

- 5.13.1. Dynamics

- 5.13.2. Application

- 5.13.2.1. Biocide

- 5.13.2.2. Corrosion and Scale Inhibitor

- 5.13.2.3. Demulsifier

- 5.13.2.4. Polymer

- 5.13.2.5. Surfactant

- 5.13.2.6. Other Chemical Types

- 5.14. Market Analysis, Insights and Forecast - by Adhesives and Sealants

- 5.14.1. Dynamics

- 5.14.2. Technology

- 5.14.2.1. Water-borne Adhesives

- 5.14.2.2. Solvent-borne Adhesives

- 5.14.2.3. Hot-melt Adhesives

- 5.14.2.4. Reactive Adhesives

- 5.14.2.5. Other Adhesives

- 5.15. Market Analysis, Insights and Forecast - by Plastic Additives

- 5.15.1. Dynamics

- 5.15.2. Plastic Type

- 5.15.2.1. Polyethylene (PE)

- 5.15.2.2. Polystyrene (PS)

- 5.15.2.3. Polypropylene (PP)

- 5.15.2.4. Polyamide (PA)

- 5.15.2.5. Polyethylene Terephthalate (PET)

- 5.15.2.6. Polyvinyl Chloride (PVC)

- 5.15.2.7. Polycarbonate (PC)

- 5.15.2.8. Other Plastic Types

- 5.16. Market Analysis, Insights and Forecast - by Rubber Processing Chemicals

- 5.16.1. Dynamics

- 5.16.2. Application

- 5.16.2.1. Tire

- 5.16.2.2. Non-tire

- 5.17. Market Analysis, Insights and Forecast - by Specialty Polymers

- 5.17.1. Dynamics

- 5.18. Market Analysis, Insights and Forecast - by Textile Chemicals

- 5.18.1. Dynamics

- 5.18.2. Application

- 5.18.2.1. Coating and Sizing Chemicals

- 5.18.2.2. Colorants and Auxiliaries

- 5.18.2.3. Finishing Agents

- 5.18.2.4. Desizing Agents

- 5.18.2.5. Other Application

- 5.19. Market Analysis, Insights and Forecast - by Region

- 5.19.1. Asia Pacific

- 5.19.2. North America

- 5.19.3. Europe

- 5.19.4. South America

- 5.19.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Paints and Coatings

- 6. Asia Pacific Speciality Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Paints and Coatings

- 6.1.1. Dynamics

- 6.1.2. Application

- 6.1.2.1. Architectural

- 6.1.2.2. Automotive

- 6.1.2.3. Industrial

- 6.1.2.4. Wood

- 6.1.2.5. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Catalysts

- 6.2.1. Dynamics

- 6.2.2. Function

- 6.2.2.1. Chemical Synthesis Catalysts

- 6.2.2.2. Petroleum Refining Catalysts

- 6.2.2.3. Polymerization Catalysts

- 6.3. Market Analysis, Insights and Forecast - by Construction Chemicals

- 6.3.1. Dynamics

- 6.3.2. Application

- 6.3.2.1. Commercial

- 6.3.2.2. Industrial

- 6.3.2.3. Infrastructure

- 6.3.2.4. Residential

- 6.3.2.5. Public Space

- 6.4. Market Analysis, Insights and Forecast - by Cosmetic Chemicals

- 6.4.1. Dynamics

- 6.4.2. Application

- 6.4.2.1. Hair Care

- 6.4.2.2. Skin Care

- 6.4.2.3. Oral Care

- 6.4.2.4. Personal Hygiene

- 6.4.2.5. Other Applications

- 6.5. Market Analysis, Insights and Forecast - by Dyes, Inks, and Pigments

- 6.5.1. Dynamics

- 6.5.2. Type

- 6.5.2.1. Organic Pigments

- 6.5.2.2. Inorganic Pigments

- 6.6. Market Analysis, Insights and Forecast - by Electronic Chemicals

- 6.6.1. Dynamics

- 6.6.2. Application

- 6.6.2.1. Semiconductors and Integrated Circuits

- 6.6.2.2. Printed Circuit Boards

- 6.7. Market Analysis, Insights and Forecast - by Water Treatment Chemicals

- 6.7.1. Dynamics

- 6.7.2. Function

- 6.7.2.1. Flocculants

- 6.7.2.2. Coagulants

- 6.7.2.3. Biocides and Disinfectants

- 6.7.2.4. Defoamers and Defoaming Agents

- 6.7.2.5. pH Adjusters and Softeners

- 6.7.2.6. Other Functions

- 6.8. Market Analysis, Insights and Forecast - by Food Additives

- 6.8.1. Dynamics

- 6.8.2. Type

- 6.8.2.1. Natural Additives

- 6.8.2.2. Synthetic Additives

- 6.9. Market Analysis, Insights and Forecast - by Agrochemicals

- 6.9.1. Dynamics

- 6.9.2. Type

- 6.9.2.1. Fertilizers

- 6.9.2.2. Herbicide

- 6.9.2.3. Fungicide

- 6.9.2.4. Insecticide

- 6.9.2.5. Nematicide

- 6.9.2.6. Molluscicide

- 6.9.2.7. Other Crop Protection Chemicals

- 6.10. Market Analysis, Insights and Forecast - by Industrial and Institutional Cleaners

- 6.10.1. Dynamics

- 6.10.2. Application

- 6.10.2.1. General Purpose Cleaners

- 6.10.2.2. Disinfectants and Sanitizers

- 6.10.2.3. Laundry Care Products

- 6.10.2.4. Vehicle Wash Products

- 6.11. Market Analysis, Insights and Forecast - by Lubricant Additives

- 6.11.1. Dynamics

- 6.11.2. Product Type

- 6.11.2.1. Dispersants and Emulsifiers

- 6.11.2.2. Detergents

- 6.11.2.3. Oxidation Inhibitors

- 6.11.2.4. Extreme-pressure Additives and Anti-wear Additives

- 6.11.2.5. Viscosity Index Modifiers

- 6.11.2.6. Friction Modifiers

- 6.11.2.7. Corrosion Inhibitors

- 6.11.2.8. Other Product Types

- 6.12. Market Analysis, Insights and Forecast - by Mining Chemicals

- 6.12.1. Dynamics

- 6.12.2. Function

- 6.12.2.1. Flotation Chemicals

- 6.12.2.2. Extraction Chemicals

- 6.12.2.3. Grinding Aids

- 6.13. Market Analysis, Insights and Forecast - by Oilfield Chemicals

- 6.13.1. Dynamics

- 6.13.2. Application

- 6.13.2.1. Biocide

- 6.13.2.2. Corrosion and Scale Inhibitor

- 6.13.2.3. Demulsifier

- 6.13.2.4. Polymer

- 6.13.2.5. Surfactant

- 6.13.2.6. Other Chemical Types

- 6.14. Market Analysis, Insights and Forecast - by Adhesives and Sealants

- 6.14.1. Dynamics

- 6.14.2. Technology

- 6.14.2.1. Water-borne Adhesives

- 6.14.2.2. Solvent-borne Adhesives

- 6.14.2.3. Hot-melt Adhesives

- 6.14.2.4. Reactive Adhesives

- 6.14.2.5. Other Adhesives

- 6.15. Market Analysis, Insights and Forecast - by Plastic Additives

- 6.15.1. Dynamics

- 6.15.2. Plastic Type

- 6.15.2.1. Polyethylene (PE)

- 6.15.2.2. Polystyrene (PS)

- 6.15.2.3. Polypropylene (PP)

- 6.15.2.4. Polyamide (PA)

- 6.15.2.5. Polyethylene Terephthalate (PET)

- 6.15.2.6. Polyvinyl Chloride (PVC)

- 6.15.2.7. Polycarbonate (PC)

- 6.15.2.8. Other Plastic Types

- 6.16. Market Analysis, Insights and Forecast - by Rubber Processing Chemicals

- 6.16.1. Dynamics

- 6.16.2. Application

- 6.16.2.1. Tire

- 6.16.2.2. Non-tire

- 6.17. Market Analysis, Insights and Forecast - by Specialty Polymers

- 6.17.1. Dynamics

- 6.18. Market Analysis, Insights and Forecast - by Textile Chemicals

- 6.18.1. Dynamics

- 6.18.2. Application

- 6.18.2.1. Coating and Sizing Chemicals

- 6.18.2.2. Colorants and Auxiliaries

- 6.18.2.3. Finishing Agents

- 6.18.2.4. Desizing Agents

- 6.18.2.5. Other Application

- 6.1. Market Analysis, Insights and Forecast - by Paints and Coatings

- 7. North America Speciality Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Paints and Coatings

- 7.1.1. Dynamics

- 7.1.2. Application

- 7.1.2.1. Architectural

- 7.1.2.2. Automotive

- 7.1.2.3. Industrial

- 7.1.2.4. Wood

- 7.1.2.5. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Catalysts

- 7.2.1. Dynamics

- 7.2.2. Function

- 7.2.2.1. Chemical Synthesis Catalysts

- 7.2.2.2. Petroleum Refining Catalysts

- 7.2.2.3. Polymerization Catalysts

- 7.3. Market Analysis, Insights and Forecast - by Construction Chemicals

- 7.3.1. Dynamics

- 7.3.2. Application

- 7.3.2.1. Commercial

- 7.3.2.2. Industrial

- 7.3.2.3. Infrastructure

- 7.3.2.4. Residential

- 7.3.2.5. Public Space

- 7.4. Market Analysis, Insights and Forecast - by Cosmetic Chemicals

- 7.4.1. Dynamics

- 7.4.2. Application

- 7.4.2.1. Hair Care

- 7.4.2.2. Skin Care

- 7.4.2.3. Oral Care

- 7.4.2.4. Personal Hygiene

- 7.4.2.5. Other Applications

- 7.5. Market Analysis, Insights and Forecast - by Dyes, Inks, and Pigments

- 7.5.1. Dynamics

- 7.5.2. Type

- 7.5.2.1. Organic Pigments

- 7.5.2.2. Inorganic Pigments

- 7.6. Market Analysis, Insights and Forecast - by Electronic Chemicals

- 7.6.1. Dynamics

- 7.6.2. Application

- 7.6.2.1. Semiconductors and Integrated Circuits

- 7.6.2.2. Printed Circuit Boards

- 7.7. Market Analysis, Insights and Forecast - by Water Treatment Chemicals

- 7.7.1. Dynamics

- 7.7.2. Function

- 7.7.2.1. Flocculants

- 7.7.2.2. Coagulants

- 7.7.2.3. Biocides and Disinfectants

- 7.7.2.4. Defoamers and Defoaming Agents

- 7.7.2.5. pH Adjusters and Softeners

- 7.7.2.6. Other Functions

- 7.8. Market Analysis, Insights and Forecast - by Food Additives

- 7.8.1. Dynamics

- 7.8.2. Type

- 7.8.2.1. Natural Additives

- 7.8.2.2. Synthetic Additives

- 7.9. Market Analysis, Insights and Forecast - by Agrochemicals

- 7.9.1. Dynamics

- 7.9.2. Type

- 7.9.2.1. Fertilizers

- 7.9.2.2. Herbicide

- 7.9.2.3. Fungicide

- 7.9.2.4. Insecticide

- 7.9.2.5. Nematicide

- 7.9.2.6. Molluscicide

- 7.9.2.7. Other Crop Protection Chemicals

- 7.10. Market Analysis, Insights and Forecast - by Industrial and Institutional Cleaners

- 7.10.1. Dynamics

- 7.10.2. Application

- 7.10.2.1. General Purpose Cleaners

- 7.10.2.2. Disinfectants and Sanitizers

- 7.10.2.3. Laundry Care Products

- 7.10.2.4. Vehicle Wash Products

- 7.11. Market Analysis, Insights and Forecast - by Lubricant Additives

- 7.11.1. Dynamics

- 7.11.2. Product Type

- 7.11.2.1. Dispersants and Emulsifiers

- 7.11.2.2. Detergents

- 7.11.2.3. Oxidation Inhibitors

- 7.11.2.4. Extreme-pressure Additives and Anti-wear Additives

- 7.11.2.5. Viscosity Index Modifiers

- 7.11.2.6. Friction Modifiers

- 7.11.2.7. Corrosion Inhibitors

- 7.11.2.8. Other Product Types

- 7.12. Market Analysis, Insights and Forecast - by Mining Chemicals

- 7.12.1. Dynamics

- 7.12.2. Function

- 7.12.2.1. Flotation Chemicals

- 7.12.2.2. Extraction Chemicals

- 7.12.2.3. Grinding Aids

- 7.13. Market Analysis, Insights and Forecast - by Oilfield Chemicals

- 7.13.1. Dynamics

- 7.13.2. Application

- 7.13.2.1. Biocide

- 7.13.2.2. Corrosion and Scale Inhibitor

- 7.13.2.3. Demulsifier

- 7.13.2.4. Polymer

- 7.13.2.5. Surfactant

- 7.13.2.6. Other Chemical Types

- 7.14. Market Analysis, Insights and Forecast - by Adhesives and Sealants

- 7.14.1. Dynamics

- 7.14.2. Technology

- 7.14.2.1. Water-borne Adhesives

- 7.14.2.2. Solvent-borne Adhesives

- 7.14.2.3. Hot-melt Adhesives

- 7.14.2.4. Reactive Adhesives

- 7.14.2.5. Other Adhesives

- 7.15. Market Analysis, Insights and Forecast - by Plastic Additives

- 7.15.1. Dynamics

- 7.15.2. Plastic Type

- 7.15.2.1. Polyethylene (PE)

- 7.15.2.2. Polystyrene (PS)

- 7.15.2.3. Polypropylene (PP)

- 7.15.2.4. Polyamide (PA)

- 7.15.2.5. Polyethylene Terephthalate (PET)

- 7.15.2.6. Polyvinyl Chloride (PVC)

- 7.15.2.7. Polycarbonate (PC)

- 7.15.2.8. Other Plastic Types

- 7.16. Market Analysis, Insights and Forecast - by Rubber Processing Chemicals

- 7.16.1. Dynamics

- 7.16.2. Application

- 7.16.2.1. Tire

- 7.16.2.2. Non-tire

- 7.17. Market Analysis, Insights and Forecast - by Specialty Polymers

- 7.17.1. Dynamics

- 7.18. Market Analysis, Insights and Forecast - by Textile Chemicals

- 7.18.1. Dynamics

- 7.18.2. Application

- 7.18.2.1. Coating and Sizing Chemicals

- 7.18.2.2. Colorants and Auxiliaries

- 7.18.2.3. Finishing Agents

- 7.18.2.4. Desizing Agents

- 7.18.2.5. Other Application

- 7.1. Market Analysis, Insights and Forecast - by Paints and Coatings

- 8. Europe Speciality Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Paints and Coatings

- 8.1.1. Dynamics

- 8.1.2. Application

- 8.1.2.1. Architectural

- 8.1.2.2. Automotive

- 8.1.2.3. Industrial

- 8.1.2.4. Wood

- 8.1.2.5. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Catalysts

- 8.2.1. Dynamics

- 8.2.2. Function

- 8.2.2.1. Chemical Synthesis Catalysts

- 8.2.2.2. Petroleum Refining Catalysts

- 8.2.2.3. Polymerization Catalysts

- 8.3. Market Analysis, Insights and Forecast - by Construction Chemicals

- 8.3.1. Dynamics

- 8.3.2. Application

- 8.3.2.1. Commercial

- 8.3.2.2. Industrial

- 8.3.2.3. Infrastructure

- 8.3.2.4. Residential

- 8.3.2.5. Public Space

- 8.4. Market Analysis, Insights and Forecast - by Cosmetic Chemicals

- 8.4.1. Dynamics

- 8.4.2. Application

- 8.4.2.1. Hair Care

- 8.4.2.2. Skin Care

- 8.4.2.3. Oral Care

- 8.4.2.4. Personal Hygiene

- 8.4.2.5. Other Applications

- 8.5. Market Analysis, Insights and Forecast - by Dyes, Inks, and Pigments

- 8.5.1. Dynamics

- 8.5.2. Type

- 8.5.2.1. Organic Pigments

- 8.5.2.2. Inorganic Pigments

- 8.6. Market Analysis, Insights and Forecast - by Electronic Chemicals

- 8.6.1. Dynamics

- 8.6.2. Application

- 8.6.2.1. Semiconductors and Integrated Circuits

- 8.6.2.2. Printed Circuit Boards

- 8.7. Market Analysis, Insights and Forecast - by Water Treatment Chemicals

- 8.7.1. Dynamics

- 8.7.2. Function

- 8.7.2.1. Flocculants

- 8.7.2.2. Coagulants

- 8.7.2.3. Biocides and Disinfectants

- 8.7.2.4. Defoamers and Defoaming Agents

- 8.7.2.5. pH Adjusters and Softeners

- 8.7.2.6. Other Functions

- 8.8. Market Analysis, Insights and Forecast - by Food Additives

- 8.8.1. Dynamics

- 8.8.2. Type

- 8.8.2.1. Natural Additives

- 8.8.2.2. Synthetic Additives

- 8.9. Market Analysis, Insights and Forecast - by Agrochemicals

- 8.9.1. Dynamics

- 8.9.2. Type

- 8.9.2.1. Fertilizers

- 8.9.2.2. Herbicide

- 8.9.2.3. Fungicide

- 8.9.2.4. Insecticide

- 8.9.2.5. Nematicide

- 8.9.2.6. Molluscicide

- 8.9.2.7. Other Crop Protection Chemicals

- 8.10. Market Analysis, Insights and Forecast - by Industrial and Institutional Cleaners

- 8.10.1. Dynamics

- 8.10.2. Application

- 8.10.2.1. General Purpose Cleaners

- 8.10.2.2. Disinfectants and Sanitizers

- 8.10.2.3. Laundry Care Products

- 8.10.2.4. Vehicle Wash Products

- 8.11. Market Analysis, Insights and Forecast - by Lubricant Additives

- 8.11.1. Dynamics

- 8.11.2. Product Type

- 8.11.2.1. Dispersants and Emulsifiers

- 8.11.2.2. Detergents

- 8.11.2.3. Oxidation Inhibitors

- 8.11.2.4. Extreme-pressure Additives and Anti-wear Additives

- 8.11.2.5. Viscosity Index Modifiers

- 8.11.2.6. Friction Modifiers

- 8.11.2.7. Corrosion Inhibitors

- 8.11.2.8. Other Product Types

- 8.12. Market Analysis, Insights and Forecast - by Mining Chemicals

- 8.12.1. Dynamics

- 8.12.2. Function

- 8.12.2.1. Flotation Chemicals

- 8.12.2.2. Extraction Chemicals

- 8.12.2.3. Grinding Aids

- 8.13. Market Analysis, Insights and Forecast - by Oilfield Chemicals

- 8.13.1. Dynamics

- 8.13.2. Application

- 8.13.2.1. Biocide

- 8.13.2.2. Corrosion and Scale Inhibitor

- 8.13.2.3. Demulsifier

- 8.13.2.4. Polymer

- 8.13.2.5. Surfactant

- 8.13.2.6. Other Chemical Types

- 8.14. Market Analysis, Insights and Forecast - by Adhesives and Sealants

- 8.14.1. Dynamics

- 8.14.2. Technology

- 8.14.2.1. Water-borne Adhesives

- 8.14.2.2. Solvent-borne Adhesives

- 8.14.2.3. Hot-melt Adhesives

- 8.14.2.4. Reactive Adhesives

- 8.14.2.5. Other Adhesives

- 8.15. Market Analysis, Insights and Forecast - by Plastic Additives

- 8.15.1. Dynamics

- 8.15.2. Plastic Type

- 8.15.2.1. Polyethylene (PE)

- 8.15.2.2. Polystyrene (PS)

- 8.15.2.3. Polypropylene (PP)

- 8.15.2.4. Polyamide (PA)

- 8.15.2.5. Polyethylene Terephthalate (PET)

- 8.15.2.6. Polyvinyl Chloride (PVC)

- 8.15.2.7. Polycarbonate (PC)

- 8.15.2.8. Other Plastic Types

- 8.16. Market Analysis, Insights and Forecast - by Rubber Processing Chemicals

- 8.16.1. Dynamics

- 8.16.2. Application

- 8.16.2.1. Tire

- 8.16.2.2. Non-tire

- 8.17. Market Analysis, Insights and Forecast - by Specialty Polymers

- 8.17.1. Dynamics

- 8.18. Market Analysis, Insights and Forecast - by Textile Chemicals

- 8.18.1. Dynamics

- 8.18.2. Application

- 8.18.2.1. Coating and Sizing Chemicals

- 8.18.2.2. Colorants and Auxiliaries

- 8.18.2.3. Finishing Agents

- 8.18.2.4. Desizing Agents

- 8.18.2.5. Other Application

- 8.1. Market Analysis, Insights and Forecast - by Paints and Coatings

- 9. South America Speciality Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Paints and Coatings

- 9.1.1. Dynamics

- 9.1.2. Application

- 9.1.2.1. Architectural

- 9.1.2.2. Automotive

- 9.1.2.3. Industrial

- 9.1.2.4. Wood

- 9.1.2.5. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Catalysts

- 9.2.1. Dynamics

- 9.2.2. Function

- 9.2.2.1. Chemical Synthesis Catalysts

- 9.2.2.2. Petroleum Refining Catalysts

- 9.2.2.3. Polymerization Catalysts

- 9.3. Market Analysis, Insights and Forecast - by Construction Chemicals

- 9.3.1. Dynamics

- 9.3.2. Application

- 9.3.2.1. Commercial

- 9.3.2.2. Industrial

- 9.3.2.3. Infrastructure

- 9.3.2.4. Residential

- 9.3.2.5. Public Space

- 9.4. Market Analysis, Insights and Forecast - by Cosmetic Chemicals

- 9.4.1. Dynamics

- 9.4.2. Application

- 9.4.2.1. Hair Care

- 9.4.2.2. Skin Care

- 9.4.2.3. Oral Care

- 9.4.2.4. Personal Hygiene

- 9.4.2.5. Other Applications

- 9.5. Market Analysis, Insights and Forecast - by Dyes, Inks, and Pigments

- 9.5.1. Dynamics

- 9.5.2. Type

- 9.5.2.1. Organic Pigments

- 9.5.2.2. Inorganic Pigments

- 9.6. Market Analysis, Insights and Forecast - by Electronic Chemicals

- 9.6.1. Dynamics

- 9.6.2. Application

- 9.6.2.1. Semiconductors and Integrated Circuits

- 9.6.2.2. Printed Circuit Boards

- 9.7. Market Analysis, Insights and Forecast - by Water Treatment Chemicals

- 9.7.1. Dynamics

- 9.7.2. Function

- 9.7.2.1. Flocculants

- 9.7.2.2. Coagulants

- 9.7.2.3. Biocides and Disinfectants

- 9.7.2.4. Defoamers and Defoaming Agents

- 9.7.2.5. pH Adjusters and Softeners

- 9.7.2.6. Other Functions

- 9.8. Market Analysis, Insights and Forecast - by Food Additives

- 9.8.1. Dynamics

- 9.8.2. Type

- 9.8.2.1. Natural Additives

- 9.8.2.2. Synthetic Additives

- 9.9. Market Analysis, Insights and Forecast - by Agrochemicals

- 9.9.1. Dynamics

- 9.9.2. Type

- 9.9.2.1. Fertilizers

- 9.9.2.2. Herbicide

- 9.9.2.3. Fungicide

- 9.9.2.4. Insecticide

- 9.9.2.5. Nematicide

- 9.9.2.6. Molluscicide

- 9.9.2.7. Other Crop Protection Chemicals

- 9.10. Market Analysis, Insights and Forecast - by Industrial and Institutional Cleaners

- 9.10.1. Dynamics

- 9.10.2. Application

- 9.10.2.1. General Purpose Cleaners

- 9.10.2.2. Disinfectants and Sanitizers

- 9.10.2.3. Laundry Care Products

- 9.10.2.4. Vehicle Wash Products

- 9.11. Market Analysis, Insights and Forecast - by Lubricant Additives

- 9.11.1. Dynamics

- 9.11.2. Product Type

- 9.11.2.1. Dispersants and Emulsifiers

- 9.11.2.2. Detergents

- 9.11.2.3. Oxidation Inhibitors

- 9.11.2.4. Extreme-pressure Additives and Anti-wear Additives

- 9.11.2.5. Viscosity Index Modifiers

- 9.11.2.6. Friction Modifiers

- 9.11.2.7. Corrosion Inhibitors

- 9.11.2.8. Other Product Types

- 9.12. Market Analysis, Insights and Forecast - by Mining Chemicals

- 9.12.1. Dynamics

- 9.12.2. Function

- 9.12.2.1. Flotation Chemicals

- 9.12.2.2. Extraction Chemicals

- 9.12.2.3. Grinding Aids

- 9.13. Market Analysis, Insights and Forecast - by Oilfield Chemicals

- 9.13.1. Dynamics

- 9.13.2. Application

- 9.13.2.1. Biocide

- 9.13.2.2. Corrosion and Scale Inhibitor

- 9.13.2.3. Demulsifier

- 9.13.2.4. Polymer

- 9.13.2.5. Surfactant

- 9.13.2.6. Other Chemical Types

- 9.14. Market Analysis, Insights and Forecast - by Adhesives and Sealants

- 9.14.1. Dynamics

- 9.14.2. Technology

- 9.14.2.1. Water-borne Adhesives

- 9.14.2.2. Solvent-borne Adhesives

- 9.14.2.3. Hot-melt Adhesives

- 9.14.2.4. Reactive Adhesives

- 9.14.2.5. Other Adhesives

- 9.15. Market Analysis, Insights and Forecast - by Plastic Additives

- 9.15.1. Dynamics

- 9.15.2. Plastic Type

- 9.15.2.1. Polyethylene (PE)

- 9.15.2.2. Polystyrene (PS)

- 9.15.2.3. Polypropylene (PP)

- 9.15.2.4. Polyamide (PA)

- 9.15.2.5. Polyethylene Terephthalate (PET)

- 9.15.2.6. Polyvinyl Chloride (PVC)

- 9.15.2.7. Polycarbonate (PC)

- 9.15.2.8. Other Plastic Types

- 9.16. Market Analysis, Insights and Forecast - by Rubber Processing Chemicals

- 9.16.1. Dynamics

- 9.16.2. Application

- 9.16.2.1. Tire

- 9.16.2.2. Non-tire

- 9.17. Market Analysis, Insights and Forecast - by Specialty Polymers

- 9.17.1. Dynamics

- 9.18. Market Analysis, Insights and Forecast - by Textile Chemicals

- 9.18.1. Dynamics

- 9.18.2. Application

- 9.18.2.1. Coating and Sizing Chemicals

- 9.18.2.2. Colorants and Auxiliaries

- 9.18.2.3. Finishing Agents

- 9.18.2.4. Desizing Agents

- 9.18.2.5. Other Application

- 9.1. Market Analysis, Insights and Forecast - by Paints and Coatings

- 10. Middle East and Africa Speciality Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Paints and Coatings

- 10.1.1. Dynamics

- 10.1.2. Application

- 10.1.2.1. Architectural

- 10.1.2.2. Automotive

- 10.1.2.3. Industrial

- 10.1.2.4. Wood

- 10.1.2.5. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Catalysts

- 10.2.1. Dynamics

- 10.2.2. Function

- 10.2.2.1. Chemical Synthesis Catalysts

- 10.2.2.2. Petroleum Refining Catalysts

- 10.2.2.3. Polymerization Catalysts

- 10.3. Market Analysis, Insights and Forecast - by Construction Chemicals

- 10.3.1. Dynamics

- 10.3.2. Application

- 10.3.2.1. Commercial

- 10.3.2.2. Industrial

- 10.3.2.3. Infrastructure

- 10.3.2.4. Residential

- 10.3.2.5. Public Space

- 10.4. Market Analysis, Insights and Forecast - by Cosmetic Chemicals

- 10.4.1. Dynamics

- 10.4.2. Application

- 10.4.2.1. Hair Care

- 10.4.2.2. Skin Care

- 10.4.2.3. Oral Care

- 10.4.2.4. Personal Hygiene

- 10.4.2.5. Other Applications

- 10.5. Market Analysis, Insights and Forecast - by Dyes, Inks, and Pigments

- 10.5.1. Dynamics

- 10.5.2. Type

- 10.5.2.1. Organic Pigments

- 10.5.2.2. Inorganic Pigments

- 10.6. Market Analysis, Insights and Forecast - by Electronic Chemicals

- 10.6.1. Dynamics

- 10.6.2. Application

- 10.6.2.1. Semiconductors and Integrated Circuits

- 10.6.2.2. Printed Circuit Boards

- 10.7. Market Analysis, Insights and Forecast - by Water Treatment Chemicals

- 10.7.1. Dynamics

- 10.7.2. Function

- 10.7.2.1. Flocculants

- 10.7.2.2. Coagulants

- 10.7.2.3. Biocides and Disinfectants

- 10.7.2.4. Defoamers and Defoaming Agents

- 10.7.2.5. pH Adjusters and Softeners

- 10.7.2.6. Other Functions

- 10.8. Market Analysis, Insights and Forecast - by Food Additives

- 10.8.1. Dynamics

- 10.8.2. Type

- 10.8.2.1. Natural Additives

- 10.8.2.2. Synthetic Additives

- 10.9. Market Analysis, Insights and Forecast - by Agrochemicals

- 10.9.1. Dynamics

- 10.9.2. Type

- 10.9.2.1. Fertilizers

- 10.9.2.2. Herbicide

- 10.9.2.3. Fungicide

- 10.9.2.4. Insecticide

- 10.9.2.5. Nematicide

- 10.9.2.6. Molluscicide

- 10.9.2.7. Other Crop Protection Chemicals

- 10.10. Market Analysis, Insights and Forecast - by Industrial and Institutional Cleaners

- 10.10.1. Dynamics

- 10.10.2. Application

- 10.10.2.1. General Purpose Cleaners

- 10.10.2.2. Disinfectants and Sanitizers

- 10.10.2.3. Laundry Care Products

- 10.10.2.4. Vehicle Wash Products

- 10.11. Market Analysis, Insights and Forecast - by Lubricant Additives

- 10.11.1. Dynamics

- 10.11.2. Product Type

- 10.11.2.1. Dispersants and Emulsifiers

- 10.11.2.2. Detergents

- 10.11.2.3. Oxidation Inhibitors

- 10.11.2.4. Extreme-pressure Additives and Anti-wear Additives

- 10.11.2.5. Viscosity Index Modifiers

- 10.11.2.6. Friction Modifiers

- 10.11.2.7. Corrosion Inhibitors

- 10.11.2.8. Other Product Types

- 10.12. Market Analysis, Insights and Forecast - by Mining Chemicals

- 10.12.1. Dynamics

- 10.12.2. Function

- 10.12.2.1. Flotation Chemicals

- 10.12.2.2. Extraction Chemicals

- 10.12.2.3. Grinding Aids

- 10.13. Market Analysis, Insights and Forecast - by Oilfield Chemicals

- 10.13.1. Dynamics

- 10.13.2. Application

- 10.13.2.1. Biocide

- 10.13.2.2. Corrosion and Scale Inhibitor

- 10.13.2.3. Demulsifier

- 10.13.2.4. Polymer

- 10.13.2.5. Surfactant

- 10.13.2.6. Other Chemical Types

- 10.14. Market Analysis, Insights and Forecast - by Adhesives and Sealants

- 10.14.1. Dynamics

- 10.14.2. Technology

- 10.14.2.1. Water-borne Adhesives

- 10.14.2.2. Solvent-borne Adhesives

- 10.14.2.3. Hot-melt Adhesives

- 10.14.2.4. Reactive Adhesives

- 10.14.2.5. Other Adhesives

- 10.15. Market Analysis, Insights and Forecast - by Plastic Additives

- 10.15.1. Dynamics

- 10.15.2. Plastic Type

- 10.15.2.1. Polyethylene (PE)

- 10.15.2.2. Polystyrene (PS)

- 10.15.2.3. Polypropylene (PP)

- 10.15.2.4. Polyamide (PA)

- 10.15.2.5. Polyethylene Terephthalate (PET)

- 10.15.2.6. Polyvinyl Chloride (PVC)

- 10.15.2.7. Polycarbonate (PC)

- 10.15.2.8. Other Plastic Types

- 10.16. Market Analysis, Insights and Forecast - by Rubber Processing Chemicals

- 10.16.1. Dynamics

- 10.16.2. Application

- 10.16.2.1. Tire

- 10.16.2.2. Non-tire

- 10.17. Market Analysis, Insights and Forecast - by Specialty Polymers

- 10.17.1. Dynamics

- 10.18. Market Analysis, Insights and Forecast - by Textile Chemicals

- 10.18.1. Dynamics

- 10.18.2. Application

- 10.18.2.1. Coating and Sizing Chemicals

- 10.18.2.2. Colorants and Auxiliaries

- 10.18.2.3. Finishing Agents

- 10.18.2.4. Desizing Agents

- 10.18.2.5. Other Application

- 10.1. Market Analysis, Insights and Forecast - by Paints and Coatings

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ferro Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Infineum International Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Henkel AG & Co KGaA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DIC Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Corteva

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Clariant

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ecolab

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GCP Applied Technologies Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Holcim

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nouryon

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ferro Corporation

List of Figures

- Figure 1: Global Speciality Chemicals Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Speciality Chemicals Market Revenue (Million), by Paints and Coatings 2025 & 2033

- Figure 3: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Paints and Coatings 2025 & 2033

- Figure 4: Asia Pacific Speciality Chemicals Market Revenue (Million), by Catalysts 2025 & 2033

- Figure 5: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Catalysts 2025 & 2033

- Figure 6: Asia Pacific Speciality Chemicals Market Revenue (Million), by Construction Chemicals 2025 & 2033

- Figure 7: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Construction Chemicals 2025 & 2033

- Figure 8: Asia Pacific Speciality Chemicals Market Revenue (Million), by Cosmetic Chemicals 2025 & 2033

- Figure 9: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Cosmetic Chemicals 2025 & 2033

- Figure 10: Asia Pacific Speciality Chemicals Market Revenue (Million), by Dyes, Inks, and Pigments 2025 & 2033

- Figure 11: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Dyes, Inks, and Pigments 2025 & 2033

- Figure 12: Asia Pacific Speciality Chemicals Market Revenue (Million), by Electronic Chemicals 2025 & 2033

- Figure 13: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Electronic Chemicals 2025 & 2033

- Figure 14: Asia Pacific Speciality Chemicals Market Revenue (Million), by Water Treatment Chemicals 2025 & 2033

- Figure 15: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Water Treatment Chemicals 2025 & 2033

- Figure 16: Asia Pacific Speciality Chemicals Market Revenue (Million), by Food Additives 2025 & 2033

- Figure 17: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Food Additives 2025 & 2033

- Figure 18: Asia Pacific Speciality Chemicals Market Revenue (Million), by Agrochemicals 2025 & 2033

- Figure 19: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Agrochemicals 2025 & 2033

- Figure 20: Asia Pacific Speciality Chemicals Market Revenue (Million), by Industrial and Institutional Cleaners 2025 & 2033

- Figure 21: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Industrial and Institutional Cleaners 2025 & 2033

- Figure 22: Asia Pacific Speciality Chemicals Market Revenue (Million), by Lubricant Additives 2025 & 2033

- Figure 23: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Lubricant Additives 2025 & 2033

- Figure 24: Asia Pacific Speciality Chemicals Market Revenue (Million), by Mining Chemicals 2025 & 2033

- Figure 25: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Mining Chemicals 2025 & 2033

- Figure 26: Asia Pacific Speciality Chemicals Market Revenue (Million), by Oilfield Chemicals 2025 & 2033

- Figure 27: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Oilfield Chemicals 2025 & 2033

- Figure 28: Asia Pacific Speciality Chemicals Market Revenue (Million), by Adhesives and Sealants 2025 & 2033

- Figure 29: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Adhesives and Sealants 2025 & 2033

- Figure 30: Asia Pacific Speciality Chemicals Market Revenue (Million), by Plastic Additives 2025 & 2033

- Figure 31: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Plastic Additives 2025 & 2033

- Figure 32: Asia Pacific Speciality Chemicals Market Revenue (Million), by Rubber Processing Chemicals 2025 & 2033

- Figure 33: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Rubber Processing Chemicals 2025 & 2033

- Figure 34: Asia Pacific Speciality Chemicals Market Revenue (Million), by Specialty Polymers 2025 & 2033

- Figure 35: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Specialty Polymers 2025 & 2033

- Figure 36: Asia Pacific Speciality Chemicals Market Revenue (Million), by Textile Chemicals 2025 & 2033

- Figure 37: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Textile Chemicals 2025 & 2033

- Figure 38: Asia Pacific Speciality Chemicals Market Revenue (Million), by Country 2025 & 2033

- Figure 39: Asia Pacific Speciality Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 40: North America Speciality Chemicals Market Revenue (Million), by Paints and Coatings 2025 & 2033

- Figure 41: North America Speciality Chemicals Market Revenue Share (%), by Paints and Coatings 2025 & 2033

- Figure 42: North America Speciality Chemicals Market Revenue (Million), by Catalysts 2025 & 2033

- Figure 43: North America Speciality Chemicals Market Revenue Share (%), by Catalysts 2025 & 2033

- Figure 44: North America Speciality Chemicals Market Revenue (Million), by Construction Chemicals 2025 & 2033

- Figure 45: North America Speciality Chemicals Market Revenue Share (%), by Construction Chemicals 2025 & 2033

- Figure 46: North America Speciality Chemicals Market Revenue (Million), by Cosmetic Chemicals 2025 & 2033

- Figure 47: North America Speciality Chemicals Market Revenue Share (%), by Cosmetic Chemicals 2025 & 2033

- Figure 48: North America Speciality Chemicals Market Revenue (Million), by Dyes, Inks, and Pigments 2025 & 2033

- Figure 49: North America Speciality Chemicals Market Revenue Share (%), by Dyes, Inks, and Pigments 2025 & 2033

- Figure 50: North America Speciality Chemicals Market Revenue (Million), by Electronic Chemicals 2025 & 2033

- Figure 51: North America Speciality Chemicals Market Revenue Share (%), by Electronic Chemicals 2025 & 2033

- Figure 52: North America Speciality Chemicals Market Revenue (Million), by Water Treatment Chemicals 2025 & 2033

- Figure 53: North America Speciality Chemicals Market Revenue Share (%), by Water Treatment Chemicals 2025 & 2033

- Figure 54: North America Speciality Chemicals Market Revenue (Million), by Food Additives 2025 & 2033

- Figure 55: North America Speciality Chemicals Market Revenue Share (%), by Food Additives 2025 & 2033

- Figure 56: North America Speciality Chemicals Market Revenue (Million), by Agrochemicals 2025 & 2033

- Figure 57: North America Speciality Chemicals Market Revenue Share (%), by Agrochemicals 2025 & 2033

- Figure 58: North America Speciality Chemicals Market Revenue (Million), by Industrial and Institutional Cleaners 2025 & 2033

- Figure 59: North America Speciality Chemicals Market Revenue Share (%), by Industrial and Institutional Cleaners 2025 & 2033

- Figure 60: North America Speciality Chemicals Market Revenue (Million), by Lubricant Additives 2025 & 2033

- Figure 61: North America Speciality Chemicals Market Revenue Share (%), by Lubricant Additives 2025 & 2033

- Figure 62: North America Speciality Chemicals Market Revenue (Million), by Mining Chemicals 2025 & 2033

- Figure 63: North America Speciality Chemicals Market Revenue Share (%), by Mining Chemicals 2025 & 2033

- Figure 64: North America Speciality Chemicals Market Revenue (Million), by Oilfield Chemicals 2025 & 2033

- Figure 65: North America Speciality Chemicals Market Revenue Share (%), by Oilfield Chemicals 2025 & 2033

- Figure 66: North America Speciality Chemicals Market Revenue (Million), by Adhesives and Sealants 2025 & 2033

- Figure 67: North America Speciality Chemicals Market Revenue Share (%), by Adhesives and Sealants 2025 & 2033

- Figure 68: North America Speciality Chemicals Market Revenue (Million), by Plastic Additives 2025 & 2033

- Figure 69: North America Speciality Chemicals Market Revenue Share (%), by Plastic Additives 2025 & 2033

- Figure 70: North America Speciality Chemicals Market Revenue (Million), by Rubber Processing Chemicals 2025 & 2033

- Figure 71: North America Speciality Chemicals Market Revenue Share (%), by Rubber Processing Chemicals 2025 & 2033

- Figure 72: North America Speciality Chemicals Market Revenue (Million), by Specialty Polymers 2025 & 2033

- Figure 73: North America Speciality Chemicals Market Revenue Share (%), by Specialty Polymers 2025 & 2033

- Figure 74: North America Speciality Chemicals Market Revenue (Million), by Textile Chemicals 2025 & 2033

- Figure 75: North America Speciality Chemicals Market Revenue Share (%), by Textile Chemicals 2025 & 2033

- Figure 76: North America Speciality Chemicals Market Revenue (Million), by Country 2025 & 2033

- Figure 77: North America Speciality Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 78: Europe Speciality Chemicals Market Revenue (Million), by Paints and Coatings 2025 & 2033

- Figure 79: Europe Speciality Chemicals Market Revenue Share (%), by Paints and Coatings 2025 & 2033

- Figure 80: Europe Speciality Chemicals Market Revenue (Million), by Catalysts 2025 & 2033

- Figure 81: Europe Speciality Chemicals Market Revenue Share (%), by Catalysts 2025 & 2033

- Figure 82: Europe Speciality Chemicals Market Revenue (Million), by Construction Chemicals 2025 & 2033

- Figure 83: Europe Speciality Chemicals Market Revenue Share (%), by Construction Chemicals 2025 & 2033

- Figure 84: Europe Speciality Chemicals Market Revenue (Million), by Cosmetic Chemicals 2025 & 2033

- Figure 85: Europe Speciality Chemicals Market Revenue Share (%), by Cosmetic Chemicals 2025 & 2033

- Figure 86: Europe Speciality Chemicals Market Revenue (Million), by Dyes, Inks, and Pigments 2025 & 2033

- Figure 87: Europe Speciality Chemicals Market Revenue Share (%), by Dyes, Inks, and Pigments 2025 & 2033

- Figure 88: Europe Speciality Chemicals Market Revenue (Million), by Electronic Chemicals 2025 & 2033

- Figure 89: Europe Speciality Chemicals Market Revenue Share (%), by Electronic Chemicals 2025 & 2033

- Figure 90: Europe Speciality Chemicals Market Revenue (Million), by Water Treatment Chemicals 2025 & 2033

- Figure 91: Europe Speciality Chemicals Market Revenue Share (%), by Water Treatment Chemicals 2025 & 2033

- Figure 92: Europe Speciality Chemicals Market Revenue (Million), by Food Additives 2025 & 2033

- Figure 93: Europe Speciality Chemicals Market Revenue Share (%), by Food Additives 2025 & 2033

- Figure 94: Europe Speciality Chemicals Market Revenue (Million), by Agrochemicals 2025 & 2033

- Figure 95: Europe Speciality Chemicals Market Revenue Share (%), by Agrochemicals 2025 & 2033

- Figure 96: Europe Speciality Chemicals Market Revenue (Million), by Industrial and Institutional Cleaners 2025 & 2033

- Figure 97: Europe Speciality Chemicals Market Revenue Share (%), by Industrial and Institutional Cleaners 2025 & 2033

- Figure 98: Europe Speciality Chemicals Market Revenue (Million), by Lubricant Additives 2025 & 2033

- Figure 99: Europe Speciality Chemicals Market Revenue Share (%), by Lubricant Additives 2025 & 2033

- Figure 100: Europe Speciality Chemicals Market Revenue (Million), by Mining Chemicals 2025 & 2033

- Figure 101: Europe Speciality Chemicals Market Revenue Share (%), by Mining Chemicals 2025 & 2033

- Figure 102: Europe Speciality Chemicals Market Revenue (Million), by Oilfield Chemicals 2025 & 2033

- Figure 103: Europe Speciality Chemicals Market Revenue Share (%), by Oilfield Chemicals 2025 & 2033

- Figure 104: Europe Speciality Chemicals Market Revenue (Million), by Adhesives and Sealants 2025 & 2033

- Figure 105: Europe Speciality Chemicals Market Revenue Share (%), by Adhesives and Sealants 2025 & 2033

- Figure 106: Europe Speciality Chemicals Market Revenue (Million), by Plastic Additives 2025 & 2033

- Figure 107: Europe Speciality Chemicals Market Revenue Share (%), by Plastic Additives 2025 & 2033

- Figure 108: Europe Speciality Chemicals Market Revenue (Million), by Rubber Processing Chemicals 2025 & 2033

- Figure 109: Europe Speciality Chemicals Market Revenue Share (%), by Rubber Processing Chemicals 2025 & 2033

- Figure 110: Europe Speciality Chemicals Market Revenue (Million), by Specialty Polymers 2025 & 2033

- Figure 111: Europe Speciality Chemicals Market Revenue Share (%), by Specialty Polymers 2025 & 2033

- Figure 112: Europe Speciality Chemicals Market Revenue (Million), by Textile Chemicals 2025 & 2033

- Figure 113: Europe Speciality Chemicals Market Revenue Share (%), by Textile Chemicals 2025 & 2033

- Figure 114: Europe Speciality Chemicals Market Revenue (Million), by Country 2025 & 2033

- Figure 115: Europe Speciality Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 116: South America Speciality Chemicals Market Revenue (Million), by Paints and Coatings 2025 & 2033

- Figure 117: South America Speciality Chemicals Market Revenue Share (%), by Paints and Coatings 2025 & 2033

- Figure 118: South America Speciality Chemicals Market Revenue (Million), by Catalysts 2025 & 2033

- Figure 119: South America Speciality Chemicals Market Revenue Share (%), by Catalysts 2025 & 2033

- Figure 120: South America Speciality Chemicals Market Revenue (Million), by Construction Chemicals 2025 & 2033

- Figure 121: South America Speciality Chemicals Market Revenue Share (%), by Construction Chemicals 2025 & 2033

- Figure 122: South America Speciality Chemicals Market Revenue (Million), by Cosmetic Chemicals 2025 & 2033

- Figure 123: South America Speciality Chemicals Market Revenue Share (%), by Cosmetic Chemicals 2025 & 2033

- Figure 124: South America Speciality Chemicals Market Revenue (Million), by Dyes, Inks, and Pigments 2025 & 2033

- Figure 125: South America Speciality Chemicals Market Revenue Share (%), by Dyes, Inks, and Pigments 2025 & 2033

- Figure 126: South America Speciality Chemicals Market Revenue (Million), by Electronic Chemicals 2025 & 2033

- Figure 127: South America Speciality Chemicals Market Revenue Share (%), by Electronic Chemicals 2025 & 2033

- Figure 128: South America Speciality Chemicals Market Revenue (Million), by Water Treatment Chemicals 2025 & 2033

- Figure 129: South America Speciality Chemicals Market Revenue Share (%), by Water Treatment Chemicals 2025 & 2033

- Figure 130: South America Speciality Chemicals Market Revenue (Million), by Food Additives 2025 & 2033

- Figure 131: South America Speciality Chemicals Market Revenue Share (%), by Food Additives 2025 & 2033

- Figure 132: South America Speciality Chemicals Market Revenue (Million), by Agrochemicals 2025 & 2033

- Figure 133: South America Speciality Chemicals Market Revenue Share (%), by Agrochemicals 2025 & 2033

- Figure 134: South America Speciality Chemicals Market Revenue (Million), by Industrial and Institutional Cleaners 2025 & 2033

- Figure 135: South America Speciality Chemicals Market Revenue Share (%), by Industrial and Institutional Cleaners 2025 & 2033

- Figure 136: South America Speciality Chemicals Market Revenue (Million), by Lubricant Additives 2025 & 2033

- Figure 137: South America Speciality Chemicals Market Revenue Share (%), by Lubricant Additives 2025 & 2033

- Figure 138: South America Speciality Chemicals Market Revenue (Million), by Mining Chemicals 2025 & 2033

- Figure 139: South America Speciality Chemicals Market Revenue Share (%), by Mining Chemicals 2025 & 2033

- Figure 140: South America Speciality Chemicals Market Revenue (Million), by Oilfield Chemicals 2025 & 2033

- Figure 141: South America Speciality Chemicals Market Revenue Share (%), by Oilfield Chemicals 2025 & 2033

- Figure 142: South America Speciality Chemicals Market Revenue (Million), by Adhesives and Sealants 2025 & 2033

- Figure 143: South America Speciality Chemicals Market Revenue Share (%), by Adhesives and Sealants 2025 & 2033

- Figure 144: South America Speciality Chemicals Market Revenue (Million), by Plastic Additives 2025 & 2033

- Figure 145: South America Speciality Chemicals Market Revenue Share (%), by Plastic Additives 2025 & 2033

- Figure 146: South America Speciality Chemicals Market Revenue (Million), by Rubber Processing Chemicals 2025 & 2033

- Figure 147: South America Speciality Chemicals Market Revenue Share (%), by Rubber Processing Chemicals 2025 & 2033

- Figure 148: South America Speciality Chemicals Market Revenue (Million), by Specialty Polymers 2025 & 2033

- Figure 149: South America Speciality Chemicals Market Revenue Share (%), by Specialty Polymers 2025 & 2033

- Figure 150: South America Speciality Chemicals Market Revenue (Million), by Textile Chemicals 2025 & 2033

- Figure 151: South America Speciality Chemicals Market Revenue Share (%), by Textile Chemicals 2025 & 2033

- Figure 152: South America Speciality Chemicals Market Revenue (Million), by Country 2025 & 2033

- Figure 153: South America Speciality Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 154: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Paints and Coatings 2025 & 2033

- Figure 155: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Paints and Coatings 2025 & 2033

- Figure 156: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Catalysts 2025 & 2033

- Figure 157: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Catalysts 2025 & 2033

- Figure 158: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Construction Chemicals 2025 & 2033

- Figure 159: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Construction Chemicals 2025 & 2033

- Figure 160: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Cosmetic Chemicals 2025 & 2033

- Figure 161: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Cosmetic Chemicals 2025 & 2033

- Figure 162: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Dyes, Inks, and Pigments 2025 & 2033

- Figure 163: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Dyes, Inks, and Pigments 2025 & 2033

- Figure 164: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Electronic Chemicals 2025 & 2033

- Figure 165: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Electronic Chemicals 2025 & 2033

- Figure 166: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Water Treatment Chemicals 2025 & 2033

- Figure 167: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Water Treatment Chemicals 2025 & 2033

- Figure 168: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Food Additives 2025 & 2033

- Figure 169: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Food Additives 2025 & 2033

- Figure 170: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Agrochemicals 2025 & 2033

- Figure 171: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Agrochemicals 2025 & 2033

- Figure 172: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Industrial and Institutional Cleaners 2025 & 2033

- Figure 173: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Industrial and Institutional Cleaners 2025 & 2033

- Figure 174: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Lubricant Additives 2025 & 2033

- Figure 175: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Lubricant Additives 2025 & 2033

- Figure 176: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Mining Chemicals 2025 & 2033

- Figure 177: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Mining Chemicals 2025 & 2033

- Figure 178: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Oilfield Chemicals 2025 & 2033

- Figure 179: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Oilfield Chemicals 2025 & 2033

- Figure 180: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Adhesives and Sealants 2025 & 2033

- Figure 181: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Adhesives and Sealants 2025 & 2033

- Figure 182: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Plastic Additives 2025 & 2033

- Figure 183: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Plastic Additives 2025 & 2033

- Figure 184: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Rubber Processing Chemicals 2025 & 2033

- Figure 185: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Rubber Processing Chemicals 2025 & 2033

- Figure 186: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Specialty Polymers 2025 & 2033

- Figure 187: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Specialty Polymers 2025 & 2033

- Figure 188: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Textile Chemicals 2025 & 2033

- Figure 189: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Textile Chemicals 2025 & 2033

- Figure 190: Middle East and Africa Speciality Chemicals Market Revenue (Million), by Country 2025 & 2033

- Figure 191: Middle East and Africa Speciality Chemicals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Speciality Chemicals Market Revenue Million Forecast, by Paints and Coatings 2020 & 2033

- Table 2: Global Speciality Chemicals Market Revenue Million Forecast, by Catalysts 2020 & 2033

- Table 3: Global Speciality Chemicals Market Revenue Million Forecast, by Construction Chemicals 2020 & 2033

- Table 4: Global Speciality Chemicals Market Revenue Million Forecast, by Cosmetic Chemicals 2020 & 2033

- Table 5: Global Speciality Chemicals Market Revenue Million Forecast, by Dyes, Inks, and Pigments 2020 & 2033

- Table 6: Global Speciality Chemicals Market Revenue Million Forecast, by Electronic Chemicals 2020 & 2033

- Table 7: Global Speciality Chemicals Market Revenue Million Forecast, by Water Treatment Chemicals 2020 & 2033

- Table 8: Global Speciality Chemicals Market Revenue Million Forecast, by Food Additives 2020 & 2033

- Table 9: Global Speciality Chemicals Market Revenue Million Forecast, by Agrochemicals 2020 & 2033

- Table 10: Global Speciality Chemicals Market Revenue Million Forecast, by Industrial and Institutional Cleaners 2020 & 2033

- Table 11: Global Speciality Chemicals Market Revenue Million Forecast, by Lubricant Additives 2020 & 2033

- Table 12: Global Speciality Chemicals Market Revenue Million Forecast, by Mining Chemicals 2020 & 2033

- Table 13: Global Speciality Chemicals Market Revenue Million Forecast, by Oilfield Chemicals 2020 & 2033