Key Insights

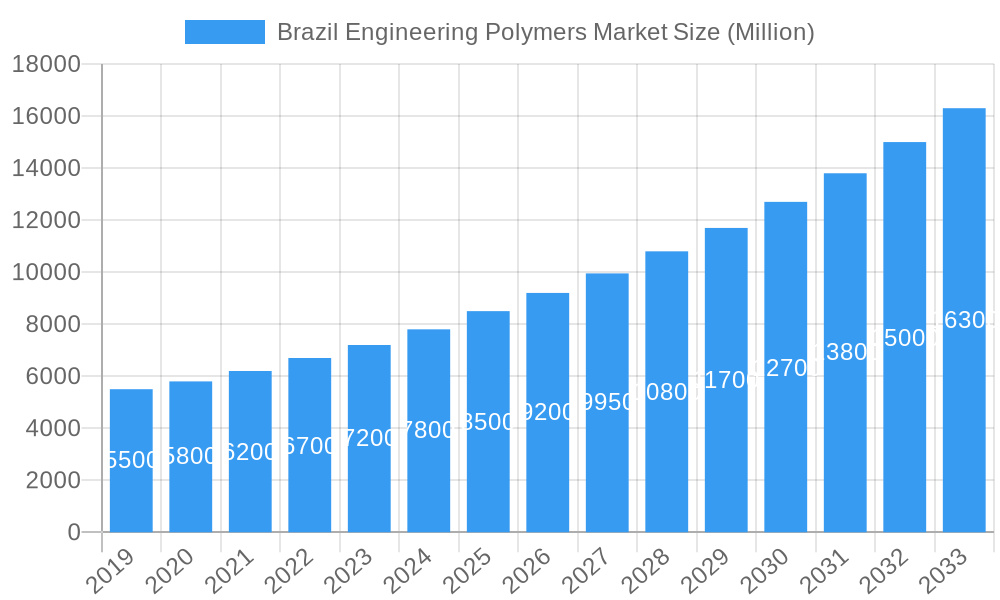

The Brazilian engineering polymers market is poised for significant expansion, driven by robust demand across key sectors like automotive, electronics, and construction. With an estimated market size of $8,500 million in 2025, the industry is set to experience a compound annual growth rate (CAGR) of 6.8% during the study period of 2019-2033. This sustained growth trajectory is fueled by increasing domestic manufacturing capabilities, a growing middle class with higher disposable incomes, and a rising preference for lightweight, durable, and high-performance materials. The automotive industry, in particular, is a major contributor, with manufacturers increasingly adopting engineering polymers to enhance fuel efficiency and meet stringent environmental regulations. Furthermore, the burgeoning electronics sector, driven by the demand for consumer gadgets and advanced industrial equipment, is also a significant growth engine. The construction industry's adoption of engineered polymers for various applications, from insulation to structural components, further solidifies the market's positive outlook.

Brazil Engineering Polymers Market Market Size (In Billion)

Looking ahead, the forecast period of 2025-2033 anticipates continued innovation and application development for engineering polymers in Brazil. Emerging trends such as the growing emphasis on sustainable and bio-based engineering polymers, coupled with advancements in material science, are expected to unlock new market opportunities. The historical data from 2019-2024 indicates a steady upward trend, setting a strong foundation for future growth. The market's ability to adapt to evolving industrial needs and regulatory landscapes will be crucial for its sustained success. Key players are expected to focus on research and development, strategic partnerships, and expanding their production capacities to meet the escalating demand. The Brazilian engineering polymers market represents a dynamic and promising landscape for both domestic and international stakeholders, offering substantial potential for investment and growth.

Brazil Engineering Polymers Market Company Market Share

Brazil Engineering Polymers Market: Comprehensive Analysis and Future Outlook (2019-2033)

The Brazil Engineering Polymers Market is experiencing robust growth, driven by burgeoning demand across key sectors such as automotive, electronics, and construction. This in-depth report provides a comprehensive analysis of market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, and strategic outlook for the Brazil engineering polymers industry. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025–2033, this report offers invaluable insights for industry stakeholders looking to capitalize on the evolving landscape of high-performance plastic materials in Brazil.

Brazil Engineering Polymers Market Market Dynamics & Concentration

The Brazil Engineering Polymers Market exhibits a moderately concentrated structure, with a few key global players holding significant market share. Innovation remains a primary driver, fueled by continuous research and development efforts aimed at enhancing polymer properties, such as improved thermal resistance, mechanical strength, and chemical inertness. The regulatory framework in Brazil, particularly concerning environmental standards and product safety, plays a crucial role in shaping market entry and product development strategies. The availability of product substitutes, ranging from traditional materials to advanced composites, necessitates constant innovation and cost-effectiveness from engineering polymer manufacturers. End-user trends are heavily influenced by the growth of critical industries like automotive (electric vehicles demanding lightweight yet strong materials) and electrical & electronics (miniaturization requiring high-performance polymers). Mergers and acquisitions (M&A) activity, though not at peak levels, is observed as companies seek to expand their product portfolios, gain market access, and achieve economies of scale. For instance, the historical period saw approximately 3-5 significant M&A deals annually within the broader Latin American polymer sector, with Brazil being a key focus. Market share for leading players often exceeds 10% individually in specific polymer segments.

Brazil Engineering Polymers Market Industry Trends & Analysis

The Brazil Engineering Polymers Market is poised for substantial expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period. This growth is primarily fueled by the increasing adoption of advanced materials in the automotive sector, driven by the need for lightweighting to improve fuel efficiency and accommodate electric vehicle components. The construction industry also contributes significantly, with engineering polymers being utilized in durable and aesthetically pleasing applications, including window profiles, pipes, and insulation. Technological disruptions, such as advancements in polymer processing techniques like injection molding and extrusion, enable the production of complex parts with enhanced precision and efficiency. Furthermore, the growing consumer demand for durable, high-performance products in electronics and appliances indirectly boosts the market. Competitive dynamics are characterized by intense innovation, with companies focusing on developing specialized grades of polymers to meet niche application requirements. Market penetration of engineering polymers is steadily increasing across various industries, replacing traditional materials like metal and glass due to their superior strength-to-weight ratios and design flexibility. The estimated market size for Brazil's engineering polymers was approximately R$5,500 Million in the base year 2025, with significant growth anticipated.

Leading Markets & Segments in Brazil Engineering Polymers Market

Within the Brazil Engineering Polymers Market, Polyamides emerge as a dominant product type, driven by their exceptional mechanical properties, chemical resistance, and thermal stability, making them indispensable in the automotive and industrial machinery sectors. Their application in engine components, fuel lines, and gears underscores their critical role. The Automotive and Transportation segment is the leading application area, accounting for an estimated 30% of the market share in 2025. This dominance is attributed to Brazil's significant automotive manufacturing base and the ongoing transition towards more fuel-efficient and electric vehicles, which necessitate lightweight and high-performance materials.

- Key Drivers for Polyamides Dominance:

- Economic Policies: Government incentives for automotive manufacturing and local production of components.

- Infrastructure: Development and expansion of the automotive industry, requiring robust material solutions.

- Technological Advancements: Improved grades of polyamides offering enhanced performance for specialized automotive applications.

The Automotive and Transportation application segment's leadership is further bolstered by:

- Economic Growth: A recovering Brazilian economy translates to increased vehicle sales and production.

- Sustainability Initiatives: The push for lighter vehicles to reduce emissions directly benefits polyamide usage.

- Innovation in Vehicle Design: The demand for complex and integrated automotive parts favors the moldability and strength of engineering polymers.

Other significant product types include Polycarbonate (PC), essential for its impact resistance and optical clarity in consumer goods and electronics, and Polyethylene Terephthalate (PET), widely used in packaging for its barrier properties and recyclability. The Electrical and Electronics segment also presents substantial demand, driven by the miniaturization of devices and the need for materials with excellent electrical insulation and thermal management properties.

Brazil Engineering Polymers Market Product Developments

Product development in the Brazil Engineering Polymers Market is characterized by a focus on creating advanced materials with enhanced performance attributes. Innovations are centered on improving thermal resistance, mechanical strength, and chemical inertness to cater to increasingly demanding applications. For example, the development of specialty polyamides with higher melting points and improved flame retardancy addresses safety concerns in automotive and electronics. New grades of polycarbonates offering superior UV resistance and impact strength are finding applications in outdoor construction and consumer electronics. Companies are also investing in bio-based and recycled engineering polymers to align with growing sustainability demands. These developments not only provide competitive advantages but also expand the application scope for engineering polymers into new and emerging industries.

Key Drivers of Brazil Engineering Polymers Market Growth

The Brazil Engineering Polymers Market is propelled by several key drivers. The robust growth of the automotive industry, especially the increasing production of vehicles requiring lightweight components for fuel efficiency and the burgeoning electric vehicle sector, is a primary catalyst. Government initiatives promoting local manufacturing and technological advancements in polymer science, leading to enhanced material properties, further fuel demand. The expanding electrical and electronics sector, driven by consumer demand for sophisticated and durable devices, also contributes significantly. Furthermore, the increasing adoption of engineering polymers in construction for durable and sustainable building solutions, alongside the growing awareness and preference for high-performance, long-lasting products across various consumer goods, are pivotal growth accelerators.

Challenges in the Brazil Engineering Polymers Market Market

Despite the positive growth trajectory, the Brazil Engineering Polymers Market faces several challenges. Fluctuations in raw material prices, largely influenced by global petrochemical markets, can impact production costs and profitability. Economic volatility and political instability in Brazil can lead to decreased investment and slowed demand from key end-use industries. Furthermore, stringent environmental regulations and the need for sustainable sourcing and disposal of polymers require significant investment in compliance and eco-friendly product development. The presence of established substitutes, such as metals and advanced composites, also presents a competitive barrier. Supply chain disruptions, particularly in logistics and raw material availability, can affect production timelines and overall market efficiency, with potential lead time increases of 15-20% during periods of instability.

Emerging Opportunities in Brazil Engineering Polymers Market

Emerging opportunities in the Brazil Engineering Polymers Market are substantial and driven by several key factors. The global shift towards electric vehicles presents a significant opportunity for lightweight and high-performance engineering polymers in battery components, charging infrastructure, and structural elements. Growing investments in renewable energy infrastructure, such as wind turbines and solar panels, also create demand for specialized polymers with enhanced durability and weather resistance. The increasing focus on sustainability is driving the market for bio-based and recycled engineering polymers, opening avenues for innovative product development and market differentiation. Moreover, advancements in additive manufacturing (3D printing) are expanding the applicability of engineering polymers in rapid prototyping and custom part production across various sectors, including medical devices and specialized industrial components. The estimated market penetration for 3D printable engineering polymers is projected to grow by 25% within the forecast period.

Leading Players in the Brazil Engineering Polymers Market Sector

- Lyondellbasell

- Solvay

- Arkema SA

- Nova Chemicals Corporation

- Polynt

- Ashland Inc

- Celanese Corporation

- Rochling Group

- Evonik Industries AG

- 3M

- Chemtura Corporation

- Chevron Phillips Chemical

- LANXESS

- BASF SE

- SABIC

- LG Chem

- DuPont

- Eastman Chemical Company

- Covestro AG

- PolyOne Corporation

Key Milestones in Brazil Engineering Polymers Market Industry

- 2019: Introduction of advanced polyamide grades with enhanced thermal resistance for automotive under-the-hood applications.

- 2020: Launch of new bio-based polycarbonate resins, aligning with growing sustainability trends.

- 2021: Significant investment by a major player in expanding local production capacity for specialty polymers to meet increasing automotive demand.

- 2022: Development of flame-retardant polycarbonates for improved safety in electrical and electronic applications, meeting stricter regulatory standards.

- 2023: Strategic partnership formed to develop novel engineering polymers for 3D printing applications in the medical sector.

- 2024: Increased focus on circular economy initiatives with the introduction of high-performance recycled engineering polymers.

Strategic Outlook for Brazil Engineering Polymers Market Market

The strategic outlook for the Brazil Engineering Polymers Market is exceptionally promising, driven by the persistent demand for high-performance, lightweight, and sustainable materials. The increasing adoption of electric vehicles and the growth in renewable energy sectors will continue to be significant growth accelerators. Companies that focus on innovation, particularly in developing bio-based, recycled, and application-specific polymer solutions, will gain a competitive edge. Strategic partnerships and collaborations, especially in research and development and market expansion, will be crucial for navigating the evolving market landscape. Investment in advanced manufacturing technologies and a commitment to sustainability will be key to capturing future market potential and ensuring long-term growth and profitability in this dynamic sector.

Brazil Engineering Polymers Market Segmentation

-

1. Product Type

- 1.1. Fluoropolymers

- 1.2. Polycarbonate (PC)

- 1.3. Polyethylene Terephthalate (PET)

- 1.4. Polybutylene Terephthalate (PBT)

- 1.5. Polyacetal/ Polyoxymethylene

- 1.6. Polymethyl Methacrylate (PMMA)

- 1.7. Polyphenylene Oxide

- 1.8. Polyphenylene Sulfide (PPS)

- 1.9. Styrene Copolymers (ABS & SAN)

- 1.10. Liquid Crystal Polymers (LCP)

- 1.11. Polyether Ether Ketone (PEEK)

- 1.12. Polyimides (PI)

- 1.13. Polyamides

-

2. Application

- 2.1. Automotive and Transportation

- 2.2. Building and Construction

- 2.3. Consumer Goods

- 2.4. Electrical and Electronics

- 2.5. Industrial and Machinery

- 2.6. Packaging

- 2.7. Medical

Brazil Engineering Polymers Market Segmentation By Geography

- 1. Brazil

Brazil Engineering Polymers Market Regional Market Share

Geographic Coverage of Brazil Engineering Polymers Market

Brazil Engineering Polymers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Engineering Plastics Replacing Traditional Materials; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Volatility in Raw Material Prices; Other Restraints

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Engineering Polymers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fluoropolymers

- 5.1.2. Polycarbonate (PC)

- 5.1.3. Polyethylene Terephthalate (PET)

- 5.1.4. Polybutylene Terephthalate (PBT)

- 5.1.5. Polyacetal/ Polyoxymethylene

- 5.1.6. Polymethyl Methacrylate (PMMA)

- 5.1.7. Polyphenylene Oxide

- 5.1.8. Polyphenylene Sulfide (PPS)

- 5.1.9. Styrene Copolymers (ABS & SAN)

- 5.1.10. Liquid Crystal Polymers (LCP)

- 5.1.11. Polyether Ether Ketone (PEEK)

- 5.1.12. Polyimides (PI)

- 5.1.13. Polyamides

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive and Transportation

- 5.2.2. Building and Construction

- 5.2.3. Consumer Goods

- 5.2.4. Electrical and Electronics

- 5.2.5. Industrial and Machinery

- 5.2.6. Packaging

- 5.2.7. Medical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lyondellbasell

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Solvay*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arkema SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nova Chemicals Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Polynt

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ashland Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Celanese Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rochling Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Evonik Industries AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 3M

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Chemtura Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Chevron Phillips Chemical

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 LANXESS

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 BASF SE

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 SABIC

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 LG Chem

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 DuPont

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Eastman Chemical Company

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Covestro AG

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 PolyOne Corporation

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 Lyondellbasell

List of Figures

- Figure 1: Brazil Engineering Polymers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Brazil Engineering Polymers Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Engineering Polymers Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Brazil Engineering Polymers Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Brazil Engineering Polymers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Brazil Engineering Polymers Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Brazil Engineering Polymers Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Brazil Engineering Polymers Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Engineering Polymers Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Brazil Engineering Polymers Market?

Key companies in the market include Lyondellbasell, Solvay*List Not Exhaustive, Arkema SA, Nova Chemicals Corporation, Polynt, Ashland Inc, Celanese Corporation, Rochling Group, Evonik Industries AG, 3M, Chemtura Corporation, Chevron Phillips Chemical, LANXESS, BASF SE, SABIC, LG Chem, DuPont, Eastman Chemical Company, Covestro AG, PolyOne Corporation.

3. What are the main segments of the Brazil Engineering Polymers Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Engineering Plastics Replacing Traditional Materials; Other Drivers.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET): The Most Used Engineering Plastic.

7. Are there any restraints impacting market growth?

; Volatility in Raw Material Prices; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Engineering Polymers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Engineering Polymers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Engineering Polymers Market?

To stay informed about further developments, trends, and reports in the Brazil Engineering Polymers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence