Key Insights

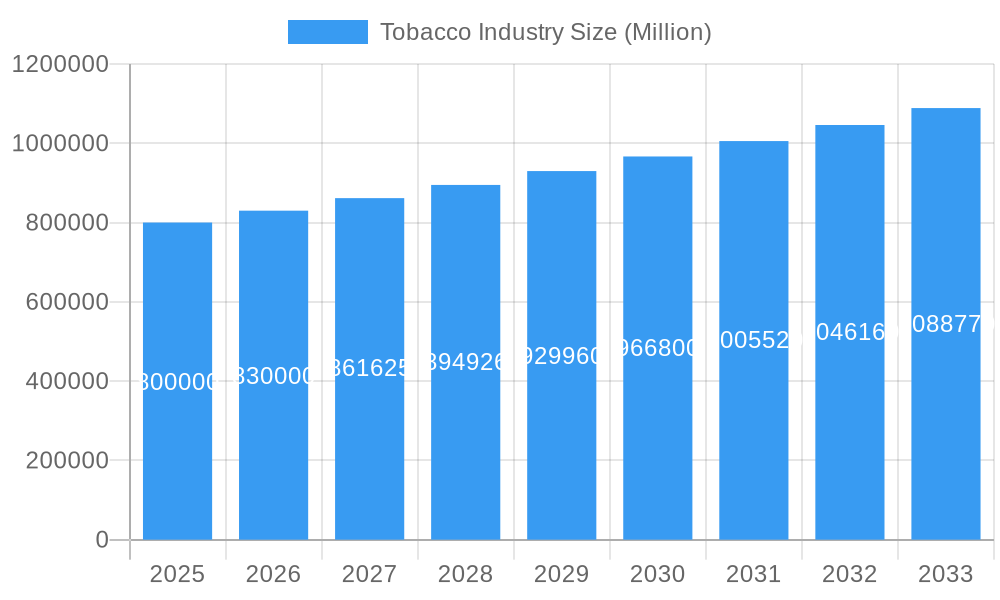

The global tobacco market, valued at approximately $1058.2 billion in 2025, is projected to grow at a compound annual growth rate (CAGR) of 2.53% from 2025 to 2033. This growth is propelled by increasing disposable incomes in emerging economies, particularly in Asia-Pacific, and the industry's adaptation to evolving consumer preferences with heated tobacco and smokeless alternatives. Key market restraints include heightened public health awareness, stringent advertising and sales regulations, and increased taxation. The market is segmented by product type, with cigarettes holding the largest share, though smokeless devices and alternatives show significant growth. Distribution channels are diverse, with supermarkets and convenience stores dominating, alongside specialty stores serving niche markets. Leading companies like Philip Morris International, British American Tobacco, and ITC Limited are investing in R&D, brand diversification, and global expansion to maintain market leadership.

Tobacco Industry Market Size (In Million)

The competitive landscape features intense rivalry between multinational and regional players. Future growth hinges on successful product innovation, effective marketing, and navigating evolving regulatory frameworks. The industry's trajectory will be shaped by the shift towards alternative products, emerging technologies, and regulatory changes in key global markets. Companies must adapt to consumer preferences and regulations while addressing public health concerns.

Tobacco Industry Company Market Share

Global Tobacco Market Analysis: 2019-2033

This report offers a comprehensive analysis of the global tobacco industry, detailing market dynamics, key players, emerging trends, and future growth projections from 2019 to 2033. The analysis covers major segments such as cigarettes, cigars, and alternative products, providing actionable insights for stakeholders, investors, and businesses. The report utilizes historical data (2019-2024), with 2025 as the base year, and forecasts up to 2033. It examines major players including Philip Morris International Inc., ITC Limited, and PT Gudang Garam Tbk, offering detailed market share, CAGR, and M&A activity insights. All monetary values are presented in millions.

Tobacco Industry Market Dynamics & Concentration

The global tobacco industry, valued at xx Million in 2024, exhibits moderate concentration with a few dominant players commanding significant market share. Market leadership is largely determined by geographic presence, brand strength, product diversification, and effective marketing strategies. Philip Morris International, British American Tobacco, and China National Tobacco Corporation represent some of the largest players. Market share fluctuations are influenced by factors like regulatory changes, consumer preferences shifting towards reduced-risk products (RRP), and aggressive M&A activity.

- Market Concentration: The top 5 players hold approximately xx% of the global market share in 2024.

- Innovation Drivers: The industry is driven by continuous innovation, particularly in the development of RRPs such as heated tobacco products and e-cigarettes, and their effective introduction to new markets.

- Regulatory Frameworks: Stringent regulations on advertising, taxation policies, and packaging requirements significantly impact market dynamics. Variations in these policies across regions influence market growth rates.

- Product Substitutes: The rise of e-cigarettes and heated tobacco products presents notable competition and also substitutes for traditional cigarettes.

- End-User Trends: A growing awareness of health risks associated with smoking is driving a shift towards less harmful alternatives, impacting market demand for traditional cigarettes.

- M&A Activity: The past 5 years have seen xx major M&A deals, primarily focused on expanding product portfolios and geographical reach. These deals help reshape market competitiveness.

Tobacco Industry Industry Trends & Analysis

The tobacco industry is undergoing a significant transformation, driven by evolving consumer preferences, technological disruptions, and stringent regulatory environments. The industry's CAGR from 2025-2033 is projected at xx%. Market penetration of RRPs is increasing steadily, posing a challenge to traditional cigarettes' dominance. The market is witnessing rapid growth in the Asia-Pacific and African regions. The increasing adoption of RRPs is a direct response to growing health concerns and changing consumer attitudes. Furthermore, the technological shift is influencing product innovation, enhancing user experience and creating new competitive advantages. The industry faces increasing pressure to embrace sustainability practices and ethical sourcing to improve its public image.

Leading Markets & Segments in Tobacco Industry

The Asia-Pacific region dominates the global tobacco market, driven by large populations, high smoking rates, and rapid economic growth in several countries. Within product types, cigarettes maintain the largest market share, although the growth rate is slower compared to RRPs. Convenience stores represent the dominant distribution channel due to their widespread availability and accessibility.

Key Drivers for Asia-Pacific Dominance:

- High population density

- Significant smoking prevalence

- Rapid economic growth

- Relatively lower regulatory pressure in some markets (compared to the West)

Product Type Analysis:

- Cigarettes: xx Million in 2024

- Cigars and Cigarillos: xx Million in 2024

- Waterpipes: xx Million in 2024

- Smokeless Devices: xx Million in 2024

Distribution Channel Analysis:

- Supermarket/Hypermarket: xx Million in 2024

- Convenience Stores: xx Million in 2024

- Specialty Stores: xx Million in 2024

- Other Distribution Channels: xx Million in 2024

Tobacco Industry Product Developments

The tobacco industry is undergoing a period of significant transformation, driven by technological advancements and evolving consumer preferences. A key focus is the development and marketing of Reduced-Risk Products (RRPs), including heated tobacco products, e-cigarettes, and other alternatives to traditional cigarettes. Major players are investing heavily in research and development, aiming to create devices with improved user experience, a wider variety of flavors and satisfying sensory attributes, while also exploring innovative heating technologies and formulations. This innovation is intended to cater to a diverse consumer base, particularly those seeking potentially less harmful alternatives and those looking for new and improved sensory experiences.

Key Drivers of Tobacco Industry Growth

Several factors are contributing to the growth and evolution of the tobacco industry. The development and adoption of RRPs are paramount, offering consumers alternatives to traditional cigarettes. Changing consumer preferences toward products perceived as less harmful are significantly impacting market trends. Growth in emerging markets with favorable economic conditions and less restrictive regulatory environments also presents significant opportunities. Successful product launches of innovative heated tobacco products and strategic expansion into high-growth markets are examples of this growth.

Challenges in the Tobacco Industry Market

The tobacco industry faces significant challenges, including stringent regulations in many developed markets, increasing health concerns and public health initiatives, and rising costs of raw materials and manufacturing. These factors contribute to decreased profitability and constrain market expansion in certain regions. The competitive landscape, characterized by the emergence of RRPs and other substitutes, further complicates the scenario, impacting market shares. This results in an overall pressure on revenue streams.

Emerging Opportunities in Tobacco Industry

Substantial opportunities exist for growth and diversification within the tobacco industry. Emerging markets in Africa and Asia, characterized by high smoking rates and less stringent regulations, represent significant untapped potential. Further opportunities lie in the ongoing development and improvement of RRPs, along with a greater focus on sustainable sourcing practices, ethical manufacturing and supply chains, and improved transparency to enhance the industry's public image. Strategic partnerships and collaborations are essential to navigating the increasingly complex regulatory landscape, accessing new markets, and fostering innovation.

Leading Players in the Tobacco Industry Sector

- Philip Morris International Inc

- ITC Limited

- PT Gudang Garam Tbk

- China National Tobacco Corporation

- Eastern Company SAE

- Japan Tobacco Inc

- KT&G Corp

- British American Tobacco plc

- Altria Group Inc

- Imperial Brands plc

Key Milestones in Tobacco Industry Industry

- November 2022: Philip Morris International Inc. launched BONDS by IQOS, a heat-not-burn tobacco heating system, marking a significant addition to their RRP portfolio and demonstrating their commitment to product innovation.

- July 2022: British American Tobacco launched gloTM hyper X2 in Tokyo, Japan, highlighting ongoing innovation in the heated tobacco category and reflecting a commitment to consumer-centric product design.

- August 2021: JT Group launched Ploom X, a next-generation heated tobacco device, in Japan, showcasing the intense competition and continuous drive for innovation within the RRP market.

- [Add another recent milestone here with details - Year, Company, Product and significance]

Strategic Outlook for Tobacco Industry Market

The long-term success of the tobacco industry depends on its ability to adapt to evolving consumer preferences, navigate complex regulatory challenges, and demonstrate a commitment to responsible practices. A strategic focus on RRPs, coupled with expansion into high-growth emerging markets and the cultivation of strategic partnerships, will be critical for sustainable growth. The industry's future will be defined by its ability to successfully balance innovation, sustainability, ethical considerations, and a commitment to reducing the health risks associated with its products.

Tobacco Industry Segmentation

-

1. Product Type

- 1.1. Cigarettes

- 1.2. Cigars and Cigarillos

- 1.3. Waterpipes

- 1.4. Smokeless Devices

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Other Distribution Channels

Tobacco Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Tobacco Industry Regional Market Share

Geographic Coverage of Tobacco Industry

Tobacco Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Fashion Trend; Inflating Income Level of Individuals

- 3.3. Market Restrains

- 3.3.1. The Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1 Rising Popularity for Low Tar

- 3.4.2 Nicotine Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cigarettes

- 5.1.2. Cigars and Cigarillos

- 5.1.3. Waterpipes

- 5.1.4. Smokeless Devices

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cigarettes

- 6.1.2. Cigars and Cigarillos

- 6.1.3. Waterpipes

- 6.1.4. Smokeless Devices

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarket/Hypermarket

- 6.2.2. Convenience Stores

- 6.2.3. Specialty Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cigarettes

- 7.1.2. Cigars and Cigarillos

- 7.1.3. Waterpipes

- 7.1.4. Smokeless Devices

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarket/Hypermarket

- 7.2.2. Convenience Stores

- 7.2.3. Specialty Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cigarettes

- 8.1.2. Cigars and Cigarillos

- 8.1.3. Waterpipes

- 8.1.4. Smokeless Devices

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarket/Hypermarket

- 8.2.2. Convenience Stores

- 8.2.3. Specialty Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Cigarettes

- 9.1.2. Cigars and Cigarillos

- 9.1.3. Waterpipes

- 9.1.4. Smokeless Devices

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarket/Hypermarket

- 9.2.2. Convenience Stores

- 9.2.3. Specialty Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Cigarettes

- 10.1.2. Cigars and Cigarillos

- 10.1.3. Waterpipes

- 10.1.4. Smokeless Devices

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarket/Hypermarket

- 10.2.2. Convenience Stores

- 10.2.3. Specialty Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Philip Morris International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ITC Limited*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PT Gudang Garam Tbk

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China National Tobacco Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eastern Company SAE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Japan Tobacco Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 KT&G Corp

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 British American Tobacco plc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Altria Group Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Imperial Brands plc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Philip Morris International Inc

List of Figures

- Figure 1: Global Tobacco Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Tobacco Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Tobacco Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Tobacco Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Tobacco Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Tobacco Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Tobacco Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Tobacco Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Tobacco Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Tobacco Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Tobacco Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Tobacco Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Tobacco Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Tobacco Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Tobacco Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Tobacco Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Tobacco Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Tobacco Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Tobacco Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Tobacco Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Tobacco Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Tobacco Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: South America Tobacco Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Tobacco Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Tobacco Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Tobacco Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Tobacco Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Tobacco Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Tobacco Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Tobacco Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Tobacco Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Tobacco Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Tobacco Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Tobacco Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Italy Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Russia Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Tobacco Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Tobacco Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 36: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Tobacco Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South Africa Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tobacco Industry?

The projected CAGR is approximately 2.53%.

2. Which companies are prominent players in the Tobacco Industry?

Key companies in the market include Philip Morris International Inc, ITC Limited*List Not Exhaustive, PT Gudang Garam Tbk, China National Tobacco Corporation, Eastern Company SAE, Japan Tobacco Inc, KT&G Corp, British American Tobacco plc, Altria Group Inc, Imperial Brands plc.

3. What are the main segments of the Tobacco Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1058.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Fast Fashion Trend; Inflating Income Level of Individuals.

6. What are the notable trends driving market growth?

Rising Popularity for Low Tar. Nicotine Products.

7. Are there any restraints impacting market growth?

The Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In November 2022, With its mix of specially designed tobacco sticks, BLENDS, Philip Morris International Inc. launched its latest heat-not-burn tobacco heating system, BONDS by IQOS.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tobacco Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tobacco Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tobacco Industry?

To stay informed about further developments, trends, and reports in the Tobacco Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence