Key Insights

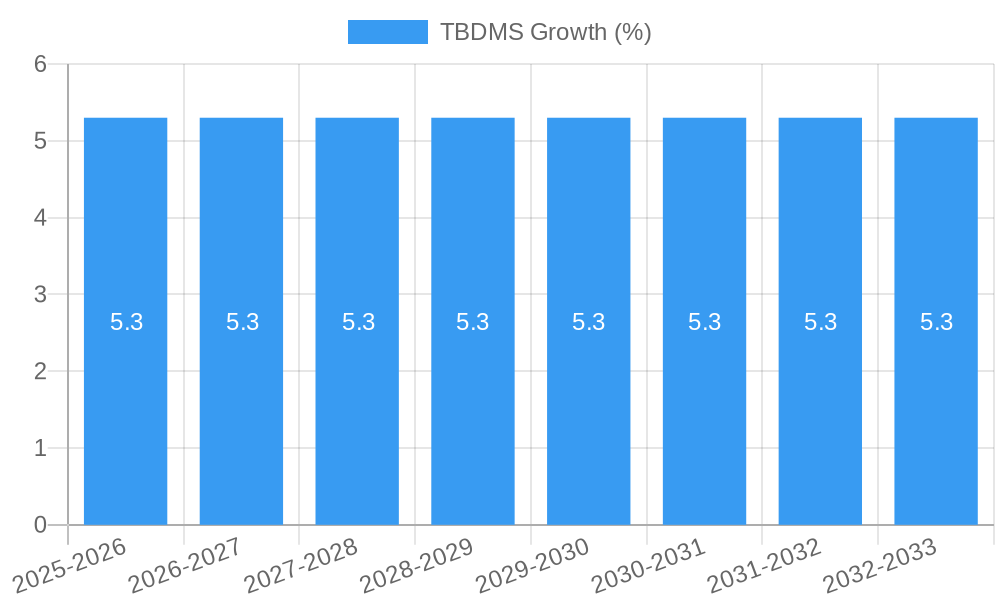

The global market for Tert-butyldimethylsilyl chloride (TBDMS), a crucial organosilicon compound, is poised for significant expansion, projected to reach an estimated USD 750 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 5.5% anticipated through 2033. This impressive trajectory is primarily fueled by the escalating demand for TBDMS in organic synthesis, where its role as a protecting group for alcohols and amines is indispensable in complex chemical reactions. The pharmaceutical industry, in particular, is a major driver, leveraging TBDMS extensively in the synthesis of Active Pharmaceutical Ingredients (APIs) and advanced intermediates, underscoring its vital contribution to drug discovery and development. The increasing complexity and multi-step nature of modern pharmaceutical manufacturing necessitate reliable and efficient protecting group strategies, positioning TBDMS as a cornerstone reagent. Furthermore, its application in the development of novel materials and specialty chemicals is also contributing to market growth, albeit at a more nascent stage.

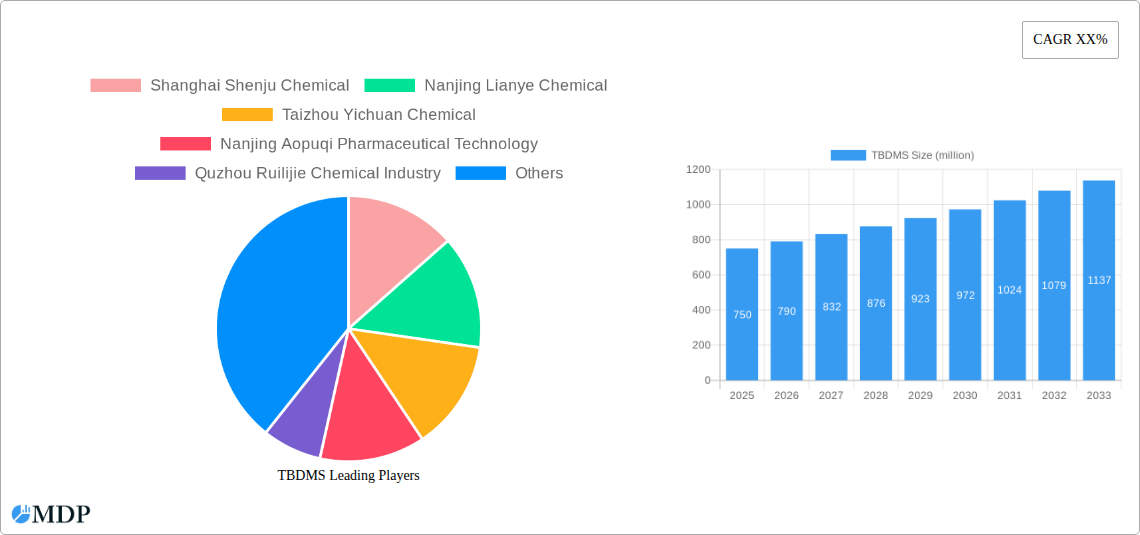

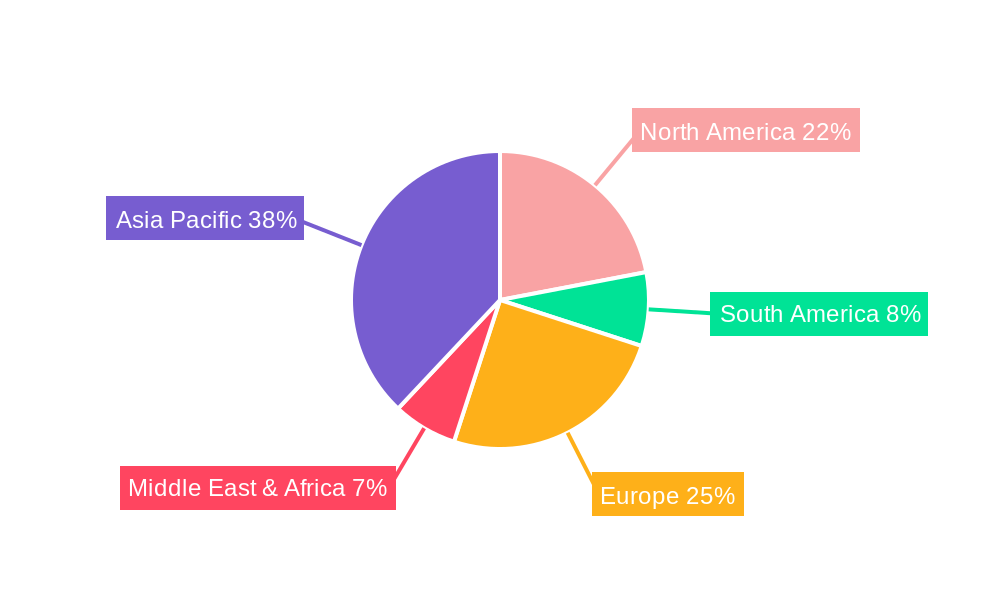

The market's dynamism is further shaped by prevailing trends such as the growing emphasis on process intensification and green chemistry, where TBDMS's efficiency in reducing reaction steps and waste generation aligns well with industry objectives. The availability of high-purity grades, such as 98% and 99% purity, caters to the stringent requirements of pharmaceutical and advanced research applications, ensuring reliability and performance. Key players like Shanghai Shenju Chemical, Nanjing Lianye Chemical, and Taizhou Yichuan Chemical are actively investing in research and development and expanding their production capacities to meet this burgeoning demand. While the market exhibits strong growth, potential restraints include fluctuations in raw material prices, particularly for silicon and its derivatives, and increasing environmental regulations concerning chemical manufacturing. Nevertheless, the sustained innovation in its applications and the increasing outsourcing of chemical synthesis to regions with competitive manufacturing bases, especially in Asia Pacific, are expected to propel the TBDMS market forward.

Here is an SEO-optimized, engaging report description for the TBDMS market, designed for maximum visibility and impact, incorporating your specified details and structure.

TBDMS Market Dynamics & Concentration

The TBDMS market exhibits a moderate to high concentration, with key players like Shanghai Shenju Chemical, Nanjing Lianye Chemical, and Taizhou Yichuan Chemical holding significant market share, estimated at over 30% combined. Innovation drivers are primarily centered around enhancing synthesis efficiency and product purity, with a focus on developing novel catalytic processes and purification techniques. Regulatory frameworks are evolving, particularly in pharmaceutical applications, demanding stringent quality control and adherence to Good Manufacturing Practices (GMP). Product substitutes, while existing for certain niche applications, are generally not direct replacements for TBDMS in its core functionalities within organic synthesis and pharmaceutical intermediates due to its unique reactivity and protective group capabilities. End-user trends are shifting towards sustainable chemical processes and increased demand for high-purity grades (99% Purity). Mergers and acquisitions (M&A) activity, though not pervasive, has seen approximately 5 significant deals over the historical period (2019-2024), driven by a desire for market consolidation and expanded product portfolios, with an estimated deal value of over 50 million. The market is characterized by a growing number of patents filed related to new synthetic routes and applications, indicating robust R&D investment.

TBDMS Industry Trends & Analysis

The TBDMS industry is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of over 6.5% from 2025 to 2033. This growth is fueled by escalating demand for advanced organic synthesis and the indispensable role of TBDMS as a protecting group in complex pharmaceutical intermediate manufacturing. The market penetration of TBDMS in emerging economies is also on an upward trajectory, driven by increasing investments in pharmaceutical R&D and the expansion of fine chemical production. Technological disruptions are playing a crucial role, with advancements in flow chemistry and green synthesis methodologies enabling more efficient and environmentally friendly production of TBDMS. Consumer preferences are increasingly leaning towards higher purity grades, with 99% Purity products witnessing a disproportionately faster growth rate than 98% Purity alternatives. Competitive dynamics are intensifying, characterized by strategic collaborations between raw material suppliers and TBDMS manufacturers, alongside efforts to diversify application bases beyond traditional organic synthesis. The continuous development of novel catalysts and optimized reaction conditions further contributes to market expansion. The increasing complexity of drug molecules necessitates reliable and versatile protecting groups, solidifying TBDMS's position. Industry stakeholders are actively investing in research to explore new applications in material science and agrochemicals, thereby broadening the market's scope. The global market for TBDMS is expected to surpass a valuation of 800 million by 2025 and is projected to reach over 1.3 billion by the end of the forecast period.

Leading Markets & Segments in TBDMS

The Pharmaceutical Intermediates segment dominates the TBDMS market, capturing an estimated 55% of the global market share in 2025. This dominance is largely attributed to the critical role of TBDMS as a highly effective silyl protecting group for alcohols, phenols, and amines, which are ubiquitous functionalities in the synthesis of complex pharmaceutical compounds. Key drivers for this segment's leadership include:

- Escalating Pharmaceutical R&D: Global investments in drug discovery and development continue to rise, leading to an increased demand for sophisticated synthetic routes and reliable protecting groups like TBDMS.

- Growth of Biopharmaceuticals: The expanding biopharmaceutical sector, with its focus on complex molecular structures, further amplifies the need for precise chemical manipulations where TBDMS excels.

- Stringent Regulatory Requirements: The pharmaceutical industry's adherence to strict quality and purity standards aligns perfectly with the availability of high-purity TBDMS grades (e.g., 99% Purity), which are essential for drug efficacy and safety.

Geographically, North America and Europe are leading markets for TBDMS, collectively accounting for approximately 60% of global consumption. This leadership is driven by the presence of major pharmaceutical companies, robust academic research institutions, and well-established chemical manufacturing infrastructure.

Within the Types segment, 99% Purity TBDMS is experiencing a faster growth rate compared to 98% Purity, driven by the aforementioned pharmaceutical demand and advancements in purification technologies that make higher purity more accessible and cost-effective. The Organic Synthesis application segment, while broader, is also a significant contributor, serving academic research, specialty chemicals, and other industrial applications. The Other segment, encompassing applications in material science, electronics, and agrochemicals, is expected to exhibit strong growth potential due to ongoing research and development.

TBDMS Product Developments

Recent product developments in the TBDMS market focus on enhancing purity, improving shelf-life, and exploring novel synthetic routes for greater efficiency. Manufacturers are investing in advanced purification techniques to consistently deliver 99% Purity grades, crucial for demanding pharmaceutical applications. Innovations also extend to developing more stable formulations and exploring eco-friendly synthesis pathways, aligning with the industry's sustainability goals. These advancements not only bolster the competitive advantage of leading players but also cater to the evolving needs of end-users seeking higher quality and greener chemical solutions, reinforcing TBDMS's indispensable role in diverse chemical processes.

Key Drivers of TBDMS Growth

The growth of the TBDMS market is primarily propelled by several key factors. Technological advancements in organic synthesis, particularly in the pharmaceutical sector, are paramount. The increasing complexity of drug molecules necessitates versatile and reliable protecting groups like TBDMS. Economic growth, especially in emerging markets, is driving increased investment in healthcare and chemical industries, thereby boosting demand. Furthermore, favorable regulatory landscapes that support pharmaceutical R&D and chemical manufacturing indirectly fuel TBDMS consumption. The continuous development of more efficient and sustainable synthesis methods for TBDMS itself also contributes to its wider adoption and market expansion.

Challenges in the TBDMS Market

The TBDMS market faces several challenges that could impact its growth trajectory. Regulatory hurdles, particularly concerning environmental impact and waste disposal from chemical manufacturing, can lead to increased compliance costs. Supply chain disruptions, as witnessed in recent global events, can affect the availability and pricing of key raw materials. Intensifying competitive pressures from both established players and emerging manufacturers can lead to price volatility. Additionally, the development of alternative protecting groups, though not yet direct replacements, presents a long-term competitive threat, especially if they offer significant cost or performance advantages in specific applications.

Emerging Opportunities in TBDMS

Emerging opportunities within the TBDMS market are largely driven by technological breakthroughs and strategic market expansion. The increasing demand for personalized medicine and complex biologics presents a significant avenue for high-purity TBDMS in specialized pharmaceutical synthesis. Furthermore, the exploration of TBDMS in advanced material science applications, such as in the development of novel polymers and functional coatings, offers substantial long-term growth potential. Strategic partnerships between TBDMS manufacturers and research institutions are crucial for unlocking these new frontiers. Moreover, the growing focus on green chemistry and sustainable manufacturing processes presents an opportunity for companies to innovate with eco-friendlier TBDMS production methods.

Leading Players in the TBDMS Sector

- Shanghai Shenju Chemical

- Nanjing Lianye Chemical

- Taizhou Yichuan Chemical

- Nanjing Aopuqi Pharmaceutical Technology

- Quzhou Ruilijie Chemical Industry

- Huangshan KBR New Material Technology

- Suzhou Highfine Biotech

- Jiangsu Cale New Material

Key Milestones in TBDMS Industry

- 2019: Increased patent filings related to novel TBDMS synthesis routes and applications in pharmaceutical intermediates.

- 2020: Emergence of stricter quality control mandates for pharmaceutical intermediates, driving demand for 99% Purity TBDMS.

- 2021: Several key players initiated R&D into greener production methods for TBDMS to address environmental concerns.

- 2022: Notable M&A activity in the fine chemical sector, with some consolidating companies having TBDMS production capabilities.

- 2023: Significant advancements in purification technologies leading to more accessible high-purity TBDMS grades.

- 2024: Growing interest in TBDMS applications beyond pharmaceuticals, particularly in material science and electronics.

Strategic Outlook for TBDMS Market

The strategic outlook for the TBDMS market remains highly positive, driven by sustained demand from the pharmaceutical sector and emerging opportunities in advanced materials. Growth accelerators will include continued investment in R&D for innovative synthetic pathways and the expansion of high-purity product offerings. Strategic collaborations and potential M&A activities will further shape the market landscape, leading to consolidation and greater market efficiency. The increasing global focus on sustainability will also incentivize the development of greener TBDMS production processes, creating a competitive edge for environmentally conscious manufacturers. The market is expected to witness robust expansion, driven by its indispensable role in complex chemical synthesis.

TBDMS Segmentation

-

1. Application

- 1.1. Organic Synthesis

- 1.2. Pharmaceutical Intermediates

- 1.3. Other

-

2. Types

- 2.1. 98% Purity

- 2.2. 99% Purity

TBDMS Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

TBDMS REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global TBDMS Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Organic Synthesis

- 5.1.2. Pharmaceutical Intermediates

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 98% Purity

- 5.2.2. 99% Purity

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America TBDMS Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Organic Synthesis

- 6.1.2. Pharmaceutical Intermediates

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 98% Purity

- 6.2.2. 99% Purity

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America TBDMS Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Organic Synthesis

- 7.1.2. Pharmaceutical Intermediates

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 98% Purity

- 7.2.2. 99% Purity

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe TBDMS Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Organic Synthesis

- 8.1.2. Pharmaceutical Intermediates

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 98% Purity

- 8.2.2. 99% Purity

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa TBDMS Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Organic Synthesis

- 9.1.2. Pharmaceutical Intermediates

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 98% Purity

- 9.2.2. 99% Purity

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific TBDMS Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Organic Synthesis

- 10.1.2. Pharmaceutical Intermediates

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 98% Purity

- 10.2.2. 99% Purity

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Shanghai Shenju Chemical

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nanjing Lianye Chemical

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Taizhou Yichuan Chemical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nanjing Aopuqi Pharmaceutical Technology

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Quzhou Ruilijie Chemical Industry

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Huangshan KBR New Material Technology

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Suzhou Highfine Biotech

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jiangsu Cale New Material

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Shanghai Shenju Chemical

List of Figures

- Figure 1: Global TBDMS Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America TBDMS Revenue (million), by Application 2024 & 2032

- Figure 3: North America TBDMS Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America TBDMS Revenue (million), by Types 2024 & 2032

- Figure 5: North America TBDMS Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America TBDMS Revenue (million), by Country 2024 & 2032

- Figure 7: North America TBDMS Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America TBDMS Revenue (million), by Application 2024 & 2032

- Figure 9: South America TBDMS Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America TBDMS Revenue (million), by Types 2024 & 2032

- Figure 11: South America TBDMS Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America TBDMS Revenue (million), by Country 2024 & 2032

- Figure 13: South America TBDMS Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe TBDMS Revenue (million), by Application 2024 & 2032

- Figure 15: Europe TBDMS Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe TBDMS Revenue (million), by Types 2024 & 2032

- Figure 17: Europe TBDMS Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe TBDMS Revenue (million), by Country 2024 & 2032

- Figure 19: Europe TBDMS Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa TBDMS Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa TBDMS Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa TBDMS Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa TBDMS Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa TBDMS Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa TBDMS Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific TBDMS Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific TBDMS Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific TBDMS Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific TBDMS Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific TBDMS Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific TBDMS Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global TBDMS Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global TBDMS Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global TBDMS Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global TBDMS Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global TBDMS Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global TBDMS Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global TBDMS Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global TBDMS Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global TBDMS Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global TBDMS Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global TBDMS Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global TBDMS Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global TBDMS Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global TBDMS Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global TBDMS Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global TBDMS Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global TBDMS Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global TBDMS Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global TBDMS Revenue million Forecast, by Country 2019 & 2032

- Table 41: China TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania TBDMS Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific TBDMS Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the TBDMS?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the TBDMS?

Key companies in the market include Shanghai Shenju Chemical, Nanjing Lianye Chemical, Taizhou Yichuan Chemical, Nanjing Aopuqi Pharmaceutical Technology, Quzhou Ruilijie Chemical Industry, Huangshan KBR New Material Technology, Suzhou Highfine Biotech, Jiangsu Cale New Material.

3. What are the main segments of the TBDMS?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "TBDMS," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the TBDMS report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the TBDMS?

To stay informed about further developments, trends, and reports in the TBDMS, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence