Key Insights

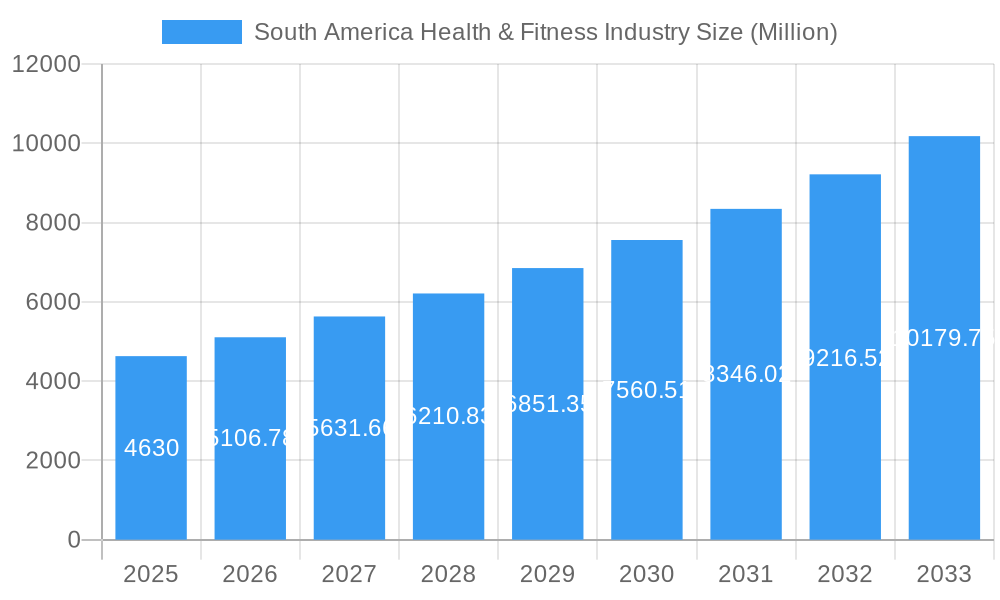

The South American health and fitness industry, valued at $4.63 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 10.26% from 2025 to 2033. This expansion is driven by several key factors. Increasing health awareness among the burgeoning middle class, coupled with rising disposable incomes, fuels demand for premium fitness services. The popularity of personalized fitness plans, including personal training and specialized instruction, contributes significantly to market growth. Furthermore, the convenience offered by diverse service models, such as membership-based gyms and pay-per-visit options, caters to a broad spectrum of consumer preferences. Competition is intense, with established players like Megatlon, OX Fitness, and Gold's Gym vying for market share alongside smaller boutique studios and rapidly expanding franchises like Anytime Fitness. The market's segmentation by service type (membership fees, admission fees, and personal training) reveals a nuanced landscape, with significant potential for growth in personalized services as consumers prioritize individualized fitness journeys. Brazil and Argentina constitute the largest regional markets, reflecting their larger populations and higher levels of disposable income compared to the rest of South America.

South America Health & Fitness Industry Market Size (In Billion)

Market restraints include infrastructure limitations in certain regions, particularly outside major metropolitan areas, hindering accessibility to fitness facilities. Economic fluctuations also pose a risk, affecting consumer spending on discretionary services like fitness memberships. However, the long-term growth trajectory remains positive, underpinned by the increasing emphasis on wellness and preventative healthcare across South America. The industry is adapting by introducing innovative technologies, such as virtual fitness classes and personalized workout apps, to overcome accessibility barriers and cater to the evolving consumer preferences. This trend, coupled with strategic expansion plans by leading fitness brands, positions the South American health and fitness industry for substantial and sustained growth throughout the forecast period.

South America Health & Fitness Industry Company Market Share

South America Health & Fitness Industry Report: 2019-2033

Unlocking the Untapped Potential of a Booming Market

This comprehensive report provides an in-depth analysis of the South America health and fitness industry, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. We project the market to reach \$XX Million by 2033, fueled by robust growth drivers and emerging opportunities. The study period covers 2019-2033, with 2025 as the base and estimated year. Our forecast period spans 2025-2033, and historical data encompasses 2019-2024.

South America Health & Fitness Industry Market Dynamics & Concentration

The South American health and fitness market exhibits a dynamic landscape characterized by a blend of established international players and thriving local businesses. Market concentration is moderate, with a few major players like Megatlon Club and GOLD'S GYM holding significant market share, but numerous smaller chains and independent gyms also contributing substantially. The market share of the top 5 players is estimated at xx%. Innovation is driven by technological advancements in fitness equipment, personalized training programs, and digital fitness platforms. Regulatory frameworks vary across countries, influencing market access and operational costs. Product substitutes, such as home fitness equipment and online workout programs, exert competitive pressure. End-user trends show a growing preference for boutique fitness studios and personalized wellness experiences. M&A activity has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024. Future M&A activity is predicted to increase due to consolidation and expansion strategies.

- Market Concentration: Moderate, with top 5 players holding xx% market share (2025 estimate).

- Innovation Drivers: Technological advancements in fitness equipment and digital platforms.

- Regulatory Frameworks: Vary across countries, impacting market access and costs.

- Product Substitutes: Home fitness equipment and online workout programs.

- End-User Trends: Growing demand for boutique studios and personalized wellness.

- M&A Activity: Approximately xx deals recorded between 2019 and 2024 (estimated).

South America Health & Fitness Industry Industry Trends & Analysis

The South American health and fitness industry is experiencing robust growth, fueled by a confluence of factors. Rising disposable incomes across diverse socioeconomic groups are empowering individuals to prioritize wellness and invest in fitness services. This is further amplified by a growing health consciousness, driven by increased awareness of chronic disease prevention and the benefits of proactive wellness. The industry is undergoing a significant digital transformation, with the proliferation of wearable fitness trackers, virtual and on-demand fitness platforms, and health and wellness apps profoundly altering consumer behavior and expectations. Consumer preferences are increasingly sophisticated, demanding personalized fitness plans, specialized workout classes catering to niche interests (yoga, CrossFit, Zumba, etc.), and convenient access to high-quality fitness facilities. The competitive landscape is dynamic, featuring intense competition among established industry giants and the disruptive entry of innovative niche players offering unique value propositions. Market projections for the Compound Annual Growth Rate (CAGR) for the period 2025-2033 are estimated at [Insert Updated CAGR Percentage]%, with anticipated market penetration reaching [Insert Updated Market Penetration Percentage]% by 2033. This robust growth trajectory reflects the increasing prioritization of health and fitness across South America.

Leading Markets & Segments in South America Health & Fitness Industry

Brazil and Argentina represent the largest markets within South America’s health & fitness sector, driven by factors such as a sizable population, higher disposable income levels, and increasing health consciousness. Within the service segments, membership fees currently dominate, contributing xx% to total revenue in 2025. However, personal training and instruction services are experiencing rapid growth, projected to reach xx% of the market by 2033, driven by increasing demand for personalized fitness guidance.

Key Drivers:

- Brazil & Argentina: Large populations, rising disposable incomes, growing health awareness.

- Membership Fees: Established revenue stream, high volume of users.

- Personal Training & Instruction: Growing demand for personalization and expertise.

- Economic Policies: Government initiatives promoting health and wellness.

- Infrastructure: Expanding fitness infrastructure in major cities.

Dominance Analysis: Brazil and Argentina's dominance stems from their large population base and relatively higher disposable incomes compared to other South American nations. The growth of personal training reflects a broader shift towards personalized wellness experiences.

South America Health & Fitness Industry Product Developments

Product innovation is heavily influenced by technological advancements. Wearable technology, virtual reality fitness applications, and AI-powered personalized training programs are gaining traction. Companies are focusing on creating user-friendly interfaces and seamless integration of technology into their services. This focus on technological innovation provides competitive advantages, attracting tech-savvy consumers and improving user engagement.

Key Drivers of South America Health & Fitness Industry Growth

Several interconnected factors are propelling the remarkable growth of the South American health and fitness industry. The rise in disposable incomes across the region is a primary driver, enabling broader access to premium fitness services and a wider range of fitness options. Government initiatives promoting public health and wellness, coupled with a growing awareness of the long-term benefits of physical activity and healthy lifestyles, are further fueling demand. Technological advancements, including the development of innovative fitness equipment, sophisticated software for personalized training, and user-friendly digital platforms, enhance the user experience and create new market opportunities. The expansion of modern fitness infrastructure, particularly in rapidly urbanizing areas, ensures greater accessibility to fitness facilities and contributes significantly to market expansion. Finally, the increasing recognition of the crucial link between physical fitness and overall well-being is driving individual engagement and sustained industry growth.

Challenges in the South America Health & Fitness Industry Market

The industry faces challenges including economic instability in certain countries, impacting consumer spending on non-essential services. Supply chain disruptions can lead to increased costs and reduced availability of equipment. Intense competition from both established and emerging players necessitates continuous innovation and differentiation. Regulatory hurdles and varying compliance requirements across different countries add complexity. These factors together represent a potential constraint on market growth, and a conservative approach is recommended for financial projections.

Emerging Opportunities in South America Health & Fitness Industry

The future growth of the South America health and fitness industry is poised for significant expansion, driven by several key emerging opportunities. Technological breakthroughs, such as AI-powered fitness coaching capable of personalized program design, virtual reality (VR) workout experiences that enhance engagement, and the integration of wearables and fitness apps with personalized health data, are creating innovative and compelling options for consumers. Strategic partnerships between established fitness centers and healthcare providers offer synergistic opportunities, enabling the development of holistic wellness programs that integrate physical fitness with preventative healthcare. Market expansion into underserved regions and demographic segments presents significant potential for untapped growth. Furthermore, the incorporation of sustainability initiatives and environmentally conscious practices within fitness facilities will appeal to environmentally aware consumers and contribute to the long-term viability of the sector.

Leading Players in the South America Health & Fitness Industry Sector

- Megatlon Club

- OX Fitness Club

- Academia Bio Ritmo

- GOLD'S GYM

- Planet Fitness Franchising LLC

- Bodytech Sports Medicine

- Anytime Fitness LLC

- AYO Fitness Club

- [Add other significant players]

Key Milestones in South America Health & Fitness Industry Industry

- 2020: The COVID-19 pandemic accelerated the adoption of online and at-home fitness platforms, demonstrating the adaptability of the sector and laying the groundwork for hybrid models.

- 2021: Significant investment in technology and digital transformation was witnessed across the industry, with many players adopting advanced data analytics and personalized training technologies.

- 2022: The emergence of numerous boutique fitness studios specializing in various workout formats reflected the rising demand for personalized and niche fitness experiences.

- 2023: A clear focus on personalized training and comprehensive wellness programs emerged, addressing individual client needs and promoting long-term health outcomes.

- 2024: Increased collaboration and partnerships between fitness centers and healthcare providers began to redefine wellness services, offering integrated and holistic healthcare options.

- [Add more recent milestones and future projections]

Strategic Outlook for South America Health & Fitness Industry Market

The South American health and fitness market presents significant long-term growth potential. Continued technological innovation, expansion into underserved markets, and strategic partnerships are key to unlocking this potential. Companies that effectively adapt to evolving consumer preferences and leverage technological advancements will be well-positioned to succeed in this dynamic market. The focus on preventative healthcare and personalized wellness will continue to drive future growth.

South America Health & Fitness Industry Segmentation

-

1. Service Type

- 1.1. Membership Fees

- 1.2. Total Admission Fees

- 1.3. Personal Training and Instruction Services

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America Health & Fitness Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Health & Fitness Industry Regional Market Share

Geographic Coverage of South America Health & Fitness Industry

South America Health & Fitness Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Increasing Inclination toward Health Clubs for Fitness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Membership Fees

- 5.1.2. Total Admission Fees

- 5.1.3. Personal Training and Instruction Services

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Brazil South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Membership Fees

- 6.1.2. Total Admission Fees

- 6.1.3. Personal Training and Instruction Services

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Argentina South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Membership Fees

- 7.1.2. Total Admission Fees

- 7.1.3. Personal Training and Instruction Services

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Colombia South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Membership Fees

- 8.1.2. Total Admission Fees

- 8.1.3. Personal Training and Instruction Services

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of South America South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Membership Fees

- 9.1.2. Total Admission Fees

- 9.1.3. Personal Training and Instruction Services

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Megatlon Club

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 OX Fitness Club*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Academia Bio Ritmo

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GOLD'S GYM

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Planet Fitness Franchising LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bodytech Sports Medicine

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Anytime Fitness LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 AYO Fitness Club

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Megatlon Club

List of Figures

- Figure 1: South America Health & Fitness Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Health & Fitness Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: South America Health & Fitness Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Health & Fitness Industry?

The projected CAGR is approximately 10.26%.

2. Which companies are prominent players in the South America Health & Fitness Industry?

Key companies in the market include Megatlon Club, OX Fitness Club*List Not Exhaustive, Academia Bio Ritmo, GOLD'S GYM, Planet Fitness Franchising LLC, Bodytech Sports Medicine, Anytime Fitness LLC, AYO Fitness Club.

3. What are the main segments of the South America Health & Fitness Industry?

The market segments include Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Increasing Inclination toward Health Clubs for Fitness.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Health & Fitness Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Health & Fitness Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Health & Fitness Industry?

To stay informed about further developments, trends, and reports in the South America Health & Fitness Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence