Key Insights

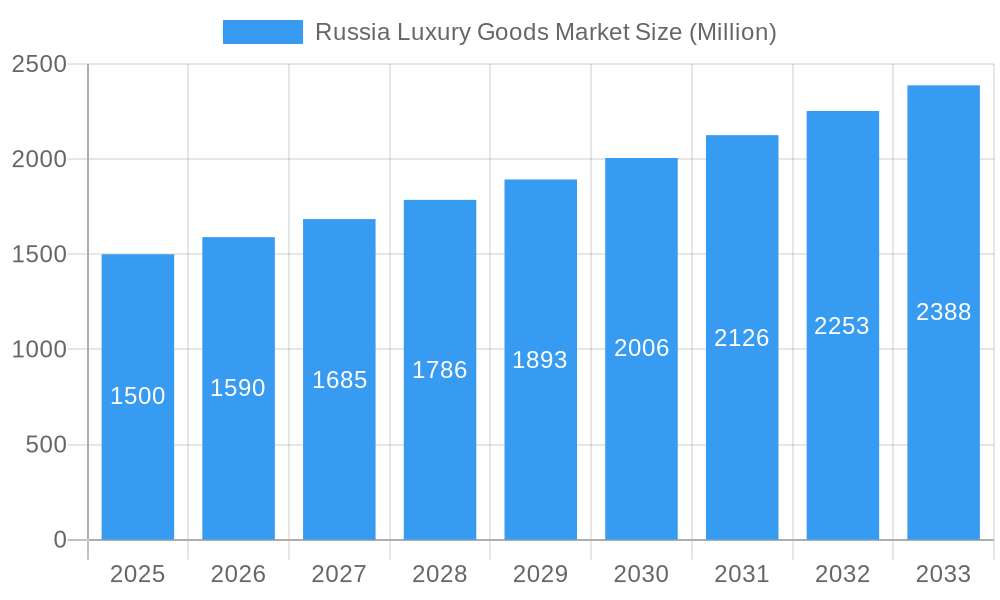

The Russia luxury goods market, valued at approximately 2.59 billion in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) of 2.81% from 2025 to 2033. This expansion is fueled by a growing affluent class with increasing disposable income and a rising appreciation for premium brands. Enhanced tourism and a strategic emphasis on domestic luxury consumption further drive market dynamics. The demand for exclusive experiences and personalized services within the luxury sector also contributes significantly to this growth. While economic volatility and geopolitical considerations may present challenges, the sector's inherent resilience and evolving consumer preferences for premium offerings suggest a positive long-term outlook. Leading luxury brands are actively adapting through refined marketing, personalized customer engagement, and expanded e-commerce strategies.

Russia Luxury Goods Market Market Size (In Billion)

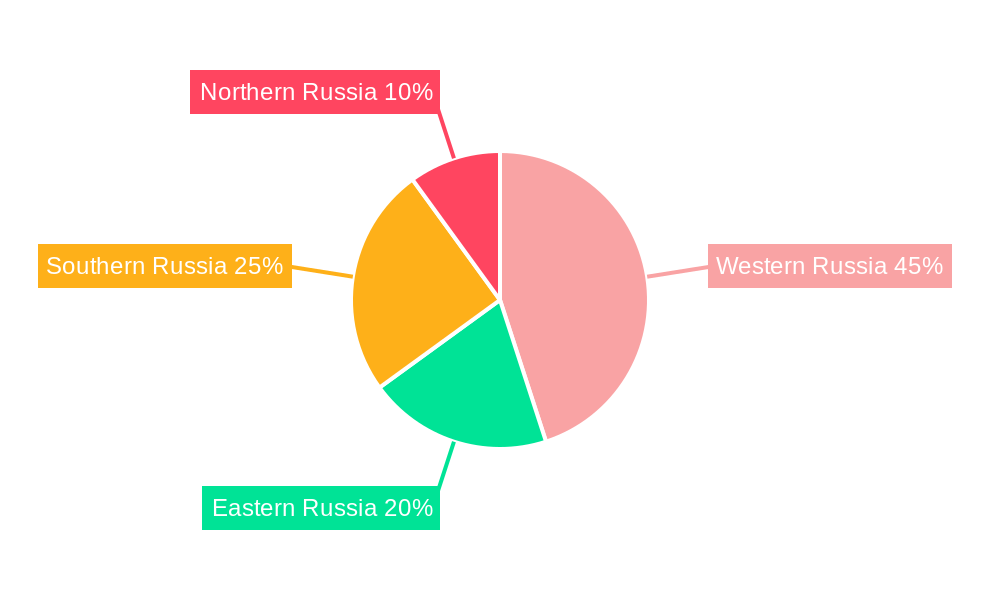

Analysis by segment indicates that apparel, jewelry, and watches will be dominant product categories. Distribution channels are evolving, with a significant rise in online sales augmenting traditional single-brand and multi-brand retail outlets. Major international brands are strengthening their market presence through strategic growth initiatives, novel product development, and robust brand reinforcement. Regional market analysis highlights Western Russia as a key hub due to its concentrated wealth and population. However, emerging economic growth in regions like Southern Russia presents substantial untapped potential for luxury brands, underscoring the importance of targeted regional investments for optimal market penetration and profitability. The forecast period (2025-2033) is anticipated to witness sustained expansion, supported by consistent consumer demand and strategic adjustments by luxury market participants in Russia.

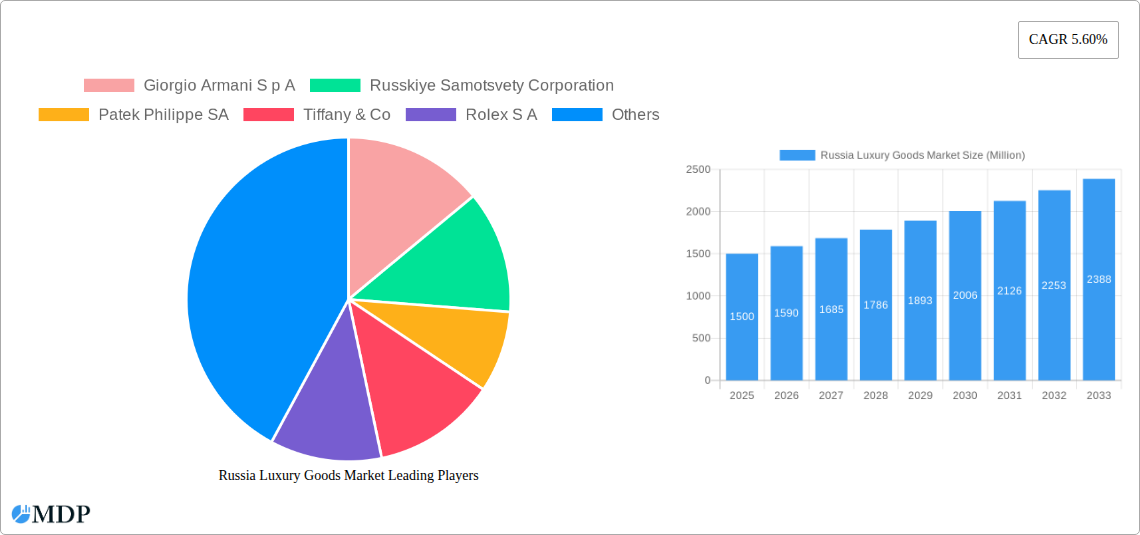

Russia Luxury Goods Market Company Market Share

Russia Luxury Goods Market: 2019-2033 Report

This comprehensive report provides an in-depth analysis of the Russia luxury goods market, offering invaluable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a complete understanding of market dynamics, trends, and future prospects. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Keywords: Russia luxury goods market, luxury market Russia, Russian luxury goods industry, luxury brands Russia, Russian luxury market size, luxury goods market trends Russia, Russia luxury retail, premium goods Russia, high-end goods Russia, Russia luxury watch market, Russia luxury jewelry market, Russia luxury fashion market.

Russia Luxury Goods Market Dynamics & Concentration

The Russia luxury goods market exhibits a moderately concentrated landscape, with several international and domestic players vying for market share. Market concentration is influenced by factors such as brand recognition, distribution networks, and consumer preferences. The market share of the top five players is estimated to be around xx% in 2025.

- Innovation Drivers: Technological advancements in product design, manufacturing, and retail experiences are driving innovation. Personalized experiences, omnichannel strategies, and sustainable luxury are gaining traction.

- Regulatory Frameworks: Government regulations concerning import/export, taxation, and consumer protection influence market dynamics. Changes in these regulations can significantly impact market growth and investment.

- Product Substitutes: The availability of affordable luxury alternatives and counterfeit products poses a challenge to established brands. Strategies to combat counterfeiting and build brand loyalty are crucial.

- End-User Trends: Affluent consumers in Russia increasingly prioritize quality, craftsmanship, and brand heritage. Experiential luxury and personalized services are becoming increasingly important.

- M&A Activities: The number of M&A deals in the luxury sector has shown fluctuations over the historical period. In the period of 2019-2024, approximately xx M&A deals were recorded in the luxury goods sector in Russia. Strategic acquisitions and mergers will likely continue to shape the market landscape.

Russia Luxury Goods Market Industry Trends & Analysis

The Russian luxury goods market is characterized by fluctuating growth driven by economic conditions, geopolitical factors, and consumer sentiment. The market experienced a period of decline during 2022 due to sanctions imposed on the country, but it's expected to recover slowly in the coming years. The historical period (2019-2024) witnessed a compound annual growth rate (CAGR) of xx%, while the projected CAGR for the forecast period (2025-2033) is estimated at xx%. Market penetration, particularly in the online luxury segment, is anticipated to see significant growth, driven by rising internet and smartphone penetration and a shift in consumer shopping behavior. The increasing preference for personalized experiences and sustainability within the luxury market also drives the overall growth. Technological disruptions such as the rise of e-commerce and digital marketing are reshaping the market, encouraging companies to engage in digital marketing campaigns for better market reach and increased sales. Consumer preferences are shifting towards unique experiences, and sustainable practices are gradually gaining traction. The competitive landscape is intensifying, with established international brands facing competition from emerging domestic players, particularly in the jewelry segment.

Leading Markets & Segments in Russia Luxury Goods Market

The Moscow and St. Petersburg metropolitan areas dominate the luxury goods market in Russia, accounting for approximately xx% of the total market value in 2025. Other major cities also contribute significantly. The jewelry segment is the largest segment by product type, followed by watches and bags.

By Product Type:

- Jewelry: High demand for precious stones and gold jewelry, coupled with strong cultural appreciation for exquisite craftsmanship, fuels significant market growth.

- Watches: The preference for luxury Swiss watches and Russian watch brands is strong. This segment is also driving growth.

- Bags: Demand for designer handbags and luggage from international and local brands contributes to this segment's growth.

- Clothing & Apparel: The luxury fashion segment is also witnessing considerable growth.

- Footwear: The demand for luxury footwear remains steady, catering to a sophisticated clientele.

- Other Types: The “other types” segment includes accessories, perfumes, and cosmetics.

By Distribution Channel:

- Single Brand Stores: Maintain brand control and prestige.

- Multi-Brand Stores: Offer broader choices to consumers.

- Online Stores: Rapidly growing due to digitalization. E-commerce is gaining rapid popularity among Russian consumers who now prefer online shopping.

- Other Distribution Channels: Include department stores, duty-free shops, and exclusive showrooms.

Key Drivers (Moscow & St. Petersburg):

- High concentration of high-net-worth individuals.

- Well-developed retail infrastructure.

- Strong tourism sector.

- Government support for luxury retail.

Russia Luxury Goods Market Product Developments

Product innovation focuses on sustainable materials, advanced manufacturing techniques (such as 3D printing for jewelry), and personalized customization options. Technological trends such as augmented reality (AR) and virtual reality (VR) are being integrated into the shopping experience to enhance customer engagement and create bespoke experiences. This ensures a better market fit and drives customer satisfaction.

Key Drivers of Russia Luxury Goods Market Growth

Several factors fuel the growth of the Russian luxury goods market. Rising disposable incomes among affluent consumers, coupled with a growing appreciation for luxury brands and a desire for unique experiences, significantly influence market expansion. Government initiatives to support the luxury sector and the increasing adoption of e-commerce platforms are contributing to market growth. Favorable demographics and a surge in inbound tourism also play vital roles.

Challenges in the Russia Luxury Goods Market Market

The Russia luxury goods market faces several challenges. Geopolitical instability and economic sanctions impact consumer spending and hinder growth, potentially resulting in an approximately xx% decrease in market growth in 2022. Supply chain disruptions and currency fluctuations impact import costs. The proliferation of counterfeit products poses a threat to established brands. Increasing competition and evolving consumer preferences necessitate continuous adaptation and innovation.

Emerging Opportunities in Russia Luxury Goods Market

Emerging opportunities include expansion into smaller cities with growing affluent populations. Strategic partnerships with local designers and businesses, to capitalize on the rising popularity of uniquely crafted Russian luxury items. Technological advancements, including personalized recommendations through AI-driven platforms, will improve the online shopping experience and drive sales. Focus on sustainable luxury will resonate increasingly with environmentally conscious consumers.

Leading Players in the Russia Luxury Goods Market Sector

- Giorgio Armani S p A

- Russkiye Samotsvety Corporation

- Patek Philippe SA

- Tiffany & Co

- Rolex S A

- Estee Lauder

- EssilorLuxottica SA

- Fossile Group

- Nika Watches Jewelry

- Sokolov Jewelry

Key Milestones in Russia Luxury Goods Market Industry

- 2020: & Other Stories opened its first store in Russia, expanding the reach of various luxury product categories.

- 2021: Alrosa consolidated its jewelry production and launched an online store, focusing on promoting origin-guaranteed Russian diamonds and combating market fraud.

- 2021: Sokolov planned a dual listing in New York and Moscow for 2023, aiming for expansion through an IPO.

Strategic Outlook for Russia Luxury Goods Market Market

The Russia luxury goods market presents significant long-term growth potential. Focusing on innovative products, e-commerce expansion, and strategic partnerships will be crucial for success. Adapting to evolving consumer preferences and navigating geopolitical challenges will determine market leadership in the years to come. The market's recovery and growth will significantly depend on macroeconomic conditions, and overall consumer confidence.

Russia Luxury Goods Market Segmentation

-

1. Product Type

- 1.1. Clothing & Apparel

- 1.2. Footwear

- 1.3. Jewelry

- 1.4. Watches

- 1.5. Bags

- 1.6. Other Types

-

2. Distibution Channel

- 2.1. Single Brand Stores

- 2.2. Multi-Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Russia Luxury Goods Market Segmentation By Geography

- 1. Russia

Russia Luxury Goods Market Regional Market Share

Geographic Coverage of Russia Luxury Goods Market

Russia Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Interest in Adventure Tourism; Growing Focus on Health and Wellness

- 3.3. Market Restrains

- 3.3.1. High Risk and Safety Concerns; Fluctuating Weather Patterns

- 3.4. Market Trends

- 3.4.1. Consumer's Willingness to Spend on Luxury Grooming

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Clothing & Apparel

- 5.1.2. Footwear

- 5.1.3. Jewelry

- 5.1.4. Watches

- 5.1.5. Bags

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single Brand Stores

- 5.2.2. Multi-Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Giorgio Armani S p A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Russkiye Samotsvety Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Patek Philippe SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tiffany & Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rolex S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Estee Lauder

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EssilorLuxottica SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fossile Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nika Watches Jewelry

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sokolov Jewelry*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: Russia Luxury Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Luxury Goods Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Russia Luxury Goods Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Russia Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: Russia Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 5: Russia Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Russia Luxury Goods Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Russia Luxury Goods Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Russia Luxury Goods Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Russia Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 10: Russia Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 11: Russia Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Russia Luxury Goods Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Luxury Goods Market?

The projected CAGR is approximately 2.81%.

2. Which companies are prominent players in the Russia Luxury Goods Market?

Key companies in the market include Giorgio Armani S p A, Russkiye Samotsvety Corporation, Patek Philippe SA, Tiffany & Co, Rolex S A, Estee Lauder, EssilorLuxottica SA, Fossile Group, Nika Watches Jewelry, Sokolov Jewelry*List Not Exhaustive.

3. What are the main segments of the Russia Luxury Goods Market?

The market segments include Product Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.59 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Interest in Adventure Tourism; Growing Focus on Health and Wellness.

6. What are the notable trends driving market growth?

Consumer's Willingness to Spend on Luxury Grooming.

7. Are there any restraints impacting market growth?

High Risk and Safety Concerns; Fluctuating Weather Patterns.

8. Can you provide examples of recent developments in the market?

In 2021, The Russian company Alrosa completed the consolidation of its jewelry production and launched its first online jewelry store. The company's goal is to promote origin-guaranteed Russian diamonds, improve the user's experience, and combat fraud in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Luxury Goods Market?

To stay informed about further developments, trends, and reports in the Russia Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence