Key Insights

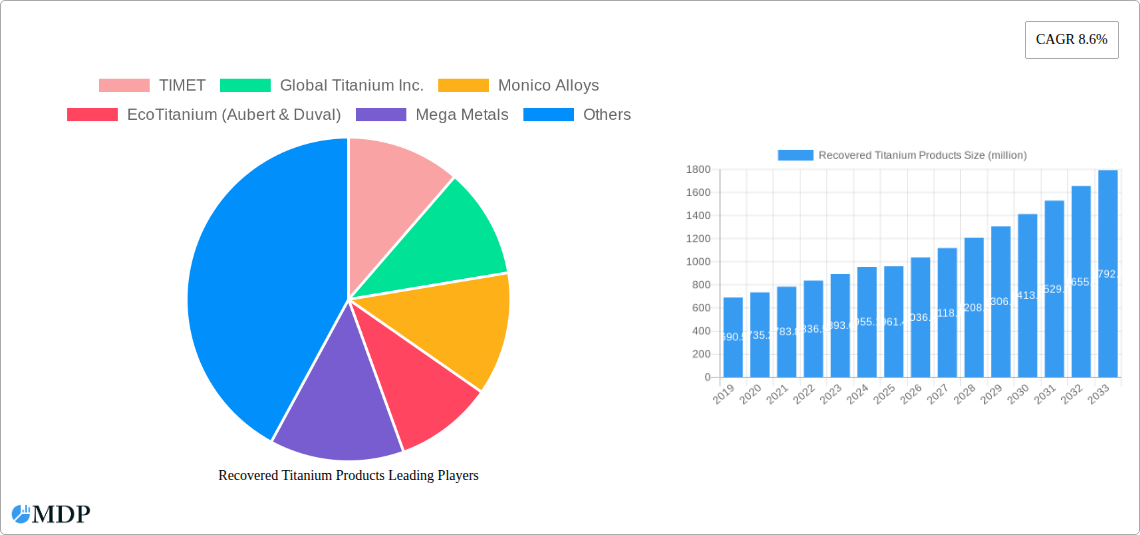

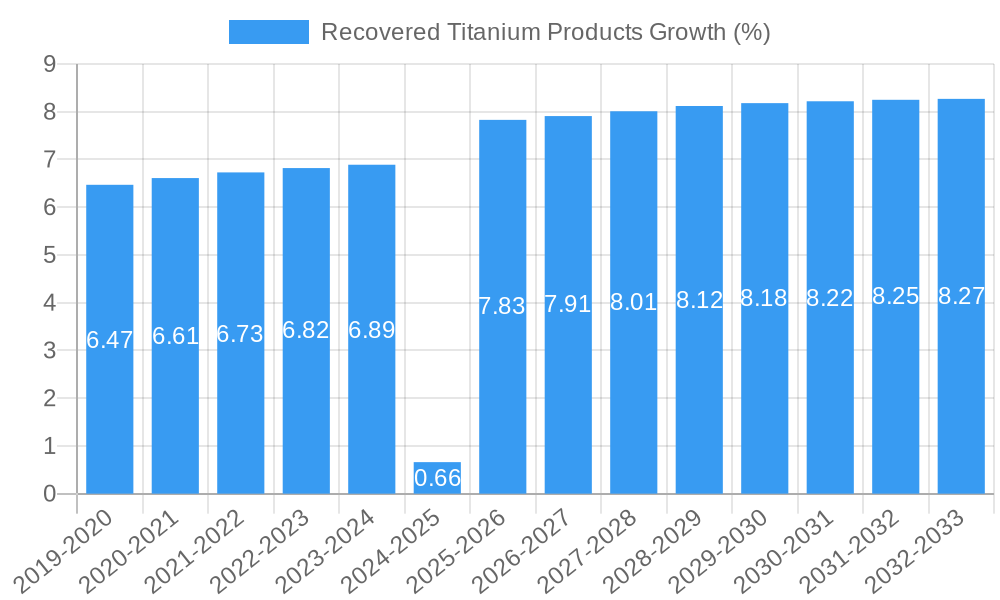

The recovered titanium products market is projected for robust growth, with a substantial current market size of $961.4 million and an impressive Compound Annual Growth Rate (CAGR) of 8.6% expected between 2025 and 2033. This expansion is primarily driven by the escalating demand for high-performance materials across key sectors. The aerospace industry, with its stringent requirements for lightweight yet durable components, continues to be a significant consumer of recovered titanium. Similarly, the medical supplies sector benefits from titanium's biocompatibility and strength, driving its use in implants and surgical instruments. The chemical industry also relies on titanium's corrosion resistance for various applications, further fueling market growth. Emerging applications in ship and ocean engineering, as well as the power industry, are also contributing to this upward trajectory. The market is further buoyed by an increasing global emphasis on sustainability and circular economy principles, making recycled titanium an attractive and cost-effective alternative to virgin materials.

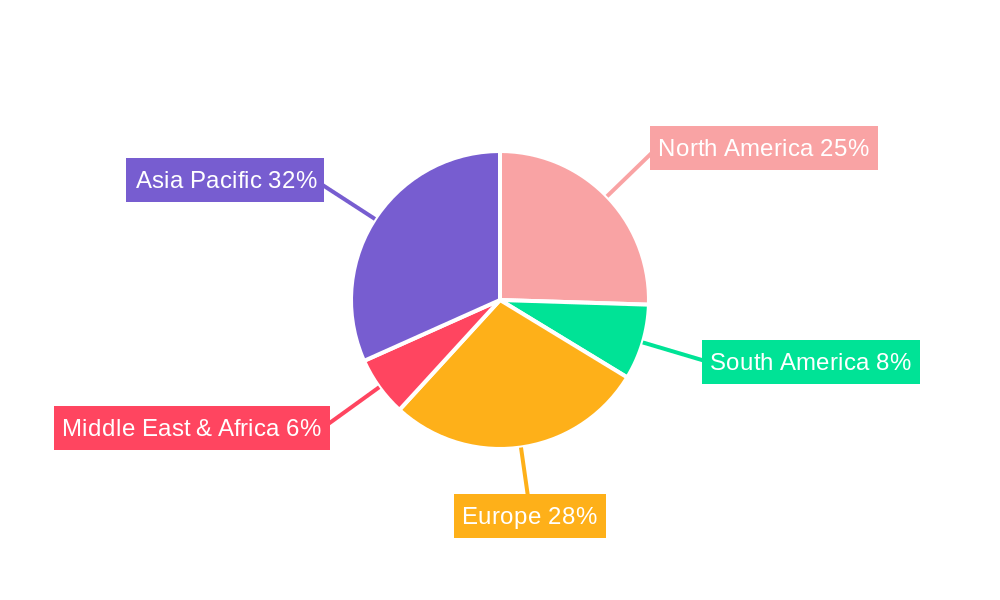

The market's expansion is supported by a growing number of leading companies actively involved in titanium recycling and processing, including TIMET, Global Titanium Inc., and Baoji Titanium Industry, among others. These players are investing in advanced recycling technologies to improve efficiency and purity. However, the market is not without its challenges. Potential restraints include the fluctuating prices of raw titanium ore, which can impact the cost-effectiveness of recovered products, and the rigorous quality control standards required for certain high-end applications, which can increase processing costs. Despite these hurdles, the dominant trend of increasing sustainability awareness and the inherent properties of titanium ensure a positive outlook. The market is segmented into pure titanium scrap and titanium alloy scrap types, with diverse applications catering to a wide range of industrial needs. Regionally, Asia Pacific is expected to lead market growth, driven by its expanding manufacturing base and increasing adoption of advanced materials, with North America and Europe also presenting significant opportunities.

Recovered Titanium Products Market Report: Unlocking Sustainable Growth and Innovation

This comprehensive Recovered Titanium Products Market Report delves into the dynamic landscape of the global titanium recycling industry, offering in-depth analysis and actionable insights for stakeholders. Covering the Study Period of 2019–2033, with a Base Year of 2025 and an Estimated Year also of 2025, this report provides a robust understanding of historical trends and future projections. The Forecast Period from 2025–2033 allows for strategic planning in this rapidly evolving sector. Discover key market drivers, emerging opportunities, and the competitive strategies of leading players in the recovered titanium market, titanium scrap market, and recycled titanium industry. Our analysis focuses on critical applications such as aerospace titanium recycling, medical titanium scrap, and industrial titanium reuse, providing valuable intelligence for titanium manufacturers, metal recyclers, and end-users seeking sustainable and cost-effective titanium solutions.

Recovered Titanium Products Market Dynamics & Concentration

The recovered titanium products market exhibits a moderate to high concentration, with a mix of established global players and emerging regional specialists. Key companies such as TIMET, Global Titanium Inc., and EcoTitanium (Aubert & Duval) hold significant market shares, driven by advanced processing technologies and strong customer relationships. Innovation drivers are primarily focused on enhancing the purity and consistency of recycled titanium to meet stringent industry specifications, particularly for high-value applications like aerospace and medical implants. Regulatory frameworks, emphasizing sustainability and circular economy principles, are increasingly influencing market dynamics, promoting the adoption of recycled materials. Product substitutes, while present in some lower-grade applications, face significant challenges in matching titanium's unique strength-to-weight ratio and corrosion resistance. End-user trends show a growing preference for recycled titanium due to environmental concerns and cost advantages, particularly in the automotive and construction sectors. Mergers and acquisitions (M&A) activities are notable, with an estimated XX M&A deals observed in the historical period, indicating strategic consolidation and expansion efforts by key players to secure supply chains and expand technological capabilities. For instance, recent M&A activities have focused on acquiring specialized processing facilities and securing long-term feedstock agreements, further shaping the competitive landscape.

Recovered Titanium Products Industry Trends & Analysis

The recovered titanium products industry is poised for significant growth, driven by a confluence of factors including increasing demand for sustainable materials, advancements in recycling technologies, and stringent environmental regulations. The global recycled titanium market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033. This growth is fueled by the inherent properties of titanium, such as its exceptional strength-to-weight ratio, corrosion resistance, and biocompatibility, which make it indispensable in critical applications. Technological disruptions, particularly in sorting, separation, and re-smelting processes, are enhancing the quality and consistency of recovered titanium, thereby increasing its acceptance in higher-value segments. Consumer preferences are shifting towards environmentally responsible products, creating a strong pull for recycled materials across various industries. The competitive dynamics are characterized by a growing number of specialized recycling companies alongside integrated titanium producers investing in secondary raw material processing. Market penetration of recovered titanium is steadily increasing, especially in industries actively pursuing decarbonization and circular economy initiatives. For example, the aerospace sector, which traditionally demands virgin titanium, is increasingly exploring the use of high-grade recycled titanium alloys to reduce its environmental footprint. Similarly, the medical supplies industry is benefiting from the cost-effectiveness of recycled titanium for non-implantable devices. The chemical industry's demand for corrosion-resistant materials also presents a substantial growth avenue for recovered titanium products. The power industry, particularly in renewable energy applications, is another emerging sector where the durability and sustainability of titanium are highly valued. The overall market is expanding as companies recognize the economic and environmental benefits of closed-loop titanium supply chains.

Leading Markets & Segments in Recovered Titanium Products

The recovered titanium products market is experiencing robust growth across various geographical regions and application segments.

Dominant Regions and Countries:

- North America is a leading market, driven by a strong presence of aerospace manufacturers and a proactive regulatory environment supporting the adoption of recycled materials.

- Europe follows closely, with significant demand from the aerospace, medical, and automotive industries, alongside a strong commitment to circular economy principles.

- Asia Pacific, particularly China, is emerging as a dominant force due to its expanding industrial base, increasing investments in recycling infrastructure, and growing domestic demand across multiple sectors. Economic policies in this region are increasingly favoring the use of recycled metals to reduce reliance on primary resources.

Dominant Application Segments:

- Aerospace: This segment represents the largest share of the recovered titanium market due to the critical need for lightweight, high-strength materials. The stringent quality requirements are being met by advanced recycling and refining technologies.

- Key Drivers: Strict material specifications, demand for fuel efficiency, governmental initiatives promoting sustainable aviation, and the cost-effectiveness of recycled titanium for non-critical components.

- Medical Supplies: The biocompatibility and inertness of titanium make it highly sought after for medical implants and instruments. Recycled titanium, when meeting stringent purity standards, offers a more sustainable and cost-effective alternative.

- Key Drivers: Growing global healthcare expenditure, increasing demand for prosthetic devices, and the push for cost-effective medical solutions.

- Chemical Industry: Titanium's exceptional corrosion resistance makes it vital for handling aggressive chemicals and high-temperature processes.

- Key Drivers: Demand for durable equipment in harsh chemical environments, increasing regulatory compliance for industrial safety, and the need for longer equipment lifecycles.

- Ship and Ocean Engineering: The corrosive marine environment necessitates the use of materials like titanium. Recycled titanium is finding its way into various marine applications.

- Key Drivers: Growing investments in naval infrastructure and offshore exploration, demand for corrosion-resistant components in harsh marine conditions.

- Power Industry: Applications in power generation, especially in renewable energy technologies like wind turbines and geothermal plants, are leveraging titanium's durability.

- Key Drivers: Transition to renewable energy sources, demand for long-lasting and reliable energy infrastructure.

- Others: This category includes automotive, consumer goods, and architectural applications where titanium's aesthetic appeal and durability are valued.

Dominant Types:

- Titanium Alloy Scrap: This segment is particularly dominant due to the widespread use of titanium alloys in various demanding applications. The ability to reclaim and re-process these alloys into high-quality secondary products is crucial for the market's growth.

- Key Drivers: High demand from aerospace and automotive industries, growing sophistication of alloy recycling technologies.

- Pure Titanium Scrap: While generally having a smaller market share compared to alloys, pure titanium scrap is essential for specific applications requiring unalloyed titanium, such as in certain medical devices and chemical processing equipment.

- Key Drivers: Niche applications requiring high purity, specific medical and chemical processing needs.

Recovered Titanium Products Product Developments

- Aerospace: This segment represents the largest share of the recovered titanium market due to the critical need for lightweight, high-strength materials. The stringent quality requirements are being met by advanced recycling and refining technologies.

- Key Drivers: Strict material specifications, demand for fuel efficiency, governmental initiatives promoting sustainable aviation, and the cost-effectiveness of recycled titanium for non-critical components.

- Medical Supplies: The biocompatibility and inertness of titanium make it highly sought after for medical implants and instruments. Recycled titanium, when meeting stringent purity standards, offers a more sustainable and cost-effective alternative.

- Key Drivers: Growing global healthcare expenditure, increasing demand for prosthetic devices, and the push for cost-effective medical solutions.

- Chemical Industry: Titanium's exceptional corrosion resistance makes it vital for handling aggressive chemicals and high-temperature processes.

- Key Drivers: Demand for durable equipment in harsh chemical environments, increasing regulatory compliance for industrial safety, and the need for longer equipment lifecycles.

- Ship and Ocean Engineering: The corrosive marine environment necessitates the use of materials like titanium. Recycled titanium is finding its way into various marine applications.

- Key Drivers: Growing investments in naval infrastructure and offshore exploration, demand for corrosion-resistant components in harsh marine conditions.

- Power Industry: Applications in power generation, especially in renewable energy technologies like wind turbines and geothermal plants, are leveraging titanium's durability.

- Key Drivers: Transition to renewable energy sources, demand for long-lasting and reliable energy infrastructure.

- Others: This category includes automotive, consumer goods, and architectural applications where titanium's aesthetic appeal and durability are valued.

Dominant Types:

- Titanium Alloy Scrap: This segment is particularly dominant due to the widespread use of titanium alloys in various demanding applications. The ability to reclaim and re-process these alloys into high-quality secondary products is crucial for the market's growth.

- Key Drivers: High demand from aerospace and automotive industries, growing sophistication of alloy recycling technologies.

- Pure Titanium Scrap: While generally having a smaller market share compared to alloys, pure titanium scrap is essential for specific applications requiring unalloyed titanium, such as in certain medical devices and chemical processing equipment.

- Key Drivers: Niche applications requiring high purity, specific medical and chemical processing needs.

Recovered Titanium Products Product Developments

- Key Drivers: High demand from aerospace and automotive industries, growing sophistication of alloy recycling technologies.

- Key Drivers: Niche applications requiring high purity, specific medical and chemical processing needs.

The recovered titanium products sector is witnessing significant product innovations aimed at enhancing material quality, expanding applications, and improving processing efficiency. Advanced refining techniques are now capable of producing recycled titanium alloys with purity levels and mechanical properties comparable to virgin titanium, thereby broadening their acceptance in demanding sectors like aerospace and medical implants. Developments include specialized alloys tailored for specific performance requirements, as well as innovative methods for reclaiming titanium from complex waste streams. These advancements provide a competitive advantage by offering sustainable, cost-effective alternatives without compromising on performance, aligning with the growing industry-wide push towards circular economy principles.

Key Drivers of Recovered Titanium Products Growth

The growth of the recovered titanium products market is propelled by several key factors. The increasing global emphasis on sustainability and environmental regulations is a primary driver, encouraging industries to adopt recycled materials. Technological advancements in titanium recycling and refining processes are significantly improving the quality and consistency of recovered titanium, making it suitable for more demanding applications. The economic benefits, such as cost savings compared to virgin titanium, are also a major incentive for end-users. Furthermore, the inherent superior properties of titanium, including its strength-to-weight ratio and corrosion resistance, ensure sustained demand across critical sectors like aerospace and medical supplies.

Challenges in the Recovered Titanium Products Market

Despite robust growth prospects, the recovered titanium products market faces several challenges. Stringent quality control and standardization remain critical hurdles, as ensuring the purity and consistency of recycled titanium to meet the exacting standards of industries like aerospace can be complex and costly. Supply chain volatility, including fluctuations in the availability of feedstock scrap and geopolitical factors influencing raw material sourcing, can impact production reliability. Initial investment costs for advanced recycling infrastructure can be substantial, posing a barrier for smaller players. Furthermore, competition from virgin titanium producers and the perception of recycled materials as being of lower quality in some legacy markets can hinder broader adoption. Regulatory compliance with evolving environmental and waste management laws also presents an ongoing challenge.

Emerging Opportunities in Recovered Titanium Products

Emerging opportunities in the recovered titanium products market are abundant, driven by innovation and evolving industry demands. Technological breakthroughs in plasma arc remelting and electron beam melting are enabling the production of ultra-high-purity recycled titanium, opening doors to even more critical applications. Strategic partnerships between scrap collectors, recyclers, and virgin titanium producers are fostering more efficient closed-loop systems and ensuring a stable supply of high-quality feedstock. Market expansion into new applications, such as advanced additive manufacturing (3D printing) of titanium components and the growing demand for lightweight materials in the electric vehicle sector, presents significant growth potential. The increasing global commitment to circular economy models and decarbonization efforts by governments and corporations will continue to act as a powerful catalyst for the increased adoption of recovered titanium products.

Leading Players in the Recovered Titanium Products Sector

- TIMET

- Global Titanium Inc.

- Monico Alloys

- EcoTitanium (Aubert & Duval)

- Mega Metals

- United Alloys and Metals

- Globe Metal

- Grandis Titanium

- Goldman Titanium

- EcoTitanium

- Baoji Titanium Industry

- Chinalco Shenyang Non-ferrous Metals Processing

Key Milestones in Recovered Titanium Products Industry

- 2019: Increased investment in advanced sorting technologies for better separation of titanium scrap alloys.

- 2020: Growing adoption of Industry 4.0 principles for enhanced process control in titanium recycling.

- 2021: Key players began investing in plasma arc remelting technology to achieve higher purity recycled titanium.

- 2022: Introduction of new certifications for recycled titanium to meet stringent aerospace and medical industry standards.

- 2023: Significant M&A activities aimed at consolidating supply chains and expanding processing capabilities.

- 2024: Development of novel techniques for reclaiming titanium from complex industrial waste streams.

Strategic Outlook for Recovered Titanium Products Market

The strategic outlook for the recovered titanium products market is exceptionally positive, fueled by a growing imperative for sustainable material solutions and continuous technological advancements. The market is set to experience accelerated growth as industries increasingly prioritize circular economy principles and seek to reduce their environmental footprint. Key growth accelerators include the ongoing refinement of recycling technologies, leading to higher quality recycled titanium alloys, and the expansion of applications into emerging sectors such as additive manufacturing and electric mobility. Strategic opportunities lie in forging stronger collaborations across the value chain, from scrap sourcing to end-product integration, and in capitalizing on favorable government policies promoting the use of recycled materials. The demand for cost-effective, high-performance titanium will continue to drive market penetration, ensuring a robust future for recovered titanium products.

Recovered Titanium Products Segmentation

-

1. Application

- 1.1. Aerospace

- 1.2. Chemical Industry

- 1.3. Medical Supplies

- 1.4. Ship and Ocean Engineering

- 1.5. Power Industry

- 1.6. Others

-

2. Types

- 2.1. Pure Titanium Scrap

- 2.2. Titanium Alloy Scrap

Recovered Titanium Products Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Recovered Titanium Products REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Recovered Titanium Products Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aerospace

- 5.1.2. Chemical Industry

- 5.1.3. Medical Supplies

- 5.1.4. Ship and Ocean Engineering

- 5.1.5. Power Industry

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Pure Titanium Scrap

- 5.2.2. Titanium Alloy Scrap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Recovered Titanium Products Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aerospace

- 6.1.2. Chemical Industry

- 6.1.3. Medical Supplies

- 6.1.4. Ship and Ocean Engineering

- 6.1.5. Power Industry

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Pure Titanium Scrap

- 6.2.2. Titanium Alloy Scrap

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Recovered Titanium Products Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aerospace

- 7.1.2. Chemical Industry

- 7.1.3. Medical Supplies

- 7.1.4. Ship and Ocean Engineering

- 7.1.5. Power Industry

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Pure Titanium Scrap

- 7.2.2. Titanium Alloy Scrap

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Recovered Titanium Products Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aerospace

- 8.1.2. Chemical Industry

- 8.1.3. Medical Supplies

- 8.1.4. Ship and Ocean Engineering

- 8.1.5. Power Industry

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Pure Titanium Scrap

- 8.2.2. Titanium Alloy Scrap

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Recovered Titanium Products Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aerospace

- 9.1.2. Chemical Industry

- 9.1.3. Medical Supplies

- 9.1.4. Ship and Ocean Engineering

- 9.1.5. Power Industry

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Pure Titanium Scrap

- 9.2.2. Titanium Alloy Scrap

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Recovered Titanium Products Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aerospace

- 10.1.2. Chemical Industry

- 10.1.3. Medical Supplies

- 10.1.4. Ship and Ocean Engineering

- 10.1.5. Power Industry

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Pure Titanium Scrap

- 10.2.2. Titanium Alloy Scrap

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 TIMET

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Global Titanium Inc.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Monico Alloys

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 EcoTitanium (Aubert & Duval)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mega Metals

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 United Alloys and Metals

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Globe Metal

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Grandis Titanium

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Goldman Titanium

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 EcoTitanium

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Baoji Titanium Industry

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Chinalco Shenyang Non-ferrous Metals Processing

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 TIMET

List of Figures

- Figure 1: Global Recovered Titanium Products Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Recovered Titanium Products Revenue (million), by Application 2024 & 2032

- Figure 3: North America Recovered Titanium Products Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Recovered Titanium Products Revenue (million), by Types 2024 & 2032

- Figure 5: North America Recovered Titanium Products Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Recovered Titanium Products Revenue (million), by Country 2024 & 2032

- Figure 7: North America Recovered Titanium Products Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Recovered Titanium Products Revenue (million), by Application 2024 & 2032

- Figure 9: South America Recovered Titanium Products Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Recovered Titanium Products Revenue (million), by Types 2024 & 2032

- Figure 11: South America Recovered Titanium Products Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Recovered Titanium Products Revenue (million), by Country 2024 & 2032

- Figure 13: South America Recovered Titanium Products Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Recovered Titanium Products Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Recovered Titanium Products Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Recovered Titanium Products Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Recovered Titanium Products Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Recovered Titanium Products Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Recovered Titanium Products Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Recovered Titanium Products Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Recovered Titanium Products Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Recovered Titanium Products Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Recovered Titanium Products Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Recovered Titanium Products Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Recovered Titanium Products Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Recovered Titanium Products Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Recovered Titanium Products Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Recovered Titanium Products Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Recovered Titanium Products Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Recovered Titanium Products Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Recovered Titanium Products Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Recovered Titanium Products Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Recovered Titanium Products Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Recovered Titanium Products Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Recovered Titanium Products Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Recovered Titanium Products Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Recovered Titanium Products Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Recovered Titanium Products Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Recovered Titanium Products Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Recovered Titanium Products Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Recovered Titanium Products Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Recovered Titanium Products Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Recovered Titanium Products Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Recovered Titanium Products Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Recovered Titanium Products Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Recovered Titanium Products Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Recovered Titanium Products Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Recovered Titanium Products Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Recovered Titanium Products Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Recovered Titanium Products Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Recovered Titanium Products Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Recovered Titanium Products?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the Recovered Titanium Products?

Key companies in the market include TIMET, Global Titanium Inc., Monico Alloys, EcoTitanium (Aubert & Duval), Mega Metals, United Alloys and Metals, Globe Metal, Grandis Titanium, Goldman Titanium, EcoTitanium, Baoji Titanium Industry, Chinalco Shenyang Non-ferrous Metals Processing.

3. What are the main segments of the Recovered Titanium Products?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 961.4 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Recovered Titanium Products," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Recovered Titanium Products report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Recovered Titanium Products?

To stay informed about further developments, trends, and reports in the Recovered Titanium Products, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence