Key Insights

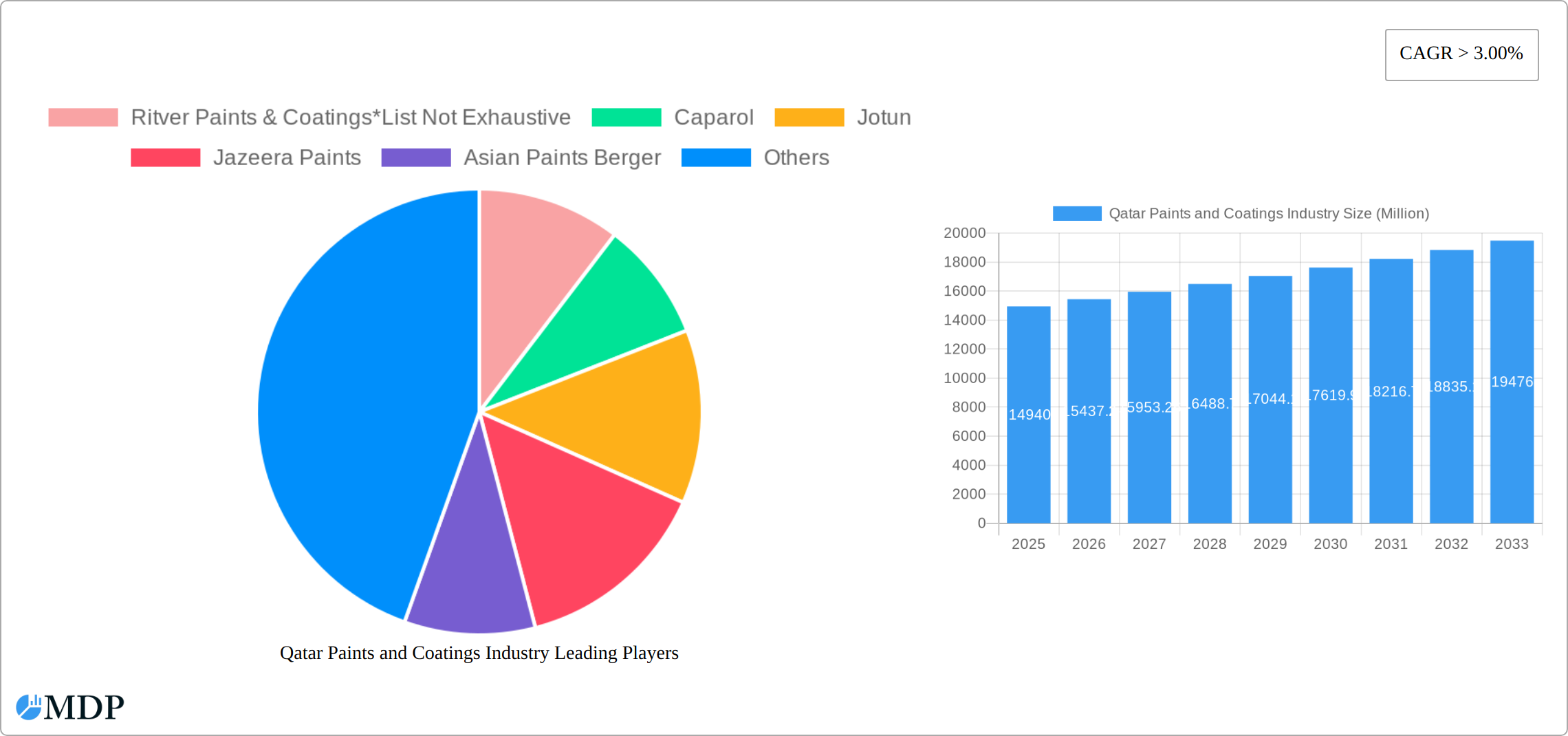

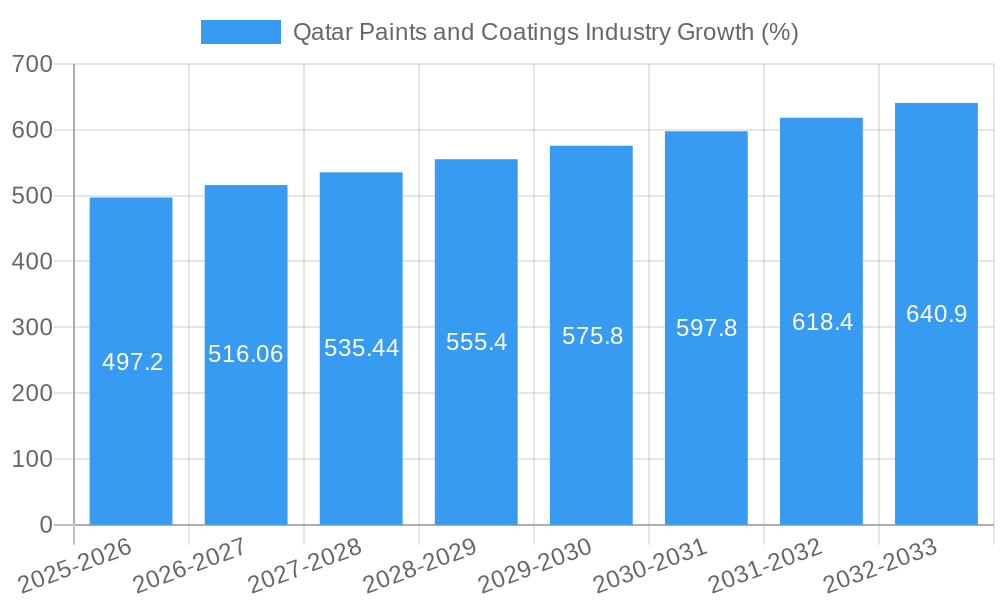

The Qatar paints and coatings market, valued at $14,940 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) exceeding 3.00% from 2025 to 2033. This expansion is fueled by several key factors. Significant infrastructure development projects, particularly in the construction and automotive sectors, are boosting demand for high-quality paints and coatings. The rising disposable incomes and increasing awareness of aesthetically pleasing and durable finishes are further stimulating market growth. The preference for eco-friendly, water-borne coatings is also gaining traction, aligning with global sustainability initiatives. While the market faces some challenges, such as fluctuating raw material prices and potential economic volatility, the overall outlook remains positive. The diverse range of applications across architectural, automotive, wood, industrial, transportation, and packaging sectors ensures a broad market base. Key players like Ritver Paints & Coatings, Caparol, Jotun, Jazeera Paints, Asian Paints Berger, Axalta Coating Systems, Akzo Nobel N.V., National Paints Factories Co Ltd, Hempel AS, and Qatar Paints are actively shaping the market dynamics through product innovation and expansion strategies. Competition is intense, driving innovation in both product offerings and service delivery, ultimately benefiting the consumer.

The segmentation within the Qatari paints and coatings industry highlights the prevalence of various resin types (acrylic, alkyd, polyurethane, epoxy, polyester, and others) and technologies (water-borne and solvent-borne). The architectural and automotive segments are likely to be significant contributors to market growth due to ongoing construction and vehicle sales within Qatar. While precise market share data for each segment is unavailable, a logical inference suggests that the architectural segment would hold a considerable share, followed by automotive and industrial coatings, given the nation's ongoing infrastructural development and industrial expansion. The continuous evolution of technology, focusing on sustainable and high-performance coatings, suggests a promising future for this sector in Qatar. Further analysis of individual company performance and specific product categories would provide a more nuanced understanding of this dynamic market.

Qatar Paints and Coatings Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Qatar paints and coatings industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, trends, leading players, and future opportunities. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Qatar Paints and Coatings Industry Market Dynamics & Concentration

The Qatari paints and coatings market presents a dynamic landscape shaped by a moderate level of concentration, innovation, regulatory pressures, and evolving consumer preferences. Major players such as Jotun, Jazeera Paints, and Asian Paints Berger command significant market share, yet a competitive fringe of smaller companies and new entrants thrives by specializing in niche segments. While precise market share figures for the top five players are currently unavailable (previously estimated at xx%), the remaining market is distributed amongst numerous smaller businesses. Mergers and acquisitions (M&A) activity has been relatively subdued in recent years (xx deals between 2019 and 2024), indicating a stable yet competitive market structure. The sector is significantly influenced by stringent environmental regulations promoting the adoption of VOC-compliant coatings and a burgeoning demand for sustainable and eco-friendly products. Innovation is driven by advancements in water-borne technologies and the increasing need for specialized coatings across diverse end-use sectors. Furthermore, product substitution remains a crucial factor, with manufacturers constantly developing cutting-edge formulations to meet ever-changing customer needs and market demands. A detailed competitive analysis including market share data is planned for the next update.

- Market Concentration: Moderately concentrated, with several key players and a significant number of smaller competitors.

- Innovation Drivers: Advancements in water-borne technology, increasing demand for specialized high-performance and sustainable coatings.

- Regulatory Framework: Stringent environmental regulations mandating VOC-compliant coatings and promoting sustainable practices.

- M&A Activity: Relatively low in recent years (xx deals between 2019-2024), suggesting a period of organic growth and consolidation.

- End-User Trends: Growing preference for sustainable, high-performance, and technologically advanced coatings across residential and commercial sectors.

Qatar Paints and Coatings Industry Industry Trends & Analysis

This section delves into the key trends shaping the Qatari paints and coatings market. Market growth is primarily driven by robust infrastructure development, particularly in construction and transportation, coupled with rising disposable incomes fueling residential and commercial painting projects. Technological advancements, specifically the increasing adoption of water-borne and eco-friendly coatings, are reshaping the market. Consumer preferences are shifting towards high-performance, durable, and aesthetically pleasing coatings with improved VOC profiles. Competitive dynamics are characterized by price competition, product differentiation, and the expansion of distribution networks. The market exhibits significant growth potential, projected to reach xx Million by 2033. The CAGR during the forecast period (2025-2033) is estimated to be xx%. Market penetration for water-borne coatings is expected to increase to xx% by 2033.

Leading Markets & Segments in Qatar Paints and Coatings Industry

This section identifies the dominant segments within the Qatari paints and coatings market, analyzing key drivers for their success.

Dominant Segments:

- Resin Type: Acrylic coatings currently dominate the market due to their versatility, cost-effectiveness, and excellent performance characteristics. Alkyd and polyurethane coatings hold substantial market share in specific applications.

- Technology: Water-borne coatings are gaining traction due to their environmental benefits, although solvent-borne coatings maintain a considerable market presence due to their performance properties.

- End-user Industry: The architectural coatings segment dominates due to the ongoing construction boom in Qatar. The industrial coatings segment is also growing rapidly, driven by the expansion of various industrial sectors.

Key Drivers:

- Economic Growth: Qatar's robust economic growth and significant investments in infrastructure projects are major drivers.

- Government Initiatives: Government policies supporting sustainable construction and infrastructure development.

- Tourism and Hospitality: Expansion of tourism and hospitality sectors fuels demand for high-quality coatings in hotels and other establishments.

Qatar Paints and Coatings Industry Product Developments

Recent product innovations focus on enhancing durability, aesthetics, and environmental friendliness. Manufacturers are increasingly introducing water-borne, low-VOC coatings with enhanced performance characteristics. Developments in fire-resistant and self-cleaning coatings are also gaining prominence, driven by the need for enhanced safety and environmental protection. These innovations cater to the growing demand for sustainable and high-performance coatings, aligning with market trends and providing competitive advantages.

Key Drivers of Qatar Paints and Coatings Industry Growth

The robust growth trajectory of the Qatari paints and coatings industry is fueled by a potent combination of factors. Firstly, sustained economic expansion and large-scale infrastructure projects consistently generate significant demand. Secondly, rising consumer disposable incomes empower increased spending on home improvements, renovations, and aesthetic enhancements. Thirdly, and critically, government initiatives championing sustainable construction practices and environmental regulations favoring VOC-compliant coatings provide substantial impetus to market growth. The alignment of economic development, consumer spending, and governmental policy creates a highly favorable environment for industry expansion.

Challenges in the Qatar Paints and Coatings Industry Market

Despite the positive outlook, the Qatari paints and coatings industry faces notable challenges. Fluctuating raw material prices pose a significant threat to profitability, requiring manufacturers to implement robust hedging strategies and efficient supply chain management. Competition remains fierce, not only from established multinational corporations but also from smaller, agile regional players specializing in localized market needs. While supply chain disruptions have lessened in recent years, the potential for future disruptions warrants ongoing vigilance and contingency planning. Finally, the stringent environmental regulations, while essential for sustainability, also elevate compliance costs and necessitate continuous innovation in environmentally friendly technologies.

Emerging Opportunities in Qatar Paints and Coatings Industry

Long-term growth prospects are promising, driven by the ongoing expansion of infrastructure projects, including the continued development of new cities and the expansion of industrial activities. The adoption of advanced technologies, such as nanotechnology and smart coatings, presents significant opportunities for innovation and market expansion. Strategic partnerships and collaborations offer avenues for growth and increased market reach.

Leading Players in the Qatar Paints and Coatings Industry Sector

- Ritver Paints & Coatings

- Caparol

- Jotun

- Jazeera Paints

- Asian Paints Berger

- Axalta Coating Systems

- Akzo Nobel N V

- National Paints Factories Co Ltd

- Hempel AS

- Qatar Paints

Key Milestones in Qatar Paints and Coatings Industry Industry

- 2020: Increased adoption of VOC-compliant coatings driven by stricter environmental regulations.

- 2021: Significant investments in R&D for sustainable and eco-friendly coatings by several major players.

- 2022: Expansion of manufacturing facilities in the region to meet rising demand.

- 2023: Launch of several new fire-resistant coating products catering to the construction industry's safety requirements.

Strategic Outlook for Qatar Paints and Coatings Industry Market

The long-term prospects for the Qatari paints and coatings market remain exceptionally promising. Sustained infrastructure development, escalating disposable incomes, and the accelerating adoption of eco-friendly coatings collectively position the market for continued expansion. Companies adept at leveraging innovation, prioritizing sustainability, and forging strategic partnerships are optimally positioned to seize substantial growth opportunities. The market's potential for considerable expansion across diverse segments underscores its attractiveness as a key investment sector in Qatar.

Qatar Paints and Coatings Industry Segmentation

-

1. Resin Type

- 1.1. Acrylic

- 1.2. Alkyd

- 1.3. Polyurethane

- 1.4. Epoxy

- 1.5. Polyester

- 1.6. Other Resin Types

-

2. Technology

- 2.1. Water-borne

- 2.2. Solvent-borne

-

3. End-user Industry

- 3.1. Architectural

- 3.2. Automotive

- 3.3. Wood

- 3.4. Industrial Coatings

- 3.5. Transportation

- 3.6. Packaging

Qatar Paints and Coatings Industry Segmentation By Geography

- 1. Qatar

Qatar Paints and Coatings Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Furniture Production; Growing Construction Industry in Asia-Pacific and Middle-East and Africa; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations; Other Restraints

- 3.4. Market Trends

- 3.4.1. Acrylic Resin Type to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Paints and Coatings Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Acrylic

- 5.1.2. Alkyd

- 5.1.3. Polyurethane

- 5.1.4. Epoxy

- 5.1.5. Polyester

- 5.1.6. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Water-borne

- 5.2.2. Solvent-borne

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Architectural

- 5.3.2. Automotive

- 5.3.3. Wood

- 5.3.4. Industrial Coatings

- 5.3.5. Transportation

- 5.3.6. Packaging

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ritver Paints & Coatings*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Caparol

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jotun

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jazeera Paints

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Asian Paints Berger

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Axalta Coating Systems

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Akzo Nobel N V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 National Paints Factories Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hempel AS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Qatar Paints

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ritver Paints & Coatings*List Not Exhaustive

List of Figures

- Figure 1: Qatar Paints and Coatings Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Paints and Coatings Industry Share (%) by Company 2024

List of Tables

- Table 1: Qatar Paints and Coatings Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Paints and Coatings Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Qatar Paints and Coatings Industry Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 4: Qatar Paints and Coatings Industry Volume K Tons Forecast, by Resin Type 2019 & 2032

- Table 5: Qatar Paints and Coatings Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Qatar Paints and Coatings Industry Volume K Tons Forecast, by Technology 2019 & 2032

- Table 7: Qatar Paints and Coatings Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Qatar Paints and Coatings Industry Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 9: Qatar Paints and Coatings Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Qatar Paints and Coatings Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: Qatar Paints and Coatings Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Qatar Paints and Coatings Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: Qatar Paints and Coatings Industry Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 14: Qatar Paints and Coatings Industry Volume K Tons Forecast, by Resin Type 2019 & 2032

- Table 15: Qatar Paints and Coatings Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: Qatar Paints and Coatings Industry Volume K Tons Forecast, by Technology 2019 & 2032

- Table 17: Qatar Paints and Coatings Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 18: Qatar Paints and Coatings Industry Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 19: Qatar Paints and Coatings Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Qatar Paints and Coatings Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Paints and Coatings Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Qatar Paints and Coatings Industry?

Key companies in the market include Ritver Paints & Coatings*List Not Exhaustive, Caparol, Jotun, Jazeera Paints, Asian Paints Berger, Axalta Coating Systems, Akzo Nobel N V, National Paints Factories Co Ltd, Hempel AS, Qatar Paints.

3. What are the main segments of the Qatar Paints and Coatings Industry?

The market segments include Resin Type, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14940 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Furniture Production; Growing Construction Industry in Asia-Pacific and Middle-East and Africa; Other Drivers.

6. What are the notable trends driving market growth?

Acrylic Resin Type to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations; Other Restraints.

8. Can you provide examples of recent developments in the market?

Rising demand for fire-resistant coatings

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Paints and Coatings Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Paints and Coatings Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Paints and Coatings Industry?

To stay informed about further developments, trends, and reports in the Qatar Paints and Coatings Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence