Key Insights

The North American proppants market is poised for significant expansion, projected to reach $6.59 billion by 2025, with a compound annual growth rate (CAGR) of 16.02%. This robust growth is propelled by the resurgence in North American oil and gas exploration and production, particularly shale gas extraction via hydraulic fracturing. Increased demand for effective well stimulation techniques, alongside innovations in proppant manufacturing yielding stronger, more cost-efficient solutions, are key market drivers. The market encompasses ceramic and sand proppants, serving diverse well conditions and operational needs. Intense competition among multinational corporations and specialized producers encourages innovation and price optimization.

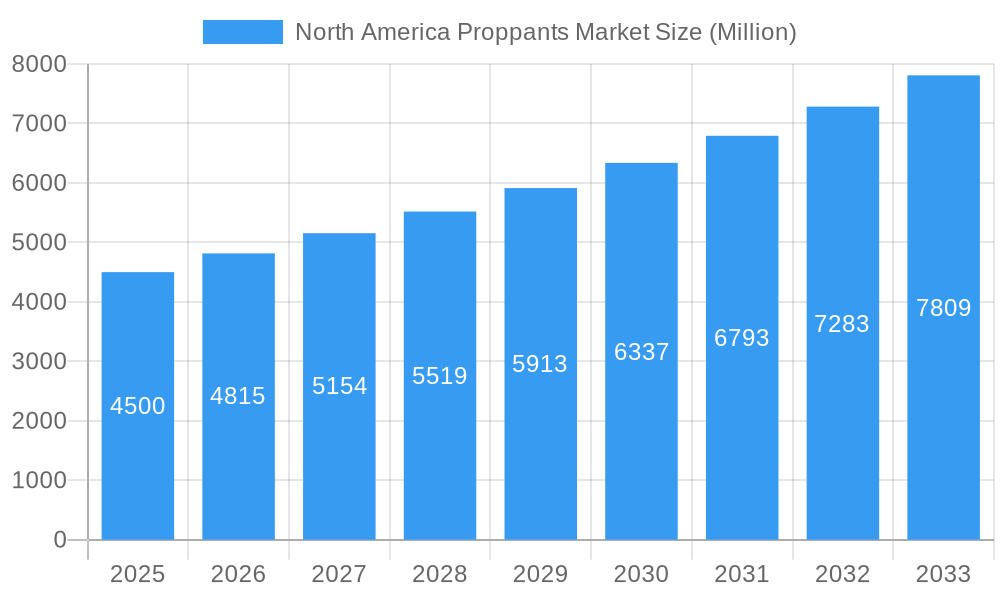

North America Proppants Market Market Size (In Billion)

Despite a positive outlook, the market confronts challenges including oil and gas price volatility, hydraulic fracturing's environmental regulations, and the potential emergence of alternative well completion methods. The development of sustainable proppant alternatives presents both opportunities and threats. Proppant manufacturers are prioritizing R&D, strategic alliances, and geographic expansion to solidify market standing and ensure sustained profitability. The core strategy remains delivering high-performance, cost-effective proppants that meet rigorous hydraulic fracturing demands while prioritizing environmental stewardship.

North America Proppants Market Company Market Share

North America Proppants Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America proppants market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033 and a base year of 2025. The report examines market dynamics, trends, leading players, and future opportunities, providing actionable intelligence for navigating this dynamic sector. The market size is expected to reach xx Million by 2033.

North America Proppants Market Market Dynamics & Concentration

The North America proppants market exhibits a moderately concentrated structure, with several major players holding significant market share. However, the presence of numerous smaller, specialized companies fosters competition and innovation. The market is influenced by several factors, including:

- Market Concentration: The top five players collectively hold approximately xx% of the market share in 2025, indicating a moderately consolidated landscape.

- Innovation Drivers: Continuous advancements in proppant technology, such as the development of resin-coated proppants and enhanced performance materials, drive market growth.

- Regulatory Frameworks: Environmental regulations and safety standards significantly impact proppant production and usage, influencing operational costs and market dynamics. Stringent regulations regarding the disposal of proppant waste are a key consideration.

- Product Substitutes: While proppants remain the dominant technology for hydraulic fracturing, alternative techniques and materials are emerging, creating a competitive landscape. The emergence of these substitutes, while still niche, puts pressure on market leaders to innovate and maintain competitive advantage.

- End-User Trends: The growth of unconventional oil and gas extraction methods, like hydraulic fracturing, directly correlates with the demand for proppants. Fluctuations in oil and gas prices thus greatly influence market demand.

- M&A Activities: The market has witnessed a moderate number of mergers and acquisitions (M&A) deals in recent years (xx deals between 2019 and 2024), indicating consolidation and strategic maneuvering among key players. These deals often involve efforts to expand geographical reach, enhance product portfolios, and secure access to raw materials.

North America Proppants Market Industry Trends & Analysis

The North America proppants market is characterized by a dynamic interplay of growth drivers, technological disruptions, and evolving consumer preferences. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including:

- Increased demand for unconventional oil and gas: The continued reliance on hydraulic fracturing for unconventional resource extraction is a major driver.

- Technological advancements in proppant production and design: Improvements in material properties, such as higher strength and durability, enhance efficiency and recovery rates.

- Strategic partnerships and collaborations: Joint ventures between proppant manufacturers and oil and gas companies aim to optimize product performance and supply chain efficiency.

- Shifting consumer preferences: There is growing emphasis on the use of eco-friendly and sustainable proppants, driving innovations in this area. Furthermore, the focus is shifting towards proppants with improved performance characteristics tailored for specific reservoir conditions.

- Market penetration of resin-coated proppants: These high-performance proppants are gradually gaining market share due to their enhanced strength and conductivity, although their higher cost remains a factor.

Leading Markets & Segments in North America Proppants Market

The [Specify Dominant Region/Country – e.g., Permian Basin in Texas] region represents the leading market for proppants in North America, driven by:

- High concentration of oil and gas activities: The region is a significant hub for shale gas and tight oil extraction, creating substantial demand for proppants.

- Favorable economic policies and infrastructure: Government incentives and existing infrastructure supporting energy production bolster market expansion.

- Significant investment in exploration and production: High levels of investment in unconventional oil and gas projects underpin the market's dominance.

The dominant segment within the North American proppants market is [Specify Dominant Segment – e.g., Sand Proppants], accounting for approximately xx% of the market in 2025. This dominance stems from its cost-effectiveness and established market presence. However, the resin-coated proppant segment is experiencing rapid growth due to its superior performance characteristics, despite its higher cost.

North America Proppants Market Product Developments

Recent innovations in proppant technology include the development of high-strength, resin-coated proppants, which offer enhanced fracture conductivity and proppant pack integrity. These advancements improve hydrocarbon recovery rates and extend the lifespan of the well. Furthermore, manufacturers are focusing on developing environmentally friendly proppants with reduced environmental impact, addressing growing concerns regarding waste disposal and potential groundwater contamination. These technological advancements cater to the increasing demands for improved efficiency and sustainability within the industry.

Key Drivers of North America Proppants Market Growth

Several factors fuel the growth of the North America proppants market:

- Increased oil and gas exploration and production: The continuous search for new energy sources and increased demand drive proppant consumption.

- Technological advancements: Developments in proppant technology such as resin-coated proppants improve efficiency.

- Government support for energy independence: Policies aiming to reduce reliance on foreign energy sources boost domestic energy production.

Challenges in the North America Proppants Market Market

The market faces several challenges, including:

- Fluctuations in oil and gas prices: Price volatility directly impacts demand and investment decisions.

- Environmental regulations and concerns: Stringent environmental regulations increase operational costs and compliance requirements.

- Supply chain disruptions: Disruptions can lead to shortages and price volatility.

- Competition from alternative fracturing technologies: Emerging technologies pose a threat to the dominance of proppants.

Emerging Opportunities in North America Proppants Market

Long-term growth is driven by:

- Expansion into new geographical areas: Exploration and production in previously untapped regions create new demand.

- Technological breakthroughs: Innovations in proppant design and manufacturing processes offer improvements in efficiency.

- Strategic partnerships and collaborations: Joint ventures facilitate innovation and supply chain optimization.

Leading Players in the North America Proppants Market Sector

- Badger Mining Corporation

- CoorsTek Inc

- Covia Holdings Corporation

- Eagle Materials Inc

- Fores LTD

- Halliburton

- Hexion

- Hi-Crush

- Imerys

- Preferred Proppants LLC

- Saint-Gobain

- Schlumberger Limited

- Superior Silica Sands (Emerge Energy Services)

- US SILICA

- WAYFINDER

Key Milestones in North America Proppants Market Industry

- September 2022: Hexion Inc. and Wayfinder Corp. partnered to better serve resin-coated proppant users in the Western Canadian Sedimentary Basin. This partnership combines Hexion's resin expertise with Wayfinder's manufacturing and logistics.

- October 2021: U.S. Silica announced plans to explore separating its non-oil and gas division.

Strategic Outlook for North America Proppants Market Market

The North America proppants market presents significant long-term growth potential, driven by continued exploration and production of unconventional oil and gas resources. Strategic partnerships, technological innovation, and expansion into new markets will be key factors in achieving sustainable growth. The focus on environmentally friendly and high-performance proppants will be crucial for maintaining a competitive edge.

North America Proppants Market Segmentation

-

1. Type

- 1.1. Frac Sand

- 1.2. Resin Coated

- 1.3. Ceramic

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

North America Proppants Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Proppants Market Regional Market Share

Geographic Coverage of North America Proppants Market

North America Proppants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improvements in Fracking Technology; Increasing Usage of Frac Sand (Quantity per Well); Increasing Shale Gas Production Activities

- 3.3. Market Restrains

- 3.3.1. Improvements in Fracking Technology; Increasing Usage of Frac Sand (Quantity per Well); Increasing Shale Gas Production Activities

- 3.4. Market Trends

- 3.4.1. Frac Sand to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Proppants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Frac Sand

- 5.1.2. Resin Coated

- 5.1.3. Ceramic

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Proppants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Frac Sand

- 6.1.2. Resin Coated

- 6.1.3. Ceramic

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Proppants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Frac Sand

- 7.1.2. Resin Coated

- 7.1.3. Ceramic

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Proppants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Frac Sand

- 8.1.2. Resin Coated

- 8.1.3. Ceramic

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Badger Mining Corporation

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 CoorsTek Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Covia Holdings Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Eagle Materials Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Fores LTD

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Halliburton

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Hexion

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Hi-Crush

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Imerys

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Preferred Proppants LLC

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Saint-Gobain

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Schlumberger Limited

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Superior Silica Sands (Emerge Energy Services)

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 US SILICA

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.15 WAYFINDER*List Not Exhaustive

- 9.2.15.1. Overview

- 9.2.15.2. Products

- 9.2.15.3. SWOT Analysis

- 9.2.15.4. Recent Developments

- 9.2.15.5. Financials (Based on Availability)

- 9.2.1 Badger Mining Corporation

List of Figures

- Figure 1: Global North America Proppants Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: United States North America Proppants Market Revenue (billion), by Type 2025 & 2033

- Figure 3: United States North America Proppants Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: United States North America Proppants Market Revenue (billion), by Geography 2025 & 2033

- Figure 5: United States North America Proppants Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: United States North America Proppants Market Revenue (billion), by Country 2025 & 2033

- Figure 7: United States North America Proppants Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Canada North America Proppants Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Canada North America Proppants Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Canada North America Proppants Market Revenue (billion), by Geography 2025 & 2033

- Figure 11: Canada North America Proppants Market Revenue Share (%), by Geography 2025 & 2033

- Figure 12: Canada North America Proppants Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Canada North America Proppants Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Mexico North America Proppants Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Mexico North America Proppants Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Mexico North America Proppants Market Revenue (billion), by Geography 2025 & 2033

- Figure 17: Mexico North America Proppants Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Mexico North America Proppants Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Mexico North America Proppants Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North America Proppants Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global North America Proppants Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Global North America Proppants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global North America Proppants Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global North America Proppants Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Global North America Proppants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global North America Proppants Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global North America Proppants Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Global North America Proppants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global North America Proppants Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global North America Proppants Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global North America Proppants Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Proppants Market?

The projected CAGR is approximately 16.02%.

2. Which companies are prominent players in the North America Proppants Market?

Key companies in the market include Badger Mining Corporation, CoorsTek Inc, Covia Holdings Corporation, Eagle Materials Inc, Fores LTD, Halliburton, Hexion, Hi-Crush, Imerys, Preferred Proppants LLC, Saint-Gobain, Schlumberger Limited, Superior Silica Sands (Emerge Energy Services), US SILICA, WAYFINDER*List Not Exhaustive.

3. What are the main segments of the North America Proppants Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.59 billion as of 2022.

5. What are some drivers contributing to market growth?

Improvements in Fracking Technology; Increasing Usage of Frac Sand (Quantity per Well); Increasing Shale Gas Production Activities.

6. What are the notable trends driving market growth?

Frac Sand to Dominate the Market.

7. Are there any restraints impacting market growth?

Improvements in Fracking Technology; Increasing Usage of Frac Sand (Quantity per Well); Increasing Shale Gas Production Activities.

8. Can you provide examples of recent developments in the market?

In September 2022, Hexion Inc. and Wayfinder Corp partnered to better serve resin-coated proppant users in the Western Canadian Sedimentary Basin. This strategic partnership joined Hexion's leading resin and chemical expertise with Wayfinder's new state-of-the-art manufacturing facility and logistics network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Proppants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Proppants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Proppants Market?

To stay informed about further developments, trends, and reports in the North America Proppants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence