Key Insights

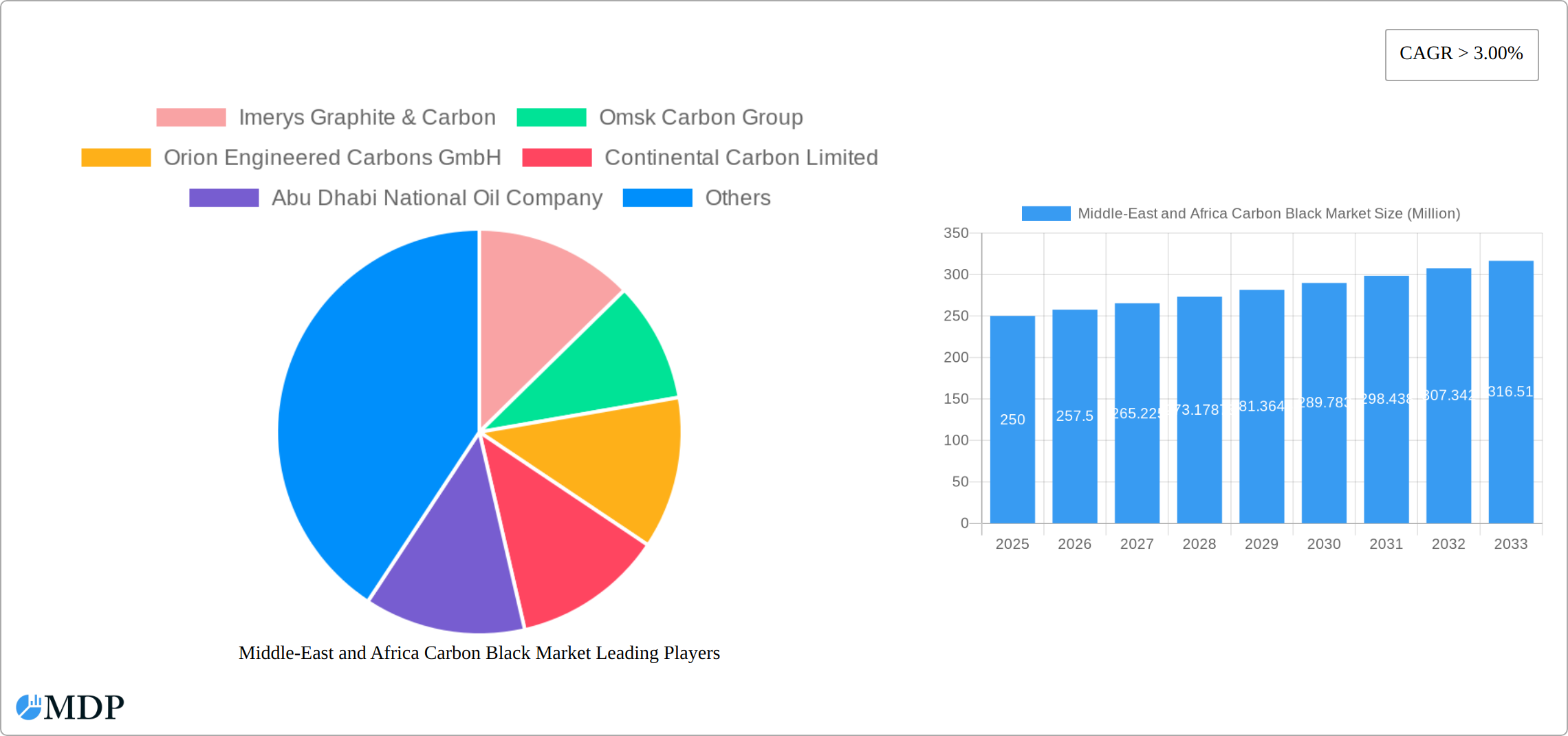

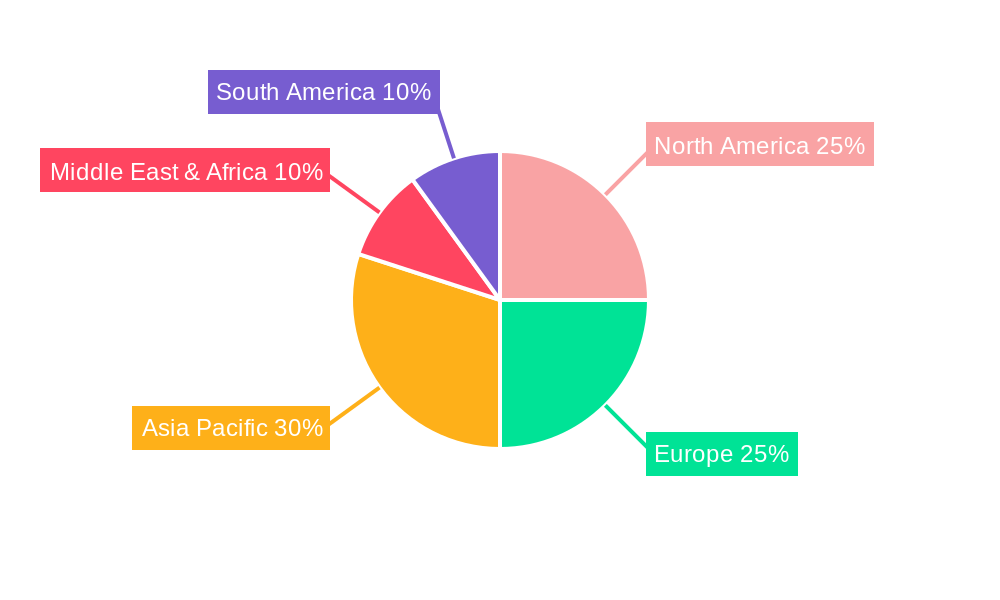

The Middle East and Africa carbon black market is experiencing robust growth, driven by the expanding tire and rubber industries, particularly in rapidly developing economies. The market's Compound Annual Growth Rate (CAGR) exceeding 3.00% reflects a steady increase in demand across diverse applications, including plastics, paints and coatings, and printing inks. While precise market sizing for the Middle East and Africa region is unavailable from the provided data, we can extrapolate a reasonable estimate. Considering the global market size (XX Million, assumed for illustrative purposes) and assigning a proportional share to the MEA region based on its industrial growth rates and infrastructure development compared to other regions (let's assume a 5% share for illustrative purposes), the MEA market size in 2025 could be estimated around [XX Million * 0.05 = estimated value in Million USD]. This estimation is inherently uncertain given the limited data, but provides a useful starting point. Key growth drivers include increasing vehicle production and infrastructure projects, boosting demand for tires and related rubber products. The rise of construction and manufacturing activities further fuels demand across various application segments. However, fluctuating crude oil prices and the potential for environmental regulations present challenges to market growth. The segmental breakdown reveals that furnace black, used extensively in tire manufacturing, dominates the process type segment, while tires and industrial rubber products comprise the largest application segment. Leading players like Imerys Graphite & Carbon, Orion Engineered Carbons, and Cabot Corporation are strategically positioned to capitalize on these market dynamics. Future growth will likely be influenced by technological advancements in carbon black production, focusing on sustainability and enhanced product properties.

The competitive landscape is characterized by a mix of international and regional players. Large multinational companies leverage their established distribution networks and technological expertise to maintain market share, while regional players cater to specific niche demands. Growth opportunities are particularly evident in the expansion of downstream industries in sub-Saharan Africa, such as industrialization, urbanization, and rising disposable incomes. However, overcoming infrastructure challenges and ensuring sustainable sourcing of raw materials remains critical for consistent market growth. Further market segmentation, identifying specific growth pockets within each region (e.g., Nigeria, South Africa, Egypt) could offer a more granular understanding of growth potential within MEA. A detailed analysis focusing on the individual contributions of countries such as South Africa, Egypt, and other key players within the Middle East would refine estimations further.

Middle East & Africa Carbon Black Market Report: 2019-2033

Unlocking Growth Opportunities in a Dynamic Market

This comprehensive report provides an in-depth analysis of the Middle East and Africa Carbon Black market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033 (Study Period), with a base year of 2025 and a forecast period extending to 2033, this report illuminates the market's current state, future trajectory, and key opportunities. We analyze market dynamics, leading players (including Imerys Graphite & Carbon, Omsk Carbon Group, Orion Engineered Carbons GmbH, Continental Carbon Limited, Abu Dhabi National Oil Company, Cabot Corporation, Epsilon Carbon Private Limited, SABIC, PCBL Limited, and Aditya Birla Group – list not exhaustive), and crucial segments (Furnace Black, Gas Black, Lamp Black, Hexamine, Thermal Black, Tires & Industrial Rubber Products, Plastics, Molded Parts, Toners & Printing Inks, Paints & Coatings, Textile Fibers, Acrylic, and Other Applications). The report's detailed analysis leverages extensive primary and secondary research to provide actionable insights and strategic recommendations.

Expected Market Value: xx Million (2025)

Projected CAGR: xx% (2025-2033)

Middle-East and Africa Carbon Black Market Market Dynamics & Concentration

The Middle East and Africa carbon black market exhibits moderate concentration, with leading players actively competing for market share. A key driver of market dynamics is the increasing focus on sustainable materials and production processes, fueled by tightening environmental regulations and growing consumer preference for eco-friendly products. The regulatory landscape varies significantly across the region, impacting production costs and market access for participants. While still nascent, the emergence of substitute materials like graphene and alternative pigments presents a potential long-term challenge to market growth. Demand is heavily influenced by end-user trends, particularly within the automotive and construction sectors. Recent years have shown relatively low mergers and acquisitions (M&A) activity, suggesting a relatively stable and consolidated market structure with limited major disruptions.

- Market Share (2024): The top five players collectively hold approximately xx% of the market share. Further segmentation by geographic region and application would provide a more detailed view of the competitive landscape.

- M&A Activity (2019-2024): An average of xx deals per year were recorded during this period. Analysis of these deals, including deal size and target companies, would offer further insights into market consolidation trends.

- Innovation Drivers: The twin drivers of demand for sustainable materials and stringent environmental regulations are reshaping the industry landscape, pushing for innovation in production methods and product formulations.

- Regulatory Frameworks: Inconsistencies in standards across different countries create challenges for manufacturers, resulting in varying production costs and compliance complexities.

Middle-East and Africa Carbon Black Market Industry Trends & Analysis

The Middle East and Africa carbon black market is experiencing consistent growth, driven by robust industrial expansion, especially within the automotive, construction, and plastics sectors. Technological advancements, including the development of specialized carbon black grades offering enhanced performance characteristics, are further accelerating market expansion. The increasing consumer demand for higher-quality, durable, and sustainable products significantly influences product development strategies. Intense competition among established players fosters continuous improvements in efficiency and cost-effectiveness. A strong correlation exists between economic growth in the region and carbon black demand, while fluctuating oil prices introduce both opportunities and challenges for market participants.

- CAGR (2019-2024): xx% - A breakdown of the CAGR by sub-segment (e.g., tire, non-tire applications) would provide a more granular perspective on market growth.

- Market Penetration (2024): xx% in key end-use sectors. This should be further specified by sector (automotive, construction, etc.) to highlight areas of high and low penetration.

- Key Growth Drivers: Industrialization, infrastructure development, rising automotive sales, and ongoing technological advancements are the primary drivers of market expansion. Additional drivers, such as government policies promoting industrial growth, could be included.

Leading Markets & Segments in Middle-East and Africa Carbon Black Market

The Furnace Black segment dominates the process type market due to its superior properties and widespread applicability. Within applications, the Tires and Industrial Rubber Products segment commands the largest market share driven by the region's growing automotive industry and infrastructure projects.

- Dominant Region: [Specify dominant region, e.g., North Africa or the Arabian Peninsula] owing to its robust industrial sector and government support for infrastructure projects.

- Dominant Country: [Specify dominant country, e.g., Egypt or Saudi Arabia] due to factors such as strong economic growth, high automotive production, and a favorable investment climate.

- Key Drivers for Dominant Segment:

- Robust automotive sector driving demand for tires and rubber products.

- Expanding construction industry fueling demand for paints and coatings.

- Government policies supporting infrastructure development and industrialization.

Middle-East and Africa Carbon Black Market Product Developments

Recent product developments emphasize sustainable and high-performance carbon blacks. Orion Engineered Carbons GmbH's launch of ECORAX Nature, a plant-based carbon black, showcases the industry's move towards eco-friendly materials. Similarly, SABIC's introduction of carbon black grade N330 for construction applications highlights innovation driven by specific end-user requirements. These developments offer enhanced performance characteristics while addressing environmental concerns, thus gaining strong market acceptance.

Key Drivers of Middle-East and Africa Carbon Black Market Growth

The growth trajectory of the Middle East and Africa carbon black market is propelled by several key factors. The burgeoning automotive industry's substantial demand for tires and other rubber products is a significant contributor. Large-scale infrastructure development projects across the region are simultaneously boosting demand in the construction sector. Supportive government policies focused on promoting industrialization and economic diversification further contribute to market expansion. Technological innovations resulting in higher-performance and more sustainable carbon black solutions are also crucial growth drivers.

Challenges in the Middle-East and Africa Carbon Black Market Market

Despite significant growth potential, the market faces notable challenges. Fluctuating oil prices, as a key raw material input, introduce considerable price volatility. Inconsistent regulatory frameworks across different countries create hurdles for manufacturers in navigating compliance requirements. Potential supply chain disruptions due to geopolitical factors or logistical issues represent further risks. Competition from substitute materials and the imperative to invest in sustainable production methods also pose ongoing challenges. Reliance on imports for some key inputs contributes to price volatility and potential supply uncertainties.

Emerging Opportunities in Middle-East and Africa Carbon Black Market

Emerging opportunities lie in expanding into new applications, particularly in renewable energy and advanced materials. Strategic partnerships focusing on research and development of sustainable carbon black production techniques are crucial for future growth. Government initiatives promoting sustainable development create significant opportunities for manufacturers offering eco-friendly alternatives. Market expansion into underserved regions with growing industrial sectors offers further potential.

Leading Players in the Middle-East and Africa Carbon Black Market Sector

- Imerys Graphite & Carbon

- Omsk Carbon Group

- Orion Engineered Carbons GmbH

- Continental Carbon Limited

- Abu Dhabi National Oil Company

- Cabot Corporation

- Epsilon Carbon Private Limited

- SABIC

- PCBL Limited

- Aditya Birla Group

Key Milestones in Middle-East and Africa Carbon Black Market Industry

- June 2021: Orion Engineered Carbons GmbH launched ECORAX Nature, a sustainable carbon black for rubber applications. This signifies a move towards environmentally friendly materials.

- April 2022: SABIC introduced carbon black grade N330 for the construction sector, enhancing concrete properties and reducing casting time by over 40% while increasing strength by 7%. This exemplifies innovation driven by specific end-user needs.

Strategic Outlook for Middle-East and Africa Carbon Black Market Market

The Middle East and Africa carbon black market offers substantial long-term growth prospects, driven by sustained industrial expansion, ongoing infrastructure development, and the increasing demand for high-performance materials. Strategic opportunities for market players include focusing on the development of sustainable and environmentally friendly production methods, exploring new applications for carbon black, and forging strategic partnerships to expand market reach and secure reliable supply chains. Investing strategically in research and development to create innovative and eco-conscious carbon black solutions will be essential for achieving long-term success and a competitive advantage in this dynamic market.

Middle-East and Africa Carbon Black Market Segmentation

-

1. Process Type

- 1.1. Furnace Black

- 1.2. Gas Black

- 1.3. Lamp Black

- 1.4. Hexamine

- 1.5. Thermal Black

-

2. Application

- 2.1. Tires and Industrial Rubber Products

-

2.2. Plastics

- 2.2.1. Films and Sheets

- 2.2.2. Pressure Pipes

- 2.2.3. Molded Parts

- 2.3. Toners and Printing Inks

- 2.4. Paints and Coatings

-

2.5. Textile Fibers

- 2.5.1. Nylon

- 2.5.2. Polyester

- 2.5.3. Acrylic

- 2.6. Other Applications

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. South Africa

- 3.3. United Arab Emirates

- 3.4. Rest of Middle East and Africa

Middle-East and Africa Carbon Black Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. United Arab Emirates

- 4. Rest of Middle East and Africa

Middle-East and Africa Carbon Black Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Application in Fiber and Textile Industries; Increasing Market Penetration of Specialty Black

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Green Tires; Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Tires and Industrial Rubber products to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Carbon Black Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Furnace Black

- 5.1.2. Gas Black

- 5.1.3. Lamp Black

- 5.1.4. Hexamine

- 5.1.5. Thermal Black

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Tires and Industrial Rubber Products

- 5.2.2. Plastics

- 5.2.2.1. Films and Sheets

- 5.2.2.2. Pressure Pipes

- 5.2.2.3. Molded Parts

- 5.2.3. Toners and Printing Inks

- 5.2.4. Paints and Coatings

- 5.2.5. Textile Fibers

- 5.2.5.1. Nylon

- 5.2.5.2. Polyester

- 5.2.5.3. Acrylic

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. South Africa

- 5.3.3. United Arab Emirates

- 5.3.4. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. United Arab Emirates

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. Saudi Arabia Middle-East and Africa Carbon Black Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Process Type

- 6.1.1. Furnace Black

- 6.1.2. Gas Black

- 6.1.3. Lamp Black

- 6.1.4. Hexamine

- 6.1.5. Thermal Black

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Tires and Industrial Rubber Products

- 6.2.2. Plastics

- 6.2.2.1. Films and Sheets

- 6.2.2.2. Pressure Pipes

- 6.2.2.3. Molded Parts

- 6.2.3. Toners and Printing Inks

- 6.2.4. Paints and Coatings

- 6.2.5. Textile Fibers

- 6.2.5.1. Nylon

- 6.2.5.2. Polyester

- 6.2.5.3. Acrylic

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. South Africa

- 6.3.3. United Arab Emirates

- 6.3.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Process Type

- 7. South Africa Middle-East and Africa Carbon Black Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Process Type

- 7.1.1. Furnace Black

- 7.1.2. Gas Black

- 7.1.3. Lamp Black

- 7.1.4. Hexamine

- 7.1.5. Thermal Black

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Tires and Industrial Rubber Products

- 7.2.2. Plastics

- 7.2.2.1. Films and Sheets

- 7.2.2.2. Pressure Pipes

- 7.2.2.3. Molded Parts

- 7.2.3. Toners and Printing Inks

- 7.2.4. Paints and Coatings

- 7.2.5. Textile Fibers

- 7.2.5.1. Nylon

- 7.2.5.2. Polyester

- 7.2.5.3. Acrylic

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. South Africa

- 7.3.3. United Arab Emirates

- 7.3.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Process Type

- 8. United Arab Emirates Middle-East and Africa Carbon Black Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Process Type

- 8.1.1. Furnace Black

- 8.1.2. Gas Black

- 8.1.3. Lamp Black

- 8.1.4. Hexamine

- 8.1.5. Thermal Black

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Tires and Industrial Rubber Products

- 8.2.2. Plastics

- 8.2.2.1. Films and Sheets

- 8.2.2.2. Pressure Pipes

- 8.2.2.3. Molded Parts

- 8.2.3. Toners and Printing Inks

- 8.2.4. Paints and Coatings

- 8.2.5. Textile Fibers

- 8.2.5.1. Nylon

- 8.2.5.2. Polyester

- 8.2.5.3. Acrylic

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. South Africa

- 8.3.3. United Arab Emirates

- 8.3.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Process Type

- 9. Rest of Middle East and Africa Middle-East and Africa Carbon Black Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Process Type

- 9.1.1. Furnace Black

- 9.1.2. Gas Black

- 9.1.3. Lamp Black

- 9.1.4. Hexamine

- 9.1.5. Thermal Black

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Tires and Industrial Rubber Products

- 9.2.2. Plastics

- 9.2.2.1. Films and Sheets

- 9.2.2.2. Pressure Pipes

- 9.2.2.3. Molded Parts

- 9.2.3. Toners and Printing Inks

- 9.2.4. Paints and Coatings

- 9.2.5. Textile Fibers

- 9.2.5.1. Nylon

- 9.2.5.2. Polyester

- 9.2.5.3. Acrylic

- 9.2.6. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. South Africa

- 9.3.3. United Arab Emirates

- 9.3.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Process Type

- 10. South Africa Middle-East and Africa Carbon Black Market Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Middle-East and Africa Carbon Black Market Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Middle-East and Africa Carbon Black Market Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Middle-East and Africa Carbon Black Market Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Middle-East and Africa Carbon Black Market Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Middle-East and Africa Carbon Black Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Imerys Graphite & Carbon

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Omsk Carbon Group

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Orion Engineered Carbons GmbH

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Continental Carbon Limited

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Abu Dhabi National Oil Company

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Cabot Corporation

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Epsilon Carbon Private Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Sabic*List Not Exhaustive

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 PCBL Limited

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Aditya Birla Group

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Imerys Graphite & Carbon

List of Figures

- Figure 1: Middle-East and Africa Carbon Black Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle-East and Africa Carbon Black Market Share (%) by Company 2024

List of Tables

- Table 1: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Process Type 2019 & 2032

- Table 3: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle-East and Africa Carbon Black Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle-East and Africa Carbon Black Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle-East and Africa Carbon Black Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle-East and Africa Carbon Black Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle-East and Africa Carbon Black Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle-East and Africa Carbon Black Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Process Type 2019 & 2032

- Table 14: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Process Type 2019 & 2032

- Table 18: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Process Type 2019 & 2032

- Table 22: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Process Type 2019 & 2032

- Table 26: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Middle-East and Africa Carbon Black Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Carbon Black Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Middle-East and Africa Carbon Black Market?

Key companies in the market include Imerys Graphite & Carbon, Omsk Carbon Group, Orion Engineered Carbons GmbH, Continental Carbon Limited, Abu Dhabi National Oil Company, Cabot Corporation, Epsilon Carbon Private Limited, Sabic*List Not Exhaustive, PCBL Limited, Aditya Birla Group.

3. What are the main segments of the Middle-East and Africa Carbon Black Market?

The market segments include Process Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Application in Fiber and Textile Industries; Increasing Market Penetration of Specialty Black.

6. What are the notable trends driving market growth?

Tires and Industrial Rubber products to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Usage of Green Tires; Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

In April 2022, SABIC introduced carbon black grade N330 as a new market option for the Kingdom's building and construction sector to improve the quality of cast-in-place concrete constructions that require an early drying process and greater strength. Premium hollow blocks from SABIC concrete mix have higher power, shorter settings, and a better look. The approach reduced casting time by more than 40% while increasing strength by 7%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Carbon Black Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Carbon Black Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Carbon Black Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Carbon Black Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence