Key Insights

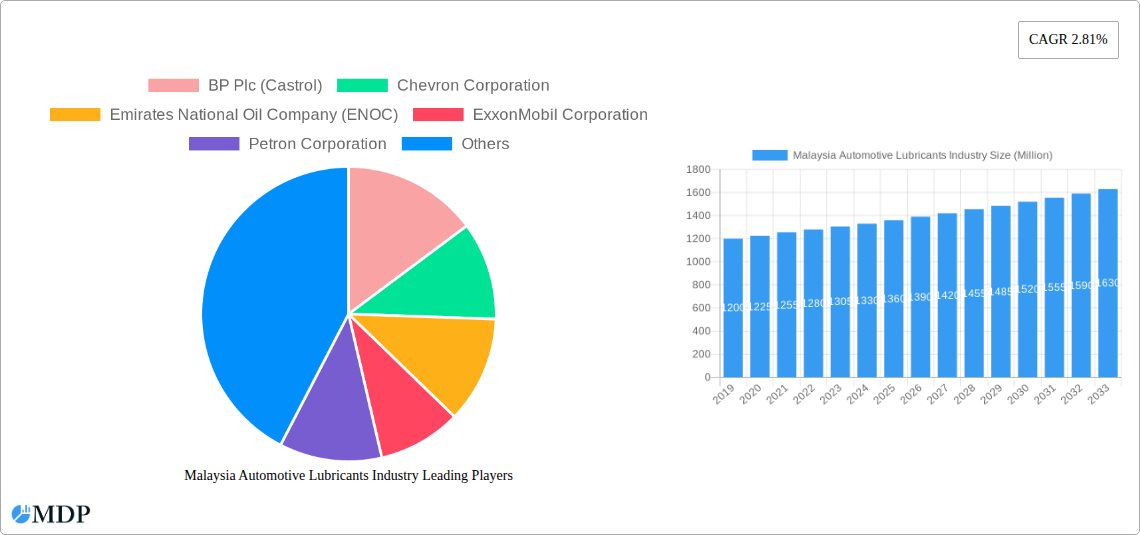

Malaysia's automotive lubricants market is set for robust expansion, with an estimated market size of 302.53 million by 2024. The sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 2.7% through 2033. This upward trend is driven by an increasing vehicle parc across commercial vehicles, passenger cars, and motorcycles, all necessitating high-performance lubricants for engine efficiency and durability. The dynamic automotive industry in Malaysia, alongside heightened consumer awareness of vehicle upkeep and the integration of advanced lubricant technologies, are key growth catalysts. Additionally, the rising demand for fuel-efficient and eco-friendly lubricants, in line with global sustainability goals, is spurring product innovation and market outreach. Major lubricant categories fueling this growth include engine oils, transmission and gear oils, hydraulic fluids, and greases, addressing diverse automotive needs and performance standards.

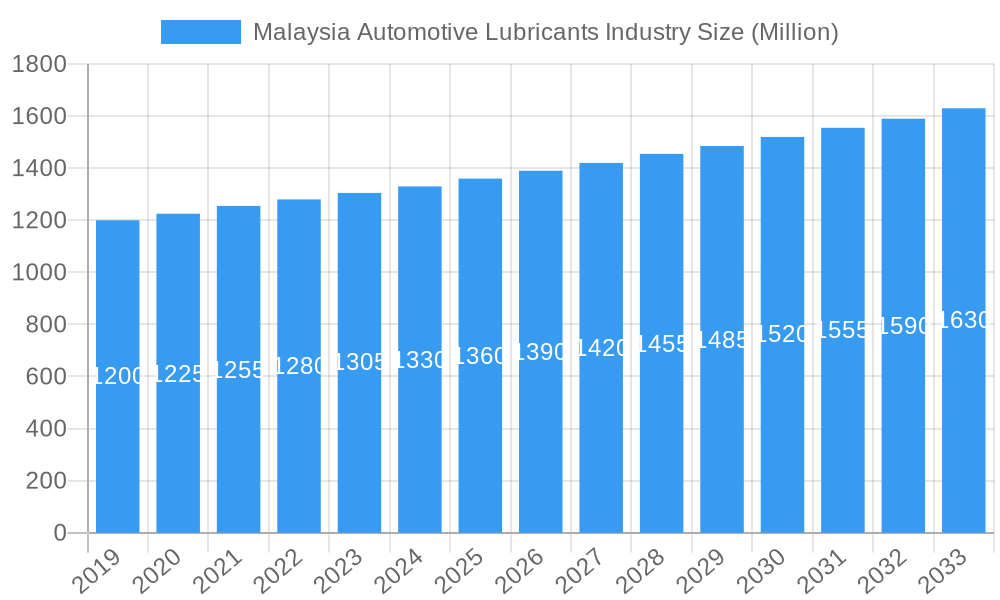

Malaysia Automotive Lubricants Industry Market Size (In Million)

While market fundamentals are strong, external factors may impact its trajectory. Shifting emission regulations and the gradual adoption of electric vehicles (EVs) present potential long-term considerations for conventional lubricant producers. However, the extended service life of internal combustion engine vehicles and the ongoing expansion of the commercial vehicle sector will ensure sustained demand for traditional lubricants in the foreseeable future. The Malaysian market features a competitive landscape with leading global companies such as BP Plc (Castrol), Chevron Corporation, ExxonMobil Corporation, Royal Dutch Shell Plc, and TotalEnergies, alongside significant local and regional players including Emirates National Oil Company (ENOC), Petron Corporation, PETRONAS Lubricants International, UMW HOLDINGS BERHAD, and Valvoline Inc. These companies are actively pursuing product innovation, strategic alliances, and market expansion to secure their position in this evolving market. The emphasis is on providing premium lubricants that meet rigorous performance criteria and satisfy the changing demands of Malaysian vehicle owners and fleet managers.

Malaysia Automotive Lubricants Industry Company Market Share

Malaysia Automotive Lubricants Industry: Market Dynamics, Trends, and Forecast 2025-2033

Unlock critical insights into the dynamic Malaysian automotive lubricants market with this comprehensive report. Covering a study period from 2019 to 2033, with a base year of 2025, this analysis provides an in-depth understanding of market share, CAGR, product developments, leading players, and future growth trajectories. Essential for industry stakeholders, manufacturers, investors, and automotive professionals seeking to navigate the evolving landscape of automotive lubricants in Malaysia.

Malaysia Automotive Lubricants Industry Market Dynamics & Concentration

The Malaysian automotive lubricants industry is characterized by a moderate market concentration, with a few dominant players holding significant market share, estimated at over 70% of the total market value. Innovation drivers such as the increasing demand for high-performance, fuel-efficient, and environmentally friendly lubricants are pushing manufacturers to invest heavily in R&D, with an estimated annual investment of over $50 Million. Regulatory frameworks, including evolving emissions standards and fuel economy mandates, are also shaping product development and market entry strategies. The availability of product substitutes, primarily lower-grade conventional lubricants and evolving EV fluids, presents a constant competitive pressure. End-user trends indicate a growing preference for synthetic and semi-synthetic engine oils due to their superior protection and extended drain intervals, driving a shift away from mineral-based lubricants. Merger and acquisition (M&A) activities, while not overtly frequent, are strategically important for market consolidation and expanding product portfolios. Recent M&A deal counts are estimated to be between 2-3 significant transactions annually, with deal values ranging from $20 Million to $100 Million. Companies like PETRONAS Lubricants International and ExxonMobil Corporation are actively pursuing strategic partnerships and expansions to maintain their competitive edge in this evolving market.

Malaysia Automotive Lubricants Industry Industry Trends & Analysis

The Malaysian automotive lubricants industry is poised for robust growth, driven by a confluence of economic, technological, and consumer-driven factors. The Compound Annual Growth Rate (CAGR) for the forecast period 2025-2033 is projected to be approximately 5.8%. This growth is underpinned by several key trends. Firstly, the expanding automotive parc, including both new vehicle sales and the aging vehicle population requiring regular maintenance, directly fuels demand for lubricants. With an estimated market penetration of over 90% for basic lubrication needs, the focus is shifting towards premium and specialized products. Secondly, technological advancements in engine technology, such as direct injection and turbocharging, necessitate the use of advanced lubricants that can withstand higher operating temperatures and pressures, offering enhanced protection and performance. This trend significantly boosts the market for synthetic and semi-synthetic engine oils.

Consumer preferences are also evolving, with a growing awareness of the benefits associated with higher-quality lubricants, including improved fuel efficiency, reduced wear and tear, and extended engine life. This is leading to a premiumization of the market, where consumers are willing to invest more in lubricants that offer superior value. Furthermore, the burgeoning motorcycle segment in Malaysia continues to be a significant volume driver, with a consistent demand for specialized motorcycle engine oils. The commercial vehicle sector, driven by logistics and transportation needs, also represents a substantial market for heavy-duty engine oils and industrial lubricants. Competitive dynamics are intensifying, with both global majors and local players vying for market share. Strategies often involve product differentiation, aggressive marketing campaigns, and the development of strong distribution networks. The increasing adoption of digital platforms for sales and customer engagement is also becoming a crucial aspect of the competitive landscape. The industry is also witnessing a gradual shift towards more environmentally friendly lubricant formulations, responding to global sustainability initiatives and evolving regulatory pressures.

Leading Markets & Segments in Malaysia Automotive Lubricants Industry

The Malaysian automotive lubricants industry showcases distinct leadership across various segments, driven by specific market dynamics and end-user needs.

Dominant Vehicle Type Segment:

Passenger Vehicles: This segment represents the largest contributor to the automotive lubricants market in Malaysia. The high volume of passenger cars on Malaysian roads, coupled with regular replacement cycles and the increasing adoption of advanced engine technologies in newer models, fuels consistent demand for engine oils, transmission fluids, and greases.

- Key Drivers: Rising disposable incomes, growing middle class, favorable financing options for new vehicle purchases, and the continuous introduction of fuel-efficient and performance-oriented passenger vehicles. The prevalence of modern engine designs requiring specific API and ACEA specifications further solidifies the demand for premium passenger vehicle lubricants.

Motorcycles: Malaysia boasts one of the highest motorcycle ownership rates in Southeast Asia. This segment is a substantial volume driver, primarily for 2T and 4T engine oils. The affordability and practicality of motorcycles for daily commuting in urban and rural areas ensure their continued dominance in this segment.

- Key Drivers: Cost-effectiveness for personal transportation, ease of navigation in congested urban environments, strong government support for motorcycle-related infrastructure, and the consistent demand for maintenance and replacement parts, including specialized motorcycle engine oils.

Commercial Vehicles: While smaller in volume compared to passenger vehicles and motorcycles, the commercial vehicle segment is a high-value market for specialized lubricants. This includes trucks, buses, and other industrial vehicles that require heavy-duty engine oils, transmission fluids, and hydraulic fluids designed for extreme operating conditions.

- Key Drivers: Growth in the logistics and transportation sector, e-commerce expansion driving freight movement, government investment in infrastructure projects, and the increasing adoption of fuel-efficient and emission-compliant heavy-duty engines that demand superior lubrication.

Dominant Product Type Segment:

Engine Oils: This category is unequivocally the largest and most crucial segment within the Malaysian automotive lubricants market. It encompasses a wide range of products for gasoline and diesel engines across all vehicle types, including conventional, semi-synthetic, and fully synthetic formulations.

- Key Drivers: Essential component for all internal combustion engines, driven by vehicle parc size and maintenance schedules. The increasing trend towards synthetic and semi-synthetic oils for enhanced performance, fuel efficiency, and extended drain intervals is a significant growth accelerator for this segment.

Transmission & Gear Oils: This segment is vital for ensuring the smooth operation and longevity of vehicle drivetrains. Demand is driven by the complexity of modern transmission systems, including automatic and continuously variable transmissions (CVTs), which require specialized fluids.

- Key Drivers: Increasing sophistication of automotive transmissions, including the growing popularity of automatic transmissions in passenger vehicles and the need for specialized gear oils in commercial vehicle transmissions and differentials.

Hydraulic Fluids: Crucial for various hydraulic systems in both automotive and industrial applications, including power steering and brake systems. While often considered industrial, automotive applications remain a significant driver.

- Key Drivers: Essential for power steering systems, brake systems, and other hydraulic functionalities in vehicles, as well as in construction and agricultural machinery that operate within or support the automotive ecosystem.

Greases: Used for lubricating moving parts that require a semi-solid lubricant, such as wheel bearings, chassis components, and universal joints.

- Key Drivers: Ongoing maintenance requirements for a vast vehicle parc, particularly for components that require long-lasting lubrication and protection against wear and corrosion.

Malaysia Automotive Lubricants Industry Product Developments

Product development in the Malaysian automotive lubricants industry is sharply focused on enhancing performance, efficiency, and environmental sustainability. Companies are investing in advanced synthetic base oils and additive technologies to create lubricants that offer superior engine protection under extreme conditions, improved fuel economy, and reduced emissions. Innovations include the introduction of ultra-low viscosity engine oils that minimize friction, extended drain interval formulations that reduce maintenance frequency, and specialized lubricants for hybrid and electric vehicle components. For instance, Castrol's introduction of Castrol Power1 Ultimate, a 100% synthetic engine oil, exemplifies the industry's drive towards cutting-edge solutions that promise exceptional performance and endurance for motorcycles. The competitive advantage lies in formulations that meet increasingly stringent OEM specifications and evolving regulatory standards, catering to the demand for longer-lasting, more efficient, and eco-friendlier automotive solutions.

Key Drivers of Malaysia Automotive Lubricants Industry Growth

The Malaysian automotive lubricants industry's growth is propelled by a multifaceted combination of factors. The increasing automotive parc, fueled by a growing population and economic development, directly translates into higher demand for lubricants. Technological advancements in vehicle engines, necessitating the use of higher-performance synthetic and semi-synthetic lubricants for optimal protection and efficiency, are a significant catalyst. Furthermore, evolving consumer preferences lean towards premium products that offer extended drain intervals and superior engine care, driving market premiumization. Regulatory mandates, such as those promoting fuel efficiency and reduced emissions, encourage the adoption of advanced lubricant technologies. Economic growth and infrastructure development, particularly in logistics and transportation, bolster the demand from the commercial vehicle sector.

Challenges in the Malaysia Automotive Lubricants Industry Market

Despite robust growth prospects, the Malaysian automotive lubricants industry faces several significant challenges. Intense price competition, particularly from unbranded and counterfeit products, erodes profit margins for legitimate manufacturers. Fluctuations in crude oil prices directly impact the cost of base oils, leading to volatility in raw material expenses. Stringent regulatory frameworks, while driving innovation, can also impose significant compliance costs and technical hurdles for product development and market entry. Supply chain disruptions, as witnessed in recent global events, can impact the availability and cost of both raw materials and finished products. The growing popularity of electric vehicles (EVs) presents a long-term challenge, as EVs require different types of specialized fluids, necessitating a strategic shift in product portfolios.

Emerging Opportunities in Malaysia Automotive Lubricants Industry

Emerging opportunities in the Malaysian automotive lubricants industry are largely driven by technological advancements and evolving market demands. The transition towards electric and hybrid vehicles presents a significant opportunity for manufacturers to develop and supply specialized EV fluids, such as coolants, battery coolants, and transmission fluids designed for electric powertrains. Strategic partnerships between lubricant manufacturers and automotive OEMs are crucial for co-developing and certifying new lubricant formulations that meet the specific requirements of next-generation vehicles. Furthermore, the growing demand for sustainable and bio-based lubricants offers a niche market with strong growth potential as environmental consciousness rises. Expansion into underserved rural markets and the development of comprehensive after-sales service and technical support packages can further enhance market penetration and customer loyalty.

Leading Players in the Malaysia Automotive Lubricants Industry Sector

- BP Plc (Castrol)

- Chevron Corporation

- Emirates National Oil Company (ENOC)

- ExxonMobil Corporation

- Petron Corporation

- PETRONAS Lubricants International

- Royal Dutch Shell Plc

- TotalEnergies

- UMW HOLDINGS BERHAD

- Valvoline Inc

Key Milestones in Malaysia Automotive Lubricants Industry Industry

- January 2022: ExxonMobil Corporation strategically reorganized along three business lines: ExxonMobil Upstream Company, ExxonMobil Product Solutions, and ExxonMobil Low Carbon Solutions, signaling a forward-looking approach to diverse energy and product markets, impacting its lubricant division's operational focus and strategic direction.

- October 2021: Castrol, a prominent player in Malaysia's automotive lubricants sector, launched Castrol Power1 Ultimate. This introduction of a 100% synthetic engine oil signifies a commitment to high-performance products, addressing the growing demand for enhanced engine protection and endurance in the motorcycle segment.

- October 2021: Valvoline and Cummins extended their long-standing marketing and technology collaboration for an additional five years. This renewal reinforces the endorsement and distribution of Valvoline's Premium Blue engine oil for Cummins' heavy-duty diesel engines and generators, solidifying Valvoline's presence in the heavy-duty lubricant market.

Strategic Outlook for Malaysia Automotive Lubricants Industry Market

The strategic outlook for the Malaysian automotive lubricants industry is one of sustained growth and adaptation. Future market potential lies in embracing the transition towards electric mobility by developing and marketing specialized EV fluids and lubricants. Strengthening strategic partnerships with automotive manufacturers will be crucial for co-creating and certifying lubricants for new vehicle technologies. Furthermore, a focus on sustainable lubricant formulations, including bio-based and biodegradable options, will cater to the growing demand for environmentally conscious products and align with global sustainability trends. Enhancing digital engagement strategies for customer service, technical support, and e-commerce will be vital for maintaining a competitive edge. Investing in advanced additive technologies and synthetic base oils will continue to drive product innovation, offering superior performance and extended drain intervals, thereby capturing value in the premium lubricant segments.

Malaysia Automotive Lubricants Industry Segmentation

-

1. Vehicle Type

- 1.1. Commercial Vehicles

- 1.2. Motorcycles

- 1.3. Passenger Vehicles

-

2. Product Type

- 2.1. Engine Oils

- 2.2. Greases

- 2.3. Hydraulic Fluids

- 2.4. Transmission & Gear Oils

Malaysia Automotive Lubricants Industry Segmentation By Geography

- 1. Malaysia

Malaysia Automotive Lubricants Industry Regional Market Share

Geographic Coverage of Malaysia Automotive Lubricants Industry

Malaysia Automotive Lubricants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Vehicle Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Automotive Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.2. Motorcycles

- 5.1.3. Passenger Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Engine Oils

- 5.2.2. Greases

- 5.2.3. Hydraulic Fluids

- 5.2.4. Transmission & Gear Oils

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BP Plc (Castrol)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chevron Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Emirates National Oil Company (ENOC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ExxonMobil Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Petron Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PETRONAS Lubricants International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Royal Dutch Shell Plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TotalEnergies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 UMW HOLDINGS BERHAD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Valvoline Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BP Plc (Castrol)

List of Figures

- Figure 1: Malaysia Automotive Lubricants Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Malaysia Automotive Lubricants Industry Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Automotive Lubricants Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Malaysia Automotive Lubricants Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Malaysia Automotive Lubricants Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Malaysia Automotive Lubricants Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Malaysia Automotive Lubricants Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Malaysia Automotive Lubricants Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Automotive Lubricants Industry?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the Malaysia Automotive Lubricants Industry?

Key companies in the market include BP Plc (Castrol), Chevron Corporation, Emirates National Oil Company (ENOC), ExxonMobil Corporation, Petron Corporation, PETRONAS Lubricants International, Royal Dutch Shell Plc, TotalEnergies, UMW HOLDINGS BERHAD, Valvoline Inc.

3. What are the main segments of the Malaysia Automotive Lubricants Industry?

The market segments include Vehicle Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 302.53 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Vehicle Type : Passenger Vehicles.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.October 2021: Castrol, one of Malaysia's major automotive lubricant manufacturers, introduced Castrol Power1 Ultimate, a brand-new type of 100% synthetic engine oil that promises exceptional performance and endurance.October 2021: Valvoline and Cummins extended their long-standing marketing and technology collaboration agreement for another five years. Cummins will endorse and promote Valvoline's Premium Blue engine oil for its heavy-duty diesel engines and generators and will distribute Valvoline products through its global distribution networks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Automotive Lubricants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Automotive Lubricants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Automotive Lubricants Industry?

To stay informed about further developments, trends, and reports in the Malaysia Automotive Lubricants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence