Key Insights

The global industrial protective footwear market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.96% from 2025 to 2033. This expansion is fueled by several key factors. The increasing emphasis on workplace safety regulations across diverse industries, including construction, manufacturing, and oil & gas, is a primary driver. Rising industrial accidents and consequent worker compensation claims are compelling businesses to prioritize protective footwear investments. Furthermore, technological advancements in materials science are leading to the development of lighter, more comfortable, and durable footwear, enhancing worker acceptance and productivity. Growth is also fueled by the expanding manufacturing and construction sectors in developing economies, particularly within the Asia-Pacific region. However, the market faces certain restraints, including fluctuating raw material prices (especially for leather and rubber) and economic downturns that can impact capital expenditure on safety equipment. The market segmentation reveals a significant share held by leather footwear due to its established performance and perceived durability, although plastic and other material segments are gaining traction due to cost-effectiveness and specialized properties. The construction and manufacturing end-users dominate market share, reflecting the high-risk nature of these sectors.

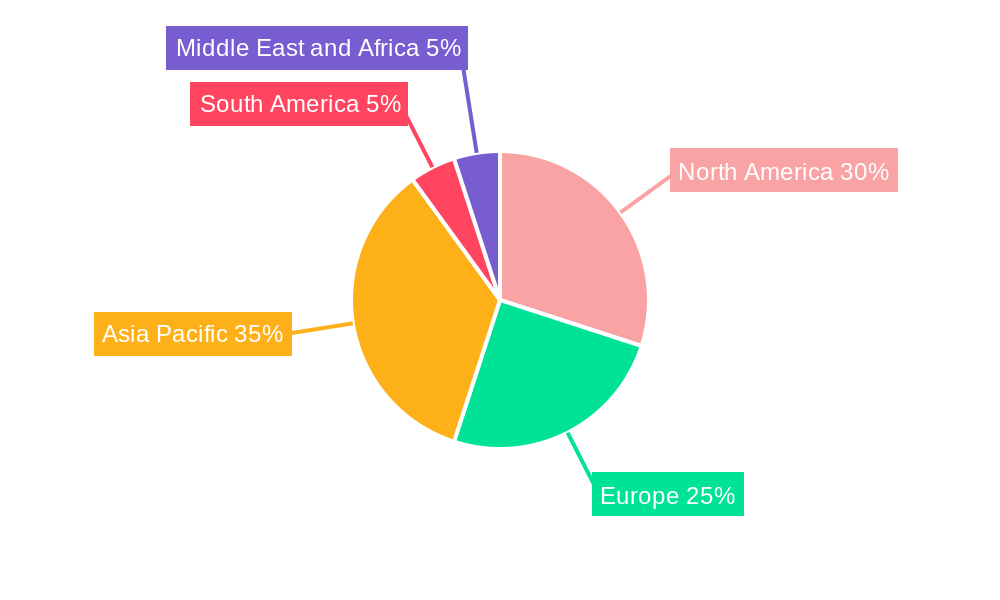

The market's geographical landscape shows significant growth opportunities across different regions. North America and Europe are established markets with high safety standards and strong regulatory frameworks, while the Asia-Pacific region, particularly India and China, is experiencing rapid growth driven by industrialization and expanding workforce. South America and the Middle East & Africa also present promising prospects, although market penetration might be slower due to varying levels of safety regulations and economic conditions. Companies like Honeywell International, VF Corporation, and Bata Corporation are key players, vying for market share through product innovation, strategic partnerships, and regional expansion. The forecast period suggests continued growth, driven by the aforementioned factors, albeit at a potentially moderated pace influenced by global economic conditions and technological disruption. Long-term market success hinges on the ability of companies to offer innovative, comfortable, and cost-effective solutions that meet the evolving needs of a diverse range of industrial workers.

Industrial Protective Footwear Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Industrial Protective Footwear market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a clear understanding of market dynamics, trends, and future growth potential. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Industrial Protective Footwear Market Dynamics & Concentration

The Industrial Protective Footwear market is characterized by a moderate level of concentration, with several key players holding significant market share. Honeywell International Inc, VF Corporation, Bata Corporation, U-power Group Spa, Cofra SRL, Uvex Group, Dunlop Protective Footwear, Rock Fall (UK) LTD, Wolverine World Wide Inc, and Hilson Footwear Pvt Ltd are among the prominent companies shaping the market landscape. Market share fluctuations are influenced by factors such as innovation, strategic acquisitions, and regulatory changes. The global market witnessed xx M&A deals in the past five years, with a significant portion focused on expanding product portfolios and geographical reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Innovation Drivers: Focus on enhanced safety features, ergonomic designs, and sustainable materials.

- Regulatory Frameworks: Stringent safety standards and compliance requirements influence market growth and product development.

- Product Substitutes: Limited substitutes exist due to the specialized nature of industrial protective footwear.

- End-User Trends: Growing demand from construction, manufacturing, and oil & gas sectors drives market expansion.

- M&A Activities: Strategic acquisitions drive market consolidation and expansion into new markets.

Industrial Protective Footwear Market Industry Trends & Analysis

The Industrial Protective Footwear market is experiencing robust growth, fueled by several key factors. The increasing prevalence of industrialization globally, coupled with a heightened awareness of workplace safety regulations and the need to mitigate workplace accidents, is significantly boosting market demand. Technological advancements in materials science are playing a pivotal role, leading to the development of lighter, more comfortable, and durable footwear with enhanced protective capabilities. This includes the integration of smart technologies, such as sensors and GPS tracking, which offer improved safety monitoring and worker productivity. Consumer preferences are evolving, with a clear shift towards footwear that prioritizes both comfort and robust protection. The competitive landscape is dynamic, characterized by intense competition among established players and new entrants alike. Companies are focusing on innovation, strategic partnerships, robust branding, and effective supply chain management to gain a competitive advantage and capture market share. The market is segmented by material (Leather, Rubber, Plastic, Composites, and Other Materials) and end-user (Construction, Manufacturing, Mining, Oil and Gas, Chemical, Pharmaceutical, Transportation, Logistics, and Other End Users).

The construction sector remains the largest end-user segment, commanding a significant market share in 2024, driven largely by increased global infrastructure spending and a surge in construction activities. However, growth is also observed across other sectors reflecting the increasingly stringent safety regulations and rising awareness of worker well-being across various industries.

Leading Markets & Segments in Industrial Protective Footwear Market

The North American region currently holds the largest market share, driven by stringent safety regulations and robust industrial activity. However, Asia-Pacific is expected to witness significant growth in the coming years, fueled by rapid industrialization and increasing urbanization.

Key Drivers by Segment:

- Material:

- Leather: Traditional preference for durability and comfort, but facing competition from lighter materials.

- Rubber: High demand due to its resistance to chemicals and abrasion.

- Plastic: Growing popularity due to cost-effectiveness and lightweight properties.

- Other Materials: Innovation in composite materials and advanced polymers are driving growth in this segment.

- End-User:

- Construction: High demand due to the inherent risks associated with construction work.

- Manufacturing: Large-scale manufacturing operations necessitate robust safety footwear.

- Mining: Stringent safety regulations and hazardous work conditions drive demand.

- Oil and Gas: High demand for specialized footwear offering protection against chemicals and extreme conditions.

- Chemical: Need for footwear resistant to various chemicals and solvents.

Industrial Protective Footwear Market Product Developments

Recent product innovations highlight a focus on enhanced comfort, improved safety features, and sustainable materials. Cat Footwear's Invader Mid Vent, with its recycled lining and advanced comfort features, exemplifies this trend. Similarly, Xena Workwear's Valence SD shoe showcases the increasing adoption of vegan leather and ergonomic designs. These developments reflect the market's response to evolving consumer preferences and a growing emphasis on sustainability.

Key Drivers of Industrial Protective Footwear Market Growth

Several key factors are propelling the growth trajectory of the Industrial Protective Footwear market. Stringent safety regulations enforced across diverse industries mandate the use of protective footwear, creating a substantial demand. The rising incidence of workplace accidents serves as a stark reminder of the critical need for high-quality, reliable safety footwear. Technological advancements in material science are not only enhancing the protective features of the footwear but also improving comfort and durability. Furthermore, the expansion of e-commerce platforms has broadened market access, facilitating increased market penetration and enabling manufacturers to reach wider customer bases.

Challenges in the Industrial Protective Footwear Market

Despite robust growth, the market faces certain challenges. Fluctuations in raw material prices, particularly for leather and rubber, impact production costs. Supply chain disruptions can lead to delays and shortages. Intense competition from both established and emerging players necessitates continuous innovation and differentiation. Meeting stringent safety standards and regulatory compliance across diverse geographies presents another significant challenge.

Emerging Opportunities in Industrial Protective Footwear Market

The integration of smart technologies, such as sensors for real-time monitoring of worker safety and GPS tracking for location awareness, presents significant growth opportunities. These technological advancements are not only enhancing workplace safety but also improving operational efficiency. Strategic collaborations between footwear manufacturers and technology providers are crucial for the development of innovative products and services that meet evolving industry needs. Expanding into emerging economies with rapidly growing industrial sectors presents particularly lucrative opportunities for market expansion and diversification, given the increasing demand for protective footwear in these regions.

Leading Players in the Industrial Protective Footwear Market Sector

- Honeywell International Inc

- VF Corporation

- Bata Corporation

- U-power Group Spa

- Cofra SRL

- Uvex Group

- Dunlop Protective Footwear

- Rock Fall (UK) LTD

- Wolverine World Wide Inc

- Hilson Footwear Pvt Ltd

Key Milestones in Industrial Protective Footwear Market Industry

- September 2023: Cat Footwear launches the Invader Mid Vent, highlighting advancements in comfort and sustainability.

- October 2022: Xena Workwear introduces the Valence SD shoe, a stylish and functional option with vegan leather choices.

- August 2022: Mallcom India expands its product line with the FREDDIE safety shoe collection, focusing on aesthetic design and worker safety.

Strategic Outlook for Industrial Protective Footwear Market Market

The future of the Industrial Protective Footwear market appears promising, driven by several converging trends. Technological innovation, a growing emphasis on worker safety and well-being, and increasing sustainability concerns will continue to shape market dynamics. Strategic partnerships will remain critical for accessing new technologies, expanding market reach, and optimizing supply chains. The increasing adoption of smart technologies and the development of eco-friendly, sustainable materials will be key factors influencing future growth and shaping the market landscape in the coming years. Companies that successfully integrate these elements into their business strategies are poised to gain a competitive edge and capitalize on the considerable growth potential within this dynamic market.

Industrial Protective Footwear Market Segmentation

-

1. Material

- 1.1. Leather

- 1.2. Rubber

- 1.3. Plastic

- 1.4. Other Materials

-

2. End-User

- 2.1. Construction

- 2.2. Manufacturing

- 2.3. Mining

- 2.4. Oil and Gas

- 2.5. Chemical

- 2.6. Pharmaceutical

- 2.7. Transportation

- 2.8. Other End Users

Industrial Protective Footwear Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Industrial Protective Footwear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Government Regulations Regarding Worker's Safety; Importance Of Occupational Safety

- 3.3. Market Restrains

- 3.3.1. Impact of Counterfeit Products Coupled With Large Unorganized Labor Population Across Various Industries

- 3.4. Market Trends

- 3.4.1. Strict Government Regulations Regarding Workers' Safety

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Protective Footwear Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Leather

- 5.1.2. Rubber

- 5.1.3. Plastic

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Construction

- 5.2.2. Manufacturing

- 5.2.3. Mining

- 5.2.4. Oil and Gas

- 5.2.5. Chemical

- 5.2.6. Pharmaceutical

- 5.2.7. Transportation

- 5.2.8. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Industrial Protective Footwear Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Leather

- 6.1.2. Rubber

- 6.1.3. Plastic

- 6.1.4. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Construction

- 6.2.2. Manufacturing

- 6.2.3. Mining

- 6.2.4. Oil and Gas

- 6.2.5. Chemical

- 6.2.6. Pharmaceutical

- 6.2.7. Transportation

- 6.2.8. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Industrial Protective Footwear Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Leather

- 7.1.2. Rubber

- 7.1.3. Plastic

- 7.1.4. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Construction

- 7.2.2. Manufacturing

- 7.2.3. Mining

- 7.2.4. Oil and Gas

- 7.2.5. Chemical

- 7.2.6. Pharmaceutical

- 7.2.7. Transportation

- 7.2.8. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Industrial Protective Footwear Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Leather

- 8.1.2. Rubber

- 8.1.3. Plastic

- 8.1.4. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Construction

- 8.2.2. Manufacturing

- 8.2.3. Mining

- 8.2.4. Oil and Gas

- 8.2.5. Chemical

- 8.2.6. Pharmaceutical

- 8.2.7. Transportation

- 8.2.8. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. South America Industrial Protective Footwear Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Leather

- 9.1.2. Rubber

- 9.1.3. Plastic

- 9.1.4. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Construction

- 9.2.2. Manufacturing

- 9.2.3. Mining

- 9.2.4. Oil and Gas

- 9.2.5. Chemical

- 9.2.6. Pharmaceutical

- 9.2.7. Transportation

- 9.2.8. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Industrial Protective Footwear Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Leather

- 10.1.2. Rubber

- 10.1.3. Plastic

- 10.1.4. Other Materials

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Construction

- 10.2.2. Manufacturing

- 10.2.3. Mining

- 10.2.4. Oil and Gas

- 10.2.5. Chemical

- 10.2.6. Pharmaceutical

- 10.2.7. Transportation

- 10.2.8. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. North America Industrial Protective Footwear Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Industrial Protective Footwear Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Russia

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Rest of Europe

- 13. Asia Pacific Industrial Protective Footwear Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America Industrial Protective Footwear Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Industrial Protective Footwear Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 Saudi Arabia

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Honeywell International Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 VF Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Bata Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 U-power Group Spa

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Cofra SRL

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Uvex Group*List Not Exhaustive

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Dunlop Protective Footwear

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Rock Fall (UK) LTD

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Wolverine World Wide Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Hilson Footwear Pvt Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Industrial Protective Footwear Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Industrial Protective Footwear Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Industrial Protective Footwear Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Industrial Protective Footwear Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Industrial Protective Footwear Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Industrial Protective Footwear Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Industrial Protective Footwear Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Industrial Protective Footwear Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Industrial Protective Footwear Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Industrial Protective Footwear Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Industrial Protective Footwear Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Industrial Protective Footwear Market Revenue (Million), by Material 2024 & 2032

- Figure 13: North America Industrial Protective Footwear Market Revenue Share (%), by Material 2024 & 2032

- Figure 14: North America Industrial Protective Footwear Market Revenue (Million), by End-User 2024 & 2032

- Figure 15: North America Industrial Protective Footwear Market Revenue Share (%), by End-User 2024 & 2032

- Figure 16: North America Industrial Protective Footwear Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Industrial Protective Footwear Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Industrial Protective Footwear Market Revenue (Million), by Material 2024 & 2032

- Figure 19: Europe Industrial Protective Footwear Market Revenue Share (%), by Material 2024 & 2032

- Figure 20: Europe Industrial Protective Footwear Market Revenue (Million), by End-User 2024 & 2032

- Figure 21: Europe Industrial Protective Footwear Market Revenue Share (%), by End-User 2024 & 2032

- Figure 22: Europe Industrial Protective Footwear Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Industrial Protective Footwear Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Industrial Protective Footwear Market Revenue (Million), by Material 2024 & 2032

- Figure 25: Asia Pacific Industrial Protective Footwear Market Revenue Share (%), by Material 2024 & 2032

- Figure 26: Asia Pacific Industrial Protective Footwear Market Revenue (Million), by End-User 2024 & 2032

- Figure 27: Asia Pacific Industrial Protective Footwear Market Revenue Share (%), by End-User 2024 & 2032

- Figure 28: Asia Pacific Industrial Protective Footwear Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Industrial Protective Footwear Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Industrial Protective Footwear Market Revenue (Million), by Material 2024 & 2032

- Figure 31: South America Industrial Protective Footwear Market Revenue Share (%), by Material 2024 & 2032

- Figure 32: South America Industrial Protective Footwear Market Revenue (Million), by End-User 2024 & 2032

- Figure 33: South America Industrial Protective Footwear Market Revenue Share (%), by End-User 2024 & 2032

- Figure 34: South America Industrial Protective Footwear Market Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Industrial Protective Footwear Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Industrial Protective Footwear Market Revenue (Million), by Material 2024 & 2032

- Figure 37: Middle East and Africa Industrial Protective Footwear Market Revenue Share (%), by Material 2024 & 2032

- Figure 38: Middle East and Africa Industrial Protective Footwear Market Revenue (Million), by End-User 2024 & 2032

- Figure 39: Middle East and Africa Industrial Protective Footwear Market Revenue Share (%), by End-User 2024 & 2032

- Figure 40: Middle East and Africa Industrial Protective Footwear Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Industrial Protective Footwear Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Industrial Protective Footwear Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Industrial Protective Footwear Market Revenue Million Forecast, by Material 2019 & 2032

- Table 3: Global Industrial Protective Footwear Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Global Industrial Protective Footwear Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Industrial Protective Footwear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Industrial Protective Footwear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Russia Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Industrial Protective Footwear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: India Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: China Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Industrial Protective Footwear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Industrial Protective Footwear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: South Africa Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Saudi Arabia Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Middle East and Africa Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Industrial Protective Footwear Market Revenue Million Forecast, by Material 2019 & 2032

- Table 33: Global Industrial Protective Footwear Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 34: Global Industrial Protective Footwear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: United States Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Canada Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Mexico Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of North America Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Industrial Protective Footwear Market Revenue Million Forecast, by Material 2019 & 2032

- Table 40: Global Industrial Protective Footwear Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 41: Global Industrial Protective Footwear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Germany Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: United Kingdom Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: France Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Russia Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Industrial Protective Footwear Market Revenue Million Forecast, by Material 2019 & 2032

- Table 50: Global Industrial Protective Footwear Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 51: Global Industrial Protective Footwear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: India Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: China Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Australia Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Asia Pacific Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Industrial Protective Footwear Market Revenue Million Forecast, by Material 2019 & 2032

- Table 58: Global Industrial Protective Footwear Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 59: Global Industrial Protective Footwear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Brazil Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Argentina Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of South America Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global Industrial Protective Footwear Market Revenue Million Forecast, by Material 2019 & 2032

- Table 64: Global Industrial Protective Footwear Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 65: Global Industrial Protective Footwear Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: South Africa Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Saudi Arabia Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Rest of Middle East and Africa Industrial Protective Footwear Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Protective Footwear Market?

The projected CAGR is approximately 4.96%.

2. Which companies are prominent players in the Industrial Protective Footwear Market?

Key companies in the market include Honeywell International Inc, VF Corporation, Bata Corporation, U-power Group Spa, Cofra SRL, Uvex Group*List Not Exhaustive, Dunlop Protective Footwear, Rock Fall (UK) LTD, Wolverine World Wide Inc, Hilson Footwear Pvt Ltd.

3. What are the main segments of the Industrial Protective Footwear Market?

The market segments include Material, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Government Regulations Regarding Worker's Safety; Importance Of Occupational Safety.

6. What are the notable trends driving market growth?

Strict Government Regulations Regarding Workers' Safety.

7. Are there any restraints impacting market growth?

Impact of Counterfeit Products Coupled With Large Unorganized Labor Population Across Various Industries.

8. Can you provide examples of recent developments in the market?

September 2023: Cat Footwear introduced the Invader Mid Vent, showcasing a range of innovative features. The Invader Mid Vent is equipped with a ReViveTech Engineered Comfort footbed, a 100% Post Industrial Recycled Lining featuring an NXT footbed cover, a durable EVA midsole, a robust nylon shank, a composite toe for added protection, and a rugged industrial-grade rubber outsole.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Protective Footwear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Protective Footwear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Protective Footwear Market?

To stay informed about further developments, trends, and reports in the Industrial Protective Footwear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence