Key Insights

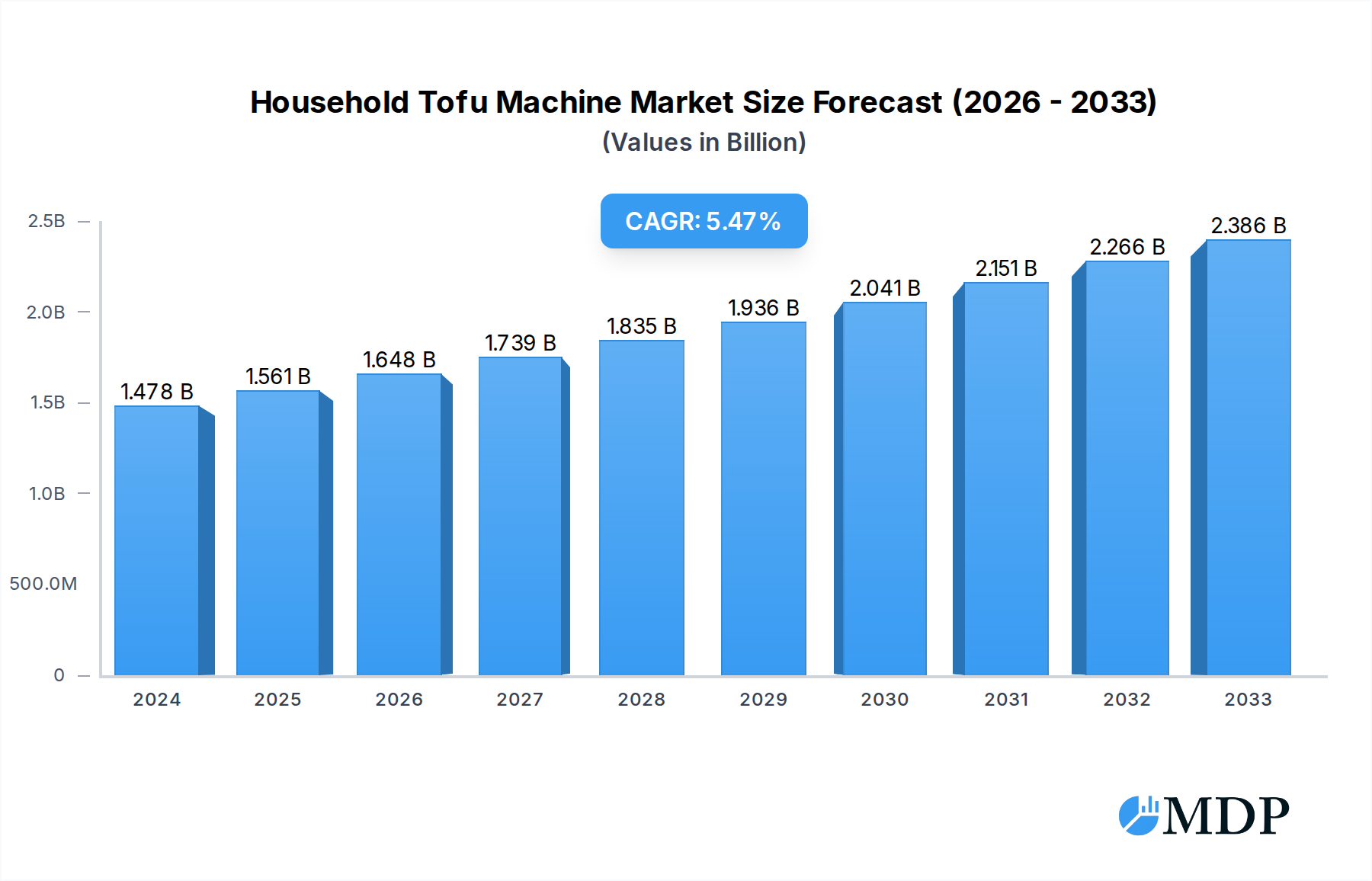

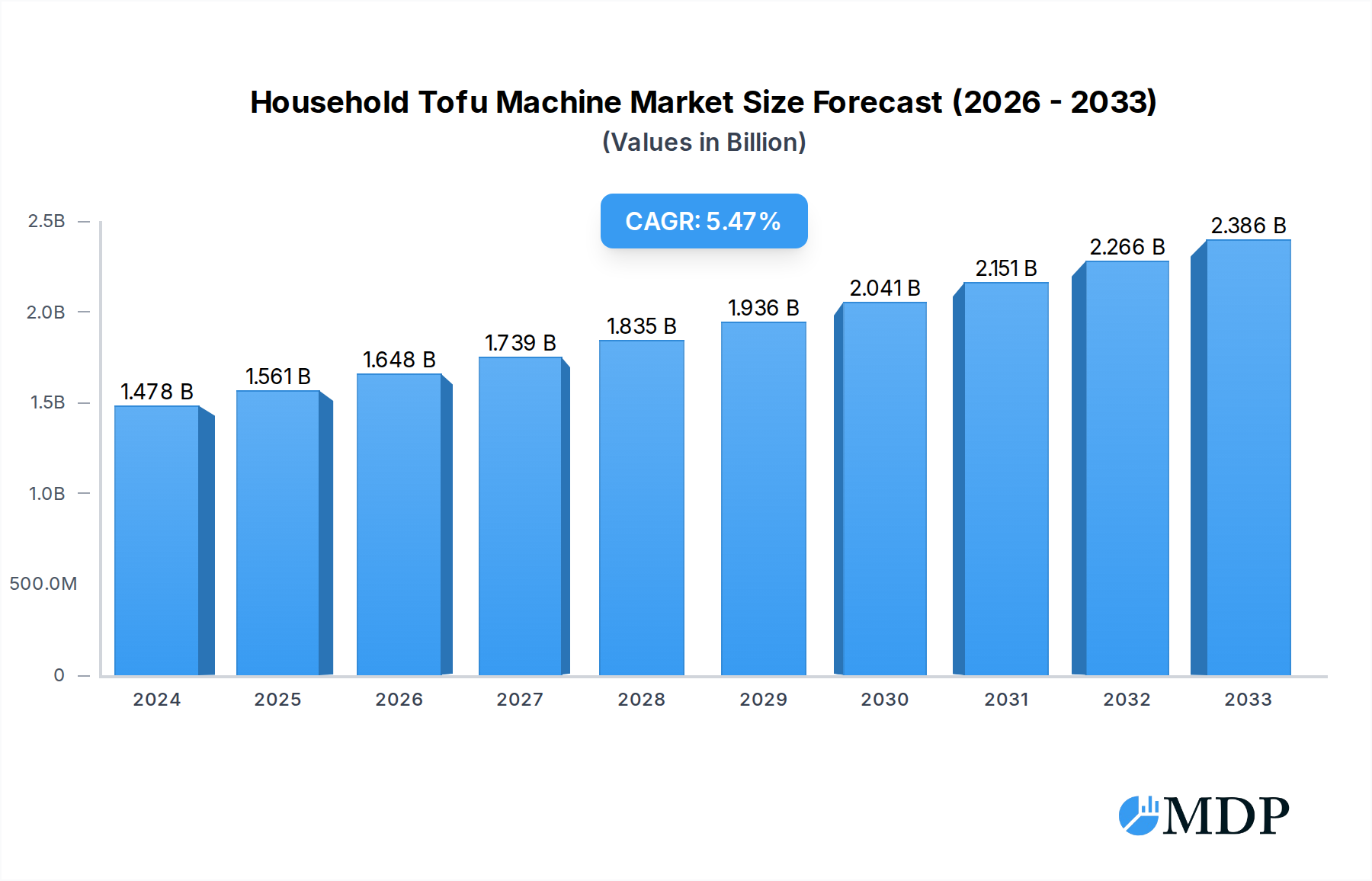

The global Household Tofu Machine market is poised for robust expansion, projected to reach a substantial market size of $1561 million by 2025. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 5.6%, indicating a healthy and sustained upward trajectory. The increasing consumer focus on health and wellness, coupled with a growing preference for plant-based diets, is a significant catalyst for this market. As tofu gains traction as a versatile and nutritious protein source, the demand for convenient and efficient home preparation methods is escalating. This trend is particularly pronounced in developed economies and is steadily gaining momentum in emerging markets as awareness and accessibility improve. The convenience offered by semi-automatic and fully automated tofu machines addresses the time constraints faced by modern households, making homemade tofu a more viable and attractive option.

Household Tofu Machine Market Size (In Billion)

Further bolstering this market growth are several key drivers. The rising disposable incomes in many regions allow consumers to invest in specialized kitchen appliances that enhance their culinary experiences and promote healthier lifestyles. Furthermore, the growing awareness of the environmental impact of traditional protein sources is nudging consumers towards sustainable alternatives like tofu, thereby indirectly driving the demand for related kitchen equipment. While the market is vibrant, potential restraints such as the initial cost of some advanced models and the availability of pre-made tofu products in supermarkets could pose challenges. However, the innovation in product features, ease of use, and the increasing affordability of these machines are expected to mitigate these concerns, paving the way for significant market penetration across diverse consumer segments.

Household Tofu Machine Company Market Share

Global Household Tofu Machine Market Report: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the global household tofu machine market, exploring its dynamics, trends, leading players, and future trajectory. With a study period spanning from 2019 to 2033, and a base year of 2025, this comprehensive report offers actionable insights for industry stakeholders. It delves into market segmentation by application (Online Sales, Offline Sales) and type (Semi-automatic, Fully Automated), providing a granular understanding of market penetration and growth drivers. The report meticulously forecasts market performance from 2025 to 2033, building upon detailed historical data from 2019–2024. This report is an indispensable resource for manufacturers, suppliers, investors, and industry analysts seeking to navigate and capitalize on the burgeoning household tofu machine market.

Household Tofu Machine Market Dynamics & Concentration

The global household tofu machine market exhibits a moderately concentrated landscape, with a significant presence of both established manufacturers and emerging players. Innovation drivers are primarily fueled by the increasing consumer demand for healthy, plant-based protein alternatives and the growing trend of home cooking. Advancements in automation, user-friendly interfaces, and energy efficiency are key areas of innovation. Regulatory frameworks, while generally supportive of food safety, can vary by region, influencing product design and market entry strategies. Product substitutes, such as pre-made tofu or alternative plant-based protein sources, present a competitive challenge, though the convenience and freshness offered by home tofu production mitigate this to some extent. End-user trends point towards a growing preference for customizable tofu, catering to dietary needs and taste preferences. Mergers and acquisition (M&A) activities in the sector have been limited but indicate a potential for consolidation as key players seek to expand their market share and technological capabilities. While specific M&A deal counts are not publicly disclosed, market share distribution shows a few leading companies holding approximately 35% of the market, with the remaining share fragmented among numerous smaller entities.

Household Tofu Machine Industry Trends & Analysis

The household tofu machine market is poised for substantial growth, driven by a confluence of factors that underscore the increasing global adoption of plant-based diets and the rise of home culinary practices. A key growth driver is the escalating awareness surrounding the health benefits associated with tofu consumption, including its rich protein content, low cholesterol, and versatility in various cuisines. This health consciousness is propelling demand for convenient and accessible ways to prepare fresh tofu at home, thereby boosting the market for household tofu machines. Technological disruptions are playing a pivotal role in shaping the industry. Innovations such as smart functionalities, automated processes, compact designs for smaller kitchens, and improved energy efficiency are making these appliances more attractive to a wider consumer base. The integration of advanced filtration systems and precise temperature control further enhances the quality and consistency of homemade tofu. Consumer preferences are evolving, with a growing emphasis on customization. Consumers are increasingly seeking machines that allow them to control ingredients, texture, and flavor profiles, moving beyond the limitations of commercially available tofu. This personalized approach to food preparation is a significant trend favoring the adoption of household tofu machines. The competitive dynamics within the market are characterized by a blend of established appliance manufacturers and specialized food equipment producers. Companies are focusing on product differentiation through unique features, enhanced user experience, and competitive pricing strategies. Market penetration is steadily increasing, particularly in regions with a strong tradition of soy consumption and a growing interest in healthy living. The Compound Annual Growth Rate (CAGR) for the household tofu machine market is projected to be approximately 7.2% over the forecast period. The market penetration rate, currently around 15% globally, is expected to rise significantly as affordability increases and consumer awareness expands, particularly in North America and Europe, which are currently experiencing rapid adoption alongside established Asian markets.

Leading Markets & Segments in Household Tofu Machine

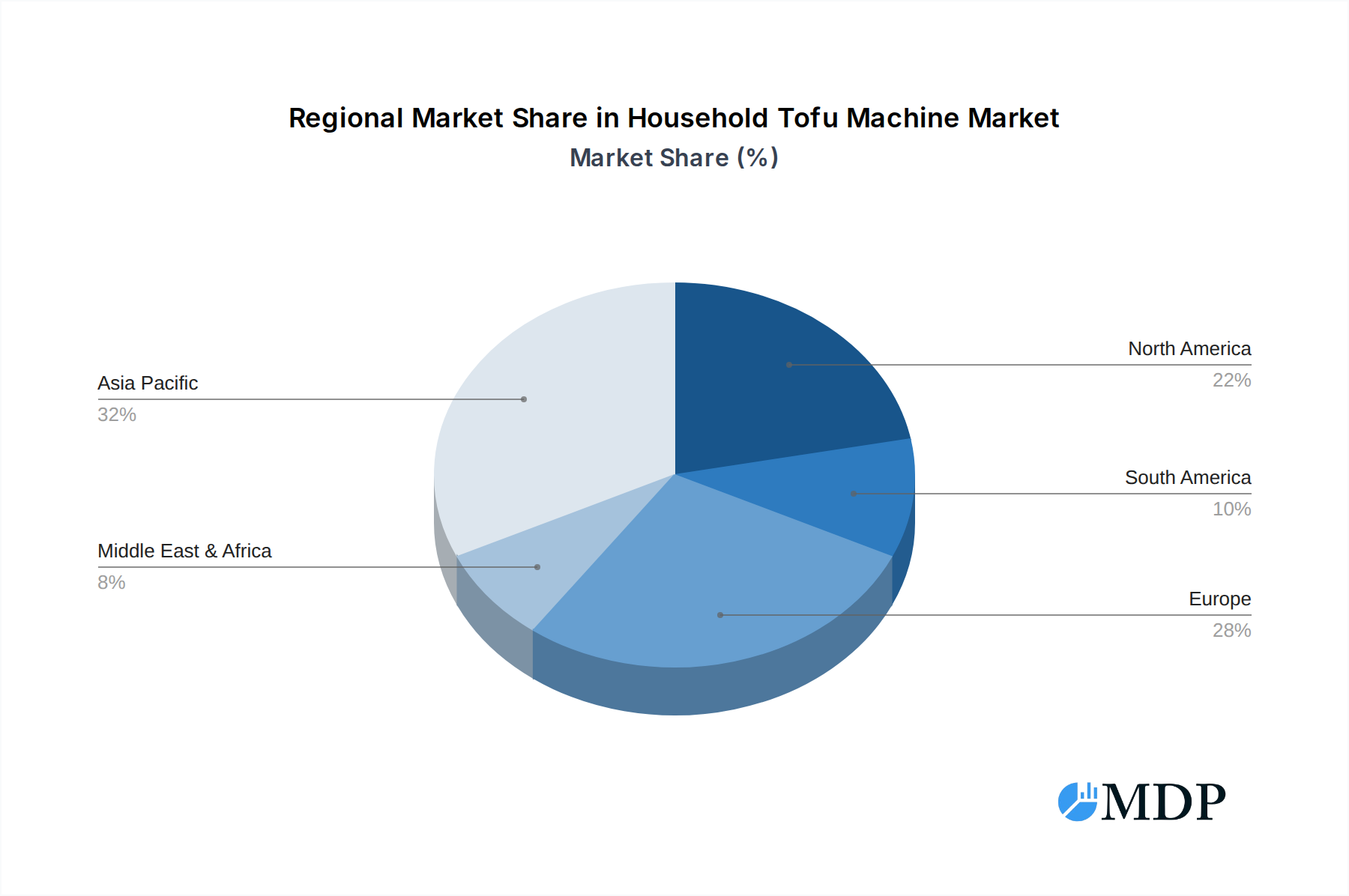

The household tofu machine market demonstrates distinct leadership across various geographical regions and product segments, driven by a combination of cultural relevance, economic conditions, and evolving consumer behaviors.

Dominant Regions and Countries:

- Asia-Pacific: This region stands as the most dominant market for household tofu machines. Countries like China, Japan, South Korea, and Vietnam have deeply ingrained soy-based culinary traditions, making tofu a staple in daily diets.

- Key Drivers:

- Cultural Affinity: Long-standing dietary habits and the traditional importance of soy products.

- Economic Accessibility: The increasing disposable income in many Asian economies allows for greater adoption of kitchen appliances.

- Health and Wellness Trends: Growing awareness of tofu's health benefits, even within traditional diets.

- Technological Adoption: High receptiveness to new kitchen technologies and innovations.

- Key Drivers:

Dominant Segments:

Application: Online Sales: The e-commerce channel has emerged as a significant driver of market growth for household tofu machines.

- Key Drivers:

- Convenience and Accessibility: Consumers can easily browse, compare, and purchase machines from the comfort of their homes.

- Wider Product Selection: Online platforms offer a broader array of brands and models than often found in physical retail stores.

- Digital Marketing Reach: Manufacturers leverage online advertising and social media to reach a global audience.

- Competitive Pricing: Online retailers often offer competitive pricing and promotional deals, attracting price-sensitive buyers.

- Key Drivers:

Types: Fully Automated: While semi-automatic machines cater to a budget-conscious segment, fully automated household tofu machines are increasingly dominating due to their convenience and superior results.

- Key Drivers:

- Time Savings: Fully automated machines minimize user intervention, perfect for busy lifestyles.

- Consistency and Quality: Advanced programming and sensors ensure consistent tofu texture and quality with every use.

- Ease of Use: Intuitive controls and pre-set programs make them accessible to users with no prior tofu-making experience.

- Enhanced Features: Often come with additional features like soy milk making capabilities and integrated cleaning cycles.

- Key Drivers:

The dominance of these segments and regions is further bolstered by robust distribution networks, effective marketing strategies that highlight convenience and health benefits, and a consistent supply chain that ensures product availability. The ongoing trend of urbanization and shrinking kitchen spaces in some developed nations also favors the development of compact, efficient, and fully automated household tofu machines.

Household Tofu Machine Product Developments

Recent product developments in the household tofu machine sector are focused on enhancing user convenience, optimizing performance, and expanding functionality. Innovations include smart features like app connectivity for remote operation and recipe guidance, advanced temperature and humidity controls for superior tofu texture, and integrated soy milk making capabilities for multi-functional appliances. Compact and aesthetically pleasing designs are being developed to fit seamlessly into modern kitchens. Furthermore, manufacturers are emphasizing energy efficiency and ease of cleaning, addressing key consumer pain points. These developments aim to make homemade tofu production more accessible, enjoyable, and consistent, thereby broadening the appeal of these appliances to a wider consumer base.

Key Drivers of Household Tofu Machine Growth

Several key factors are propelling the growth of the household tofu machine market. Technologically, advancements in automation, user-friendly interfaces, and energy efficiency are making these appliances more appealing and accessible. Economically, rising disposable incomes globally and a growing middle class in emerging economies are increasing purchasing power for kitchen appliances. The surge in plant-based diets, driven by health and environmental consciousness, is a significant consumer trend, creating a direct demand for home preparation of tofu. Regulatory support for food safety and innovation in the kitchen appliance sector also contributes positively. Furthermore, the increasing popularity of home cooking and DIY food preparation trends provides a fertile ground for the adoption of specialized kitchen gadgets like household tofu machines.

Challenges in the Household Tofu Machine Market

Despite robust growth, the household tofu machine market faces several challenges. Regulatory hurdles related to food-grade materials and electrical safety standards can vary significantly across different countries, impacting market entry and product compliance. Supply chain issues, including the sourcing of quality raw materials and efficient distribution networks, can lead to production delays and increased costs. Competitive pressures from both established appliance brands and numerous smaller manufacturers can lead to price wars and reduced profit margins. Consumer education remains a barrier, as some potential buyers may be unfamiliar with the process or perceive home tofu making as complex. Lastly, the availability of affordable, pre-made tofu in many markets can be a substitute that limits the perceived necessity of owning a dedicated machine.

Emerging Opportunities in Household Tofu Machine

Emerging opportunities in the household tofu machine market are ripe for exploitation. The continued global expansion of plant-based eating habits presents a vast untapped market. Technological breakthroughs in miniaturization and energy efficiency can lead to more compact and affordable models, broadening accessibility. Strategic partnerships between appliance manufacturers and health and wellness influencers or plant-based food bloggers can significantly boost consumer awareness and adoption. Furthermore, focusing on niche markets, such as organic tofu production or machines catering to specific dietary needs (e.g., gluten-free), can unlock new revenue streams. The development of integrated systems that combine soy milk making, tofu pressing, and even fermentation capabilities could offer a compelling value proposition for consumers seeking comprehensive plant-based food preparation solutions at home.

Leading Players in the Household Tofu Machine Sector

- Takai Tofu & Soymilk Equipment Co.

- Pushpanjali Agro Ind.

- Mase Tofu Machine Co.,Ltd.

- S. K. Engineers

- Yanagiya Machinery Co.,Ltd.

- Yida Liyan Co.,Ltd.

- Yung Soon Lih Food Machine Co.,Ltd.

- Zhejiang Zhonghe Machinery Co.,Ltd.

- Beijing Rock Machinery Co.,Ltd.

- Beijing Kangdeli Intelligent Technology Co.,Ltd.

- Shanxi Ruifei Machinery Manufacturing Co.,Ltd.

- Shanghai Yongde Food Machinery Co.,Ltd.

- Shanghai Wangxin Bean Products Equipment Co.,Ltd.

- Harbin Fanya Food Machinery Co.,Ltd.

- Wenling Yongjin Machinery Manufacturing Co.,Ltd.

Key Milestones in Household Tofu Machine Industry

- 2019: Increased global awareness of plant-based diets and their health benefits spurs initial growth in the household tofu machine market.

- 2020: Early adoption of online sales channels for kitchen appliances accelerates the reach of household tofu machine manufacturers.

- 2021: Introduction of more compact and user-friendly semi-automatic models catering to urban dwellers with limited kitchen space.

- 2022: Significant advancements in automated pressing and temperature control technologies lead to the release of higher-quality fully automated machines.

- 2023: Growing demand for multi-functional kitchen appliances encourages manufacturers to integrate soy milk making features into tofu machines.

- 2024: Enhanced marketing efforts focusing on health, convenience, and DIY food trends contribute to increased consumer interest.

- 2025 (Estimated): Expected launch of smart-enabled household tofu machines with app connectivity and personalized recipe suggestions.

- 2026-2033 (Forecast): Continued innovation in energy efficiency, sustainability, and integration with smart home ecosystems, alongside market expansion into new geographical regions.

Strategic Outlook for Household Tofu Machine Market

The strategic outlook for the household tofu machine market is overwhelmingly positive, driven by persistent global trends in health consciousness and plant-based eating. Future growth will be accelerated by continuous innovation in automation and smart technology, making home tofu production even more convenient and accessible. Companies that focus on product differentiation through unique features, enhanced user experience, and sustainable manufacturing practices will likely gain a competitive edge. Expanding distribution channels, particularly through e-commerce and strategic retail partnerships, will be crucial. Moreover, targeted marketing campaigns emphasizing the health, economic, and culinary benefits of homemade tofu will further drive adoption. Exploring opportunities in emerging markets and developing eco-friendly product lines will solidify long-term market leadership and capitalize on the growing demand for sustainable and healthy food solutions.

Household Tofu Machine Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Semi-automatic

- 2.2. Fully Automated

Household Tofu Machine Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Household Tofu Machine Regional Market Share

Geographic Coverage of Household Tofu Machine

Household Tofu Machine REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Household Tofu Machine Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Semi-automatic

- 5.2.2. Fully Automated

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Household Tofu Machine Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Semi-automatic

- 6.2.2. Fully Automated

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Household Tofu Machine Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Semi-automatic

- 7.2.2. Fully Automated

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Household Tofu Machine Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Semi-automatic

- 8.2.2. Fully Automated

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Household Tofu Machine Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Semi-automatic

- 9.2.2. Fully Automated

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Household Tofu Machine Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Semi-automatic

- 10.2.2. Fully Automated

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Takai Tofu & Soymilk Equipment Co.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pushpanjali Agro Ind.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mase Tofu Machine Co.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ltd.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 S. K. Engineers

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Yanagiya Machinery Co.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Yida Liyan Co.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yung Soon Lih Food Machine Co.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ltd.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Zhejiang Zhonghe Machinery Co.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ltd.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Beijing Rock Machinery Co.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Ltd.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Beijing Kangdeli Intelligent Technology Co.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Ltd.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Shanxi Ruifei Machinery Manufacturing Co.

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Ltd.

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Shanghai Yongde Food Machinery Co.

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Ltd.

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Shanghai Wangxin Bean Products Equipment Co.

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Ltd.

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Harbin Fanya Food Machinery Co.

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Ltd.

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Wenling Yongjin Machinery Manufacturing Co.

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Ltd.

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.1 Takai Tofu & Soymilk Equipment Co.

List of Figures

- Figure 1: Global Household Tofu Machine Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Household Tofu Machine Revenue (million), by Application 2025 & 2033

- Figure 3: North America Household Tofu Machine Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Household Tofu Machine Revenue (million), by Types 2025 & 2033

- Figure 5: North America Household Tofu Machine Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Household Tofu Machine Revenue (million), by Country 2025 & 2033

- Figure 7: North America Household Tofu Machine Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Household Tofu Machine Revenue (million), by Application 2025 & 2033

- Figure 9: South America Household Tofu Machine Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Household Tofu Machine Revenue (million), by Types 2025 & 2033

- Figure 11: South America Household Tofu Machine Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Household Tofu Machine Revenue (million), by Country 2025 & 2033

- Figure 13: South America Household Tofu Machine Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Household Tofu Machine Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Household Tofu Machine Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Household Tofu Machine Revenue (million), by Types 2025 & 2033

- Figure 17: Europe Household Tofu Machine Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Household Tofu Machine Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Household Tofu Machine Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Household Tofu Machine Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Household Tofu Machine Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Household Tofu Machine Revenue (million), by Types 2025 & 2033

- Figure 23: Middle East & Africa Household Tofu Machine Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Household Tofu Machine Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Household Tofu Machine Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Household Tofu Machine Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Household Tofu Machine Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Household Tofu Machine Revenue (million), by Types 2025 & 2033

- Figure 29: Asia Pacific Household Tofu Machine Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Household Tofu Machine Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Household Tofu Machine Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Household Tofu Machine Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Household Tofu Machine Revenue million Forecast, by Types 2020 & 2033

- Table 3: Global Household Tofu Machine Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Household Tofu Machine Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Household Tofu Machine Revenue million Forecast, by Types 2020 & 2033

- Table 6: Global Household Tofu Machine Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Household Tofu Machine Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Household Tofu Machine Revenue million Forecast, by Types 2020 & 2033

- Table 12: Global Household Tofu Machine Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Household Tofu Machine Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Household Tofu Machine Revenue million Forecast, by Types 2020 & 2033

- Table 18: Global Household Tofu Machine Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Household Tofu Machine Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Household Tofu Machine Revenue million Forecast, by Types 2020 & 2033

- Table 30: Global Household Tofu Machine Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Household Tofu Machine Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Household Tofu Machine Revenue million Forecast, by Types 2020 & 2033

- Table 39: Global Household Tofu Machine Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Household Tofu Machine Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Household Tofu Machine?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Household Tofu Machine?

Key companies in the market include Takai Tofu & Soymilk Equipment Co., Pushpanjali Agro Ind., Mase Tofu Machine Co., Ltd., S. K. Engineers, Yanagiya Machinery Co., Ltd., Yida Liyan Co., Ltd., Yung Soon Lih Food Machine Co., Ltd., Zhejiang Zhonghe Machinery Co., Ltd., Beijing Rock Machinery Co., Ltd., Beijing Kangdeli Intelligent Technology Co., Ltd., Shanxi Ruifei Machinery Manufacturing Co., Ltd., Shanghai Yongde Food Machinery Co., Ltd., Shanghai Wangxin Bean Products Equipment Co., Ltd., Harbin Fanya Food Machinery Co., Ltd., Wenling Yongjin Machinery Manufacturing Co., Ltd..

3. What are the main segments of the Household Tofu Machine?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 1561 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Household Tofu Machine," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Household Tofu Machine report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Household Tofu Machine?

To stay informed about further developments, trends, and reports in the Household Tofu Machine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence