Key Insights

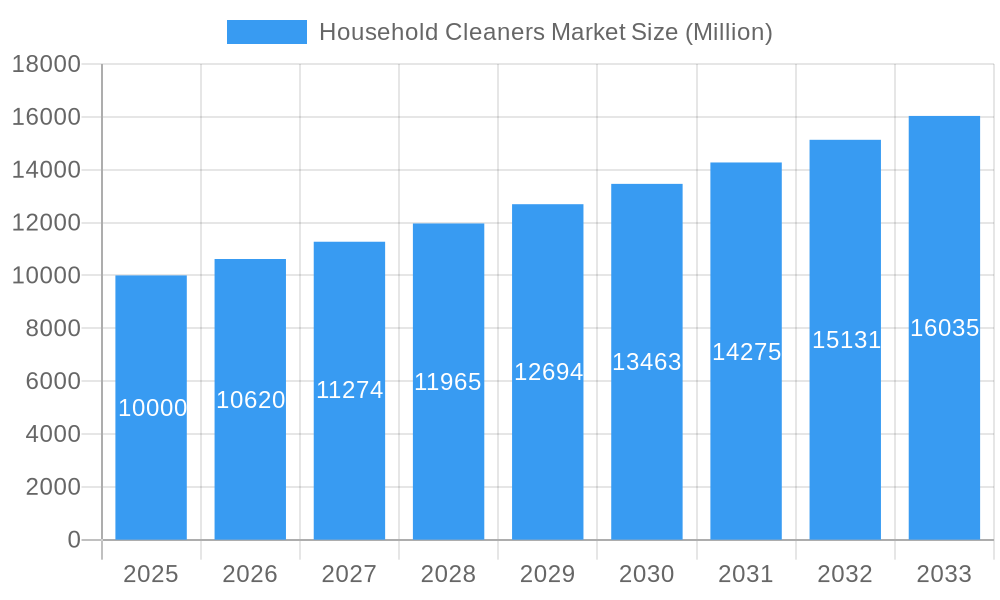

The global household cleaners market is poised for significant expansion, projected to reach $40.1 billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 3.54%. Key growth drivers include rising disposable incomes in emerging economies, a heightened consumer focus on hygiene and sanitation, and a growing preference for eco-friendly and sustainable cleaning solutions. The proliferation of e-commerce platforms also presents substantial opportunities for market penetration and sales growth. Product innovation, such as the development of multi-purpose and specialized formulations, further fuels market dynamism. The market is segmented by product type and distribution channel, with leading companies actively investing in R&D to meet evolving consumer demands.

Household Cleaners Market Market Size (In Billion)

Challenges such as raw material price volatility and stringent environmental regulations may present hurdles. However, the sustained demand for household cleaning products globally underpins a positive long-term growth trajectory. Strategic initiatives in geographic expansion and partnerships will be vital for continued market success.

Household Cleaners Market Company Market Share

Deep Dive into the Household Cleaners Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the global Household Cleaners Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's current dynamics and future trajectory. The report meticulously examines market size (in Millions), growth drivers, challenges, and emerging opportunities across various segments and geographical regions. Key players like Henkel AG & Co KGaA, Reckitt Benckiser Group PLC, and Unilever PLC are profiled, providing a competitive landscape overview. Download now to gain a competitive edge!

Household Cleaners Market Market Dynamics & Concentration

The Household Cleaners Market is characterized by a moderately concentrated landscape, with a few major players commanding significant market share. Market concentration is influenced by factors such as brand recognition, economies of scale, and strong distribution networks. While precise market share figures for individual companies vary, larger players like Procter & Gamble and Unilever hold substantial portions, often exceeding xx%.

Several factors drive innovation within the market:

- Growing consumer demand for eco-friendly and sustainable products: This has led to increased R&D investment in biodegradable formulas and sustainable packaging.

- Stringent regulatory frameworks: Regulations related to chemical composition and environmental impact are pushing companies to develop safer and more sustainable products.

- Rise of product substitutes: Natural and homemade cleaning solutions present a competitive challenge, though the overall market remains dominated by established brands.

- Evolving end-user preferences: Consumers are increasingly demanding specialized cleaners targeting specific surfaces or needs (e.g., pet-friendly, hypoallergenic).

Mergers and acquisitions (M&A) play a vital role in shaping the market dynamics. While precise M&A deal counts for the period are unavailable (xx), activity is expected to remain robust, driven by the need to expand product portfolios and strengthen market positions. Smaller companies may pursue acquisitions to gain access to larger distribution networks and enhance brand visibility.

Household Cleaners Market Industry Trends & Analysis

The Household Cleaners Market exhibits robust growth, driven primarily by increasing household incomes, rising urbanization, and growing awareness of hygiene. The historical period (2019-2024) showcased a CAGR of xx%, and this upward trajectory is expected to continue. Market penetration varies regionally, with developed economies exhibiting higher penetration than developing markets.

Technological disruptions are shaping the market landscape:

- Smart home integration: The incorporation of smart technologies into cleaning devices is increasing convenience and efficiency.

- E-commerce growth: Online retail stores are gaining market share, offering increased convenience and broader product selection.

- Changing consumer preferences: Growing demand for concentrated, multi-purpose, and eco-friendly cleaners is influencing product development.

Competitive dynamics are intense, with companies differentiating through brand image, product innovation, and pricing strategies. The competitive landscape remains dynamic, with established players and new entrants vying for market share.

Leading Markets & Segments in Household Cleaners Market

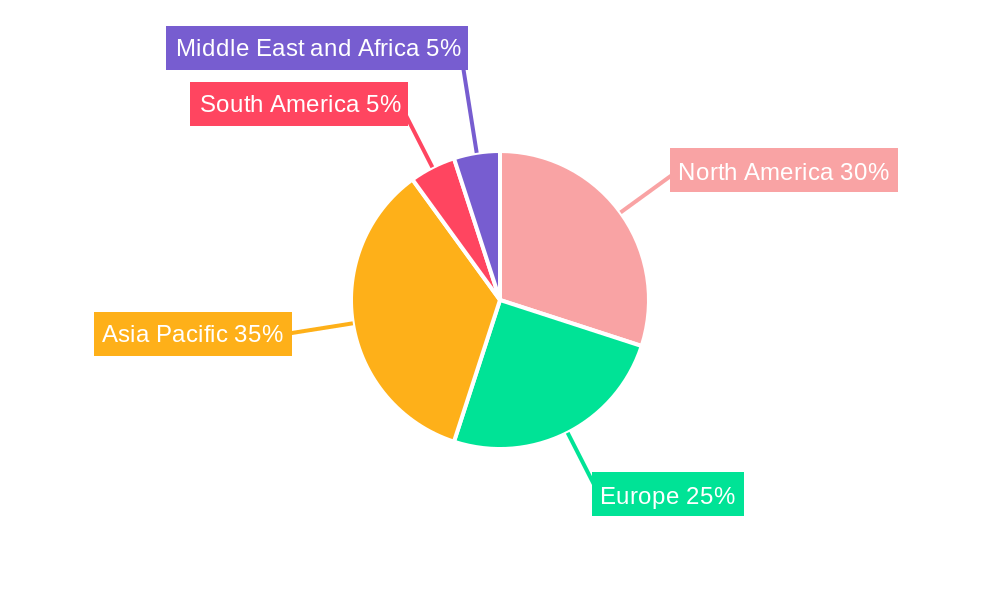

The North American and European regions historically dominated the Household Cleaners Market, driven by higher disposable incomes and greater awareness of hygiene. However, Asia-Pacific is rapidly emerging as a major market, fueled by increasing urbanization and rising consumer spending.

Key Drivers for Leading Segments:

- Product Type:

- Surface Cleaners: This segment remains the largest, driven by consistent demand in both residential and commercial settings.

- Glass Cleaners: Driven by consistent demand across households and commercial sectors.

- Toilet Bowl Cleaners: This segment witnesses steady demand but faces competition from multi-purpose cleaners.

- Other Product Types: Specialised cleaners (e.g., oven cleaners, floor cleaners) cater to specific needs and drive innovation.

- Distribution Channel:

- Supermarkets/Hypermarkets: Remains the primary distribution channel due to wide reach and established relationships.

- Online Retail Stores: Growing rapidly, boosted by ease of access and wider product choices.

- Convenience Stores: Offer convenience but cater to a smaller customer base with less variety.

Household Cleaners Market Product Developments

Recent product developments focus on sustainability, efficacy, and convenience. This includes formulations with natural ingredients, concentrated formulas, and innovative packaging (refillable dispensers, recycled materials). These advancements meet the growing consumer demand for eco-friendly and effective cleaning solutions. Technological advancements in dispensing mechanisms, ingredient formulation, and packaging are further enhancing product competitiveness.

Key Drivers of Household Cleaners Market Growth

Several factors contribute to the growth of the Household Cleaners Market:

- Rising disposable incomes: Increased purchasing power allows for greater spending on household products.

- Growing urbanization: Urban populations tend to prioritize convenient and effective cleaning solutions.

- Enhanced awareness of hygiene: Public health concerns and awareness of germs drive demand for effective cleaners.

- Technological innovations: New formulations and packaging enhance product appeal and convenience.

Challenges in the Household Cleaners Market Market

The Household Cleaners Market faces several challenges:

- Stringent regulations: Compliance with safety and environmental regulations can increase production costs.

- Fluctuations in raw material prices: Changes in the prices of raw materials can impact profitability.

- Intense competition: Established players and new entrants are vying for market share, leading to pricing pressure.

- Supply chain disruptions: Global events can lead to difficulties in sourcing raw materials or distributing finished products.

Emerging Opportunities in Household Cleaners Market

Several factors present significant opportunities for growth:

- Expansion into emerging markets: Untapped potential exists in developing countries with growing middle classes.

- Development of specialized cleaning products: Catering to niche segments (e.g., pet owners, allergy sufferers) offers growth potential.

- Partnerships and collaborations: Strategic alliances can enhance product development, distribution, and market reach.

- Innovation in sustainable packaging: Eco-friendly packaging options can differentiate brands and attract environmentally conscious consumers.

Leading Players in the Household Cleaners Market Sector

- Henkel AG & Co KGaA

- Reckitt Benckiser Group PLC

- Vikara Services Pvt Ltd (THE BETTER HOME)

- McBride PLC

- Church & Dwight Co Inc

- S C Johnson & Son Inc

- Unilever PLC

- Colgate-Palmolive Company

- The Procter & Gamble Company

- Kao Corporation

Key Milestones in Household Cleaners Market Industry

- February 2022: Henkel launched Pril Stark & Natürlich, a dishwashing liquid range featuring natural ingredients and sustainable packaging.

- March 2022: Palmolive and Walmart launched Palmolive Shake & Clean Dish Soap with 100% recycled plastic bottles.

- April 2022: J.R. Watkins launched its foaming dish soap in select Target stores, highlighting plant-derived ingredients and hypoallergenic qualities.

Strategic Outlook for Household Cleaners Market Market

The Household Cleaners Market is poised for continued growth, driven by ongoing innovation, changing consumer preferences, and expanding market reach. Strategic opportunities lie in focusing on sustainability, developing specialized cleaning products, and leveraging digital channels for increased market penetration. Companies that can effectively address consumer demand for eco-friendly and convenient cleaning solutions will be best positioned for success.

Household Cleaners Market Segmentation

-

1. Product Type

- 1.1. Surface Cleaners

- 1.2. Glass Cleaners

- 1.3. Toilet Bowl Cleaners

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Household Cleaners Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Household Cleaners Market Regional Market Share

Geographic Coverage of Household Cleaners Market

Household Cleaners Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolving Consumer Perception Toward Oral Hygiene Routines; Increased Focus on Marketing Activities & Distribution Network

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Synthetic Chemicals Used in Mouth Washes

- 3.4. Market Trends

- 3.4.1. Demand for Organic Cleaning Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Household Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Surface Cleaners

- 5.1.2. Glass Cleaners

- 5.1.3. Toilet Bowl Cleaners

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Household Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Surface Cleaners

- 6.1.2. Glass Cleaners

- 6.1.3. Toilet Bowl Cleaners

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Household Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Surface Cleaners

- 7.1.2. Glass Cleaners

- 7.1.3. Toilet Bowl Cleaners

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Household Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Surface Cleaners

- 8.1.2. Glass Cleaners

- 8.1.3. Toilet Bowl Cleaners

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Household Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Surface Cleaners

- 9.1.2. Glass Cleaners

- 9.1.3. Toilet Bowl Cleaners

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Household Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Surface Cleaners

- 10.1.2. Glass Cleaners

- 10.1.3. Toilet Bowl Cleaners

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Reckitt Benckiser Group PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vikara Services Pvt Ltd (THE BETTER HOME)*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 McBride PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Church & Dwight Co Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 S C Johnson & Son Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Unilever PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Colgate-Palmolive Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Procter & Gamble Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kao Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Global Household Cleaners Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Household Cleaners Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Household Cleaners Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Household Cleaners Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Household Cleaners Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Household Cleaners Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Household Cleaners Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Household Cleaners Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Household Cleaners Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Household Cleaners Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Household Cleaners Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Household Cleaners Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Household Cleaners Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Household Cleaners Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Household Cleaners Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Household Cleaners Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Household Cleaners Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Household Cleaners Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Household Cleaners Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Household Cleaners Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Household Cleaners Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Household Cleaners Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: South America Household Cleaners Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Household Cleaners Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Household Cleaners Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Household Cleaners Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Household Cleaners Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Household Cleaners Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Household Cleaners Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Household Cleaners Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Household Cleaners Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Household Cleaners Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Household Cleaners Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Household Cleaners Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Household Cleaners Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Household Cleaners Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Household Cleaners Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Household Cleaners Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Household Cleaners Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Household Cleaners Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Spain Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Russia Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Household Cleaners Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Household Cleaners Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Household Cleaners Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Household Cleaners Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Household Cleaners Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Household Cleaners Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Household Cleaners Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 36: Global Household Cleaners Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Household Cleaners Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South Africa Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Household Cleaners Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Household Cleaners Market?

The projected CAGR is approximately 3.54%.

2. Which companies are prominent players in the Household Cleaners Market?

Key companies in the market include Henkel AG & Co KGaA, Reckitt Benckiser Group PLC, Vikara Services Pvt Ltd (THE BETTER HOME)*List Not Exhaustive, McBride PLC, Church & Dwight Co Inc, S C Johnson & Son Inc, Unilever PLC, Colgate-Palmolive Company, The Procter & Gamble Company, Kao Corporation.

3. What are the main segments of the Household Cleaners Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Evolving Consumer Perception Toward Oral Hygiene Routines; Increased Focus on Marketing Activities & Distribution Network.

6. What are the notable trends driving market growth?

Demand for Organic Cleaning Products.

7. Are there any restraints impacting market growth?

Adverse Effects of Synthetic Chemicals Used in Mouth Washes.

8. Can you provide examples of recent developments in the market?

In April 2022, J.R. Watkins launched their clean and powerful Foaming Dish Soap in select Target stores in Califonia. The soap is formulated with plant-derived cleansing agents such as coconut and is hypoallergenic, dermatologically tested, and free of sulfates, parabens, and triclosan. The formula is also free of petroleum-based and sulfate cleansing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Household Cleaners Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Household Cleaners Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Household Cleaners Market?

To stay informed about further developments, trends, and reports in the Household Cleaners Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence