Key Insights

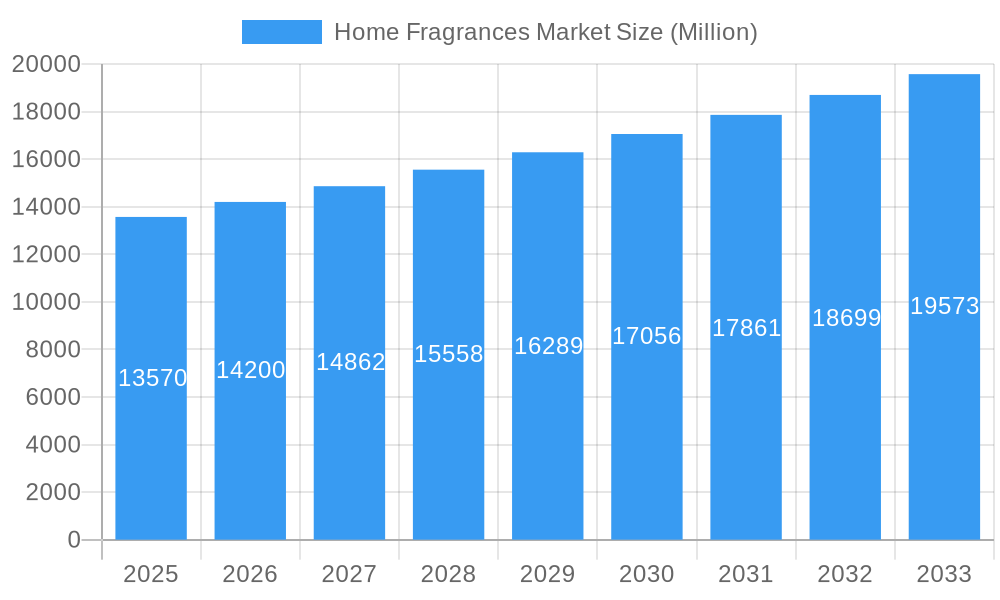

The global home fragrances market, valued at $13.57 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.66% from 2025 to 2033. This expansion is driven by several key factors. Increasing disposable incomes in developing economies are fueling consumer spending on premium home fragrance products, creating a larger market segment for luxury scents and sophisticated packaging. The rising popularity of aromatherapy and its perceived health benefits is further boosting demand for essential oil-based diffusers and candles. Furthermore, the shift towards creating more aesthetically pleasing and personalized living spaces is propelling the adoption of home fragrances as a crucial element of interior design. Consumers are increasingly seeking out unique and natural scents, leading to a surge in demand for organic and sustainable options. The e-commerce boom has also played a significant role, providing convenient access to a wider variety of products and brands, stimulating market growth.

Home Fragrances Market Market Size (In Billion)

However, the market is not without challenges. Fluctuations in raw material prices, particularly for essential oils and waxes, can impact profitability and pricing strategies. Growing environmental concerns regarding the potential impact of certain fragrance chemicals are leading to increased scrutiny and stricter regulations, requiring manufacturers to adapt and invest in more eco-friendly formulations. Competition amongst established players and the influx of new entrants are also contributing to a more dynamic and competitive landscape, necessitating innovative product development and strategic marketing initiatives to maintain a strong market position. Segmentation analysis reveals that premium products and online retail channels are exhibiting the strongest growth, reflecting evolving consumer preferences and the changing retail landscape. North America and Europe are anticipated to continue dominating the market, driven by high consumer awareness and established distribution networks, while Asia-Pacific is poised for significant growth due to rising middle-class populations and changing lifestyle trends.

Home Fragrances Market Company Market Share

Home Fragrances Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Home Fragrances Market, offering invaluable insights for stakeholders seeking to navigate this dynamic industry. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report values the market at xx Million in 2025 and projects a CAGR of xx% during the forecast period. This report is essential for businesses seeking to understand market trends, competitive landscapes, and future growth opportunities within the home fragrance sector.

Home Fragrances Market Dynamics & Concentration

The global home fragrances market is characterized by a moderately concentrated landscape, with key players holding significant market share. Reckitt Benckiser Group PLC, Godrej Group, Henkel AG & Co Kgaa, SC Johnson & Sons Inc, and The Procter & Gamble Company are some of the dominant players, collectively accounting for an estimated xx% of the market share in 2025. Market concentration is influenced by factors such as brand recognition, distribution networks, and R&D capabilities.

Innovation is a key driver, with companies continually introducing new fragrances, formulations, and delivery systems (e.g., smart diffusers, sustainable packaging). Regulatory frameworks concerning fragrance ingredients and environmental impact are evolving, presenting both challenges and opportunities. Product substitutes, such as essential oil diffusers and air purifiers, are impacting market dynamics. End-user trends, including a growing preference for natural and sustainable products, and the increasing adoption of online retail channels, are reshaping the market landscape. The number of mergers and acquisitions (M&A) in the sector has been steadily increasing, with xx deals recorded in the past five years, reflecting the consolidation trend within the industry.

- Market Concentration: Highly concentrated, with top 5 players holding xx% market share (2025).

- Innovation Drivers: New fragrances, formulations, and delivery systems.

- Regulatory Frameworks: Increasing focus on ingredient safety and environmental sustainability.

- Product Substitutes: Essential oil diffusers, air purifiers.

- End-User Trends: Growing demand for natural and sustainable products, online shopping.

- M&A Activity: xx deals over the past five years.

Home Fragrances Market Industry Trends & Analysis

The home fragrances market is experiencing robust growth, fueled by several interconnected factors. Rising disposable incomes, particularly in developing economies, are significantly increasing consumer spending on home décor and enhancing personal well-being, thereby boosting demand for home fragrances. This trend is further amplified by a growing awareness of the positive psychological impact of fragrances on mood and mental wellness, leading to higher adoption rates among consumers seeking improved comfort and ambiance in their homes. Furthermore, technological advancements in fragrance technology are revolutionizing the industry. These innovations include the development of longer-lasting fragrances with improved scent diffusion technologies, as well as the introduction of smart diffusers offering convenient remote control and personalized scent experiences. This technological evolution is enhancing both the longevity and customization of home fragrance products.

While developed countries exhibit high market penetration of home fragrances, nearing saturation levels (approximately xx% in 2025), substantial growth opportunities abound in emerging markets where penetration rates remain considerably lower. This presents a significant expansion potential for existing and new market players. The competitive landscape is dynamic, with established players facing increasing competition from smaller, niche brands offering unique and specialized product lines catering to specific consumer preferences and demands. The overall market is poised for continued strong growth, projected to maintain a healthy CAGR of xx% from 2025 to 2033.

Leading Markets & Segments in Home Fragrances Market

North America currently holds the leading position in the global home fragrances market, driven by robust consumer spending and a strong presence of established brands. Within this region, the United States commands the largest market share. Key growth catalysts in North America include:

- High disposable incomes coupled with significant consumer expenditure on home improvement and wellness products.

- Well-established distribution networks and extensive retail presence, ensuring widespread product availability.

- High adoption of online shopping channels, facilitating convenient and accessible purchasing options.

Analyzing market segments, the premium category is experiencing the fastest growth rate, reflecting a rising consumer preference for high-quality, luxurious products and unique sensory experiences. In terms of product type, scented candles retain the largest market share, followed by sprays and diffusers, highlighting the enduring popularity of classic formats alongside emerging technologies. Supermarkets/hypermarkets remain the dominant distribution channel, although online retail channels are exhibiting exponential growth, indicating a significant shift towards e-commerce platforms.

Home Fragrances Market Product Developments

Recent years have witnessed substantial innovation in home fragrance product development, significantly impacting market dynamics. This includes the introduction of smart diffusers with app-based control, offering advanced customization and convenience. The incorporation of natural and sustainable ingredients reflects growing consumer environmental awareness and demand for eco-friendly products. Personalized fragrance blends are becoming increasingly popular, catering to individual preferences and enhancing the overall user experience. Furthermore, novel delivery systems are being developed to offer alternative and more efficient ways to dispense and enjoy home fragrances. These innovations not only enhance the consumer experience but also address growing environmental concerns by prioritizing sustainability and ethical sourcing.

Key Drivers of Home Fragrances Market Growth

Several factors contribute to the growth of the home fragrances market. Rising disposable incomes and increased consumer spending on home improvement significantly influence market expansion. The increasing preference for creating a relaxing and aesthetically pleasing home environment fuels demand. Additionally, the development of smart and technologically advanced home fragrance systems, along with the growing popularity of natural and eco-friendly options, drives market growth. Finally, effective marketing and branding strategies employed by manufacturers reinforce market expansion.

Challenges in the Home Fragrances Market

The home fragrances market faces certain challenges, including intense competition from both established and emerging brands, leading to price wars and pressure on profit margins. Stricter regulations on fragrance ingredients and packaging necessitate higher compliance costs for manufacturers. Supply chain disruptions caused by geopolitical instability can impact the availability of raw materials and affect overall production. Fluctuations in raw material prices can impact production costs and profitability.

Emerging Opportunities in Home Fragrances Market

The sustained long-term growth of the home fragrances market is propelled by several promising emerging opportunities. The increasing consumer demand for natural and sustainable products presents lucrative prospects for eco-conscious brands focusing on ethically sourced and environmentally friendly ingredients and packaging. Strategic partnerships and collaborations between fragrance manufacturers and technology companies are creating innovative products and enhancing the overall consumer experience, merging traditional craftsmanship with cutting-edge technology. Finally, expanding into untapped regions, particularly in emerging economies, presents significant growth potential for brands seeking global market penetration and diverse consumer bases.

Leading Players in the Home Fragrances Market Sector

- Reckitt Benckiser Group PLC

- Godrej Group

- Henkel AG & Co Kgaa

- SC Johnson & Sons Inc

- The Procter & Gamble Company

- Newell Brands Inc

- Doterra International LLC

- Now Health Group Inc

- Puzhen Life Co Ltd

- Bath & Body Works Inc

Key Milestones in Home Fragrances Market Industry

- September 2022: Paul Smith's launch of a home fragrance line, in collaboration with International Flavors and Fragrances Inc., showcases the increasing synergy between luxury brands and established fragrance houses, leveraging brand recognition and expertise.

- July 2023: The Yankee Candle Company's "Daydreaming of Autumn" collection highlights the enduring popularity of scented candles and the importance of seasonal trends in driving sales and product innovation.

- October 2023: Enesco's introduction of Herb Dublin and Irish Botanicals, a new home fragrance brand emphasizing wellness and natural ingredients, underscores the growing market trend toward natural and sustainable products, appealing to health-conscious consumers.

Strategic Outlook for Home Fragrances Market Market

The home fragrance market presents strong growth potential due to increasing consumer spending on home improvement and wellness, technological advancements, and the rising popularity of natural products. Strategic partnerships and expansion into new geographical markets are vital for manufacturers. Leveraging digital marketing and e-commerce platforms will help reach a wider consumer base and personalize experiences. Focusing on sustainable and ethical practices will attract environmentally conscious consumers, thereby boosting brand reputation and driving market share.

Home Fragrances Market Segmentation

-

1. Type

- 1.1. Sprays

- 1.2. Diffusers

- 1.3. Scented Candles

- 1.4. Other Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores/Grocery Stores

- 2.3. Online Retail

- 2.4. Other Didtribution channels

-

3. Category

- 3.1. Mass

- 3.2. Premium

Home Fragrances Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. South Africa

- 6.2. Rest of Middle East

Home Fragrances Market Regional Market Share

Geographic Coverage of Home Fragrances Market

Home Fragrances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Multi-dimensional Products; Growing Consumers' Inclination toward Home Decor

- 3.3. Market Restrains

- 3.3.1. Rising Environmental Concerns and Raw Material Price Volatility

- 3.4. Market Trends

- 3.4.1. Growing Consumers’ Inclination Toward Home Decor

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Home Fragrances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sprays

- 5.1.2. Diffusers

- 5.1.3. Scented Candles

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores/Grocery Stores

- 5.2.3. Online Retail

- 5.2.4. Other Didtribution channels

- 5.3. Market Analysis, Insights and Forecast - by Category

- 5.3.1. Mass

- 5.3.2. Premium

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.4.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Home Fragrances Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Sprays

- 6.1.2. Diffusers

- 6.1.3. Scented Candles

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores/Grocery Stores

- 6.2.3. Online Retail

- 6.2.4. Other Didtribution channels

- 6.3. Market Analysis, Insights and Forecast - by Category

- 6.3.1. Mass

- 6.3.2. Premium

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Home Fragrances Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Sprays

- 7.1.2. Diffusers

- 7.1.3. Scented Candles

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores/Grocery Stores

- 7.2.3. Online Retail

- 7.2.4. Other Didtribution channels

- 7.3. Market Analysis, Insights and Forecast - by Category

- 7.3.1. Mass

- 7.3.2. Premium

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Home Fragrances Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Sprays

- 8.1.2. Diffusers

- 8.1.3. Scented Candles

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores/Grocery Stores

- 8.2.3. Online Retail

- 8.2.4. Other Didtribution channels

- 8.3. Market Analysis, Insights and Forecast - by Category

- 8.3.1. Mass

- 8.3.2. Premium

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Home Fragrances Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Sprays

- 9.1.2. Diffusers

- 9.1.3. Scented Candles

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores/Grocery Stores

- 9.2.3. Online Retail

- 9.2.4. Other Didtribution channels

- 9.3. Market Analysis, Insights and Forecast - by Category

- 9.3.1. Mass

- 9.3.2. Premium

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Home Fragrances Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Sprays

- 10.1.2. Diffusers

- 10.1.3. Scented Candles

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores/Grocery Stores

- 10.2.3. Online Retail

- 10.2.4. Other Didtribution channels

- 10.3. Market Analysis, Insights and Forecast - by Category

- 10.3.1. Mass

- 10.3.2. Premium

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. United Arab Emirates Home Fragrances Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Sprays

- 11.1.2. Diffusers

- 11.1.3. Scented Candles

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Convenience Stores/Grocery Stores

- 11.2.3. Online Retail

- 11.2.4. Other Didtribution channels

- 11.3. Market Analysis, Insights and Forecast - by Category

- 11.3.1. Mass

- 11.3.2. Premium

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Reckitt Benckiser Group PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Godrej Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Henkel AG & Co Kgaa

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 SC Johnson & Sons Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 The Procter & Gamble Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Newell Brands Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Doterra International LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Now Health Group Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Puzhen Life Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Bath & Body Works Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Reckitt Benckiser Group PLC

List of Figures

- Figure 1: Global Home Fragrances Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Home Fragrances Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Home Fragrances Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Home Fragrances Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Home Fragrances Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Home Fragrances Market Revenue (Million), by Category 2025 & 2033

- Figure 7: North America Home Fragrances Market Revenue Share (%), by Category 2025 & 2033

- Figure 8: North America Home Fragrances Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Home Fragrances Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Home Fragrances Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Home Fragrances Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Home Fragrances Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 13: Europe Home Fragrances Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Europe Home Fragrances Market Revenue (Million), by Category 2025 & 2033

- Figure 15: Europe Home Fragrances Market Revenue Share (%), by Category 2025 & 2033

- Figure 16: Europe Home Fragrances Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Home Fragrances Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Home Fragrances Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Home Fragrances Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Home Fragrances Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 21: Asia Pacific Home Fragrances Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Asia Pacific Home Fragrances Market Revenue (Million), by Category 2025 & 2033

- Figure 23: Asia Pacific Home Fragrances Market Revenue Share (%), by Category 2025 & 2033

- Figure 24: Asia Pacific Home Fragrances Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Home Fragrances Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Home Fragrances Market Revenue (Million), by Type 2025 & 2033

- Figure 27: South America Home Fragrances Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Home Fragrances Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: South America Home Fragrances Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: South America Home Fragrances Market Revenue (Million), by Category 2025 & 2033

- Figure 31: South America Home Fragrances Market Revenue Share (%), by Category 2025 & 2033

- Figure 32: South America Home Fragrances Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Home Fragrances Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Home Fragrances Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East Home Fragrances Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East Home Fragrances Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 37: Middle East Home Fragrances Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Middle East Home Fragrances Market Revenue (Million), by Category 2025 & 2033

- Figure 39: Middle East Home Fragrances Market Revenue Share (%), by Category 2025 & 2033

- Figure 40: Middle East Home Fragrances Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Home Fragrances Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: United Arab Emirates Home Fragrances Market Revenue (Million), by Type 2025 & 2033

- Figure 43: United Arab Emirates Home Fragrances Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: United Arab Emirates Home Fragrances Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 45: United Arab Emirates Home Fragrances Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: United Arab Emirates Home Fragrances Market Revenue (Million), by Category 2025 & 2033

- Figure 47: United Arab Emirates Home Fragrances Market Revenue Share (%), by Category 2025 & 2033

- Figure 48: United Arab Emirates Home Fragrances Market Revenue (Million), by Country 2025 & 2033

- Figure 49: United Arab Emirates Home Fragrances Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Home Fragrances Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Home Fragrances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Home Fragrances Market Revenue Million Forecast, by Category 2020 & 2033

- Table 4: Global Home Fragrances Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Home Fragrances Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Home Fragrances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Home Fragrances Market Revenue Million Forecast, by Category 2020 & 2033

- Table 8: Global Home Fragrances Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Home Fragrances Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Home Fragrances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Home Fragrances Market Revenue Million Forecast, by Category 2020 & 2033

- Table 16: Global Home Fragrances Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Germany Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: France Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Spain Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Home Fragrances Market Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global Home Fragrances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Home Fragrances Market Revenue Million Forecast, by Category 2020 & 2033

- Table 27: Global Home Fragrances Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: India Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: China Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Japan Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Australia Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Home Fragrances Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global Home Fragrances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Home Fragrances Market Revenue Million Forecast, by Category 2020 & 2033

- Table 36: Global Home Fragrances Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Home Fragrances Market Revenue Million Forecast, by Type 2020 & 2033

- Table 41: Global Home Fragrances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Home Fragrances Market Revenue Million Forecast, by Category 2020 & 2033

- Table 43: Global Home Fragrances Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Home Fragrances Market Revenue Million Forecast, by Type 2020 & 2033

- Table 45: Global Home Fragrances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 46: Global Home Fragrances Market Revenue Million Forecast, by Category 2020 & 2033

- Table 47: Global Home Fragrances Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: South Africa Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Rest of Middle East Home Fragrances Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Fragrances Market?

The projected CAGR is approximately 4.66%.

2. Which companies are prominent players in the Home Fragrances Market?

Key companies in the market include Reckitt Benckiser Group PLC, Godrej Group, Henkel AG & Co Kgaa, SC Johnson & Sons Inc, The Procter & Gamble Company, Newell Brands Inc, Doterra International LLC, Now Health Group Inc, Puzhen Life Co Ltd, Bath & Body Works Inc.

3. What are the main segments of the Home Fragrances Market?

The market segments include Type, Distribution Channel, Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Multi-dimensional Products; Growing Consumers' Inclination toward Home Decor.

6. What are the notable trends driving market growth?

Growing Consumers’ Inclination Toward Home Decor.

7. Are there any restraints impacting market growth?

Rising Environmental Concerns and Raw Material Price Volatility.

8. Can you provide examples of recent developments in the market?

October 2023: Enesco launched a new home fragrance brand, Herb Dublin and Irish Botanicals. The products include a wide range of scented candles and reed diffusers. The products are available in wellness-centered home and giftware offerings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Home Fragrances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Home Fragrances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Home Fragrances Market?

To stay informed about further developments, trends, and reports in the Home Fragrances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence