Key Insights

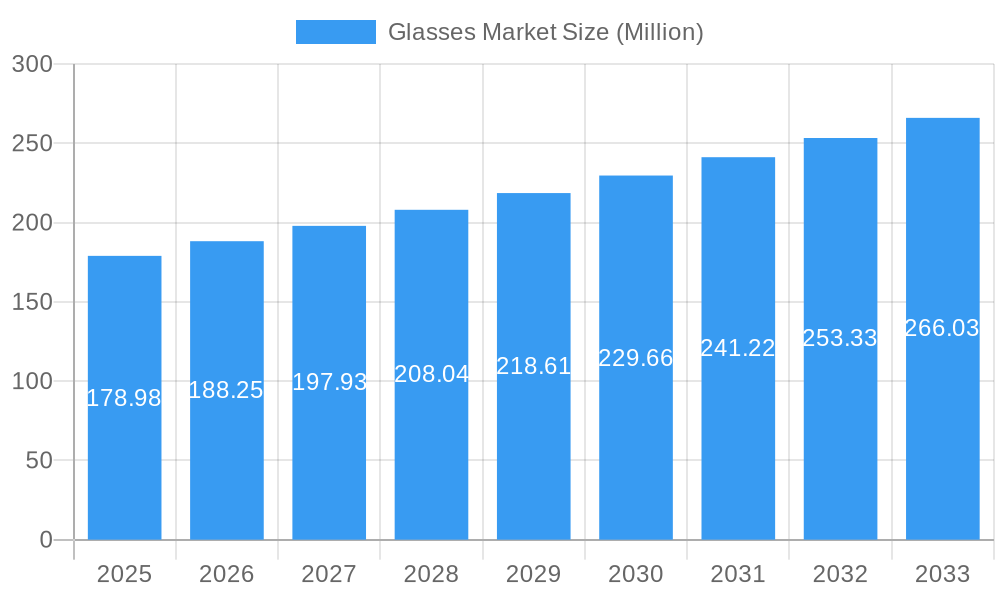

The global glasses market, valued at $178.98 million in 2025, is projected to experience robust growth, driven by increasing myopia rates worldwide, rising disposable incomes leading to higher spending on eyewear, and the growing popularity of fashionable eyewear as a fashion accessory. The market's Compound Annual Growth Rate (CAGR) of 5.08% from 2019 to 2024 suggests a continued expansion through 2033. Key growth drivers include technological advancements in lens technology (like progressive lenses and blue light filtering lenses), the rising adoption of online eyewear retailers offering convenience and competitive pricing, and the increasing demand for specialized eyewear like sports glasses and safety glasses. The market is segmented by distribution channel (offline and online), product type (spectacles, sunglasses, contact lenses, and other products), and geographic region. While the offline channel currently dominates, the online channel is experiencing rapid growth fueled by e-commerce platforms and improved digital marketing strategies. The spectacles segment holds the largest market share, followed by sunglasses, reflecting the high prevalence of refractive errors and the strong fashion appeal of sunglasses. Competitive landscape analysis reveals key players such as EssilorLuxottica SA, Johnson & Johnson, and Safilo Group, constantly innovating and expanding their product portfolios to cater to diverse consumer needs and preferences.

Glasses Market Market Size (In Million)

The regional distribution of the glasses market showcases significant variations. North America and Europe are currently mature markets with high per capita consumption, while Asia-Pacific is experiencing rapid growth due to its large and expanding middle class. Factors such as evolving consumer preferences, increasing awareness of eye health, and government initiatives promoting eye care contribute to the market’s dynamism. However, factors like price sensitivity in developing economies and the availability of affordable generic eyewear pose certain restraints to market growth. Nevertheless, the long-term outlook for the glasses market remains positive, driven by continuous innovation, evolving consumer demands, and the growing recognition of eye health as a crucial aspect of overall well-being. Further segmentation analysis might reveal promising niche markets, such as personalized eyewear solutions and advanced lens technologies, offering opportunities for new entrants and existing players alike.

Glasses Market Company Market Share

Glasses Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the global Glasses Market, encompassing market size, trends, and future projections from 2019 to 2033. With a focus on key players like EssilorLuxottica SA, Johnson & Johnson Services Inc., and others, this report offers crucial insights for investors, industry professionals, and strategic decision-makers. The report covers a total addressable market (TAM) valued at xx Million in 2025, with detailed segmentation across distribution channels (offline and online), product types (spectacles, sunglasses, contact lenses, and other products), and leading geographic regions. The study period covers 2019-2024 (historical), with the base year being 2025 and the forecast period extending to 2033.

Glasses Market Market Dynamics & Concentration

The global glasses market exhibits a moderately concentrated structure, with a few major players holding significant market share. EssilorLuxottica SA, for instance, commands a substantial portion due to its extensive product portfolio and global distribution network. However, smaller, specialized companies and emerging direct-to-consumer brands like Pair Eyewear are also gaining traction, driven by innovation and changing consumer preferences. Market concentration is further influenced by factors such as mergers and acquisitions (M&A) activity. In recent years, the market has witnessed several significant M&A deals, xx in 2023 and xx in 2022, mainly driven by the desire to expand product portfolios, enhance distribution capabilities, and access new technologies. This consolidated market structure is poised to evolve as technological advancements, like smart glasses and customized eyewear, reshape the competitive landscape. Regulatory frameworks related to eye health and safety also play a significant role, influencing product development and market access. The substitution of traditional glasses with contact lenses, and now, to some extent, augmented reality glasses, presents a dynamic challenge that companies must navigate effectively. End-user trends, primarily towards personalized and technologically advanced eyewear, significantly influence market growth.

- Market Share: EssilorLuxottica SA holds an estimated xx% market share.

- M&A Activity: An estimated xx M&A deals were recorded between 2020 and 2024.

Glasses Market Industry Trends & Analysis

The global glasses market is experiencing robust growth, driven by increasing prevalence of vision impairments, rising disposable incomes, and the growing popularity of fashion eyewear. The market is estimated to have achieved a CAGR of xx% from 2019 to 2024 and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Technological advancements, such as the integration of smart technology into eyewear, are revolutionizing the industry, creating new segments and expanding market potential. Consumer preferences are shifting towards personalized eyewear, customized frames, and fashionable designs, driving demand for direct-to-consumer brands and bespoke services. Competitive dynamics are marked by innovation, strategic partnerships (as seen in the Ray-Ban and EssilorLuxottica collaboration), and the continuous expansion of online distribution channels. Market penetration of online sales is expected to increase from xx% in 2024 to xx% by 2033.

Leading Markets & Segments in Glasses Market

The North American and European regions currently dominate the glasses market, driven by high disposable incomes, advanced healthcare infrastructure, and the prevalence of vision correction needs. The online channel segment is experiencing rapid growth, driven by e-commerce expansion and consumer preference for convenience. In terms of product type, spectacles continue to be the largest segment, followed by sunglasses. Contact lenses represent a significant portion, particularly within established markets. "Other" product types, including smart glasses and specialized eyewear, are expected to become significant contributors to market expansion in the future.

- Key Drivers – North America: Strong healthcare infrastructure, high disposable incomes, strong brand preference.

- Key Drivers – Europe: High prevalence of vision correction needs, established distribution networks.

- Key Drivers – Online Channel: Convenience, wider product selection, competitive pricing.

- Key Drivers – Spectacles: High demand for vision correction, wide range of styles available.

Glasses Market Product Developments

The glasses market is witnessing significant innovation. Smart glasses, integrating advanced features like augmented reality and improved audio-visual capabilities, are gaining traction. Customizable eyewear, offered by brands like Pair Eyewear, allows consumers to personalize their glasses. This focus on personalization, combined with advancements in lens technology and frame materials, is creating a more diverse and sophisticated product landscape.

Key Drivers of Glasses Market Growth

Several factors contribute to the Glasses Market’s growth. Technological advancements, such as the development of smart glasses and improved lens materials, drive innovation and attract new consumers. Rising disposable incomes in emerging economies contribute to increased purchasing power, fueling market demand. Stringent regulatory frameworks regarding eye health enhance awareness and drive demand for eye care products. Furthermore, strategic partnerships and M&A activities promote market expansion and introduce innovative products.

Challenges in the Glasses Market Market

The Glasses Market faces several challenges. Stringent regulatory hurdles regarding product safety and labeling can impede market entry and expansion. Supply chain disruptions can lead to increased costs and production delays. Intense competition from both established and emerging players creates pressure on pricing and profitability. These factors contribute to an overall complex market environment.

Emerging Opportunities in Glasses Market

The integration of augmented reality and virtual reality technologies presents significant opportunities. Strategic partnerships between eyewear brands and technology companies can create synergistic growth. Expansion into emerging markets and untapped segments offers substantial potential for market growth. These factors indicate the future of glasses markets is bright, with strong potential for continued innovation and expansion.

Leading Players in the Glasses Market Sector

- Burberry Group PLC

- Carl-Zeiss-Stiftung

- Fielmann AG

- EssilorLuxottica SA

- De Rigo Vision SpA

- Bausch Health Companies Inc

- Johnson & Johnson Services Inc

- Alcon Laboratories Inc

- Charmant Group

- Safilo Group SpA

- The Cooper Companies Inc

Key Milestones in Glasses Market Industry

- September 2023: Ray-Ban and EssilorLuxottica launched a new generation of Ray-Ban Meta smart glasses, showcasing technological advancement.

- January 2024: Pair Eyewear's partnership with National Vision Inc. expanded its reach within the US market, highlighting the growing importance of direct-to-consumer models.

- March 2022: Web Eyewear launched a new sunglasses collection, demonstrating ongoing innovation in eyewear design.

Strategic Outlook for Glasses Market Market

The Glasses Market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and expansion into new markets. Strategic partnerships and investments in research and development will be key to securing a competitive advantage. Companies that effectively adapt to technological changes and cater to consumer demand for personalization and style will be best positioned for success in this dynamic market.

Glasses Market Segmentation

-

1. Product Type

- 1.1. Spectacles

- 1.2. Sunglasses

- 1.3. Contact Lenses

- 1.4. Other Product Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Unisex

-

3. Distribution Channel

- 3.1. Offline Channel

- 3.2. Online Channel

Glasses Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Glasses Market Regional Market Share

Geographic Coverage of Glasses Market

Glasses Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Vegan and Cruelty-free Products; Influence of Social Media on Young Adults

- 3.3. Market Restrains

- 3.3.1. Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Growing Popularity of Sports Sunglasses

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Glasses Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Spectacles

- 5.1.2. Sunglasses

- 5.1.3. Contact Lenses

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Unisex

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Channel

- 5.3.2. Online Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Glasses Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Spectacles

- 6.1.2. Sunglasses

- 6.1.3. Contact Lenses

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Unisex

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Offline Channel

- 6.3.2. Online Channel

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Glasses Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Spectacles

- 7.1.2. Sunglasses

- 7.1.3. Contact Lenses

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Unisex

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Offline Channel

- 7.3.2. Online Channel

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Glasses Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Spectacles

- 8.1.2. Sunglasses

- 8.1.3. Contact Lenses

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Unisex

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Offline Channel

- 8.3.2. Online Channel

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Glasses Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Spectacles

- 9.1.2. Sunglasses

- 9.1.3. Contact Lenses

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Unisex

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Offline Channel

- 9.3.2. Online Channel

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Glasses Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Spectacles

- 10.1.2. Sunglasses

- 10.1.3. Contact Lenses

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Men

- 10.2.2. Women

- 10.2.3. Unisex

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Offline Channel

- 10.3.2. Online Channel

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Burberry Group PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Carl-Zeiss-Stiftung

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fielmann AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 EssilorLuxottica SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 De Rigo Vision SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bausch Health Companies Inc *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson & Johnson Services Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Alcon Laboratories Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Charmant Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Safilo Group SpA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Cooper Companies Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Burberry Group PLC

List of Figures

- Figure 1: Global Glasses Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Glasses Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Glasses Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Glasses Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Glasses Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Glasses Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Glasses Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Glasses Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Glasses Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Glasses Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Glasses Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Glasses Market Revenue (Million), by End User 2025 & 2033

- Figure 13: Europe Glasses Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe Glasses Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: Europe Glasses Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Glasses Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Glasses Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Glasses Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Glasses Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Glasses Market Revenue (Million), by End User 2025 & 2033

- Figure 21: Asia Pacific Glasses Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Pacific Glasses Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Glasses Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Glasses Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Glasses Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Glasses Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: South America Glasses Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Glasses Market Revenue (Million), by End User 2025 & 2033

- Figure 29: South America Glasses Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Glasses Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: South America Glasses Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Glasses Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Glasses Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Glasses Market Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Middle East and Africa Glasses Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East and Africa Glasses Market Revenue (Million), by End User 2025 & 2033

- Figure 37: Middle East and Africa Glasses Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East and Africa Glasses Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Middle East and Africa Glasses Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East and Africa Glasses Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Glasses Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Glasses Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 7: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Glasses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Glasses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Spain Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Germany Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Italy Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Russia Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 25: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Glasses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: China Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Japan Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: India Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Australia Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Glasses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 41: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Glasses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: South Africa Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Saudi Arabia Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East and Africa Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Glasses Market?

The projected CAGR is approximately 5.08%.

2. Which companies are prominent players in the Glasses Market?

Key companies in the market include Burberry Group PLC, Carl-Zeiss-Stiftung, Fielmann AG, EssilorLuxottica SA, De Rigo Vision SpA, Bausch Health Companies Inc *List Not Exhaustive, Johnson & Johnson Services Inc, Alcon Laboratories Inc, Charmant Group, Safilo Group SpA, The Cooper Companies Inc.

3. What are the main segments of the Glasses Market?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 178.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Vegan and Cruelty-free Products; Influence of Social Media on Young Adults.

6. What are the notable trends driving market growth?

Growing Popularity of Sports Sunglasses.

7. Are there any restraints impacting market growth?

Counterfeit Products.

8. Can you provide examples of recent developments in the market?

January 2024: Pair Eyewear, the direct-to-consumer customizable eyewear brand, unveiled a new partnership with National Vision Inc., the second-largest optical retailer in America. The brand stated that this partnership helps introduce affordable bundles, including Pair’s customizable, stylish, and accessible eyewear.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Glasses Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Glasses Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Glasses Market?

To stay informed about further developments, trends, and reports in the Glasses Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence