Key Insights

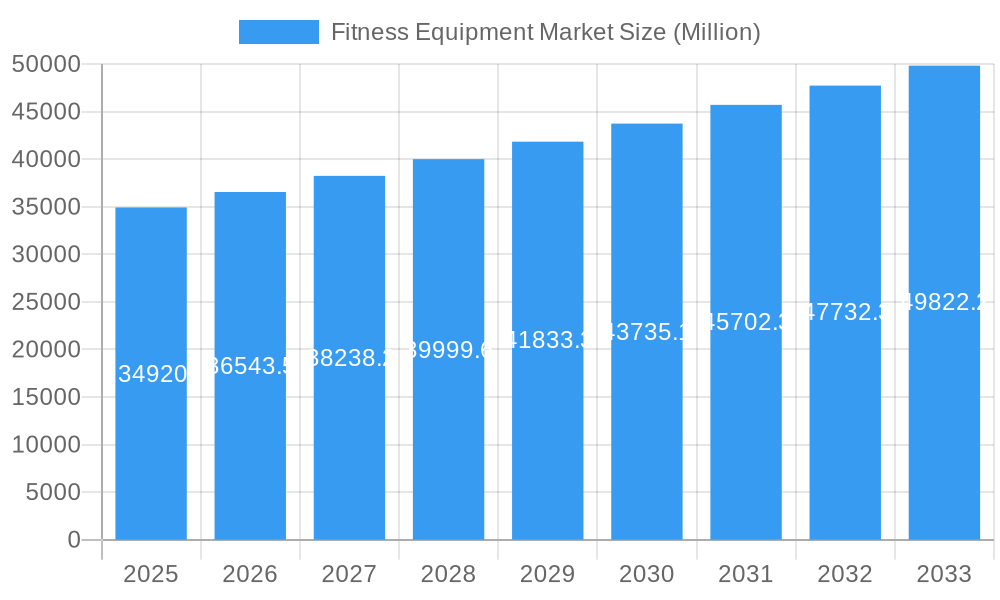

The global fitness equipment market, valued at $34.92 billion in 2025, is projected to experience robust growth, driven by several key factors. Increasing health consciousness, rising disposable incomes in developing economies, and the expanding adoption of home fitness solutions are major contributors to this expansion. The market's 4.74% CAGR indicates a steady increase in demand across various product types, including treadmills, elliptical machines, stationary cycles, and strength training equipment. The shift towards personalized fitness routines, fueled by advancements in technology and the rise of fitness apps, is further accelerating market growth. Online retail channels are gaining significant traction, offering consumers convenience and a wider selection compared to traditional offline stores. However, the market faces challenges like fluctuating raw material prices and increasing competition from budget-friendly brands. The residential segment continues to dominate, albeit with increasing demand from the commercial sector, especially in gyms and fitness centers, reflecting the growth of the overall fitness industry. Specific regional variations exist, with North America and Europe currently holding substantial market shares, while the Asia-Pacific region presents a promising growth opportunity due to increasing urbanization and rising health awareness. The competitive landscape is characterized by established players alongside emerging brands, leading to innovation and price competition.

Fitness Equipment Market Market Size (In Billion)

Over the forecast period (2025-2033), the fitness equipment market is expected to witness continued expansion, driven by factors such as technological advancements in equipment design, the integration of smart features, and the rising popularity of virtual fitness classes. Growth will likely be concentrated in regions experiencing rapid economic growth and increasing health awareness. The continued development of innovative product types and targeted marketing strategies, catering to diverse customer demographics and fitness goals, will play a crucial role in shaping future market dynamics. The emergence of subscription-based fitness models and the integration of wearable technology with fitness equipment are also expected to contribute to the market's expansion. However, maintaining sustainable supply chains and addressing concerns about product durability will be critical for long-term market success. Companies must adapt to evolving consumer preferences and competitive pressures to maintain their market position.

Fitness Equipment Market Company Market Share

This comprehensive report provides a detailed analysis of the Fitness Equipment Market, covering the period 2019-2033, with a focus on the year 2025. It offers actionable insights for industry stakeholders, investors, and businesses looking to navigate this dynamic market. The report leverages extensive market research to provide a clear picture of current trends and future projections, including market size (in Millions), growth rates, and key market drivers. Download now to gain a competitive edge!

Fitness Equipment Market Dynamics & Concentration

The global fitness equipment market exhibits a moderately concentrated structure, with key players holding significant market share. Market concentration is influenced by factors like brand recognition, technological innovation, and distribution network strength. The market share of the top 5 players is estimated at xx%.

Innovation Drivers: Technological advancements, such as smart fitness equipment integration, virtual reality workouts, and personalized fitness tracking, are key innovation drivers. These features cater to the evolving demands of health-conscious consumers.

Regulatory Frameworks: Government regulations concerning product safety and standards influence market dynamics. For instance, compliance with safety standards can increase production costs, while stringent environmental regulations may affect material sourcing.

Product Substitutes: The availability of alternative fitness options, including outdoor activities, online fitness classes, and bodyweight exercises, presents competitive pressure. This affects the market's growth depending on consumer preferences and economic factors.

End-User Trends: The increasing awareness of health and wellness is a primary driver of market growth. Consumers are increasingly seeking convenient and effective fitness solutions, driving demand for both home and commercial fitness equipment.

M&A Activities: The fitness equipment industry has seen notable M&A activity in recent years. The number of M&A deals recorded between 2019 and 2024 is estimated at xx. These activities primarily aim to expand market reach, enhance product portfolios, and strengthen competitive positioning. For example, Johnson Health Tech’s acquisition of Matrix Fitness South Africa in August 2021 significantly expanded its presence in the African market.

Fitness Equipment Market Industry Trends & Analysis

The global fitness equipment market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) projected at xx% during the forecast period (2025-2033). Several factors contribute to this growth:

- Rising health consciousness: Increased awareness of the importance of physical fitness and overall wellness among consumers is a significant driver.

- Technological advancements: The integration of smart technology and connected fitness features enhances user experience and engagement, stimulating demand.

- Evolving consumer preferences: Consumers are increasingly seeking personalized and convenient workout solutions, driving demand for at-home fitness equipment.

- Competitive dynamics: Intense competition among manufacturers pushes innovation and affordability, benefiting consumers. Market penetration of smart fitness equipment is estimated at xx% in 2025.

- Growing adoption of online fitness platforms: The rising popularity of online fitness classes and virtual training programs has increased demand for compatible equipment.

Leading Markets & Segments in Fitness Equipment Market

The North American region currently holds the dominant position in the fitness equipment market, followed by Europe and Asia-Pacific. Within the segments, strength training equipment and treadmills are the most popular product types. The online retail channel is experiencing significant growth, fueled by e-commerce expansion and convenient home delivery.

Key Drivers for Dominant Regions/Segments:

- North America: High disposable income, increasing health awareness, and well-established fitness culture.

- Strength Training Equipment: Versatility for diverse fitness goals and effectiveness in building muscle strength.

- Online Retail Stores: Convenience, wider product selection, and competitive pricing.

Detailed Dominance Analysis: The dominance of North America is attributed to high health consciousness, disposable income, and established fitness culture. Strength training equipment’s popularity stems from its effectiveness and versatility, appealing to a broad range of fitness enthusiasts. The rapid growth of online retail is driven by enhanced convenience and expanding reach.

Fitness Equipment Market Product Developments

Recent product developments focus on incorporating smart technology, enhanced user experience, and compact designs. Smart features like integrated apps, personalized workout programs, and heart rate monitoring are increasingly common. This trend aligns with the growing demand for convenient and personalized fitness solutions, catering to both home and commercial settings. Compact and foldable designs are gaining popularity, addressing space constraints in urban living environments.

Key Drivers of Fitness Equipment Market Growth

The fitness equipment market is experiencing robust growth, propelled by a confluence of powerful factors. These include:

- Technological Advancements & Smart Integration: The integration of smart technology is revolutionizing the fitness landscape. Connected fitness equipment, offering real-time performance tracking, personalized training programs guided by AI, and seamless integration with popular fitness apps, is driving significant consumer adoption. Innovations like interactive displays, virtual coaching, and biometric feedback systems are enhancing user experience and efficacy.

- Rising Disposable Incomes & Economic Expansion: As global economies continue to develop, particularly in emerging markets, a growing middle class with increased disposable incomes is prioritizing health and wellness. This financial capacity translates directly into higher spending on home fitness solutions and gym memberships, fueling market demand.

- Government Initiatives & Public Health Focus: Governments worldwide are increasingly recognizing the importance of public health and promoting active lifestyles. Initiatives such as subsidies for fitness facilities, campaigns encouraging physical activity, and investments in community wellness programs are creating a more supportive environment for the fitness equipment market.

- Shifting Consumer Lifestyles & Health Consciousness: A growing awareness of the benefits of regular exercise for physical and mental well-being, coupled with the convenience of home-based workouts, is a major catalyst. The desire for preventative healthcare and a proactive approach to fitness is leading more individuals to invest in home fitness equipment and seek out professional training solutions.

Challenges in the Fitness Equipment Market

The fitness equipment market faces several challenges:

- Supply chain disruptions: Global events can cause delays and shortages, affecting production and delivery timelines. The impact on sales in 2022 due to supply chain issues is estimated at xx Million.

- Intense competition: Competition among numerous manufacturers necessitates continuous innovation and cost optimization.

- Economic downturns: Recessions or economic instability can significantly reduce consumer spending on discretionary items like fitness equipment.

Emerging Opportunities in Fitness Equipment Market

The fitness equipment market is ripe with emerging opportunities, driven by evolving consumer demands and technological innovations. Key areas for growth include:

- Expansion into Underserved Markets: Significant potential lies in reaching demographics and geographical regions that are currently underserved. This could involve developing more affordable or accessible equipment options for lower-income segments or tailoring product offerings to the unique needs of specific cultural or regional markets.

- Strategic Partnerships with Digital Fitness Ecosystems: Collaborations with fitness apps, virtual reality (VR) platforms, and online coaching services are becoming increasingly vital. Integrating equipment seamlessly with these digital platforms provides users with a more holistic and engaging fitness experience, creating new revenue streams and expanding market reach. The integration of VR technology into fitness equipment, for instance, promises to create immersive and gamified workouts, attracting a wider audience.

- Niche Market Development & Specialization: The development of highly specialized equipment catering to specific niche segments presents a significant opportunity. This includes creating fitness solutions tailored for particular demographics, such as adaptive equipment for individuals with disabilities, senior-friendly exercise machines, or engaging and safe equipment designed for children's fitness.

- Sustainability and Eco-Friendly Equipment: A growing consumer preference for sustainable and environmentally conscious products offers a new avenue for innovation. Developing fitness equipment made from recycled materials, with energy-efficient designs, or offering repair and refurbishment programs can appeal to a socially responsible consumer base.

Leading Players in the Fitness Equipment Market Sector

- IFIT Inc

- Jerai Fitness Pvt Ltd

- Life Fitness

- Nautilus Inc

- Technogym SpA

- Total Gym

- Johnson Health Tech Co

- Body-Solid Inc

- Waterrower NOHRD Gmbh

- Powertec

Key Milestones in Fitness Equipment Market Industry

- August 2021: Johnson Health Tech (JHT) strategically acquired Matrix Fitness South Africa, significantly expanding its presence and distribution network across the African continent and reinforcing its commitment to global market penetration.

- September 2022: Peloton Interactive, Inc. unveiled the Peloton Row, a new rowing machine featuring advanced technology and immersive content, aiming to diversify its product portfolio and cater to a broader range of fitness enthusiasts.

- April 2023: Life Fitness solidified its position in the hospitality sector by partnering with Bayerwaldhof, a renowned wellness hotel, to equip its premium facilities with Life Fitness's state-of-the-art fitness equipment, showcasing the brand's suitability for high-end leisure environments.

- November 2023: Technogym announced the launch of its innovative "Mywellness Cloud" platform update, enhancing personalized training experiences and data integration for both consumers and fitness professionals, further solidifying its digital fitness leadership.

Strategic Outlook for Fitness Equipment Market

The fitness equipment market is on an upward trajectory, projecting sustained and significant growth in the coming years. This optimistic outlook is fueled by a powerful combination of relentless technological innovation, a pervasive increase in health and wellness awareness across all age groups, and the expanding market penetration into developing economies where fitness is becoming a growing priority. To achieve continued success and capitalize on future opportunities, companies must embrace strategic partnerships, not only with digital platforms but also within the broader health and wellness ecosystem. Diversifying product offerings to cater to a wider range of consumer needs and preferences, with a particular emphasis on personalized fitness solutions and smart integration, will be paramount. The market is anticipated to reach approximately $XX Billion by 2033, underscoring the immense potential for growth and innovation within this dynamic industry.

Fitness Equipment Market Segmentation

-

1. Product Type

- 1.1. Treadmills

- 1.2. Elliptical Machines

- 1.3. Stationary Cycles

- 1.4. Rowing Machines

- 1.5. Strength Training Equipment

- 1.6. Other Product Types

-

2. Category

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Offline Retail Stores

- 3.2. Online Retail Stores

Fitness Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Fitness Equipment Market Regional Market Share

Geographic Coverage of Fitness Equipment Market

Fitness Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Healthy Lifestyle; Integration of Technology In Fitness Equipment

- 3.3. Market Restrains

- 3.3.1. Alternative Fitness Solutions Pose a Threat

- 3.4. Market Trends

- 3.4.1. Inclination Toward a Healthy Lifestyle

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Treadmills

- 5.1.2. Elliptical Machines

- 5.1.3. Stationary Cycles

- 5.1.4. Rowing Machines

- 5.1.5. Strength Training Equipment

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Retail Stores

- 5.3.2. Online Retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Treadmills

- 6.1.2. Elliptical Machines

- 6.1.3. Stationary Cycles

- 6.1.4. Rowing Machines

- 6.1.5. Strength Training Equipment

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Offline Retail Stores

- 6.3.2. Online Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Treadmills

- 7.1.2. Elliptical Machines

- 7.1.3. Stationary Cycles

- 7.1.4. Rowing Machines

- 7.1.5. Strength Training Equipment

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Offline Retail Stores

- 7.3.2. Online Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Treadmills

- 8.1.2. Elliptical Machines

- 8.1.3. Stationary Cycles

- 8.1.4. Rowing Machines

- 8.1.5. Strength Training Equipment

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Offline Retail Stores

- 8.3.2. Online Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Treadmills

- 9.1.2. Elliptical Machines

- 9.1.3. Stationary Cycles

- 9.1.4. Rowing Machines

- 9.1.5. Strength Training Equipment

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Category

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Offline Retail Stores

- 9.3.2. Online Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Fitness Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Treadmills

- 10.1.2. Elliptical Machines

- 10.1.3. Stationary Cycles

- 10.1.4. Rowing Machines

- 10.1.5. Strength Training Equipment

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Category

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Offline Retail Stores

- 10.3.2. Online Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 IFIT Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jerai Fitness Pvt Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Life Fitness

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nautilus Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Technogym SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Total Gym

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson Health Tech Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Body-Solid Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Waterrower NOHRD Gmbh

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Powertec *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 IFIT Inc

List of Figures

- Figure 1: Global Fitness Equipment Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Fitness Equipment Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Fitness Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Fitness Equipment Market Revenue (Million), by Category 2025 & 2033

- Figure 5: North America Fitness Equipment Market Revenue Share (%), by Category 2025 & 2033

- Figure 6: North America Fitness Equipment Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Fitness Equipment Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Fitness Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Fitness Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Fitness Equipment Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Fitness Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Fitness Equipment Market Revenue (Million), by Category 2025 & 2033

- Figure 13: Europe Fitness Equipment Market Revenue Share (%), by Category 2025 & 2033

- Figure 14: Europe Fitness Equipment Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: Europe Fitness Equipment Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Fitness Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Fitness Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Fitness Equipment Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Fitness Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Fitness Equipment Market Revenue (Million), by Category 2025 & 2033

- Figure 21: Asia Pacific Fitness Equipment Market Revenue Share (%), by Category 2025 & 2033

- Figure 22: Asia Pacific Fitness Equipment Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Fitness Equipment Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Fitness Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Fitness Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Fitness Equipment Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: South America Fitness Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Fitness Equipment Market Revenue (Million), by Category 2025 & 2033

- Figure 29: South America Fitness Equipment Market Revenue Share (%), by Category 2025 & 2033

- Figure 30: South America Fitness Equipment Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: South America Fitness Equipment Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Fitness Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Fitness Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Fitness Equipment Market Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Middle East and Africa Fitness Equipment Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East and Africa Fitness Equipment Market Revenue (Million), by Category 2025 & 2033

- Figure 37: Middle East and Africa Fitness Equipment Market Revenue Share (%), by Category 2025 & 2033

- Figure 38: Middle East and Africa Fitness Equipment Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Middle East and Africa Fitness Equipment Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East and Africa Fitness Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Fitness Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fitness Equipment Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Fitness Equipment Market Revenue Million Forecast, by Category 2020 & 2033

- Table 3: Global Fitness Equipment Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Fitness Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Fitness Equipment Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Fitness Equipment Market Revenue Million Forecast, by Category 2020 & 2033

- Table 7: Global Fitness Equipment Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Fitness Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Fitness Equipment Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Fitness Equipment Market Revenue Million Forecast, by Category 2020 & 2033

- Table 15: Global Fitness Equipment Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Fitness Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Spain Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Germany Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Italy Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Fitness Equipment Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Fitness Equipment Market Revenue Million Forecast, by Category 2020 & 2033

- Table 25: Global Fitness Equipment Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 26: Global Fitness Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: China Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Japan Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: India Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Australia Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Fitness Equipment Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Fitness Equipment Market Revenue Million Forecast, by Category 2020 & 2033

- Table 34: Global Fitness Equipment Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Fitness Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Brazil Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Argentina Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of South America Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Fitness Equipment Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 40: Global Fitness Equipment Market Revenue Million Forecast, by Category 2020 & 2033

- Table 41: Global Fitness Equipment Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Fitness Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: South Africa Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: United Arab Emirates Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of Middle East and Africa Fitness Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fitness Equipment Market?

The projected CAGR is approximately 4.74%.

2. Which companies are prominent players in the Fitness Equipment Market?

Key companies in the market include IFIT Inc, Jerai Fitness Pvt Ltd, Life Fitness, Nautilus Inc, Technogym SpA, Total Gym, Johnson Health Tech Co, Body-Solid Inc, Waterrower NOHRD Gmbh, Powertec *List Not Exhaustive.

3. What are the main segments of the Fitness Equipment Market?

The market segments include Product Type, Category , Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Healthy Lifestyle; Integration of Technology In Fitness Equipment.

6. What are the notable trends driving market growth?

Inclination Toward a Healthy Lifestyle.

7. Are there any restraints impacting market growth?

Alternative Fitness Solutions Pose a Threat.

8. Can you provide examples of recent developments in the market?

April 2023: Life Fitness partnered with Bayerwaldhof, a wellness hotel, to furnish its new fitness room with premium fitness equipment, ensuring a top-notch wellness experience for guests.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fitness Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fitness Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fitness Equipment Market?

To stay informed about further developments, trends, and reports in the Fitness Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence