Key Insights

The European winter sports equipment market, valued at approximately €17.78 billion in 2025, is projected for consistent growth at a Compound Annual Growth Rate (CAGR) of 5.87%. This expansion is driven by increasing participation across demographics and rising disposable incomes in key European nations. Germany, France, Italy, and the UK are primary contributors, leveraging established winter sports culture and robust tourism infrastructure. The market is segmented by sport, with skiing and snowboarding leading, by end-user (balanced distribution across men, women, and children), and by distribution channel (significant presence of both online and offline retail). Technological advancements in equipment design, focusing on enhanced performance, safety, and comfort, alongside targeted marketing to younger audiences, further fuel growth. Potential restraints include unpredictable weather, environmental concerns, and economic volatility. The forecast period (2025-2033) anticipates moderate, continued expansion, shaped by these dynamics. The competitive landscape features established global brands and specialized niche players. Sustainable and eco-conscious product development is poised to become a key differentiator.

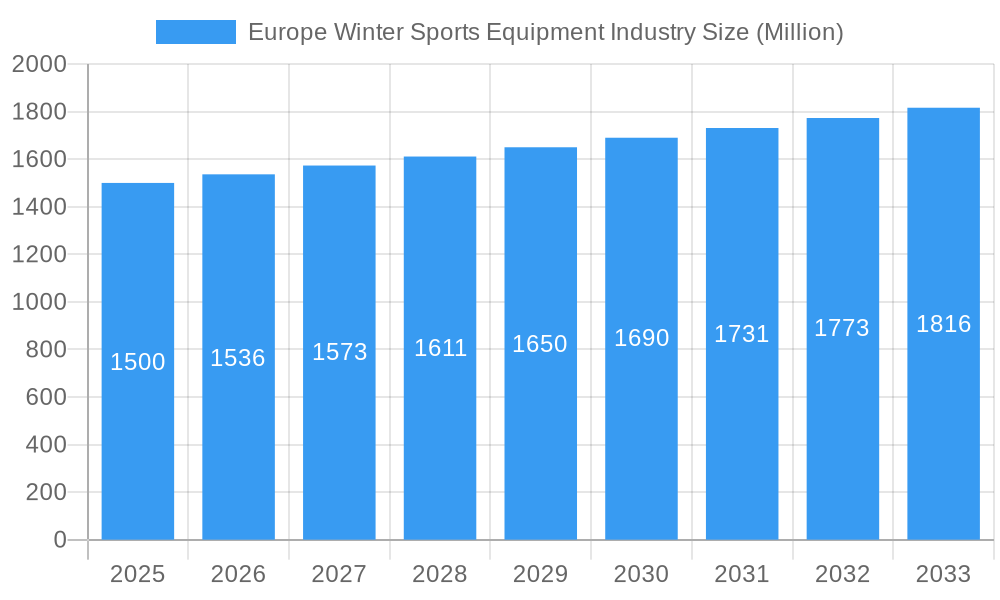

Europe Winter Sports Equipment Industry Market Size (In Billion)

The market's 5.87% CAGR indicates a steady growth trajectory. While online retail is expanding, physical stores remain vital for product evaluation and expert advice. Regional variations exist, with countries like Sweden showing high per capita spending due to strong skiing traditions. Future success hinges on innovation, adaptability to consumer preferences, and addressing sustainability concerns while maintaining competitive pricing and efficient distribution. Enhanced customer experience, technology integration, and promotion of responsible tourism practices will be crucial.

Europe Winter Sports Equipment Industry Company Market Share

Europe Winter Sports Equipment Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Winter Sports Equipment industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. From market size and segmentation to leading players and future trends, this report covers all key aspects, utilizing data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033). The total market value in 2025 is estimated at xx Million, with a projected CAGR of xx% during the forecast period.

Europe Winter Sports Equipment Industry Market Dynamics & Concentration

The European winter sports equipment market exhibits a moderately concentrated landscape, with several key players holding significant market share. While precise market share data for each company is proprietary and varies based on specific product categories, we estimate that the top five players collectively hold approximately xx% of the market in 2025. Innovation drives market dynamics, with companies constantly developing advanced materials, improved designs, and integrated technologies to enhance performance and safety. Stringent safety regulations, particularly concerning equipment durability and child safety, are significant factors shaping product development and distribution. The rise of e-commerce is a key disruptive force, impacting both sales channels and customer expectations. Product substitutes, such as virtual reality winter sports experiences, pose a minor but growing challenge. Consumer trends favor sustainability and eco-friendly materials, influencing both purchasing decisions and manufacturing practices. M&A activity in the sector has been relatively moderate in recent years, with an estimated xx merger and acquisition deals between 2019-2024.

- Key Market Drivers: Innovation, Safety Regulations, E-commerce Growth

- Key Challenges: Substitute Products, Sustainability Concerns, Moderate M&A activity

Europe Winter Sports Equipment Industry Industry Trends & Analysis

The European winter sports equipment market is projected to experience steady growth driven by increasing participation in winter sports, particularly amongst younger demographics. However, climate change and unpredictable snowfall patterns pose a significant risk, potentially impacting the demand for certain equipment types. Technological advancements, including the integration of smart sensors, improved materials, and personalized fitting technologies, are transforming product design and functionality. Consumer preferences are shifting towards lighter, more durable, and environmentally friendly equipment, influencing innovation and market positioning. The competitive landscape is characterized by both intense rivalry amongst established players and the emergence of niche brands catering to specific segments or sustainability-focused consumers. The market penetration of online retail channels is steadily increasing, altering distribution strategies and consumer engagement. This translates to an overall CAGR of xx% between 2025 and 2033.

Leading Markets & Segments in Europe Winter Sports Equipment Industry

The dominance within the European winter sports equipment market is shared among several countries, with France, Germany, and Austria consistently leading in sales. This leadership is fueled by strong winter sports cultures, established infrastructure, and robust tourism sectors. The ski segment remains the dominant sport, accounting for approximately xx% of total market value in 2025.

By Sport:

- Ski: Dominant segment due to established participation levels and diverse equipment needs (Alpine, Nordic, etc.).

- Snowboard: Significant segment with steady growth driven by evolving board designs and increased participation.

By End-User:

- Men: Largest segment due to higher overall participation rates.

- Women: Growing segment with increasing participation and specialized equipment.

- Children: Significant segment with specialized equipment needs and considerable growth potential.

By Distribution Channel:

- Offline Retail Stores: Remains the primary distribution channel, though online penetration is increasing.

- Online Retail Stores: Experiencing rapid growth due to convenience and broader reach.

Key Drivers of Regional Dominance: Strong winter sports culture, well-developed tourism infrastructure, favorable economic conditions, government support for winter sports development.

Europe Winter Sports Equipment Industry Product Developments

The European winter sports equipment industry is experiencing a wave of innovation focused on enhancing performance, safety, and sustainability. Lightweight yet incredibly durable materials, such as advanced composites and recycled plastics, are revolutionizing equipment design. Sophisticated binding systems, incorporating improved safety mechanisms and personalized adjustments, are minimizing injury risks. Integration of cutting-edge technologies, including GPS tracking, biometrics monitoring, and smart connectivity features, provides real-time performance data and enhanced safety features. Manufacturers are increasingly focusing on customizable and personalized fitting solutions, utilizing 3D scanning and other technologies to ensure optimal comfort and performance for a wider range of body types and skill levels. Crucially, a significant shift towards eco-friendly materials, sustainable manufacturing processes, and responsible sourcing is gaining momentum, reflecting the growing consumer demand for environmentally conscious products and brands. This includes the use of recycled materials, reduced carbon footprints, and ethically sourced components.

Key Drivers of Europe Winter Sports Equipment Industry Growth

Robust growth in the European winter sports equipment industry is fueled by a confluence of factors. The rising popularity of winter sports, particularly amongst younger demographics, is driving demand for both high-performance and entry-level equipment. Technological advancements continuously enhance product features and performance, creating a cycle of innovation and consumer interest. Favorable economic conditions in several key European markets contribute to increased discretionary spending on recreational activities, including winter sports. Significant investments in winter sports infrastructure, including the development of new resorts and the improvement of existing facilities, are further boosting the industry. Government initiatives promoting winter tourism and supporting local industries, coupled with the growing popularity of eco-tourism, also provide valuable support for the sector's expansion.

Challenges in the Europe Winter Sports Equipment Industry Market

The European winter sports equipment industry faces several significant challenges. The most pressing is the undeniable impact of climate change on snowfall patterns, leading to shorter winter seasons, reduced resort profitability, and increased uncertainty for the industry. Supply chain disruptions, exacerbated by geopolitical instability and global events, continue to impact the availability and cost of raw materials. This, combined with rising energy prices and transportation costs, increases manufacturing expenses and puts pressure on profit margins. Intense competition amongst established and emerging brands necessitates continuous innovation and efficient cost management to maintain market share and profitability. The escalating demand for environmentally sustainable products increases manufacturing complexity and costs, requiring companies to make substantial investments in eco-friendly processes and materials. Finally, economic fluctuations across Europe directly impact consumer spending on recreational activities such as winter sports, creating further volatility in the market.

Emerging Opportunities in Europe Winter Sports Equipment Industry

Despite the challenges, significant growth opportunities exist for innovative players in the European winter sports equipment industry. The development of smart and connected equipment, utilizing sensors, wearables, and IoT technology, offers substantial potential. These technologies enable performance monitoring, real-time feedback, and improved safety features, appealing to both professional athletes and recreational users. Expanding into new, underserved markets within Europe presents further growth potential, as does targeting niche segments with highly personalized and specialized products. Strategic partnerships and collaborations between manufacturers, retailers, technology providers, and even tourism operators can foster innovation, accelerate market expansion, and create more robust supply chains. Investing in sustainable practices can also attract environmentally conscious consumers and unlock new market segments.

Leading Players in the Europe Winter Sports Equipment Industry Sector

- Vista Outdoor Inc

- Marker Dalbello Volkl (International) GmbH

- Åre Skidfabrik AB

- Burton Snowboards

- Tecnica Group SpA

- Groupe Rossignol

- Amer Sports Oyj

- UVEX group

- Alpina d o o

- Clarus Corporation

- Fischer Beteiligungsverwaltungs GmbH

Key Milestones in Europe Winter Sports Equipment Industry Industry

- 2020: Several major players launched sustainable product lines, reflecting the growing demand for eco-friendly equipment.

- 2021: Significant investments were made in research and development focused on smart and connected winter sports equipment.

- 2022: The impact of the global supply chain crisis resulted in material shortages and increased production costs.

- 2023: Several key mergers and acquisitions consolidated market share among leading players.

Strategic Outlook for Europe Winter Sports Equipment Industry Market

The future of the European winter sports equipment industry hinges on adapting to climate change impacts and embracing technological innovations. Sustainable manufacturing practices will become increasingly crucial for long-term success. Strategic partnerships and diversification into related markets, such as outdoor apparel and accessories, will offer growth potential. Focusing on specialized segments and leveraging e-commerce channels will be key to gaining market share and driving revenue growth.

Europe Winter Sports Equipment Industry Segmentation

-

1. Sport

-

1.1. Ski

- 1.1.1. Skis and Poles

- 1.1.2. Ski Boots

- 1.1.3. Other Protective Gear and Accessories

- 1.2. Snowboard

-

1.1. Ski

-

2. End-User

- 2.1. Men

- 2.2. Women

- 2.3. Children

-

3. Distribution Channel

- 3.1. Online Retail Stores

- 3.2. Offline Retail Stores

Europe Winter Sports Equipment Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Switzerland

- 6. Austria

- 7. Spain

- 8. Rest of Europe

Europe Winter Sports Equipment Industry Regional Market Share

Geographic Coverage of Europe Winter Sports Equipment Industry

Europe Winter Sports Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Growing Number Of Ski Destinations Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sport

- 5.1.1. Ski

- 5.1.1.1. Skis and Poles

- 5.1.1.2. Ski Boots

- 5.1.1.3. Other Protective Gear and Accessories

- 5.1.2. Snowboard

- 5.1.1. Ski

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Children

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online Retail Stores

- 5.3.2. Offline Retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Switzerland

- 5.4.6. Austria

- 5.4.7. Spain

- 5.4.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Sport

- 6. United Kingdom Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sport

- 6.1.1. Ski

- 6.1.1.1. Skis and Poles

- 6.1.1.2. Ski Boots

- 6.1.1.3. Other Protective Gear and Accessories

- 6.1.2. Snowboard

- 6.1.1. Ski

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Children

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online Retail Stores

- 6.3.2. Offline Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Sport

- 7. Germany Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sport

- 7.1.1. Ski

- 7.1.1.1. Skis and Poles

- 7.1.1.2. Ski Boots

- 7.1.1.3. Other Protective Gear and Accessories

- 7.1.2. Snowboard

- 7.1.1. Ski

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Children

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online Retail Stores

- 7.3.2. Offline Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Sport

- 8. France Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sport

- 8.1.1. Ski

- 8.1.1.1. Skis and Poles

- 8.1.1.2. Ski Boots

- 8.1.1.3. Other Protective Gear and Accessories

- 8.1.2. Snowboard

- 8.1.1. Ski

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Children

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online Retail Stores

- 8.3.2. Offline Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Sport

- 9. Italy Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sport

- 9.1.1. Ski

- 9.1.1.1. Skis and Poles

- 9.1.1.2. Ski Boots

- 9.1.1.3. Other Protective Gear and Accessories

- 9.1.2. Snowboard

- 9.1.1. Ski

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Children

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online Retail Stores

- 9.3.2. Offline Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Sport

- 10. Switzerland Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sport

- 10.1.1. Ski

- 10.1.1.1. Skis and Poles

- 10.1.1.2. Ski Boots

- 10.1.1.3. Other Protective Gear and Accessories

- 10.1.2. Snowboard

- 10.1.1. Ski

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Men

- 10.2.2. Women

- 10.2.3. Children

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Online Retail Stores

- 10.3.2. Offline Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Sport

- 11. Austria Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Sport

- 11.1.1. Ski

- 11.1.1.1. Skis and Poles

- 11.1.1.2. Ski Boots

- 11.1.1.3. Other Protective Gear and Accessories

- 11.1.2. Snowboard

- 11.1.1. Ski

- 11.2. Market Analysis, Insights and Forecast - by End-User

- 11.2.1. Men

- 11.2.2. Women

- 11.2.3. Children

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Online Retail Stores

- 11.3.2. Offline Retail Stores

- 11.1. Market Analysis, Insights and Forecast - by Sport

- 12. Spain Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Sport

- 12.1.1. Ski

- 12.1.1.1. Skis and Poles

- 12.1.1.2. Ski Boots

- 12.1.1.3. Other Protective Gear and Accessories

- 12.1.2. Snowboard

- 12.1.1. Ski

- 12.2. Market Analysis, Insights and Forecast - by End-User

- 12.2.1. Men

- 12.2.2. Women

- 12.2.3. Children

- 12.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.3.1. Online Retail Stores

- 12.3.2. Offline Retail Stores

- 12.1. Market Analysis, Insights and Forecast - by Sport

- 13. Rest of Europe Europe Winter Sports Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Sport

- 13.1.1. Ski

- 13.1.1.1. Skis and Poles

- 13.1.1.2. Ski Boots

- 13.1.1.3. Other Protective Gear and Accessories

- 13.1.2. Snowboard

- 13.1.1. Ski

- 13.2. Market Analysis, Insights and Forecast - by End-User

- 13.2.1. Men

- 13.2.2. Women

- 13.2.3. Children

- 13.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 13.3.1. Online Retail Stores

- 13.3.2. Offline Retail Stores

- 13.1. Market Analysis, Insights and Forecast - by Sport

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Vista Outdoor Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Marker Dalbello Volkl (International) GmbH

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Åre Skidfabrik AB

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Burton Snowboards

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Tecnica Group SpA*List Not Exhaustive

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Groupe Rossignol

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Amer Sports Oyj

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 UVEX group

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Alpina d o o

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Clarus Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Fischer Beteiligungsverwaltungs GmbH

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Vista Outdoor Inc

List of Figures

- Figure 1: Europe Winter Sports Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Winter Sports Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 2: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 3: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 5: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 10: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 11: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 13: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 18: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 19: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 20: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 21: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 26: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 27: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 28: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 29: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 31: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 34: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 35: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 36: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 37: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 38: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 39: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 41: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 42: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 43: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 44: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 45: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 46: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 47: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 49: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 50: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 51: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 52: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 53: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 54: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 55: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 56: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 57: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 58: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 59: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 60: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 61: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 62: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 63: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 64: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 65: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Sport 2020 & 2033

- Table 66: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Sport 2020 & 2033

- Table 67: Europe Winter Sports Equipment Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 68: Europe Winter Sports Equipment Industry Volume K Units Forecast, by End-User 2020 & 2033

- Table 69: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 70: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 71: Europe Winter Sports Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Europe Winter Sports Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Winter Sports Equipment Industry?

The projected CAGR is approximately 5.87%.

2. Which companies are prominent players in the Europe Winter Sports Equipment Industry?

Key companies in the market include Vista Outdoor Inc, Marker Dalbello Volkl (International) GmbH, Åre Skidfabrik AB, Burton Snowboards, Tecnica Group SpA*List Not Exhaustive, Groupe Rossignol, Amer Sports Oyj, UVEX group, Alpina d o o, Clarus Corporation, Fischer Beteiligungsverwaltungs GmbH.

3. What are the main segments of the Europe Winter Sports Equipment Industry?

The market segments include Sport, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Growing Number Of Ski Destinations Drives the Market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Winter Sports Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Winter Sports Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Winter Sports Equipment Industry?

To stay informed about further developments, trends, and reports in the Europe Winter Sports Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence