Key Insights

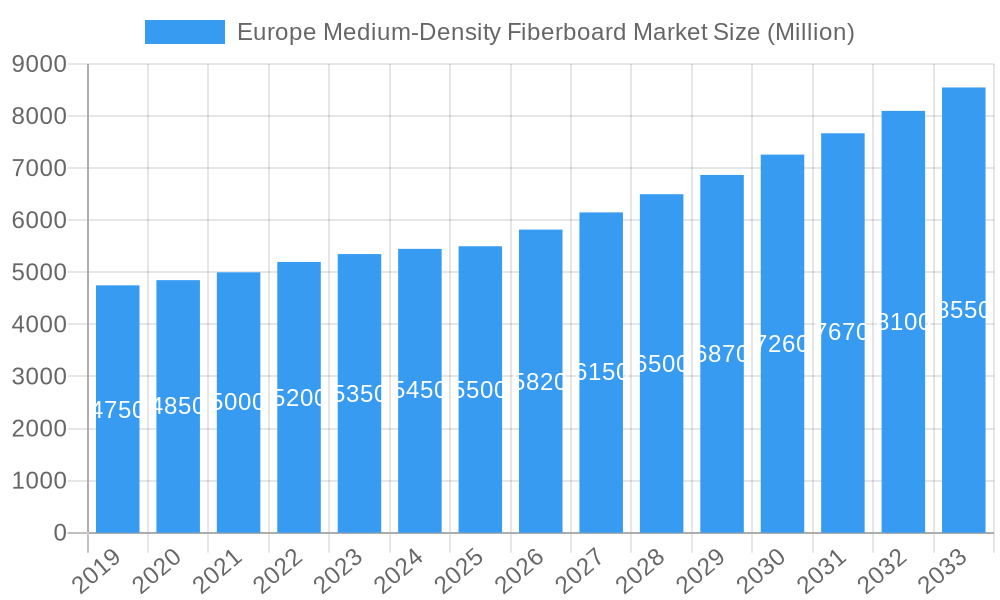

The Europe Medium-Density Fiberboard (MDF) market is projected to experience significant expansion, fueled by sustained demand from the construction and furniture industries. With a projected market size of USD 13.58 billion in 2025, the sector is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 9.03% during the forecast period of 2025-2033. This growth trajectory is supported by increasing urbanization, a rising middle class, and a growing preference for durable and aesthetically appealing interior design. The emphasis on sustainable building materials and the widespread application of MDF in cabinetry, shelving, and decorative panels are key drivers of this market's upward trend. The market size in the base year, 2025, is estimated at USD 13.58 billion.

Europe Medium-Density Fiberboard Market Market Size (In Billion)

The forecast period from 2025 to 2033 anticipates continuous innovation and market penetration. Advancements in manufacturing technologies and the development of low-emission MDF products are expected to further stimulate market growth. The European region, a prominent player in the global wood-based panel industry, is set to maintain its leading position. The increasing adoption of MDF in ready-to-assemble furniture, a rapidly growing segment across Europe, will significantly contribute to market expansion. The overall outlook for the Europe MDF market is highly positive, characterized by steady growth and evolving product offerings.

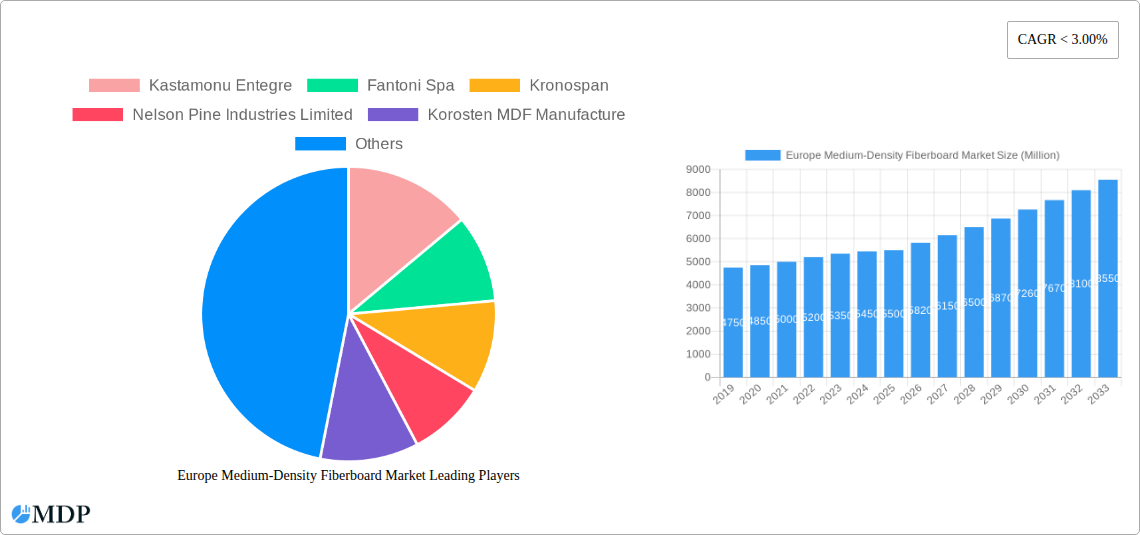

Europe Medium-Density Fiberboard Market Company Market Share

This comprehensive report offers critical insights into the dynamic European Medium-Density Fiberboard (MDF) market, spanning from 2019 to 2033. Featuring a detailed analysis of the base year 2025 and a robust forecast period (2025-2033), it provides essential data and actionable intelligence for industry stakeholders. Explore market size, segmentation, key trends, competitive dynamics, and future opportunities within the European wood panel sector.

Europe Medium-Density Fiberboard Market Market Dynamics & Concentration

The European Medium-Density Fiberboard (MDF) market exhibits a moderate to high level of concentration, with a few key players dominating production and market share. Innovation drivers are primarily focused on sustainability, eco-friendly production methods, and the development of advanced MDF products with enhanced properties, such as increased moisture resistance and improved fire retardancy. Regulatory frameworks, particularly those related to environmental protection and forest management certifications like FSC and PEFC, significantly influence market entry and product development. Product substitutes, including particleboard, plywood, and high-density fiberboard (HDF), present a competitive challenge, necessitating continuous product differentiation and value-added solutions by MDF manufacturers. End-user trends are shifting towards demand for durable, aesthetically pleasing, and sustainable materials in furniture, cabinetry, and flooring applications. Mergers and acquisitions (M&A) activities, while not dominant, play a role in market consolidation and the expansion of product portfolios. For instance, Kronospan has been actively involved in strategic acquisitions to bolster its European presence. The market share is distributed, with leading companies holding significant portions, and M&A deal counts are indicative of a maturing market seeking efficiency and market penetration.

Europe Medium-Density Fiberboard Market Industry Trends & Analysis

The European Medium-Density Fiberboard (MDF) market is experiencing robust growth, driven by an escalating demand from the construction, furniture, and interior design sectors. The CAGR for the forecast period is projected to be around 5.5%, indicating a healthy expansion trajectory. Market penetration of MDF continues to rise as its versatility, cost-effectiveness, and excellent workability make it a preferred material for a wide array of applications. Technological disruptions are primarily centered on enhancing the sustainability of MDF production. Innovations in wood fiber recycling and the development of bio-based adhesives are crucial for reducing the environmental footprint. For example, the EcoReFibre research initiative, backed by European funding, aims to create more sustainable fiberboard by recycling post-consumer fiberboards. Consumer preferences are increasingly leaning towards products with a lower environmental impact, driving demand for certified and recycled-content MDF. Furthermore, the aesthetic appeal and customizability of MDF, allowing for various finishes and laminations, are key factors in its adoption for furniture and cabinetry. Competitive dynamics are shaped by price sensitivity, product quality, and supply chain reliability. Manufacturers are investing in advanced production technologies to improve efficiency and reduce operational costs. The Residential segment remains a significant contributor, fueled by new housing construction and renovation projects across Europe, while the Commercial sector, encompassing office spaces and retail environments, also presents substantial growth opportunities. The increasing focus on interior aesthetics and functional design within these sectors further propels the demand for high-quality MDF products.

Leading Markets & Segments in Europe Medium-Density Fiberboard Market

Germany stands out as a dominant market within Europe for Medium-Density Fiberboard (MDF), driven by its robust construction industry, a strong manufacturing base for furniture and cabinetry, and a high consumer demand for quality interior finishing. Economic policies supporting sustainable building practices and infrastructure development further bolster Germany's leading position. Following closely are France and the United Kingdom, with substantial contributions from the furniture and renovation sectors.

Application Segment Dominance:

- Furniture: This segment is the largest consumer of MDF in Europe, accounting for over 40% of the market share. Key drivers include the rising disposable incomes, increasing urbanization, and a growing preference for modern, flat-pack furniture that utilizes MDF for its ease of manufacturing and finishing. Countries like Italy and Poland are major furniture manufacturing hubs heavily reliant on MDF.

- Cabinet: The cabinet application, particularly in kitchens and bathrooms, represents another significant segment. The demand is driven by residential renovations and new constructions. The consistent quality and smooth surface of MDF make it ideal for lacquering, veneering, and lamination, enhancing its appeal for cabinet doors and components.

- Flooring: While a smaller segment compared to furniture and cabinets, MDF-based laminate flooring is gaining traction due to its durability, scratch resistance, and cost-effectiveness. The increasing trend towards DIY home improvement projects further fuels the demand in this segment.

End-user Sector Dominance:

- Residential: This sector is the primary driver of MDF consumption across Europe. Factors such as population growth, increasing household formation, and a steady demand for home furnishings and renovations contribute to its dominance. Economic policies encouraging homeownership and urban development initiatives directly impact MDF demand in residential applications.

- Commercial: The commercial sector, including offices, retail spaces, and hospitality venues, is also a crucial market. The demand here is influenced by business expansion, interior design trends, and the need for durable and aesthetically pleasing furnishings and fit-outs.

Europe Medium-Density Fiberboard Market Product Developments

European MDF manufacturers are actively innovating to enhance product performance and sustainability. Key developments include the introduction of low-emission MDF (E1 and E0 standards) to meet stringent health regulations, and the incorporation of advanced binders to reduce formaldehyde content further. Moisture-resistant and fire-retardant MDF variants are being developed for specialized applications in demanding environments. Companies like Kronospan are investing in advanced coating technologies to provide superior surface finishes and increased durability. These product advancements aim to differentiate offerings, cater to evolving customer needs, and maintain a competitive edge in the European market.

Key Drivers of Europe Medium-Density Fiberboard Market Growth

Several key factors are propelling the growth of the European MDF market. The robust growth of the construction industry, fueled by infrastructure investments and residential development, is a primary driver. The furniture manufacturing sector, a significant consumer of MDF, benefits from increasing consumer spending on home interiors and the popularity of flat-pack furniture. Furthermore, the sustainability movement is creating opportunities for MDF manufacturers adopting eco-friendly production processes and utilizing recycled wood content. Technological advancements in manufacturing, leading to improved product quality and cost efficiencies, also contribute to market expansion.

Challenges in the Europe Medium-Density Fiberboard Market Market

Despite the positive growth outlook, the European MDF market faces several challenges. Volatile raw material prices, particularly for wood fiber and adhesives, can impact profitability. Stringent environmental regulations and increasing compliance costs can pose a hurdle for some manufacturers. Intense competition from alternative wood-based panels and other materials necessitates continuous innovation and cost optimization. Supply chain disruptions, as witnessed in recent years, can affect production and delivery timelines, impacting customer satisfaction and market share.

Emerging Opportunities in Europe Medium-Density Fiberboard Market

Emerging opportunities within the European MDF market are significant. The growing demand for sustainable and eco-friendly building materials presents a strong opportunity for manufacturers investing in green technologies and certified sourcing. Product diversification into specialized applications like acoustic panels, decorative surfaces, and exterior-grade MDF can open new revenue streams. Strategic partnerships and collaborations with furniture designers and construction firms can foster innovation and create market-specific solutions. The increasing focus on circular economy principles is also a key opportunity, with potential for growth in recycled MDF products.

Leading Players in the Europe Medium-Density Fiberboard Market Sector

- Kastamonu Entegre

- Fantoni Spa

- Kronospan

- Nelson Pine Industries Limited

- Korosten MDF Manufacture

- Daiken Corporation

- Duratex SA

- ARAUCO

- Egger Group

- Roseburg

- Siempelkamp Group

- Eucatex SA

- Norbord Inc

- Daiken Group

- Dieffenbacher

Key Milestones in Europe Medium-Density Fiberboard Market Industry

- October 2022: Dieffenbacher and 19 organizations from seven countries initiated the EcoReFibre research initiative, aiming to enhance the sustainability of MDF and HDF production through the recycling of post-consumer fiberboards, backed by a USD 12 million European Horizon Europe grant.

- February 2022: West Fraser Timber Co. Ltd. committed to setting science-based near-term greenhouse gas (GHG) reductions across its European businesses, joining the Science Based Targets Initiative (SBTi) to demonstrate leadership in sustainability and contribute to European climate action.

Strategic Outlook for Europe Medium-Density Fiberboard Market Market

The strategic outlook for the European Medium-Density Fiberboard market is positive, with continued growth anticipated. Key accelerators include further investment in sustainable production technologies, the development of high-value-added MDF products, and expansion into emerging applications such as modular construction and interior acoustic solutions. Manufacturers focusing on digitalization of supply chains and customer-centric product development are likely to gain a competitive advantage. The increasing awareness and demand for eco-certified products will also shape future market strategies, encouraging collaboration with forest certification bodies and a commitment to responsible sourcing.

Europe Medium-Density Fiberboard Market Segmentation

-

1. Application

- 1.1. Cabinet

- 1.2. Flooring

- 1.3. Furniture

- 1.4. Molding, Door, and Millwork

- 1.5. Packaging System

- 1.6. Other Applications

-

2. End-user Sector

- 2.1. Residential

- 2.2. Commercial

- 2.3. Institutional

Europe Medium-Density Fiberboard Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

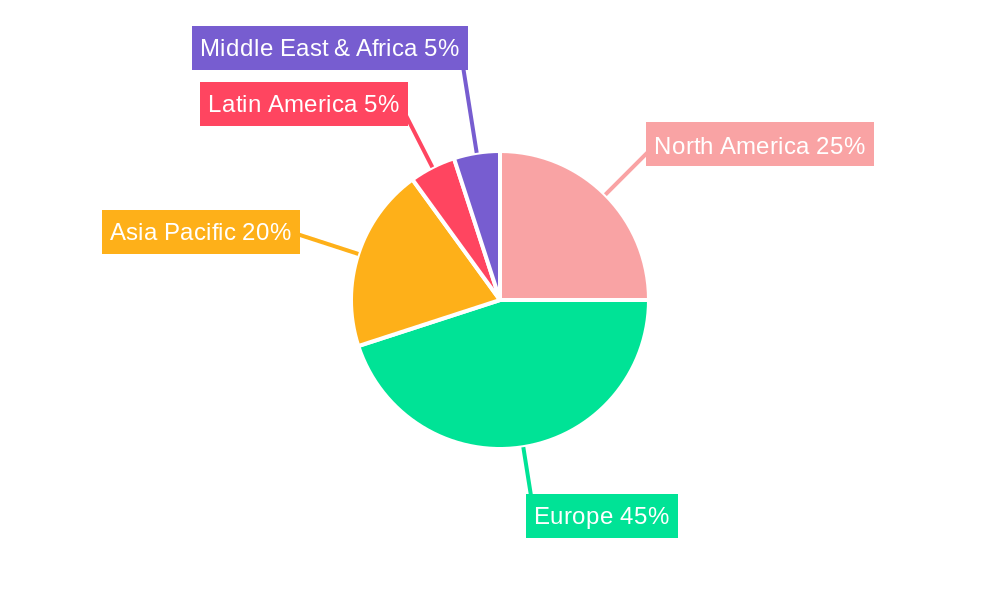

Europe Medium-Density Fiberboard Market Regional Market Share

Geographic Coverage of Europe Medium-Density Fiberboard Market

Europe Medium-Density Fiberboard Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for MDF for Furniture; Easy Availability of Raw Materials

- 3.3. Market Restrains

- 3.3.1. Strict Government Regulations; Impact of Hot-Pressing Temperature on MDF

- 3.4. Market Trends

- 3.4.1. The Residential Segment is Anticipated to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Medium-Density Fiberboard Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cabinet

- 5.1.2. Flooring

- 5.1.3. Furniture

- 5.1.4. Molding, Door, and Millwork

- 5.1.5. Packaging System

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Sector

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Institutional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kastamonu Entegre

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fantoni Spa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kronospan

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nelson Pine Industries Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Korosten MDF Manufacture

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Daiken Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Duratex SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ARAUCO

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Egger Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Roseburg

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Siempelkamp Grou

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Eucatex SA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Norbord Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Daiken Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Dieffenbacher

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Kastamonu Entegre

List of Figures

- Figure 1: Europe Medium-Density Fiberboard Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Medium-Density Fiberboard Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Medium-Density Fiberboard Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Europe Medium-Density Fiberboard Market Revenue billion Forecast, by End-user Sector 2020 & 2033

- Table 3: Europe Medium-Density Fiberboard Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Medium-Density Fiberboard Market Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Europe Medium-Density Fiberboard Market Revenue billion Forecast, by End-user Sector 2020 & 2033

- Table 6: Europe Medium-Density Fiberboard Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Medium-Density Fiberboard Market?

The projected CAGR is approximately 9.03%.

2. Which companies are prominent players in the Europe Medium-Density Fiberboard Market?

Key companies in the market include Kastamonu Entegre, Fantoni Spa, Kronospan, Nelson Pine Industries Limited, Korosten MDF Manufacture, Daiken Corporation, Duratex SA, ARAUCO, Egger Group, Roseburg, Siempelkamp Grou, Eucatex SA, Norbord Inc, Daiken Group, Dieffenbacher.

3. What are the main segments of the Europe Medium-Density Fiberboard Market?

The market segments include Application, End-user Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for MDF for Furniture; Easy Availability of Raw Materials.

6. What are the notable trends driving market growth?

The Residential Segment is Anticipated to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Strict Government Regulations; Impact of Hot-Pressing Temperature on MDF.

8. Can you provide examples of recent developments in the market?

October 2022: Dieffenbacher and 19 organizations from seven countries collaborated on the EcoReFibre (Ecological methods for secondary material recovery from post-consumer fiberboards) research initiative to make fiberboard (MDF & HDF) production more sustainable. The project aims to recycle wood fibers at the end of their life cycle and utilize them to create new fiberboard. Currently, fresh wood is nearly entirely used to manufacture wood fiberboard. Europe funded the four-year initiative, which began in May, with USD 12 million under its Horizon Europe research and innovation financing program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Medium-Density Fiberboard Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Medium-Density Fiberboard Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Medium-Density Fiberboard Market?

To stay informed about further developments, trends, and reports in the Europe Medium-Density Fiberboard Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence