Key Insights

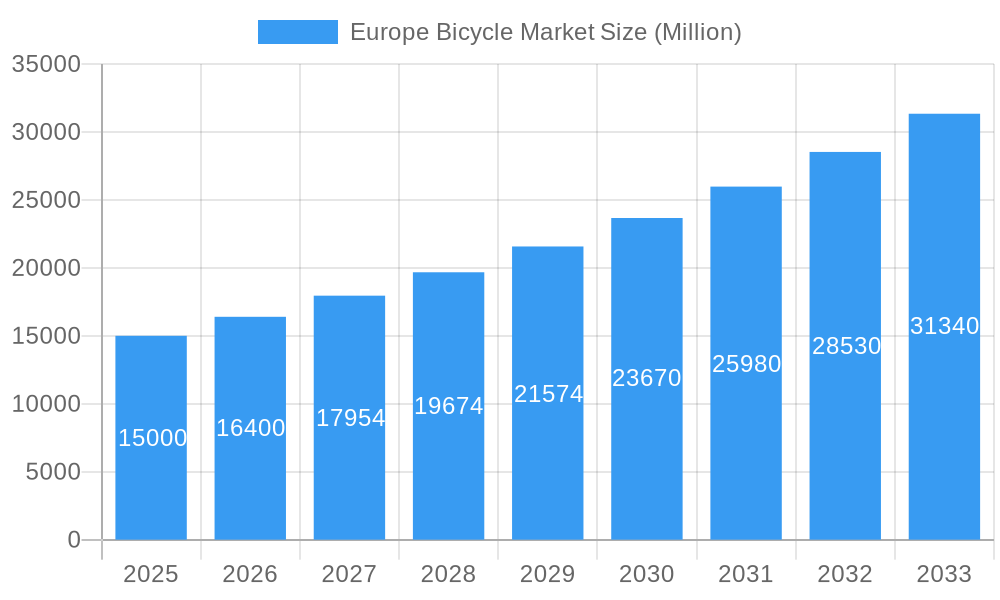

The European bicycle market, projected at €24406 million in 2025, is poised for substantial growth with a Compound Annual Growth Rate (CAGR) of 11.4% from 2025 to 2033. This upward trajectory is propelled by escalating environmental consciousness and the widespread adoption of sustainable transport solutions, particularly in European urban centers. Government initiatives focused on enhancing cycling infrastructure and promoting cycling-friendly policies in nations like Germany, the Netherlands, and the UK are significant growth catalysts. The surge in e-bike popularity, offering enhanced assistance for longer journeys and challenging terrains, is a primary segment driver, complemented by growing interest in road cycling and mountain biking. The market is segmented by bicycle type, including road, hybrid, all-terrain, and e-bikes, and by distribution channel, encompassing both offline and online retail. While traditional offline channels presently lead, the online segment is experiencing rapid expansion due to e-commerce convenience and product diversity. The competitive landscape features established companies such as Accell Group NV, Giant Manufacturing Co Ltd, and Trek Bicycle Corporation, alongside specialized niche brands. Key challenges include volatile raw material costs and potential supply chain interruptions impacting production.

Europe Bicycle Market Market Size (In Billion)

Despite these hurdles, the long-term outlook for the European bicycle market remains exceptionally strong. Sustained investment in cycling infrastructure, continuous innovation in e-bike technology, and evolving consumer priorities towards health and well-being are expected to ensure consistent market expansion. Germany and the Netherlands, with their established cycling cultures, will continue to be pivotal growth markets. However, increasing adoption rates in other European countries, fueled by government support and heightened awareness of cycling's environmental and health advantages, will also drive significant growth. Understanding these dynamics is essential for businesses aiming to thrive in this evolving market.

Europe Bicycle Market Company Market Share

Europe Bicycle Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe bicycle market, covering market dynamics, industry trends, leading segments, key players, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and strategic planners. The report leverages extensive data analysis to provide actionable insights and forecasts for this dynamic market, projected to reach xx Million by 2033.

Europe Bicycle Market Market Dynamics & Concentration

The Europe bicycle market is characterized by a moderately concentrated landscape, with key players such as Accell Group NV, Scott Corporation SA, Pon Holdings BV, and Giant Manufacturing Co Ltd holding significant market share. However, the presence of numerous smaller, specialized brands fosters competition and innovation. Market concentration is estimated at xx% in 2025, indicating a relatively fragmented yet competitive environment.

Several factors drive market dynamics:

- Innovation: Continuous innovation in e-bike technology, materials, and design fuels market growth. Lightweight materials, improved battery technology, and integrated smart features are key drivers.

- Regulatory Framework: Government initiatives promoting cycling infrastructure and sustainable transportation positively impact market demand. Regulations related to e-bike safety and standardization also play a role.

- Product Substitutes: Competition from other modes of transportation, such as public transit and electric scooters, influences market growth.

- End-User Trends: Growing health consciousness, environmental concerns, and a preference for eco-friendly commuting options fuel demand for bicycles.

- M&A Activities: The market has witnessed significant merger and acquisition activity in recent years, as evidenced by xx M&A deals in the 2019-2024 period. This consolidation reflects industry growth and strategic positioning by key players. For example, Pon Bike's acquisition of Veloretti demonstrates a strategic move towards the growing e-bike segment.

Europe Bicycle Market Industry Trends & Analysis

The Europe bicycle market exhibits robust growth, with a CAGR of xx% projected during the forecast period (2025-2033). Several factors contribute to this growth:

- Rising Demand for E-bikes: The e-bike segment is experiencing explosive growth, driven by technological advancements, increasing affordability, and government incentives. Market penetration for e-bikes is expected to reach xx% by 2033.

- Technological Disruptions: Advancements in battery technology, motor efficiency, and connectivity features are transforming the e-bike landscape, enhancing user experience and driving adoption.

- Changing Consumer Preferences: Consumers increasingly seek high-quality, durable bicycles with advanced features, pushing manufacturers to innovate and improve product offerings. A growing preference for customized and personalized bikes is also observed.

- Competitive Dynamics: Intense competition amongst manufacturers necessitates continuous innovation and strategic partnerships to maintain market share. Price wars and product differentiation are key competitive tactics.

Leading Markets & Segments in Europe Bicycle Market

Germany and the Netherlands are currently the leading markets in Europe for bicycles, driven by strong cycling infrastructure, government support, and a high level of consumer awareness. The e-bike segment represents the fastest-growing market segment, accounting for xx% of total bicycle sales in 2025.

Key Drivers:

- Germany: Well-developed cycling infrastructure, strong government support for cycling initiatives, and a high disposable income among consumers.

- Netherlands: Extensive cycling infrastructure, high levels of cycling participation, and a strong preference for cycling as a mode of transport.

Segment Dominance:

- E-bikes: Rapid technological advancements, government subsidies, and increasing consumer preference contribute to e-bike segment dominance.

- Offline Retail Stores: While online retail is growing, offline stores still represent the primary distribution channel, offering consumers the ability to test ride and receive personalized service.

Europe Bicycle Market Product Developments

Recent product developments are largely focused on enhancing e-bike technology and functionality. Lightweight designs, longer battery ranges, integrated smart features, and improved motor performance are central themes. New materials, such as carbon fiber, are also being utilized to improve bike performance and durability, catering to various segments and price points. This focus on innovation and improved user experience drives the growth within the market.

Key Drivers of Europe Bicycle Market Growth

Several factors are driving growth in the Europe bicycle market:

- Technological advancements: Improved battery technology, lightweight materials, and connected features enhance e-bike appeal and functionality.

- Government initiatives: Subsidies and incentives promoting e-bike adoption are boosting market demand. Investments in cycling infrastructure also contribute significantly.

- Rising health consciousness: Increasing awareness of health benefits associated with cycling drives demand across various bicycle types.

Challenges in the Europe Bicycle Market Market

The Europe bicycle market faces several challenges:

- Supply chain disruptions: Global supply chain issues impacting component availability can hinder production and increase costs. This resulted in a xx% decrease in production in 2022.

- Raw material price fluctuations: Increased costs of raw materials can inflate production costs and affect pricing strategies.

- Intense competition: The presence of numerous players and varying product offerings creates a highly competitive environment.

Emerging Opportunities in Europe Bicycle Market

The Europe bicycle market presents promising opportunities for growth:

- Expansion into niche segments: Growing demand for specialized bicycles, such as cargo bikes and folding bikes, provides opportunities for manufacturers.

- Strategic partnerships: Collaborations among manufacturers, technology providers, and retailers can facilitate innovation and expand market reach.

- Development of sustainable solutions: Focus on eco-friendly manufacturing processes and sustainable materials can improve brand image and appeal to environmentally conscious consumers.

Leading Players in the Europe Bicycle Market Sector

- Accell Group NV

- Scott Corporation SA

- Pon Holdings BV

- Simplon Fahrrad GmbH

- Bulls Bikes

- Merida Industry Co Ltd

- Giant Manufacturing Co Ltd

- Ribble Cycles

- Trek Bicycle Corporation

- Riese und Muller GmbH

Key Milestones in Europe Bicycle Market Industry

- September 2022: Pon Bike acquired the Dutch e-bike brand Veloretti, expanding its presence in the e-bike market.

- September 2022: The Accell Group's Haibike brand launched the Lyke eMTB, a new e-mountain bike, demonstrating innovation in the e-bike segment.

- October 2022: Pon Holdings' Cervélo launched the ZHT-5, a high-performance cross-country mountain bike, highlighting the company’s commitment to top-tier cycling technology.

Strategic Outlook for Europe Bicycle Market Market

The Europe bicycle market is poised for continued growth, driven by technological advancements, supportive government policies, and evolving consumer preferences. Strategic opportunities exist in expanding e-bike offerings, developing sustainable solutions, and forging strategic partnerships to gain a competitive edge. Focus on innovation, sustainability, and customer experience will be crucial for success in this dynamic market.

Europe Bicycle Market Segmentation

-

1. Type

- 1.1. Road Bicycles

- 1.2. Hybrid Bicycles

- 1.3. All Terrain Bicycles

- 1.4. E-bicycles

- 1.5. Other Types

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

Europe Bicycle Market Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. Germany

- 4. France

- 5. Italy

- 6. Netherlands

- 7. Rest of Europe

Europe Bicycle Market Regional Market Share

Geographic Coverage of Europe Bicycle Market

Europe Bicycle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Cycling Events; Growing Health Conscious and Environmentally Friendly Population

- 3.3. Market Restrains

- 3.3.1. Availability of Alternative Transport Solutions

- 3.4. Market Trends

- 3.4.1. Increasing Number of Cycling Events

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Road Bicycles

- 5.1.2. Hybrid Bicycles

- 5.1.3. All Terrain Bicycles

- 5.1.4. E-bicycles

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.3.2. United Kingdom

- 5.3.3. Germany

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Netherlands

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Spain Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Road Bicycles

- 6.1.2. Hybrid Bicycles

- 6.1.3. All Terrain Bicycles

- 6.1.4. E-bicycles

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Road Bicycles

- 7.1.2. Hybrid Bicycles

- 7.1.3. All Terrain Bicycles

- 7.1.4. E-bicycles

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Germany Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Road Bicycles

- 8.1.2. Hybrid Bicycles

- 8.1.3. All Terrain Bicycles

- 8.1.4. E-bicycles

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Road Bicycles

- 9.1.2. Hybrid Bicycles

- 9.1.3. All Terrain Bicycles

- 9.1.4. E-bicycles

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Road Bicycles

- 10.1.2. Hybrid Bicycles

- 10.1.3. All Terrain Bicycles

- 10.1.4. E-bicycles

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Offline Retail Stores

- 10.2.2. Online Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Netherlands Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Road Bicycles

- 11.1.2. Hybrid Bicycles

- 11.1.3. All Terrain Bicycles

- 11.1.4. E-bicycles

- 11.1.5. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Offline Retail Stores

- 11.2.2. Online Retail Stores

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Road Bicycles

- 12.1.2. Hybrid Bicycles

- 12.1.3. All Terrain Bicycles

- 12.1.4. E-bicycles

- 12.1.5. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Offline Retail Stores

- 12.2.2. Online Retail Stores

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Accell Group NV

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Scott Corporation SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Pon Holdings BV

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Simplon Fahrrad GmbH *List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Bulls Bikes

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Merida Industry Co Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Giant Manufacturing Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Ribble Cycles

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Trek Bicycle Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Riese und Muller GmbH

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Accell Group NV

List of Figures

- Figure 1: Europe Bicycle Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Bicycle Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Europe Bicycle Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Bicycle Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 9: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 14: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 15: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 17: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 18: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 20: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 21: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 26: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 27: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 29: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 30: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 32: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 33: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 35: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 36: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 37: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 38: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 39: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 40: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 41: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 42: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 43: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 44: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 45: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 46: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 47: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 48: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Bicycle Market?

The projected CAGR is approximately 11.4%.

2. Which companies are prominent players in the Europe Bicycle Market?

Key companies in the market include Accell Group NV, Scott Corporation SA, Pon Holdings BV, Simplon Fahrrad GmbH *List Not Exhaustive, Bulls Bikes, Merida Industry Co Ltd, Giant Manufacturing Co Ltd, Ribble Cycles, Trek Bicycle Corporation, Riese und Muller GmbH.

3. What are the main segments of the Europe Bicycle Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 24406 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Cycling Events; Growing Health Conscious and Environmentally Friendly Population.

6. What are the notable trends driving market growth?

Increasing Number of Cycling Events.

7. Are there any restraints impacting market growth?

Availability of Alternative Transport Solutions.

8. Can you provide examples of recent developments in the market?

October 2022: Pon Holdings' Cervélo launched ZHT-5, a cross-country mountain bike that prioritizes low weight and efficiency. Cervélo claimed that the ZHT-5 is 'purpose-built' for XC racing and will make its race debut at the first round of the XCO World Cups in Valkenburg, Netherlands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Bicycle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Bicycle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Bicycle Market?

To stay informed about further developments, trends, and reports in the Europe Bicycle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence