Key Insights

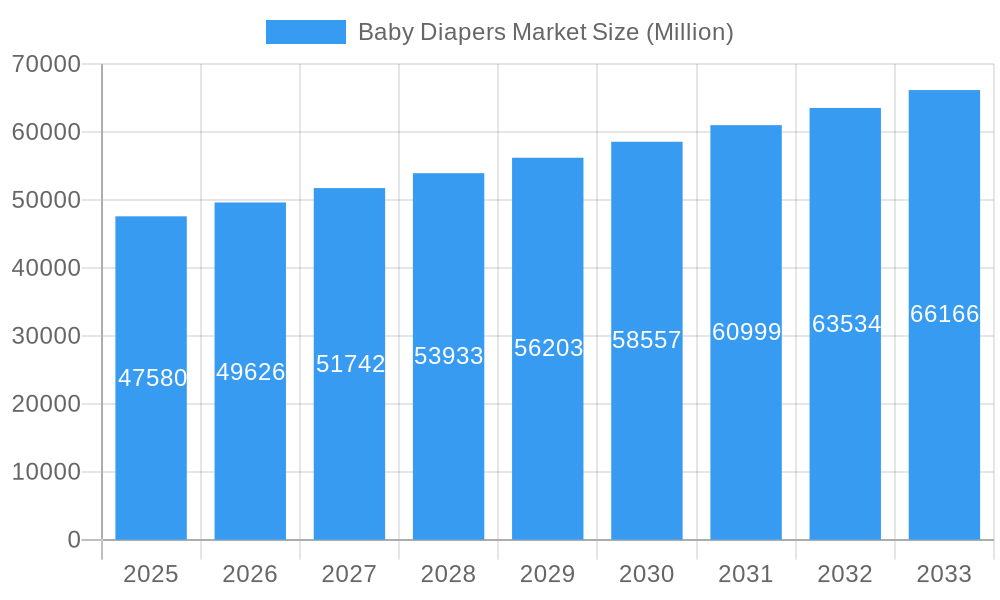

The global baby diapers market, valued at $47.58 billion in 2025, is projected to experience steady growth, driven by a rising global birth rate and increasing disposable incomes in developing economies. The market's Compound Annual Growth Rate (CAGR) of 4.43% from 2025 to 2033 indicates a significant expansion potential. Key growth drivers include the increasing preference for convenience among parents, coupled with enhanced product features like improved absorbency, breathability, and eco-friendly materials. The rising awareness of hygiene and health concerns surrounding baby care also fuels demand for high-quality diapers. Market segmentation reveals a strong preference for disposable diapers, although the cloth diaper segment is gaining traction due to growing environmental concerns and cost-effectiveness in the long term. Distribution channels are diversifying, with online retail channels experiencing rapid growth, complemented by established brick-and-mortar stores like supermarkets, hypermarkets, and pharmacies. Major players such as Procter & Gamble, Unicharm, and Kimberly-Clark dominate the market, but smaller companies offering niche products, such as eco-friendly or specialized diapers, are also gaining market share. Regional analysis suggests that North America and Asia Pacific are major contributors to market revenue, driven by high birth rates and strong consumer spending.

Baby Diapers Market Market Size (In Billion)

Continued market expansion will depend on several factors. Technological advancements in diaper manufacturing, leading to superior performance and cost-effectiveness, are crucial. Furthermore, strategic marketing initiatives focusing on the benefits of specific diaper types, such as eco-friendly options, will be critical in shaping consumer preferences. Regulatory changes related to material safety and environmental regulations will also impact market dynamics. Addressing the increasing demand for sustainable and affordable diaper options, alongside continuous innovation in product features and distribution strategies, are key to driving sustained growth in this significant market. Competition among established players and emerging brands will also play a vital role in shaping market trends over the forecast period.

Baby Diapers Market Company Market Share

Baby Diapers Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the global baby diapers market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. Covering the period 2019-2033, with a focus on 2025, this report unveils key trends, growth drivers, and challenges shaping the future of baby diaper consumption. The market is segmented by product type (cloth diapers, disposable diapers) and distribution channel (supermarkets/hypermarkets, convenience/grocery stores, pharmacy/drug stores, online retail channels, other distribution channels). Leading players such as Procter & Gamble Co, Kimberly-Clark Corporation, Unicharm Corporation, and Essity Aktiebolag are analyzed, along with emerging brands. The report's findings are based on extensive research and data analysis, providing actionable intelligence for strategic decision-making. The market size is projected to reach xx Million by 2033.

Baby Diapers Market Dynamics & Concentration

The global baby diapers market is characterized by a high level of concentration, with a few major players controlling a significant market share. Procter & Gamble Co and Kimberly-Clark Corporation hold leading positions, commanding xx% and xx% respectively, in 2025. However, increasing consumer demand for eco-friendly and innovative products is creating opportunities for smaller players and fostering competition.

Market Concentration Metrics (2025):

- Top 5 players: xx% market share

- Top 10 players: xx% market share

- M&A activity (2019-2024): xx deals

Innovation Drivers:

- Sustainable materials (biodegradable, plant-based)

- Advanced absorbency technologies

- Improved comfort and design features (e.g., breathable materials, softer fabrics)

- Smart diaper technology (e.g., sensors for wetness detection)

Regulatory Frameworks:

- Regulations regarding diaper safety and composition vary across regions, influencing product development and marketing strategies.

- Growing focus on environmental sustainability is driving the adoption of eco-friendly materials and manufacturing processes.

Product Substitutes:

- Cloth diapers are gaining popularity as an eco-friendly alternative, posing a challenge to disposable diapers.

- However, convenience and disposability still make disposable diapers a widely preferred option.

End-User Trends:

- Increasing awareness of baby skin health is driving demand for hypoallergenic and sensitive skin diapers.

- Parental preferences for convenience and ease of use significantly influence purchasing decisions.

M&A Activities: The market has witnessed a moderate level of mergers and acquisitions activity in recent years, with larger companies acquiring smaller brands to expand their product portfolios and market reach.

Baby Diapers Market Industry Trends & Analysis

The global baby diapers market is expected to witness robust growth during the forecast period (2025-2033), driven by several key factors. The Compound Annual Growth Rate (CAGR) is projected to be xx% between 2025 and 2033. This growth is fueled by factors such as increasing birth rates in developing economies, rising disposable incomes, and increasing awareness about baby hygiene and comfort. The market penetration of premium diaper brands is also rising, driven by consumers' willingness to pay more for superior quality, comfort, and features. Technological disruptions, such as the introduction of smart diapers with sensors, are creating new opportunities for growth and innovation. However, fluctuating raw material prices and the growing preference for cloth diapers pose potential challenges to market growth. Competitive dynamics are intensifying with established players focusing on brand building, product innovation, and market expansion, while new entrants seek to establish a foothold.

Leading Markets & Segments in Baby Diapers Market

The Asia-Pacific region is expected to dominate the baby diapers market throughout the forecast period, driven by high birth rates, increasing urbanization, and rising disposable incomes. China and India are projected to be the largest markets within this region. Within product types, disposable diapers continue to hold the majority market share, owing to their convenience. However, the market share of cloth diapers is growing steadily, driven by rising environmental concerns and increasing awareness of sustainable products.

Key Drivers in Leading Markets:

- Asia-Pacific (Dominant Region): High birth rates, rising disposable incomes, increasing urbanization, growing awareness of hygiene

- North America: Relatively stable birth rates, high disposable incomes, preference for premium products

- Europe: Relatively lower birth rates compared to Asia-Pacific, focus on sustainability and eco-friendly products

Dominant Segments:

- Product Type: Disposable diapers dominate due to convenience, with cloth diapers witnessing steady growth due to sustainability concerns.

- Distribution Channel: Supermarkets/hypermarkets and online retail channels are significant distribution channels, with online retail demonstrating strong growth potential.

Baby Diapers Market Product Developments

The baby diapers market is witnessing a dynamic evolution driven by a strong focus on enhanced absorbency, superior comfort, and robust sustainability initiatives. Manufacturers are increasingly integrating innovative materials such as bio-based polymers derived from renewable resources and plant-derived fibers to create disposable diapers with a significantly reduced environmental footprint. Beyond materials, substantial advancements in diaper design are prioritizing improved leak protection through advanced channeling systems and the incorporation of highly breathable materials that promote air circulation, thereby minimizing the risk of skin irritation and maximizing comfort for infants. A groundbreaking development is the introduction of smart diapers equipped with integrated sensors that accurately detect wetness levels, offering parents real-time alerts and contributing to a more proactive approach to baby care. These multifaceted developments underscore a prevailing trend towards empowering parents with unparalleled convenience, ensuring optimal baby comfort, and offering ethically sound and sustainable product choices.

Key Drivers of Baby Diapers Market Growth

The sustained growth trajectory of the baby diapers market is propelled by a synergistic interplay of critical factors. A fundamental driver is the increasing global birth rates, particularly evident in rapidly developing emerging economies where population expansion is a significant demographic trend. Complementing this is the rise in disposable incomes within developing nations, affording more households the ability to invest in premium baby care products, coupled with a heightened awareness regarding the importance of optimal infant hygiene. Furthermore, continuous technological advancements are playing a pivotal role, leading to the development of superior product features that address evolving consumer demands, including enhanced absorbency, improved comfort, and greater environmental responsibility. The strategic expansion of retail channels, with a particular emphasis on the burgeoning e-commerce sector, is significantly broadening accessibility and convenience for consumers, further fueling market expansion.

Challenges in the Baby Diapers Market

The baby diapers market, while experiencing robust growth, is not without its inherent challenges. Volatility in raw material prices, encompassing essential components like pulp and polymers, directly influences production costs and can exert considerable pressure on profit margins for manufacturers. The burgeoning popularity of cloth diapers, driven by increasing consumer demand for more sustainable and eco-friendly alternatives, presents a discernible competitive challenge to the disposable diaper segment. Additionally, the implementation of stringent environmental regulations in various global regions can escalate manufacturing costs and introduce complexities throughout the product lifecycle, from sourcing to disposal. Moreover, the market is characterized by intense competition among established major players, further amplified by the agile entry of smaller, niche brands that frequently introduce innovative and disruptive products, collectively intensifying market pressures. The cumulative impact of these challenges on overall market growth is currently estimated at approximately 5-7% annually.

Emerging Opportunities in Baby Diapers Market

The baby diapers market presents significant opportunities for growth. The increasing demand for sustainable and eco-friendly products creates a market niche for biodegradable and plant-based diapers. Technological advancements, such as smart diapers, offer potential for premium pricing and increased consumer appeal. Strategic partnerships with retailers and e-commerce platforms can expand market reach. Finally, expanding into developing countries with growing populations and rising disposable incomes unlocks substantial growth potential.

Leading Players in the Baby Diapers Market Sector

- Procter & Gamble Co

- Nuggles Designs Canada

- Unicharm Corporation

- Essity Aktiebolag

- Daio Paper Corporation

- Ontex Group

- Domtar Corporation

- Kimberly-Clark Corporation

- Winc Design Limited

- Kao Corporation

Key Milestones in Baby Diapers Market Industry

- March 2022: Kimberly-Clark invests USD 100 Million in a new manufacturing facility in Nigeria, expanding its Huggies diaper production capacity.

- May 2022: SUMO introduces a long-lasting, biodegradable fitted cloth baby diaper, appealing to the growing eco-conscious consumer segment.

- January 2023: Kimberly-Clark relaunches its Huggies brand in India with a new "Complete Comfort" range, focusing on enhanced features and a refreshed brand image.

- April 2023: Millie Moon launches its luxury baby diaper and wipe line in Canada, targeting the premium segment with a focus on comfort, high performance, and affordability.

Strategic Outlook for Baby Diapers Market

The baby diapers market is poised for continued growth, driven by rising birth rates, increasing disposable incomes, and a growing preference for premium and sustainable products. Strategic opportunities lie in developing innovative products that cater to evolving consumer preferences, such as eco-friendly options and smart diapers. Expanding market reach through strategic partnerships, especially in emerging economies, is crucial for maximizing growth potential. Companies can further enhance their market position by investing in research and development, focusing on enhancing production efficiencies, and adapting to evolving regulatory environments.

Baby Diapers Market Segmentation

-

1. Product Type

- 1.1. Cloth Diapers

- 1.2. Disposable Diapers

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Pharmacy/Drug Stores

- 2.4. Online Retail Channels

- 2.5. Other Distribution Channels

Baby Diapers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Baby Diapers Market Regional Market Share

Geographic Coverage of Baby Diapers Market

Baby Diapers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Natural Cosmetics; Increasing Demand for Cruelty Free Cosmetics

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Awareness about Baby Hygiene

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Baby Diapers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cloth Diapers

- 5.1.2. Disposable Diapers

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Pharmacy/Drug Stores

- 5.2.4. Online Retail Channels

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Baby Diapers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cloth Diapers

- 6.1.2. Disposable Diapers

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience/Grocery Stores

- 6.2.3. Pharmacy/Drug Stores

- 6.2.4. Online Retail Channels

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Baby Diapers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cloth Diapers

- 7.1.2. Disposable Diapers

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience/Grocery Stores

- 7.2.3. Pharmacy/Drug Stores

- 7.2.4. Online Retail Channels

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Baby Diapers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cloth Diapers

- 8.1.2. Disposable Diapers

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience/Grocery Stores

- 8.2.3. Pharmacy/Drug Stores

- 8.2.4. Online Retail Channels

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Baby Diapers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Cloth Diapers

- 9.1.2. Disposable Diapers

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience/Grocery Stores

- 9.2.3. Pharmacy/Drug Stores

- 9.2.4. Online Retail Channels

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Baby Diapers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Cloth Diapers

- 10.1.2. Disposable Diapers

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience/Grocery Stores

- 10.2.3. Pharmacy/Drug Stores

- 10.2.4. Online Retail Channels

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Procter & Gamble Co

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nuggles Designs Canada

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Unicharm Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Essity Aktiebolag

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Daio Paper Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ontex Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Domtar Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kimberly-Clark Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Winc Design Limited*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kao Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Procter & Gamble Co

List of Figures

- Figure 1: Global Baby Diapers Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Baby Diapers Market Volume Breakdown (K Units , %) by Region 2025 & 2033

- Figure 3: North America Baby Diapers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Baby Diapers Market Volume (K Units ), by Product Type 2025 & 2033

- Figure 5: North America Baby Diapers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Baby Diapers Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Baby Diapers Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: North America Baby Diapers Market Volume (K Units ), by Distribution Channel 2025 & 2033

- Figure 9: North America Baby Diapers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Baby Diapers Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Baby Diapers Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Baby Diapers Market Volume (K Units ), by Country 2025 & 2033

- Figure 13: North America Baby Diapers Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Baby Diapers Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Baby Diapers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 16: Europe Baby Diapers Market Volume (K Units ), by Product Type 2025 & 2033

- Figure 17: Europe Baby Diapers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Baby Diapers Market Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Baby Diapers Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 20: Europe Baby Diapers Market Volume (K Units ), by Distribution Channel 2025 & 2033

- Figure 21: Europe Baby Diapers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Baby Diapers Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: Europe Baby Diapers Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Baby Diapers Market Volume (K Units ), by Country 2025 & 2033

- Figure 25: Europe Baby Diapers Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Baby Diapers Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Baby Diapers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Baby Diapers Market Volume (K Units ), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Baby Diapers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Baby Diapers Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Baby Diapers Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 32: Asia Pacific Baby Diapers Market Volume (K Units ), by Distribution Channel 2025 & 2033

- Figure 33: Asia Pacific Baby Diapers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Asia Pacific Baby Diapers Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Asia Pacific Baby Diapers Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Baby Diapers Market Volume (K Units ), by Country 2025 & 2033

- Figure 37: Asia Pacific Baby Diapers Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Baby Diapers Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Baby Diapers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 40: South America Baby Diapers Market Volume (K Units ), by Product Type 2025 & 2033

- Figure 41: South America Baby Diapers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: South America Baby Diapers Market Volume Share (%), by Product Type 2025 & 2033

- Figure 43: South America Baby Diapers Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: South America Baby Diapers Market Volume (K Units ), by Distribution Channel 2025 & 2033

- Figure 45: South America Baby Diapers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: South America Baby Diapers Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: South America Baby Diapers Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Baby Diapers Market Volume (K Units ), by Country 2025 & 2033

- Figure 49: South America Baby Diapers Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Baby Diapers Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Baby Diapers Market Revenue (Million), by Product Type 2025 & 2033

- Figure 52: Middle East and Africa Baby Diapers Market Volume (K Units ), by Product Type 2025 & 2033

- Figure 53: Middle East and Africa Baby Diapers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East and Africa Baby Diapers Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East and Africa Baby Diapers Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Middle East and Africa Baby Diapers Market Volume (K Units ), by Distribution Channel 2025 & 2033

- Figure 57: Middle East and Africa Baby Diapers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Middle East and Africa Baby Diapers Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Middle East and Africa Baby Diapers Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Baby Diapers Market Volume (K Units ), by Country 2025 & 2033

- Figure 61: Middle East and Africa Baby Diapers Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Baby Diapers Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Baby Diapers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Baby Diapers Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Global Baby Diapers Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Baby Diapers Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Baby Diapers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Baby Diapers Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Baby Diapers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Baby Diapers Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Global Baby Diapers Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Baby Diapers Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Baby Diapers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Baby Diapers Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 15: Canada Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 17: Mexico Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 19: Rest of North America Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of North America Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 21: Global Baby Diapers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Baby Diapers Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 23: Global Baby Diapers Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global Baby Diapers Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Baby Diapers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Baby Diapers Market Volume K Units Forecast, by Country 2020 & 2033

- Table 27: Germany Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 29: United Kingdom Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 31: France Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: France Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 33: Italy Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 35: Russia Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 37: Spain Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Spain Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Europe Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 41: Global Baby Diapers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 42: Global Baby Diapers Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 43: Global Baby Diapers Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Baby Diapers Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Baby Diapers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Global Baby Diapers Market Volume K Units Forecast, by Country 2020 & 2033

- Table 47: India Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 49: China Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: China Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 51: Japan Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Japan Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 53: Australia Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Australia Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 55: South Korea Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: South Korea Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 57: Rest of Asia Pacific Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 59: Global Baby Diapers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 60: Global Baby Diapers Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 61: Global Baby Diapers Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 62: Global Baby Diapers Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 63: Global Baby Diapers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Global Baby Diapers Market Volume K Units Forecast, by Country 2020 & 2033

- Table 65: Brazil Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Brazil Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 67: Argentina Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Argentina Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 69: Rest of South America Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Rest of South America Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 71: Global Baby Diapers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 72: Global Baby Diapers Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 73: Global Baby Diapers Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 74: Global Baby Diapers Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 75: Global Baby Diapers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 76: Global Baby Diapers Market Volume K Units Forecast, by Country 2020 & 2033

- Table 77: South Africa Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: South Africa Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 79: Saudi Arabia Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Saudi Arabia Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East and Africa Baby Diapers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East and Africa Baby Diapers Market Volume (K Units ) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Baby Diapers Market?

The projected CAGR is approximately 4.43%.

2. Which companies are prominent players in the Baby Diapers Market?

Key companies in the market include Procter & Gamble Co, Nuggles Designs Canada, Unicharm Corporation, Essity Aktiebolag, Daio Paper Corporation, Ontex Group, Domtar Corporation, Kimberly-Clark Corporation, Winc Design Limited*List Not Exhaustive, Kao Corporation.

3. What are the main segments of the Baby Diapers Market?

The market segments include Product Type, Distribution Channel .

4. Can you provide details about the market size?

The market size is estimated to be USD 47.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Natural Cosmetics; Increasing Demand for Cruelty Free Cosmetics.

6. What are the notable trends driving market growth?

Increasing Awareness about Baby Hygiene.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

April 2023: Millie Moon baby diapers announced their launch in Canada. Millie Moon claims to be a clean, luxury diaper brand offering high-performance and beautifully crafted diapers and sensitive wipes at affordable prices. Further, Millie Moon Luxury Diapers feature double leak guards to keep wetness contained, a snug and high waistband for a secure fit, and an ultra-absorbent core to help prevent blowouts and leaks. The company also claims that the materials in its Luxury Diapers are extremely soft on babies' skin and engineered with CloudTouch Softness for optimum comfort.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Baby Diapers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Baby Diapers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Baby Diapers Market?

To stay informed about further developments, trends, and reports in the Baby Diapers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence