Key Insights

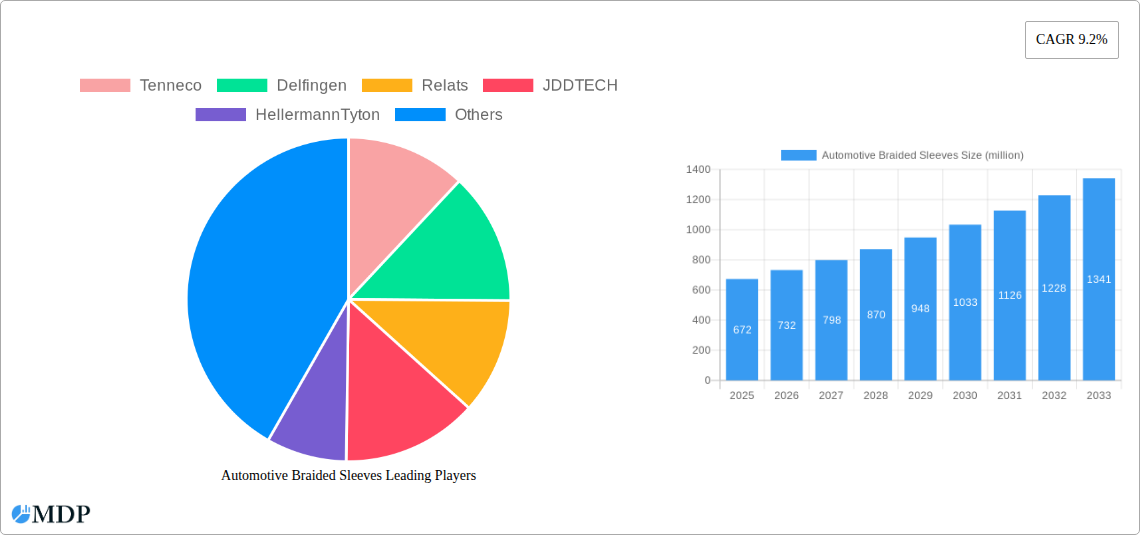

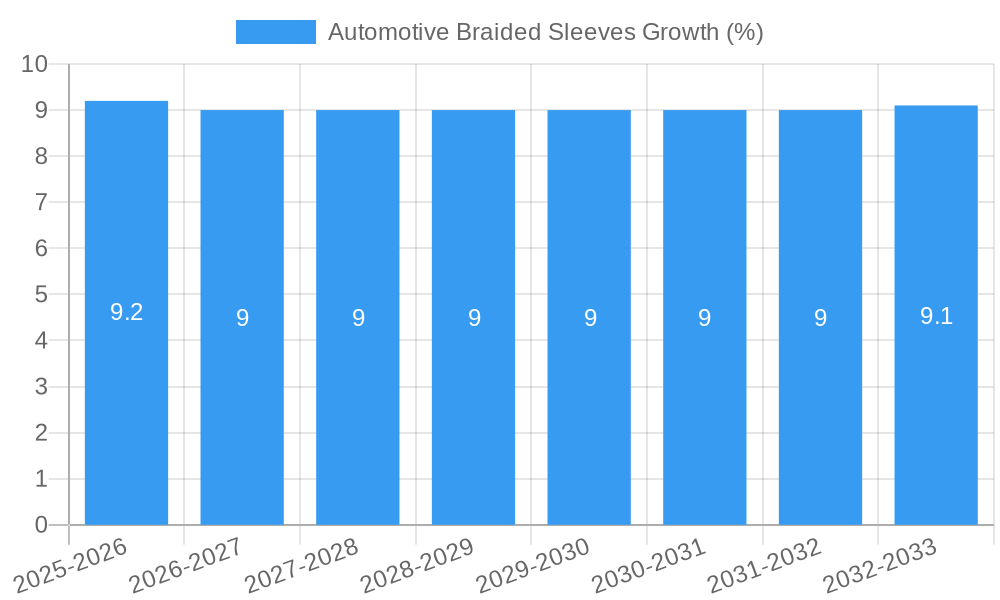

The global automotive braided sleeves market is poised for significant expansion, projected to reach approximately \$672 million in 2025 and exhibit a robust Compound Annual Growth Rate (CAGR) of 9.2% through 2033. This growth trajectory is primarily propelled by the increasing complexity of vehicle wiring systems and the escalating demand for robust wire protection solutions. A key driver is the continuous evolution of automotive electronics, necessitating highly durable and reliable sleeving to safeguard against abrasion, heat, and chemical exposure. The burgeoning automotive industry, particularly in emerging economies, further fuels this demand. Furthermore, the rising adoption of New Energy Vehicles (NEVs), such as electric and hybrid cars, presents a substantial opportunity. NEVs feature more intricate and high-voltage electrical systems, requiring advanced braided sleeves for enhanced safety and performance. The market is segmented by application into Internal Combustion Engine Vehicles and New Energy Vehicles, with NEVs expected to be a significant growth engine due to their unique electrical system demands. By type, Metal Braided Sleeves offer superior thermal resistance and EMI shielding, while Polyester Braided Sleeves provide flexibility and cost-effectiveness, catering to diverse application needs.

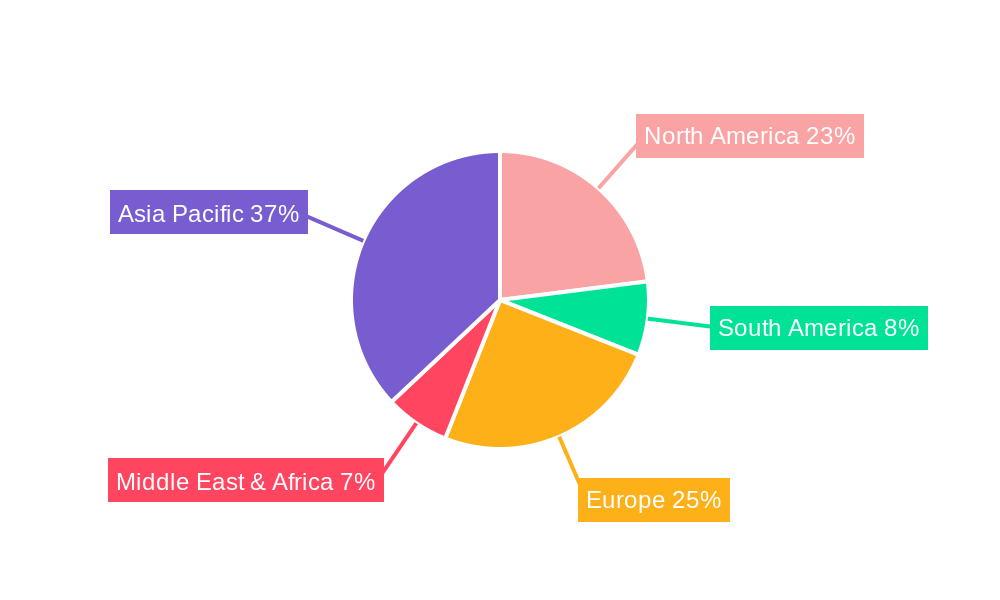

The competitive landscape is characterized by a blend of established players like Tenneco, Delfingen, and HellermannTyton, alongside emerging innovators. These companies are actively engaged in research and development to introduce advanced materials and manufacturing techniques that enhance sleeve performance, such as improved flame retardancy, lightweighting, and eco-friendly options. The market's expansion is also influenced by evolving regulatory standards concerning vehicle safety and emissions, which indirectly promote the use of high-quality protective sleeving. Geographically, Asia Pacific, led by China and India, is anticipated to be a dominant region, driven by its massive automotive production and increasing consumer disposable income leading to higher vehicle sales. Europe and North America, with their strong focus on technological advancement and stringent safety regulations, will also remain significant markets. The market, however, may face some restraints related to the cost of advanced materials and potential supply chain disruptions. Despite these challenges, the overall outlook for the automotive braided sleeves market remains exceptionally positive, underpinned by technological advancements and the accelerating shift towards electrified mobility.

The global automotive braided sleeves market exhibits moderate concentration, with key players like Tenneco, Delfingen, Relats, JDDTECH, HellermannTyton, Tresse Industrie, Techflex, and Safeplast holding significant market share. Market penetration for specialized braided sleeves is estimated to be in the range of XX%. Innovation drivers are primarily fueled by the increasing demand for enhanced wire and cable protection in both Internal Combustion Engine Vehicles and the rapidly expanding New Energy Vehicles segment. The robust growth in electric vehicles (EVs) necessitates advanced thermal management and EMI shielding solutions, directly impacting the demand for sophisticated metal and high-performance polyester braided sleeves. Regulatory frameworks, particularly those concerning automotive safety standards and emissions, indirectly drive the adoption of high-quality protective sleeving solutions. Product substitutes, while present in the form of basic plastic tubing, lack the durability, flexibility, and specialized protection offered by braided sleeves, especially in demanding automotive environments. End-user trends lean towards lighter, more compact, and highly reliable wiring harnesses, pushing manufacturers to develop innovative braided sleeve materials and designs. Mergers and acquisitions (M&A) activity in the sector, with an estimated XX M&A deals in the historical period (2019-2024), indicates strategic consolidation aimed at expanding product portfolios and market reach. For instance, the acquisition of specialized braiding technology by a larger Tier 1 supplier could significantly alter the market landscape.

Automotive Braided Sleeves Industry Trends & Analysis (600 words)

The automotive braided sleeves market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033). This expansion is primarily driven by the escalating adoption of advanced automotive technologies and the increasing complexity of vehicle electrical systems. The transition towards New Energy Vehicles (NEVs), including electric and hybrid vehicles, is a significant growth catalyst. NEVs feature extensive high-voltage cabling systems that require superior protection against thermal stress, electrical interference (EMI/RFI), and mechanical abrasion. Consequently, the demand for advanced materials like metal braided sleeves, offering excellent conductivity and fire retardancy, is surging. Simultaneously, internal combustion engine vehicles continue to evolve with more sophisticated electronic control units (ECUs) and sensor networks, necessitating reliable and durable cable protection solutions.

Technological disruptions are reshaping the industry. Innovations in material science are leading to the development of lightweight, high-temperature resistant, and flame-retardant braided sleeves. For example, the integration of nanotechnology in polyester braided sleeves is enhancing their mechanical strength and thermal conductivity. Furthermore, advancements in braiding machinery are enabling the production of more complex and customized sleeve structures, catering to specific application needs. The growing emphasis on vehicle safety and the stringent safety regulations globally are compelling automotive manufacturers to invest in premium cable protection systems. This includes braided sleeves that can withstand extreme temperatures, vibration, and exposure to automotive fluids.

Consumer preferences are also subtly influencing market trends. While end-users may not directly specify braided sleeves, their demand for quieter, more efficient, and safer vehicles indirectly drives the adoption of high-performance components that reduce noise, vibration, and harshness (NVH), and prevent electrical failures. Braided sleeves play a crucial role in mitigating electromagnetic interference, which can affect the performance of sensitive electronic components and infotainment systems, thus contributing to a better user experience. The competitive dynamics within the automotive braided sleeves market are characterized by intense innovation and a focus on cost-effectiveness. Companies are investing heavily in research and development to create differentiated products that offer superior performance and competitive pricing. The market penetration of specialized braided sleeves is expected to continue its upward trajectory as automotive manufacturers prioritize reliability and longevity in their vehicle designs. The estimated market size for automotive braided sleeves in the base year of 2025 is valued at over a million US dollars.

Leading Markets & Segments in Automotive Braided Sleeves (600 words)

The global automotive braided sleeves market is dominated by Asia-Pacific, driven by its substantial automotive manufacturing base and rapid adoption of New Energy Vehicles. Countries like China, Japan, and South Korea are at the forefront of this growth. The robust economic policies supporting the automotive industry, coupled with significant investments in EV infrastructure, have created a fertile ground for braided sleeve manufacturers. North America and Europe follow as significant markets, propelled by stringent safety regulations and a strong focus on technological advancements in their mature automotive sectors.

Within the Application segment, New Energy Vehicles (NEVs) are emerging as the fastest-growing segment. The intricate high-voltage power distribution systems in EVs and plug-in hybrid electric vehicles (PHEVs) necessitate advanced protection against electrical arcing, thermal runaway, and electromagnetic interference. The sheer volume of wiring and the demanding operational environments within NEVs make braided sleeves indispensable.

- Key Drivers for NEV Dominance:

- Government subsidies and mandates for EV adoption worldwide.

- Increasing consumer demand for sustainable transportation.

- Technological advancements in battery management systems and powertrain components.

- The need for lightweight and efficient thermal management solutions for EV batteries and motors.

The Internal Combustion Engine Vehicle (ICEV) segment, while mature, remains a substantial contributor to the market. The continuous integration of advanced electronic control units (ECUs), sophisticated driver-assistance systems (ADAS), and infotainment technology in ICEVs requires robust and reliable wire harness protection.

- Key Drivers for ICEV Segment Stability:

- Established global automotive production capacity.

- Ongoing technological upgrades to meet emission standards and enhance performance.

- The sheer volume of vehicles still being produced globally.

In terms of Type, Polyester Braided Sleeves are experiencing significant demand due to their excellent flexibility, abrasion resistance, and cost-effectiveness, making them suitable for a wide range of applications in both ICEVs and NEVs. Their inherent chemical resistance also contributes to their widespread use.

- Key Drivers for Polyester Braided Sleeves:

- Versatility and adaptability to various wire and cable configurations.

- Good balance of performance and cost.

- Ease of installation and customization.

Metal Braided Sleeves, particularly those made from materials like stainless steel or copper, are gaining traction, especially in high-temperature and high-voltage applications within NEVs. Their superior EMI shielding capabilities and high-temperature resistance make them ideal for critical components.

- Key Drivers for Metal Braided Sleeves:

- Superior electromagnetic interference (EMI) and radio frequency interference (RFI) shielding.

- High-temperature resistance for powertrain and battery components.

- Durability and mechanical strength for critical applications.

The "Other" category, encompassing specialized materials like fiberglass or hybrid composites, caters to niche applications requiring unique properties such as extreme temperature resistance or chemical inertness. The dominance of the Asia-Pacific region, driven by NEV growth and extensive manufacturing capabilities, coupled with the increasing demand for advanced protective solutions in both NEVs and evolving ICEVs, positions these segments for substantial growth.

Automotive Braided Sleeves Product Developments (100–150 words)

Recent product developments in the automotive braided sleeves market focus on enhancing thermal management, EMI/RFI shielding, and overall durability. Innovations include self-extinguishing polyester braids that improve fire safety in electric vehicles. Advanced metal braided sleeves are being engineered with improved conductivity for better grounding and shielding of sensitive electronic components. Manufacturers are also developing lighter-weight and more flexible solutions to accommodate increasingly complex and confined automotive architectures. These advancements offer competitive advantages by meeting stringent automotive standards, reducing vehicle weight, and improving the reliability and longevity of electrical systems. The market fit is particularly strong in the burgeoning New Energy Vehicle sector, where advanced protection is paramount.

Key Drivers of Automotive Braided Sleeves Growth (150 words)

The automotive braided sleeves market is propelled by several key drivers. The exponential growth of New Energy Vehicles (NEVs), with their complex electrical systems and high-voltage requirements, is a primary catalyst. Stringent automotive safety regulations worldwide mandate superior wire and cable protection, driving demand for high-performance braided sleeves. Technological advancements in automotive electronics, including sophisticated sensor networks and advanced driver-assistance systems (ADAS), necessitate robust EMI/RFI shielding capabilities. Furthermore, the ongoing trend towards vehicle electrification and the associated need for effective thermal management solutions for batteries and powertrains significantly boost the demand for specialized braided sleeves. The pursuit of lighter, more fuel-efficient vehicles also encourages the adoption of advanced, yet lightweight, protective materials.

Challenges in the Automotive Braided Sleeves Market (150 words)

Despite robust growth, the automotive braided sleeves market faces several challenges. Intense price competition among manufacturers can impact profit margins, especially for standard product offerings. Supply chain disruptions, amplified by global geopolitical events and raw material price volatility, can affect production schedules and costs. The development and adoption of new, advanced materials are often hampered by lengthy qualification processes within the automotive industry, which prioritizes reliability and extensive testing. Furthermore, the emergence of alternative, albeit less comprehensive, cable management solutions in certain segments could pose a competitive threat. Navigating evolving environmental regulations and ensuring sustainable manufacturing practices also presents an ongoing challenge for market players.

Emerging Opportunities in Automotive Braided Sleeves (150 words)

Emerging opportunities in the automotive braided sleeves market are largely driven by continued innovation and strategic expansion. The ongoing evolution of autonomous driving technologies, with their intricate sensor arrays and high-bandwidth data transmission requirements, presents a significant growth avenue for advanced EMI/RFI shielding braided sleeves. The increasing adoption of vehicle-to-everything (V2X) communication systems will further elevate the need for robust signal integrity protection. Strategic partnerships between braided sleeve manufacturers and automotive OEMs or Tier 1 suppliers can lead to the development of custom solutions tailored for next-generation vehicle platforms. Expansion into emerging automotive markets with growing EV adoption rates and the development of biodegradable or recyclable braided sleeve materials to meet sustainability goals represent further lucrative opportunities.

Leading Players in the Automotive Braided Sleeves Sector

- Tenneco

- Delfingen

- Relats

- JDDTECH

- HellermannTyton

- Tresse Industrie

- Techflex

- Safeplast

Key Milestones in Automotive Braided Sleeves Industry

- 2019: Increased focus on lightweight materials in braided sleeve development to enhance fuel efficiency.

- 2020: Introduction of advanced EMI/RFI shielding braided sleeves for 5G automotive applications.

- 2021: Significant investment in R&D for high-temperature resistant braided sleeves for EV battery systems.

- 2022: Emergence of self-healing braided sleeve technologies for enhanced durability.

- 2023: Partnerships formed to develop braided sleeves with integrated sensor capabilities.

- 2024: Growing adoption of metal braided sleeves in advanced driver-assistance systems (ADAS).

- 2025 (Estimated): Expected surge in demand for braided sleeves specifically designed for solid-state battery technologies.

Strategic Outlook for Automotive Braided Sleeves Market (150 words)

- 2019: Increased focus on lightweight materials in braided sleeve development to enhance fuel efficiency.

- 2020: Introduction of advanced EMI/RFI shielding braided sleeves for 5G automotive applications.

- 2021: Significant investment in R&D for high-temperature resistant braided sleeves for EV battery systems.

- 2022: Emergence of self-healing braided sleeve technologies for enhanced durability.

- 2023: Partnerships formed to develop braided sleeves with integrated sensor capabilities.

- 2024: Growing adoption of metal braided sleeves in advanced driver-assistance systems (ADAS).

- 2025 (Estimated): Expected surge in demand for braided sleeves specifically designed for solid-state battery technologies.

Strategic Outlook for Automotive Braided Sleeves Market (150 words)

The strategic outlook for the automotive braided sleeves market is exceptionally positive, fueled by an ongoing technological revolution in the automotive industry. Growth accelerators include the sustained expansion of the New Energy Vehicle sector and the increasing complexity of automotive electrical architectures. Manufacturers that focus on developing advanced, high-performance braided sleeves with superior thermal management and EMI/RFI shielding capabilities will be well-positioned for success. Strategic opportunities lie in forging deeper collaborations with OEMs to co-develop bespoke solutions for emerging vehicle platforms, particularly those incorporating autonomous driving and advanced connectivity features. Furthermore, investing in sustainable material innovation and expanding global manufacturing footprints to cater to evolving regional demands will be crucial for long-term market leadership and capitalizing on the projected significant market growth.

Automotive Braided Sleeves Segmentation

-

1. Application

- 1.1. Internal Combustion Engine Vehicle

- 1.2. New Energy Vehicles

-

2. Type

- 2.1. Metal Braided Sleeves

- 2.2. Polyester Braided Sleeves

- 2.3. Other

Automotive Braided Sleeves Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automotive Braided Sleeves REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Braided Sleeves Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Internal Combustion Engine Vehicle

- 5.1.2. New Energy Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Metal Braided Sleeves

- 5.2.2. Polyester Braided Sleeves

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automotive Braided Sleeves Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Internal Combustion Engine Vehicle

- 6.1.2. New Energy Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Metal Braided Sleeves

- 6.2.2. Polyester Braided Sleeves

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Automotive Braided Sleeves Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Internal Combustion Engine Vehicle

- 7.1.2. New Energy Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Metal Braided Sleeves

- 7.2.2. Polyester Braided Sleeves

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Automotive Braided Sleeves Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Internal Combustion Engine Vehicle

- 8.1.2. New Energy Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Metal Braided Sleeves

- 8.2.2. Polyester Braided Sleeves

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Automotive Braided Sleeves Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Internal Combustion Engine Vehicle

- 9.1.2. New Energy Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Metal Braided Sleeves

- 9.2.2. Polyester Braided Sleeves

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Automotive Braided Sleeves Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Internal Combustion Engine Vehicle

- 10.1.2. New Energy Vehicles

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Metal Braided Sleeves

- 10.2.2. Polyester Braided Sleeves

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tenneco

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Delfingen

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Relats

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 JDDTECH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HellermannTyton

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tresse Industrie

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Techflex

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Safeplast

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Tenneco

List of Figures

- Figure 1: Global Automotive Braided Sleeves Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Braided Sleeves Revenue (million), by Application 2024 & 2032

- Figure 3: North America Automotive Braided Sleeves Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Automotive Braided Sleeves Revenue (million), by Type 2024 & 2032

- Figure 5: North America Automotive Braided Sleeves Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Automotive Braided Sleeves Revenue (million), by Country 2024 & 2032

- Figure 7: North America Automotive Braided Sleeves Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Automotive Braided Sleeves Revenue (million), by Application 2024 & 2032

- Figure 9: South America Automotive Braided Sleeves Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Automotive Braided Sleeves Revenue (million), by Type 2024 & 2032

- Figure 11: South America Automotive Braided Sleeves Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Automotive Braided Sleeves Revenue (million), by Country 2024 & 2032

- Figure 13: South America Automotive Braided Sleeves Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automotive Braided Sleeves Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Automotive Braided Sleeves Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Automotive Braided Sleeves Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Automotive Braided Sleeves Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Automotive Braided Sleeves Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Automotive Braided Sleeves Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Automotive Braided Sleeves Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Automotive Braided Sleeves Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Automotive Braided Sleeves Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Automotive Braided Sleeves Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Automotive Braided Sleeves Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Automotive Braided Sleeves Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automotive Braided Sleeves Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Automotive Braided Sleeves Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Automotive Braided Sleeves Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Automotive Braided Sleeves Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Automotive Braided Sleeves Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Automotive Braided Sleeves Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Braided Sleeves Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Braided Sleeves Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Automotive Braided Sleeves Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Automotive Braided Sleeves Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Automotive Braided Sleeves Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Automotive Braided Sleeves Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Automotive Braided Sleeves Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive Braided Sleeves Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Automotive Braided Sleeves Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Automotive Braided Sleeves Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive Braided Sleeves Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Automotive Braided Sleeves Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Automotive Braided Sleeves Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Automotive Braided Sleeves Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Automotive Braided Sleeves Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Automotive Braided Sleeves Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Automotive Braided Sleeves Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Automotive Braided Sleeves Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Automotive Braided Sleeves Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Automotive Braided Sleeves Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Braided Sleeves?

The projected CAGR is approximately 9.2%.

2. Which companies are prominent players in the Automotive Braided Sleeves?

Key companies in the market include Tenneco, Delfingen, Relats, JDDTECH, HellermannTyton, Tresse Industrie, Techflex, Safeplast.

3. What are the main segments of the Automotive Braided Sleeves?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 672 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Braided Sleeves," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Braided Sleeves report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Braided Sleeves?

To stay informed about further developments, trends, and reports in the Automotive Braided Sleeves, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence