Key Insights

The North American athletic footwear market, a key component of the global sports apparel sector, is poised for significant expansion. Fueled by rising health consciousness, increased participation in fitness activities, and the growing influence of athletic-inspired fashion, the market is projected to experience sustained growth. The historical Compound Annual Growth Rate (CAGR) of 4.18% indicates continued momentum through the forecast period. Leading segments include running shoes, driven by the enduring popularity of running, and e-commerce, reflecting evolving consumer demand for convenience and broader product selection. Dominant players such as Nike, Adidas, and Under Armour highlight the critical role of brand recognition and strategic marketing in this competitive arena. Potential challenges, including volatile raw material costs and economic uncertainties, are expected to be offset by robust underlying demand and ongoing product innovation. Market segmentation by gender and age offers opportunities for targeted strategies and product development, supporting overall market expansion. The increasing integration of sustainable materials and manufacturing practices is a notable emerging trend shaping market dynamics.

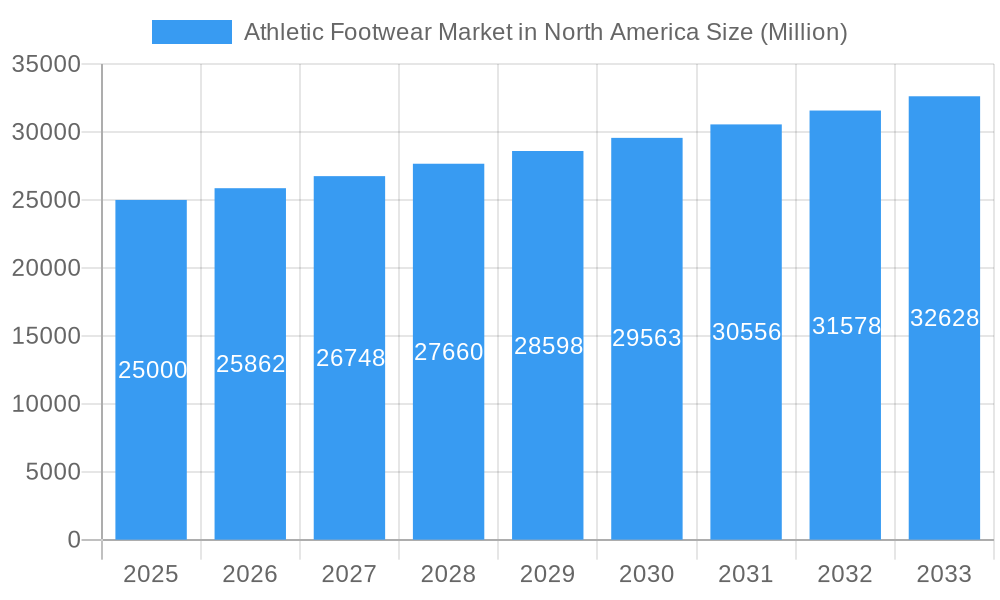

Athletic Footwear Market in North America Market Size (In Billion)

The United States represents the largest market within North America for athletic footwear, followed by Canada and Mexico. However, the "Rest of North America" segment may present accelerated growth opportunities, particularly with the emergence of new fitness trends and rising disposable incomes in developing regions. Intense competition among established brands necessitates substantial investment in research and development to deliver innovative products, improve performance features, and broaden product portfolios to meet diverse consumer needs. In-depth analysis of consumer behavior within specific demographics can further refine targeted marketing campaigns and optimize product placement strategies. The ongoing emphasis on personalized experiences and technological integration, such as smart footwear, will continue to shape future market trajectories. The projected market size for North America in 2025 is estimated at $121.34 billion, with a base year of 2025 and a market size unit of billions.

Athletic Footwear Market in North America Company Market Share

Athletic Footwear Market in North America: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North American athletic footwear market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, leading players, emerging trends, and future growth opportunities. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Athletic Footwear Market in North America Market Dynamics & Concentration

The North American athletic footwear market is characterized by a high level of competition among established players and emerging brands. Market concentration is relatively high, with a few dominant players controlling a significant market share. Innovation is a key driver, with companies constantly developing new materials, technologies, and designs to enhance performance, comfort, and style. Stringent regulatory frameworks related to product safety and environmental concerns influence manufacturing practices and product development. The market experiences competition from product substitutes, such as casual footwear and sandals, impacting market segmentation. End-user trends, particularly towards specialized footwear for specific activities, drive demand for niche products. M&A activities, while not frequent, have contributed to market consolidation and expansion of product portfolios. In the historical period (2019-2024), the average number of M&A deals per year was approximately xx. The market share held by the top 5 players in 2024 was approximately xx%, indicating a degree of concentration.

Athletic Footwear Market in North America Industry Trends & Analysis

The North American athletic footwear market is experiencing robust growth, fueled by a confluence of factors. A surge in health consciousness and participation in fitness activities, ranging from casual workouts to competitive sports, significantly drives demand across all market segments. This demand is further amplified by continuous technological advancements in materials science and manufacturing. These advancements result in lighter, more durable, and performance-enhancing footwear, catering to the evolving needs of athletes and fitness enthusiasts. Furthermore, a growing consumer preference for sustainable and ethically produced goods is influencing brand choices and prompting manufacturers to adopt eco-friendly practices.

The competitive landscape is fiercely dynamic, with established industry giants investing heavily in research and development to not only maintain their market share but also to capture new customer segments. Fashion trends, particularly within specific product categories like running shoes or basketball shoes, also exert a significant impact on market demand. The considerable growth of e-commerce over the past several years has fundamentally reshaped distribution channels and consumer purchasing behavior. This shift has created new opportunities while also presenting challenges for established brick-and-mortar retailers. Looking ahead, market growth is projected to accelerate, primarily driven by the sustained rise of fitness culture and the continuous introduction of innovative products boasting improved features and cutting-edge technology.

Leading Markets & Segments in Athletic Footwear Market in North America

- By Product Type: Running shoes remain the dominant segment, driven by the popularity of running as a fitness activity. Sport shoes constitute a significant portion, catering to a wide range of sports and activities. Trekking/hiking shoes hold a substantial share. The "other product types" segment includes specialized footwear for various activities and shows promising growth potential.

- By End User: Men's athletic footwear holds the largest market share, followed by women's and children's segments, with notable growth in women’s market segment due to increasing participation in sports.

- By Distribution Channel: Online retail stores are witnessing rapid growth, while supermarkets/hypermarkets remain an important channel. The "others" segment includes specialty stores, and independent retailers.

The US constitutes the largest market within North America, driven by high disposable income, a strong fitness culture, and a large consumer base. Key drivers for this dominance include robust economic conditions, well-developed retail infrastructure, and strong marketing campaigns by major brands. Canada follows as a significant market, with similar trends although on a smaller scale.

Athletic Footwear Market in North America Product Developments

Innovation is a defining characteristic of the athletic footwear market. Manufacturers are relentlessly pursuing enhancements in performance, comfort, and sustainability. Advanced materials like graphene and carbon fiber are being incorporated to improve durability and responsiveness, leading to footwear that provides superior performance and longevity. Significant progress in cushioning and support systems is translating into a noticeably enhanced athlete experience, reducing injury risk and boosting overall comfort. The increasing emphasis on sustainable and ethical manufacturing is driving the development of eco-friendly materials and production processes, addressing growing consumer concerns about environmental impact.

Data-driven design approaches, leveraging biomechanics analysis, are enabling the creation of highly customized products tailored to individual needs and preferences. This personalized approach optimizes performance and enhances the overall customer experience, fostering greater brand loyalty. The integration of smart technology, such as embedded sensors for performance tracking, is also gaining traction, further blurring the lines between athletic footwear and wearable technology.

Key Drivers of Athletic Footwear Market in North America Growth

The growth trajectory of the North American athletic footwear market is fueled by several interconnected factors. Technological advancements in materials and manufacturing processes consistently deliver improved product performance and comfort, directly impacting consumer satisfaction and demand. The rising health consciousness among consumers, coupled with the increasing popularity of various fitness activities, is a key driver of market expansion. Favorable economic conditions and increased disposable incomes further enhance consumer purchasing power, contributing to higher sales volumes. Government initiatives promoting physical activity and healthy lifestyles provide additional impetus to market growth.

Challenges in the Athletic Footwear Market in North America Market

The market faces several challenges including rising raw material costs affecting production costs, impacting profitability margins. Supply chain disruptions and logistical complexities affect the timely availability of products. Intense competition among established brands and emerging players puts pressure on pricing and innovation. Stringent environmental regulations increase the cost of manufacturing and compliance.

Emerging Opportunities in Athletic Footwear Market in North America

The market presents several promising opportunities. Technological breakthroughs such as personalized footwear based on biometrics will cater to individual needs and preferences, driving market expansion. Strategic partnerships between brands and fitness technology companies facilitate innovative product development and enhanced customer experiences. Market expansion into niche segments such as specialized sports and activities will create new avenues for growth.

Leading Players in the Athletic Footwear Market in North America Sector

- Adidas AG

- Wolverine World Wide Inc

- Nfinity Athletic Corporation

- Skechers USA Inc

- Puma SE

- Avia

- Under Armour Inc

- Nike Inc

- New Balance Athletics Inc

- ASICS Corporation

Key Milestones in Athletic Footwear Market in North America Industry

- April 2021: Reebok launched a vegan and sustainable version of its Nano X1 training shoes.

- September 2022: Under Armour launched UA HOVR Phantom 3 running shoes in North America.

- March 2022: Lululemon launched its first running shoes for women, Blisfeel.

Strategic Outlook for Athletic Footwear Market in North America Market

The North American athletic footwear market is poised for sustained growth, propelled by ongoing technological innovation, evolving consumer preferences, and the expanding fitness and wellness market. Strategic partnerships, a commitment to sustainable manufacturing practices, and expansion into niche market segments will be critical for accelerating growth. A strong focus on developing personalized products and delivering exceptional customer experiences will be key to driving market penetration and fostering lasting brand loyalty. Furthermore, adapting to the changing retail landscape, leveraging digital marketing strategies, and addressing the growing demand for ethical and sustainable products will prove crucial for success in this competitive market.

Athletic Footwear Market in North America Segmentation

-

1. Product Type

- 1.1. Running Shoes

- 1.2. Sport Shoes

- 1.3. Trekking/Hiking Shoes

- 1.4. Other Product Types

-

2. End user

- 2.1. Men

- 2.2. Women

- 2.3. Children

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Online Retail Stores

- 3.3. Others Distribution Channel

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

- 4.4. Rest of North America

Athletic Footwear Market in North America Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

Athletic Footwear Market in North America Regional Market Share

Geographic Coverage of Athletic Footwear Market in North America

Athletic Footwear Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Sports Participation and Flourishing Demand for Sports Apparel; Rising Innovation in Athleisure Products

- 3.3. Market Restrains

- 3.3.1. Penetration of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Growing Fitness Conscious Consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Athletic Footwear Market in North America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Running Shoes

- 5.1.2. Sport Shoes

- 5.1.3. Trekking/Hiking Shoes

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End user

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Children

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Online Retail Stores

- 5.3.3. Others Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.5.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States Athletic Footwear Market in North America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Running Shoes

- 6.1.2. Sport Shoes

- 6.1.3. Trekking/Hiking Shoes

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End user

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Children

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Online Retail Stores

- 6.3.3. Others Distribution Channel

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.4.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada Athletic Footwear Market in North America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Running Shoes

- 7.1.2. Sport Shoes

- 7.1.3. Trekking/Hiking Shoes

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End user

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Children

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Online Retail Stores

- 7.3.3. Others Distribution Channel

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.4.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico Athletic Footwear Market in North America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Running Shoes

- 8.1.2. Sport Shoes

- 8.1.3. Trekking/Hiking Shoes

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End user

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Children

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Online Retail Stores

- 8.3.3. Others Distribution Channel

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.4.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America Athletic Footwear Market in North America Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Running Shoes

- 9.1.2. Sport Shoes

- 9.1.3. Trekking/Hiking Shoes

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End user

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Children

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Online Retail Stores

- 9.3.3. Others Distribution Channel

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. United States

- 9.4.2. Canada

- 9.4.3. Mexico

- 9.4.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Adidas AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Wolverine World Wide Inc *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Nfinity Athletic Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Skechers USA Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Puma SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Avia

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Under Armour Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nike Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 New Balance Athletics Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ASICS Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Adidas AG

List of Figures

- Figure 1: Athletic Footwear Market in North America Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Athletic Footwear Market in North America Share (%) by Company 2025

List of Tables

- Table 1: Athletic Footwear Market in North America Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Athletic Footwear Market in North America Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Athletic Footwear Market in North America Revenue billion Forecast, by End user 2020 & 2033

- Table 4: Athletic Footwear Market in North America Volume K Units Forecast, by End user 2020 & 2033

- Table 5: Athletic Footwear Market in North America Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Athletic Footwear Market in North America Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: Athletic Footwear Market in North America Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Athletic Footwear Market in North America Volume K Units Forecast, by Geography 2020 & 2033

- Table 9: Athletic Footwear Market in North America Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Athletic Footwear Market in North America Volume K Units Forecast, by Region 2020 & 2033

- Table 11: Athletic Footwear Market in North America Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Athletic Footwear Market in North America Volume K Units Forecast, by Product Type 2020 & 2033

- Table 13: Athletic Footwear Market in North America Revenue billion Forecast, by End user 2020 & 2033

- Table 14: Athletic Footwear Market in North America Volume K Units Forecast, by End user 2020 & 2033

- Table 15: Athletic Footwear Market in North America Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 16: Athletic Footwear Market in North America Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 17: Athletic Footwear Market in North America Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Athletic Footwear Market in North America Volume K Units Forecast, by Geography 2020 & 2033

- Table 19: Athletic Footwear Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Athletic Footwear Market in North America Volume K Units Forecast, by Country 2020 & 2033

- Table 21: Athletic Footwear Market in North America Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Athletic Footwear Market in North America Volume K Units Forecast, by Product Type 2020 & 2033

- Table 23: Athletic Footwear Market in North America Revenue billion Forecast, by End user 2020 & 2033

- Table 24: Athletic Footwear Market in North America Volume K Units Forecast, by End user 2020 & 2033

- Table 25: Athletic Footwear Market in North America Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 26: Athletic Footwear Market in North America Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 27: Athletic Footwear Market in North America Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Athletic Footwear Market in North America Volume K Units Forecast, by Geography 2020 & 2033

- Table 29: Athletic Footwear Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Athletic Footwear Market in North America Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Athletic Footwear Market in North America Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: Athletic Footwear Market in North America Volume K Units Forecast, by Product Type 2020 & 2033

- Table 33: Athletic Footwear Market in North America Revenue billion Forecast, by End user 2020 & 2033

- Table 34: Athletic Footwear Market in North America Volume K Units Forecast, by End user 2020 & 2033

- Table 35: Athletic Footwear Market in North America Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: Athletic Footwear Market in North America Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 37: Athletic Footwear Market in North America Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Athletic Footwear Market in North America Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: Athletic Footwear Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Athletic Footwear Market in North America Volume K Units Forecast, by Country 2020 & 2033

- Table 41: Athletic Footwear Market in North America Revenue billion Forecast, by Product Type 2020 & 2033

- Table 42: Athletic Footwear Market in North America Volume K Units Forecast, by Product Type 2020 & 2033

- Table 43: Athletic Footwear Market in North America Revenue billion Forecast, by End user 2020 & 2033

- Table 44: Athletic Footwear Market in North America Volume K Units Forecast, by End user 2020 & 2033

- Table 45: Athletic Footwear Market in North America Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 46: Athletic Footwear Market in North America Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 47: Athletic Footwear Market in North America Revenue billion Forecast, by Geography 2020 & 2033

- Table 48: Athletic Footwear Market in North America Volume K Units Forecast, by Geography 2020 & 2033

- Table 49: Athletic Footwear Market in North America Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Athletic Footwear Market in North America Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Athletic Footwear Market in North America?

The projected CAGR is approximately 4.18%.

2. Which companies are prominent players in the Athletic Footwear Market in North America?

Key companies in the market include Adidas AG, Wolverine World Wide Inc *List Not Exhaustive, Nfinity Athletic Corporation, Skechers USA Inc, Puma SE, Avia, Under Armour Inc, Nike Inc, New Balance Athletics Inc, ASICS Corporation.

3. What are the main segments of the Athletic Footwear Market in North America?

The market segments include Product Type, End user, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 121.34 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Sports Participation and Flourishing Demand for Sports Apparel; Rising Innovation in Athleisure Products.

6. What are the notable trends driving market growth?

Growing Fitness Conscious Consumers.

7. Are there any restraints impacting market growth?

Penetration of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In March 2022, Lululemon launched the first ever running shoes for women called Blisfeel across North America, Mainland China, and the United Kingdom. The running shoes will retail for USD 148.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Athletic Footwear Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Athletic Footwear Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Athletic Footwear Market in North America?

To stay informed about further developments, trends, and reports in the Athletic Footwear Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence