Key Insights

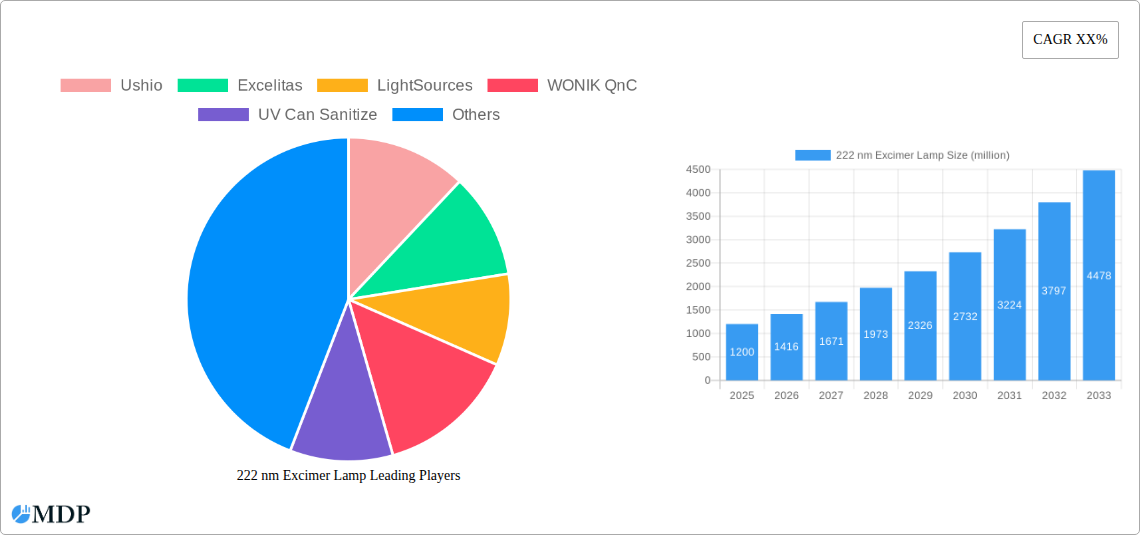

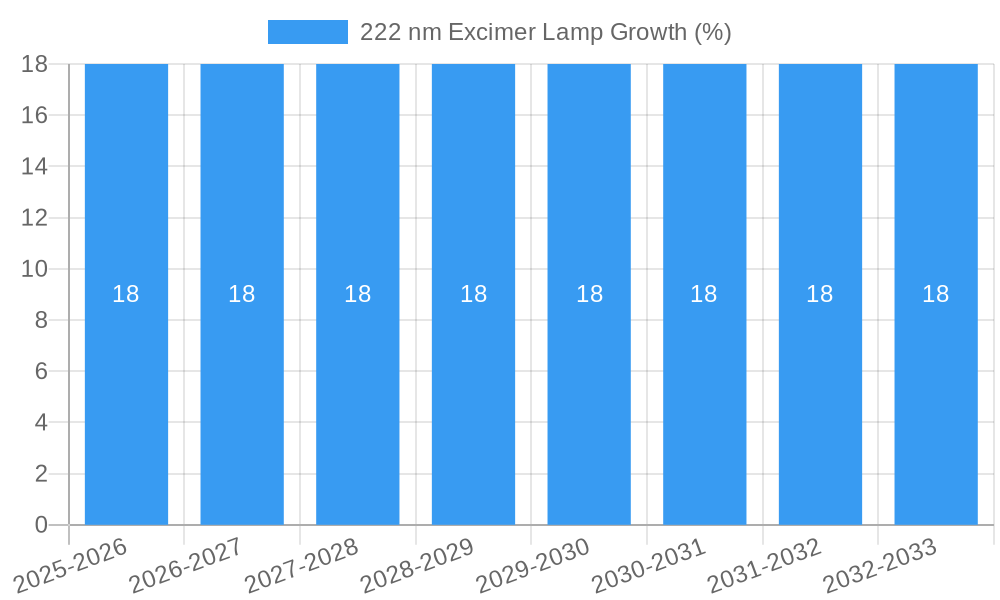

The global 222 nm Excimer Lamp market is poised for significant expansion, projected to reach a substantial market size of approximately USD 1.2 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 18% anticipated throughout the forecast period from 2025 to 2033. This impressive growth trajectory is primarily fueled by the escalating demand for advanced disinfection and sterilization solutions across diverse sectors. Key drivers include the growing awareness of hygiene protocols, particularly in healthcare settings where the lamp's ability to inactivate pathogens without generating harmful ozone is highly valued. The catering industry is also a major contributor, driven by stringent food safety regulations and the need for efficient sanitization of preparation areas and equipment. Furthermore, the education sector is increasingly adopting these lamps for maintaining germ-free learning environments, especially post-pandemic. The industrial segment, encompassing applications like water purification and air sterilization, also presents substantial growth opportunities.

The market is segmented into various power categories, with lamps below 100W showing strong adoption due to their versatility and suitability for localized disinfection, while the 100-200W and above 200W segments cater to larger-scale applications. Emerging trends such as the integration of 222 nm excimer lamps into smart devices and automated disinfection systems are expected to further propel market growth. However, the market faces certain restraints, including the initial high cost of some advanced systems and the need for continued research and development to optimize efficiency and cost-effectiveness. Regulatory approvals and standardization for widespread adoption in certain applications also remain a consideration. Leading companies like Ushio, Excelitas, and LightSources are at the forefront of innovation, investing in R&D to expand the application scope and enhance the performance of these next-generation disinfection technologies.

Here is an SEO-optimized, engaging report description for the 222 nm Excimer Lamp market, designed for immediate use without modification.

222 nm Excimer Lamp Market: Global Forecast to 2033 – Unlocking Advanced Disinfection & Sterilization Technologies

This comprehensive market research report provides an in-depth analysis of the global 222 nm Excimer Lamp market, a rapidly evolving sector driven by escalating demand for advanced disinfection and sterilization solutions across critical industries. Spanning from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report leverages historical data from 2019–2024 to deliver actionable insights. Explore the market dynamics, key trends, leading players, and future opportunities within this high-growth segment, powered by cutting-edge ultraviolet germicidal irradiation (UVGI) technology. This report is essential for industry stakeholders seeking to understand market concentration, innovation drivers, regulatory landscapes, and the strategic imperatives for success in the 222 nm excimer lamp ecosystem.

222 nm Excimer Lamp Market Dynamics & Concentration

The 222 nm Excimer Lamp market is characterized by a moderate to high concentration, with key players investing heavily in research and development to enhance germicidal efficacy and safety profiles. Innovation drivers include the escalating need for effective surface and air disinfection in healthcare settings, the growing awareness of microbial contamination risks in food and beverage industries, and the increasing adoption of UVGI technology in schools and public spaces. Regulatory frameworks are gradually evolving to accommodate the unique benefits of 222 nm UV, distinguishing it from traditional UVC sources due to its reduced harmful effects on human tissue and materials. Product substitutes, primarily other UV-C technologies and chemical disinfectants, face increasing competition from the superior safety and efficacy of 222 nm excimer lamps. End-user trends are shifting towards non-chemical, efficient, and continuous disinfection methods. Merger and acquisition (M&A) activities, though currently at a moderate level, are expected to increase as companies seek to expand their product portfolios and market reach. Estimated M&A deal counts are projected to grow by 15% over the forecast period. Current market share distribution indicates a significant presence of established lighting and germicidal solution providers, with innovative startups also carving out niche segments.

222 nm Excimer Lamp Industry Trends & Analysis

The global 222 nm Excimer Lamp market is poised for substantial growth, driven by a confluence of technological advancements, increasing health consciousness, and supportive regulatory environments. The primary market growth driver is the undeniable efficacy of 222 nm UV light in inactivating a broad spectrum of pathogens, including bacteria, viruses, and fungi, at significantly reduced exposure times compared to traditional UV-C. This germicidal power, coupled with its purported safety for human exposure at appropriate dosages, positions 222 nm excimer lamps as a superior solution for continuous disinfection in occupied spaces, a paradigm shift from older UV technologies requiring strict space evacuation. Technological disruptions are centered around improving lamp efficiency, extending lifespan, miniaturization for broader integration, and developing intelligent control systems for optimized deployment. Consumer preferences are increasingly leaning towards health and safety, fueling demand for reliable and non-intrusive disinfection methods, especially in the wake of global health concerns. Competitive dynamics are intensifying, with established players like Ushio and Excelitas actively innovating and new entrants emerging, particularly from Asia. The market penetration of 222 nm excimer lamps is still in its nascent stages but is rapidly expanding, propelled by widespread adoption in the medical sector for operating rooms and patient areas, and emerging applications in catering for food safety and schools for enhanced student health. The compound annual growth rate (CAGR) is projected to be in the region of 25% over the forecast period, reaching an estimated market size of over 5,000 million USD by 2033. Furthermore, advancements in material science and power management are enabling the development of more cost-effective and energy-efficient 222 nm lamp solutions, further accelerating market adoption and expanding the addressable market. The development of advanced optical designs and reflector systems to precisely direct the germicidal radiation is also a key trend, optimizing disinfection coverage and minimizing energy wastage.

Leading Markets & Segments in 222 nm Excimer Lamp

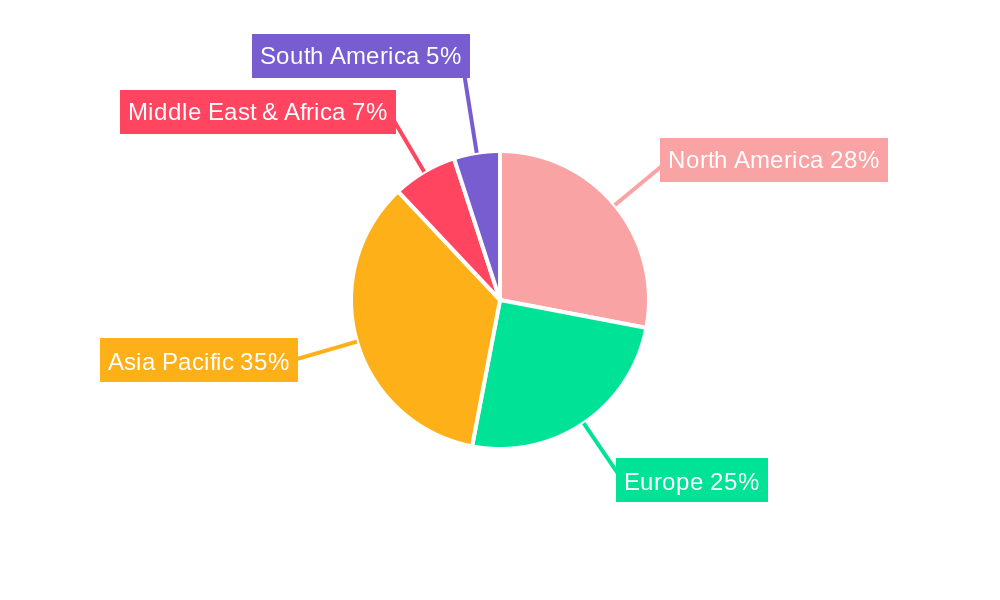

The Medical application segment is currently the most dominant force in the 222 nm Excimer Lamp market, driven by stringent hygiene requirements and the critical need for effective pathogen control in healthcare facilities. Within the medical segment, the above 200W power type exhibits significant traction, particularly for large-area disinfection in hospitals and clinics. The economic policies promoting enhanced healthcare infrastructure and patient safety standards, coupled with government initiatives to curb hospital-acquired infections, are major economic drivers for this segment. North America, particularly the United States, leads in market penetration due to advanced healthcare systems and significant R&D investments. However, the Asia-Pacific region, especially China and South Korea, is emerging as a high-growth market, fueled by increasing healthcare expenditure and rapid adoption of advanced sterilization technologies.

Application Dominance:

- Medical: Paramount importance due to its germicidal efficacy and safety profile, essential for combating hospital-acquired infections and ensuring sterile environments.

- Catering: Growing demand for ensuring food safety and preventing cross-contamination in food processing plants and preparation areas.

- School: Rising adoption for maintaining healthy learning environments and reducing the spread of common illnesses.

- Industrial: Increasing use in sensitive manufacturing processes where microbial control is crucial, such as pharmaceuticals and electronics.

- Others: Encompasses emerging applications in public transport, hospitality, and consumer electronics.

Type Dominance:

- Above 200W: Preferred for large-scale disinfection applications in hospitals, industrial facilities, and public spaces due to their higher output and coverage area.

- 100-200W: Increasingly popular for mid-sized applications, offering a balance of power and portability.

- Below 100W: Gaining traction in niche applications and consumer-focused devices where compactness and lower energy consumption are prioritized.

The robust infrastructure for healthcare in developed nations, coupled with substantial government funding for infection control, solidifies the medical segment's lead. Furthermore, the ongoing development of specialized 222 nm lamp solutions tailored for specific medical procedures and environments further cements its dominance. The increasing awareness about the benefits of germ-free environments post-pandemic is a significant catalyst, pushing demand across all segments but with the medical sector being the primary beneficiary.

222 nm Excimer Lamp Product Developments

Recent product developments in the 222 nm Excimer Lamp sector are focused on enhancing germicidal efficacy, improving energy efficiency, and expanding application versatility. Innovations include the development of more compact and integrated lamp modules, enabling their incorporation into a wider range of devices and fixtures. Enhanced spectrum control and optimized irradiation patterns are leading to more targeted and effective disinfection. Companies are also focusing on extending lamp lifespan and reducing power consumption, making these solutions more economically viable for long-term deployment. The competitive advantage lies in offering differentiated features such as precise wavelength control, variable intensity, and smart connectivity for remote monitoring and management, catering to diverse end-user needs across medical, industrial, and public spaces.

Key Drivers of 222 nm Excimer Lamp Growth

The growth of the 222 nm Excimer Lamp market is fundamentally driven by the escalating global demand for effective, non-chemical disinfection and sterilization solutions. This is amplified by heightened awareness of public health and hygiene, particularly post-pandemic, leading to increased investment in advanced germicidal technologies across various sectors. Technological advancements, such as improved lamp efficiency and durability, are making 222 nm excimer lamps more accessible and cost-effective. Furthermore, evolving regulatory frameworks that increasingly recognize the unique safety and efficacy benefits of 222 nm UV are paving the way for broader market acceptance and adoption. The medical industry's continuous need for sterile environments remains a significant impetus, alongside growing applications in food safety, water purification, and air quality management in public spaces.

Challenges in the 222 nm Excimer Lamp Market

Despite its promising growth, the 222 nm Excimer Lamp market faces several challenges. Regulatory clarity and standardization for 222 nm UV applications are still evolving in many regions, creating uncertainty for manufacturers and end-users. The initial cost of some 222 nm excimer lamp systems can be higher compared to traditional disinfection methods, posing a barrier for cost-sensitive segments. Supply chain disruptions and the availability of key raw materials can also impact production and pricing. Furthermore, widespread consumer education about the differences and benefits of 222 nm UV compared to other UV technologies is crucial to overcome potential skepticism and ensure proper application, preventing misuse and maximizing efficacy.

Emerging Opportunities in 222 nm Excimer Lamp

Emerging opportunities in the 222 nm Excimer Lamp market lie in the untapped potential of new application areas and technological integrations. The expansion into consumer-facing products, such as home air purifiers and smart appliances with integrated disinfection capabilities, represents a significant growth avenue. Strategic partnerships between lamp manufacturers and device integrators, particularly in the fields of HVAC systems, robotics, and smart building technologies, will unlock new market segments. Furthermore, advancements in solid-state 222 nm UV sources could revolutionize the market, offering enhanced flexibility, miniaturization, and performance, thereby driving adoption in novel applications like disinfection of electronics and textiles.

Leading Players in the 222 nm Excimer Lamp Sector

- Ushio

- Excelitas

- LightSources

- WONIK QnC

- UV Can Sanitize

- First UVC

- Unilam

- JK Lighting

- GMY Lighting Technology

- LONGPRO

- UV Medico

- Sterilray

- Acuity Brands

- ERGO HealthTech

Key Milestones in 222 nm Excimer Lamp Industry

- 2019: Early research and development of Far-UVC (222 nm) germicidal lamps gain traction, focusing on safety and efficacy.

- 2020: Increased global demand for disinfection solutions due to the COVID-19 pandemic accelerates interest and investment in 222 nm technology.

- 2021: Several key players begin commercializing 222 nm excimer lamps, targeting the medical and industrial sectors.

- 2022: Introduction of new product lines with improved efficiency and extended lifespan by leading manufacturers.

- 2023: Growing regulatory discussions and initial approvals for 222 nm UV applications in public spaces and specific healthcare settings.

- 2024: Expansion of manufacturing capacities and diversification of product offerings to cater to a wider range of applications.

Strategic Outlook for 222 nm Excimer Lamp Market

The strategic outlook for the 222 nm Excimer Lamp market is exceptionally positive, driven by sustained demand for advanced disinfection and sterilization solutions. Future growth will be accelerated by ongoing technological innovations, leading to more compact, energy-efficient, and cost-effective products. Expansion into emerging markets and diverse applications, including smart home devices and advanced industrial processes, presents significant revenue potential. Strategic partnerships and collaborations will be crucial for market penetration and the development of integrated solutions. Continued investment in research and development to address any lingering regulatory concerns and to further enhance germicidal performance will solidify the market's trajectory towards widespread adoption as a leading disinfection technology.

222 nm Excimer Lamp Segmentation

-

1. Application

- 1.1. Medical

- 1.2. Catering

- 1.3. School

- 1.4. Industrial

- 1.5. Others

-

2. Types

- 2.1. below 100W

- 2.2. 100-200W

- 2.3. above 200W

222 nm Excimer Lamp Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

222 nm Excimer Lamp REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 222 nm Excimer Lamp Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical

- 5.1.2. Catering

- 5.1.3. School

- 5.1.4. Industrial

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. below 100W

- 5.2.2. 100-200W

- 5.2.3. above 200W

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America 222 nm Excimer Lamp Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical

- 6.1.2. Catering

- 6.1.3. School

- 6.1.4. Industrial

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. below 100W

- 6.2.2. 100-200W

- 6.2.3. above 200W

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America 222 nm Excimer Lamp Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical

- 7.1.2. Catering

- 7.1.3. School

- 7.1.4. Industrial

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. below 100W

- 7.2.2. 100-200W

- 7.2.3. above 200W

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe 222 nm Excimer Lamp Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical

- 8.1.2. Catering

- 8.1.3. School

- 8.1.4. Industrial

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. below 100W

- 8.2.2. 100-200W

- 8.2.3. above 200W

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa 222 nm Excimer Lamp Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical

- 9.1.2. Catering

- 9.1.3. School

- 9.1.4. Industrial

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. below 100W

- 9.2.2. 100-200W

- 9.2.3. above 200W

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific 222 nm Excimer Lamp Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical

- 10.1.2. Catering

- 10.1.3. School

- 10.1.4. Industrial

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. below 100W

- 10.2.2. 100-200W

- 10.2.3. above 200W

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ushio

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Excelitas

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LightSources

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 WONIK QnC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 UV Can Sanitize

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 First UVC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Unilam

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 JK Lighting

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GMY Lighting Technology

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LONGPRO

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 UV Medico

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sterilray

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Acuity Brands

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ERGO HealthTech

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Ushio

List of Figures

- Figure 1: Global 222 nm Excimer Lamp Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America 222 nm Excimer Lamp Revenue (million), by Application 2024 & 2032

- Figure 3: North America 222 nm Excimer Lamp Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America 222 nm Excimer Lamp Revenue (million), by Types 2024 & 2032

- Figure 5: North America 222 nm Excimer Lamp Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America 222 nm Excimer Lamp Revenue (million), by Country 2024 & 2032

- Figure 7: North America 222 nm Excimer Lamp Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America 222 nm Excimer Lamp Revenue (million), by Application 2024 & 2032

- Figure 9: South America 222 nm Excimer Lamp Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America 222 nm Excimer Lamp Revenue (million), by Types 2024 & 2032

- Figure 11: South America 222 nm Excimer Lamp Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America 222 nm Excimer Lamp Revenue (million), by Country 2024 & 2032

- Figure 13: South America 222 nm Excimer Lamp Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe 222 nm Excimer Lamp Revenue (million), by Application 2024 & 2032

- Figure 15: Europe 222 nm Excimer Lamp Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe 222 nm Excimer Lamp Revenue (million), by Types 2024 & 2032

- Figure 17: Europe 222 nm Excimer Lamp Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe 222 nm Excimer Lamp Revenue (million), by Country 2024 & 2032

- Figure 19: Europe 222 nm Excimer Lamp Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa 222 nm Excimer Lamp Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa 222 nm Excimer Lamp Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa 222 nm Excimer Lamp Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa 222 nm Excimer Lamp Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa 222 nm Excimer Lamp Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa 222 nm Excimer Lamp Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific 222 nm Excimer Lamp Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific 222 nm Excimer Lamp Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific 222 nm Excimer Lamp Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific 222 nm Excimer Lamp Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific 222 nm Excimer Lamp Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific 222 nm Excimer Lamp Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global 222 nm Excimer Lamp Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global 222 nm Excimer Lamp Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global 222 nm Excimer Lamp Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global 222 nm Excimer Lamp Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global 222 nm Excimer Lamp Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global 222 nm Excimer Lamp Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global 222 nm Excimer Lamp Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global 222 nm Excimer Lamp Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global 222 nm Excimer Lamp Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global 222 nm Excimer Lamp Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global 222 nm Excimer Lamp Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global 222 nm Excimer Lamp Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global 222 nm Excimer Lamp Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global 222 nm Excimer Lamp Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global 222 nm Excimer Lamp Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global 222 nm Excimer Lamp Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global 222 nm Excimer Lamp Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global 222 nm Excimer Lamp Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global 222 nm Excimer Lamp Revenue million Forecast, by Country 2019 & 2032

- Table 41: China 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific 222 nm Excimer Lamp Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 222 nm Excimer Lamp?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the 222 nm Excimer Lamp?

Key companies in the market include Ushio, Excelitas, LightSources, WONIK QnC, UV Can Sanitize, First UVC, Unilam, JK Lighting, GMY Lighting Technology, LONGPRO, UV Medico, Sterilray, Acuity Brands, ERGO HealthTech.

3. What are the main segments of the 222 nm Excimer Lamp?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "222 nm Excimer Lamp," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 222 nm Excimer Lamp report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 222 nm Excimer Lamp?

To stay informed about further developments, trends, and reports in the 222 nm Excimer Lamp, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence