Key Insights

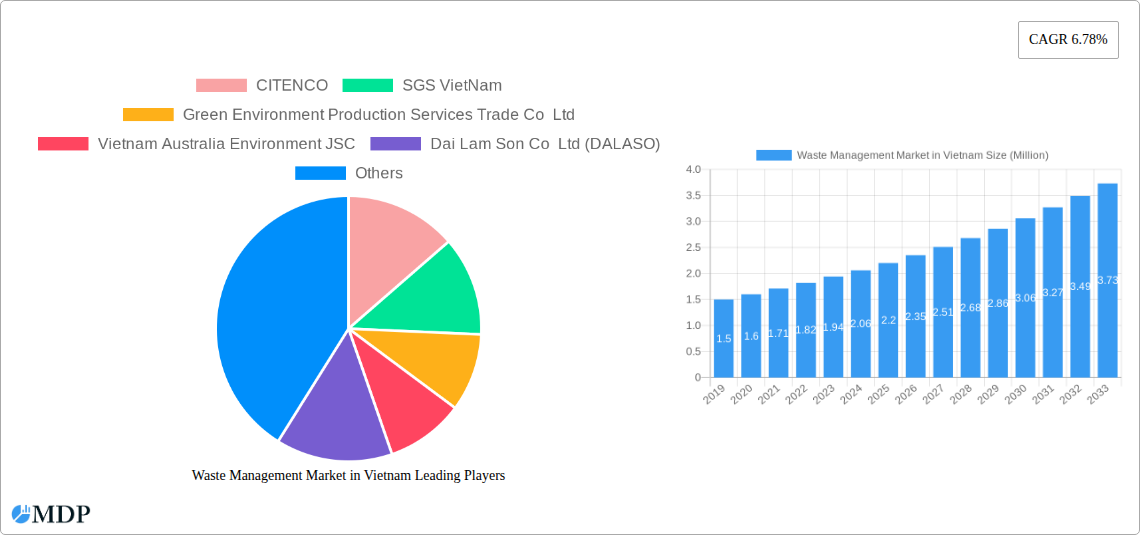

The Vietnamese waste management market is poised for significant expansion, driven by a growing economy, increasing industrialization, and a greater emphasis on environmental sustainability. With a current market size estimated at USD 2.07 Million and a projected Compound Annual Growth Rate (CAGR) of 6.78% between 2019 and 2033, the sector is set for robust development. This growth is fueled by several key drivers, including stricter government regulations on waste disposal and pollution control, rising public awareness regarding environmental protection, and substantial investments in modern waste management infrastructure. The increasing volume of industrial waste generated by a burgeoning manufacturing sector, coupled with the continuous generation of municipal solid waste from rapidly urbanizing areas, creates a persistent demand for effective waste management solutions. Furthermore, the growing awareness and concern surrounding hazardous waste, e-waste, and plastic waste are compelling businesses and municipalities to adopt more responsible disposal and recycling practices, further contributing to market expansion.

Waste Management Market in Vietnam Market Size (In Million)

The market is segmented across various waste types, including Industrial Waste, Municipal Solid Waste, Hazardous Waste, E-waste, Plastic Waste, and Bio-medical Waste, with a focus on diverse disposal methods such as Landfill, Incineration, and Recycling. Innovations in recycling technologies and the increasing adoption of circular economy principles are expected to reshape the waste management landscape, moving towards more sustainable and resource-efficient models. While landfilling remains a dominant method, growing environmental concerns and land scarcity are pushing for greater adoption of incineration with energy recovery and advanced recycling processes. Key players like CITENCO, SGS VietNam, and Vietnam Waste Solutions are actively investing in advanced technologies and expanding their service offerings to meet the evolving demands of this dynamic market. Despite the promising outlook, challenges such as underdeveloped infrastructure in certain regions and the need for enhanced public-private partnerships to finance large-scale projects may pose some restraints, but the overall trajectory remains strongly positive.

Waste Management Market in Vietnam Company Market Share

Vietnam Waste Management Market Analysis: Opportunities, Trends, and Key Players 2025-2033

Unlock strategic insights into Vietnam's burgeoning waste management market with this comprehensive report. Covering the study period of 2019–2033, with a base year of 2025, this analysis delves deep into market dynamics, industry trends, technological advancements, and competitive landscapes. Discover key drivers, challenges, and emerging opportunities within Vietnam's waste management sector, crucial for environmental services companies, government agencies, investment firms, and technology providers seeking to capitalize on this rapidly evolving market. We forecast the market to reach an estimated USD 5,500 Million by 2033, with a projected Compound Annual Growth Rate (CAGR) of 7.2% during the forecast period (2025–2033). The historical period (2019–2024) has seen significant initial growth, setting the stage for future expansion.

Waste Management Market in Vietnam Market Dynamics & Concentration

The Vietnam waste management market exhibits a moderately concentrated structure, with a few prominent players dominating key segments while a larger number of smaller enterprises cater to niche or localized needs. Innovation is primarily driven by the increasing need for sustainable waste disposal solutions, stricter environmental regulations, and the growing adoption of advanced technologies for waste-to-energy and resource recovery. Regulatory frameworks, such as Decree 167/2017/ND-CP on waste management and associated environmental protection laws, are becoming more stringent, pushing for better practices and higher standards across all waste types. Product substitutes are limited in direct disposal, but innovation in recycling technologies and alternative material development presents indirect competitive pressures. End-user trends highlight a growing demand for efficient, compliant, and environmentally responsible waste management services, particularly from industrial and manufacturing sectors. Mergers and acquisitions (M&A) activity is anticipated to increase as larger companies seek to expand their geographic reach and service portfolios, consolidating market share. Recent M&A activity indicates a trend towards strategic alliances and acquisitions aimed at integrating advanced technologies and expanding operational capabilities. The market share distribution is dynamic, with major players holding approximately 35-40% of the market in key urban centers, while the remaining share is fragmented. M&A deal counts are projected to rise by 15-20% over the forecast period.

Waste Management Market in Vietnam Industry Trends & Analysis

The Vietnam waste management market is experiencing robust growth, propelled by rapid industrialization, urbanization, and increasing environmental consciousness. The escalating generation of municipal solid waste (MSW) and industrial waste due to economic expansion presents both a challenge and a significant market opportunity. Technological disruptions are transforming the sector, with a shift towards smart waste management systems, including the use of IoT sensors for real-time monitoring of waste levels, automated collection routes, and advanced sorting technologies. This adoption of digital solutions, as exemplified by CITENCO’s use of GPS in its garbage trucks, enhances operational efficiency and reduces costs. Consumer preferences are evolving towards more sustainable practices, driving demand for recycling and waste-to-energy (WTE) solutions over traditional landfill methods. Growing public awareness regarding the environmental and health impacts of improper waste disposal is further fueling this trend. The competitive dynamics are intensifying, with both domestic and international players vying for market share. Key growth drivers include government initiatives promoting a circular economy, foreign direct investment in infrastructure development, and the rising demand for specialized waste treatment for hazardous waste and e-waste. Market penetration for advanced recycling and WTE technologies is still in its early stages but is projected to grow significantly, driven by supportive policies and technological advancements. The market penetration for formal MSW collection is estimated to be around 75% in urban areas and significantly lower in rural regions, indicating substantial room for growth. The overall market CAGR is projected at 7.2% from 2025 to 2033, reflecting strong and sustained growth.

Leading Markets & Segments in Waste Management Market in Vietnam

The Municipal Solid Waste (MSW) segment is currently the largest and most dominant in the Vietnam waste management market, driven by rapid urbanization and increasing population density in cities. The sheer volume of daily waste generated by households and commercial establishments makes MSW management a primary focus for local governments and service providers.

- Key Drivers for MSW Dominance:

- Economic Policies: Government policies supporting urban development and infrastructure have led to increased population concentration in cities, directly contributing to higher MSW generation.

- Infrastructure Development: Investment in collection systems, transfer stations, and disposal facilities for MSW is a continuous priority for municipalities.

- Public Health Concerns: Growing awareness of public health risks associated with unmanaged waste further necessitates efficient MSW management.

Another critical and rapidly growing segment is Industrial Waste, fueled by Vietnam's strong manufacturing and export-oriented economy. Factories, construction sites, and industrial parks generate substantial volumes of diverse industrial by-products, requiring specialized handling and disposal.

- Key Drivers for Industrial Waste Growth:

- Foreign Direct Investment (FDI): A surge in FDI into manufacturing sectors directly translates to increased industrial waste generation.

- Export-Oriented Economy: The focus on manufacturing for export leads to high production volumes and, consequently, more industrial by-products.

- Environmental Compliance: Stricter regulations are compelling industries to adopt compliant and environmentally sound practices for managing their waste.

In terms of Disposal Method, Landfill remains the most prevalent method, accounting for approximately 60% of total waste disposal. However, this is gradually shifting.

- Dominance Analysis of Landfill: Landfills are often the most cost-effective and readily available option for large-scale waste disposal, especially in regions with ample land. However, concerns over land scarcity, environmental pollution (leachate, greenhouse gas emissions), and the loss of potential resources are driving a move towards alternatives.

Recycling is a segment with immense growth potential, currently holding around 20-25% market share. The government's push towards a circular economy and increasing consumer demand for sustainable products are key catalysts.

- Key Drivers for Recycling Growth:

- Circular Economy Initiatives: Government policies and international collaborations are promoting resource recovery and waste minimization.

- Technological Advancements: Improved sorting and processing technologies are making recycling more economically viable.

- Corporate Social Responsibility (CSR): Businesses are increasingly investing in recycling programs to enhance their environmental credentials.

Incineration, particularly Waste-to-Energy (WTE), is an emerging segment with significant expansion prospects, currently representing about 10-15% of the market.

- Key Drivers for Incineration Growth:

- Energy Security: WTE offers a dual benefit of waste reduction and electricity generation, contributing to energy security.

- Land Scarcity: Incineration significantly reduces waste volume, alleviating pressure on landfill space.

- Environmental Benefits: Modern incineration plants with advanced emission controls can offer a cleaner alternative to uncontrolled burning or poorly managed landfills.

The Hazardous Waste and E-waste segments, while smaller in volume, are critically important due to their high environmental and health risks. Stricter regulations and specialized treatment needs are driving growth and investment in these niche areas. Plastic Waste management is a particular focus due to its pervasive environmental impact.

Waste Management Market in Vietnam Product Developments

Product developments in Vietnam's waste management sector are increasingly focused on enhancing efficiency, sustainability, and technological integration. Innovations include advanced sorting technologies utilizing artificial intelligence and robotics for better material recovery from mixed waste streams. The development of modular and scalable waste-to-energy plants, designed to cater to varying waste volumes and local energy demands, is gaining traction. Furthermore, there's a growing emphasis on the creation of specialized containment and treatment systems for hazardous and bio-medical waste, ensuring compliance with stringent environmental and safety standards. Companies are also developing integrated digital platforms that offer real-time waste tracking, route optimization, and data analytics for better operational management and reporting, providing a competitive advantage in service delivery.

Key Drivers of Waste Management Market in Vietnam Growth

The Vietnam waste management market is propelled by several key drivers. Rapid Industrialization and Urbanization are leading to a significant increase in waste generation across all categories. Government Support and Favorable Regulations, including policies promoting a circular economy and stricter environmental enforcement, are compelling businesses and municipalities to adopt compliant and sustainable waste management practices. Technological Advancements in recycling, waste-to-energy, and smart waste management systems are making solutions more efficient and cost-effective. Additionally, Growing Environmental Awareness among the public and corporations is creating demand for responsible waste disposal and resource recovery.

Challenges in the Waste Management Market in Vietnam Market

Despite robust growth potential, the Vietnam waste management market faces several challenges. Inadequate Infrastructure in many rural areas and for specialized waste types like e-waste remains a significant barrier. Limited Funding and Investment for large-scale, advanced waste treatment facilities, especially for private sector participation, can hinder progress. Lack of Public Awareness and Participation in proper waste segregation at the source contributes to inefficiencies in the collection and recycling processes. Regulatory Enforcement Gaps and inconsistencies in implementation can create an uneven playing field. Furthermore, the high cost of advanced waste management technologies can be a deterrent for smaller municipalities and businesses.

Emerging Opportunities in Waste Management Market in Vietnam

Catalysts for long-term growth in the Vietnam waste management market are abundant. The drive towards a Circular Economy presents significant opportunities for companies involved in material recovery, remanufacturing, and waste valorization. Technological breakthroughs in plastic recycling, bio-degradation of organic waste, and advanced incineration with energy recovery are poised to reshape the market. Strategic partnerships between government bodies, private enterprises, and international organizations can unlock new funding streams and facilitate technology transfer. The increasing focus on Sustainable Tourism and Green Building also creates demand for specialized waste management solutions. Furthermore, the expansion of collection and treatment services into less-served rural areas represents a substantial market expansion opportunity.

Leading Players in the Waste Management Market in Vietnam Sector

- CITENCO

- SGS VietNam

- Green Environment Production Services Trade Co Ltd

- Vietnam Australia Environment JSC

- Dai Lam Son Co Ltd (DALASO)

- VN Green Environment Joint Stock Company

- Vietnam Clean Environmental Treatment Co Ltd

- Urban Environment Company

- Vietnam Waste Solutions

- INSEE ECOCYCLE

- Tan Phat Tai Co Ltd

Key Milestones in Waste Management Market in Vietnam Industry

- July 2023: Vietnam committed to collaborating closely with fellow ASEAN member countries, non-ASEAN nations, and international partners to mobilize resources dedicated to capacity building, technology transfer, and exchanging experiences concerning hazardous chemicals and waste management. This signifies a strengthened international focus on environmental cooperation.

- May 2023: The HCM City Urban Environment Company Limited (CITENCO) integrated digital technology, such as a global positioning system, into its 265 garbage trucks. This initiative enhanced the efficiency of garbage collection and disposal operations through real-time monitoring and route optimization.

Strategic Outlook for Waste Management Market in Vietnam Market

The strategic outlook for Vietnam's waste management market is highly optimistic, driven by a confluence of economic growth, policy support, and increasing environmental consciousness. Future growth accelerators include the continued expansion of waste-to-energy projects, supported by government incentives and the need for sustainable power generation. The adoption of smart waste management technologies, offering real-time data analytics and operational efficiencies, will be crucial for service providers. Furthermore, investments in advanced recycling infrastructure for plastics and e-waste, aligned with global circular economy principles, present significant opportunities. The market is expected to see increased consolidation through mergers and acquisitions, as larger players aim to achieve economies of scale and broaden their service offerings. Companies that can effectively integrate innovative technologies, adhere to evolving regulatory frameworks, and cater to the growing demand for sustainable waste solutions will be well-positioned for long-term success.

Waste Management Market in Vietnam Segmentation

-

1. Waste Type

- 1.1. Industrial Waste

- 1.2. Municipal Solid Waste

- 1.3. Hazardous Waste

- 1.4. E-waste

- 1.5. Plastic Waste

- 1.6. Bio-medical Waste

-

2. Disposal Method

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Recycling

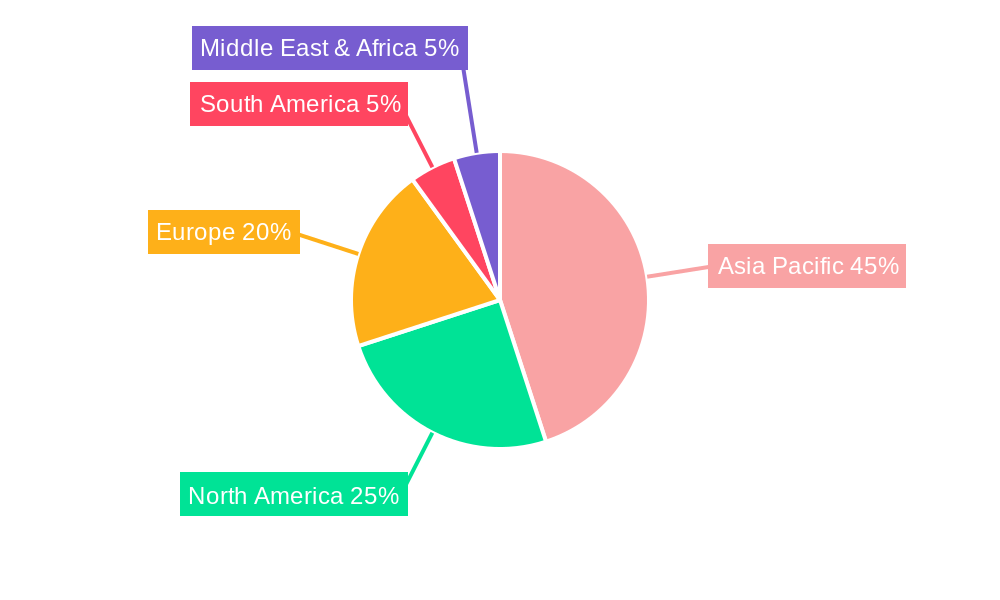

Waste Management Market in Vietnam Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Waste Management Market in Vietnam Regional Market Share

Geographic Coverage of Waste Management Market in Vietnam

Waste Management Market in Vietnam REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Tight Regulatory Compliance Will Drive the Market's Growth; Growing Awareness About Healthy Environment

- 3.3. Market Restrains

- 3.3.1. Tight Regulatory Compliance Will Drive the Market's Growth; Growing Awareness About Healthy Environment

- 3.4. Market Trends

- 3.4.1. Vietnam's Rapid Industrialization and Environmental Challenges

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Waste Management Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 5.1.1. Industrial Waste

- 5.1.2. Municipal Solid Waste

- 5.1.3. Hazardous Waste

- 5.1.4. E-waste

- 5.1.5. Plastic Waste

- 5.1.6. Bio-medical Waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal Method

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 6. North America Waste Management Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Waste Type

- 6.1.1. Industrial Waste

- 6.1.2. Municipal Solid Waste

- 6.1.3. Hazardous Waste

- 6.1.4. E-waste

- 6.1.5. Plastic Waste

- 6.1.6. Bio-medical Waste

- 6.2. Market Analysis, Insights and Forecast - by Disposal Method

- 6.2.1. Landfill

- 6.2.2. Incineration

- 6.2.3. Recycling

- 6.1. Market Analysis, Insights and Forecast - by Waste Type

- 7. South America Waste Management Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Waste Type

- 7.1.1. Industrial Waste

- 7.1.2. Municipal Solid Waste

- 7.1.3. Hazardous Waste

- 7.1.4. E-waste

- 7.1.5. Plastic Waste

- 7.1.6. Bio-medical Waste

- 7.2. Market Analysis, Insights and Forecast - by Disposal Method

- 7.2.1. Landfill

- 7.2.2. Incineration

- 7.2.3. Recycling

- 7.1. Market Analysis, Insights and Forecast - by Waste Type

- 8. Europe Waste Management Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Waste Type

- 8.1.1. Industrial Waste

- 8.1.2. Municipal Solid Waste

- 8.1.3. Hazardous Waste

- 8.1.4. E-waste

- 8.1.5. Plastic Waste

- 8.1.6. Bio-medical Waste

- 8.2. Market Analysis, Insights and Forecast - by Disposal Method

- 8.2.1. Landfill

- 8.2.2. Incineration

- 8.2.3. Recycling

- 8.1. Market Analysis, Insights and Forecast - by Waste Type

- 9. Middle East & Africa Waste Management Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Waste Type

- 9.1.1. Industrial Waste

- 9.1.2. Municipal Solid Waste

- 9.1.3. Hazardous Waste

- 9.1.4. E-waste

- 9.1.5. Plastic Waste

- 9.1.6. Bio-medical Waste

- 9.2. Market Analysis, Insights and Forecast - by Disposal Method

- 9.2.1. Landfill

- 9.2.2. Incineration

- 9.2.3. Recycling

- 9.1. Market Analysis, Insights and Forecast - by Waste Type

- 10. Asia Pacific Waste Management Market in Vietnam Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Waste Type

- 10.1.1. Industrial Waste

- 10.1.2. Municipal Solid Waste

- 10.1.3. Hazardous Waste

- 10.1.4. E-waste

- 10.1.5. Plastic Waste

- 10.1.6. Bio-medical Waste

- 10.2. Market Analysis, Insights and Forecast - by Disposal Method

- 10.2.1. Landfill

- 10.2.2. Incineration

- 10.2.3. Recycling

- 10.1. Market Analysis, Insights and Forecast - by Waste Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CITENCO

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SGS VietNam

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Green Environment Production Services Trade Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Vietnam Australia Environment JSC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dai Lam Son Co Ltd (DALASO)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 VN Green Environment Joint Stock Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vietnam Clean Environmental Treatment Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Urban Environment Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Vietnam Waste Solutions

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 INSEE ECOCYCLE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tan Phat Tai Co Ltd**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 CITENCO

List of Figures

- Figure 1: Global Waste Management Market in Vietnam Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Waste Management Market in Vietnam Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Waste Management Market in Vietnam Revenue (Million), by Waste Type 2025 & 2033

- Figure 4: North America Waste Management Market in Vietnam Volume (Billion), by Waste Type 2025 & 2033

- Figure 5: North America Waste Management Market in Vietnam Revenue Share (%), by Waste Type 2025 & 2033

- Figure 6: North America Waste Management Market in Vietnam Volume Share (%), by Waste Type 2025 & 2033

- Figure 7: North America Waste Management Market in Vietnam Revenue (Million), by Disposal Method 2025 & 2033

- Figure 8: North America Waste Management Market in Vietnam Volume (Billion), by Disposal Method 2025 & 2033

- Figure 9: North America Waste Management Market in Vietnam Revenue Share (%), by Disposal Method 2025 & 2033

- Figure 10: North America Waste Management Market in Vietnam Volume Share (%), by Disposal Method 2025 & 2033

- Figure 11: North America Waste Management Market in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Waste Management Market in Vietnam Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Waste Management Market in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Waste Management Market in Vietnam Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Waste Management Market in Vietnam Revenue (Million), by Waste Type 2025 & 2033

- Figure 16: South America Waste Management Market in Vietnam Volume (Billion), by Waste Type 2025 & 2033

- Figure 17: South America Waste Management Market in Vietnam Revenue Share (%), by Waste Type 2025 & 2033

- Figure 18: South America Waste Management Market in Vietnam Volume Share (%), by Waste Type 2025 & 2033

- Figure 19: South America Waste Management Market in Vietnam Revenue (Million), by Disposal Method 2025 & 2033

- Figure 20: South America Waste Management Market in Vietnam Volume (Billion), by Disposal Method 2025 & 2033

- Figure 21: South America Waste Management Market in Vietnam Revenue Share (%), by Disposal Method 2025 & 2033

- Figure 22: South America Waste Management Market in Vietnam Volume Share (%), by Disposal Method 2025 & 2033

- Figure 23: South America Waste Management Market in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 24: South America Waste Management Market in Vietnam Volume (Billion), by Country 2025 & 2033

- Figure 25: South America Waste Management Market in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Waste Management Market in Vietnam Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Waste Management Market in Vietnam Revenue (Million), by Waste Type 2025 & 2033

- Figure 28: Europe Waste Management Market in Vietnam Volume (Billion), by Waste Type 2025 & 2033

- Figure 29: Europe Waste Management Market in Vietnam Revenue Share (%), by Waste Type 2025 & 2033

- Figure 30: Europe Waste Management Market in Vietnam Volume Share (%), by Waste Type 2025 & 2033

- Figure 31: Europe Waste Management Market in Vietnam Revenue (Million), by Disposal Method 2025 & 2033

- Figure 32: Europe Waste Management Market in Vietnam Volume (Billion), by Disposal Method 2025 & 2033

- Figure 33: Europe Waste Management Market in Vietnam Revenue Share (%), by Disposal Method 2025 & 2033

- Figure 34: Europe Waste Management Market in Vietnam Volume Share (%), by Disposal Method 2025 & 2033

- Figure 35: Europe Waste Management Market in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Waste Management Market in Vietnam Volume (Billion), by Country 2025 & 2033

- Figure 37: Europe Waste Management Market in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Waste Management Market in Vietnam Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Waste Management Market in Vietnam Revenue (Million), by Waste Type 2025 & 2033

- Figure 40: Middle East & Africa Waste Management Market in Vietnam Volume (Billion), by Waste Type 2025 & 2033

- Figure 41: Middle East & Africa Waste Management Market in Vietnam Revenue Share (%), by Waste Type 2025 & 2033

- Figure 42: Middle East & Africa Waste Management Market in Vietnam Volume Share (%), by Waste Type 2025 & 2033

- Figure 43: Middle East & Africa Waste Management Market in Vietnam Revenue (Million), by Disposal Method 2025 & 2033

- Figure 44: Middle East & Africa Waste Management Market in Vietnam Volume (Billion), by Disposal Method 2025 & 2033

- Figure 45: Middle East & Africa Waste Management Market in Vietnam Revenue Share (%), by Disposal Method 2025 & 2033

- Figure 46: Middle East & Africa Waste Management Market in Vietnam Volume Share (%), by Disposal Method 2025 & 2033

- Figure 47: Middle East & Africa Waste Management Market in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Waste Management Market in Vietnam Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East & Africa Waste Management Market in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Waste Management Market in Vietnam Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Waste Management Market in Vietnam Revenue (Million), by Waste Type 2025 & 2033

- Figure 52: Asia Pacific Waste Management Market in Vietnam Volume (Billion), by Waste Type 2025 & 2033

- Figure 53: Asia Pacific Waste Management Market in Vietnam Revenue Share (%), by Waste Type 2025 & 2033

- Figure 54: Asia Pacific Waste Management Market in Vietnam Volume Share (%), by Waste Type 2025 & 2033

- Figure 55: Asia Pacific Waste Management Market in Vietnam Revenue (Million), by Disposal Method 2025 & 2033

- Figure 56: Asia Pacific Waste Management Market in Vietnam Volume (Billion), by Disposal Method 2025 & 2033

- Figure 57: Asia Pacific Waste Management Market in Vietnam Revenue Share (%), by Disposal Method 2025 & 2033

- Figure 58: Asia Pacific Waste Management Market in Vietnam Volume Share (%), by Disposal Method 2025 & 2033

- Figure 59: Asia Pacific Waste Management Market in Vietnam Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Waste Management Market in Vietnam Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Pacific Waste Management Market in Vietnam Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Waste Management Market in Vietnam Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Waste Management Market in Vietnam Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 2: Global Waste Management Market in Vietnam Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 3: Global Waste Management Market in Vietnam Revenue Million Forecast, by Disposal Method 2020 & 2033

- Table 4: Global Waste Management Market in Vietnam Volume Billion Forecast, by Disposal Method 2020 & 2033

- Table 5: Global Waste Management Market in Vietnam Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Waste Management Market in Vietnam Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Waste Management Market in Vietnam Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 8: Global Waste Management Market in Vietnam Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 9: Global Waste Management Market in Vietnam Revenue Million Forecast, by Disposal Method 2020 & 2033

- Table 10: Global Waste Management Market in Vietnam Volume Billion Forecast, by Disposal Method 2020 & 2033

- Table 11: Global Waste Management Market in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Waste Management Market in Vietnam Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Global Waste Management Market in Vietnam Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 20: Global Waste Management Market in Vietnam Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 21: Global Waste Management Market in Vietnam Revenue Million Forecast, by Disposal Method 2020 & 2033

- Table 22: Global Waste Management Market in Vietnam Volume Billion Forecast, by Disposal Method 2020 & 2033

- Table 23: Global Waste Management Market in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Waste Management Market in Vietnam Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Brazil Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Argentina Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Global Waste Management Market in Vietnam Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 32: Global Waste Management Market in Vietnam Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 33: Global Waste Management Market in Vietnam Revenue Million Forecast, by Disposal Method 2020 & 2033

- Table 34: Global Waste Management Market in Vietnam Volume Billion Forecast, by Disposal Method 2020 & 2033

- Table 35: Global Waste Management Market in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Waste Management Market in Vietnam Volume Billion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Germany Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: France Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Italy Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Spain Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Russia Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Benelux Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Nordics Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Global Waste Management Market in Vietnam Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 56: Global Waste Management Market in Vietnam Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 57: Global Waste Management Market in Vietnam Revenue Million Forecast, by Disposal Method 2020 & 2033

- Table 58: Global Waste Management Market in Vietnam Volume Billion Forecast, by Disposal Method 2020 & 2033

- Table 59: Global Waste Management Market in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Waste Management Market in Vietnam Volume Billion Forecast, by Country 2020 & 2033

- Table 61: Turkey Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Israel Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: GCC Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: North Africa Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: South Africa Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Global Waste Management Market in Vietnam Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 74: Global Waste Management Market in Vietnam Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 75: Global Waste Management Market in Vietnam Revenue Million Forecast, by Disposal Method 2020 & 2033

- Table 76: Global Waste Management Market in Vietnam Volume Billion Forecast, by Disposal Method 2020 & 2033

- Table 77: Global Waste Management Market in Vietnam Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Waste Management Market in Vietnam Volume Billion Forecast, by Country 2020 & 2033

- Table 79: China Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: India Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Japan Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 85: South Korea Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Oceania Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Waste Management Market in Vietnam Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Waste Management Market in Vietnam Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Waste Management Market in Vietnam?

The projected CAGR is approximately 6.78%.

2. Which companies are prominent players in the Waste Management Market in Vietnam?

Key companies in the market include CITENCO, SGS VietNam, Green Environment Production Services Trade Co Ltd, Vietnam Australia Environment JSC, Dai Lam Son Co Ltd (DALASO), VN Green Environment Joint Stock Company, Vietnam Clean Environmental Treatment Co Ltd, Urban Environment Company, Vietnam Waste Solutions, INSEE ECOCYCLE, Tan Phat Tai Co Ltd**List Not Exhaustive.

3. What are the main segments of the Waste Management Market in Vietnam?

The market segments include Waste Type, Disposal Method.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Tight Regulatory Compliance Will Drive the Market's Growth; Growing Awareness About Healthy Environment.

6. What are the notable trends driving market growth?

Vietnam's Rapid Industrialization and Environmental Challenges.

7. Are there any restraints impacting market growth?

Tight Regulatory Compliance Will Drive the Market's Growth; Growing Awareness About Healthy Environment.

8. Can you provide examples of recent developments in the market?

July 2023: Vietnam committed to collaborating closely with fellow ASEAN member countries, non-ASEAN nations, and international partners. This collaboration aims to mobilize resources dedicated to capacity building, technology transfer, and exchanging experiences concerning hazardous chemicals and waste management.May 2023: The HCM City Urban Environment Company Limited (CITENCO) used digital technology, such as a global positioning system, in its 265 garbage trucks. This monitoring helped increase the company's efficiency in garbage collection and disposal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Waste Management Market in Vietnam," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Waste Management Market in Vietnam report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Waste Management Market in Vietnam?

To stay informed about further developments, trends, and reports in the Waste Management Market in Vietnam, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence