Key Insights

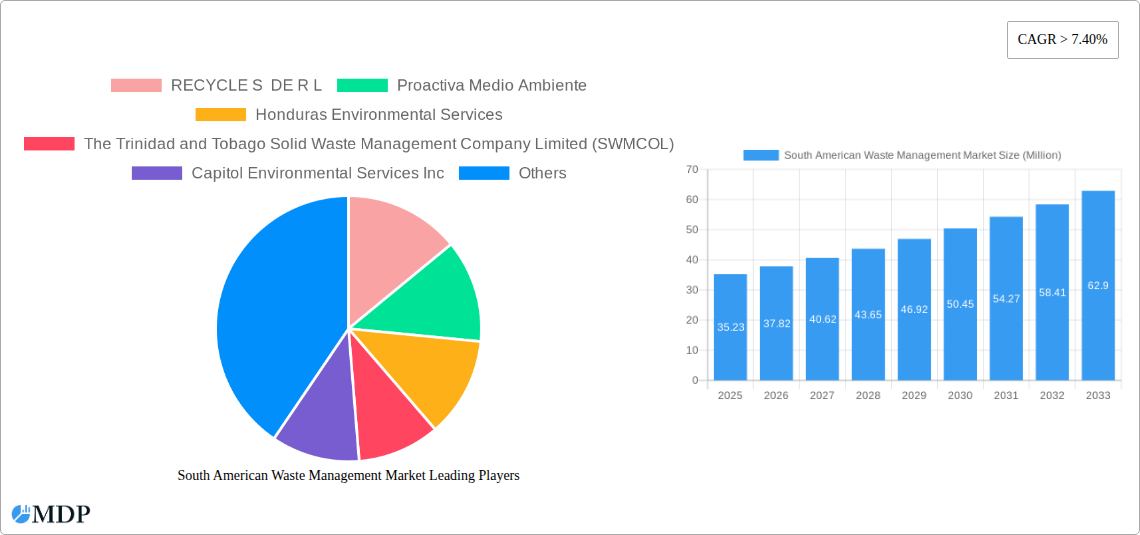

The South American waste management market is poised for robust expansion, with a projected market size of $35.23 million in 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) exceeding 7.40%, indicating a dynamic and evolving industry. A significant driver for this expansion is the increasing generation of diverse waste streams, including industrial waste, municipal solid waste (MSW), and a growing concern around e-waste and plastic waste. Governments across South America are implementing stricter environmental regulations and promoting sustainable waste disposal practices, fostering the adoption of advanced collection, landfill, incineration, and recycling technologies. The burgeoning middle class and rapid urbanization also contribute to higher waste generation, further stimulating demand for efficient and comprehensive waste management solutions. Investment in modern infrastructure, such as advanced recycling facilities and controlled landfills, is crucial to meeting these demands and mitigating environmental impact.

South American Waste Management Market Market Size (In Million)

Emerging trends such as the circular economy, emphasizing waste reduction and resource recovery, are gaining traction across South America. This shift is driving innovation in recycling technologies and the development of markets for recycled materials. For instance, the growing focus on bio-medical waste management due to increased healthcare activities and stricter disposal protocols is another key segment fueling market growth. While the market benefits from strong demand and supportive policies, certain restraints, such as insufficient infrastructure in some regions, limited public awareness, and the high initial investment for advanced technologies, can pose challenges. However, with leading companies like Waste Management Inc., Covanta Holding Corporation, and Republic Services Inc. actively participating and investing in the region, alongside local players, the South American waste management market is on a trajectory of significant and sustained growth, driven by both necessity and a growing commitment to environmental sustainability.

South American Waste Management Market Company Market Share

Gain unparalleled insights into the burgeoning South American waste management market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this analysis delves into market dynamics, industry trends, leading segments, and key players shaping the future of waste management across the continent. Essential for industry stakeholders, investors, and policymakers, this report provides actionable intelligence on industrial waste, municipal solid waste, e-waste, plastic waste, and bio-medical waste, alongside disposal methods like collection, landfill, incineration, and recycling.

South American Waste Management Market Market Dynamics & Concentration

The South American waste management market is characterized by a moderate to high concentration, with a few dominant players holding significant market share. Innovation is primarily driven by increasing environmental regulations, technological advancements in recycling and waste-to-energy solutions, and a growing public awareness of sustainability. Regulatory frameworks are evolving, with governments across the region implementing stricter policies on waste disposal and encouraging circular economy initiatives. Product substitutes are emerging, particularly in the form of advanced recycling technologies and biodegradable materials, challenging traditional landfill and incineration methods. End-user trends are shifting towards more sustainable practices, with businesses and municipalities prioritizing waste reduction and resource recovery. Mergers and acquisition (M&A) activities are on the rise as larger companies seek to consolidate their market presence and expand their service offerings. For instance, the historical period (2019-2024) saw an estimated xx M&A deal counts, indicating a healthy appetite for consolidation and strategic expansion. Market share distribution varies by country and segment, but key players are strategically positioning themselves to capture growth opportunities across the diverse South American landscape.

South American Waste Management Market Industry Trends & Analysis

The South American waste management market is experiencing robust growth, driven by a confluence of economic, social, and environmental factors. The increasing urbanization and population growth across the continent are directly contributing to a surge in the volume of waste generated, particularly municipal solid waste. This escalating waste stream necessitates sophisticated collection, treatment, and disposal solutions, thereby fueling market expansion. Furthermore, a growing awareness of the environmental impact of improper waste management, coupled with more stringent government regulations and international agreements, is compelling businesses and municipalities to invest in advanced waste management infrastructure and technologies. The adoption of circular economy principles is gaining traction, encouraging a shift from linear waste disposal models to those that prioritize resource recovery, recycling, and reuse. Technological disruptions are playing a pivotal role, with innovations in areas such as automated sorting systems, advanced incineration with energy recovery, and sophisticated e-waste processing significantly improving efficiency and environmental performance. Consumer preferences are also evolving, with a greater demand for products and services that align with sustainable practices, pushing companies to integrate eco-friendly waste management into their operations. The competitive dynamics within the market are intensifying, with both local and international players vying for market share. This competition is spurring innovation and driving down costs, making advanced waste management solutions more accessible. The market penetration of advanced recycling technologies is steadily increasing, projected to reach xx% by 2033, indicating a strong upward trend. The overall compound annual growth rate (CAGR) for the South American waste management market is estimated at xx% for the forecast period, underscoring its significant growth potential.

Leading Markets & Segments in South American Waste Management Market

The Municipal solid waste segment is the dominant force within the South American waste management market, driven by the ever-increasing volumes generated by urban populations. Countries like Brazil, Mexico, and Colombia, with their large and rapidly growing cities, represent leading markets within this segment. The primary disposal method for municipal solid waste continues to be Collection and Landfill, though there is a significant and growing emphasis on Recycling and Incineration with energy recovery as governments and industries seek more sustainable solutions.

- Municipal Solid Waste: The sheer volume of household and commercial waste generated by densely populated urban centers makes this segment the largest contributor to the overall market. Economic development, coupled with changing consumption patterns, further exacerbates this trend.

- Collection: Efficient and widespread collection systems are foundational to effective waste management. Investments in modern collection vehicles, route optimization software, and smart bins are crucial for addressing the growing needs of cities.

- Landfill: While still prevalent, the reliance on traditional landfilling is gradually decreasing due to land scarcity, environmental concerns, and the promotion of waste diversion strategies. New landfill constructions are increasingly incorporating advanced features like leachate collection and gas capture systems.

- Recycling: This segment is witnessing substantial growth, fueled by government mandates, corporate social responsibility initiatives, and increasing consumer participation. The focus is shifting towards higher-value recycling of plastics, metals, and paper.

- Industrial Waste: As manufacturing and industrial activities expand across South America, the generation of industrial waste, including hazardous materials, becomes a critical area of focus. Stringent regulations are driving demand for specialized treatment and disposal services.

- E-waste: With the rapid adoption of electronic devices, the volume of e-waste is a growing concern. Specialized recycling facilities capable of safely recovering valuable materials and disposing of hazardous components are crucial. Government initiatives and extended producer responsibility schemes are key drivers in this segment.

- Plastic Waste: The pervasive issue of plastic pollution has propelled plastic waste management and recycling to the forefront. Innovative solutions for collecting and processing diverse types of plastic are in high demand.

- Bio-medical Waste: The healthcare sector's growth necessitates specialized handling and disposal of bio-medical waste to prevent the spread of infections and environmental contamination. Incineration and autoclaving are common disposal methods.

The dominance of these segments is underpinned by economic policies that encourage investment in waste infrastructure, the development of recycling capabilities, and the implementation of robust regulatory frameworks.

South American Waste Management Market Product Developments

Recent product developments in the South American waste management market are largely centered on enhancing the efficiency and sustainability of waste processing and resource recovery. Innovations in automated sorting technologies for mixed waste streams are improving recycling rates and reducing contamination. Advanced waste-to-energy solutions are being developed to maximize energy output from non-recyclable waste, contributing to cleaner energy generation. Furthermore, there is a growing focus on developing specialized equipment and processes for handling challenging waste types such as e-waste and bio-medical waste, ensuring their safe and environmentally responsible disposal. The competitive advantage for companies lies in offering integrated solutions that combine collection, sorting, recycling, and energy recovery, catering to the increasing demand for comprehensive waste management services.

Key Drivers of South American Waste Management Market Growth

The South American waste management market growth is propelled by several key drivers. Economic development and urbanization are leading to increased waste generation, necessitating more sophisticated management solutions. Stringent environmental regulations and government mandates are pushing for sustainable practices and higher recycling rates. Technological advancements in waste processing, recycling, and waste-to-energy technologies are making more efficient and environmentally friendly solutions available. Growing public awareness and demand for sustainable practices are also influencing corporate and governmental decisions, driving investment in greener waste management approaches. The push for a circular economy further incentivizes resource recovery and waste reduction initiatives.

Challenges in the South American Waste Management Market Market

Despite the growth potential, the South American waste management market faces several challenges. Inadequate infrastructure in many regions, particularly in rural areas, limits the reach and efficiency of waste management services. Limited public awareness and participation in recycling programs can hinder diversion efforts. Informal waste picking presents both a social and operational challenge, requiring integration into formal systems. Economic volatility and political instability in some countries can disrupt investment and long-term planning. Furthermore, the cost of advanced waste management technologies can be a barrier to adoption for smaller municipalities and businesses. Regulatory enforcement inconsistencies across different regions also pose a challenge to market players.

Emerging Opportunities in South American Waste Management Market

Emerging opportunities in the South American waste management market are significant, driven by the global shift towards a circular economy and increased focus on sustainability. The growing demand for recycling of specific waste streams, such as plastics and e-waste, presents lucrative avenues for specialized service providers. The development of waste-to-energy projects offers a dual benefit of waste reduction and renewable energy generation. Strategic partnerships between private companies and government entities are crucial for expanding infrastructure and implementing comprehensive waste management plans. The increasing adoption of smart waste management technologies, including IoT-enabled bins and data analytics, offers opportunities for optimizing operations and improving efficiency. Furthermore, the focus on extended producer responsibility schemes creates new business models and revenue streams for waste management companies.

Leading Players in the South American Waste Management Market Sector

- RECYCLE S DE R L

- Proactiva Medio Ambiente

- Honduras Environmental Services

- The Trinidad and Tobago Solid Waste Management Company Limited (SWMCOL)

- Capitol Environmental Services Inc

- Inciner8 Limited

- Casella Waste Systems Inc

- US Ecology Inc

- Waste Management Inc

- Covanta Holding Corporation

- Republic Services Inc

Key Milestones in South American Waste Management Market Industry

- May 2023: Amcor, Delterra, Mars, and P&G concertedly advertise the launch of strategic cooperation to stem the drift of plastic pollution in the Global South. These global leaders will likely work together to gauge upstream and downstream results for an indirect plastics frugality, concertedly committing USD 6 million USD over five times. The advertisement comes in the lead-up to the alternate negotiating commission meeting for a Global Plastics Treaty( INC- 2), working to develop an encyclopedically binding instrument on plastic pollution.

- May 2023: Circulate Capital, a leading environmental impact investor advancing the circular economy for plastics in high-growth requests, announced today the launch of a new action to combat plastic pollution in Latin America and the Caribbean( LAC). IDB Lab, the invention laboratory of theInter-American Development Bank Group, Builders Vision, the impact platform innovated by Lukas Walton, Chevron Phillips Chemical, Danone, Dow, Mondelēz International, and Unilever have joined forces to pledge an aggregate of USD 65 Million to help gauge results and support best- in- class recycling businesses across the LAC region. The new LAC action will concentrate originally on Brazil, Chile, Colombia, and Mexico and soon expand across the region.

Strategic Outlook for South American Waste Management Market Market

The strategic outlook for the South American waste management market is overwhelmingly positive, driven by a sustained demand for sustainable solutions and increasing regulatory pressures. The market is poised for continued growth as countries prioritize investments in modern waste management infrastructure, including advanced recycling facilities and waste-to-energy plants. Strategic partnerships and collaborations between international waste management leaders and local entities will be instrumental in expanding market reach and operational efficiency. The focus on circular economy principles will foster innovation in resource recovery and waste valorization. Emerging technologies, such as AI-driven waste sorting and blockchain for waste tracking, are expected to gain traction, enhancing transparency and traceability. Governments are anticipated to play a pivotal role through supportive policies, incentives, and stringent enforcement, creating a conducive environment for market expansion and sustainable waste management practices across the continent.

South American Waste Management Market Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. E-waste

- 1.4. Plastic waste

- 1.5. Bio-medical waste

-

2. Disposal methods

- 2.1. Collection

- 2.2. Landfill

- 2.3. Incineration

- 2.4. Recycling

South American Waste Management Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South American Waste Management Market Regional Market Share

Geographic Coverage of South American Waste Management Market

South American Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The rapid urbanization and population growth in South America have led to increased municipal waste generation.4.; The need to reduce landfill usage and generate clean energy has led to investments in waste-to-energy facilities.

- 3.3. Market Restrains

- 3.3.1. 4.; The rapid urbanization and population growth in South America have led to increased municipal waste generation.4.; The need to reduce landfill usage and generate clean energy has led to investments in waste-to-energy facilities.

- 3.4. Market Trends

- 3.4.1. Increasing demand for recycling driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South American Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. E-waste

- 5.1.4. Plastic waste

- 5.1.5. Bio-medical waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Collection

- 5.2.2. Landfill

- 5.2.3. Incineration

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 RECYCLE S DE R L

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Proactiva Medio Ambiente

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honduras Environmental Services

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Trinidad and Tobago Solid Waste Management Company Limited (SWMCOL)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Capitol Environmental Services Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Inciner8 Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Casella Waste Systems Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 US Ecology Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Waste Management Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 RECYCLE S DE R L

List of Figures

- Figure 1: South American Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South American Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: South American Waste Management Market Revenue Million Forecast, by Waste type 2020 & 2033

- Table 2: South American Waste Management Market Volume Billion Forecast, by Waste type 2020 & 2033

- Table 3: South American Waste Management Market Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 4: South American Waste Management Market Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 5: South American Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South American Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: South American Waste Management Market Revenue Million Forecast, by Waste type 2020 & 2033

- Table 8: South American Waste Management Market Volume Billion Forecast, by Waste type 2020 & 2033

- Table 9: South American Waste Management Market Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 10: South American Waste Management Market Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 11: South American Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: South American Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Brazil South American Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Brazil South American Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Argentina South American Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Argentina South American Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Chile South American Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Chile South American Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Colombia South American Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Colombia South American Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Peru South American Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Peru South American Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Venezuela South American Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Venezuela South American Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Ecuador South American Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Ecuador South American Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Bolivia South American Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Bolivia South American Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Paraguay South American Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Paraguay South American Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Uruguay South American Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Uruguay South American Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South American Waste Management Market?

The projected CAGR is approximately > 7.40%.

2. Which companies are prominent players in the South American Waste Management Market?

Key companies in the market include RECYCLE S DE R L, Proactiva Medio Ambiente, Honduras Environmental Services, The Trinidad and Tobago Solid Waste Management Company Limited (SWMCOL), Capitol Environmental Services Inc, Inciner8 Limited, Casella Waste Systems Inc, US Ecology Inc, Waste Management Inc:, Covanta Holding Corporation, Republic Services Inc**List Not Exhaustive.

3. What are the main segments of the South American Waste Management Market?

The market segments include Waste type, Disposal methods.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.23 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The rapid urbanization and population growth in South America have led to increased municipal waste generation.4.; The need to reduce landfill usage and generate clean energy has led to investments in waste-to-energy facilities..

6. What are the notable trends driving market growth?

Increasing demand for recycling driving the market.

7. Are there any restraints impacting market growth?

4.; The rapid urbanization and population growth in South America have led to increased municipal waste generation.4.; The need to reduce landfill usage and generate clean energy has led to investments in waste-to-energy facilities..

8. Can you provide examples of recent developments in the market?

May 2023: Amcor, Delterra, Mars, and P&G concertedly advertise the launch of strategic cooperation to stem the drift of plastic pollution in the Global South. These global leaders will likely work together to gauge upstream and downstream results for an indirect plastics frugality, concertedly committing USD 6 million USD over five times. The advertisement comes in the lead-up to the alternate negotiating commission meeting for a Global Plastics Treaty( INC- 2), working to develop an encyclopedically binding instrument on plastic pollution.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South American Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South American Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South American Waste Management Market?

To stay informed about further developments, trends, and reports in the South American Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence