Key Insights

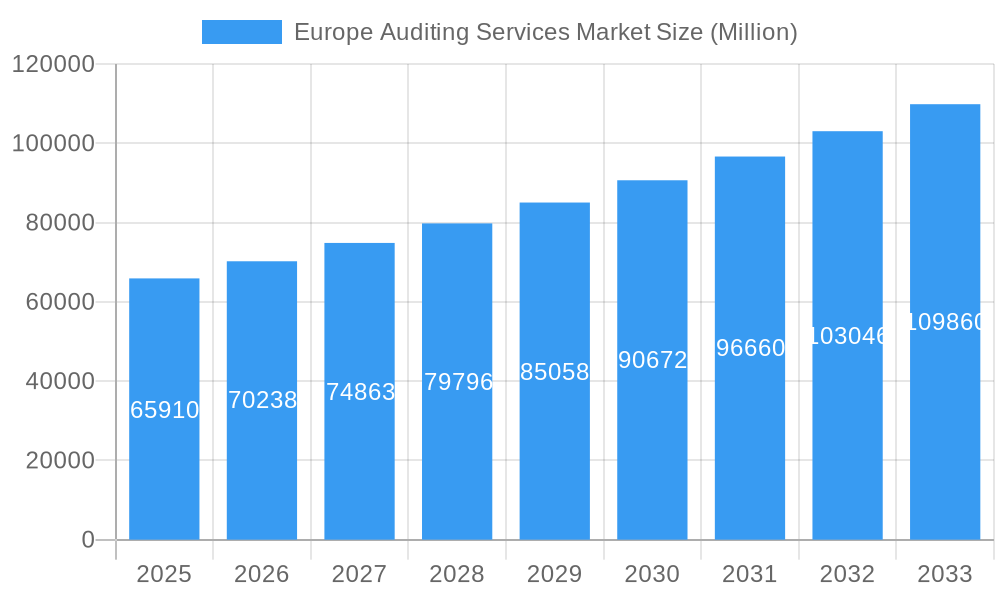

The European auditing services market, valued at €65.91 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.33% from 2025 to 2033. This expansion is driven by several key factors. Increasing regulatory scrutiny across various sectors, particularly in finance and healthcare, necessitates comprehensive auditing practices, fueling demand for specialized services. The rising complexity of global businesses and the increasing prevalence of cross-border transactions also contribute significantly. Furthermore, the growing adoption of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) in auditing processes is enhancing efficiency and accuracy, further stimulating market growth. The market is characterized by a high degree of consolidation, with major players like Deloitte, EY, KPMG, and PwC holding substantial market share. However, smaller firms and niche players continue to compete effectively by offering specialized expertise in areas like environmental, social, and governance (ESG) auditing. The market is also witnessing an increasing demand for integrated audit services that combine financial statement audits with other assurance services, allowing for a more holistic assessment of an organization's performance and risk profile.

Europe Auditing Services Market Market Size (In Billion)

Significant regional variations within the European market are expected, with countries possessing robust financial sectors and stringent regulatory frameworks experiencing higher growth rates. The increasing focus on sustainability and ethical business practices is driving the demand for ESG auditing services. This trend necessitates a shift in the skills and expertise within auditing firms. Despite the positive growth outlook, the market faces challenges such as intense competition, economic fluctuations, and the need for continuous adaptation to evolving regulatory landscapes. The market's future trajectory will likely be shaped by the effectiveness of firms in adapting to technological advancements, incorporating ESG considerations, and maintaining a competitive edge in a dynamic and increasingly complex environment.

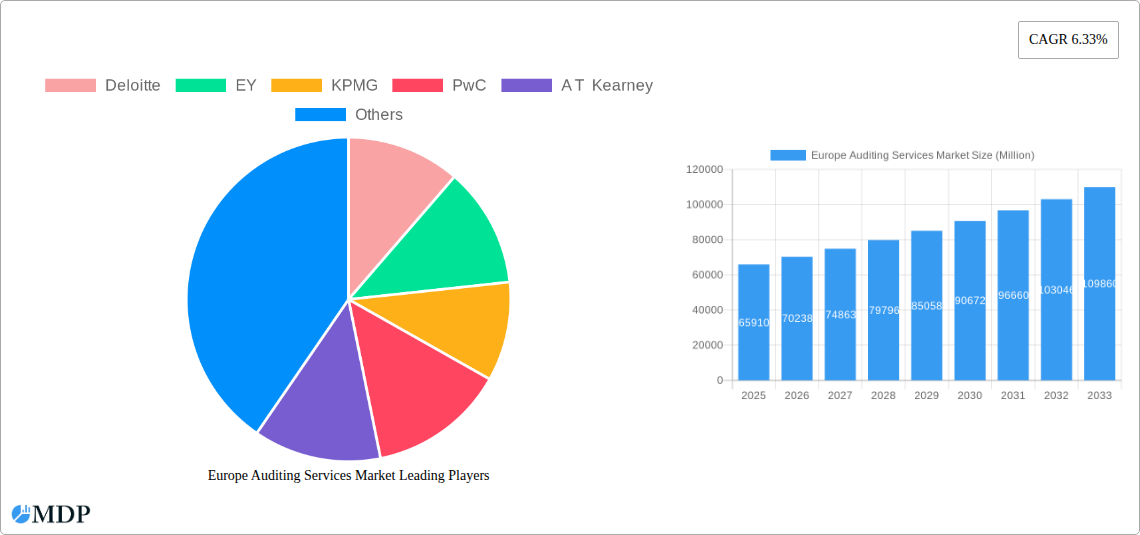

Europe Auditing Services Market Company Market Share

Europe Auditing Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Auditing Services Market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic landscape. The report covers the period 2019-2033, with a focus on the base year 2025 and forecast period 2025-2033. It leverages extensive market research to deliver actionable strategies and forecasts, providing a clear understanding of market dynamics, competitive landscape, and future growth potential. The market size is expected to reach xx Million by 2033.

Europe Auditing Services Market Market Dynamics & Concentration

The European auditing services market is characterized by a high degree of concentration, with the "Big Four" firms – Deloitte, EY, KPMG, and PwC – holding a significant market share, estimated at approximately 70% in 2025. This concentration is driven by economies of scale, global reach, and extensive brand recognition. However, smaller firms like A T Kearney, Grant Thornton LLP, Bain & Company, BDO USA, Rodl and Partners, and Alvarez & Marsal, among others, contribute to the market’s diversity, particularly in niche segments. Innovation drivers include the increasing adoption of technology, including AI and data analytics, in auditing processes. Regulatory frameworks, like those established by the European Union, significantly impact market operations, driving compliance requirements and shaping service offerings. The market faces limited product substitutes, as the nature of auditing demands specific expertise and rigorous standards. End-user trends towards greater transparency and accountability are pushing demand for sophisticated auditing services. The M&A activity, as seen in recent acquisitions by PwC and KPMG (detailed in the Key Milestones section), signals a push for market consolidation and expansion into specialized service areas.

- Market Concentration: Big Four firms hold ~70% market share (2025 estimate).

- M&A Activity: Significant increase in M&A deals in recent years (xx deals in 2024).

- Regulatory Framework: EU regulations significantly impact market operations.

- Innovation: Technology adoption (AI, data analytics) is reshaping auditing practices.

Europe Auditing Services Market Industry Trends & Analysis

The Europe Auditing Services Market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is propelled by several factors: increased regulatory scrutiny driving demand for robust compliance services; the rise of complex financial instruments demanding specialized audit expertise; heightened investor focus on corporate governance and risk management. Technological disruptions, particularly the adoption of AI and data analytics, are streamlining auditing processes, enhancing accuracy, and improving efficiency. Consumer preferences (corporations and financial institutions) are increasingly focused on the ability to provide assurance services, in response to investor and regulator demand. Competitive dynamics are characterized by intense rivalry among large firms, with strategic alliances, geographical expansion, and service diversification being critical competitive strategies. Market penetration remains high in established markets but shows potential for growth in emerging sectors, such as the renewable energy industry.

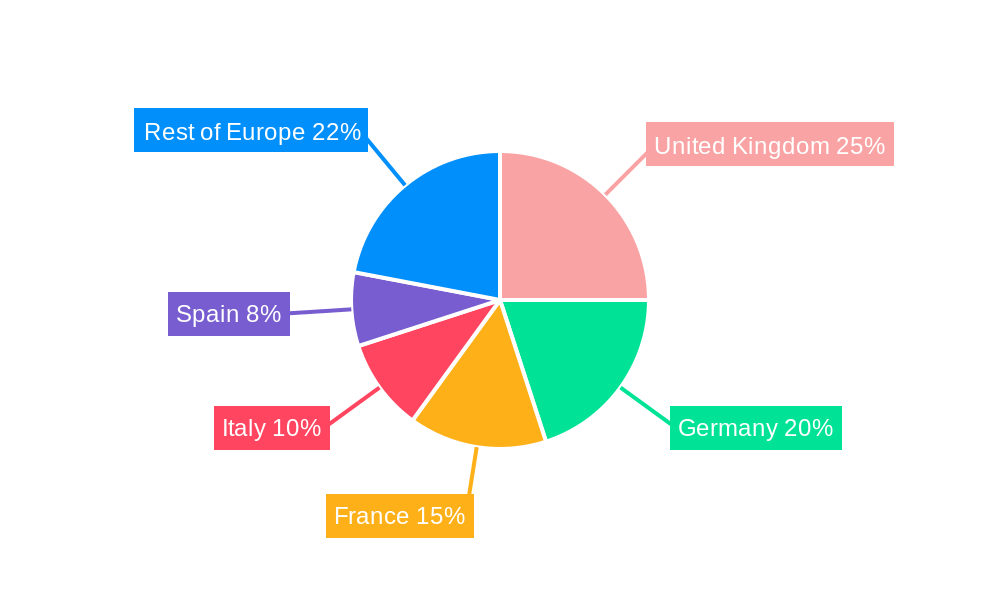

Leading Markets & Segments in Europe Auditing Services Market

Germany and the UK represent the leading markets within Europe, accounting for approximately 40% of the total market revenue in 2025. This dominance stems from their large economies, robust financial sectors, and high regulatory compliance standards. Other key markets include France, Italy, and Spain. The financial services segment dominates the market, driven by stringent regulatory requirements and the complexity of financial instruments.

- Key Drivers in Germany and UK:

- Large and developed economies

- Strong financial sectors

- High regulatory compliance standards

- Advanced technological infrastructure

- Dominance Analysis: Germany and UK benefit from strong regulatory environments and significant numbers of large businesses requiring extensive audit services.

Europe Auditing Services Market Product Developments

Recent product innovations in the auditing services market focus on leveraging technology to improve efficiency and accuracy. These innovations include AI-powered audit tools for enhanced risk assessment, data analytics platforms for improved fraud detection, and blockchain technology for enhanced audit trails and security. This is driving the development of specialized services catering to specific industry needs. The market fit for these innovations is strong, with clients increasingly seeking efficient and cost-effective solutions.

Key Drivers of Europe Auditing Services Market Growth

Several factors fuel the growth of the Europe Auditing Services Market. Stringent regulatory compliance needs drive continuous demand for auditing services, notably in the financial sector. Increased corporate transparency and accountability further amplify this demand. Technological advancements, especially in AI and data analytics, are streamlining audits and improving efficiency. Lastly, the growing complexity of business operations and financial instruments creates a need for specialized audit expertise.

Challenges in the Europe Auditing Services Market Market

The Europe Auditing Services Market faces several challenges. Intense competition among large and small firms puts pressure on pricing and profitability. Maintaining high standards of quality and independence in the face of increased regulatory scrutiny is also critical. Supply chain disruptions can indirectly impact audit processes, specifically for specialized software and hardware. Moreover, evolving regulatory frameworks and the need for continuous professional development present significant challenges.

Emerging Opportunities in Europe Auditing Services Market

Significant opportunities exist in the European Auditing Services Market. Expanding into niche sectors like sustainable finance and the renewable energy industry presents substantial potential. Strategic partnerships with technology providers to integrate advanced analytics and AI will continue to reshape offerings. Finally, expansion into emerging markets within Europe presents an opportunity for geographic diversification and market share growth.

Key Milestones in Europe Auditing Services Market Industry

- April 2023: PwC Switzerland acquires Avoras, expanding its SAP-enabled business transformation services in pharmaceuticals and life sciences.

- June 2023: KPMG acquires QuadriO, a German SAP consultancy, strengthening its IT services capabilities, particularly for the banking sector.

Strategic Outlook for Europe Auditing Services Market Market

The future of the Europe Auditing Services Market appears bright. Technological innovation and strategic partnerships will continue to shape the market. Companies that successfully adapt to evolving regulatory frameworks and embrace technological advancements will thrive. Niche specialization and expansion into growing sectors will be key strategic imperatives for achieving sustained growth and profitability.

Europe Auditing Services Market Segmentation

-

1. Type

- 1.1. Internal Audit

- 1.2. External Audit

-

2. Service Line

- 2.1. Operational Audits

- 2.2. Financial Audits

- 2.3. Advisory and Consulting

- 2.4. Investigation Audits

- 2.5. Information System Audits

- 2.6. Compliance Audits

- 2.7. Other Service Lines

Europe Auditing Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Auditing Services Market Regional Market Share

Geographic Coverage of Europe Auditing Services Market

Europe Auditing Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Complexity of Business Operations Driving Demand for Market; Increasing Use of Technology in Financial Reporting Driving Demand for Market

- 3.3. Market Restrains

- 3.3.1. Growing Complexity of Business Operations Driving Demand for Market; Increasing Use of Technology in Financial Reporting Driving Demand for Market

- 3.4. Market Trends

- 3.4.1. External Audit is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Auditing Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Internal Audit

- 5.1.2. External Audit

- 5.2. Market Analysis, Insights and Forecast - by Service Line

- 5.2.1. Operational Audits

- 5.2.2. Financial Audits

- 5.2.3. Advisory and Consulting

- 5.2.4. Investigation Audits

- 5.2.5. Information System Audits

- 5.2.6. Compliance Audits

- 5.2.7. Other Service Lines

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deloitte

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EY

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KPMG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PwC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 A T Kearney

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Grant Thornton LLP

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bain & Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BDO USA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rodl and Partners

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Alvarez & Marsal**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Deloitte

List of Figures

- Figure 1: Europe Auditing Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Auditing Services Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Auditing Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Auditing Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Europe Auditing Services Market Revenue Million Forecast, by Service Line 2020 & 2033

- Table 4: Europe Auditing Services Market Volume Billion Forecast, by Service Line 2020 & 2033

- Table 5: Europe Auditing Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Auditing Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Auditing Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Auditing Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Europe Auditing Services Market Revenue Million Forecast, by Service Line 2020 & 2033

- Table 10: Europe Auditing Services Market Volume Billion Forecast, by Service Line 2020 & 2033

- Table 11: Europe Auditing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Auditing Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Auditing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Auditing Services Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Auditing Services Market?

The projected CAGR is approximately 6.33%.

2. Which companies are prominent players in the Europe Auditing Services Market?

Key companies in the market include Deloitte, EY, KPMG, PwC, A T Kearney, Grant Thornton LLP, Bain & Company, BDO USA, Rodl and Partners, Alvarez & Marsal**List Not Exhaustive.

3. What are the main segments of the Europe Auditing Services Market?

The market segments include Type, Service Line.

4. Can you provide details about the market size?

The market size is estimated to be USD 65.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Complexity of Business Operations Driving Demand for Market; Increasing Use of Technology in Financial Reporting Driving Demand for Market.

6. What are the notable trends driving market growth?

External Audit is Driving the Market.

7. Are there any restraints impacting market growth?

Growing Complexity of Business Operations Driving Demand for Market; Increasing Use of Technology in Financial Reporting Driving Demand for Market.

8. Can you provide examples of recent developments in the market?

In April 2023, PwC Switzerland pursued an expansion strategy by acquiring Avoras, a renowned SAP-enabled business transformation services provider for the pharmaceutical and life sciences industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Auditing Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Auditing Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Auditing Services Market?

To stay informed about further developments, trends, and reports in the Europe Auditing Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence