Key Insights

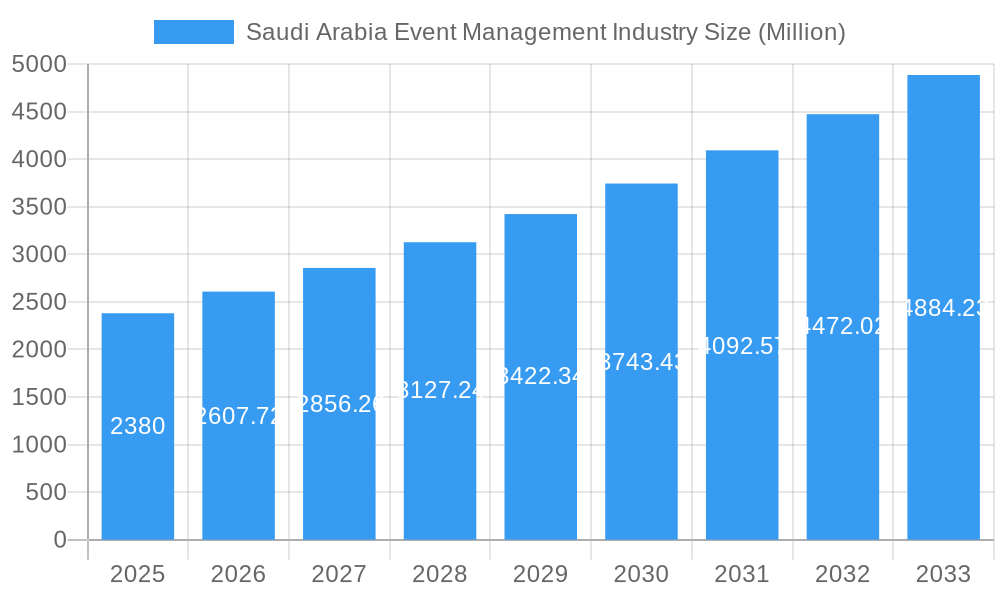

The Saudi Arabian event management industry is experiencing robust growth, projected to reach \$2.38 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 9.74% from 2025 to 2033. This expansion is fueled by several key drivers. The Kingdom's Vision 2030 initiative, aimed at diversifying the economy and boosting tourism, is significantly increasing investments in large-scale events, conferences, and exhibitions. Furthermore, a growing young population with rising disposable incomes is driving demand for entertainment and leisure activities, creating a fertile ground for the event management sector. Government support through infrastructure development, improved visa processes, and streamlined regulations further contributes to this positive trajectory. The industry encompasses diverse segments, including corporate events, conferences, exhibitions, festivals, and entertainment shows. Leading players like SoundKraft LLC, Global Event Management, and Riyadh Exhibitions Company Ltd. are capitalizing on this growth, competing through innovative event design, technology integration, and specialized services. Challenges include the need for skilled professionals, maintaining consistent high-quality standards, and adapting to evolving technological trends to enhance attendee experiences. However, the long-term outlook remains extremely positive, given the sustained government commitment to economic diversification and the growing appetite for events within Saudi Arabia.

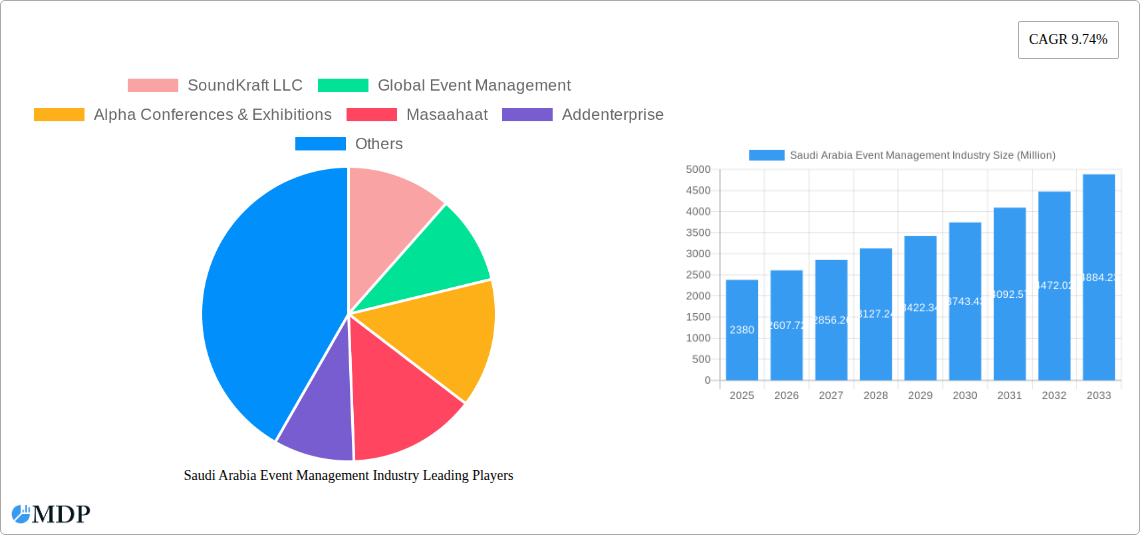

Saudi Arabia Event Management Industry Market Size (In Billion)

The ongoing development of world-class infrastructure, such as new convention centers and entertainment venues, further strengthens the industry's growth potential. This infrastructure allows for larger and more sophisticated events, attracting both domestic and international participants. The burgeoning tourism sector also plays a vital role, as events become key attractions for visitors, creating a synergistic effect of economic growth and industry development. The sector’s growth trajectory is expected to be further propelled by strategic partnerships between event management companies and government entities, fostering a collaborative environment for event planning and execution. While competitive pressures exist, the sheer size and potential of the Saudi Arabian market offer ample opportunities for both established players and new entrants to thrive. Continuous innovation and adaptation to changing market demands will be crucial for sustained success in this dynamic and expanding sector.

Saudi Arabia Event Management Industry Company Market Share

Saudi Arabia Event Management Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Saudi Arabia event management industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence on market dynamics, trends, and future opportunities. The report leverages extensive data analysis to project a market size exceeding xx Million by 2033.

Saudi Arabia Event Management Industry Market Dynamics & Concentration

The Saudi Arabian event management market, valued at xx Million in 2025, is experiencing robust growth fueled by Vision 2030's diversification initiatives. Market concentration is moderate, with several large players vying for market share alongside a multitude of smaller, specialized firms. SoundKraft LLC, Global Event Management, Alpha Conferences & Exhibitions, and Masaahaat represent some of the prominent players, though precise market share data remains unavailable. The competitive landscape is characterized by intense competition, particularly in the high-value segments such as corporate events and large-scale exhibitions.

Innovation Drivers: Government initiatives promoting tourism and entertainment are driving innovation in event technology, experiential design, and sustainable practices.

Regulatory Framework: Clear regulatory guidelines are largely absent, creating both opportunities and challenges. Further clarity and standardization could attract additional investment and foreign players.

Product Substitutes: Virtual and hybrid events pose a growing threat, requiring event management firms to adapt and integrate digital technologies.

End-User Trends: Increasing demand for personalized, immersive experiences, particularly among younger demographics, is reshaping event formats and designs.

M&A Activities: The number of M&A deals in the sector is expected to increase, reaching approximately xx deals annually in the forecast period. These transactions will be mostly driven by seeking synergy and scale in operation.

Saudi Arabia Event Management Industry Industry Trends & Analysis

The Saudi Arabia event management industry is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is primarily driven by increasing government spending on entertainment and tourism, coupled with a burgeoning MICE (Meetings, Incentives, Conferences, and Exhibitions) sector. Market penetration in niche segments, such as luxury events and corporate gatherings, is also increasing. The sector is undergoing significant technological disruption, particularly with the integration of Artificial Intelligence (AI) in event planning and execution. Consumer preferences are shifting toward experiences that are sustainable and culturally sensitive. Competitive dynamics are characterized by partnerships, strategic alliances, and a growing emphasis on innovation and differentiation.

Leading Markets & Segments in Saudi Arabia Event Management Industry

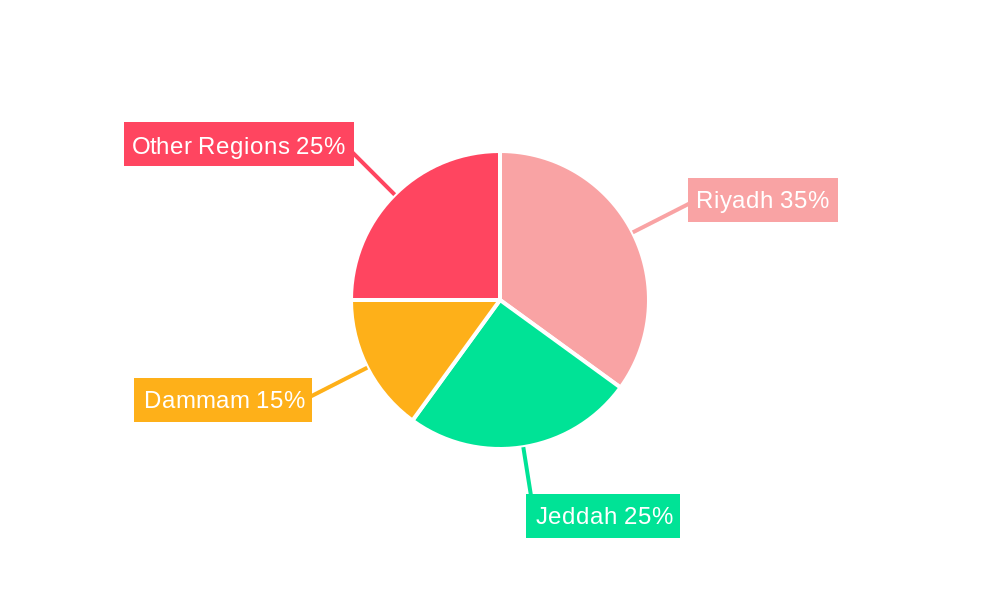

The Riyadh and Jeddah metropolitan areas dominate the event management market in Saudi Arabia. These cities offer advanced infrastructure, favorable regulatory environments and large populations, drawing in major industry players and events.

Key Drivers:

- Government Support: The Saudi government's extensive investment in infrastructure and tourism through Vision 2030 directly boosts the market.

- Economic Diversification: The shift away from oil dependence creates new avenues for events related to technology, finance, and entertainment.

- Improved Infrastructure: New convention centers, hotels, and transportation systems enhance event hosting capabilities.

- Growing Tourism Sector: The rise of leisure tourism fuels the demand for festivals, concerts, and other entertainment events.

The most lucrative segments are corporate events, conferences, and exhibitions, followed by weddings and private celebrations.

Saudi Arabia Event Management Industry Product Developments

Recent product innovations include advanced event management software incorporating AI-driven tools for planning, budgeting, and marketing. The integration of virtual reality and augmented reality is enhancing the audience experience. Event organizers are increasingly emphasizing sustainable practices, such as using eco-friendly materials and reducing carbon footprints. This focus on sustainability aligns with global trends and enhances the image of the industry.

Key Drivers of Saudi Arabia Event Management Industry Growth

The Saudi Arabia event management industry's growth is primarily fueled by Vision 2030's ambitious targets for tourism and entertainment. Increased government investment in infrastructure, a burgeoning middle class with higher disposable income, and the influx of international events contribute to market expansion. The adoption of advanced technologies, such as AI-powered event management platforms, further enhances efficiency and customer satisfaction, driving growth.

Challenges in the Saudi Arabia Event Management Industry Market

The industry faces challenges including a shortage of skilled professionals, particularly in specialized areas like event technology and design. Stringent regulations related to licenses and permits may create procedural bottlenecks. Furthermore, competition from regional and international players remains intense, putting pressure on pricing and profitability. The impact of these challenges is estimated to result in a reduced annual growth of xx% in the event management sector.

Emerging Opportunities in Saudi Arabia Event Management Industry

Significant opportunities exist in developing niche event segments, such as e-sports events and luxury experiential tourism. Strategic partnerships with international event organizers and technology providers can enhance capabilities and expand market reach. Exploring opportunities beyond Riyadh and Jeddah to other cities will also unlock new potentials. Government support for developing the industry is expected to create more favorable market conditions.

Leading Players in the Saudi Arabia Event Management Industry Sector

- SoundKraft LLC

- Global Event Management

- Alpha Conferences & Exhibitions

- Masaahaat

- Addenterprise

- SELA

- Luxury KSA

- Heights

- Benchmark Events

- Riyadh Exhibitions Company Ltd

- Markable General Trading LLC

- KonozRetaj (List Not Exhaustive)

Key Milestones in Saudi Arabia Event Management Industry Industry

- December 2023: Comma, a leading Saudi PR and event management agency, partnered with UK-based ALTER, expanding its capabilities and access to international expertise.

- January 2024: dmg events announced two new exhibitions in Saudi Arabia: the Saudi Sports and Leisure Facilities (SSLF) Expo and Sports Build Show, signaling growing confidence in the market.

Strategic Outlook for Saudi Arabia Event Management Industry Market

The Saudi Arabia event management industry shows immense growth potential, driven by Vision 2030 and the nation's evolving economic landscape. Strategic partnerships, technological innovation, and a focus on sustainability will be crucial for companies to thrive. The market is expected to mature in the near future with increased competition and an emphasis on highly curated events and experiences.

Saudi Arabia Event Management Industry Segmentation

-

1. End User

- 1.1. Corporate

- 1.2. Individual

- 1.3. Public

-

2. Type

- 2.1. Music Concert

- 2.2. Festivals

- 2.3. Sports

- 2.4. Exhibitions and Conferences

- 2.5. Corporate Events and Seminars

- 2.6. Other Types

-

3. Revenue Source

- 3.1. Ticket Sale

- 3.2. Sponsorship

- 3.3. Other Revenue Sources

Saudi Arabia Event Management Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Event Management Industry Regional Market Share

Geographic Coverage of Saudi Arabia Event Management Industry

Saudi Arabia Event Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Number of Events and Conference in the Country; Raise in Disposable Income and Lifestyle

- 3.3. Market Restrains

- 3.3.1. Increase in the Number of Events and Conference in the Country; Raise in Disposable Income and Lifestyle

- 3.4. Market Trends

- 3.4.1. The Market is Influenced by Major International Events Being Held in Saudi Arabia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Event Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Corporate

- 5.1.2. Individual

- 5.1.3. Public

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Music Concert

- 5.2.2. Festivals

- 5.2.3. Sports

- 5.2.4. Exhibitions and Conferences

- 5.2.5. Corporate Events and Seminars

- 5.2.6. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Revenue Source

- 5.3.1. Ticket Sale

- 5.3.2. Sponsorship

- 5.3.3. Other Revenue Sources

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SoundKraft LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Global Event Management

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alpha Conferences & Exhibitions

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Masaahaat

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Addenterprise

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SELA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Luxury KSA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Heights

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Benchmark Events

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Riyadh Exhibitions Company Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Markable General Trading LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 KonozRetaj **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 SoundKraft LLC

List of Figures

- Figure 1: Saudi Arabia Event Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Event Management Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Event Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Saudi Arabia Event Management Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 3: Saudi Arabia Event Management Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Saudi Arabia Event Management Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Saudi Arabia Event Management Industry Revenue Million Forecast, by Revenue Source 2020 & 2033

- Table 6: Saudi Arabia Event Management Industry Volume Billion Forecast, by Revenue Source 2020 & 2033

- Table 7: Saudi Arabia Event Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Saudi Arabia Event Management Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Saudi Arabia Event Management Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Saudi Arabia Event Management Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Saudi Arabia Event Management Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Saudi Arabia Event Management Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 13: Saudi Arabia Event Management Industry Revenue Million Forecast, by Revenue Source 2020 & 2033

- Table 14: Saudi Arabia Event Management Industry Volume Billion Forecast, by Revenue Source 2020 & 2033

- Table 15: Saudi Arabia Event Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Saudi Arabia Event Management Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Event Management Industry?

The projected CAGR is approximately 9.74%.

2. Which companies are prominent players in the Saudi Arabia Event Management Industry?

Key companies in the market include SoundKraft LLC, Global Event Management, Alpha Conferences & Exhibitions, Masaahaat, Addenterprise, SELA, Luxury KSA, Heights, Benchmark Events, Riyadh Exhibitions Company Ltd, Markable General Trading LLC, KonozRetaj **List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Event Management Industry?

The market segments include End User, Type, Revenue Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Number of Events and Conference in the Country; Raise in Disposable Income and Lifestyle.

6. What are the notable trends driving market growth?

The Market is Influenced by Major International Events Being Held in Saudi Arabia.

7. Are there any restraints impacting market growth?

Increase in the Number of Events and Conference in the Country; Raise in Disposable Income and Lifestyle.

8. Can you provide examples of recent developments in the market?

January 2024 - dmg events, an international exhibition organizer, is preparing to introduce two upcoming events in Saudi Arabia: the Saudi Sports and Leisure Facilities (SSLF) Expo and Sports Build Show.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Event Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Event Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Event Management Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Event Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence