Key Insights

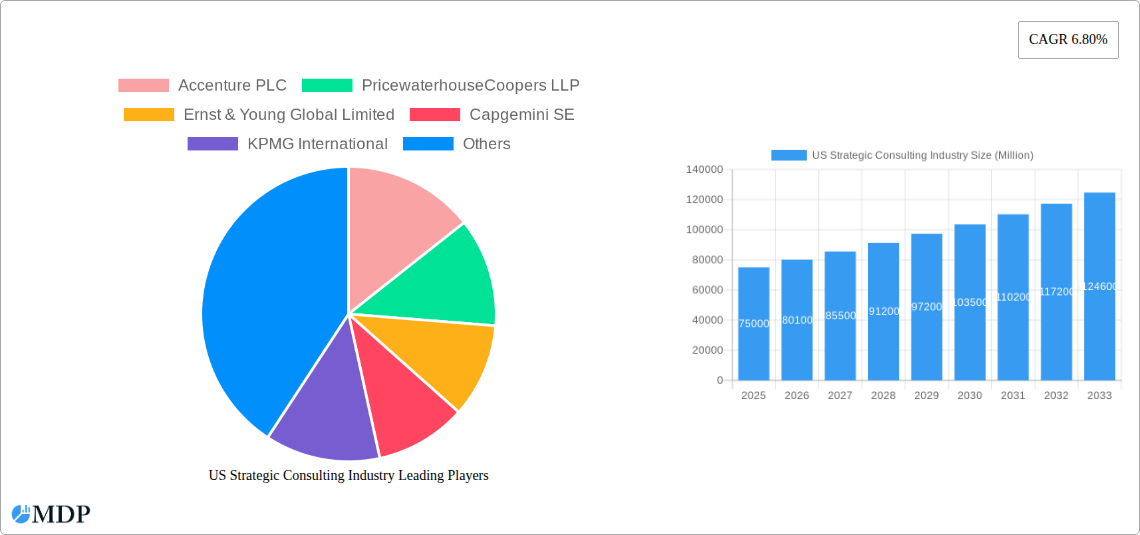

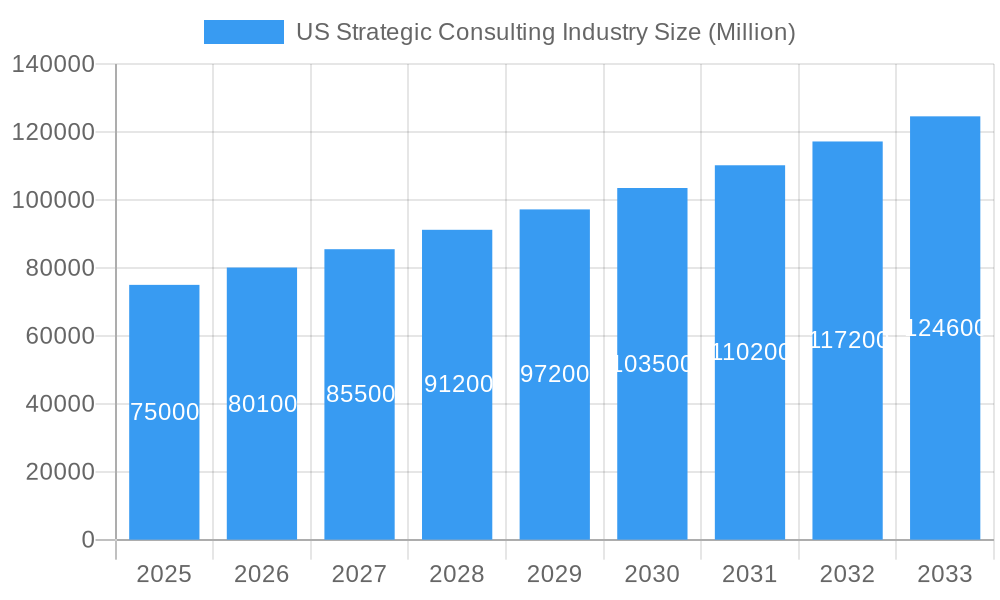

The US strategic consulting industry, a significant contributor to the global economy, is experiencing robust growth, driven by increasing business complexity and the need for data-driven decision-making across various sectors. The market, estimated at $75 billion in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) of 6.80% from 2025 to 2033, reaching approximately $125 billion by the end of the forecast period. This expansion is fueled by several key factors. Firstly, the digital transformation sweeping industries necessitates expert advice in navigating technological changes and optimizing operational efficiency. Secondly, growing regulatory scrutiny and increasing pressure for ethical and sustainable business practices are leading organizations to seek guidance from strategic consultants. Finally, the rise of private equity and mergers & acquisitions activity further fuels demand for strategic consulting services in areas such as due diligence and post-merger integration. Major players, including Accenture, PwC, EY, Capgemini, KPMG, BCG, AT Kearney, McKinsey, Bain & Company, and Roland Berger, compete fiercely for market share, leveraging their specialized expertise and global reach.

US Strategic Consulting Industry Market Size (In Billion)

Despite the positive outlook, several factors could temper growth. Economic downturns can lead to reduced client spending on non-essential consulting services. Increased competition from smaller, specialized firms and the rise of advanced analytics tools may also put pressure on pricing and profit margins. However, the long-term prospects for the US strategic consulting market remain strong, driven by the continuing need for organizations to adapt to evolving market conditions and optimize their performance in a dynamic and competitive landscape. The industry’s expertise in areas such as digital strategy, sustainability consulting, and risk management will continue to be crucial for businesses across all sectors.

US Strategic Consulting Industry Company Market Share

US Strategic Consulting Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the US Strategic Consulting industry, covering market dynamics, leading players, emerging trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report utilizes data from the historical period (2019-2024) and projects future market trends based on robust methodologies. Expect detailed analysis of market concentration, leading segments, and key drivers shaping this dynamic industry, along with valuable insights into challenges and opportunities. The report projects a xx Million market size by 2033, representing a CAGR of xx%.

US Strategic Consulting Industry Market Dynamics & Concentration

The US strategic consulting industry is characterized by a high degree of concentration, with a few major players dominating the market. Market share is heavily influenced by brand recognition, expertise, and global reach. Accenture, PwC, EY, KPMG, and Deloitte consistently rank among the top firms, collectively holding an estimated xx% market share in 2024. The industry is driven by innovation, particularly in areas like data analytics, digital transformation, and AI-powered solutions. Regulatory frameworks, while generally supportive of competition, influence compliance costs and project scopes. Substitutes, such as in-house capabilities or smaller boutique firms, exist but often lack the scale and expertise of the major players. End-user trends, such as increasing demand for digital transformation services and data-driven decision-making, are significant growth drivers. The market has witnessed robust M&A activity in recent years, with an estimated xx M&A deals closed between 2019-2024, primarily driven by the need to expand capabilities and gain market share. This consolidation is expected to continue, further shaping the competitive landscape. Examples include the acquisition of smaller niche players by larger firms to augment specific technological expertise and broaden their client base.

US Strategic Consulting Industry Industry Trends & Analysis

The US strategic consulting industry is experiencing robust growth, driven by several key factors. Technological disruptions, particularly in artificial intelligence, big data analytics, and cloud computing, are reshaping the industry, presenting both opportunities and challenges. Companies are increasingly adopting digital transformation strategies, driving demand for consulting services to navigate these complex changes. Consumer preferences are shifting towards data-driven insights and personalized experiences, further fueling the demand for specialized strategic consulting. Competitive dynamics are intense, with major players vying for market share through strategic acquisitions, investments in innovation, and talent acquisition. Market growth is further fueled by increasing globalization, expanding economic activity in several sectors, and the growing complexity of business challenges requiring specialized expertise. The industry’s CAGR from 2019-2024 was estimated at xx%, with a projected increase to xx% during the forecast period. Market penetration is expected to further expand, especially among smaller and medium-sized enterprises.

Leading Markets & Segments in US Strategic Consulting Industry

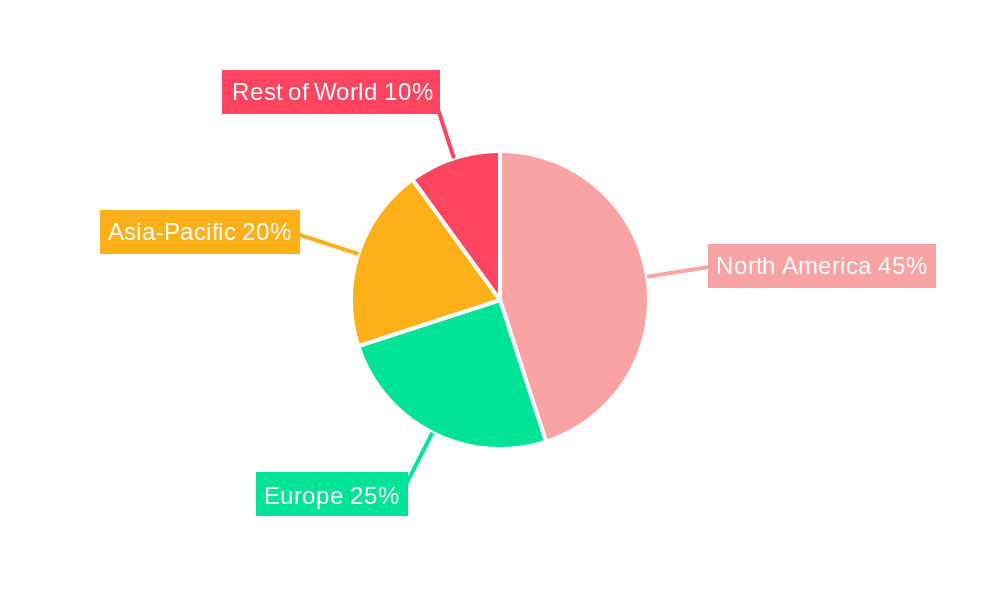

The US strategic consulting market is geographically diverse, with significant activity across major metropolitan areas. However, the Northeast and West Coast regions currently dominate, driven by higher concentrations of Fortune 500 companies and a robust technology sector. Key drivers for regional dominance include:

- Strong economic activity: These regions experience higher GDP growth, leading to increased investment in consulting services.

- Technological innovation: A large concentration of tech firms and startups drives demand for digital transformation and strategic advisory.

- Robust talent pool: A large and skilled workforce attracts consulting firms and creates a competitive advantage.

- Government initiatives: Certain state or regional policies might incentivize innovation and business expansion, further influencing market presence.

The leading segments within the US strategic consulting industry include financial services, technology, healthcare, and manufacturing, driven by their high growth rates and the increasing complexity of their operations. Detailed analysis of each segment reveals specific challenges and opportunities for growth, which are thoroughly discussed within the full report.

US Strategic Consulting Industry Product Developments

Recent product innovations focus on integrating AI and big data analytics into consulting services, improving accuracy and efficiency. This includes advanced data visualization tools, predictive modeling, and AI-driven automation. The competitive advantage lies in the ability to leverage these technologies to provide unique insights and solutions to clients. The market fit is strong, driven by growing demand for data-driven decision-making, especially amidst increasing business complexity. These advancements contribute to the overall efficiency of strategic consulting and help firms optimize business processes and deliver superior results.

Key Drivers of US Strategic Consulting Industry Growth

Several factors are driving growth in the US strategic consulting industry:

- Technological advancements: AI, Big Data, and Cloud computing are transforming industries, creating opportunities for strategic guidance.

- Economic growth: A robust US economy drives increased spending on consulting services, particularly within the financial and technology sectors.

- Regulatory changes: New regulations frequently necessitate strategic adaptations, creating a demand for expert advisory services.

- Globalization: Increasing international business requires cross-border expertise.

Challenges in the US Strategic Consulting Industry Market

The US strategic consulting industry faces challenges such as:

- Intense competition: A large number of firms vying for market share puts downward pressure on pricing and margins. This pressure is also impacting the industry's profitability margins.

- Economic downturns: Recessions can significantly impact client spending on non-essential services like strategic consulting.

- Talent acquisition and retention: Competition for skilled consultants is fierce, necessitating considerable investment in employee training and compensation. This contributes to a high cost of operations.

Emerging Opportunities in US Strategic Consulting Industry

The US strategic consulting industry is poised for growth driven by several opportunities:

- Expansion into emerging technologies: The increasing adoption of AI, Blockchain, and other technologies creates opportunities for specialized consulting services.

- Strategic partnerships: Collaboration with technology providers expands service offerings and strengthens the value proposition.

- Market expansion: Growth is expected in new and underserved markets.

Leading Players in the US Strategic Consulting Industry Sector

Key Milestones in US Strategic Consulting Industry Industry

- June 2022: McKinsey & Company acquired Caserta, a New York-based data analytics consulting and implementation firm, significantly strengthening its data analytics capabilities and expanding its reach within Fortune 100 companies.

Strategic Outlook for US Strategic Consulting Industry Market

The US strategic consulting industry is expected to experience continued growth, driven by technological advancements, economic expansion, and the growing need for strategic guidance in an increasingly complex business environment. Strategic partnerships and investments in emerging technologies will be crucial for firms to maintain a competitive edge. The focus will be on delivering data-driven insights and value-added solutions to clients navigating digital transformation and navigating the uncertainties of a rapidly evolving market. The industry's future success lies in its ability to adapt and innovate, meeting the ever-evolving needs of its clients and successfully leveraging technological advancements.

US Strategic Consulting Industry Segmentation

-

1. END-USER INDUSTRY

- 1.1. Financial Services

- 1.2. Life Sciences and Healthcare

- 1.3. Retail

- 1.4. Government

- 1.5. Energy

- 1.6. Other End-user Industries

US Strategic Consulting Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Strategic Consulting Industry Regional Market Share

Geographic Coverage of US Strategic Consulting Industry

US Strategic Consulting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-user Domain

- 3.3. Market Restrains

- 3.3.1. Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-user Domain

- 3.4. Market Trends

- 3.4.1. United States Strategic Consulting Services Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 5.1.1. Financial Services

- 5.1.2. Life Sciences and Healthcare

- 5.1.3. Retail

- 5.1.4. Government

- 5.1.5. Energy

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 6. North America US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 6.1.1. Financial Services

- 6.1.2. Life Sciences and Healthcare

- 6.1.3. Retail

- 6.1.4. Government

- 6.1.5. Energy

- 6.1.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 7. South America US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 7.1.1. Financial Services

- 7.1.2. Life Sciences and Healthcare

- 7.1.3. Retail

- 7.1.4. Government

- 7.1.5. Energy

- 7.1.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 8. Europe US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 8.1.1. Financial Services

- 8.1.2. Life Sciences and Healthcare

- 8.1.3. Retail

- 8.1.4. Government

- 8.1.5. Energy

- 8.1.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 9. Middle East & Africa US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 9.1.1. Financial Services

- 9.1.2. Life Sciences and Healthcare

- 9.1.3. Retail

- 9.1.4. Government

- 9.1.5. Energy

- 9.1.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 10. Asia Pacific US Strategic Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 10.1.1. Financial Services

- 10.1.2. Life Sciences and Healthcare

- 10.1.3. Retail

- 10.1.4. Government

- 10.1.5. Energy

- 10.1.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by END-USER INDUSTRY

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Accenture PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PricewaterhouseCoopers LLP

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ernst & Young Global Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Capgemini SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 KPMG International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Boston Consulting Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 A T Kearney Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 McKinsey & Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bain & Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Roland Berge

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Accenture PLC

List of Figures

- Figure 1: Global US Strategic Consulting Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America US Strategic Consulting Industry Revenue (undefined), by END-USER INDUSTRY 2025 & 2033

- Figure 3: North America US Strategic Consulting Industry Revenue Share (%), by END-USER INDUSTRY 2025 & 2033

- Figure 4: North America US Strategic Consulting Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America US Strategic Consulting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America US Strategic Consulting Industry Revenue (undefined), by END-USER INDUSTRY 2025 & 2033

- Figure 7: South America US Strategic Consulting Industry Revenue Share (%), by END-USER INDUSTRY 2025 & 2033

- Figure 8: South America US Strategic Consulting Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: South America US Strategic Consulting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe US Strategic Consulting Industry Revenue (undefined), by END-USER INDUSTRY 2025 & 2033

- Figure 11: Europe US Strategic Consulting Industry Revenue Share (%), by END-USER INDUSTRY 2025 & 2033

- Figure 12: Europe US Strategic Consulting Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe US Strategic Consulting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa US Strategic Consulting Industry Revenue (undefined), by END-USER INDUSTRY 2025 & 2033

- Figure 15: Middle East & Africa US Strategic Consulting Industry Revenue Share (%), by END-USER INDUSTRY 2025 & 2033

- Figure 16: Middle East & Africa US Strategic Consulting Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East & Africa US Strategic Consulting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific US Strategic Consulting Industry Revenue (undefined), by END-USER INDUSTRY 2025 & 2033

- Figure 19: Asia Pacific US Strategic Consulting Industry Revenue Share (%), by END-USER INDUSTRY 2025 & 2033

- Figure 20: Asia Pacific US Strategic Consulting Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific US Strategic Consulting Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 2: Global US Strategic Consulting Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 4: Global US Strategic Consulting Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 9: Global US Strategic Consulting Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Brazil US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Argentina US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 14: Global US Strategic Consulting Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Russia US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Benelux US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Nordics US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 25: Global US Strategic Consulting Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Turkey US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Israel US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: GCC US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: North Africa US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global US Strategic Consulting Industry Revenue undefined Forecast, by END-USER INDUSTRY 2020 & 2033

- Table 33: Global US Strategic Consulting Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: China US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: India US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Japan US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Korea US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: ASEAN US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Oceania US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific US Strategic Consulting Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Strategic Consulting Industry?

The projected CAGR is approximately 8.78%.

2. Which companies are prominent players in the US Strategic Consulting Industry?

Key companies in the market include Accenture PLC, PricewaterhouseCoopers LLP, Ernst & Young Global Limited, Capgemini SE, KPMG International, Boston Consulting Group, A T Kearney Inc, McKinsey & Company, Bain & Company, Roland Berge.

3. What are the main segments of the US Strategic Consulting Industry?

The market segments include END-USER INDUSTRY.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-user Domain.

6. What are the notable trends driving market growth?

United States Strategic Consulting Services Market.

7. Are there any restraints impacting market growth?

Growing Investment in Emerging Technologies is Surging Companies Growth Strategy; Adoption of BI and Advanced Data Management Strategies across Multiple End-user Domain.

8. Can you provide examples of recent developments in the market?

June 2022 - McKinsey & Company has acquired Caserta, a New York-based data analytics consulting and implementation firm. McKinsey strengthens data capabilities with the Caserta acquisition; Caserta, the firm, works with Fortune 100 companies to roadmap, design, and implement cutting-edge data architectures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Strategic Consulting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Strategic Consulting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Strategic Consulting Industry?

To stay informed about further developments, trends, and reports in the US Strategic Consulting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence