Key Insights

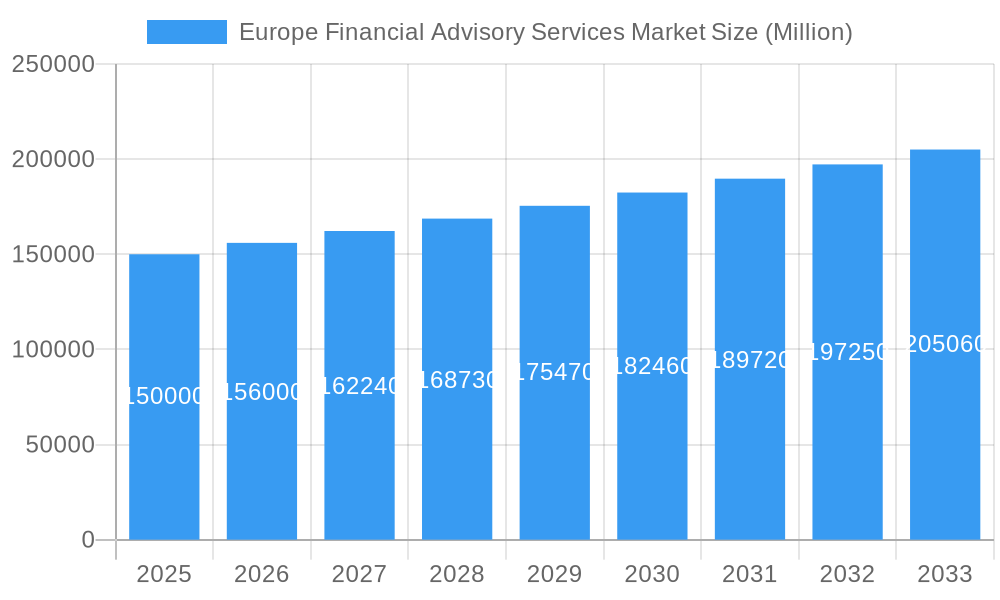

The European financial advisory services market is poised for significant expansion, driven by escalating regulatory complexity, the imperative for strategic counsel amid economic volatility, and the pervasive integration of digital technologies within the finance sector. The market, valued at approximately 184.8 billion in 2025, is forecasted to achieve a Compound Annual Growth Rate (CAGR) of 4.5%, reaching an estimated value of [Estimate based on CAGR and 2025 value] by 2033. This growth is propelled by heightened demand for mergers and acquisitions advisory, sophisticated wealth management solutions, and robust risk management strategies, directly responding to dynamic geopolitical conditions and market fluctuations. Additionally, the escalating preference for sustainable and responsible investment approaches is a significant contributor to this upward trend.

Europe Financial Advisory Services Market Market Size (In Billion)

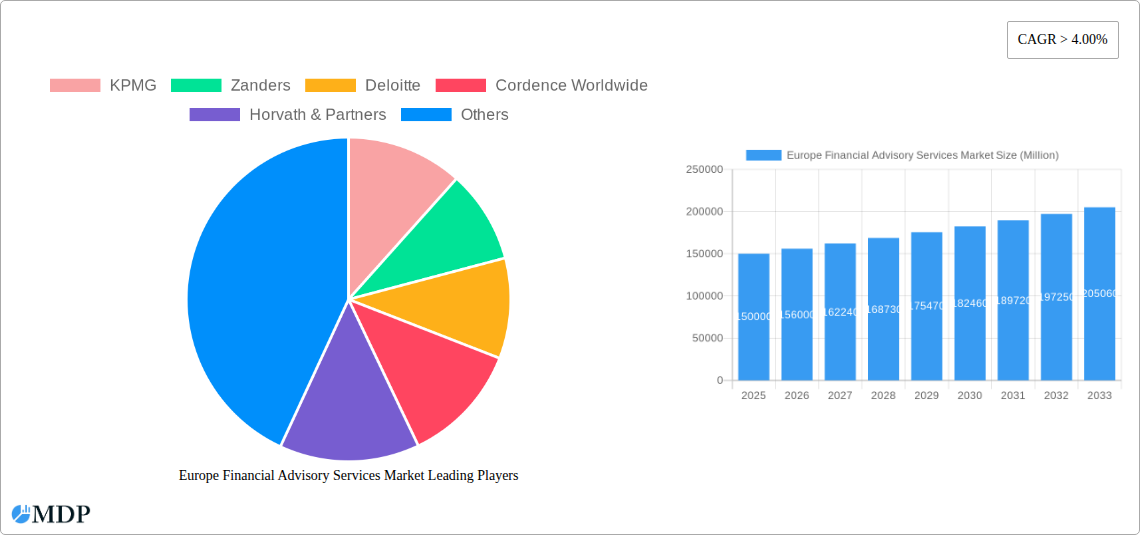

Leading industry participants, including KPMG, Deloitte, McKinsey & Company, and Mercer, hold substantial market influence, deploying their profound expertise and global presence to cater to a varied clientele comprising large enterprises, SMEs, and high-net-worth individuals. The competitive arena is characterized by dynamism, with specialized boutique advisory firms carving out significant market share in niche segments. Despite the market's promising outlook, inherent challenges remain, such as potential economic downturns impacting client expenditure on advisory services and intensified competition from both established and emerging entities. Evolving regulatory frameworks and shifting client expectations necessitate continuous adaptation for market participants. Nevertheless, the long-term forecast remains optimistic, underpinned by the persistent requirement for expert financial guidance and the profound influence of technological advancements on financial services.

Europe Financial Advisory Services Market Company Market Share

Europe Financial Advisory Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe Financial Advisory Services Market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic landscape. The study period covers 2019-2033, with 2025 as the base year and a forecast period spanning 2025-2033. The report leverages rigorous research and data analysis to illuminate market trends, challenges, and opportunities, providing actionable strategic recommendations. The market is estimated to be worth xx Million in 2025.

Europe Financial Advisory Services Market Market Dynamics & Concentration

The European financial advisory services market exhibits a moderately concentrated landscape, with a few major players commanding significant market share. KPMG, Deloitte, and McKinsey & Company, for instance, consistently rank among the leading firms, benefiting from established brand recognition, extensive global networks, and diverse service offerings. However, smaller, specialized boutiques and niche players also thrive, catering to specific client segments or service areas. Market concentration is influenced by several factors:

- Innovation Drivers: The market is driven by continuous innovation in areas such as fintech, regulatory technology (RegTech), and data analytics. Firms that proactively adopt and integrate new technologies gain a competitive edge.

- Regulatory Frameworks: Stringent regulations, particularly within the financial sector, significantly impact market dynamics. Compliance costs and the need for specialized expertise create both challenges and opportunities for advisory firms.

- Product Substitutes: The rise of online platforms and digital advisory tools presents a degree of substitution, although human expertise remains highly valued for complex financial decisions.

- End-User Trends: Growing demand for personalized financial advice, coupled with increasing awareness of sustainable and responsible investing, shapes market demand.

- M&A Activities: The market has witnessed a significant number of mergers and acquisitions (M&A) in recent years, with approximately xx M&A deals in 2024, indicating consolidation and strategic expansion efforts. Deloitte's acquisition of 27 Pilots and BearingPoint's acquisition of Levo Consultants illustrate this trend. Market share analysis reveals that the top 5 players hold an estimated xx% of the market, leaving ample opportunity for smaller firms to specialize and compete.

Europe Financial Advisory Services Market Industry Trends & Analysis

The European financial advisory services market is characterized by robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%. Market penetration is anticipated to reach xx% by 2033, primarily fueled by:

- Increased regulatory scrutiny: Demand for compliance expertise and advisory services related to new regulations is driving market growth.

- Technological advancements: The adoption of AI, machine learning, and big data analytics enhances efficiency, improves decision-making, and expands the scope of advisory services.

- Growing demand for personalized wealth management: High-net-worth individuals and affluent families increasingly seek personalized financial advice and bespoke investment solutions.

- Competitive landscape: The intense competition amongst firms drives innovation and improvement in service offerings.

Leading Markets & Segments in Europe Financial Advisory Services Market

The United Kingdom and Germany are currently the leading markets within the European financial advisory services sector, followed by France and other major Western European economies. This dominance stems from:

Strong Financial Centers: London and Frankfurt remain major hubs for finance, attracting numerous financial institutions and requiring extensive advisory services.

Robust Economic Performance: Strong economic growth in these regions fuels demand for sophisticated financial advice.

Developed Regulatory Frameworks: Established and well-defined regulatory frameworks provide a stable business environment, encouraging investment and growth within the sector.

Key Drivers:

- Advanced Infrastructure: Well-developed financial infrastructure such as sophisticated exchanges, robust technology, and well-trained professionals all contribute to this strong growth.

- Government Policies: Supportive governmental policies and regulations can also support investment and contribute to economic growth, bolstering the financial services sector.

Europe Financial Advisory Services Market Product Developments

Recent product developments in the European financial advisory services market emphasize digital transformation, data analytics, and personalized solutions. Firms are increasingly leveraging AI-powered tools to enhance efficiency, improve forecasting accuracy, and deliver tailored advisory services. This integration of technology improves customer experience, reduces operational costs, and provides a competitive advantage.

Key Drivers of Europe Financial Advisory Services Market Growth

The growth of the European financial advisory services market is primarily driven by several intertwined factors:

- Technological advancements: The increasing adoption of fintech and RegTech solutions is enhancing efficiency and improving the quality of financial advisory services.

- Economic growth: Stable economic growth within Europe fuels demand for investment strategies, wealth management solutions, and business advisory services.

- Regulatory changes: New regulations often necessitate specialized advisory services, increasing market demand and creating new opportunities for firms with expertise in compliance.

Challenges in the Europe Financial Advisory Services Market Market

The European financial advisory services market faces several challenges:

- Intense competition: The market is highly competitive, with a multitude of firms vying for client business. This necessitates continuous innovation and differentiation to remain competitive.

- Regulatory complexity: Navigating the complex web of financial regulations presents challenges and increases the cost of compliance for advisory firms.

- Economic uncertainty: Periods of economic uncertainty can impact investor confidence and reduce demand for certain advisory services. This can lead to a xx% reduction in revenue for some firms in a challenging economic climate.

Emerging Opportunities in Europe Financial Advisory Services Market

Long-term growth opportunities for the European financial advisory services market are abundant and hinge on several key factors:

- Expansion into niche markets: Specialized advisory services focusing on sustainable investing, ESG compliance, and specific industries present significant growth potential.

- Strategic partnerships: Collaborative partnerships between financial institutions and technology providers can foster innovation and expand service offerings.

- International expansion: Expanding into new markets, particularly in Eastern Europe, presents considerable opportunities for growth.

Leading Players in the Europe Financial Advisory Services Market Sector

- KPMG

- Zanders

- Deloitte

- Cordence Worldwide

- Horvath & Partners

- Alvarez & Marsal

- Coeus Consulting

- McKinsey & Company

- Mercer

- Delta Capita

- List Not Exhaustive

Key Milestones in Europe Financial Advisory Services Market Industry

- February 2023: Deloitte's acquisition of 27 Pilots significantly enhances its capabilities in serving start-ups and scale-ups, broadening its service offerings and strengthening its position in the market.

- January 2023: BearingPoint's acquisition of Levo Consultants strengthens its presence in the French market and expands its expertise in financial services advisory.

Strategic Outlook for Europe Financial Advisory Services Market Market

The European financial advisory services market offers substantial long-term growth potential. Strategic opportunities lie in leveraging technological advancements, focusing on niche markets, and forging strategic partnerships. Firms that adapt to evolving regulatory landscapes, embrace innovation, and provide customized solutions will thrive in this dynamic market. The continued integration of technology and the growing demand for sophisticated financial advice will drive market expansion in the coming years.

Europe Financial Advisory Services Market Segmentation

-

1. Type

- 1.1. Corporate Finance

- 1.2. Accounting Advisory

- 1.3. Tax Advisory

- 1.4. Transaction Services

- 1.5. Risk Management

- 1.6. Other Types

-

2. Organization Size

- 2.1. Large Enterprises

- 2.2. Small & Medium-Sized Enterprises

-

3. Industry Vertical

- 3.1. Bfsi

- 3.2. It And Telecom

- 3.3. Manufacturing

- 3.4. Retail And E-Commerce

- 3.5. Public Sector

- 3.6. Healthcare

- 3.7. Other Industry Verticals

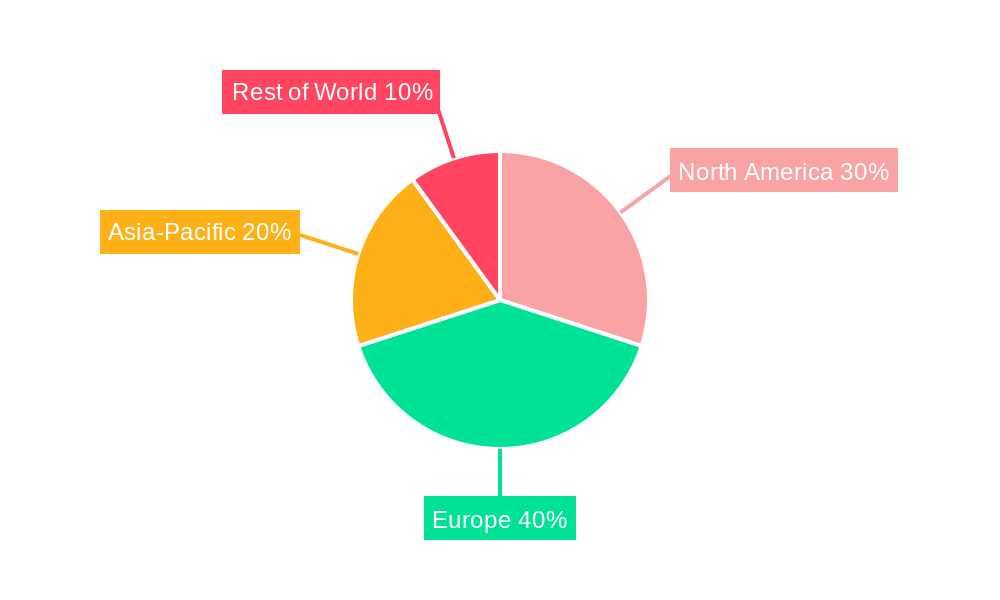

Europe Financial Advisory Services Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Financial Advisory Services Market Regional Market Share

Geographic Coverage of Europe Financial Advisory Services Market

Europe Financial Advisory Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Tax Advisory by Financial Advisory Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Financial Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corporate Finance

- 5.1.2. Accounting Advisory

- 5.1.3. Tax Advisory

- 5.1.4. Transaction Services

- 5.1.5. Risk Management

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Large Enterprises

- 5.2.2. Small & Medium-Sized Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. Bfsi

- 5.3.2. It And Telecom

- 5.3.3. Manufacturing

- 5.3.4. Retail And E-Commerce

- 5.3.5. Public Sector

- 5.3.6. Healthcare

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KPMG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zanders

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Deloitte

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cordence Worldwide

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Horvath & Partners

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alvarez & Marsal

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Coeus Consulting

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 McKinsey & Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mercer

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Delta Capita**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 KPMG

List of Figures

- Figure 1: Europe Financial Advisory Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Financial Advisory Services Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 3: Europe Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 4: Europe Financial Advisory Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Financial Advisory Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Financial Advisory Services Market Revenue billion Forecast, by Organization Size 2020 & 2033

- Table 7: Europe Financial Advisory Services Market Revenue billion Forecast, by Industry Vertical 2020 & 2033

- Table 8: Europe Financial Advisory Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Financial Advisory Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Financial Advisory Services Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Europe Financial Advisory Services Market?

Key companies in the market include KPMG, Zanders, Deloitte, Cordence Worldwide, Horvath & Partners, Alvarez & Marsal, Coeus Consulting, McKinsey & Company, Mercer, Delta Capita**List Not Exhaustive.

3. What are the main segments of the Europe Financial Advisory Services Market?

The market segments include Type, Organization Size, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 184.8 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Tax Advisory by Financial Advisory Services.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Deloitte boosted its start-up and scale-up capabilities with the acquisition of 27 pilots, a Germany-based incubator, a venture capitalist, and a matchmaker. With 27 Pilots as part of its portfolio, Deloitte will be able to better serve its base of start-ups and scale-ups with a full range of services, from incubation and growth through to technology, infrastructure, and venture capital solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Financial Advisory Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Financial Advisory Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Financial Advisory Services Market?

To stay informed about further developments, trends, and reports in the Europe Financial Advisory Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence