Key Insights

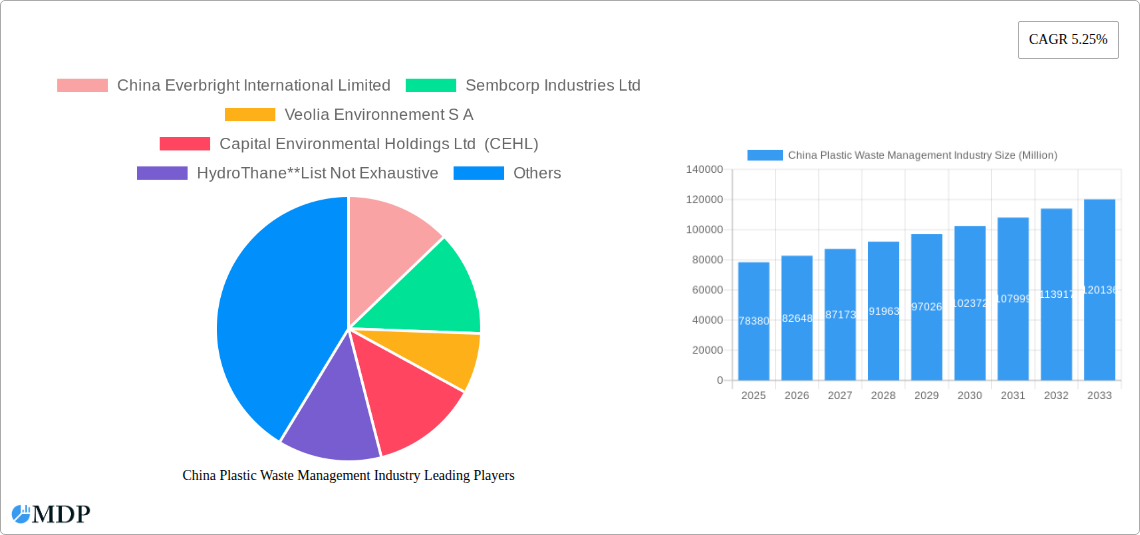

The China plastic waste management industry is experiencing robust growth, projected to reach a market size of $78.38 billion in 2025, with a compound annual growth rate (CAGR) of 5.25% from 2019 to 2033. This expansion is driven by several key factors. Stringent government regulations aimed at curbing environmental pollution and promoting recycling are significantly impacting industry growth. The rising awareness among consumers regarding environmental sustainability is fueling demand for eco-friendly waste management solutions. Furthermore, technological advancements in plastic waste recycling and processing, coupled with increasing investments in infrastructure development, are contributing to the market's expansion. Key players such as China Everbright International Limited, Sembcorp Industries Ltd, and Veolia Environnement S.A. are actively shaping the market landscape through strategic partnerships, technological innovations, and expansion into new regions. The industry's segmentation is likely diverse, encompassing collection, sorting, processing, and recycling services, each with its own growth trajectory and market dynamics.

China Plastic Waste Management Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained growth, driven by continuous policy support and increased private sector involvement. However, challenges remain, including the need for further technological advancements to efficiently handle complex plastic waste streams and the costs associated with infrastructure development. Despite these challenges, the long-term outlook for the China plastic waste management industry remains positive, fueled by the nation's commitment to environmental protection and the growing global focus on sustainable waste management practices. The market's success will depend on collaborative efforts among government agencies, private companies, and communities to ensure effective implementation of recycling programs and technological solutions.

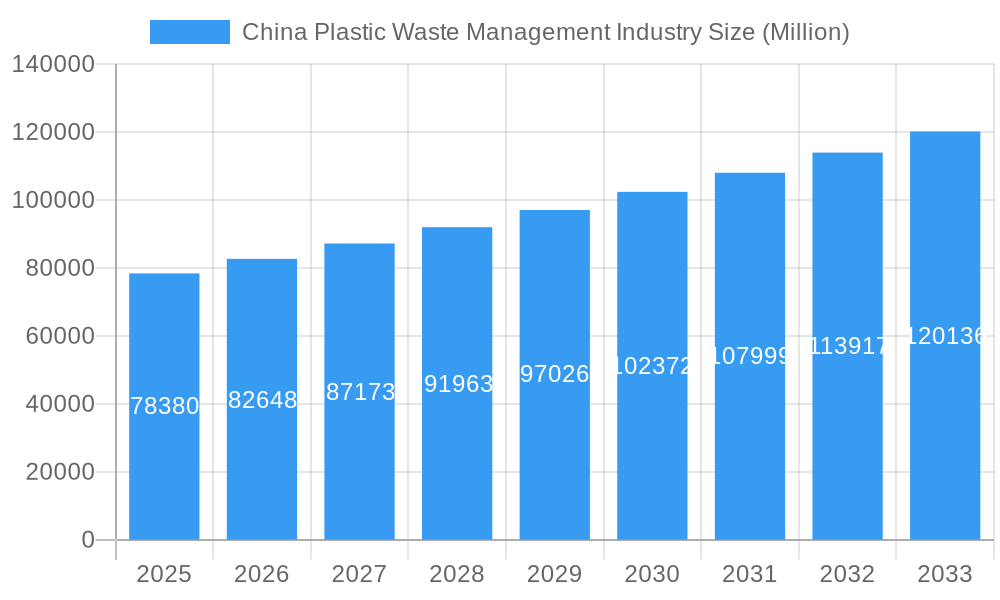

China Plastic Waste Management Industry Company Market Share

China Plastic Waste Management Industry: A Comprehensive Market Report (2019-2033)

Unlocking Growth Opportunities in a Thriving Market: This in-depth report provides a comprehensive analysis of the China plastic waste management industry, offering invaluable insights for investors, stakeholders, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report illuminates the market's dynamic landscape, identifying key trends, challenges, and opportunities for sustainable growth. The report leverages extensive data analysis to project a market valued at xx Million by 2033, showcasing significant potential for expansion.

China Plastic Waste Management Industry Market Dynamics & Concentration

This section analyzes the competitive landscape, innovation drivers, regulatory shifts, and market forces shaping the China plastic waste management industry. The market is characterized by a moderate level of concentration, with several key players vying for market share. The total market size in 2025 is estimated at xx Million, with a projected CAGR of xx% from 2025 to 2033.

Market Concentration: While precise market share figures for individual players are confidential, the market is not dominated by a single entity. Competition is intense, driven by both domestic and international players. The estimated Herfindahl-Hirschman Index (HHI) for 2025 is xx, suggesting a moderately competitive market.

Innovation Drivers: Technological advancements in waste sorting, recycling technologies (chemical recycling, mechanical recycling), and waste-to-energy solutions are key innovation drivers. The increasing adoption of AI and automation in waste management is also contributing to efficiency gains.

Regulatory Framework: The Chinese government’s stringent environmental regulations, including the National Sword policy and subsequent initiatives, have significantly influenced the industry, promoting investment in waste management infrastructure and driving the adoption of sustainable practices.

Product Substitutes: Bioplastics and biodegradable plastics are emerging as potential substitutes, but their widespread adoption is still limited due to cost and scalability challenges.

End-User Trends: Growing environmental awareness among consumers and increasing demand for recycled materials are creating positive market momentum.

M&A Activities: The number of M&A deals in the sector from 2019 to 2024 is estimated at xx, reflecting consolidation and strategic expansion moves by key players.

China Plastic Waste Management Industry Industry Trends & Analysis

This section delves into the key trends influencing the market's growth trajectory. The industry is experiencing a period of significant transformation, driven by several factors.

The market is experiencing robust growth fueled by increasing government support for waste management infrastructure development, rising environmental concerns, and advancements in recycling technologies. The CAGR during the historical period (2019-2024) was approximately xx%, while the projected CAGR from 2025-2033 is xx%. Market penetration of advanced recycling technologies remains relatively low, presenting a significant opportunity for growth. Consumer preferences are shifting towards eco-friendly products and sustainable consumption patterns, driving demand for recycled materials. Competitive dynamics are intense, with both domestic and international companies vying for market share through strategic investments, technological innovation, and acquisitions.

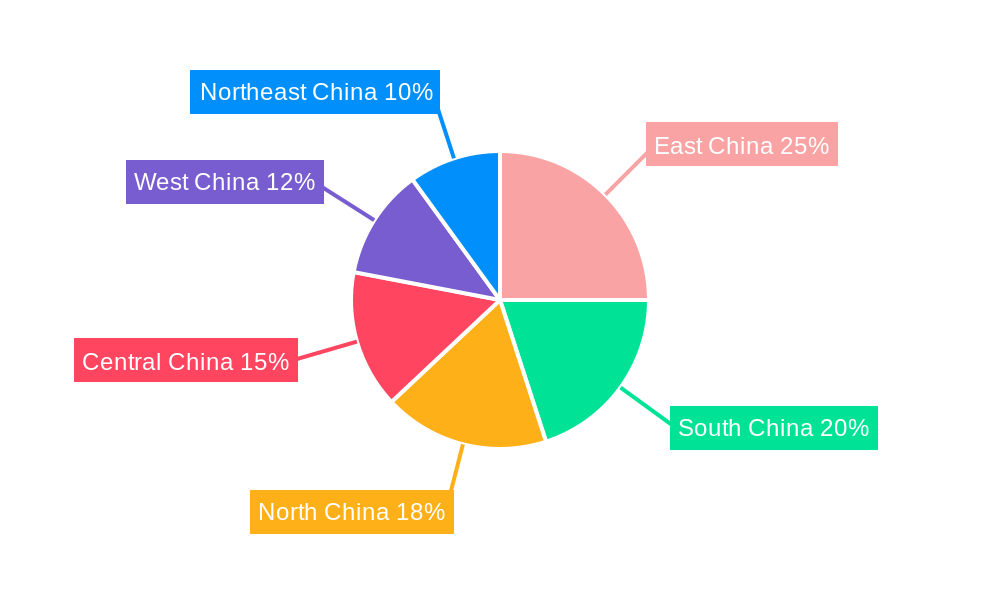

Leading Markets & Segments in China Plastic Waste Management Industry

The coastal regions of China, particularly those with high population density and industrial activity, are currently the most significant markets for plastic waste management. This dominance is attributed to factors such as:

Economic Policies: Government incentives and subsidies for waste management projects are concentrated in these areas.

Infrastructure Development: Existing infrastructure, including waste collection systems and processing facilities, is more developed in coastal areas.

Industrial Activity: High levels of industrial activity generate a large volume of plastic waste, creating a substantial demand for waste management services.

This concentrated growth highlights opportunities for expansion in less developed regions of China.

China Plastic Waste Management Industry Product Developments

Recent product innovations focus on advanced recycling technologies, including chemical recycling and pyrolysis, to address the limitations of traditional mechanical recycling methods. New applications of recycled plastics are emerging in various industries, expanding the market for recycled materials. Competitive advantages are increasingly tied to technological capabilities, efficiency, and environmental sustainability. The industry is witnessing the rise of innovative solutions like AI-powered waste sorting systems and improved plastic-to-fuel conversion techniques.

Key Drivers of China Plastic Waste Management Industry Growth

Several factors are propelling the growth of the China plastic waste management industry:

Technological Advancements: Innovations in recycling technologies, AI-powered waste sorting, and waste-to-energy solutions are enhancing efficiency and sustainability.

Government Regulations: Stringent environmental policies and regulations are driving investment in waste management infrastructure and promoting the adoption of sustainable practices.

Economic Growth: Continued economic development generates increasing volumes of plastic waste, creating a corresponding demand for waste management services.

Challenges in the China Plastic Waste Management Industry Market

Despite its growth potential, the industry faces several challenges:

Regulatory Hurdles: Navigating complex regulations and obtaining necessary permits can be time-consuming and costly.

Supply Chain Issues: Establishing efficient and reliable supply chains for collecting and transporting plastic waste presents logistical challenges.

Competitive Pressures: The market is becoming increasingly competitive, with both domestic and international companies vying for market share. This competition can lead to price pressure and reduced profitability.

Emerging Opportunities in China Plastic Waste Management Industry

The long-term growth of the China plastic waste management industry is supported by several promising opportunities:

Technological breakthroughs in chemical recycling and waste-to-energy technologies are opening new avenues for value creation and resource recovery. Strategic partnerships between waste management companies and technology providers are facilitating the adoption of innovative solutions. Expansion into underserved regions of China offers significant potential for market growth.

Leading Players in the China Plastic Waste Management Industry Sector

- China Everbright International Limited

- Sembcorp Industries Ltd

- Veolia Environnement S A

- Capital Environmental Holdings Ltd (CEHL)

- HydroThane (List Not Exhaustive)

Key Milestones in China Plastic Waste Management Industry Industry

- 2020: Implementation of stricter regulations on plastic waste imports.

- 2021: Launch of several large-scale waste-to-energy projects.

- 2022: Increased investment in advanced recycling technologies.

- 2023: Several significant M&A deals shaping the industry landscape.

- 2024: Growing adoption of AI-powered waste sorting systems.

Strategic Outlook for China Plastic Waste Management Industry Market

The China plastic waste management industry is poised for continued growth, driven by technological innovation, supportive government policies, and increasing environmental awareness. Strategic opportunities exist for companies that can effectively leverage these factors, focusing on technological advancement, efficient operations, and sustainable practices. The market's future trajectory is positive, with significant opportunities for companies that can adapt to the evolving regulatory environment and meet the growing demand for sustainable waste management solutions. The projected market value of xx Million by 2033 underscores the considerable potential for long-term growth and profitability.

China Plastic Waste Management Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. Hazardous waste

- 1.4. E-waste

- 1.5. Plastic waste

- 1.6. Bio-medical waste

-

2. Disposal methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Dismantling

- 2.4. Recycling

-

3. Type of ownership

- 3.1. Public

- 3.2. Private

- 3.3. Public - Private Patnership

China Plastic Waste Management Industry Segmentation By Geography

- 1. China

China Plastic Waste Management Industry Regional Market Share

Geographic Coverage of China Plastic Waste Management Industry

China Plastic Waste Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Spotlight on the China e-waste generation and its effective management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Plastic Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. Hazardous waste

- 5.1.4. E-waste

- 5.1.5. Plastic waste

- 5.1.6. Bio-medical waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Dismantling

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Type of ownership

- 5.3.1. Public

- 5.3.2. Private

- 5.3.3. Public - Private Patnership

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Everbright International Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sembcorp Industries Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Veolia Environnement S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Capital Environmental Holdings Ltd (CEHL)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HydroThane**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 China Everbright International Limited

List of Figures

- Figure 1: China Plastic Waste Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Plastic Waste Management Industry Share (%) by Company 2025

List of Tables

- Table 1: China Plastic Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 2: China Plastic Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 3: China Plastic Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 4: China Plastic Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 5: China Plastic Waste Management Industry Revenue Million Forecast, by Type of ownership 2020 & 2033

- Table 6: China Plastic Waste Management Industry Volume Billion Forecast, by Type of ownership 2020 & 2033

- Table 7: China Plastic Waste Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: China Plastic Waste Management Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: China Plastic Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 10: China Plastic Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 11: China Plastic Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 12: China Plastic Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 13: China Plastic Waste Management Industry Revenue Million Forecast, by Type of ownership 2020 & 2033

- Table 14: China Plastic Waste Management Industry Volume Billion Forecast, by Type of ownership 2020 & 2033

- Table 15: China Plastic Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: China Plastic Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Plastic Waste Management Industry?

The projected CAGR is approximately 5.25%.

2. Which companies are prominent players in the China Plastic Waste Management Industry?

Key companies in the market include China Everbright International Limited, Sembcorp Industries Ltd, Veolia Environnement S A, Capital Environmental Holdings Ltd (CEHL), HydroThane**List Not Exhaustive.

3. What are the main segments of the China Plastic Waste Management Industry?

The market segments include Waste type, Disposal methods, Type of ownership.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.38 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Spotlight on the China e-waste generation and its effective management.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Plastic Waste Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Plastic Waste Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Plastic Waste Management Industry?

To stay informed about further developments, trends, and reports in the China Plastic Waste Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence