Key Insights

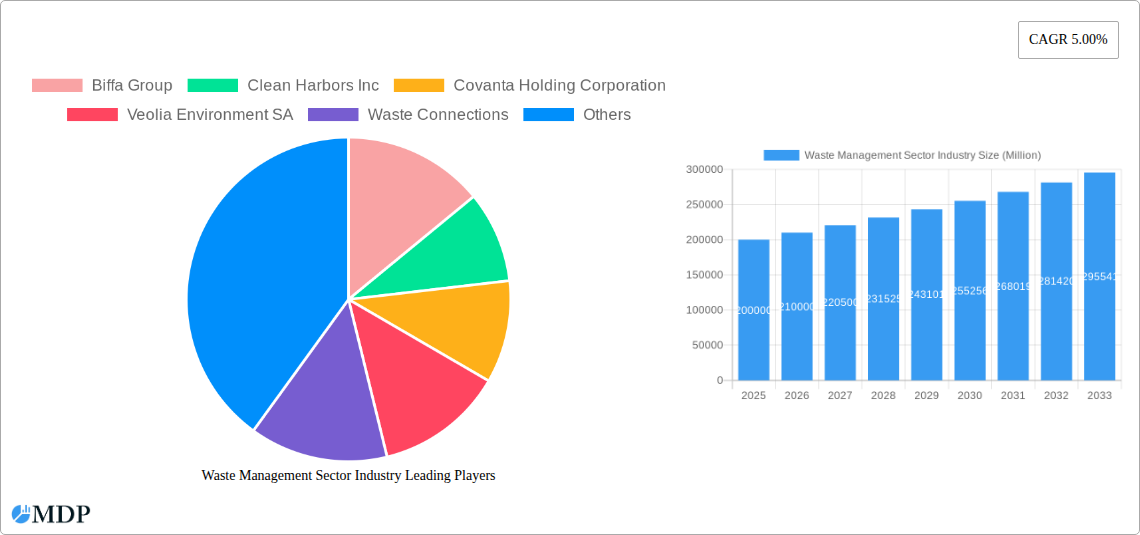

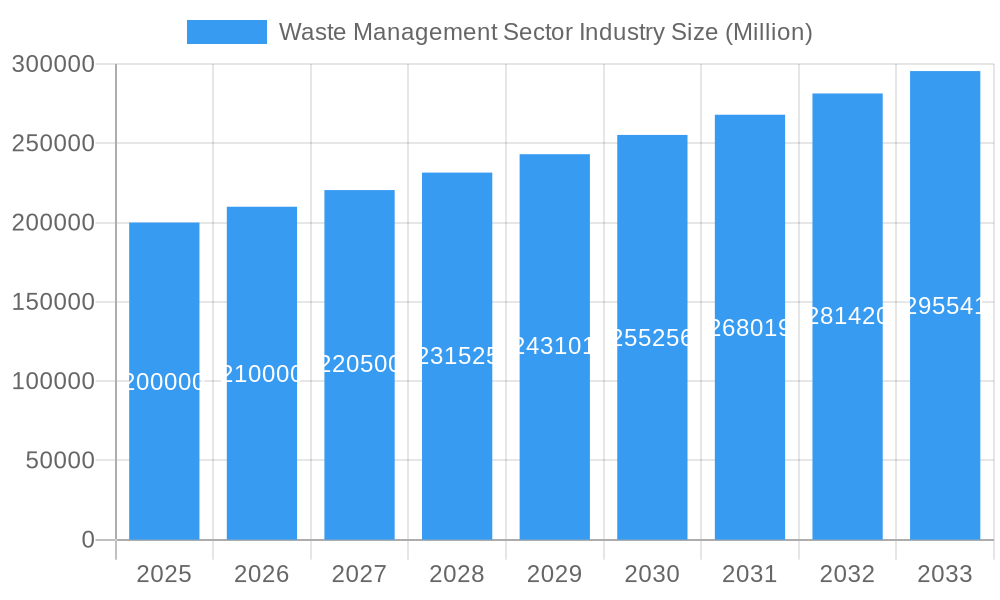

The global waste management market, projected to reach $10.58 billion by 2025, is set for significant expansion. Experts forecast a compound annual growth rate (CAGR) of 6.63% from 2025 to 2033. This growth trajectory is fueled by increasing urbanization, which drives higher waste generation and intensifies the need for effective waste management solutions. Heightened environmental consciousness and stringent government regulations on waste disposal are also key market drivers. The adoption of sustainable practices like recycling and composting, coupled with technological advancements in waste-to-energy systems, are considerably contributing to the sector's progress. The growing demand for specialized waste management services, particularly for hazardous and medical waste, presents substantial opportunities. Intense competition among leading companies, including Biffa Group, Clean Harbors Inc., Covanta Holding Corporation, Veolia Environment SA, Waste Connections, Remondis AG & Co Kg, Suez Environment S A, Daiseki Co Ltd, Waste Management Inc., Republic Services, and Averda, is fostering innovation and operational efficiencies.

Waste Management Sector Industry Market Size (In Billion)

Despite the positive outlook, the industry encounters challenges. Volatile raw material prices and substantial capital investment for infrastructure development may impede market expansion. Furthermore, regional regulatory inconsistencies and the necessity for robust public-private collaborations to manage waste complexities pose significant obstacles. Nevertheless, the long-term prospects for the waste management sector remain strong, driven by the escalating global demand for sustainable and efficient waste disposal solutions. The market segmentation, encompassing factors such as waste type, service type, and geographical region, offers diverse avenues for investment and expansion for both established and emerging players. A thorough analysis of these segments and their growth dynamics is essential for informed strategic decisions within the industry.

Waste Management Sector Industry Company Market Share

Waste Management Sector Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global waste management sector, offering crucial insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages a robust methodology, incorporating historical data (2019-2024), current market conditions, and future projections (2025-2033) to deliver actionable intelligence. Key players analyzed include Biffa Group, Clean Harbors Inc, Covanta Holding Corporation, Veolia Environment SA, Waste Connections, Remondis AG & Co Kg, Suez Environment S A, Daiseki Co Ltd, Waste Management Inc, Republic Services, and Averda (list not exhaustive). Expect detailed breakdowns of market segments, growth drivers, challenges, and emerging opportunities, empowering informed strategic planning.

Waste Management Sector Industry Market Dynamics & Concentration

The global waste management market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller, regional players fosters competition and innovation. Market concentration is influenced by factors such as economies of scale, technological advancements, and regulatory frameworks. The industry has witnessed significant mergers and acquisitions (M&A) activity in recent years, further shaping the competitive landscape. For instance, the number of M&A deals in the sector totaled xx in 2024, representing a xx% increase from the previous year. This surge reflects the increasing consolidation within the industry and the pursuit of efficiency gains and market expansion.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Innovation Drivers: Technological advancements in waste processing, recycling, and resource recovery are key drivers of innovation.

- Regulatory Frameworks: Stringent environmental regulations and policies across various regions are shaping market dynamics and driving demand for sustainable waste management solutions.

- Product Substitutes: The emergence of alternative waste management technologies and biodegradable materials poses a competitive threat to traditional methods.

- End-User Trends: The increasing awareness of environmental sustainability among consumers and businesses is boosting demand for eco-friendly waste management services.

- M&A Activity: The xx billion USD in M&A deals in 2024 signifies a strategic shift towards consolidation and expansion.

Waste Management Sector Industry Industry Trends & Analysis

The global waste management sector is experiencing robust growth, driven by several factors. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), propelled by several key trends. Growing urbanization and industrialization contribute to increased waste generation, while stricter environmental regulations mandate more efficient and sustainable waste management practices. Technological advancements in waste-to-energy technologies and smart waste management solutions are significantly improving waste processing efficiency and resource recovery. Changing consumer preferences toward environmentally responsible products and services also influence market growth. Intensifying competition among established players and new entrants is stimulating innovation and fostering price optimization. Market penetration of advanced recycling technologies is gradually increasing, with an estimated xx% of recyclable waste processed using these technologies in 2025.

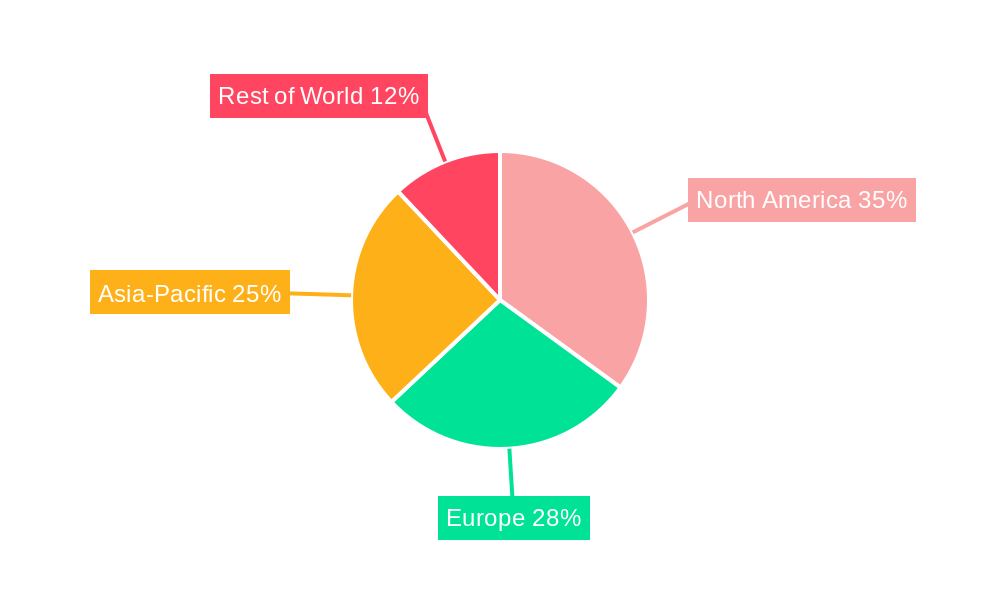

Leading Markets & Segments in Waste Management Sector Industry

North America currently dominates the global waste management market, driven by factors such as robust infrastructure, stringent environmental regulations, and high per capita waste generation. European markets also show significant growth, particularly in countries with advanced waste management policies.

Key Drivers in North America:

- Stringent environmental regulations

- High per capita waste generation

- Developed infrastructure

- High investment in advanced technologies

Key Drivers in Europe:

- Growing focus on circular economy models

- Increasing implementation of Extended Producer Responsibility (EPR) schemes

- Stringent waste management regulations

The industrial waste segment is the fastest-growing segment, owing to the increased waste generation from manufacturing activities and industrial processes. This segment’s growth is further fueled by the growing need for specialized waste handling and disposal solutions across various industries. The residential waste segment still holds the largest share, but its growth rate is expected to moderate over the forecast period as industrial waste generation accelerates.

Waste Management Sector Industry Product Developments

Significant advancements in waste management technologies have resulted in innovative products and services. These include advanced sorting technologies, waste-to-energy plants, anaerobic digestion facilities, and smart waste management systems. These innovations offer improved efficiency, cost-effectiveness, and environmental sustainability, thereby enhancing their market competitiveness. Companies are increasingly focusing on developing closed-loop recycling systems and sustainable waste disposal solutions, aligning with global environmental goals.

Key Drivers of Waste Management Sector Industry Growth

The growth of the waste management sector is driven by a confluence of factors:

- Stringent Environmental Regulations: Governments worldwide are implementing stricter environmental regulations to reduce landfill waste and promote recycling.

- Technological Advancements: Innovations in waste processing technologies, such as waste-to-energy and advanced recycling, are enhancing efficiency and sustainability.

- Growing Urbanization and Industrialization: Rising populations and industrial activities contribute to increased waste generation.

- Increasing Awareness of Environmental Sustainability: Consumer demand for eco-friendly products and services is growing.

Challenges in the Waste Management Sector Industry Market

Several factors hinder the growth of the waste management sector:

- High Capital Expenditure: The construction and operation of waste processing facilities require significant upfront investments. This represents a barrier for smaller companies, which can lead to market consolidation.

- Fluctuating Commodity Prices: The prices of recyclable materials are volatile, affecting the profitability of recycling operations.

- Complex Regulatory Landscape: Differing waste management regulations across regions can make compliance challenging and costly.

- Lack of Infrastructure in Developing Countries: Inadequate waste management infrastructure in many developing nations poses a major hurdle.

Emerging Opportunities in Waste Management Sector Industry

The waste management sector presents promising long-term growth opportunities:

- Development of Innovative Waste-to-Energy Technologies: Converting waste into energy sources holds considerable potential.

- Expansion of Closed-Loop Recycling Systems: Implementing systems that recover and reuse materials efficiently is gaining traction.

- Growth of Smart Waste Management Solutions: Utilizing data and technology to optimize waste collection and processing provides significant cost savings and efficiency.

- Strategic Partnerships and Collaborations: Joint ventures between waste management companies and technology providers foster innovation.

Leading Players in the Waste Management Sector Industry Sector

- Biffa Group

- Clean Harbors Inc

- Covanta Holding Corporation

- Veolia Environment SA

- Waste Connections

- Remondis AG & Co Kg

- Suez Environment S A

- Daiseki Co Ltd

- Waste Management Inc

- Republic Services

- Averda

Key Milestones in Waste Management Sector Industry Industry

- October 2020: Waste Management completed its acquisition of Advanced Disposal for USD 4.6 billion, significantly altering market share dynamics.

- February 2021: Biffa Group's acquisition of Company Shop Group expanded its presence in the UK's surplus food redistribution market.

Strategic Outlook for Waste Management Sector Industry Market

The future of the waste management sector is bright, with significant growth potential driven by technological advancements, increasing environmental awareness, and supportive government policies. Strategic partnerships, investments in innovative technologies, and expansion into emerging markets will be key to success. Companies focusing on sustainability and circular economy solutions are poised for significant growth. The market is expected to witness continued consolidation, with larger players acquiring smaller ones to gain market share and efficiency.

Waste Management Sector Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. E-waste

- 1.4. Plastic waste

- 1.5. Biomedical and Other Waste Types

-

2. Disposal methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Recycling

Waste Management Sector Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Middle East

- 5. Latin America

Waste Management Sector Industry Regional Market Share

Geographic Coverage of Waste Management Sector Industry

Waste Management Sector Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Spotlight on the Construction and Demolition waste management systems

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Waste Management Sector Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. E-waste

- 5.1.4. Plastic waste

- 5.1.5. Biomedical and Other Waste Types

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. North America Waste Management Sector Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Waste type

- 6.1.1. Industrial waste

- 6.1.2. Municipal solid waste

- 6.1.3. E-waste

- 6.1.4. Plastic waste

- 6.1.5. Biomedical and Other Waste Types

- 6.2. Market Analysis, Insights and Forecast - by Disposal methods

- 6.2.1. Landfill

- 6.2.2. Incineration

- 6.2.3. Recycling

- 6.1. Market Analysis, Insights and Forecast - by Waste type

- 7. Europe Waste Management Sector Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Waste type

- 7.1.1. Industrial waste

- 7.1.2. Municipal solid waste

- 7.1.3. E-waste

- 7.1.4. Plastic waste

- 7.1.5. Biomedical and Other Waste Types

- 7.2. Market Analysis, Insights and Forecast - by Disposal methods

- 7.2.1. Landfill

- 7.2.2. Incineration

- 7.2.3. Recycling

- 7.1. Market Analysis, Insights and Forecast - by Waste type

- 8. Asia Pacific Waste Management Sector Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Waste type

- 8.1.1. Industrial waste

- 8.1.2. Municipal solid waste

- 8.1.3. E-waste

- 8.1.4. Plastic waste

- 8.1.5. Biomedical and Other Waste Types

- 8.2. Market Analysis, Insights and Forecast - by Disposal methods

- 8.2.1. Landfill

- 8.2.2. Incineration

- 8.2.3. Recycling

- 8.1. Market Analysis, Insights and Forecast - by Waste type

- 9. Middle East Waste Management Sector Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Waste type

- 9.1.1. Industrial waste

- 9.1.2. Municipal solid waste

- 9.1.3. E-waste

- 9.1.4. Plastic waste

- 9.1.5. Biomedical and Other Waste Types

- 9.2. Market Analysis, Insights and Forecast - by Disposal methods

- 9.2.1. Landfill

- 9.2.2. Incineration

- 9.2.3. Recycling

- 9.1. Market Analysis, Insights and Forecast - by Waste type

- 10. Latin America Waste Management Sector Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Waste type

- 10.1.1. Industrial waste

- 10.1.2. Municipal solid waste

- 10.1.3. E-waste

- 10.1.4. Plastic waste

- 10.1.5. Biomedical and Other Waste Types

- 10.2. Market Analysis, Insights and Forecast - by Disposal methods

- 10.2.1. Landfill

- 10.2.2. Incineration

- 10.2.3. Recycling

- 10.1. Market Analysis, Insights and Forecast - by Waste type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Biffa Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clean Harbors Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Covanta Holding Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Veolia Environment SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Waste Connections

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Remondis AG & Co Kg

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Suez Environment S A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Daiseki Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Waste Management Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Republic Services

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Averda**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Biffa Group

List of Figures

- Figure 1: Global Waste Management Sector Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Waste Management Sector Industry Revenue (billion), by Waste type 2025 & 2033

- Figure 3: North America Waste Management Sector Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 4: North America Waste Management Sector Industry Revenue (billion), by Disposal methods 2025 & 2033

- Figure 5: North America Waste Management Sector Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 6: North America Waste Management Sector Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Waste Management Sector Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Waste Management Sector Industry Revenue (billion), by Waste type 2025 & 2033

- Figure 9: Europe Waste Management Sector Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 10: Europe Waste Management Sector Industry Revenue (billion), by Disposal methods 2025 & 2033

- Figure 11: Europe Waste Management Sector Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 12: Europe Waste Management Sector Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Waste Management Sector Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Waste Management Sector Industry Revenue (billion), by Waste type 2025 & 2033

- Figure 15: Asia Pacific Waste Management Sector Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 16: Asia Pacific Waste Management Sector Industry Revenue (billion), by Disposal methods 2025 & 2033

- Figure 17: Asia Pacific Waste Management Sector Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 18: Asia Pacific Waste Management Sector Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Waste Management Sector Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East Waste Management Sector Industry Revenue (billion), by Waste type 2025 & 2033

- Figure 21: Middle East Waste Management Sector Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 22: Middle East Waste Management Sector Industry Revenue (billion), by Disposal methods 2025 & 2033

- Figure 23: Middle East Waste Management Sector Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 24: Middle East Waste Management Sector Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East Waste Management Sector Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Waste Management Sector Industry Revenue (billion), by Waste type 2025 & 2033

- Figure 27: Latin America Waste Management Sector Industry Revenue Share (%), by Waste type 2025 & 2033

- Figure 28: Latin America Waste Management Sector Industry Revenue (billion), by Disposal methods 2025 & 2033

- Figure 29: Latin America Waste Management Sector Industry Revenue Share (%), by Disposal methods 2025 & 2033

- Figure 30: Latin America Waste Management Sector Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Latin America Waste Management Sector Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Waste Management Sector Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 2: Global Waste Management Sector Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 3: Global Waste Management Sector Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Waste Management Sector Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 5: Global Waste Management Sector Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 6: Global Waste Management Sector Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Waste Management Sector Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 10: Global Waste Management Sector Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 11: Global Waste Management Sector Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Russia Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Waste Management Sector Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 18: Global Waste Management Sector Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 19: Global Waste Management Sector Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: South Korea Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Waste Management Sector Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Waste Management Sector Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 26: Global Waste Management Sector Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 27: Global Waste Management Sector Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global Waste Management Sector Industry Revenue billion Forecast, by Waste type 2020 & 2033

- Table 29: Global Waste Management Sector Industry Revenue billion Forecast, by Disposal methods 2020 & 2033

- Table 30: Global Waste Management Sector Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Waste Management Sector Industry?

The projected CAGR is approximately 6.63%.

2. Which companies are prominent players in the Waste Management Sector Industry?

Key companies in the market include Biffa Group, Clean Harbors Inc, Covanta Holding Corporation, Veolia Environment SA, Waste Connections, Remondis AG & Co Kg, Suez Environment S A, Daiseki Co Ltd, Waste Management Inc, Republic Services, Averda**List Not Exhaustive.

3. What are the main segments of the Waste Management Sector Industry?

The market segments include Waste type, Disposal methods.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.58 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Spotlight on the Construction and Demolition waste management systems.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2021: Biffa group announced the acquisition of Company Shop Group ('CSG'), the UK's leading and largest redistributor of surplus food and household products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Waste Management Sector Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Waste Management Sector Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Waste Management Sector Industry?

To stay informed about further developments, trends, and reports in the Waste Management Sector Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence