Key Insights

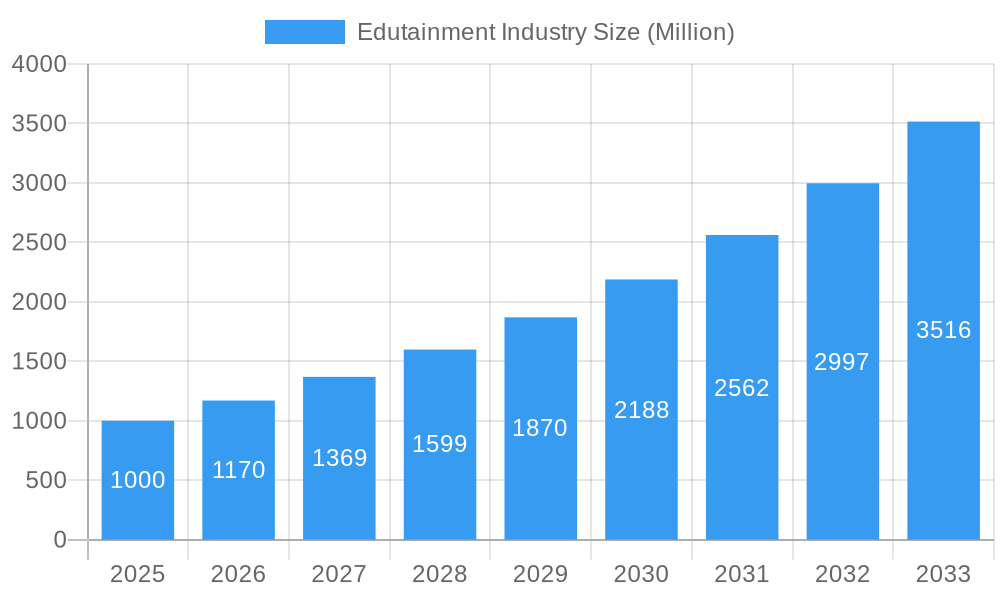

The global Edutainment market is poised for substantial expansion, projected to reach $3 billion by 2033. Driven by a strong Compound Annual Growth Rate (CAGR) of 16.1% from the base year 2025, this growth is underpinned by rising parental disposable incomes, increased technology integration in education, and a growing recognition of edutainment's role in holistic child development. Parents are actively seeking engaging and fun learning experiences that foster cognitive and social-emotional growth, stimulating innovation and the development of novel edutainment products and services.

Edutainment Industry Market Size (In Billion)

Key challenges include potential impacts from economic downturns, competitive market dynamics, and the continuous need to balance educational efficacy with entertainment value, which necessitates ongoing R&D and impacts operational costs. Success within this market depends on companies' agility in adapting to evolving consumer preferences, effective technology leverage, and the delivery of unique, high-quality experiences that offer demonstrable value to parents. Geographic variations in market penetration and economic conditions also play a significant role in overall growth trajectories.

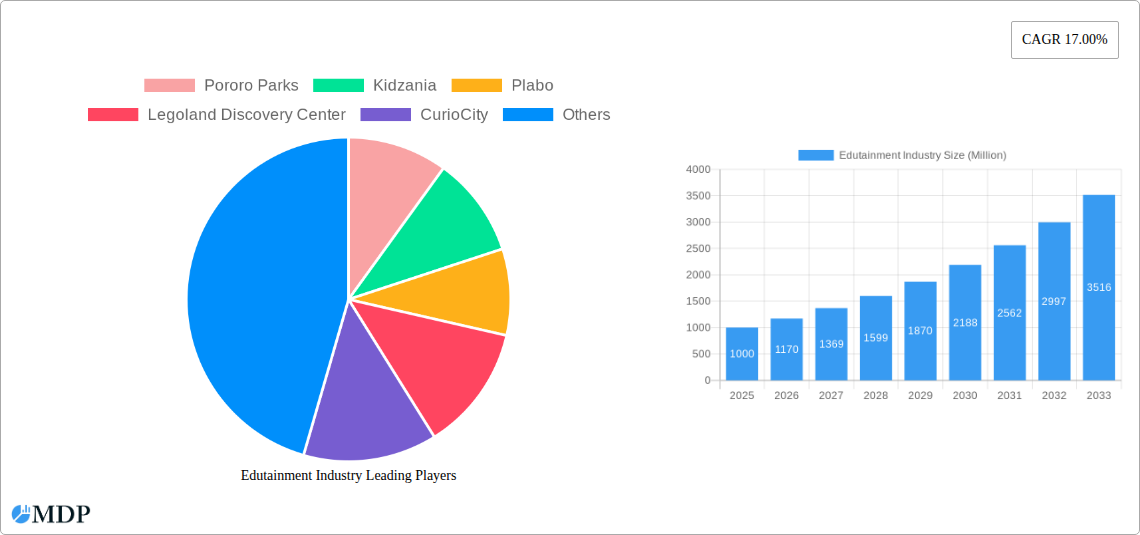

Edutainment Industry Company Market Share

Unlock the Thriving Edutainment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global edutainment industry, projecting a market value exceeding $XX Billion by 2033. Leveraging data from 2019-2024 (Historical Period), with 2025 as the base and estimated year, and forecasting until 2033, this report offers invaluable insights for investors, industry stakeholders, and entrepreneurs seeking to navigate this dynamic sector. The study meticulously examines market dynamics, key players like Pororo Parks, Kidzania, and Legoland Discovery Center, and emerging trends shaping the future of edutainment.

Study Period: 2019–2033; Base Year: 2025; Estimated Year: 2025; Forecast Period: 2025–2033; Historical Period: 2019–2024

Edutainment Industry Market Dynamics & Concentration

The global edutainment market exhibits a moderately concentrated landscape, with key players commanding significant market share. Pororo Parks, Kidzania, and Legoland Discovery Center, among others, are prominent examples. The market is driven by increasing disposable incomes, rising parental awareness of the importance of early childhood development, and technological advancements creating immersive and engaging learning experiences. Regulatory frameworks related to safety and educational standards also play a crucial role. Product substitutes include traditional educational methods and home-based learning resources, but the experiential nature of edutainment offers a distinct advantage. End-user trends indicate a growing preference for personalized and interactive learning solutions. Mergers and acquisitions (M&A) activity has been moderate in recent years, with approximately xx M&A deals concluded between 2019 and 2024. Key players are continuously seeking strategic alliances to expand their reach and product offerings. Market share analysis reveals that the top 5 players collectively hold approximately xx% of the market share, indicating scope for both consolidation and the emergence of niche players.

Edutainment Industry Industry Trends & Analysis

The edutainment industry is experiencing robust growth, driven by several factors. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%, exceeding xx% achieved during the historical period. Technological disruptions, particularly the integration of virtual and augmented reality (VR/AR), gamification, and AI-powered personalized learning platforms, are revolutionizing the sector. Consumer preferences increasingly favor interactive, experiential learning, pushing companies to invest in innovative offerings. Competitive dynamics are characterized by continuous innovation, strategic partnerships, and the emergence of new technologies. Market penetration of edutainment services is increasing steadily across various demographics, especially in developed and emerging economies alike. Significant growth is observed in the segment catering to preschool and primary school children, indicating a strong potential in this segment. The overall market is highly fragmented, with many players competing on factors like content quality, branding, location, and price.

Leading Markets & Segments in Edutainment Industry

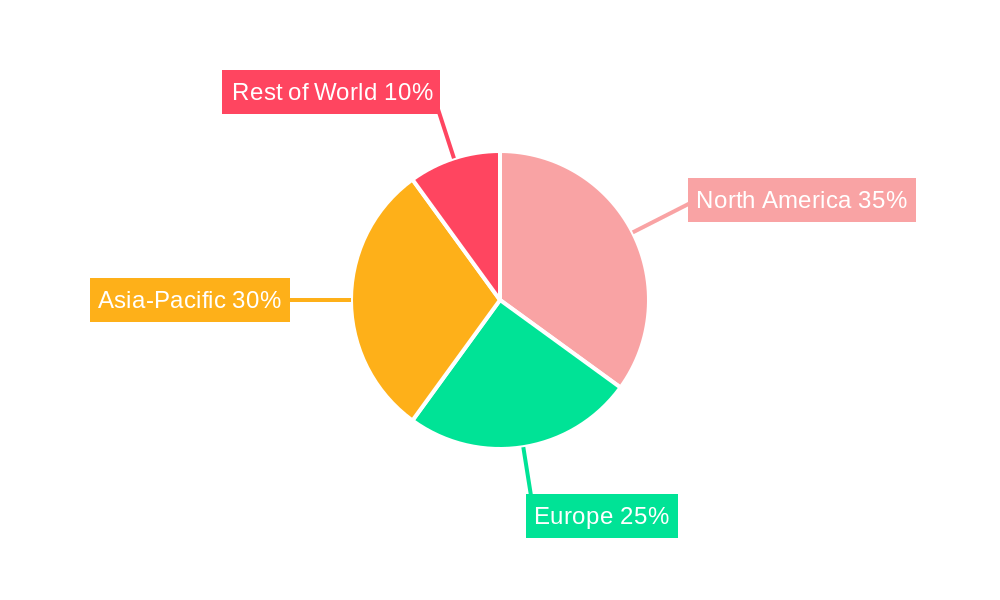

The North American region currently dominates the global edutainment market, followed closely by Asia-Pacific. Key drivers in North America include strong consumer spending on children’s education, a developed infrastructure, and favorable government policies promoting early childhood development.

- North America Dominance: High disposable incomes, advanced technological infrastructure, strong brand presence, and a culture embracing experiential learning.

- Asia-Pacific Growth Potential: Rapid urbanization, rising middle class, increasing awareness of the importance of early childhood education, and government initiatives promoting education.

- Europe's Steady Growth: Established edutainment market with substantial investment in innovative learning technologies.

This dominance is attributed to several factors:

- Strong consumer spending: High disposable incomes allow parents to invest more in enriching educational experiences for their children.

- Developed infrastructure: The presence of well-developed infrastructure, including transportation networks and robust retail spaces, facilitates the establishment and operation of edutainment centers.

- Government support: Favorable government policies and initiatives that support early childhood development foster a conducive environment for the growth of the edutainment industry.

Edutainment Industry Product Developments

Recent product innovations focus on immersive and interactive experiences, leveraging technology to enhance learning outcomes. Gamified learning platforms, VR/AR simulations, and AI-powered personalized learning systems are gaining traction. These developments offer compelling competitive advantages by providing engaging, personalized, and data-driven educational experiences that cater to diverse learning styles. The market is witnessing a shift from passive learning to active engagement, with products increasingly focusing on problem-solving, creativity, and collaboration. The integration of technology with traditional edutainment formats, like theme parks and museums, is expected to further drive market growth.

Key Drivers of Edutainment Industry Growth

Several key factors are driving the growth of the edutainment industry. Firstly, the increasing awareness of the importance of early childhood development amongst parents is fueling demand for high-quality educational experiences. Secondly, technological advancements, such as VR/AR and AI, are enabling the creation of more immersive and personalized learning environments. Thirdly, favorable government policies in several countries are promoting investments in education and early childhood development. Lastly, the rising disposable incomes in many parts of the world are providing consumers with more discretionary spending power to invest in edutainment services.

Challenges in the Edutainment Industry Market

The edutainment industry faces several challenges. High operational costs associated with maintaining interactive facilities and developing engaging content can present a significant hurdle. Competition from traditional educational methods and the emergence of new technologies constantly pressure companies to innovate. Supply chain disruptions, particularly concerning technological components, can affect production and availability. Additionally, strict regulatory frameworks related to safety, curriculum standards, and intellectual property can pose challenges. These factors combined can significantly impact profitability and market penetration for smaller players.

Emerging Opportunities in Edutainment Industry

The edutainment industry is poised for significant growth, driven by several key opportunities. Strategic partnerships between edutainment companies and educational institutions can broaden market reach and create robust learning ecosystems. Technological advancements like AI-powered personalized learning platforms and the use of extended reality (XR) technologies can open new avenues for creating highly engaging and effective learning experiences. Market expansion into untapped regions, especially in emerging economies with growing middle classes, offers substantial potential.

Leading Players in the Edutainment Industry Sector

- Pororo Parks

- Kidzania

- Plabo

- Legoland Discovery Center

- CurioCity

- Kindercity

- Mattel Play! Town

- Totter's Otterville

- Kidz Holding S A L

- Little Explorers

- ConveGenius

- Grey Sim

- Edsys

- IdeaCrate Edutainment Company

- DreamUs Edutainment

*List Not Exhaustive

Key Milestones in Edutainment Industry Industry

- 2020: Increased adoption of online edutainment platforms due to pandemic lockdowns.

- 2021: Launch of several innovative VR/AR-based edutainment products.

- 2022: Strategic partnerships between major edutainment players and educational institutions.

- 2023: Significant investments in AI-powered personalized learning solutions.

- 2024: Expansion of edutainment services into new geographical markets.

Strategic Outlook for Edutainment Industry Market

The edutainment market is poised for continued growth, driven by technological innovation, increasing parental investment in children's education, and favorable government policies. Strategic partnerships, expansion into new markets, and the development of cutting-edge learning technologies will be critical for success. Companies that effectively leverage technology to create immersive and personalized learning experiences will be best positioned to capitalize on the growing market. The future success of companies in this sector will depend on their ability to adapt to the evolving needs of consumers and stay at the forefront of technological advancements.

Edutainment Industry Segmentation

-

1. product type

- 1.1. Interactive

- 1.2. Non interactive

- 1.3. Hybrid

- 1.4. Explorative

-

2. end use age group

- 2.1. Children

- 2.2. Teenagers

- 2.3. Young Adult

-

3. region/ country

- 3.1. United States of America

- 3.2. Europe

- 3.3. China

- 3.4. Japan

- 3.5. South East Asia

- 3.6. India

- 3.7. Central and South America

Edutainment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Edutainment Industry Regional Market Share

Geographic Coverage of Edutainment Industry

Edutainment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Technological Advancement Is Driving Edutech To Newer Heights

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Edutainment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by product type

- 5.1.1. Interactive

- 5.1.2. Non interactive

- 5.1.3. Hybrid

- 5.1.4. Explorative

- 5.2. Market Analysis, Insights and Forecast - by end use age group

- 5.2.1. Children

- 5.2.2. Teenagers

- 5.2.3. Young Adult

- 5.3. Market Analysis, Insights and Forecast - by region/ country

- 5.3.1. United States of America

- 5.3.2. Europe

- 5.3.3. China

- 5.3.4. Japan

- 5.3.5. South East Asia

- 5.3.6. India

- 5.3.7. Central and South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by product type

- 6. North America Edutainment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by product type

- 6.1.1. Interactive

- 6.1.2. Non interactive

- 6.1.3. Hybrid

- 6.1.4. Explorative

- 6.2. Market Analysis, Insights and Forecast - by end use age group

- 6.2.1. Children

- 6.2.2. Teenagers

- 6.2.3. Young Adult

- 6.3. Market Analysis, Insights and Forecast - by region/ country

- 6.3.1. United States of America

- 6.3.2. Europe

- 6.3.3. China

- 6.3.4. Japan

- 6.3.5. South East Asia

- 6.3.6. India

- 6.3.7. Central and South America

- 6.1. Market Analysis, Insights and Forecast - by product type

- 7. South America Edutainment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by product type

- 7.1.1. Interactive

- 7.1.2. Non interactive

- 7.1.3. Hybrid

- 7.1.4. Explorative

- 7.2. Market Analysis, Insights and Forecast - by end use age group

- 7.2.1. Children

- 7.2.2. Teenagers

- 7.2.3. Young Adult

- 7.3. Market Analysis, Insights and Forecast - by region/ country

- 7.3.1. United States of America

- 7.3.2. Europe

- 7.3.3. China

- 7.3.4. Japan

- 7.3.5. South East Asia

- 7.3.6. India

- 7.3.7. Central and South America

- 7.1. Market Analysis, Insights and Forecast - by product type

- 8. Europe Edutainment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by product type

- 8.1.1. Interactive

- 8.1.2. Non interactive

- 8.1.3. Hybrid

- 8.1.4. Explorative

- 8.2. Market Analysis, Insights and Forecast - by end use age group

- 8.2.1. Children

- 8.2.2. Teenagers

- 8.2.3. Young Adult

- 8.3. Market Analysis, Insights and Forecast - by region/ country

- 8.3.1. United States of America

- 8.3.2. Europe

- 8.3.3. China

- 8.3.4. Japan

- 8.3.5. South East Asia

- 8.3.6. India

- 8.3.7. Central and South America

- 8.1. Market Analysis, Insights and Forecast - by product type

- 9. Middle East & Africa Edutainment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by product type

- 9.1.1. Interactive

- 9.1.2. Non interactive

- 9.1.3. Hybrid

- 9.1.4. Explorative

- 9.2. Market Analysis, Insights and Forecast - by end use age group

- 9.2.1. Children

- 9.2.2. Teenagers

- 9.2.3. Young Adult

- 9.3. Market Analysis, Insights and Forecast - by region/ country

- 9.3.1. United States of America

- 9.3.2. Europe

- 9.3.3. China

- 9.3.4. Japan

- 9.3.5. South East Asia

- 9.3.6. India

- 9.3.7. Central and South America

- 9.1. Market Analysis, Insights and Forecast - by product type

- 10. Asia Pacific Edutainment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by product type

- 10.1.1. Interactive

- 10.1.2. Non interactive

- 10.1.3. Hybrid

- 10.1.4. Explorative

- 10.2. Market Analysis, Insights and Forecast - by end use age group

- 10.2.1. Children

- 10.2.2. Teenagers

- 10.2.3. Young Adult

- 10.3. Market Analysis, Insights and Forecast - by region/ country

- 10.3.1. United States of America

- 10.3.2. Europe

- 10.3.3. China

- 10.3.4. Japan

- 10.3.5. South East Asia

- 10.3.6. India

- 10.3.7. Central and South America

- 10.1. Market Analysis, Insights and Forecast - by product type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Pororo Parks

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kidzania

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Plabo

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Legoland Discovery Center

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CurioCity

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kindercity

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mattel Play! Town

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Totter's Otterville

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kidz Holding S A L

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Little Explorers

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ConveGenius

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Grey Sim

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Edsys

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 IdeaCrate Edutainment Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 DreamUs Edutainment*List Not Exhaustive

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Pororo Parks

List of Figures

- Figure 1: Global Edutainment Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Edutainment Industry Revenue (billion), by product type 2025 & 2033

- Figure 3: North America Edutainment Industry Revenue Share (%), by product type 2025 & 2033

- Figure 4: North America Edutainment Industry Revenue (billion), by end use age group 2025 & 2033

- Figure 5: North America Edutainment Industry Revenue Share (%), by end use age group 2025 & 2033

- Figure 6: North America Edutainment Industry Revenue (billion), by region/ country 2025 & 2033

- Figure 7: North America Edutainment Industry Revenue Share (%), by region/ country 2025 & 2033

- Figure 8: North America Edutainment Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Edutainment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Edutainment Industry Revenue (billion), by product type 2025 & 2033

- Figure 11: South America Edutainment Industry Revenue Share (%), by product type 2025 & 2033

- Figure 12: South America Edutainment Industry Revenue (billion), by end use age group 2025 & 2033

- Figure 13: South America Edutainment Industry Revenue Share (%), by end use age group 2025 & 2033

- Figure 14: South America Edutainment Industry Revenue (billion), by region/ country 2025 & 2033

- Figure 15: South America Edutainment Industry Revenue Share (%), by region/ country 2025 & 2033

- Figure 16: South America Edutainment Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Edutainment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Edutainment Industry Revenue (billion), by product type 2025 & 2033

- Figure 19: Europe Edutainment Industry Revenue Share (%), by product type 2025 & 2033

- Figure 20: Europe Edutainment Industry Revenue (billion), by end use age group 2025 & 2033

- Figure 21: Europe Edutainment Industry Revenue Share (%), by end use age group 2025 & 2033

- Figure 22: Europe Edutainment Industry Revenue (billion), by region/ country 2025 & 2033

- Figure 23: Europe Edutainment Industry Revenue Share (%), by region/ country 2025 & 2033

- Figure 24: Europe Edutainment Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Edutainment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Edutainment Industry Revenue (billion), by product type 2025 & 2033

- Figure 27: Middle East & Africa Edutainment Industry Revenue Share (%), by product type 2025 & 2033

- Figure 28: Middle East & Africa Edutainment Industry Revenue (billion), by end use age group 2025 & 2033

- Figure 29: Middle East & Africa Edutainment Industry Revenue Share (%), by end use age group 2025 & 2033

- Figure 30: Middle East & Africa Edutainment Industry Revenue (billion), by region/ country 2025 & 2033

- Figure 31: Middle East & Africa Edutainment Industry Revenue Share (%), by region/ country 2025 & 2033

- Figure 32: Middle East & Africa Edutainment Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Edutainment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Edutainment Industry Revenue (billion), by product type 2025 & 2033

- Figure 35: Asia Pacific Edutainment Industry Revenue Share (%), by product type 2025 & 2033

- Figure 36: Asia Pacific Edutainment Industry Revenue (billion), by end use age group 2025 & 2033

- Figure 37: Asia Pacific Edutainment Industry Revenue Share (%), by end use age group 2025 & 2033

- Figure 38: Asia Pacific Edutainment Industry Revenue (billion), by region/ country 2025 & 2033

- Figure 39: Asia Pacific Edutainment Industry Revenue Share (%), by region/ country 2025 & 2033

- Figure 40: Asia Pacific Edutainment Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Edutainment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Edutainment Industry Revenue billion Forecast, by product type 2020 & 2033

- Table 2: Global Edutainment Industry Revenue billion Forecast, by end use age group 2020 & 2033

- Table 3: Global Edutainment Industry Revenue billion Forecast, by region/ country 2020 & 2033

- Table 4: Global Edutainment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Edutainment Industry Revenue billion Forecast, by product type 2020 & 2033

- Table 6: Global Edutainment Industry Revenue billion Forecast, by end use age group 2020 & 2033

- Table 7: Global Edutainment Industry Revenue billion Forecast, by region/ country 2020 & 2033

- Table 8: Global Edutainment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Edutainment Industry Revenue billion Forecast, by product type 2020 & 2033

- Table 13: Global Edutainment Industry Revenue billion Forecast, by end use age group 2020 & 2033

- Table 14: Global Edutainment Industry Revenue billion Forecast, by region/ country 2020 & 2033

- Table 15: Global Edutainment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Edutainment Industry Revenue billion Forecast, by product type 2020 & 2033

- Table 20: Global Edutainment Industry Revenue billion Forecast, by end use age group 2020 & 2033

- Table 21: Global Edutainment Industry Revenue billion Forecast, by region/ country 2020 & 2033

- Table 22: Global Edutainment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Edutainment Industry Revenue billion Forecast, by product type 2020 & 2033

- Table 33: Global Edutainment Industry Revenue billion Forecast, by end use age group 2020 & 2033

- Table 34: Global Edutainment Industry Revenue billion Forecast, by region/ country 2020 & 2033

- Table 35: Global Edutainment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Edutainment Industry Revenue billion Forecast, by product type 2020 & 2033

- Table 43: Global Edutainment Industry Revenue billion Forecast, by end use age group 2020 & 2033

- Table 44: Global Edutainment Industry Revenue billion Forecast, by region/ country 2020 & 2033

- Table 45: Global Edutainment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Edutainment Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Edutainment Industry?

The projected CAGR is approximately 16.1%.

2. Which companies are prominent players in the Edutainment Industry?

Key companies in the market include Pororo Parks, Kidzania, Plabo, Legoland Discovery Center, CurioCity, Kindercity, Mattel Play! Town, Totter's Otterville, Kidz Holding S A L, Little Explorers, ConveGenius, Grey Sim, Edsys, IdeaCrate Edutainment Company, DreamUs Edutainment*List Not Exhaustive.

3. What are the main segments of the Edutainment Industry?

The market segments include product type, end use age group, region/ country.

4. Can you provide details about the market size?

The market size is estimated to be USD 3 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Technological Advancement Is Driving Edutech To Newer Heights.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Edutainment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Edutainment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Edutainment Industry?

To stay informed about further developments, trends, and reports in the Edutainment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence