Key Insights

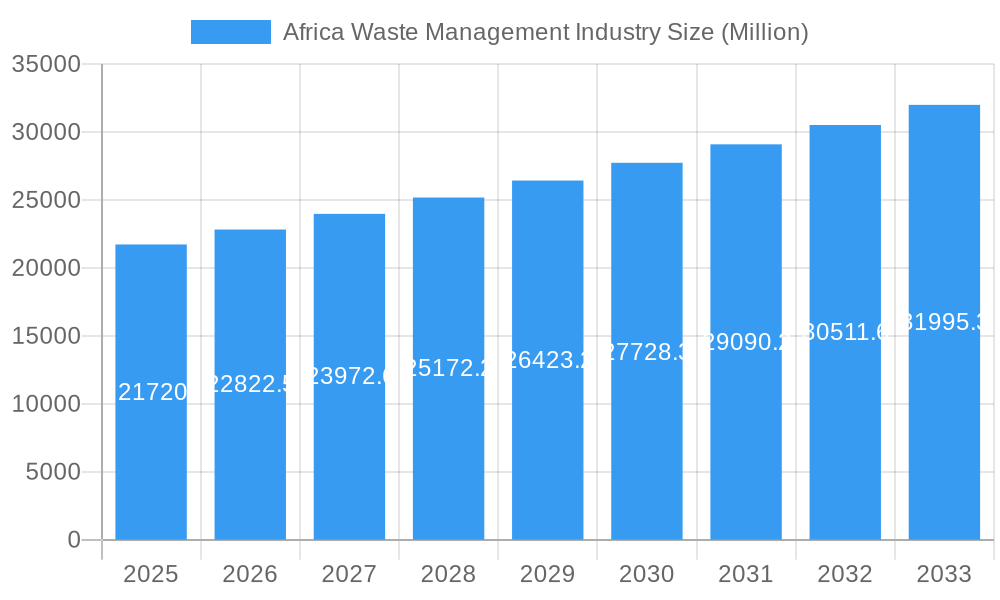

The African waste management industry, currently valued at $21.72 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 4.98% from 2025 to 2033. This growth is fueled by several key factors. Rapid urbanization across the continent is leading to increased waste generation, demanding more efficient and sustainable waste management solutions. Rising environmental awareness among governments and citizens is driving demand for improved recycling and waste-to-energy initiatives. Furthermore, increasing foreign direct investment in the sector, coupled with supportive government regulations aimed at promoting private sector participation, is bolstering industry development. Significant opportunities exist in developing robust waste collection infrastructure, particularly in underserved rural areas, and leveraging technological advancements such as smart waste management systems and advanced recycling technologies. Challenges remain, however, including inadequate funding, a lack of skilled labor, and the informal nature of a significant portion of the waste management sector. Addressing these challenges is crucial to unlocking the full potential of this growing market.

Africa Waste Management Industry Market Size (In Billion)

Despite these challenges, the industry presents significant investment opportunities. The increasing adoption of sustainable waste management practices, driven by both environmental concerns and the potential for resource recovery, is a major trend. Companies like Averda, Enviroserv, and Interwaste are already established players, demonstrating the industry's maturity in certain regions. However, substantial room exists for new entrants, particularly those focusing on innovative technologies and solutions tailored to the specific needs of diverse African markets. The expansion of waste-to-energy projects, improved recycling rates, and the growth of the informal waste sector into a more organized and regulated system present opportunities for significant growth and positive environmental impact. The forecast period of 2025-2033 is expected to witness considerable consolidation and further investment in the sector, leading to a more efficient and environmentally conscious waste management landscape across Africa.

Africa Waste Management Industry Company Market Share

Africa Waste Management Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Africa waste management industry, covering market dynamics, leading players, key trends, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for investors, industry stakeholders, and anyone seeking to understand this rapidly evolving sector. The report leverages extensive data analysis to provide actionable insights and strategic recommendations for navigating the complexities of the African waste management landscape. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Africa Waste Management Industry Market Dynamics & Concentration

The African waste management market is characterized by a complex interplay of factors influencing its growth and concentration. Market concentration is relatively low, with numerous regional and international players competing for market share. However, consolidation is accelerating, driven by mergers and acquisitions (M&A) activity. In 2024, approximately xx M&A deals were recorded, contributing to increased market concentration among larger players. Key innovation drivers include technological advancements in waste collection, processing, and recycling, alongside a growing focus on sustainable waste management practices. Regulatory frameworks vary significantly across African nations, impacting investment and operational efficiency. The presence of informal waste management sectors presents both challenges and opportunities for formal players. Product substitutes, such as incineration and anaerobic digestion, are gaining traction, although landfill remains the dominant disposal method. End-user trends are shifting towards environmentally conscious solutions, driving demand for recycling and waste-to-energy technologies.

- Market Concentration: Low, but increasing due to M&A activity.

- Innovation Drivers: Technological advancements in waste collection, processing, and recycling; increasing focus on sustainability.

- Regulatory Frameworks: Vary significantly across African nations.

- Product Substitutes: Incineration and anaerobic digestion are gaining traction.

- End-User Trends: Growing preference for environmentally conscious solutions.

- M&A Activity: Approximately xx M&A deals in 2024.

Africa Waste Management Industry Industry Trends & Analysis

The African waste management industry is undergoing a transformative period, characterized by rapid urbanization, escalating industrialization, and a heightened global and local awareness of environmental sustainability. This confluence of factors is not only increasing waste generation but also catalyzing a significant demand for sophisticated and responsible waste handling solutions. The sector is actively embracing technological advancements, with the integration of smart waste management systems, including IoT-enabled bins, route optimization software, and advanced sorting technologies, becoming increasingly prominent. Consumers and businesses alike are shifting their preferences towards eco-friendly and circular economy principles, prioritizing recycling, upcycling, and waste-to-energy initiatives. The competitive landscape is a dynamic interplay between established multinational corporations seeking to leverage their expertise and local enterprises demonstrating deep understanding of regional nuances and challenges. Despite the nascent stage of modern waste management services in many African regions, the significant growth potential is undeniable. This potential is further amplified by increasingly supportive governmental policies and investments aimed at improving sanitation and environmental protection across the continent. The industry's Compound Annual Growth Rate (CAGR) is projected to be robust, estimated at around XX% during the forecast period of 2025-2033, signifying substantial opportunities for investment and innovation.

Leading Markets & Segments in Africa Waste Management Industry

While the entire African continent holds potential, South Africa currently holds the dominant position in the waste management market. This dominance is due to a combination of factors:

- Key Drivers in South Africa:

- Advanced infrastructure compared to other African nations

- More established regulatory frameworks

- Higher economic activity and waste generation

- Significant investments in waste management technology and infrastructure.

- Dominance Analysis: South Africa benefits from a more developed economy leading to higher per capita waste generation and a larger capacity to invest in sophisticated waste management systems. This creates a larger market size and attracts more international players, further strengthening its leading position. Other countries are showing significant growth potential, but currently lag behind due to factors such as limited infrastructure, regulatory challenges, and lower economic activity.

Africa Waste Management Industry Product Developments

The industry is seeing notable innovations such as smart bins with sensors for waste level monitoring, advanced sorting technologies for recyclables, and waste-to-energy plants leveraging innovative conversion technologies. These advancements are enhancing operational efficiency, improving waste diversion rates, and promoting environmentally friendly practices. The competitive advantage lies in offering sustainable and cost-effective solutions tailored to specific local contexts, and incorporating technological capabilities that create scalable business models.

Key Drivers of Africa Waste Management Industry Growth

The exponential growth of the African waste management market is underpinned by several potent drivers. The most significant is rapid urbanization, which is leading to a dramatic increase in population density and, consequently, a surge in municipal solid waste generation. This necessitates the development and expansion of efficient collection, transportation, and disposal infrastructure. Secondly, economic development and industrialization are contributing to higher volumes of both municipal and industrial waste. As industries expand, so does the complexity and quantity of the waste they produce, demanding specialized management strategies. Thirdly, there is a growing imperative driven by stringent environmental regulations and increasing public pressure for sustainable waste management practices. Governments are enacting and enforcing policies that promote waste reduction, recycling, and safe disposal, pushing companies to adopt more responsible operational models. The rising awareness of the health and environmental consequences of improper waste disposal further fuels this demand. These interconnected factors create a highly conducive environment for substantial and sustained market expansion.

Challenges in the Africa Waste Management Industry Market

Significant hurdles remain in this sector. Regulatory inconsistencies across nations hinder the development of a unified market. Supply chain challenges, such as inadequate infrastructure and logistical limitations, increase operational costs and create inefficiencies. Furthermore, intense competition from both informal and formal players necessitates efficient strategies for sustainable growth. These factors contribute to the relatively low market penetration of modern waste management solutions across several African regions.

Emerging Opportunities in Africa Waste Management Industry

The African waste management sector presents a landscape rich with emerging opportunities for forward-thinking businesses. Technological innovation is a primary catalyst, with the adoption of artificial intelligence (AI) for waste stream analysis, the development of advanced recycling and upcycling technologies, and the implementation of digital platforms for waste tracking and management. These innovations promise to enhance efficiency, reduce costs, and improve environmental outcomes. Strategic partnerships and collaborations between international waste management giants and agile local companies are proving instrumental in facilitating knowledge transfer, adapting global best practices to local contexts, and accelerating market penetration. Furthermore, the vast, underserved rural and peri-urban regions of Africa represent significant untapped market potential, offering opportunities for innovative and scalable service delivery models. The burgeoning interest in the circular economy is also opening new avenues, encouraging the development of waste-to-resource initiatives, including waste-to-energy plants and the creation of new products from recycled materials.

Leading Players in the Africa Waste Management Industry Sector

- Averda

- Enviroserv

- Interwaste

- WasteMart

- Universal Recycling Company

- Desco

- PETCO

- The Glass Recycling Company

- Oricol Environmental Services SA (PTY) LTD

- WeCyclers

- The Waste Group (Pty) Ltd

- SA Waste (PTY) Ltd

- List Not Exhaustive

Key Milestones in Africa Waste Management Industry Industry

- October 2022: SUEZ, in a strategic move, collaborated with Royal Bafokeng Holdings (RBH) and African Infrastructure Investment Managers (AIIM) to finalize the acquisition of EnviroServ, significantly bolstering SUEZ's operational footprint and capabilities within the African continent.

- May 2022: The International Finance Corporation (IFC) made a pivotal investment by providing a USD 30 million loan to Averda. This funding is earmarked to support Averda's expansion initiatives across Africa and the Middle East, marking a significant milestone as the IFC's first direct investment in the private waste management market within the region.

Strategic Outlook for Africa Waste Management Industry Market

The future trajectory of the African waste management industry appears exceptionally promising, brimming with potential for considerable growth and sustainable development. A key strategic imperative for companies will be to foster and leverage strategic partnerships, creating synergistic relationships that combine global expertise with local market understanding. Continued investment in and adoption of cutting-edge technological innovations will be crucial for enhancing operational efficiency, improving service delivery, and developing novel waste valorization solutions. Governments are expected to play an increasingly vital role through the implementation of more robust regulatory frameworks and supportive policies, which will further stimulate market expansion and attract investment. Companies that demonstrate agility in adapting to the unique socio-economic and logistical challenges inherent in the African context, while maintaining an unwavering commitment to sustainable and efficient waste management solutions, are optimally positioned to secure substantial market share. The overarching trend towards establishing and strengthening circular economies within the waste management sector is set to unlock immense growth potential in the coming years, transforming waste from a liability into a valuable resource.

Africa Waste Management Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. Hazardous Waste

- 1.4. E-waste

- 1.5. Plastic waste

- 1.6. Bio-medical waste

-

2. Disposal methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Dismantling

- 2.4. Recycling

Africa Waste Management Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Waste Management Industry Regional Market Share

Geographic Coverage of Africa Waste Management Industry

Africa Waste Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Awareness towards the Waste Management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. Hazardous Waste

- 5.1.4. E-waste

- 5.1.5. Plastic waste

- 5.1.6. Bio-medical waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Dismantling

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Averda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Enviroserv

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Interwaste

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WasteMart

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Universal Recycling Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Desco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PETCO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Glass Recycling Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oricol Environmental Services SA (PTY) LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 WeCyclers

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Waste Group (Pty) Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SA Waste (PTY) Ltd **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Averda

List of Figures

- Figure 1: Africa Waste Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Waste Management Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 2: Africa Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 3: Africa Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 4: Africa Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 5: Africa Waste Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Africa Waste Management Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Africa Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 8: Africa Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 9: Africa Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 10: Africa Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 11: Africa Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Africa Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Nigeria Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Nigeria Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: South Africa Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: South Africa Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Egypt Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Egypt Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Kenya Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Kenya Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Ethiopia Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Ethiopia Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Morocco Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Morocco Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Ghana Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Ghana Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Algeria Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Algeria Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Tanzania Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Tanzania Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Ivory Coast Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Ivory Coast Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Waste Management Industry?

The projected CAGR is approximately 4.98%.

2. Which companies are prominent players in the Africa Waste Management Industry?

Key companies in the market include Averda, Enviroserv, Interwaste, WasteMart, Universal Recycling Company, Desco, PETCO, The Glass Recycling Company, Oricol Environmental Services SA (PTY) LTD, WeCyclers, The Waste Group (Pty) Ltd, SA Waste (PTY) Ltd **List Not Exhaustive.

3. What are the main segments of the Africa Waste Management Industry?

The market segments include Waste type, Disposal methods.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.72 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Awareness towards the Waste Management.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022- In line with the conditions stated on June 9, 2022, SUEZ, Royal Bafokeng Holdings (RBH), and African Infrastructure Investment Managers (AIIM) finalized the acquisition of EnviroServ Proprietary Holdings Ltd and its subsidiaries (collectively, "EnviroServ") after receiving permission from the regional antitrust authorities. By this purchase, SUEZ will be able to solidify both its presence in Africa and its position as a global leader in the treatment of municipal and industrial waste.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Waste Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Waste Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Waste Management Industry?

To stay informed about further developments, trends, and reports in the Africa Waste Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence