Key Insights

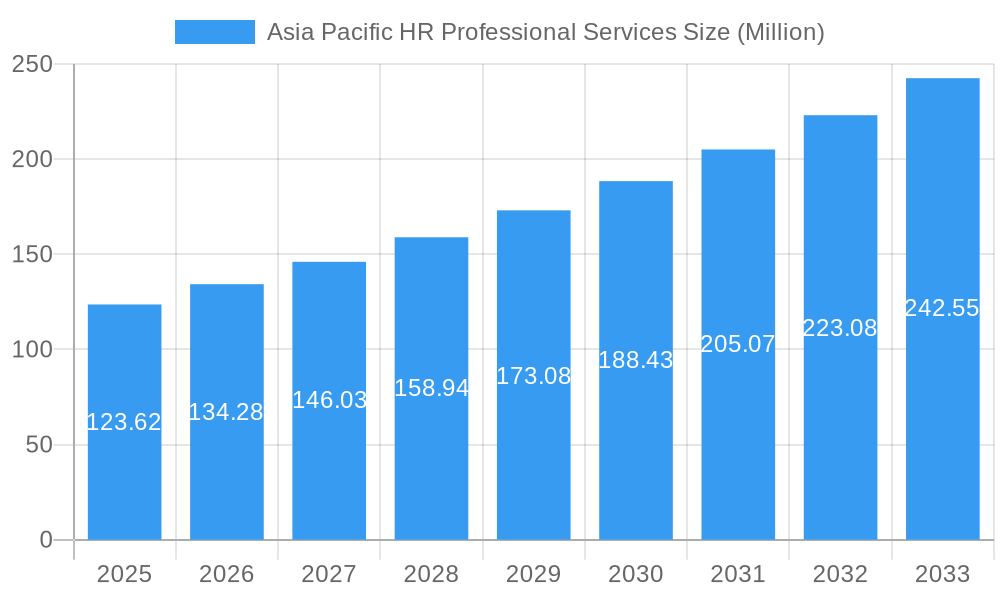

The Asia Pacific HR professional services market, valued at $123.62 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.63% from 2025 to 2033. This growth is fueled by several key factors. Increasing adoption of digital HR technologies, including AI-powered recruitment tools and HR analytics platforms, is streamlining processes and boosting efficiency for businesses across the region. The burgeoning need for skilled talent in rapidly developing economies within the Asia Pacific, coupled with a growing awareness of the importance of employee engagement and retention strategies, is driving demand for specialized HR services. Furthermore, the rise of gig work and the increasing complexity of global employment regulations contribute significantly to the market's expansion. Major players like Adecco, Randstad, and ManpowerGroup are actively investing in expanding their presence and service offerings within the region to capitalize on this growth opportunity.

Asia Pacific HR Professional Services Market Size (In Million)

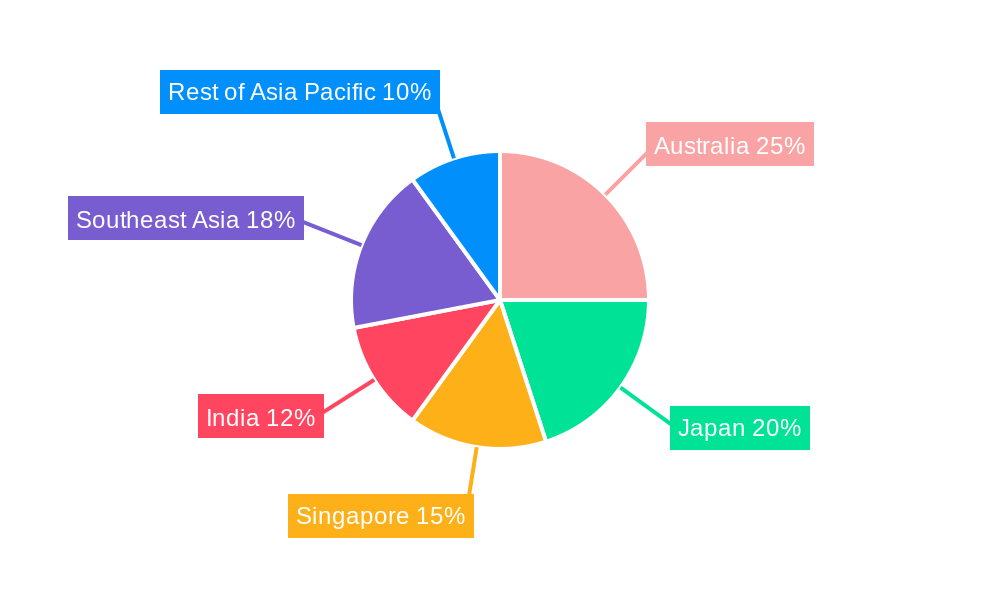

The market segmentation within Asia Pacific likely reflects variations in economic development and regulatory environments across different nations. We can anticipate stronger growth in rapidly developing economies, driven by greater demand for HR expertise in managing expansion and attracting talent. Conversely, more mature economies might experience a comparatively moderate growth trajectory, with a focus on optimizing existing HR functions through technology and process improvement. While specific regional data is unavailable, a reasonable assumption would be a higher concentration of market share within more developed economies such as Australia, Japan, and Singapore, balanced by strong growth potential within emerging markets like India and Southeast Asia. Competition is intense, with established global players facing increasing pressure from local firms offering specialized expertise and localized knowledge. This competitive landscape is likely to drive further innovation and service differentiation within the industry.

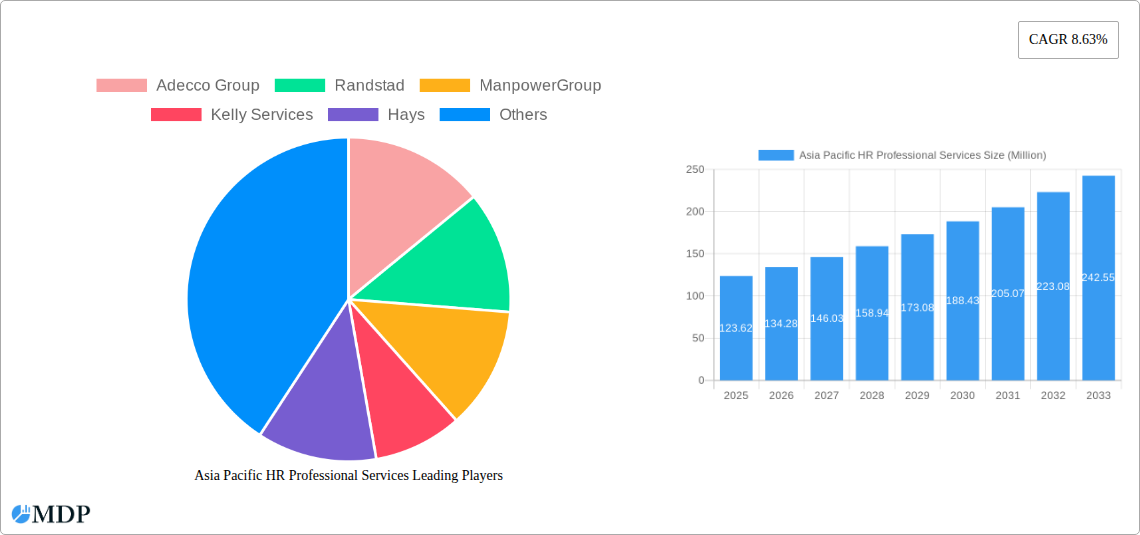

Asia Pacific HR Professional Services Company Market Share

Asia Pacific HR Professional Services Market Report: 2019-2033

Unlocking Growth in a Dynamic Market: A Comprehensive Analysis of the Asia Pacific HR Professional Services Sector

This comprehensive report provides an in-depth analysis of the Asia Pacific HR Professional Services market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and an estimated and forecast period of 2025-2033, this report illuminates the market's historical performance, current state, and future trajectory. The report analyzes a market valued at $XX Million in 2025, projected to reach $XX Million by 2033, exhibiting a CAGR of XX%.

Asia Pacific HR Professional Services Market Dynamics & Concentration

The Asia Pacific HR professional services market is characterized by a moderately concentrated landscape, with key players like Adecco Group, Randstad, ManpowerGroup, Kelly Services, Hays, Robert Half, Allegis Group, Hudson, Michael Page, and Mercer commanding significant market share. Market concentration is further influenced by factors such as mergers and acquisitions (M&A) activity, regulatory frameworks varying across nations, and the increasing adoption of innovative technologies. Over the historical period (2019-2024), approximately XX M&A deals were recorded, contributing to market consolidation and reshaping competitive dynamics. The market share of the top 10 players is estimated at XX% in 2025. Innovation in areas such as AI-powered recruitment tools and data analytics is driving market expansion, while regulatory changes related to data privacy and labor laws create both challenges and opportunities. Product substitutes, such as in-house recruitment teams and freelance platforms, pose competitive pressure, while end-user trends towards flexible work arrangements and specialized skill sets are shaping service demand.

Asia Pacific HR Professional Services Industry Trends & Analysis

The Asia Pacific HR professional services market is experiencing robust growth driven by several key factors. The increasing prevalence of globalization and the need for specialized talent are major catalysts, leading to heightened demand for recruitment and HR consulting services. Technological disruptions, particularly the adoption of AI and machine learning in recruitment processes, are transforming the industry landscape. Consumer preferences are shifting towards more flexible and personalized HR solutions, pushing providers to adapt their offerings. The market penetration of AI-powered recruitment tools is projected to reach XX% by 2033, driving substantial efficiency gains. Intense competition necessitates continuous innovation and adaptation to changing market conditions. This competitive landscape is further fueled by the entrance of new players and the expansion of existing ones. The market's overall growth trajectory is anticipated to remain positive, driven by the continued evolution of the business environment and increasing awareness of the value of strategic HR management.

Leading Markets & Segments in Asia Pacific HR Professional Services

While the entire Asia Pacific region presents significant opportunities, [Insert Dominant Country/Region, e.g., China or India] emerges as a leading market for HR professional services. This dominance stems from several key factors:

- Robust Economic Growth: [Dominant Country/Region]'s strong economic growth fuels demand for talent across various sectors.

- Expanding Middle Class: The burgeoning middle class translates to a larger workforce and increased demand for HR solutions.

- Favorable Government Policies: Government initiatives aimed at promoting employment and foreign investment contribute to market expansion.

- Developing Infrastructure: Improved infrastructure enhances business operations and attracts further investment.

[Insert detailed paragraph elaborating on the dominance analysis, supporting the points listed above with quantifiable data wherever possible. Mention specific market segments within the dominant country/region – e.g., specific industries with strong growth in HR services].

Asia Pacific HR Professional Services Product Developments

Recent product innovations in the Asia Pacific HR professional services market include the increasing adoption of AI-powered recruitment tools, which streamline candidate screening and matching processes, improving efficiency and accuracy. Furthermore, the rise of data analytics platforms provides deeper insights into workforce trends, enabling HR professionals to make more informed decisions regarding talent acquisition and retention strategies. The integration of these technological advancements with traditional HR services is creating a more comprehensive and effective approach to talent management, fostering greater market fit and competitive advantage.

Key Drivers of Asia Pacific HR Professional Services Growth

Technological advancements, especially AI and automation, are revolutionizing recruitment and HR management, driving efficiency and cost reduction. Economic growth across the region, particularly in emerging economies, creates a strong demand for skilled labor and HR services. Favorable government policies promoting entrepreneurship and foreign investment further enhance market opportunities. The increasing adoption of flexible work arrangements and the growing emphasis on employee well-being are also major growth drivers.

Challenges in the Asia Pacific HR Professional Services Market

Regulatory hurdles related to data privacy and labor laws present significant challenges for HR service providers. Supply chain disruptions and talent shortages within the HR industry itself limit capacity and increase costs. Intense competition among established and emerging players necessitates continuous innovation and adaptation. The combined impact of these factors could result in a XX% reduction in profit margins for some players in 2026.

Emerging Opportunities in Asia Pacific HR Professional Services

Technological breakthroughs in AI, machine learning, and big data analytics promise to further enhance efficiency and accuracy in recruitment and HR management. Strategic partnerships between HR service providers and technology companies can unlock significant growth potential. Expanding into underserved markets within the Asia Pacific region and offering specialized services tailored to specific industries will also drive future growth.

Leading Players in the Asia Pacific HR Professional Services Sector

Key Milestones in Asia Pacific HR Professional Services Industry

- July 2023: Kelly Services announced a strategic restructuring to enhance operational efficiency.

- May 2024: ManpowerGroup reaffirmed its commitment to VivaTech as a Platinum Partner, highlighting its focus on innovation and the tech sector.

Strategic Outlook for Asia Pacific HR Professional Services Market

The Asia Pacific HR professional services market is poised for continued growth, driven by technological advancements, economic expansion, and evolving business needs. Strategic opportunities exist for providers who can adapt to changing market demands, leverage technological innovations, and establish strong partnerships. The focus on data-driven decision-making, personalized HR solutions, and specialized talent acquisition will be critical for success in this dynamic market.

Asia Pacific HR Professional Services Segmentation

-

1. Provider Type

- 1.1. Consulting Companies

- 1.2. Software-as-a-Service Providers Companies

-

2. Function Type

- 2.1. Recruitment and Talent Acquisition

- 2.2. Benefits and Claims Management

- 2.3. Workforce Planning and Analytics

- 2.4. Payroll And Compensation Management

- 2.5. Other Functions

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. IT & Telecom

- 3.4. Manufacturing

- 3.5. Retail

- 3.6. Government

- 3.7. Other Industries

-

4. Geography

-

4.1. Asia-Pacific

- 4.1.1. China

- 4.1.2. India

- 4.1.3. Japan

- 4.1.4. Australia

- 4.1.5. Rest of Asia-Pacific

-

4.1. Asia-Pacific

Asia Pacific HR Professional Services Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. Australia

- 1.5. Rest of Asia Pacific

Asia Pacific HR Professional Services Regional Market Share

Geographic Coverage of Asia Pacific HR Professional Services

Asia Pacific HR Professional Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services

- 3.3. Market Restrains

- 3.3.1. Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services

- 3.4. Market Trends

- 3.4.1. Recruitment and Talent Acquisition is the Largest Segment in the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia Pacific HR Professional Services Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 5.1.1. Consulting Companies

- 5.1.2. Software-as-a-Service Providers Companies

- 5.2. Market Analysis, Insights and Forecast - by Function Type

- 5.2.1. Recruitment and Talent Acquisition

- 5.2.2. Benefits and Claims Management

- 5.2.3. Workforce Planning and Analytics

- 5.2.4. Payroll And Compensation Management

- 5.2.5. Other Functions

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. IT & Telecom

- 5.3.4. Manufacturing

- 5.3.5. Retail

- 5.3.6. Government

- 5.3.7. Other Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Asia-Pacific

- 5.4.1.1. China

- 5.4.1.2. India

- 5.4.1.3. Japan

- 5.4.1.4. Australia

- 5.4.1.5. Rest of Asia-Pacific

- 5.4.1. Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Adecco Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Randstad

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ManpowerGroup

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kelly Services

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hays

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Robert Half

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Allegis Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hudson

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Michael Page

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mercer

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Adecco Group

List of Figures

- Figure 1: Global Asia Pacific HR Professional Services Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Asia Pacific HR Professional Services Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Provider Type 2025 & 2033

- Figure 4: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Provider Type 2025 & 2033

- Figure 5: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Provider Type 2025 & 2033

- Figure 6: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Provider Type 2025 & 2033

- Figure 7: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Function Type 2025 & 2033

- Figure 8: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Function Type 2025 & 2033

- Figure 9: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Function Type 2025 & 2033

- Figure 10: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Function Type 2025 & 2033

- Figure 11: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by End-user Industry 2025 & 2033

- Figure 13: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Geography 2025 & 2033

- Figure 16: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Geography 2025 & 2033

- Figure 17: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Geography 2025 & 2033

- Figure 19: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Country 2025 & 2033

- Figure 20: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 2: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 3: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Function Type 2020 & 2033

- Table 4: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Function Type 2020 & 2033

- Table 5: Global Asia Pacific HR Professional Services Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Asia Pacific HR Professional Services Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Geography 2020 & 2033

- Table 9: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 12: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 13: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Function Type 2020 & 2033

- Table 14: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Function Type 2020 & 2033

- Table 15: Global Asia Pacific HR Professional Services Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Asia Pacific HR Professional Services Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Geography 2020 & 2033

- Table 19: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Country 2020 & 2033

- Table 21: China Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: India Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Australia Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific HR Professional Services?

The projected CAGR is approximately 8.63%.

2. Which companies are prominent players in the Asia Pacific HR Professional Services?

Key companies in the market include Adecco Group, Randstad, ManpowerGroup, Kelly Services, Hays, Robert Half, Allegis Group, Hudson, Michael Page, Mercer.

3. What are the main segments of the Asia Pacific HR Professional Services?

The market segments include Provider Type, Function Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 123.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services.

6. What are the notable trends driving market growth?

Recruitment and Talent Acquisition is the Largest Segment in the Market Studied.

7. Are there any restraints impacting market growth?

Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services.

8. Can you provide examples of recent developments in the market?

May 2024: ManpowerGroup is set to reaffirm its status as a critical contributor to the 8th edition of Europe's largest startup and tech event, VivaTech, by returning as a Platinum Partner.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific HR Professional Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific HR Professional Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific HR Professional Services?

To stay informed about further developments, trends, and reports in the Asia Pacific HR Professional Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence